Super Junction MOSFET Market Size, Share, Trends and Forecast by Type, Technology, Material, Application, and Region, 2025-2033

Super Junction MOSFET Market Size and Share:

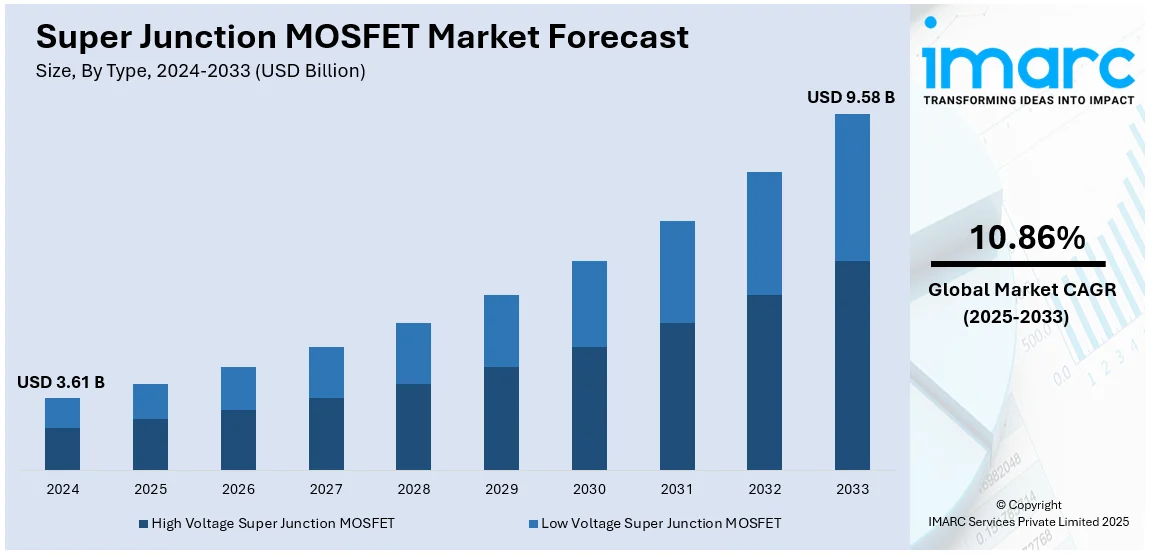

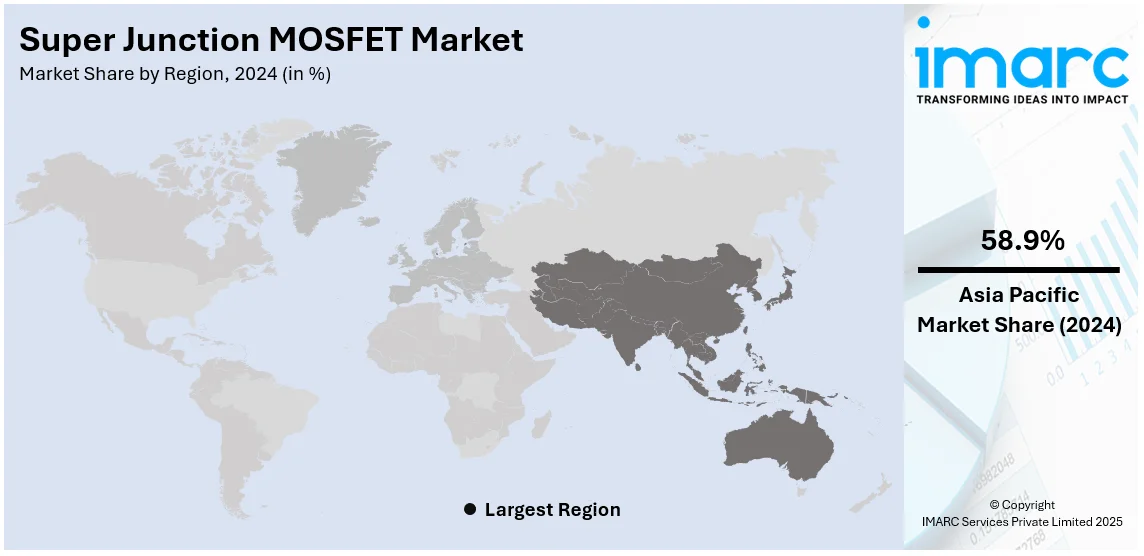

The global super junction MOSFET market size was valued at USD 3.61 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.58 Billion by 2033, exhibiting a CAGR of 10.86% from 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 58.9% in 2024. The super junction MOSFET market share is expanding, driven by the rising usage in the automotive industry that focuses on shifting to EVs and making traditional vehicles more environment friendly, along with the growing adoption of clean and renewable energy, which requires effective power conversion systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.61 Billion |

|

Market Forecast in 2033

|

USD 9.58 Billion |

| Market Growth Rate (2025-2033) | 10.86% |

At present, the increasing demand for energy-efficient devices in industries like consumer electronics and industrial applications is impelling the market growth. The super junction MOSFETs show minimal power loss and serve higher functionality, thereby providing the best application in the field for power-intensive applications, such as renewable energy systems, and data centers. In addition to these, it accelerates their use in the automotive industry, especially as a result of increasing electric vehicles (EVs) and charging infrastructures. Additionally, renewable energy projects like solar and wind farms, which require reliable power devices, are fueling the super junction MOSFET market growth. Additionally, advancements in manufacturing processes assist in reducing costs and enhance the accessibility of super junction MOSFETs. Their superior thermal execution and compact design also make them a selected choice in modern power systems.

The United States has emerged as a major region in the super junction MOSFET market owing to many factors. The increasing production of HVs and EVs in the country where high-performance power devices are needed for charging infrastructure is impelling the market growth. As per the information provided on the official website of the US Energy Information Administration, the combined sales of HVs, plug-in hybrid electric vehicles (HEVs), and battery electric vehicles (BEVs) rose from 19.1% of total new light-duty vehicle (LDV) sales in the United States during 2Q24 to 21.2% during the third quarter of 2024, according to Wards Intelligence estimates. In addition to this, renewable energy initiatives like solar and wind farms encourage the adoption of super junction MOSFETs for effective power management. Tighter energy usage regulations and environmental issues allow industries to utilize advanced power components such as super junction MOSFETs.

