Sukuk Market Size, Share, Trends and Forecast by Sukuk Type, Currency, Issuer Type, and Region, 2026-2034

Sukuk Market Size and Share:

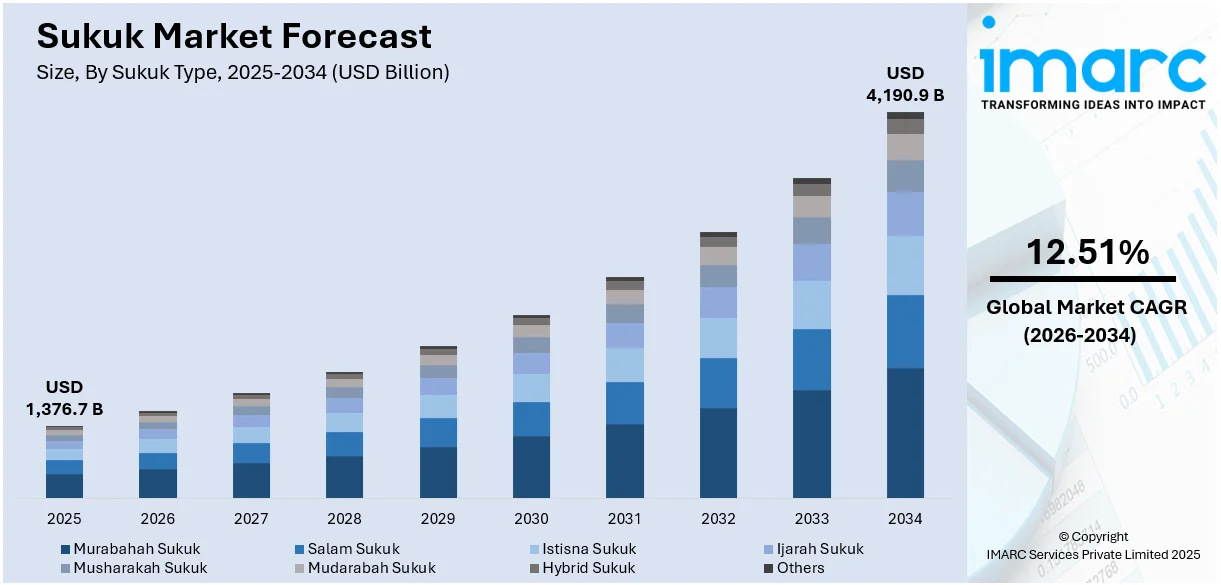

The global sukuk market size was valued at USD 1,376.7 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4,190.9 Billion by 2034, exhibiting a CAGR of 12.51% from 2026-2034. South East Asia currently dominates the market, holding a market share of over 57.3% in 2025. The sukuk market share is expanding, driven by the increasing expansion of Islamic finance and banking institutions, rising diversification of assets, the growing investments in infrastructure projects, and the development of comprehensive and investor-friendly regulatory frameworks by Islamic finance authorities and standardization bodies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,376.7 Billion |

| Market Forecast in 2034 | USD 4,190.9 Billion |

| Market Growth Rate (2026-2034) | 12.51% |

The rising demand for Sharia-compliant financial instruments among investors seeking ethical and interest-free options is fueling the market growth. Besides this, government agencies are introducing favorable regulations to support Sukuk issuance, making it easier for institutions to raise funds. Countries use Sukuk to finance large infrastructure and development projects, driving the market further. Moreover, investors look for diversification, and Sukuk provides a stable and asset-backed choice compared to conventional bonds. Non-Muslim nations, such as the UK and Hong Kong, also issue Sukuk to attract worldwide capital. Apart from this, the rise of eco-friendly and sustainable investments encourages the issuance of Sukuk linked to Environmental, Social, and Governance (ESG) projects. Standardization efforts further improve transparency and accessibility, making Sukuk more appealing to international investors.

To get more information on this market Request Sample

The United States has emerged as a major region in the sukuk market owing to many factors. The rising interest in Islamic finance among both domestic and international investors is impelling the sukuk market growth. Financial institutions recognize Sukuk as a valuable tool for diversification, attracting ethical investors seeking Sharia-compliant alternatives to conventional bonds. Additionally, regulatory bodies are working to create a more structured framework for Sukuk issuance, making it easier for corporations and municipalities to raise funds through Islamic finance. The increasing sustainable and ESG-linked investments are also driving interest in green Sukuk, as businesses and government entities look for responsible financing options. According to the US Department of Commerce, the Biden-Harris Administration planned to allocate up to USD 100 Million to fast-track research and development (R&D) activities and artificial intelligence (AI) technologies for sustainable semiconductor materials. Projects like these are gaining traction among international investors. As awareness among people improves, the United States sees more Sukuk-based financial instruments entering its debt market.

