Supply Chain Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2025-2033

Supply Chain Analytics Market Size and Share:

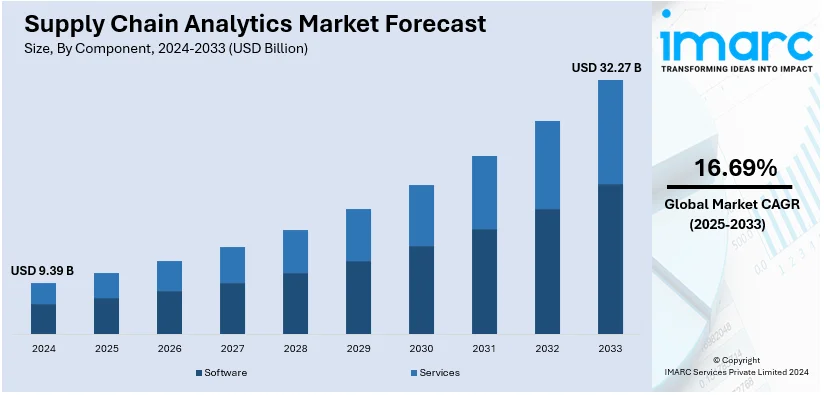

The global supply chain analytics market size was valued at USD 9.39 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 32.27 Billion by 2033, exhibiting a CAGR of 16.69% from 2025-2033. North America currently dominates the market, holding a market share of over 36.9% in 2024. The growth of the North American region is driven by technological advancements, robust e-commerce activity, and increasing adoption of supply chain analytics.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 9.39 Billion |

| Market Forecast in 2033 | USD 32.27 Billion |

| Market Growth Rate (2025-2033) | 16.69% |

Organizations are relying on real-time analytics to monitor and optimize their supply chain operations. These solutions provide actionable insights, enabling businesses to improve efficiency, adapt to market changes, and enhance decision-making, ensuring competitiveness in dynamic environments. Furthermore, the integration of advanced technologies such as artificial intelligence (AI), machine learning (ML), big data, and the internet of things (IoT) are revolutionizing supply chain analytics. These innovations enhance predictive and prescriptive analytics, enabling businesses to forecast demand accurately, manage risks proactively, and optimize operations with precision. Besides this, businesses are using analytics to identify inefficiencies, reduce operational costs, and improve profitability. These tools offer detailed insights into procurement, inventory management, and logistics, helping organizations allocate resources effectively and maximize return on investment.

The United States is pivotal in the market, supported by progress in integrated analytics solutions provided by leading technology companies. These solutions allow companies to obtain real-time, tailored dashboards and reports that improve decision-making and optimize operations. In 2024, AWS revealed that AWS Supply Chain now includes embedded analytics driven by Amazon QuickSight. This functionality offers adjustable dashboards and reports to improve supply chain activities, integrating smoothly with current applications such as Demand Planning. It can be found in specific areas, such as the US, Europe, and Asia-Pacific. In addition to this, the rise of online shopping is bringing challenges in logistics, inventory control, and customer satisfaction. Supply chain analytics is essential for handling demand fluctuations, optimizing last-mile deliveries, and fulfilling user expectations, which encourages its use in the e-commerce industry.

Supply Chain Analytics Market Trends:

Rising Digital Transformation of Businesses

The growing digital transformation of businesses is currently exerting a positive influence on the expansion of the supply chain analytics market. According to World Bank data, between April 2020 and December 2022, the proportion of microbusinesses (those with less than four employees) investing in digital solutions doubled from 10% to 20%, while the rate for large businesses (those with more than 100 employees) tripled from 20% to 60%. Besides this, organizations are continually investing in advanced data analytics technologies and tools to harness the power of big data. This investment is enabling businesses to capture, store, and analyze vast amounts of supply chain data in real time. As a result, companies are better equipped to make correct decisions and optimize their supply chain operations continuously. Furthermore, the inclusion of artificial intelligence (AI) and machine learning (ML) algorithms into supply chain analytics solutions is enhancing its functionalities. These technologies enable predictive and prescriptive analytics, allowing businesses to anticipate demand fluctuations, optimize inventory levels & recognize disruptions or bottlenecks in the supply chain.

