Surface Disinfectant Market Size, Share, Trends and Forecast by Type, Composition, Application, End User, and Region, 2025-2033

Surface Disinfectant Market Size and Share:

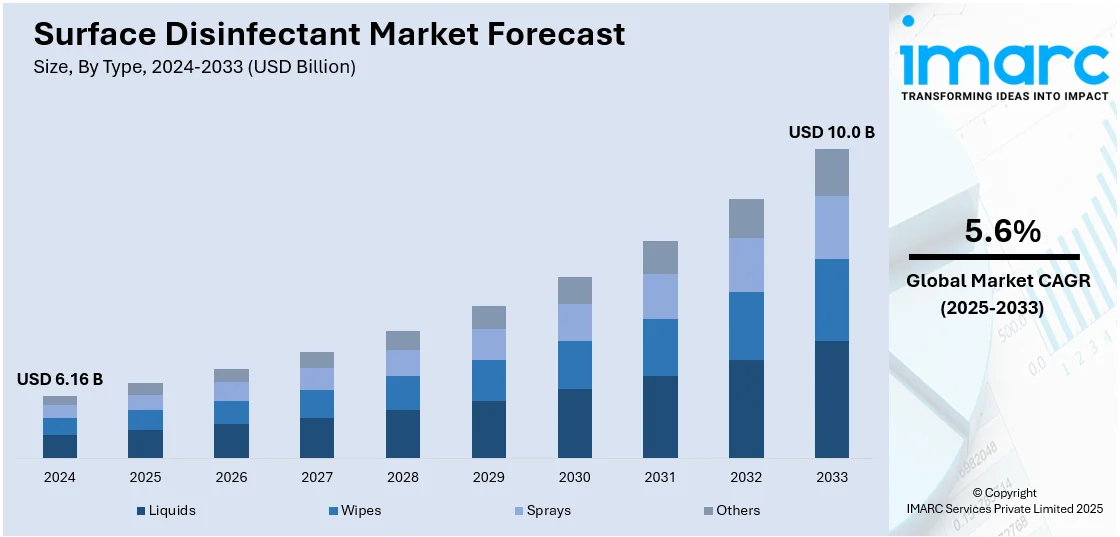

The global surface disinfectant market size was valued at USD 6.16 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 10.0 Billion by 2033, exhibiting a CAGR of 5.6% from 2025-2033. North America currently dominates the market, holding a market share of over 33.02% in 2024. The North American region is driven by the growing awareness about the importance of various hygiene products, increasing adoption of comprehensive hygiene practices in the residential, commercial, and industrial sectors, and heightened advancements in the manufacturing of products.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.16 Billion |

|

Market Forecast in 2033

|

USD 10.0 Billion |

| Market Growth Rate (2025-2033) | 5.6% |

Surface disinfectants are extremely important for maintaining overall hygiene especially in places with higher footfall. The rise in the prevalence of various infectious diseases combined with the implementation of rigorous cleaning protocols in different industries is enabling the use of surface disinfectants with strong ingredients. Surface disinfectants often play a critical role in preventing the transmission of several harmful pathogens and this is elevating their importance in daily cleaning and maintenance routines worldwide. Hospitals, clinics, and long term care facilities have a number of stringent requirements for maintaining a sterile environment for reducing healthcare associated infections (HAIs). Surface disinfectants that can kill bacteria, viruses, and fungi have become an indispensable tool in curbing the overall spread of diseases.

The United States has emerged as a key region in the surface disinfectant market owing to the rising health awareness and strong hygiene standards. People are becoming increasingly aware about the harmful effects of various infectious diseases as the Internet is providing ample amount of information and also government health campaigns are spreading the knowledge about the importance of maintaining cleanliness. Apart from this, there is a high occurrence of HAIs in various healthcare clinics. This alarming statistic is motivating healthcare providers to adopt rigorous cleaning and disinfection protocols, significantly driving the demand for effective surface disinfectants. Beyond healthcare, the commercial and industrial sectors in the United States are emerging as significant contributors to the market. Businesses across industries like food and beverage (F&B), hospitality, and retail, are prioritizing cleanliness to meet expectations and comply with regulatory standards. As per the predictions of the IMARC Group, the United States surface disinfectant market is expected to exhibit a growth rate (CAGR) of 9.40% during 2024-2032.