Sukuk Market Trends:

Increasing worldwide economic uncertainty

The rising worldwide economic uncertainty is positively influencing the market. According to industry reports, global growth was anticipated to slow to 2.4% in 2024 before edging up to 2.7% in 2025. In times of economic volatility, investors seek stable and secure investment avenues to safeguard their capital. With its asset-supported and risk-sharing nature, Sukuk aligns perfectly with these objectives. It offers a compelling alternative to conventional financial instruments, operating on ethical principles prohibiting interest-based transactions and speculative activities. As economic uncertainty persists, its appeal as a safe-haven asset intensifies. Investors view it as a reliable means to preserve wealth and generate steady returns while avoiding the risks associated with conventional financial markets. Government agencies and corporations also turn to Sukuk to secure financing for essential projects, as it provides a stable funding source amid economic unpredictability.

Rapid urbanization activities in the Middle Eastern countries

The rapid urbanization activities in Middle Eastern countries are offering a favorable sukuk market outlook. According to the United Nations, 68% of the world’s population is set to reside in urban areas by 2050. As these nations experience swift urban construction and infrastructure expansion, the financing demand for these initiatives has increased. With its Sharia-compliant and asset-backed structure, Sukuk presents an attractive financing option for government agencies and corporations undertaking large-scale projects. The development of modern cities, transportation networks, utilities, and real estate projects requires substantial capital, and it provides a viable and ethically sound solution. Investors are drawn to Sukuk offerings tied to these infrastructure projects, attracted by their stability and predictable returns. Moreover, the Middle East is a hub of Islamic finance activity, and the local government agencies are keen on fostering the market. This commitment and supportive regulatory frameworks encourage the issuance of Sukuk to fund urbanization efforts.

Growing digitization of financial services

The rising digitization of financial services is propelling the market growth. According to industry reports, digital transformation spending reached USD 2.5 Trillion in 2024 and is set to attain USD 3.9 Trillion by 2027. As financial services increasingly migrate to digital platforms, Sukuk issuers and investors benefit from enhanced accessibility, transparency, and efficiency in issuance and trading. Digitization streamlines the Sukuk issuance process, reducing administrative complexities and costs. This technological advancement enables issuers to reach a broader investor base worldwide, attracting a diverse range of participants to the market. Additionally, digital platforms facilitate real-time tracking of performance and market developments, providing investors with up-to-date information and analysis. This transparency builds investor confidence and encourages greater participation in product offerings. Moreover, the integration of blockchain technology and smart contracts in this issuance enhances security. It reduces settlement times, making the market more enticing for investors seeking efficient and safe spending options.

Sukuk Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sukuk market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on sukuk type, currency, and issuer type.

Analysis by Sukuk Type:

- Murabahah Sukuk

- Salam Sukuk

- Istisna Sukuk

- Ijarah Sukuk

- Musharakah Sukuk

- Mudarabah Sukuk

- Hybrid Sukuk

- Others

Murabahah Sukuk held 45.6% of the market share in 2025. It is characterized by its underlying transaction, which is based on selling commodities or assets at a cost-plus profit. It appeals to a broad spectrum of investors and issuers due to its transparent and straightforward structure, making it a preferred choice for various financing needs. One key driver is its versatility in catering to corporate and government financing requirements, supporting diverse sectors, such as infrastructure, real estate, and trade finance. This adaptability enhances its relevance in various economic scenarios. Additionally, Murabahah Sukuk aligns closely with Islamic finance principles, making it an attractive option for investors seeking Sharia-compliant investments. Its ethical and asset-backed nature ensures a consistent and reliable stream of returns, further fostering investor confidence and market growth. As government agencies and corporations increasingly turn to Murabahah Sukuk to fund their initiatives and investors look for ethical investment avenues, it continues to dominate the market.

Analysis by Currency:

- Turkish Lira

- Indonesian Rupiah

- Saudi Riyal

- Kuwaiti Dinar

- Malaysian Ringgit

- United States Dollar

- Others

Malaysian Ringgit accounts for 50.6% of market share. Malaysia has established itself as a worldwide hub for Islamic finance, with a well-developed regulatory framework and a deep pool of expertise. This conducive environment encourages the issuance of Malaysian Ringgit-denominated Sukuk, attracting both domestic and international issuers. The Malaysian government actively promotes Islamic finance and Sukuk issuance to fund infrastructure projects and stimulate economic development. This support fosters a robust pipeline of Malaysian Ringgit-denominated offerings, further contributing to the market growth. Moreover, the stability of the Malaysian economy and the Malaysian Ringgit as a currency enhances investor confidence. Investors seeking Sharia-compliant investments and exposure to the Malaysian market are drawn to Malaysian Ringgit-denominated Sukuk. With ongoing financial reforms, the demand for Malaysian Ringgit-denominated Sukuk is increasing, particularly from neighboring countries in Southeast Asia.