Super Junction MOSFET Market Trends:

Increasing demand for MOSFETs in automotive electronics

The rising requirement for super junction MOSFETs in automotive electronics is supporting the market growth. As per industry reports, the global automotive electronics market size was estimated at USD 342.55 Billion in 2024. Super junction MOSFETs are crucial for managing power in modern vehicles, especially EVs and HEVs. They help to improve energy efficiency by lowering power losses and enhancing the performance of key systems like battery management, inverters, and charging stations. As the automotive industry focuses on transitioning to EVs and making traditional vehicles more eco-friendly, the need for reliable power devices grows. Super junction MOSFETs are capable of managing higher voltages and excel at heat dissipation, making them perfect for power-demanding automotive uses. Additionally, the high adoption of modern driver-assistance systems (ADAS) and electric power steering systems drives the demand for these power devices, as they enable more cost-effective electronics in cars.

Growing applications in renewable energy

The rising applications in renewable energy are offering a favorable super junction MOSFET market outlook. These devices play a crucial role in efficient power conversion in systems such as solar inverters and wind turbines. They assist in optimizing energy efficiency by reducing power losses during the transfer of renewable energy into usable electricity. With the rising demand for clean and sustainable energy, the necessity for dependable power devices in renewable energy systems escalates. These MOSFETs can handle high voltages and provide better thermal performance, making them ideal for renewable energy usages that require long-lasting components. The shift towards renewable energy, supported by government policies and environmental concerns, further promotes the employment of super junction MOSFETs. Deloitte's 2024 survey shows that 97% of utilities are focusing on clean and renewable energy to facilitate data center expansion, motivated by tech firms' decarbonization objectives. As more solar and wind projects are developed, the adoption of super junction MOSFETs is expected to rise, helping to make renewable energy systems more workable and cost-effective.

