Surfing Equipment Market Size, Share, Trends and Forecast by Product, Distribution Channel, and Region, 2025-2033

Surfing Equipment Market Size and Share:

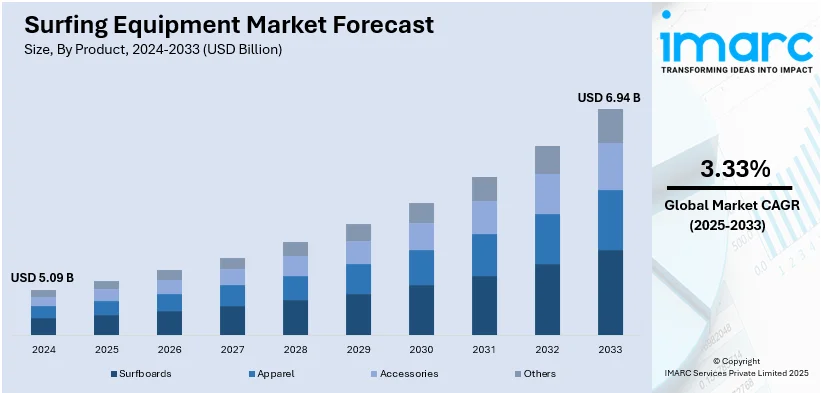

The global surfing equipment market size was valued at USD 5.09 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 6.94 Billion by 2033, exhibiting a CAGR of 3.33% from 2025-2033. North America currently dominates the market, holding a surfing equipment market share of over 48.6% in 2024. The growing popularity of surfing as a recreational and competitive sports event, increasing awareness regarding numerous types of water sports among the masses, rising health-consciousness along with growing engagement in outdoor activities represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5.09 Billion |

|

Market Forecast in 2033

|

USD 6.94 Billion |

| Market Growth Rate (2025-2033) | 3.33% |

One major driver in the surfing equipment market is the rising popularity of surfing as a recreational and competitive sport. Increasing coastal tourism, coupled with the influence of social media and surfing events, has significantly boosted participation. The growing awareness of health benefits associated with surfing, such as improved cardiovascular fitness and mental well-being, further fuels surfing equipment market demand. Additionally, the expansion of surf schools and training programs has attracted new enthusiasts, creating a steady market for boards, wetsuits, and accessories. Advancements in material technology, such as eco-friendly surfboards and high-performance wetsuits, also contribute to market growth by catering to sustainability-conscious consumers. The sport’s inclusion in international competitions, including the Olympics, further amplifies global interest and demand for quality surfing gear.

The U.S. is a dominant player with a 94.90% significant market share in the surfing equipment market, driven by its extensive coastline, strong surf culture, and high participation rates. California, Hawaii, and Florida serve as key hubs, attracting both local surfers and international enthusiasts. The presence of major surf brands and innovative startups fosters market growth, offering advanced surfboards, wetsuits, and accessories. Rising eco-consciousness has also led to increased demand for sustainable materials, such as recycled foam and plant-based resins. Additionally, the sport’s inclusion in the Olympics has boosted interest, particularly among younger demographics. Technological advancements, including smart surfboards with tracking capabilities, further enhance market appeal. A strong retail network, both online and offline, ensures easy accessibility of high-quality surfing gear across the country.

Surfing Equipment Market Trends:

Rise of Eco-Friendly Surfing Equipment

Sustainability is a major trend shaping the surfing equipment market, with growing demand for eco-friendly boards, wetsuits, and accessories. Traditional surfboards made from polyurethane and epoxy are being replaced with alternatives using recycled materials, plant-based resins, and biodegradable waxes. Brands are also developing wetsuits using limestone-based neoprene and Yulex, a natural rubber substitute. Consumers are increasingly prioritizing environmentally responsible products, pushing manufacturers to innovate with sustainable production methods. Companies are also investing in carbon offset programs and circular economy initiatives, promoting gear recycling and waste reduction. This shift is particularly strong in regions like California and Hawaii, where environmental consciousness influences purchasing decisions, further driving the adoption of greener surfing technologies.

Technological Advancements in Surfing Gear

Another major surfing equipment market trends is the innovation in surfing equipment is enhancing performance and safety. Smart surfboards with GPS tracking, wave data analytics, and inbuilt sensors help surfers analyze their performance and improve techniques. Advanced wetsuit designs incorporating graphene-infused fabrics and temperature-regulating materials offer better insulation, flexibility, and durability. Hydrofoil surfboards, which allow riders to glide above the water with reduced drag, are gaining traction among high-performance surfers. Additionally, AI-powered coaching apps and virtual reality training tools are becoming popular, helping beginners refine their skills before hitting the waves. These technological enhancements are making surfing more accessible, appealing to a broader audience and driving continuous market expansion through premium, high-tech equipment offerings.