Surface Disinfectant Market Trends:

Rising awareness about hygiene practices

The surface disinfectant market is significantly driven by the increasing knowledge regarding hygiene practices among the masses. This awareness has been magnified by recent health crises, emphasizing the importance of regular disinfection to prevent disease spread, thus continuously driving demand for effective surface disinfectants. Such events are catalyzing the demand for effective disinfectants in a variety of sectors, including healthcare, hospitality, residential, and commercial spaces. Additionally, the focus on maintaining sanitized and germ-free environments has transcended being a mere reactionary tactic to past health emergencies and has evolved into a standard practice, thus ensuring a consistent rise in the demand for surface disinfectants.

Technological advancements in disinfectant products

Surface disinfectant market recent developments have benefited from technological enhancements that improve product effectiveness and user convenience. The development of environment friendly and high-performance formulations is a response to increased demand, which is vital for the surface disinfectant market outlook. In addition, innovations include advanced formulations offering extended protection, eco-friendly ingredients, and versatile features, responding to the heightened demand for high-performance and eco-conscious disinfecting solutions. Companies are heavily investing in R&D to develop products effective against a wide array of pathogens while being safe for both users and the environment. The market enhances a range of options such as biodegradable, non-toxic, and unscented formulas, which cater to expanding preferences and drive market growth. For instance, in 2024, CloroxPro Canada launched CloroxPro Clorox EcoClean line of plant-based active ingredient cleaners and disinfectants for the eco-conscious users. Furthermore, the incorporation of sophisticated dispensing technologies and IoT-enabled systems for automated disinfection processes resonates with the consumer shift towards innovative, efficient, and convenient disinfection methods, further propelling market expansion.

Stringent regulatory standards and compliance requirements

The development and enforcement of strict regulatory standards bolster the market growth. Regulatory compliance ensures the safety and efficacy of disinfectants, which is critical for their increased acceptance and use in various settings, thereby impacting the surface disinfectant market revenue positively. Regulatory bodies such as the EPA, FDA, and WHO require thorough testing and validation of disinfectants, motivating manufacturers to meet rigorous standards in terms of product formulation, efficacy, and labeling. In 2024, The Bureau of Indian Standards (BIS) tightened its code of practice for food hygiene by employing an updated framework across the supply chain. This stringent compliance secures a supply of reliable and safe disinfectants, facilitating their widespread use in healthcare settings, laboratories, commercial spaces, and homes.

Surface Disinfectant Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global surface disinfectant market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, composition, application, and end user.

Analysis by Type:

- Liquids

- Wipes

- Sprays

- Others

Liquids stand as the largest component in 2024, holding 62.0% of the market share. Liquids are widely accepted as liquid disinfectants across various sectors, coupled with their ability to be applied extensively across large surfaces. Their affordability, versatility in combating a range of pathogens, and effectiveness in cleaning diverse spaces, from homes to intensive care units, make them highly favored. Liquids are routinely used for purification and maintaining regular hygiene, thanks to their efficiency in ensuring cleanliness. Moreover, their adaptability for use in automated systems adds to their convenience, enhancing their market presence. The variety within this segment is considerable, offering everything from biodegradable to potent chemical-based options, thus meeting a wide array of consumer needs and market demands.

Analysis by Composition:

- Alcohols

- Chlorine Compounds

- Hydrogen Peroxide

- Quaternary Ammonium Compounds

- Peracetic Acid

- Others

Alcohols are the largest segment, and their widespread adoption is driven by their ability to quickly inactivate many microorganisms and their rapid evaporative tendency, leaving minimal residue. Alcohol-based disinfectants, mainly consisting of ethanol and isopropanol, are particularly valued for their broad-spectrum antimicrobial activity, quick action, and user-friendliness. According to a report published in the Centers for Disease Control and Prevention, ethyl alcohol was tested against Mycobacterium tuberculosis, and the results showed that 95% ethanol destroyed the tubercle bacilli in sputum or water suspension in under 15 seconds. These properties make them indispensable in healthcare, food processing, and personal hygiene products. The widespread use of ethanol-based disinfectants in various applications, including medical formulations and personal care items, is attributed to their effective antimicrobial properties against viruses, bacteria, and fungi.

