Supercapacitor Market Size, Share, Trends and Forecast by Product Type, Module Type, Material Type, End Use Industry, and Region, 2025-2033

Supercapacitor Market Size and Share:

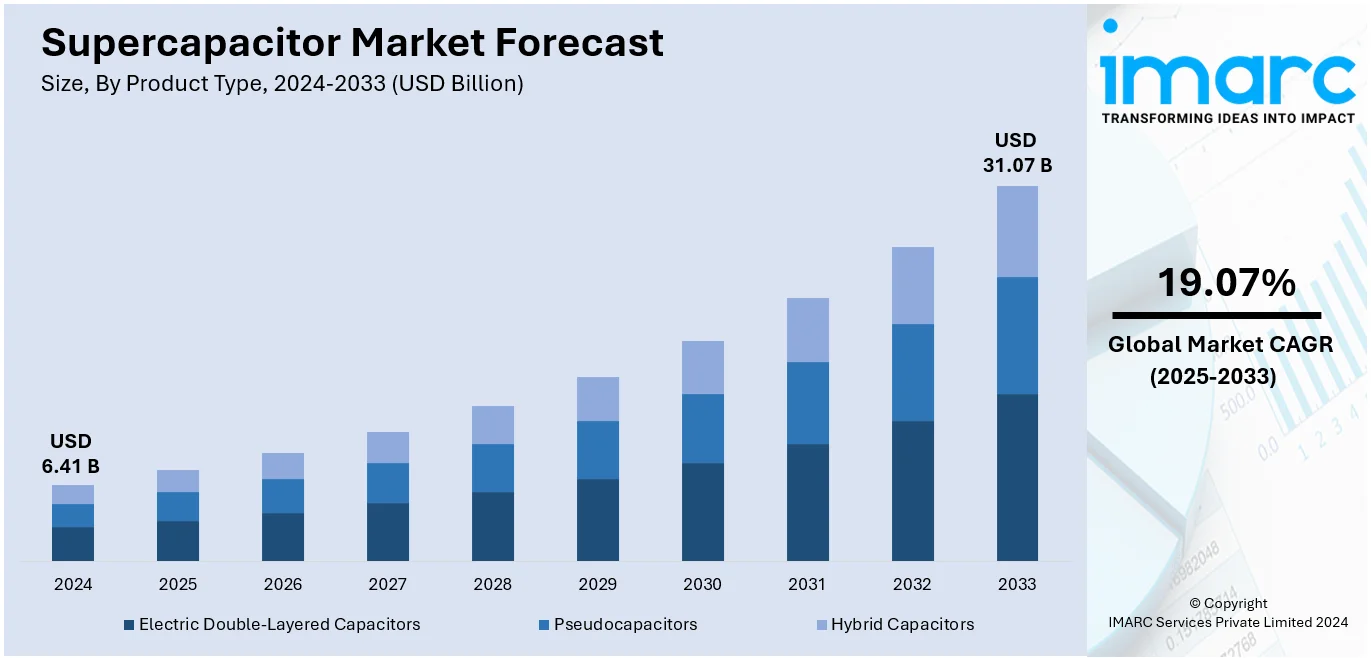

The global supercapacitor market size was valued at USD 6.41 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 31.07 Billion by 2033, exhibiting a CAGR of 19.07% from 2025-2033. Asia Pacific currently dominates the market, holding a significant market share. The market is primarily driven by the expanding renewable energy projects, growing demand for electric mobility, breakthroughs in technological advancements of energy storage, increased dependency on compact power solutions, rapid development of IoT devices, growing adoption of industrial automation, changing nature of energy recovery systems, and growing usage of sustainable, high-performance materials to deploy applications in advanced energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.41 Billion |

| Market Forecast in 2033 | USD 31.07 Billion |

| Market Growth Rate (2025-2033) |

19.07%

|

The increasing demand for energy storage systems from renewable energy systems such as solar power and wind energy drives supercapacitor market growth, as supercapacitors can offer fast energy bursts in association with batteries. Moreover, the numbers of electric and hybrid electric vehicle sales are increasing rapidly, thereby enhancing the need for supercapacitors that enable quick charging, regenerative braking, and a longer lifetime of battery. Continuous innovation in consumer electronics-from wearable gadgets to portable devices contributes to significant market expansion. For example, on September 5, 2024, researchers at the Indian Institute of Science (IISc) and Clemson University developed a light-charged supercapacitor that shows a remarkable 3,000% increase in capacitance under ultraviolet (UV) light. This innovation leverages zinc oxide (ZnO) nanorods and liquid electrolytes, enabling fast charging and high energy density. The innovation has great promise for microelectronic applications, streetlights, and self-powered gadgets. Another factor that fuels market adoption is the increasing requirement for standby power and UPS applications in critical applications such as data centers and telecommunication.