Technological advancements

Technological advancements are progressing the accomplishment and cost-effectiveness of these devices. Innovations in manufacturing techniques, such as better epitaxy growth and enhanced substrate materials, allow the production of MOSFETs with lower on-resistance and higher voltage handling. These advancements result in improved thermal control, increased switching rates, and lower power losses, which are crucial for applications in electric vehicles, renewable energy, and consumer electronics. In June 2024, Infineon Technologies introduced a 600V super junction MOSFET, ‘CoolMOS S7TA’, featuring a built-in temperature sensor for automotive power management uses. The S7TA’s built-in sensor provides a 40 percent increase in precision and can respond up to four times quicker than independent onboard sensors. Additionally, advancements in design and materials, such as the utilization of silicon carbide (SiC), boost the efficiency of super junction MOSFETs, especially in high-voltage applications. As industries require more compact power solutions, these innovations help to meet super junction MOSFETs market demand.

Super Junction MOSFET Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global super junction MOSFET market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology, material, and application.

Analysis by Type:

- High Voltage Super Junction MOSFET

- Low Voltage Super Junction MOSFET

High voltage super junction MOSFETs are designed for applications requiring voltage handling above 600V. They are employed in EVs, renewable energy systems, and industrial equipment where managing high power efficiently is critical. These MOSFETs deliver low on-resistance and superior thermal performance, making them ideal for high-performance systems like solar inverters, wind turbines, and data centers.

Low voltage super junction MOSFETs are utilized in fields with voltage requirements below 600V. They are common in consumer electronics, telecom equipment, and lighting systems where efficient power conversion and compact designs are essential. These MOSFETs provide low switching losses and improved efficiency, making them ideal for smaller devices like chargers, adapters, and LED drivers.

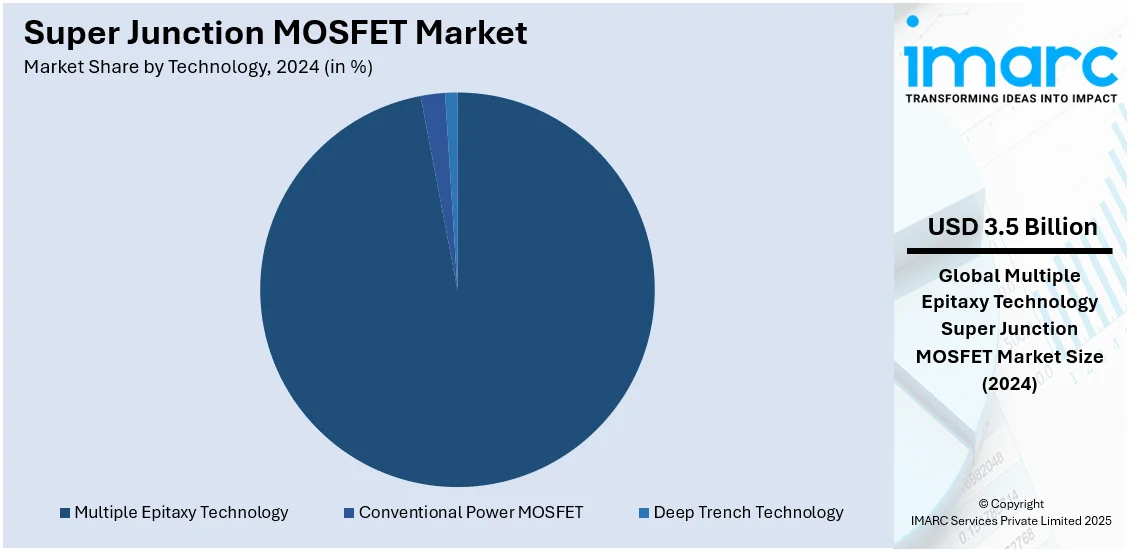

Analysis by Technology:

- Conventional Power MOSFET

- Multiple Epitaxy Technology

- Deep Trench Technology

Multiple epitaxy technology leads the market with 97.5% of the market share. It delivers high efficiency and performance, making it a preferred choice for manufacturers and industries. This technology creates the alternating p-type and n-type layers required for the super junction structure with great precision, reducing on-resistance and improving voltage handling. It is highly reliable, which is essential for applications like HEVs, renewable energy systems, and industrial automation where consistent performance is important. Multiple epitaxy also supports the production of MOSFETs with higher breakdown voltage, which is crucial for power-intensive systems like solar inverters and data centers. Additionally, its ability to deliver energy-optimized, compact, and durable components justifies the investment. As companies focus on power savings and reliability, this technology continues to dominate the market by meeting the high requirement for advanced power devices in various applications.

Analysis by Material:

- Substrate Material

- Transition/Oxide Layer

- Electrode Material

- Others

The substrate material helps to achieve high voltage blocking by supporting the super junction's ability to distribute the electric field more evenly across the device. It includes silicon and emerging options like SiC. Silicon continues to be the most commonly used material because of its affordability and well-established production methods. SiC is also gaining traction for its superior performance in high-temperature and high-voltage applications, especially in renewable energy projects and EVs.

The transition/oxide layer in super junction MOSFETs plays a crucial role in enhancing device efficiency and reliability. Most devices use silicon dioxide (SiO₂) due to its excellent insulating properties and compatibility with traditional fabrication processes. Advancements in transition materials, such as high-k dielectrics, improve the electrical performance of MOSFETs by minimizing leakage and increasing switching speed.

Electrode materials in super junction MOSFETs are designed to ensure efficient current flow and reliable device operation. Commonly employed materials comprise aluminum and copper, which are known for their outstanding conductivity and thermal properties. Copper electrodes are preferred for high-performance applications due to their superior heat dissipation and reduced energy losses. Innovations in electrode designs like advanced metal alloys and coatings further increase the longevity of MOSFETs.

Analysis by Application:

- Lighting Supply

- Power Supply

- Display Devices

- Others

Power supply leads the market with 50.6% of the market share in 2024. Power supply is crucial in almost all sectors, from consumer electronics to industrial systems. Super junction MOSFETs are used in power supplies to enhance energy efficiency, decrease heat production, and manage high power demands. They are perfect for devices like laptops, TVs, servers, and telecom systems where reliable and effective power conversion is a must. With the rise of data centers, renewable energy projects, and EV chargers, the demand for modern power supplies is growing rapidly. These MOSFETs allow power supplies to function at increased frequencies with reduced energy loss, making them perfect for space-saving designs and environmentally friendly products. Additionally, stricter energy efficiency regulations encourage companies to adopt advanced MOSFETs in their power supply systems. Their ability to ensure stable power delivery across various voltage ranges is why power supply applications dominate this market.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia-Pacific, accounting for 58.9%, enjoys the leading position in the market. The region is noted for its well-established electronics manufacturing hubs like China, Japan, South Korea, and Taiwan. These countries dominate the production of automotive components and industrial equipment, which depend on super junction MOSFETs for efficient power management. The region is known for the large-scale production of EVs, further driving the demand for these high-performance devices. Besides this, local manufacturers continually innovate to produce cost-effective solutions, making super junction MOSFETs more accessible. Additionally, the rising adoption of 5G technology and data centers adds to the requirements. Supportive government policies and investments in renewable energy projects also contribute to the region’s leadership in the market, making it the largest user and producer of super junction MOSFETs. In November 2024, the Chinese government announced the guiding statements on actively advancing the renewable energy substitution initiative, called the new renewable energy plan, to expedite the employment of renewable energy. The National Development and Reform Commission (NDRC) and five additional organizations have just unveiled a renewable energy strategy that seeks to elevate annual renewable energy consumption to 1 Billion Tons of standard coal equivalent (SCE) by 2025, marking a 30 percent rise from 2023 levels. In a renewable energy framework or industrial environment, utilizing high-efficiency power electronics founded on SJ-MOSFETs helps reduce energy consumption.