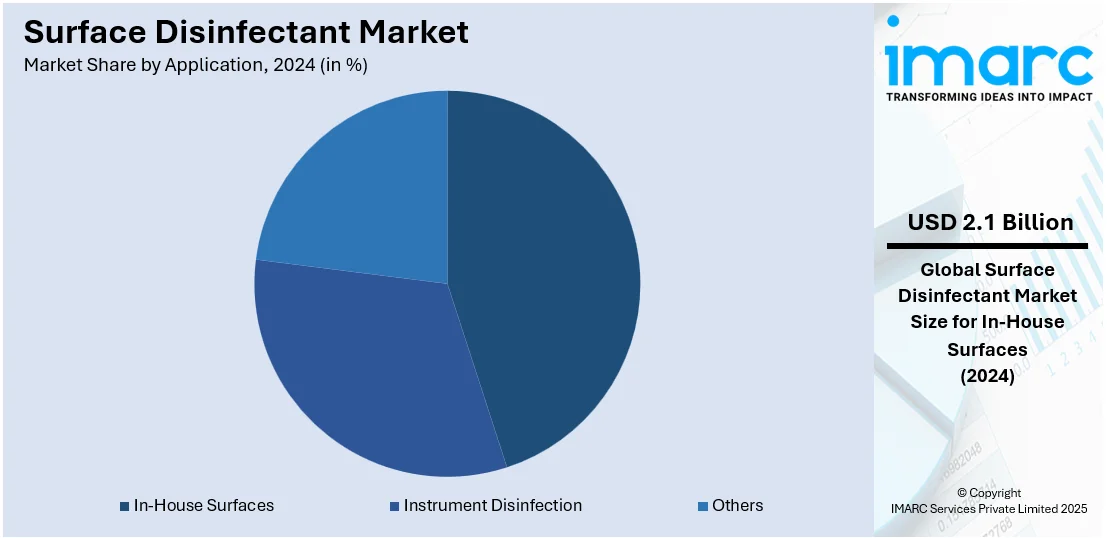

Analysis by Application:

- In-House Surfaces

- Instrument Disinfection

- Others

In-house surfaces stand as the largest component in 2024, holding 33.3% of the market share. The in-house surfaces segment is the largest as there is an extensive utilization of disinfectants in residential and commercial environments to uphold the highest standards of hygiene and prevent the spread of infectious diseases. After a 52-week survey, the home cleaning product with the largest multi-outlet sales in the US was an all-purpose cleaner/disinfectant, with sales of over 1.7 Billion dollars on September 10, 2023. The leading position of this segment is largely due to accelerating public awareness regarding cleanliness and the preventive use of regular disinfection as a means to reduce pathogen transmission. This demand is especially notable in environments such as households, healthcare settings, schools, and business premises, where there are numerous high-touch surfaces. The escalation in consumer spending on disinfectants for in-house use significantly propels the market, creating a landscape where safety and cleanliness are essential.

Analysis by End User:

- Hospitals

- Laboratories

- Households

- Others

Hospitals lead the market with 18.7% of the market share in 2024. Hospitals account for the majority of the market share and play a crucial role in upholding stringent hygiene and infection control standards. The prominence of this segment is due to the essential, uncompromising requirement for effective surface disinfection in healthcare environments to prevent healthcare-associated infections (HAIs), manage outbreaks, and ensure a safe setting for patients, staff, and visitors. Hospitals necessitate a broad spectrum of disinfectants capable of eliminating various pathogens, including those that are multi-drug-resistant, to meet regulatory standards and guidelines. The increased investments in healthcare infrastructure and a heightened focus on infection prevention, especially following global health emergencies, have significantly propelled the demand for surface disinfectants. The sector's steadfast dedication to advanced disinfection methodologies underscores its central importance in the broader surface disinfectant market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.02%. North America leads the market in terms of regional segmentation which can be attributed to its robust healthcare infrastructure, significantly higher regulatory standard fulfillment of hygiene and infection control processes, and increased awareness. The regional market is predominantly driven by the United States due to its large-scale healthcare system, a wide array of commercial and industrial applications, and the presence of major market players that manufacture disinfectants. Health and safety regulations and the proactive approach towards the adoption of innovative disinfecting methods propel the surface disinfectant demand in the region. The American Health Association's 2024 statistics indicate that there were around 33,679,935 hospital admissions. Numerous chronic illnesses and necessary treatments such as heart bypass surgery were the cause of many of these hospitalizations. As a result, it is anticipated that the rising number of hospital admissions is also influencing demand for surface disinfectants and expanding the market in the area.

