Surface Vision and Inspection Market Size, Share, Trends and Forecast by Component Type, Deployment, System Type, Surface, Vertical, and Region, 2025-2033

Surface Vision and Inspection Market Size and Share:

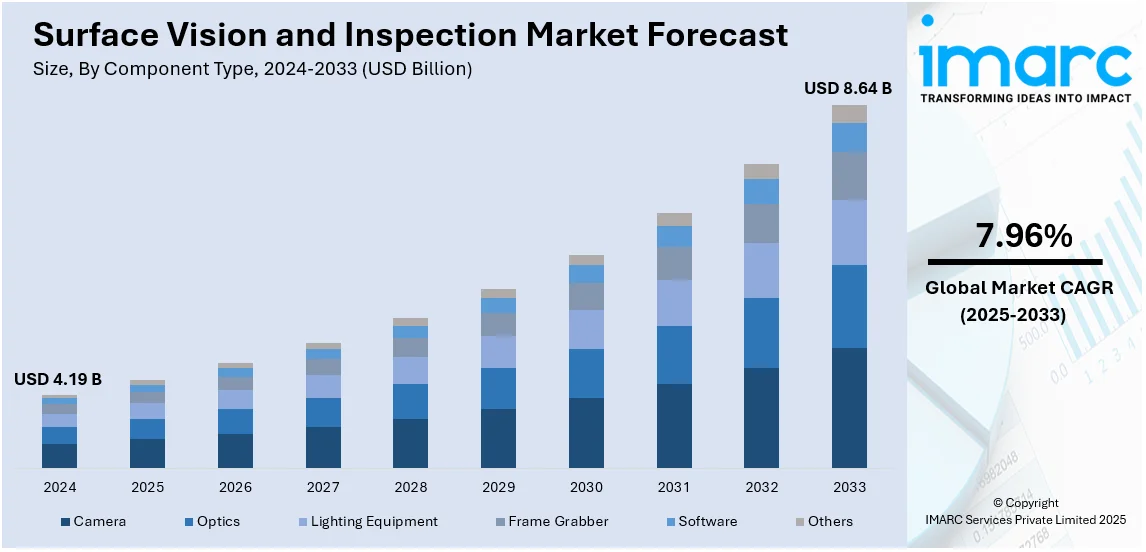

The global surface vision and inspection market size was valued at USD 4.19 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.64 Billion by 2033, exhibiting a CAGR of 7.96% from 2025-2033. North America currently dominates the market, holding a market share of over 34.0% in 2024. The market is growing due to the increasing demand for automation, AI-driven quality control, and defect detection across industries like automotive, electronics, and pharmaceuticals. Advancements in machine vision, 3D imaging, and AI are driving efficiency and precision. With rising automation and smart manufacturing adoption, the surface vision and inspection market share is expanding rapidly.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.19 Billion |

|

Market Forecast in 2033

|

USD 8.64 Billion |

| Market Growth Rate 2025-2033 | 7.96% |

The surface vision and inspection market is growing due to increasing demand for automation, quality control and defect detection in manufacturing. Advancements in AI-powered image processing, machine vision and deep learning algorithms enhance accuracy and efficiency. For instance, in January 2025, Rockwell Automation launched FactoryTalk Analytics VisionAI an advanced AI-driven inspection solution aimed at improving manufacturing quality control. The no-code platform enables users to detect subtle anomalies, optimize decision-making and gain real-time insights. Key features include advanced anomaly detection, remote management and seamless integration with existing Rockwell systems. Rising adoption in industries like automotive, electronics, pharmaceuticals and food processing drives market expansion. Stringent regulatory standards and the need for cost-effective production further accelerate adoption. Additionally, Industry 4.0 integration and smart manufacturing trends are propelling the market’s technological evolution.

The United States surface vision and inspection market is expanding due to the increasing adoption of automation and AI-driven quality control systems across industries. For instance, in April 2024, Cognex Corporation launched the In-Sight L38 3D Vision System, combining AI and traditional imaging technologies for enhanced manufacturing inspections. The system simplifies configuration with embedded AI, allowing quick setup using minimal labeled images. It features patented laser optics for high-resolution imaging and meets Class 2 safety standards. The automotive, electronics, and semiconductor sectors are investing in machine vision technology to enhance defect detection and manufacturing precision. Strict regulatory compliance in pharmaceuticals and food processing is further driving demand. Additionally, the rise of Industry 4.0, smart factories, and robotics is fueling innovation, making real-time surface inspection an essential part of industrial production in the US.