Key Regional Takeaways:

United States Super Junction MOSFET Market Analysis

The United States hold 89.80% of the market share in North America. The increasing need for energy-efficient power management solutions in sectors such as automotive, consumer electronics, and renewable energy is driving market growth. In 2023, approximately 1.2 million buyers of vehicles in the US opted for EVs, representing a historic increase, as reported by the latest figures from Kelley Blue Book, a company under Cox Automotive. This trend has increased the adoption of advanced semiconductor technologies, with super junction MOSFETs playing a vital role in enhancing the effectiveness of power converters and inverters employed in EVs. Additionally, the high emphasis on reducing carbon footprints and complying with stringent regulatory standards is prompting manufacturers to invest in high-performance components that offer superior thermal management and lower switching losses. The expansion of data centers and the rising need for reliable power supplies in telecommunications further contribute to the market growth. Moreover, advancements in manufacturing processes and materials enable the production of more compact and efficient devices, thereby catalyzing the demand. The presence of key industry players and ongoing research and development (R&D) initiatives in the semiconductor sector are expected to support innovations, positioning the region as a leader in the worldwide market.

Asia-Pacific Super Junction MOSFET Market Analysis

The APAC market is poised for significant growth owing to the increasing demand for energy-efficient solutions across various industries. In 2023, the India semiconductor materials market reached a notable size of USD 4.8 Billion, highlighting the area's broadening technological capabilities and investments in semiconductor manufacturing. This expansion is further enhanced by the high adoption of EVs and renewable energy systems, which require advanced power management components like super junction MOSFETs. Additionally, the encouragement for sustainable practices and compliance with stringent regulations enables manufacturers to seek high-performance semiconductor solutions that enhance reliability and reduce energy consumption. The ongoing advancements in semiconductor technology and materials are expected to improve the production of more compact and efficient devices, thereby driving the demand for super junction MOSFETs in the region.

Europe Super Junction MOSFET Market Analysis

In Europe, the market is considerably influenced by the region's devotion to sustainability and energy efficiency. The European Commission states that the EU has steadily cut its greenhouse gas emissions since 1990, reaching an outstanding 37% reduction in net emissions by 2023 relative to levels in 1990. This advancement highlights the success of initiatives focused on encouraging renewable energy and improving energy efficiency, which is boosting the need for sophisticated power electronics. Super junction MOSFETs are utilized in applications, such as EVs, solar inverters, and reliable power supplies, aligning with the region's green initiatives. The automotive sector, in particular, is undergoing a transformation with the rise of HEVs, necessitating the employment of high-performance semiconductors to enhance energy conversion efficiency. Additionally, the increasing trend of digitalization and the growth of data centers necessitate the demand for efficient and contemporary power management solutions. These collaborative efforts are expected to position Europe as a key player in the global market.

Latin America Super Junction MOSFET Market Analysis

In Latin America, the automotive sector's applications are influencing the market, with the automotive connectors segment hitting USD 475.2 Million in 2023. This expansion is largely attributed to the high demand for advanced automotive technologies, including HEVs, which require high-performance power management solutions. With manufacturers aiming to improve energy efficiency and performance in these vehicles, the use of super junction MOSFETs is anticipated to increase. This trend reflects the broader modernization and technological advancements within the automotive industry, positioning Latin America as a significant player in the market.

Middle East and Africa Super Junction MOSFET Market Analysis

The market in the Middle East is being significantly driven by the region's high number of renewable energy projects, which is set to exhibit a compound annual growth rate (CAGR) of 13.53% from 2024 to 2032. This expansion is supported by large scale investments in sustainable energy sources and a strong commitment to reducing carbon emissions. As countries in the region prioritize energy diversification and the adoption of advanced technologies, the demand for high-performance power management solutions, such as super junction MOSFETs, is expected to rise. This trend positions this area as a key player in the market around the world.