Increasing Demand for End-to-end Visibility and Transparency in Supply Chains

The rising need for comprehensive insight and clarity in supply chains is driving the demand for the supply chain analytics. Companies in different sectors are acknowledging the vital significance of having real-time insights into their supply chain activities. They are progressively allocating resources to sophisticated analytics solutions to achieve ongoing insight into all aspects of their supply chain, ranging from raw material procurement to final product distribution. In a study carried out by a leading consulting firm, roughly 93% of organizations reported their intention to keep boosting investments in data and analytics. Additionally, businesses are actively adopting supply chain analytics systems that can monitor, track, and analyze data from countless sources, such as suppliers, logistics companies, and internal processes. This immediate monitoring allows them to quickly address disruptions, pinpoint bottlenecks, improve inventory levels, and boost overall operational efficiency. Additionally, the increasing individual knowledge regarding product traceability, sustainability, and ethical sourcing is motivating companies to offer complete transparency into their supply chains.

Growing Online Shopping Activities of Individuals

The increasing online shopping activities of individuals are bolstering the demand for supply chain analytics. Global B2C e-commerce revenue is predicted to reach USD 5.5 Trillion by 2027 at a consistent 14.4% compound annual growth rate, according to data from the International Trade Administration. Besides this, as consumers increasingly turn to online platforms to make their purchases, businesses are confronted with a multitude of challenges in managing their supply chains efficiently. These challenges include fluctuating demand patterns, complex logistics, and the need for real-time visibility into inventory and order fulfillment. In response to these evolving requirements, companies are turning to supply chain analytics solutions as a means to gain actionable insights and optimize their operations. Furthermore, there is a rise in the maintenance of supply chain resilience and agility, driven by factors, such as global disruptions and unexpected events. The continuous growth of online shopping intensifies the importance of supply chain analytics in risk mitigation, enabling organizations to proactively identify vulnerabilities, develop contingency plans, and ensure business continuity.

Blockchain Integration to Provide Data Clarity

The convergence of blockchain technology with supply chain analytics signifies a major trend promoting efficiency, accountability, and data transparency in various sectors. Utilizing blockchain's decentralized and unchangeable ledger technology, supply chain operations achieve improved traceability, guaranteeing that each transaction or transfer of goods is precisely documented and confirmed. This ability reduces risks linked to fraud, mistakes, and inefficiencies, while promoting trust between stakeholders. Moreover, blockchain's capacity to facilitate data exchange among supply chain stakeholders improves decision-making and operational flexibility. The necessity for such solutions is increasingly driven by the rising need for adherence to sustainability standards and ethical sourcing, as blockchain facilitates immediate tracking of materials and products from their origin to the final consumer. These developments establish blockchain as a crucial instrument in promoting market expansion and transforming supply chain management approaches. In 2024, SmartMatrix unveiled its blockchain and AI integrated platform to improve supply chain management.

Supply Chain Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global supply chain analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, enterprise size, and industry vertical.

Analysis by Component:

- Software

- Demand Analysis and Forecasting

- Supplier Performance Analytics

- Spend and Procurement Analytics

- Inventory Analytics

- Transportation and Logistics Analytics

- Services

- Professional

- Support and Maintenance

Software (demand analysis and forecasting, supplier performance analytics, spend and procurement analytics, inventory analytics, and transportation and logistics analytics) leads the market with 27.6% of market share in 2024. The software segment holds the biggest market share, driven by its ability to offer tailored insights across various operational areas. Tools like demand analysis and forecasting help businesses predict customer needs accurately, reducing overstock or stockouts. Supplier performance analytics enhances vendor relationships by evaluating delivery timelines, quality metrics, and overall reliability, leading to better decision-making. Spend and procurement analytics provide visibility into purchasing patterns, enabling cost savings and streamlined supplier selection. Inventory analytics ensures optimized stock levels by analyzing turnover rates, demand variability, and storage costs, minimizing waste and improving efficiency. Transportation and logistics analytics enhance route optimization, carrier selection, and freight cost management, resulting in faster deliveries and reduced expenses. These solutions collectively empower businesses with real-time data visualization and actionable insights, fostering agility and competitiveness.

Analysis by Deployment Mode:

- On-premises

- Cloud-based

On-premises dominates the market with a 61.2% share in 2024. On-premises supply chain analytics entails implementing and managing analytics software and tools within the organization’s own infrastructure, providing greater control and customization. This method enables organizations to customize their analytics environment to match particular operational requirements and business objectives, ensuring smooth integration with current systems. By overseeing the complete analytics stack internally, companies can enforce strong security measures, access controls, and data governance protocols, essential for sectors handling sensitive data or strict regulatory requirements. Additionally, on-premises solutions remove reliance on external networks, providing quicker data access and processing, particularly in areas with inconsistent or poor internet connection. This configuration is especially beneficial for organizations dealing with large data volumes and applications that are sensitive to latency. Moreover, on-premises analytics offers lasting financial advantages by eliminating ongoing cloud subscription expenses. It also provides the capability to maintain complete ownership and control of data, safeguarding privacy and reducing risks tied to third-party data management.