Surface Vision and Inspection Market Trends:

Rising Automation and Industry 4.0

The increasing focus on automation and digital transformation in the manufacturing sector has led to the widespread implementation of vision and inspection systems aimed at improving quality control and operational efficiency. For example, Norwalt introduced its latest bottle vision inspection system, the Vue Inspection System, in July 2023. Developed in the company’s Vision Systems Lab, this new product is designed to combine standardized vision components with bespoke elements and deep learning technologies. Norwalt, a supplier specializing in custom automation and line integration for complex manufacturing, asserts that this system can monitor gaging imperfections as minor as 10 thousandths of an inch and can identify defects even on translucent surfaces. The Vue Inspection System utilizes shape transformation techniques on the sloped contours of bottles to achieve this capability. The trend toward Industry 4.0, characterized by smart factories and interconnected systems, further drives the surface vision and inspection market demand. According to a report by the IMARC Group, the global Industry 4.0 market reached USD 164.7 billion in 2024 and is anticipated to expand at a CAGR of 14.44% from 2025 to 2033.

Increasing Demand for High-Quality Standards

Industries, such as automotive, electronics, and pharmaceuticals, require stringent quality standards, driving the need for precise and reliable inspection technologies to detect defects and ensure product consistency. For instance, in June 2024, AMETEK Surface Vision announced its advanced Real-Time Electrode Inspection & Traceability System, now optimized for use in the electric vehicle (EV) industry, the global market for which is projected to grow at a CAGR of 21.5% during 2025-2033, as per recent industry reports. This proven system meets the stringent quality demands of EV battery production, ensuring unparalleled battery cell quality and manufacturing efficiency. In the EV sector, the quality and reliability of battery cells are crucial. AMETEK Surface Vision's state-of-the-art automated online surface inspection systems enable continuous monitoring and identification of surface defects throughout the entire production process. This reduces the risk of defective products reaching the market, which enhances customer satisfaction and reduces recall costs, thus creating a positive surface vision and inspection market outlook.

Significant Advancements in Technology

Advancements in machine vision, particularly with high-resolution imaging, artificial intelligence, and machine learning, are enhancing defect detection capabilities and driving market expansion by providing more precise and efficient inspection solutions. The IMARC Group projects that the global machine learning market will reach USD 440.6 billion by 2033, with a compound annual growth rate (CAGR) of 32.6% from 2025 to 2033. For example, in April 2023, ASCONA and D-CUBE formed a strategic partnership to introduce a comprehensive solution for inline surface inspection of aluminum profiles. This collaboration merges an innovative product with established expertise from some of Europe's largest aluminum extrusion facilities, supported by a global service network. Promex CYRUS, which utilizes artificial intelligence, identifies various types of surface defects in real-time, regardless of the extruded profile strands' shape, quantity, or size, and translates these findings into actionable alerts. As indicated by the forecast for the surface vision and inspection market, these technological developments are anticipated to substantially propel market growth in the coming years.

Surface Vision and Inspection Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global surface vision and inspection market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component type, deployment, system type, surface, and vertical.

Analysis by Component Type:

- Camera

- Optics

- Lighting Equipment

- Frame Grabber

- Software

- Others

Camera stand as the largest component type in 2024, holding around 32.0% of the market. Cameras are essential for capturing high-resolution images needed to detect surface defects with precision. Technological advancements in camera resolution, frame rates, and imaging sensors enable detailed and fast inspections, which are critical in industries like automotive, electronics, and pharmaceuticals. The integration of cameras with machine vision software, AI, and machine learning further enhances defect detection accuracy and efficiency, making them the most crucial component in inspection systems.

Analysis by Deployment:

- Traditional Surface Inspection Systems

- Robotic Cells

Traditional surface inspection systems lead the market with around 65.4% of market share in 2024. Traditional surface inspection systems hold the largest deployment segment in the market due to their established reliability and widespread use across industries like automotive, electronics, and packaging. These systems have proven effective in detecting defects and ensuring consistent product quality. Additionally, they offer lower initial costs and are easier to integrate into existing manufacturing processes. Many companies prefer these tried-and-tested solutions over newer technologies, making traditional systems the dominant choice for surface inspection.

Analysis by System Type:

- Computer-based

- Camera-based

Computer-based leads the market with around 55.8% of market share in 2024. Computer-based systems hold the largest segment in the market because of their superior processing power, flexibility, and scalability. These systems can handle complex algorithms and large amounts of data, enabling high-precision defect detection and real-time analysis. Computer-based solutions also offer greater customization and integration with advanced technologies like AI, machine learning, and high-resolution cameras. This versatility makes them ideal for industries requiring detailed inspections, such as automotive, electronics, and pharmaceuticals, positioning them as the preferred system type.