The United States supercapacitor market is primarily driven by the increasing demand for energy storage solutions across various sectors, including electronics, automotive, and renewable energy. Furthermore, advancements in material science, including the development of graphene-based supercapacitors, have enhanced their energy density and lifespan, making them increasingly viable for a broader range of applications. For instance, on November 18, 2024, researchers at NETL, U.S. National Laboratory, announced the successful conversion of coal tar pitch into high-quality graphene for use in advanced supercapacitors. This breakthrough enhances energy storage performance and reduces costs by utilizing an abundant, low-cost feedstock. The development is expected to benefit the energy storage and renewable energy sectors significantly. Besides these factors, the rising demand for compact and lightweight energy storage devices in consumer electronics and portable devices further drives innovation and adoption within the U.S. supercapacitor market.

Supercapacitor Market Trends:

Acceleration of Electric Vehicle Adoption

Electric cars are becoming increasingly popular as a clean alternative to traditional combustion-engine cars due to improvements in battery technology and favorable government incentives. According to the International Energy Agency (IEA), electric car sales approached 14 million in 2023, with 95% of the total sales occurring in China, Europe, and the United States. However, long charging times and the limited life span of batteries continue to raise consumer concerns. Supercapacitors are widely used to overcome these challenges. They can easily accept rapid charging and discharging cycles, which makes them suitable for applications such as regenerative braking or quick acceleration. Furthermore, several automakers are exploring hybrid systems combining supercapacitors and batteries to enhance the overall life of the energy storage system and improve performance. The market size for supercapacitors is projected to increase proportionally as there is an estimated exponential increase in EV adoption in the upcoming years.

Advancements in Consumer Electronics

Consumer electronics, including laptops, smartphones, and wearable devices, have seen extraordinary growth over the last decade. The global smartphone market size reached 1,517 million Units in 2024. The sophistication of these devices leads to a growing requirement for energy storage solutions with respect to fast charging and energy outflow. In this context, supercapacitors also completely meet the criterion. They feature a long operational life, a high-power output for improved device performance, and can be charged in a few seconds. In addition, consumer electronics' fast-charging trend is making producers seek supercapacitors as a feasible, efficient energy storage option. This develops an emerging market for supercapacitors in consumer electronics, thereby driving the growth of the market. The growing demand for fast-charging and efficient energy storage in consumer electronics is contributing to the expansion of the supercapacitor market share, as manufacturers incorporate supercapacitor technology to enhance device performance and meet user needs.

Increasing Industrial Automation and IoT Applications

Industrial automation and internet of things (IoT) applications are transforming sectors such as health care, manufacturing, and supply chain management. Applications often incorporate sensors and other small devices, which demand dependable, fast, and efficient energy storage solutions. According to IoT Analytics, the number of connected IoT devices is expected to grow by 13% by the end of 2024. Supercapacitors are suitable for demanding environments due to their quick charge and discharge properties and long cycle life. These supercapacitors offer rapid energy bursts, which are frequently required to operate machines flawlessly in automated industries. Supercapacitors are increasingly being deployed in IoT devices that necessitate a compact, reliable source of power. As the two fields of industrial automation and IoT advance in growth, there is an increasing demand for advanced energy storage solutions, which is also providing a favorable supercapacitor market outlook.

Supercapacitor Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global supercapacitor market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type, module type, material type, and end use industry.