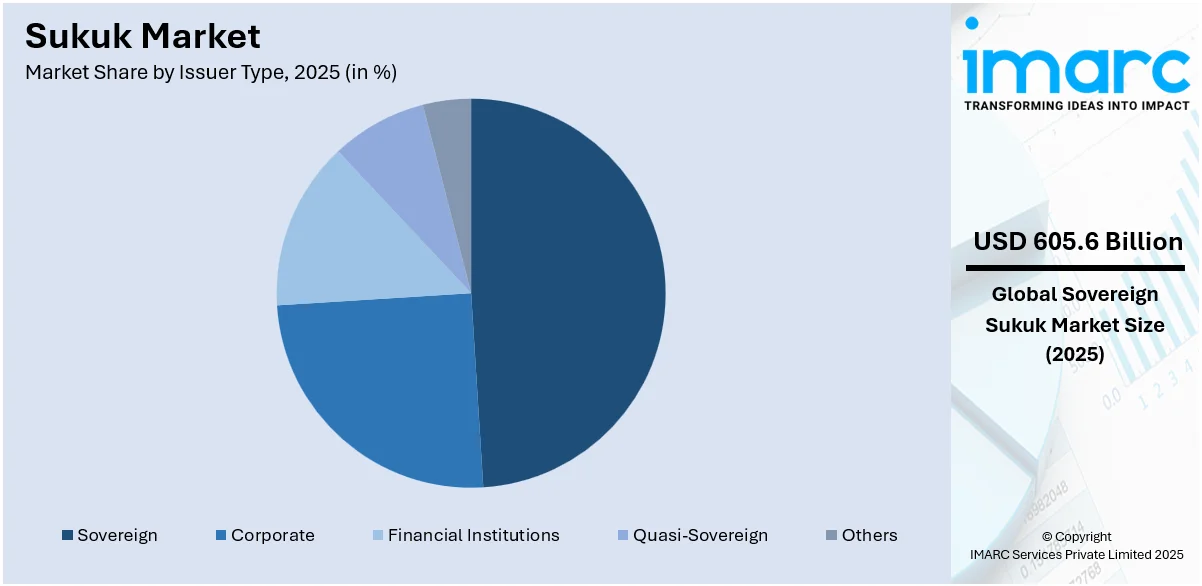

Analysis by Issuer Type:

Access the comprehensive market breakdown Request Sample

- Sovereign

- Corporate

- Financial Institutions

- Quasi-Sovereign

- Others

Sovereign holds 49.9% of the market share. Sovereign issuers in the market refer to national government agencies or state-owned entities that issue Islamic bonds to finance public projects and governmental activities. These Sukuks are generally considered the most secure and attract a large pool of investors due to their low risk, supported by the creditworthiness of the issuing government or state-owned entities. They are primarily used to finance public projects and governmental initiatives, such as infrastructure and social welfare programs. Their low-risk nature and high liquidity make them attractive to a broad range of investors, both domestic and international. Moreover, sovereign Sukuks serve as a benchmark for pricing in the market, influencing how corporate and other issuer types are valued. They also play a pivotal role in the development of the Islamic financial market by drawing in more participants and thereby fostering market liquidity and depth.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- Gulf Cooperation Council (GCC)

- South East Asia

- Middle East and Africa (Excluding GCC Countries)

- Others

South East Asia, accounting for 57.3%, enjoys the leading position in the market. The region, with countries like Malaysia, the Philippines, Indonesia, and Singapore, has a strong Islamic finance ecosystem. These nations have well-established regulatory frameworks, Sharia-compliant financial institutions, and a deep pool of expertise, making them key contributors to the market. Besides this, the government agencies in South East Asia fund infrastructure projects, thereby impelling the market growth. In December 2024, the Department of Transportation (DOTr) of the Philippines revealed plans for the advancement of five significant infrastructure projects to enhance the country's transport system. These initiatives involved the building of the New Cebu International Container Port (NCICP), new airports in Dumaguete and Siargao, Cebu Bus Rapid Transit (CBRT), as well as the enlargement of Bohol-Panglao International Airport (BPIA). Moreover, the rising interest in sustainable and ESG-related investments is driving the demand for green Sukuk, as companies and governmental organizations seek ethical financing alternatives. Additionally, the region's proximity to key Islamic finance markets, such as the Middle East, fosters cross-border collaborations, further expanding the market reach.