Analysis by Enterprise Size:

- Large Enterprises

- Small and Medium Enterprises

Large enterprises lead the market with 58.9% of market share in 2024. Large enterprises require supply chain analytics to enhance efficiency, competitiveness, and profitability by addressing the complexities of their operations. Analytics enables these organizations to better understand demand patterns, lead times, and seasonality, allowing for precise forecasting and inventory management. With complex manufacturing and distribution networks, supply chain analytics helps streamline operations, minimize lead times, and optimize resource allocation, improving overall operational efficiency. Moreover, by leveraging analytics, large enterprises can enhance client service through better order accuracy, shorter delivery times, and the ability to meet user demands effectively. Additionally, supply chain analytics supports adherence to environmental, social, and governance (ESG) standards by tracking compliance and identifying areas for improvement. It also plays a key role in mitigating risks, identifying potential disruptions, and developing contingency plans.

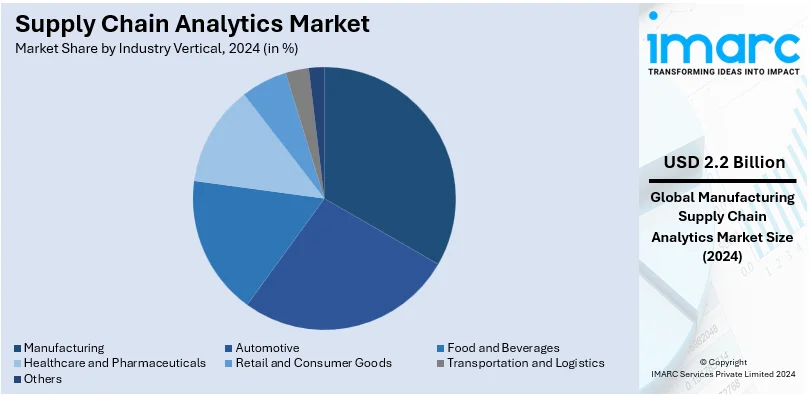

Analysis by Industry Vertical:

- Automotive

- Food and Beverages

- Healthcare and Pharmaceuticals

- Manufacturing

- Retail and Consumer Goods

- Transportation and Logistics

- Others

Manufacturing leads the market with 23.8% of market share in 2024. Supply chain analytics plays a crucial role in optimizing the manufacturing sector by enabling producers to predict demand more accurately through the analysis of historical sales data, market trends, and economic indicators. This precision allows for improved production planning and the prevention of overproduction or stockouts. Manufacturers use analytics to optimize inventory levels by evaluating factors such as lead times, demand variability, and production capacity, which helps determine the ideal stock levels to lower carrying costs while maintaining product availability. Additionally, supply chain analytics streamlines production schedules, reducing downtime by identifying bottlenecks and ensuring alignment with demand forecasts. In logistics, it enhances efficiency by optimizing transportation routes, selecting cost-effective carriers, and minimizing shipping costs. Advanced analytics also provides insights into supplier performance, helping manufacturers build stronger, more reliable partnerships.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America represented the largest share of the market at 36.9%. North America leads the market because of its sophisticated technological framework and a significant emphasis on digital transformation in various sectors. The area gains advantages from the extensive use of advanced analytical tools, artificial intelligence, and machine learning, which are incorporated into supply chain processes to improve efficiency and decision-making. Furthermore, the area hosts many global technology suppliers and innovators in supply chain solutions, fostering a competitive environment that promotes ongoing progress. The regulatory framework in the area encourages the adoption of data-driven solutions, guaranteeing secure and compliant practices. Moreover, the growth of e-commerce in North America is also boosting the need for real-time tracking, inventory optimization, and predictive analytics, allowing companies to fulfill consumer demands for swift and precise deliveries. IMARC Group estimates that the e-commerce industry in the United States will attain US$ 2,083.97 Billion by 2032, demonstrating a compound annual growth rate (CAGR) of 6.80% from 2024 to 2032.

Key Regional Takeaways:

United States Supply Chain Analytics Market Analysis

In North America, the United States accounted for 80.00% of the total market share. The increasing complexity of supply networks and the requirement for real-time data-driven decision-making are driving the supply chain analytics industry in the US. With U.S. e-commerce sales reaching USD 1 Trillion in 2023 and expected to reach USD 1.22 Trillion in 2024 as per industry reports, businesses are using advanced analytics to streamline inventory control, speed up delivery, and enhance customer happiness. Artificial intelligence (AI) and machine learning (ML) are being rapidly used in supply chain operations; in 2024, several organizations reported spending more on AI-driven analytics solutions.