Analysis by Product Type:

- Electric Double-Layered Capacitors

- Pseudocapacitors

- Hybrid Capacitors

Pseudocapacitors is the market leader in 2024. They are a special type of supercapacitor that provides higher energy density due to the faradaic reactions that take place at the electrode-electrolyte interface. Therefore, they are especially well-suited for uses requiring both high energy and great power density. One of the major market drivers for pseudocapacitors is their increasing application in portable electronics. Pseudocapacitors are emerging as a strong, reliable solution for consumers seeking devices with longer battery life, faster charging capabilities, and quick energy delivery. They are suitable for medical applications, were immediate, reliable power are critical. Another area in which pseudocapacitors are gaining increased usage is the growing domain of the Internet of Things (IoT). This is due to IoT devices are frequently in need of energy-efficient, long-lasting, and fast-response power sources. Furthermore, continuous research and development (R&D) activities in material science related to pseudocapacitors are expected to improve their performance, thus generating better market interest.

Analysis by Module Type:

- Less than 25V

- 25-100V

- More than 100V

In 2024, the market will be dominated by modules with less than 25V. In the supercapacitor market, this module type is in high demand due to its adaptability to a wide range of end-use systems. Additionally, the growing consumer electronics sector, where these low-voltage modules are well-suited for gadgets, is significantly supporting the market. Less than 25V supercapacitors are excellent in providing rapid cycles of charge and discharge without sacrificing longevity, which is required by devices in their energy storage solutions. In addition, low-voltage supercapacitors are used more in industrial settings for control systems, sensors, and backup power supplies. They are perfect for maintaining manufacturing processes' operational continuity because of their consistent, fast energy bursts. The expansion of the internet of things (IoT) is also a significant element since small internet of things (IoT) devices that require effective, long-lasting power sources can use low-voltage supercapacitors. Considering these versatile applications that require reliable and efficient low-voltage energy storage solutions, the market for less than 25V module type supercapacitors is set to grow at a tremendous rate.

Analysis by Material Type:

- Carbon and Metal Oxide

- Conducting Polymer

- Composite Materials

Carbon and metal oxide material types will lead the market in 2024. They play a vital role in driving the supercapacitor industry, with each bringing its market drivers. Carbon-based supercapacitors are popular as the material allows for a more significant surface area, storing more energy. They are used in automotive applications, consumer electronics, and renewable energy systems as they are cost-effective and highly conductive electrically. Metal oxide-based supercapacitors, which include ruthenium oxide, have high energy, and power density. These are mainly targeted for specialized applications that require high-performance metrics, such as aerospace applications and medical devices. In addition, the growing research in nanotechnology is leading to the further enhancement of their properties, thereby making the materials more efficient and scalable. Also, the demand in the industries for sustainable solutions for high-performance energy storage products will lead to the growth of carbon and metal oxide types of materials.