Key Regional Takeaways:

United States Surface Disinfectant Market Analysis

The United States accounts 85.60% of the market share and has emerged as a key adopter of surface disinfectants, leveraging their application to bolster public health and safety across diverse environments. Two significant advantages driving this adoption include enhanced infection control in healthcare settings and improved sanitation in high-traffic public spaces. Hospitals and clinics across states are extensively using surface disinfectants to mitigate healthcare-associated infections, safeguarding both patients and staff. For instance, according to CDC, surface disinfectants like ethyl alcohol (70%) and isopropyl alcohol (70%) show rapid bactericidal, virucidal, and fungicidal efficacy in healthcare settings. Furthermore, these products play a critical role in maintaining hygiene in schools, offices, and public transportation systems, particularly in densely populated regions. One key driver of the surface disinfectant market in the USA is the lasting impact of the COVID-19 pandemic on cleaning habits. A survey conducted by SC Johnson in November 2023 revealed that 61% of Americans, particularly young adults, believe the pandemic has improved their cleaning habits. This shift towards heightened hygiene awareness continues to drive demand for surface disinfectants across various sectors, including healthcare, education, hospitality, and commercial spaces. The widespread availability and use of these disinfectants have positioned the United States as a leader in implementing advanced cleaning protocols, fostering a safer and healthier environment in both urban and rural areas.

Asia Pacific Surface Disinfectant Market Analysis

The Asia-Pacific region is emerging as a key market for surface disinfectants, driven by its dense population, rapid urbanization, and growing awareness of hygiene standards. In the Asia-Pacific region, the risks of HAIs have been estimated to be 2–20 times higher than in developed countries, with up to 25% of hospitalized patients reported to have acquired infections. In response to the COVID-19 pandemic, companies like ITC expanded their hygiene portfolio by launching products like Savlon Surface Disinfectant Spray and Savlon Hexa hand sanitizer, which in turn favored the market growth. Surface disinfectants are being extensively used in hospitals for sterilizing medical equipment, in schools to maintain cleanliness, and in public transportation to reduce microbial spread. This rising usage is particularly critical in densely populated urban hubs in the region where disease transmission risks are high. Two major advantages of surface disinfectants include their ability to eliminate harmful pathogens and their versatility across various surfaces such as glass, plastic, and metal. With governments emphasizing hygiene campaigns and businesses prioritizing cleanliness, Asia-Pacific is positioned to lead in the adoption of advanced disinfectant solutions, ensuring public safety and health.

Europe Surface Disinfectant Market Analysis

The surface disinfectant market in Europe is driven by several key factors, including heightened awareness around hygiene, regulatory standards, and the ongoing demand for infection control solutions. The COVID-19 pandemic significantly accelerated the demand for disinfectants, reinforcing the importance of cleanliness in public and private spaces. As a result, the market saw a surge in disinfectant product usage across healthcare facilities, schools, hospitality, and offices. According to ECDC, approximately 4.3 Million people acquire a healthcare‑associated infection (HAI) each year in acute care hospitals in EU. Regulatory standards, particularly in healthcare settings, continue to push the need for effective and certified disinfectant products. The European Union’s regulations on chemical safety and hygiene protocols ensure that surface disinfectants meet specific criteria for efficacy and safety. Furthermore, the rise in industrial cleaning, coupled with the growing trend of environmentally friendly products, has led to increased demand for eco-friendly disinfectants. As consumers and businesses become more conscious of sustainability, there is a shift toward disinfectants with minimal environmental impact, contributing to market growth.

Latin America Surface Disinfectant Market Analysis

The Latin America is witnessing a significant rise in the adoption of surface disinfectants, driven by increasing hygiene awareness and public health initiatives. This region's diverse urban centers, rural communities, and healthcare hubs are integrating disinfectants for applications ranging from hospitals and schools to public transportation and households. According to the ITA, Brazil is the largest healthcare market in Latin America and spends 9.47% of its GDP on healthcare, which represents USD161 Billion. A recent SC Johnson survey revealed that 63% of Brazilians adopted new surface disinfection habits during the COVID-19 pandemic. The growing focus on infection control and pandemic preparedness underscores the pivotal role of surface disinfectants in enhancing Latin America's health standards.

Middle East and Africa Surface Disinfectant Market Analysis

In the Middle East and Africa (MEA), the surface disinfectant market is driven by a combination of factors, including rapid urbanization, government initiatives, and a growing awareness of hygiene, particularly in healthcare settings. The region's healthcare infrastructure is expanding, with hospitals and medical facilities increasingly prioritizing infection prevention measures. For instance, Saudi Arabia is set to open five new hospitals by 2025, adding 963 beds across key provinces. The COVID-19 pandemic further underscored the importance of cleaning and sanitation, leading to continued demand for disinfectant products. In addition, governments in the MEA region have implemented stricter regulations and standards regarding hygiene and safety in public spaces, which has increased the demand for effective disinfectant solutions. The region’s increasing focus on tourism, hospitality, and industrial development also contributes to the need for surface disinfectants, as businesses seek to maintain cleanliness and adhere to health and safety protocols. With 74 Million in the Arab region lacking access to basic handwashing facilities and daily household water demand increasing by 4-5 Million cubic meters, surface disinfectants provide a critical alternative in mitigating risks like COVID-19.