Growth of Surfing Tourism and Competitive Events

The expansion of surf tourism and global competitions is fueling demand for high-quality surfing equipment. Destinations such as the U.S., Australia, Portugal, and Indonesia are attracting a surge in surf travelers, boosting local surfboard rentals, schools, and retail sales. Surf camps and guided experiences are becoming popular among beginners and adventure tourists, leading to increased sales of entry-level gear. Additionally, the inclusion of surfing in the Olympics and professional circuits like the World Surf League (WSL) is driving brand sponsorships and product innovations. The rising number of international surfing festivals and competitions further elevates the sport’s visibility, encouraging enthusiasts to invest in premium boards, wetsuits, and accessories to enhance their performance.

Surfing Equipment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global surfing equipment market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and distribution channel.

Analysis by Product:

- Surfboards

- Apparel

- Accessories

- Others

Surfboards account for the majority share of 72.7% in the surfing equipment market due to their essential role in the sport. The rising participation in recreational and competitive surfing has driven demand for a wide variety of surfboards, including shortboards, longboards, and fish boards, catering to different skill levels. Technological advancements, such as lightweight epoxy boards, carbon fiber reinforcements, and eco-friendly materials, have further boosted surfing equipment market share. Additionally, the expansion of surf tourism, surf schools, and rental services has increased the accessibility of surfboards to new enthusiasts. Customization trends, where surfers seek personalized board shapes, sizes, and designs, also contribute to market dominance. Growing online retail channels ensure easy availability, making surfboards the highest-selling segment in the industry.

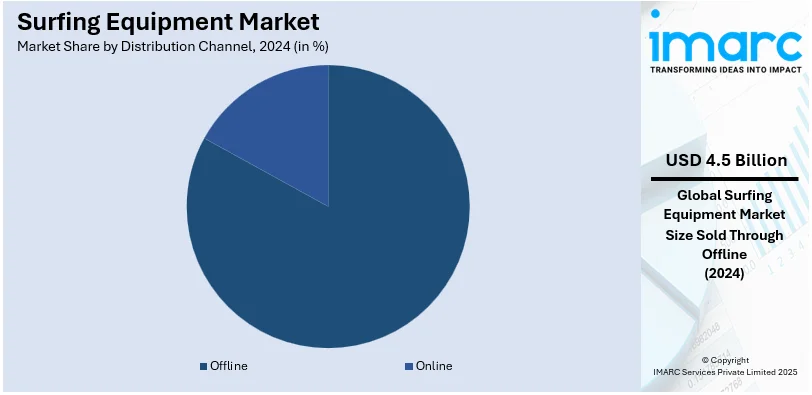

Analysis by Distribution Channel:

- Online

- Offline

Offline channels represent the majority share of 87.8% in the surfing equipment market due to the preference for in-store purchases, where customers can physically assess product quality, size, and performance. Surfboards, wetsuits, and accessories require a proper fit, leading buyers to opt for specialty surf shops and sporting goods stores. The presence of expert staff in offline stores provides guidance on selecting suitable equipment, enhancing the customer experience. Additionally, coastal regions with high surfing activity have numerous surf shops, rental services, and branded outlets catering to both locals and tourists. Many surfers also prefer purchasing gear from surf schools and resorts, further boosting offline sales. The strong retail presence of established brands solidifies offline dominance in the surfing equipment market outlook.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

According to the surfing equipment market forecast, the North America leads the market with a 48.6% share due to its strong surf culture, extensive coastlines, and high participation rates. The U.S., particularly California, Hawaii, and Florida, serves as a major hub for professional and recreational surfing, driving consistent demand for surfboards, wetsuits, and accessories. The presence of leading surf brands and manufacturers fosters innovation, offering high-performance and eco-friendly products. Additionally, the region hosts numerous international surfing events, boosting equipment sales and sponsorship opportunities. The growth of surf schools and tourism in coastal areas further increases market penetration. A well-established retail network, including specialty stores and major sporting goods chains, ensures accessibility, solidifying North America’s dominance in the global surfing equipment market.