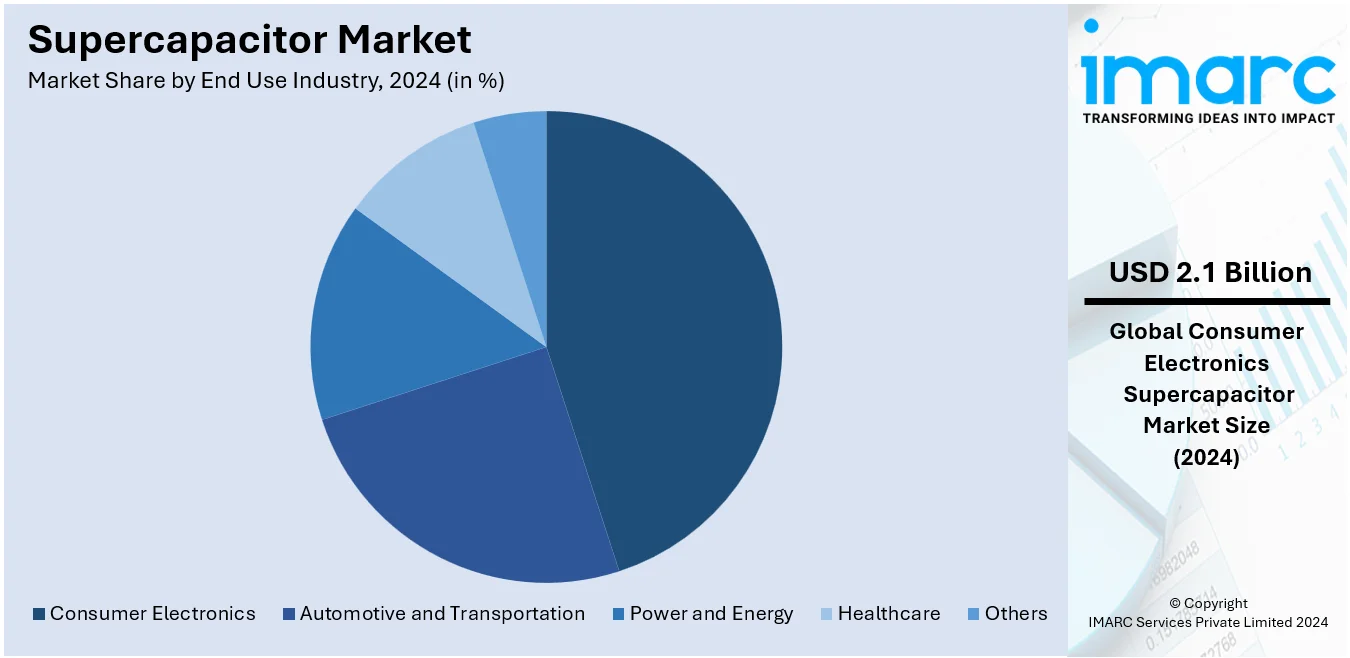

Analysis by End Use Industry:

- Automotive and Transportation

- Consumer Electronics

- Power and Energy

- Healthcare

- Others

Consumer electronics hold a notable supercapacitor market share due to the increasing demand for fast-charging devices with high energy efficiency levels. Enhanced smart devices, such as smartphones, laptops, and wearables, require energy storage that can support the rapid rate of charging with longevity properties. Supercapacitors, especially of low voltage, fulfill these needs effectively and hence have great appeal for consumer electronics applications. Additionally, as the devices become more compact and integrated, supercapacitors are advantageous as they have a smaller form factor than traditional batteries, without losing energy. Another trend that propels the supercapacitor market is wireless and portability-oriented gadgets, which generally require short bursts of high energy to operate the device appropriately. The threshold level for battery life and charging rates is also raised by consumers' growing demands for device performance; by using a supercapacitor to meet these demands, manufacturers may gain an advantage in the supercapacitor market in the forecast period.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific holds the largest market share. The Asia Pacific region is emerging as a significant market driver for the supercapacitor industry, driven by technological advancements, industrial growth, and favorable government initiatives. The rapid adoption of electric vehicles (EVs) in countries such as China and Japan contribute significantly to market growth. Supercapacitors are experiencing a rising demand due to the requirements for fast-charging solutions and regenerative braking systems. Asia Pacific is a center to produce consumer electronics. Therefore, supercapacitors are also increasingly being used in the region. Countries such as South Korea and Taiwan, which dominate the manufacture of portable devices like smartphones, find a growing demand for energy storage solutions. Additionally, the growing trend of renewable energy projects in India and China is pushing for dependable energy storage, to which supercapacitors are more suited. In addition, government policies and subsidies, along with research grants, are also motivating companies to invest in supercapacitor technology.

Key Regional Takeaways:

United States Supercapacitor Market Analysis

The U.S. supercapacitor market is experiencing robust growth, fueled by significant advancements in electric vehicles (EVs), renewable energy, and consumer electronics. According to the International Energy Agency (IEA), new electric car registrations in the United States totaled 1.4 Million in 2023, marking a more than 40% increase compared to 2022. This rise in EV adoption is driven by government policies promoting green technologies and sustainability, creating a strong demand for energy storage solutions like supercapacitors. Supercapacitors, known for their high-power density and rapid charging capabilities, are essential for enhancing battery performance and enabling functions such as regenerative braking in EVs. Moreover, the U.S. government's focus on clean energy and grid modernization is driving the integration of supercapacitors into energy storage systems, which is supporting various renewable energy sources such as solar and wind. Another factor fueling the market growth is the increased application of supercapacitors in consumer electronic devices, such as smartphones and wearables. Also, the telecommunication and manufacturing sectors mainly depend on the need for high power backup and energy efficiency, which contributes to market growth. The hybrid power systems, where supercapacitors work alongside conventional batteries, are also driving innovation, creating new opportunities across diverse sectors, and contributing to the overall supercapacitor market growth.