Competitive Landscape:

The key players in the surface disinfectant market are investing in R&D to launch cutting-edge, efficient, and eco-friendly products. They are also expanding their product range to adapt to changing consumer needs for upgraded disinfecting solutions, spurred by increasing health concerns in the aftermath of global health crises. Moreover, these companies are prioritizing mergers and acquisitions (M&As) and collaborations, including joint ventures and partnerships with distributors, to broaden their global presence and reach a wider customer base. Additionally, they are channeling investments into technological innovations, such as IoT-connected automatic dispensers and environment friendly compositions, to meet the market's demand for sustainability and efficiency, which are pivotal in shaping market trends. In 2024, Klin Space, a brand dedicated to providing safe and environment friendly cleaning solutions, carried out an exciting rebranding to reflect its core values as they bring the business to the online market. The company launched innovative organic products in cleaning solution sector.

The report provides a comprehensive analysis of the competitive landscape in the surface disinfectant market with detailed profiles of all major companies, including:

- 3M Company

- BASF SE

- Betco

- CarrollCLEAN

- Ecolab Inc.

- Evonik Industries AG (RAG-Stiftung)

- Henkel AG & Co. KGaA

- Johnson & Johnson Private Limited

- Medline Industries Inc.

- Metrex Research LLC

- Reckitt Benckiser Group PLC

- STERIS plc

- The Clorox Company

- The Procter & Gamble Company

Latest News and Developments:

- May 2024: Diversey, a Solenis company, introduced Oxivir® Three 64, a one-step hospital disinfectant cleaner. This solution is bactericidal, virucidal, and fungicidal, achieving efficacy in three minutes at a 1:64 dilution. With over 70 disinfectant claims, it leads Diversey's Accelerated Hydrogen Peroxide® (AHP®) product line. Designed for healthcare settings, it is gentle on users and surfaces, requiring no personal protective equipment.

- November 2024: Byotrol announced the launch of Anigene Professional Surface Disinfectant Wipes, the first and only plastic-free surface wipe which is compliant with all biocidal regulations.

Surface Disinfectant Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquids, Wipes, Sprays, Others |

| Compositions Covered | Alcohols, Chlorine Compounds, Hydrogen Peroxide, Quaternary Ammonium Compounds, Peracetic Acid, Others |

| Applications Covered | In-House Surfaces, Instrument Disinfection, Others |

| End Users Covered | Hospitals, Laboratories, Households, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, BASF SE, Betco, CarrollCLEAN, Ecolab Inc., Evonik Industries AG (RAG-Stiftung), Henkel AG & Co. KGaA, Johnson & Johnson Private Limited, Medline Industries Inc., Metrex Research LLC, Reckitt Benckiser Group PLC, STERIS plc, The Clorox Company, The Procter & Gamble Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the surface disinfectant market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global surface disinfectant market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the surface disinfectant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Surface disinfectants are chemical agents designed to eliminate or inactivate harmful pathogens, such as bacteria, viruses, and fungi, on surfaces to prevent the spread of infectious diseases. They are widely used in healthcare, commercial, industrial, and residential settings to ensure cleanliness and hygiene.

The global surface disinfectant market was valued at USD 6.16 Billion in 2024.

IMARC estimates the global surface disinfectant market to exhibit a CAGR of 5.6% during 2025-2033.

The market is driven by increasing awareness of hygiene practices, the growing prevalence of healthcare-associated infections (HAIs), stringent regulatory compliance, and the rising demand for eco-friendly and advanced disinfectant solutions across residential, healthcare, and industrial sectors.

In 2024, liquids represented the largest segment by type, driven by their affordability, versatility, and ability to cover large surface areas efficiently.

Alcohols lead the market by composition owing to their rapid antimicrobial action, broad-spectrum efficacy, and widespread use in healthcare and food processing applications.

The in-house surfaces segment is the leading segment by application, driven by its extensive use in residential, commercial, and institutional cleaning to maintain high hygiene standards.

The hospital segment is the leading segment by end user, driven by the critical need for infection control, prevention of HAIs, and adherence to strict regulatory standards in healthcare settings.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global surface disinfectant market include 3M Company, BASF SE, Betco, CarrollCLEAN, Ecolab Inc., Evonik Industries AG (RAG-Stiftung), Henkel AG & Co. KGaA, Johnson & Johnson Private Limited, Medline Industries Inc., Metrex Research LLC, Reckitt Benckiser Group PLC, STERIS plc, The Clorox Company, The Procter & Gamble Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)