Key Regional Takeaways:

United States Surfing Equipment Market Analysis

Growing surfing equipment adoption due to growing recreational and competitive sports events is driving demand across various age groups and skill levels. With increasing participation in organized competitions and leisure surfing, there is a surge in demand for advanced boards, wetsuits, and safety gear. For instance, in 2023, the total number of active sports and fitness participants in the U.S. hit its highest level ever at 242 Million, up 12.1% from 215.8 Million in 2016. Surfing tournaments are gaining popularity, attracting both professional and amateur surfers, leading to increased spending on high-performance equipment. Recreational surfing is expanding as more individuals seek outdoor activities, boosting the sales of beginner-friendly boards and accessories. Sports tourism is fuelling demand as enthusiasts travel to coastal locations, further supporting the surfing equipment market growth. Innovations in design and materials cater to evolving consumer preferences, enhancing performance and comfort. Rental services are also flourishing, making equipment accessible to occasional surfers and beginners. Media coverage and digital platforms are promoting the sport, encouraging more participation and influencing purchasing behavior. Customization trends are contributing to premium product demand, with consumers seeking personalized surfing gear.

Asia Pacific Surfing Equipment Market Analysis

Growing disposable income is significantly influencing the expansion of the surfing equipment market, enabling consumers to invest in premium and technologically advanced products. According to India Brand Equity Foundation, India's per capita disposable income was USD 2.11 thousand in 2019, and rose to USD 2.54 thousand in 2023. It is projected to reach USD 4.34 thousand by 2029. With rising earnings, individuals are more inclined to engage in recreational sports, leading to higher spending on boards, wetsuits, and accessories. Increasing urbanization is creating new avenues for outdoor activities, further supporting the demand for quality gear. Economic growth is fuelling leisure and adventure tourism, prompting more people to explore surfing as a recreational pursuit. The market is experiencing a shift towards branded and high-performance equipment, reflecting changing consumer preferences. Affluent consumers are driving demand for customized and eco-friendly surfboards, aligning with sustainability trends. The influence of social media and sports influencers is encouraging interest in surfing, prompting aspirational purchases. Expansion of sports retail chains and dedicated surfing outlets is making products more accessible, facilitating higher sales.

Europe Surfing Equipment Market Analysis

Growing surfing equipment adoption due to growing sport and physical activity trends is fostering market expansion, as more individuals incorporate surfing into their active lifestyles. According to reports, sport and physical activity contribute USD 48.37 Billion to the UK’s economy. Health consciousness is driving people toward water-based sports, increasing demand for boards, wetsuits, and fitness-focused gear. Surfing is being embraced as a full-body workout, attracting both beginners and experienced surfers. Fitness trends are promoting endurance training, strength-building, and flexibility, leading to a surge in sales of advanced and customized equipment. Adventure sports are gaining mainstream attention, further encouraging participation in surfing activities. Water sports facilities and surfing schools are expanding, making equipment more accessible to newcomers. Innovation in lightweight and durable materials is appealing to fitness-conscious consumers looking for better performance. Yoga and mindfulness trends are contributing to the popularity of surfing, as it aligns with mental and physical wellness. Cross-training enthusiasts are incorporating surfing into their routines, boosting demand for specialized gear.

Latin America Surfing Equipment Market Analysis

Growing surfing equipment adoption due to growing online distribution channels is expanding market reach, making products more accessible to a wider audience. According to reports, the Latin America market currently boasts over 300 Million digital buyers. E-commerce platforms are enabling consumers to purchase high-quality boards, wetsuits, and accessories conveniently, driving sales growth. Digital marketing and influencer promotions are increasing awareness, encouraging more people to invest in premium equipment. The rise of direct-to-consumer (D2C) brands is reducing dependency on physical retail stores, offering competitive pricing and exclusive product launches. Online product reviews and video tutorials are educating buyers, enhancing their confidence in purchasing decisions. Subscription-based models and online rental services are further facilitating product accessibility.

Middle East and Africa Surfing Equipment Market Analysis

Growing surfing equipment adoption due to the growing rise in travel and tourism activities is accelerating market growth as more tourists engage in water sports. For instance, Dubai welcomed 14.96 Million overnight visitors from January to October 2024, marking an 8% increase compared to the same period in 2023, highlighting a strong growth in tourism. Surfing destinations are witnessing an influx of adventure-seeking travellers, increasing demand for boards, wetsuits, and rental services. Hotel and resort partnerships with surf schools are making equipment more accessible, driving sales. Tourism campaigns promoting surfing experiences are creating awareness, encouraging participation among international and domestic travellers. Luxury travel trends are boosting demand for high-end, customized surfboards. The rise of experiential tourism is attracting new demographics to surfing, influencing product demand.