Analysis by Surface:

- 2D

- 3D

3D surface inspection provides detailed, accurate measurements of complex surfaces. Unlike 2D systems, 3D inspection captures depth and texture, making it ideal for detecting minute defects, such as scratches, dents, and deformations, in industries like automotive, electronics, and aerospace. With the growing demand for high precision and quality control in manufacturing, 3D systems offer superior defect detection, ensuring enhanced product reliability and consistency, driving their widespread adoption.

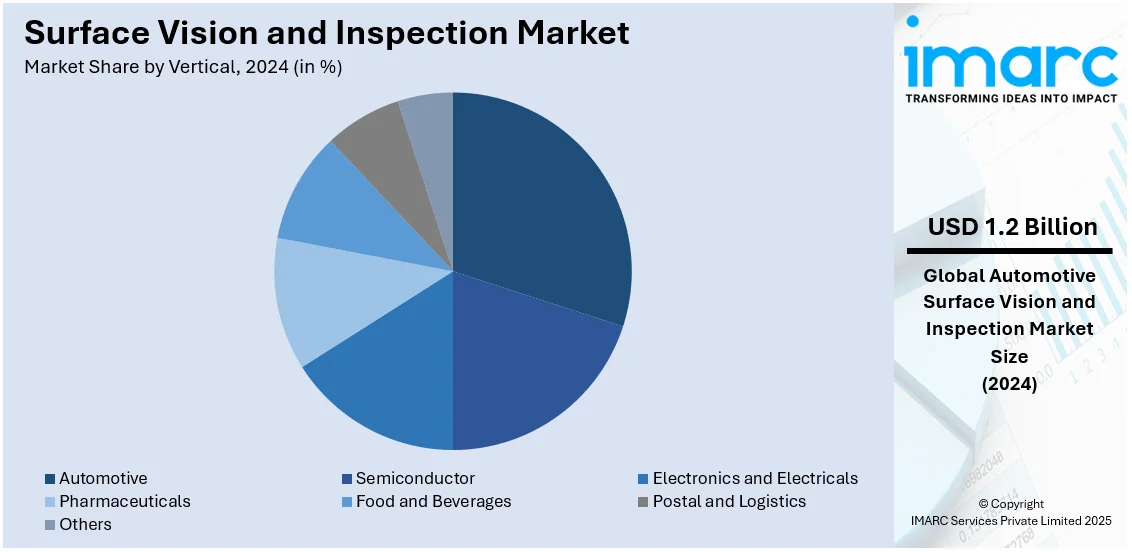

Analysis by Vertical:

- Automotive

- Semiconductor

- Electronics and Electricals

- Pharmaceuticals

- Food and Beverages

- Postal and Logistics

- Others

Automotive leads the market with around 28.5% of market share in 2024. The automotive sector holds the largest share in the market in the vertical segment due to its high demand for precision and quality in manufacturing. Surface inspection systems are critical for detecting defects in automotive components, such as body panels and parts, ensuring safety and performance. With stringent industry standards and the growing complexity of vehicle designs, manufacturers rely on advanced inspection technologies to maintain quality control, reduce defects, and optimize production processes, making the automotive industry a key market for surface vision systems.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 34.0%. The strong focus on automation and Industry 4.0 adoption pushes industries to integrate advanced surface inspection systems for enhanced quality control and efficiency which represents the major surface vision and inspection market growth drivers across North America. Key sectors like automotive, aerospace, and electronics, which demand precision manufacturing, are increasingly using these systems to detect defects and ensure product consistency. Additionally, technological advancements in AI, machine learning, and high-resolution imaging enhance inspection accuracy. In March 2023, Teledyne announced that its Sapera Vision Software Edition 2023-03 is now ready for use. This software from Teledyne DALSA offers reliable features for image acquisition, control, image processing, and artificial intelligence, aiding in the creation, development, and deployment of advanced machine vision applications. Recent updates include improvements to the AI training graphical tool Astrocyte™ 1.40 and the image processing and AI libraries tool, Sapera Processing 9.40.