Asia Pacific Supercapacitor Market Analysis

The supercapacitor market in the Asia-Pacific (APAC) region is experiencing notable expansion fueled by swift industrial development, urban growth, and the extensive use of electric vehicles. The World Bank points out that East Asia and the Pacific is the quickest urbanizing area in the world, experiencing an average annual urbanization rate of 3%. This urban growth is driving the need for sophisticated energy storage options such as supercapacitors, especially in electric vehicles (EVs), as they improve battery efficiency and support functionalities like regenerative braking. China serves as a significant market catalyst, as the government emphasizes green technologies, electric mobility, and cutting down carbon emissions. Furthermore, the growing adoption of renewable energy in the area is fueling the demand for supercapacitors for grid stabilization and energy storage solutions. Nations like Japan, South Korea, and India are witnessing considerable expansion in the consumer electronics sector, which is increasing the need for supercapacitors in gadgets such as smartphones, wearables, and IoT devices. Investments in research and development are improving the performance and acceptance of supercapacitors in multiple sectors.

Europe Supercapacitor Market Analysis

The European supercapacitor market is experiencing strong growth, driven by a focus on sustainability, energy efficiency, and the transition to renewable energy. According to the International Energy Agency (IEA), while electric car sales are increasing globally, they remain significantly concentrated in a few major markets, with Europe accounting for 25% of global electric car sales in 2023. This surge in EV adoption in Europe is spurred by stringent government regulations aimed at reducing carbon emissions and promoting green technologies, creating high demand for energy storage solutions like supercapacitors. Supercapacitors, with their fast-charging capabilities and high power density, are increasingly integrated into EVs to improve battery performance, especially for functions like regenerative braking and energy recovery. Additionally, the growing need for energy storage systems to support renewable energy integration further drives the market. Supercapacitors play a crucial role in stabilizing the grid by storing excess energy from solar and wind power for later use. Furthermore, the expanding consumer electronics market in Europe, especially in countries like Germany, France, and the UK, is contributing to the supercapacitors demand in devices like smartphones, wearables, and IoT systems. With ongoing investments in R&D and government support, the European supercapacitor market is poised for continued growth.

Latin America Supercapacitor Market Analysis

The supercapacitor market in Latin America is fueled by the area's transition to renewable energy and the increasing need for electric vehicles (EVs). The International Energy Agency (IEA) approximates that nearly two-thirds of the region's energy mix is generated from fossil fuels, significantly lower than the global average of 80%. This is mainly attributed to the 60% contribution of renewables in electricity generation, with hydropower representing 45% of the area's electricity supply. With the region prioritizing clean energy integration and electric vehicle adoption, the need for energy storage options such as supercapacitors is rising.

Middle East and Africa Supercapacitor Market Analysis

The Middle East supercapacitor market is on the rise since the region has been turning toward more environmentally friendly energy sources and EV adoption. According to EMBER, the region’s energy mix is dominated by gas and oil, with minimal coal use. In 2023, 76% of the power was generated from gas, while 18% came from other fossil fuels. This heavy reliance on fossil fuels is propelling the need for efficient energy storage systems such as supercapacitors, especially as the region also strives to integrate renewable sources of energy. Moreover, the increasing demand for EVs is further driving the market for supercapacitors in the region.

Competitive Landscape:

The main participants in the market are actively involved in different efforts to promote technology and its uses. Many are concentrating on research and development (R&D) efforts to improve the energy storage capability, power density, and overall effectiveness of supercapacitors. Moreover, they are investigating methods to enhance the cost-effectiveness and sustainability of production processes. Moreover, businesses are partnering with academic and research organizations to obtain knowledge on novel materials and designs. This study-focused strategy seeks to enhance supercapacitors for various sectors, such as automotive, electronics, renewable energy, and consumer electronics. In addition to this, firms are creating supercapacitors intended for electric vehicles, as their rapid charging and discharging abilities can improve regenerative braking systems and overall energy effectiveness. Additionally, they are investigating incorporation into renewable energy systems for quick energy storage and release, supporting the variable nature of solar and wind power production. The supercapacitor market forecast highlights the continuous innovation by key players through R&D, aimed at improving energy storage capacity, power density, and sustainability.