Competitive Landscape:

Key players in the market work on developing and producing high-performance super junctions MOSFETs, making them essential for applications in power electronics, EVs, and renewable energy systems. Big companies focus on improving efficiency, reducing energy loss, and enhancing thermal management, which is important for modern power applications. Their R&D efforts help to push the boundaries of voltage capability and switching speed, making SJ-MOSFETs more reliable. They also wager on creating new technologies and expanding their product portfolios to come up with energy-efficient solutions. Their innovations and partnerships with other industry leaders aid in the higher adoption of these devices in various sectors. For instance, in July 2023, ROHM launched the R60xxRNx series, comprising three new 600V Super Junction MOSFETs in its PrestoMOS™ range, aimed at motor-driven applications that need noise reduction, including refrigerators and ventilation fans. These devices achieve a quick reverse recovery time (trr) of 40ns, cutting switching losses by 30% in comparison to conventional products. The new MOSFETs also provide a 15dB decrease in noise, reducing the necessity for extra noise mitigation strategies.

The report provides a comprehensive analysis of the competitive landscape in the super junction MOSFET market with detailed profiles of all major companies, including:

- Alpha and Omega Semiconductor

- Fuji Electric Co. Ltd.

- IceMOS Technology Ltd.

- Infineon Technologies AG

- NXP Semiconductors

- On Semiconductor Corporation

- Rohm Co Ltd.

- STMicroelectronics

- Toshiba Corporation

- Vishay Intertechnology Inc.

Latest News and Developments:

- January 2025: Renesas launched new MOSFETs utilizing the REXFET-1 process, delivering 30% reduced on-resistance, enhanced Qg and Qgd properties, and lower power loss. Offered in compact TOLL and TOLG formats, they are 50% more compact than conventional TO-263 and compatible with standard industry devices, with TOLL providing wettable flanks for optical examination.

- January 2024: Alpha and Omega Semiconductor (AOS) released two αMOS5™ 600V FRD Super Junction MOSFETs, the AOK095A60FD and AOTF125A60FDL, providing enhanced efficiency and strong body diodes for high efficiency utilization in servers, solar inverters, and EV charging. These MOSFETs exhibit minimal turn-off energy, better functionality at high di/dt, and are intended for bi-directional uses in energy storage systems and power supplies.

Super Junction MOSFET Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | High Voltage Super Junction MOSFET, Low Voltage Super Junction MOSFET |

| Technologies Covered | Conventional Power MOSFET, Multiple Epitaxy Technology, Deep Trench Technology |

| Materials Covered | Substrate Material, Transition/Oxide Layer, Electrode Material, Others |

| Applications Covered | Lighting Supply, Power Supply, Display Devices, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alpha and Omega Semiconductor, Fuji Electric Co. Ltd., IceMOS Technology Ltd., Infineon Technologies AG, NXP Semiconductors, On Semiconductor Corporation, Rohm Co Ltd., STMicroelectronics, Toshiba Corporation, Vishay Intertechnology Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the super junction MOSFET market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global super junction MOSFET market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the super junction MOSFET industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The super junction MOSFET market was valued at USD 3.61 Billion in 2024.

The super junction MOSFET market is projected to exhibit a CAGR of 10.86% during 2025-2033, reaching a value of USD 9.58 Billion by 2033.

The rise of EVs and the expansion of EV charging infrastructure is driving the demand for super junction MOSFETs due to their high efficiency and compact design. Besides this, innovations in manufacturing and design are enhancing the performance and affordability of super junction MOSFETs. Moreover, stricter energy optimization standards and environmental concerns are encouraging industries to adopt advanced power devices.

Asia-Pacific currently dominates the super junction MOSFET market, accounting for a share of 58.9% in 2024, driven by the presence of major electronics manufacturers and demanding applications in industries like renewable energy and consumer electronics. The region's strong focus on innovations and cost-effective production is creating the need for these devices.

Some of the major players in the super junction MOSFET market include Alpha and Omega Semiconductor, Fuji Electric Co. Ltd., IceMOS Technology Ltd., Infineon Technologies AG, NXP Semiconductors, On Semiconductor Corporation, Rohm Co Ltd., STMicroelectronics, Toshiba Corporation, Vishay Intertechnology Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)