Key Regional Takeaways:

United States Surface Vision and Inspection Market Analysis

In 2024, the United States accounted for over 86.50% of the surface vision and inspection market in North America. The United States surface vision and inspection market is primarily driven by increasing automation in manufacturing, fueled by the need for higher precision, efficiency, and defect detection. Industries such as automotive, electronics, pharmaceuticals, and food and beverage are adopting advanced surface vision systems to enhance quality control and regulatory compliance. The growing demand for high-resolution imaging, AI-powered defect detection, and real-time monitoring is also fueling innovation in machine vision technology. Moreover, rising investments in Industry 4.0 and smart manufacturing are propelling companies to integrate surface inspection systems with IoT-enabled platforms and data analytics for predictive maintenance and process optimization. Furthermore, stricter regulations from agencies such as the FDA and OSHA are encouraging manufacturers to implement advanced inspection solutions to ensure product safety and consistency. The expansion of semiconductor and electronics manufacturing, driven by demand for consumer electronics and electric vehicles, is further boosting the adoption of surface vision systems. According to recent industry projections, there will be approximately 26.4 million electric vehicles (EVs) on American roads by 2030, accounting for more than 10% of all automobiles. Other than this, strategic collaborations between technology providers and manufacturing companies are expediting the deployment of next-generation surface inspection solutions, supporting industry expansion.

Asia Pacific Surface Vision and Inspection Market Analysis

The Asia Pacific surface vision and inspection market is expanding due to rapid industrialization, growing adoption of automation, and increasing quality control requirements in manufacturing. As per the Press Information Bureau, in November 2024, the Index of Industrial Manufacturing in India saw a 5.2% increase, highlighting the robust industrialization in the country. The expansion of e-commerce and increased packaging requirements are also driving the need for automated inspection systems to ensure product integrity and labeling accuracy. Additionally, growing investments in AI, deep learning, and robotics are improving surface inspection capabilities, while increasing labor costs in emerging economies are making manufacturers turn toward automated quality control solutions for efficiency and cost reduction. For instance, Asia accounted for 70% of all newly installed robots globally in 2023, according to the International Federation of Robotics (IFR). Besides this, government investments in industrial automation, particularly in India and Southeast Asia, are fostering the adoption of machine vision technologies in manufacturing.

Europe Surface Vision and Inspection Market Analysis

The Europe surface vision and inspection market is growing, fueled by increasing demand for high-precision manufacturing and stringent quality control requirements across industries such as aerospace, packaging, and metallurgy. The rise of sustainable manufacturing practices is also propelling companies to adopt advanced inspection systems that minimize material waste and optimize production efficiency. The rapid advancement of semiconductor and electronics manufacturing, particularly in Germany and France, is further boosting demand for high-resolution imaging and automated inspection solutions. Moreover, the automotive sector, with its increasing focus on electric vehicles and autonomous driving, is investing in sophisticated vision systems to enhance precision in component manufacturing and assembly. According to the International Council on Clean Transportation, in 2023, 15% of all newly registered vehicles in Europe were battery-electric. Additionally, the pharmaceutical sector, driven by stricter EU regulations on drug safety and packaging integrity, is increasingly adopting automated vision inspection solutions to ensure compliance. The food and beverage industry is also integrating vision-based inspection systems to detect contaminants, verify labeling accuracy, and maintain hygiene standards. The emergence of collaborative robotics and smart sensors is further driving adoption, allowing seamless integration of vision systems into automated production lines.

Latin America Surface Vision and Inspection Market Analysis

The Latin America surface vision and inspection market is growing due to increasing industrial automation and quality control requirements in sectors such as automotive, food and beverage, and pharmaceuticals. Expanding manufacturing operations in countries such as Brazil and Mexico are driving the adoption of machine vision systems to enhance efficiency and reduce production defects. For instance, Brazil’s industrial manufacturing increased by 4.1% from May to June 2024. Additionally, foreign investments in industrial automation and the expansion of local manufacturing facilities are contributing substantially to industry expansion. The increasing focus on reducing operational costs and improving product consistency is further boosting demand for surface vision technologies.

Middle East and Africa Surface Vision and Inspection Market Analysis

The Middle East and Africa surface vision and inspection market is propelled by increasing industrial automation, rising quality control standards, and growing investments in manufacturing. The automotive, electronics, and pharmaceutical sectors are adopting machine vision systems to enhance defect detection and ensure regulatory compliance. Moreover, government initiatives promoting smart manufacturing, particularly in the UAE and Saudi Arabia, are expediting the adoption of AI-powered inspection technologies. According to a report published by the IMARC Group, the Middle East smart manufacturing market is expected to grow at a CAGR of 14.88% during 2024-2032. Additionally, the expansion of logistics and packaging industries, driven by e-commerce growth, is boosting demand for automated inspection solutions. Investments in robotics, AI, and IoT-based quality control systems are further enhancing production efficiency and driving market growth.