The report provides a comprehensive analysis of the competitive landscape in the steel market with detailed profiles of all major companies, including:

- Cap-XX

- Cornell-Dubilier

- Eaton Corporation

- Fastcap Ultracapacitors, LLC

- Ioxus

- KYOCERA AVX Components Corporation

- Maxwell Technologies

- Nippon Chemi-Con Corporation

- Skeleton Technologies

- TDK Corporation

- Tecate Group

- VINATech Co., Ltd.

Latest News and Developments:

- January 2025: Scientists at the Daegu Gyeongbuk Institute of Science and Technology in South Korea created a solar-powered supercapacitor featuring significant energy and power density. By utilizing nickel-based compounds for the electrodes, the system reached energy densities of 35.5 Wh/kg and power densities of 2,555.6 W/kg.

- October 2024: Keltron Component Complex Limited (KCCL) has launched India’s first super-capacitor production facility in Kannur, with the first phase of the project completed. Developed in collaboration with ISRO, the facility has a daily output capability of 2,100 capacitors.

- September 2024: Scientists at the Indian Institute of Science (IISc) created a light-activated supercapacitor capable of storing energy from light, demonstrating a 3,000% boost in capacitance when exposed to illumination. This innovative supercapacitor may energize equipment such as streetlights and sensors, providing rapid charging and elevated energy density.

- August 2024: Flex and Musashi Energy Solutions collaborated to develop a hybrid supercapacitor energy solution for data center power needs. As AI-driven data centers grew rapidly, their energy demand increased and became intermittent, causing spikes that challenged grid reliability and performance.

- March 2024: Knowles Precision Devices introduced a new series of three-cell supercapacitors for voltages reaching 9V, tailored for high-power uses such as solar energy harvesting, IoT, and emergency lighting. These supercapacitors provide a compact design, high energy density, low self-discharge rates, and can endure more than 500,000 charge/discharge cycles. They are also more economical in comparison to other choices available in the market.

- January 2024: LS Materials, a South Korean company specializing in ultracapacitors, revealed a 35 billion KRW ($26 million) investment to enhance its ultracapacitor technology. The firm intends to improve its manufacturing and worldwide presence, expecting considerable expansion in the upcoming years.

- November 2023: EnyGy, an Australia-based company, developed the graphene-enhanced enyGcap supercapacitor, offering increased energy density for compact, fast energy storage. The supercapacitor integrated activated carbon electrodes with sophisticated electrolytes to provide three volts of energy.

- February 2023: KYOCERA AVX has introduced its first automotive-grade supercapacitors, the SCC Series, designed to meet the AEC-Q200 standard. These cylindrical electrochemical double-layer capacitors have been evaluated to endure demanding mechanical and electrical conditions in automotive use.

Supercapacitor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electric Double-Layered Capacitors, Pseudocapacitors, Hybrid Capacitors |

| Module Types Covered | Less than 25V, 25-100V, More than 100V |

| Material Types Covered | Carbon and Metal Oxide, Conducting Polymer, Composite Materials |

| End Use Industries Covered | Automotive and Transportation, Consumer Electronics, Power and Energy, Healthcare, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cap-XX, Cornell-Dubilier, Eaton Corporation, Fastcap Ultracapacitors, LLC, Ioxus, KYOCERA AVX Components Corporation, Maxwell Technologies, Nippon Chemi-Con Corporation, Skeleton Technologies, TDK Corporation, Tecate Group, VINATech Co., Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the supercapacitor market from 2019-2033.

- The supercapacitor market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the supercapacitor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The supercapacitor market was valued at USD 6.41 Billion in 2024.

IMARC estimates the supercapacitor market to exhibit a CAGR of 19.07% during 2025-2033.

The global supercapacitor market is driven by increasing demand for energy-efficient and fast-charging devices, advancements in electric vehicles (EVs), renewable energy storage, and consumer electronics. Additionally, the growing need for eco-friendly, high-performance energy storage solutions, coupled with innovations in materials and manufacturing processes, further accelerates market growth and adoption across various industries.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the market.

Some of the major players in the supercapacitor market include Cap-XX, Cornell-Dubilier, Eaton Corporation, Fastcap Ultracapacitors, LLC, Ioxus, KYOCERA AVX Components Corporation, Maxwell Technologies, Nippon Chemi-Con Corporation, Skeleton Technologies, TDK Corporation, Tecate Group, and VINATech Co., Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)