Strengthening the domestic production side and decreasing dependence on foreign supply chains through government programs is the CHIPS Act for the semiconductor industry. The increasing cybersecurity risks and regulations compliance are pushing the adoption of predictive and prescriptive analytics to avoid risks. Analytics help supply chain resilience, supplier performance assessments, and demand forecasting make the retail and healthcare sectors important drivers as well.

Europe Supply Chain Analytics Market Analysis

The market for supply chain analytics in Europe is driven by the region's focus on digital transformation, sustainability, and compliance with stringent laws. The European Union's Green Deal and carbon neutrality goals are driving businesses to use analytics to monitor carbon footprints and optimize resource usage. According to data from European Commission, around 33% of European businesses used analytics technologies in 2023 to achieve sustainability objectives.

Supply chain analytics are being driven up by digital transformation initiatives across manufacturing, retail, and automotive. The leading adopters, such as Germany, France, and the UK, utilize analytics to calculate demand, plan production, and interact with suppliers. For instance, the auto industry utilizes analytics to tackle the complexities of supply chains of electric vehicles. Moreover, the COVID-19 pandemic and current geopolitical tensions have focused attention on the necessity of Europe to reduce the potential of supply chain disruptions, thus hastening the adoption of risk analytics technologies. As reported in studies, companies using analytics in their supply chains realized a 30% gain in efficiency.

Asia Pacific Supply Chain Analytics Market Analysis

Asia-Pacific's fast-paced industrialization, the booming e-commerce industry, and its digitalization aspirations have placed it at the forefront as the region with the most rapidly growing supply chain analytics market. Heads above everyone, though, are China and India, whose upscale manufacturing facilities and ever-increasing transportation systems require them to wield sophisticated analytics tools. Statistics from the International Trade Administration indicate that business-to-business e-commerce in Asia is growing at an average of 15% in the region every year; an outgrowth which is relatively stronger than the 14.5% gross merchandise value every year that the worldwide would experience. As part of their digital transformation targets, governments in countries like Singapore, South Korea, and Japan are promoting smart supply chain solutions. For example, "Made in China 2025" program in China encourages smart manufacturing and adoption of analytics in supply chain management. Demand is growing in the market in the region because cross border trade is becoming increasingly complicated and requires efficient port operations to manage it.

Latin America Supply Chain Analytics Market Analysis

The market for supply chain analytics is growing in Latin America due to the rising popularity of e-commerce and investments in logistics infrastructure. Given the extensive activities to promote supply chains in the region, the scope of supply chain analytics is tremendous, as the top two markets are businesses that deploy analytics to enhance customer satisfaction and operational efficiency. For instance, the Inter-American Development Bank (IDB) has provided Panama with a Policy-Based Loan (PBL) of USD 200 Million for improving the competitiveness of the logistics industry by removing institutional and regulatory barriers. The desire for supply chain efficiency and transparency has also contributed to the use of analytics amid economic uncertainty. Demand forecasting and production planning analytics tools also greatly help industries like retail and agriculture, which propels regional market growth.

Middle East and Africa Supply Chain Analytics Market Analysis

The increased emphasis on logistics and trade facilitation in the Middle East and Africa is driving the market for supply chain analytics in these regions. The United Arab Emirates and Saudi Arabia lead the market as its major infrastructure projects, including Saudi Vision 2030, promote the use of supply chain management to go more digital. The adoption of analytics is also propelled by the growing retail and e-commerce industries in the region, which have more intensive requirements for efficient inventory and logistics management. Industry forecasts reveal that the e-commerce market of the Middle East is bound to surge. It is anticipated that the market will be worth USD 50 Billion by 2025. Analytics technologies also help solve problems like resource optimization and supply chain breaks, which are essential for agriculture and oil & gas sectors.

Competitive Landscape:

Major market participants are integrating IoT devices and sensors to gather real-time data from multiple points in the supply chain, allowing for improved visibility and decision-making. They are incorporating sustainability metrics into their analytic solutions to assist organizations in minimizing their carbon footprint, optimizing routes, and making environmentally friendly sourcing choices. Moreover, top firms are significantly investing in sophisticated analytics technologies, such as ML, AI, and predictive analytics, as these tools allow for improved demand forecasting, inventory optimization, and the discovery of cost-saving opportunities. They are likewise broadening their cloud services to serve more clients and deliver real-time data analysis features. In September 2023, International Business Machines Corporation revealed the growth of its IBM cloud security and compliance center designed to assist organizations in reducing risk and safeguarding data within their hybrid, multi-cloud settings and tasks.