Competitive Landscape:

The competitive landscape of the surface vision and inspection market is marked by the presence of numerous players offering innovative solutions driven by advancements in AI, machine learning, and automation. Companies are focusing on enhancing product offerings with high-resolution imaging, 3D vision systems, and real-time defect detection. Strategic partnerships, acquisitions, and the integration of AI technologies are key strategies for market leaders aiming to expand their product portfolios and geographical reach. Additionally, the rise of Industry 4.0 and smart manufacturing is fostering a dynamic competitive environment, with continuous innovation in sensor technology and software solutions.

The report provides a comprehensive analysis of the competitive landscape in the surface vision and inspection market with detailed profiles of all major companies, including:

- Ametek Inc.

- Cognex Corporation

- Datalogic S.p.A.

- Industrial Vision Systems Ltd

- Keyence Corporation

- Matrox Electronic Systems

- Omron Corporation

- Qualitas Technologies Pvt Ltd

- QVision Systems LLP

- Shelton Machines Limited

- Teledyne Technologies Incorporated

- Vitronic

Latest News and Developments:

- January 2025: Evident's Inspection Technologies division, previously a part of Olympus Corporation's Scientific Solutions Department, a leading provider of non-destructive assessment, remote visual inspection, and analytical equipment services for essential assets, reached a final agreement to be acquired by Wabtec Corporation. This acquisition strengthens Wabtec's longstanding dedication to improving client productivity, dependability, and safety while positioning the company for faster, more lucrative growth.

- May 2024: OMRON Automation Americas, one of the leading providers of industrial automation systems, showcased its revolutionary inspection and factory automation systems at IPC APEX 2024. This innovative 3D CT X-ray inspection equipment is made especially for surface mount technology (SMT) production lines for electric vehicles (EVs).

- April 2024: Onoto Innovation Inc. introduced a new sub-surface inspection feature in its Dragonfly® G3 sub-micron 2D/3D inspection and measurement system. This new feature allows for full wafer inspection for major faults that impair yield, enabling the detection of hidden defects, improving final yield, and reducing overall wafer waste.

- February 2024, Siemens AG acquired Inspekto GmbH, a startup specializing in automated visual inspection, from D11Z. Ventures GmbH & Co. KG, a venture capital firm based in Heilbronn, Germany, which primarily invests in early-stage AI companies, facilitated the acquisition.

- January 2024: Mitsubishi Electric Corporation and HACARUS Corporation announced the expansion of their partnership to develop AI-driven visual inspection solutions for manufacturing. As part of this collaboration, Mitsubishi Electric will acquire an equity interest in HACARUS.

- June 2023: ZEISS introduced the latest version of its innovative ABIS surface inspection system. With its ability to reliably and swiftly inspect the entire surface of the component, the new ZEISS ABIS III sensor is the perfect equipment for quality assurance for press businesses and automotive repair facilities.

Surface Vision and Inspection Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Camera, Optics, Lighting Equipment, Frame Grabber, Software, Others |

| Deployments Covered | Traditional Surface Inspection Systems, Robotic Cells |

| System Types Covered | Computer-based, Camera-based |

| Surfaces Covered | 2D, 3D |

| Verticals Covered | Automotive, Semiconductor, Electronics and Electricals, Pharmaceuticals, Food and Beverages, Postal and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ametek Inc., Cognex Corporation, Datalogic S.p.A., Industrial Vision Systems Ltd, Keyence Corporation, Matrox Electronic Systems, Omron Corporation, Qualitas Technologies Pvt Ltd, QVision Systems LLP, Shelton Machines Limited, Teledyne Technologies Incorporated, Vitronic, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the surface vision and inspection market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global surface vision and inspection market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the surface vision and inspection industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The surface vision and inspection market was valued at USD 4.19 Billion in 2024.

IMARC estimates the surface vision and inspection market to reach USD 8.64 Billion by 2033, exhibiting a CAGR of 7.96% from 2025-2033.

Key factors driving the surface vision and inspection market include increasing demand for automation and quality control, advancements in AI and machine learning, the need for high-precision inspections in industries like automotive and electronics, regulatory compliance, and the rise of Industry 4.0 and smart manufacturing solutions.

North America currently dominates the surface vision and inspection market due to the presence of advanced manufacturing industries, strong adoption of automation, and significant investments in AI and machine vision technologies. The region’s focus on innovation, high manufacturing standards, and regulatory compliance further contributes to its market leadership.

Some of the major players in the surface vision and inspection market include Ametek Inc., Cognex Corporation, Datalogic S.p.A., Industrial Vision Systems Ltd, Keyence Corporation, Matrox Electronic Systems, Omron Corporation, Qualitas Technologies Pvt Ltd, QVision Systems LLP, Shelton Machines Limited, Teledyne Technologies Incorporated, Vitronic, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)