Competitive Landscape:

The surfing equipment market is highly competitive, driven by innovation, sustainability, and brand differentiation. Established players dominate through advanced material technology, premium product offerings, and extensive distribution networks. Emerging brands focus on eco-friendly alternatives, catering to the growing demand for sustainable surfing gear. The market also sees strong competition from local manufacturers specializing in custom and handmade surfboards. Online retail expansion has intensified price competition, making affordability and D2C models key strategies. Sponsorships, athlete endorsements, and partnerships with surf schools further enhance brand visibility. Additionally, technological advancements, such as smart surfboards and high-performance wetsuits, create opportunities for differentiation. The industry continues to evolve with a focus on sustainability, performance enhancement, and accessibility for a broader consumer base.

The report provides a comprehensive analysis of the competitive landscape in the surfing equipment market with detailed profiles of all major companies, including:

- Agit Global Inc.

- Boardriders Inc.

- Channel Islands Surfboards

- Cobra International Co Ltd.

- Firewire Surfboards LLC

- Huizhou Xinyitong Sports Equipment Co Ltd.

- Rusty Surfboards Inc.

- Simon Anderson Surfboards

- Tahe Outdoors

- Xanadu Surfboards

Latest News and Developments:

- December 2024: Newave Surfboards, a Vendée-based start-up founded in 2023, has successfully secured funding ahead of its January 2025 production launch. The company will introduce a range of dismountable, easily transportable surfboards. This innovation aims to enhance convenience for surfing enthusiasts. Mass production is set to begin as the brand enters the market.

- November 2024: LIND, a marine electric mobility specialist, is revolutionizing watersports with its electric surfboard, Canvas. Blending traditional surfboard craftsmanship with modern electric drivetrains, LIND offers a sustainable way to ride anytime, anywhere. Founded in 2021, the company aims to serve riders without access to tides or flexible schedules. Canvas is the first in a series of game-changing boards promised by LIND.

- September 2024: Slater Designs has announced the global launch of the FRK SWALLOW, a new surfboard model by 11-time world champion Kelly Slater and designer Dan Mann. The board is designed for versatility in various wave conditions and pairs with Slater’s KS1 Endorfins Fin Set. Slater describes the FRK SWALLOW as an aesthetic and performance-driven evolution of the FRK and FRK+ models.

- September 2024: Volvo Penta will debut Joystick Surfing and showcase Twin Forward Drive at IBEX 2024, enhancing watersports versatility. VP Jens Bering will join a panel discussing the company’s innovations in comfort and sustainability. The new technology aims to make boating more accessible and enjoyable. Volvo Penta continues advancing easy boating with integrated marine solutions.

- April 2024: A Santa Cruz startup is revolutionizing surfing with 3D-printed surfboards made from recycled hospital trays. Founder Patricio Guerrero began printing boards in his garage in 2022, inspired by his first translucent, diamond-patterned design. His innovative approach aims to replace traditional plastic foam boards with a more sustainable alternative. The technology is already making waves at Santa Cruz’s iconic Steamer Lane.

Surfing Equipment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Surfboards, Apparel, Accessories, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Agit Global Inc., Boardriders Inc., Channel Islands Surfboards, Cobra International Co Ltd., Firewire Surfboards LLC, Huizhou Xinyitong Sports Equipment Co Ltd., Rusty Surfboards Inc., Simon Anderson Surfboards, Tahe Outdoors, Xanadu Surfboards, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the surfing equipment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global surfing equipment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the surfing equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surfing equipment market was valued at USD 5.09 Billion in 2024.

The surfing equipment market was valued at USD 6.94 Billion in 2024 exhibiting a CAGR of 3.33% during 2025-2033.

Key factors driving the surfing equipment market include the rising popularity of surfing as a sport, increasing coastal tourism, and growing awareness of health benefits. Technological advancements in gear, eco-friendly product innovations, and the expansion of surf schools further fuel demand. Additionally, global surfing events and online retail accessibility boost market growth.

North America dominates the surfing equipment market with 48.6% share due to its extensive coastlines, strong surf culture, and high participation rates. The presence of leading brands, technological innovations, and sustainability-focused products further drive growth. Additionally, major surf destinations, competitive events, and expanding e-commerce channels contribute to market expansion.

Some of the major players in the surfing equipment market include Agit Global Inc., Boardriders Inc., Channel Islands Surfboards, Cobra International Co Ltd., Firewire Surfboards LLC, Huizhou Xinyitong Sports Equipment Co Ltd., Rusty Surfboards Inc., Simon Anderson Surfboards, Tahe Outdoors, Xanadu Surfboards, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)