The report provides a comprehensive analysis of the competitive landscape in the supply chain analytics market with detailed profiles of all major companies, including:

- Axway

- Capgemini SE

- International Business Machines Corporation

- Infor Inc (Koch Industries Inc.)

- Kinaxis Inc.

- Manhattan Associates Inc.

- Microstrategy Incorporated

- Oracle Corporation

- QlikTech International AB

- SAP SE

- SAS Institute Inc.

- Tableau Software LLC (Salesforce Inc.)

Latest News and Developments:

- October 2024: Infor said that it has expanded its product line to include industry-specific solutions for supply chain management (SCM) transformation. For example, sophisticated demand forecasting in retail guarantees higher consumer satisfaction, while predictive analytics in manufacturing helps optimize inventories and cut waste.

- October 2024: Everstream Analytics revealed the introduction of an innovative supply chain risk feature, Climate Risk Scores. With this new feature, Everstream becomes the first in the sector to measure the influence of key climate indicators and forecast how recognized risks will affect customer supply chains.

- December 2024: Log-hub introduced Supply Chain Analytics Pulse, an entirely complimentary resource aimed at equipping supply chain experts with advanced insights and techniques. Supply Chain Analytics Pulse is a bi-weekly publication designed for supply chain experts who aim to remain at the forefront of a constantly changing sector.

- May 2024: Marsh McLennan, the top global professional services firm specializing in risk, strategy, and workforce, unveiled Sentrisk, an innovative AI-driven platform featuring integrated advisory services aimed at transforming how companies handle international supply chain risk.

- July 2024: Accenture announced its plans to purchase Camelot Management Consultants, a global management and technology consulting firm from Germany that specializes in SAP® and has particular expertise in supply chain, data, and analytics. The purchase aims to bolster Accenture’s capabilities in SAP and AI-powered supply chains, assisting clients in developing the intelligent and robust supply chains required by the current business environment.

Supply Chain Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| Industry Verticals Covered | Automotive, Food and Beverages, Healthcare and Pharmaceuticals, Manufacturing, Retail and Consumer Goods, Transportation and Logistics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Axway, Capgemini SE, International Business Machines Corporation, Infor Inc (Koch Industries Inc.), Kinaxis Inc., Manhattan Associates Inc., Microstrategy Incorporated, Oracle Corporation, QlikTech International AB, SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the supply chain analytics market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global supply chain analytics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the supply chain analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Supply chain analytics involves analyzing data from procurement, production, inventory, and logistics to optimize operations, reduce costs, and improve efficiency. It uses descriptive, predictive, prescriptive, and cognitive analytics to identify trends, forecast demand, and enhance decision-making. By leveraging insights, businesses streamline processes, manage risks, and adapt to market changes, ensuring better performance and client satisfaction.

The supply chain analytics market was valued at USD 9.39 Billion in 2024.

IMARC estimates the global supply chain analytics market to exhibit a CAGR of 16.69% during 2025-2033.

The global supply chain analytics market is driven by increasing demand for real-time insights, rising adoption of AI and IoT in logistics, and the need to optimize operational efficiency. The growing e-commerce activity, advancements in data visualization tools, and a focus on reducing costs and improving decision-making is offering a favorable market outlook.

In 2024, software represented the largest segment by component, driven by the rising adoption of advanced analytics platforms, demand for real-time insights, and the integration of AI and ML.

On-premises leads the market by deployment mode owing to enhanced data security, better control over infrastructure, and its preference among industries with stringent compliance requirements.

Large enterprises are the leading segment by enterprise size attributed to their significant investments in advanced analytics tools, the need for supply chain optimization, and the capacity to handle complex operations and vast datasets.

Manufacturing leads the market by industry vertical due to the growing need for inventory optimization, demand forecasting, real-time tracking, and the adoption of analytics to enhance operational efficiency and reduce production costs.

On a regional level, the market has been categorized into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global supply chain analytics market include Axway, Capgemini SE, International Business Machines Corporation, Infor Inc (Koch Industries Inc.), Kinaxis Inc., Manhattan Associates Inc., Microstrategy Incorporated, Oracle Corporation, QlikTech International AB, SAP SE, SAS Institute Inc., Tableau Software LLC (Salesforce Inc.), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)