Key Regional Takeaways:

Gulf Cooperation Council (GCC) Sukuk Market Analysis

The Gulf Cooperation Council (GCC) is experiencing high sukuk adoption owing to the presence of Islamic finance and banking institutions. As of January 2025, in Saudi Arabia, there were 37 banks licensed by the Saudi Central Bank (SAMA) in Saudi Arabia: 11 domestic banks, 23 foreign bank branches, and 3 digital banks. Countries, such as Saudi Arabia, UAE, and Qatar, are seeing an influx of sukuk issuances, as banks integrate Islamic finance into mainstream economic strategies. The rapid expansion of Islamic banking institutions is increasing sukuk issuance for infrastructure projects, corporate financing, and sovereign funding. Additionally, GCC regulators are promoting Islamic capital markets, leading to higher investor participation in Sharia-compliant bonds. Government-supportive initiatives to strengthen the Islamic finance ecosystem further accelerate sukuk issuance. As Islamic banks increase cross-border financial activities, the demand for sukuk as a preferred fundraising mechanism continues to rise, reinforcing the region's status as a worldwide Islamic finance hub. This growth ensures the long-term sustainability and resilience of sukuk markets.

South East Asia Sukuk Market Analysis

The growing adoption of sukuk in the South East Asian countries is influenced by the rising digitization and internet penetration of financial services, transforming the regional financial ecosystem. According to industry reports, ASEAN was the fastest expanding Internet market globally in 2022. With 125,000 new Internet users joining daily, the ASEAN digital economy is poised for substantial growth, potentially contributing an estimated USD 1 Trillion to the regional GDP by 2032. The integration of digital platforms has enhanced accessibility to sukuk investments, encouraging broader investor participation. The rising digitization of financial services has enabled seamless transactions, making sukuk more attractive to retail and institutional investors. Digital banking solutions have facilitated efficient sukuk issuance and trading, increasing market liquidity. The automation of financial services has led to cost efficiencies, motivating financial institutions to expand sukuk offerings. Financial technology advancements continue to streamline regulatory compliance and simplify sukuk structuring, thereby propelling the market growth.

Middle East and Africa (Excluding GCC Countries) Sukuk Market Analysis

The market is witnessing growth due to rapid urbanization activities, reshaping economic structures and infrastructure financing needs. According to the United Nations Population Division, over 58% of the population lived in urban areas in 2016. The urban population is set to cross 80% by 2050. The demand for Sharia-compliant funding solutions has increased, as urban expansion accelerates. Rapid urbanization activities have attracted higher infrastructure investments, positioning sukuk as a key financing instrument. They have also contributed to increased government and corporate sukuk issuance, supporting long-term financing strategies. Moreover, the need for sustainable urban development has led to sukuk issuance for projects ranging from transportation to utilities. The shift in demographic trends has heightened the demand for housing and commercial development, encouraging sukuk-backed funding models. The high adoption of sukuk aligns with evolving financial market requirements where urbanization creates opportunities for Islamic finance growth. Ongoing smart city expansion has enhanced the significance of alternative funding methods, resulting in a more prominent market.

Competitive Landscape:

Key players work on developing new solutions to meet the high sukuk market demand. They focus on facilitating issuance, improving market accessibility, and enhancing investor confidence. Government agencies and regulatory bodies create supportive policies and legal frameworks that encourage Sukuk adoption. Financial institutions, including banks and investment firms, structure and distribute Sukuk, making them available to a broader range of investors. Large corporations and sovereign entities issue Sukuk to raise funds for infrastructure, energy, and development projects, increasing market activity. Rating agencies assess Sukuk creditworthiness, helping investors to make informed decisions. Additionally, worldwide organizations promote standardization, improving transparency and making Sukuk more attractive to international investors. With the rising need for ethical and sustainable spending, key players continue to innovate, introduce green Sukuk, and expand the market, strengthening Sukuk’s position as a viable alternative to conventional bonds. For instance, in January 2024, the Asian Development Bank (ADB) facilitated Indonesia's inaugural social bond and sukuk issuance by PT Sarana Multigriya Finansial (SMF), securing 700 billion rupiah (USD 45.4 Million). The instruments were registered on the Indonesia Stock Exchange and comply with worldwide and ASEAN social bond standards. The money was to be employed to support affordable housing initiatives, encouraging homeownership for individuals with low incomes.

The report provides a comprehensive analysis of the competitive landscape in the sukuk market with detailed profiles of all major companies, including:

- Abu Dhabi Islamic Bank PJSC

- Al Baraka Group B.S.C.

- Al Rajhi Bank

- Banque Saudi Fransi

- Dubai Islamic Bank Public Joint Stock Company

- Kuwait Finance House

- Malayan Banking Berhad

- Qatar International Islamic Bank

- RHB Bank Berhad

- The Saudi National Bank

Latest News and Developments:

- December 2024: The IILM introduced its last Ṣukūk issuance for 2024, highlighting significant accomplishments in liquidity management. The 14th auction concluded a year of significant growth, with notable issuance increasing by almost 20% to USD 4.14 Billion. The issuance also broadened the investor base across various regions and developing markets.

- December 2024: Saudi Awwal Bank (SAB) completed a SAR 4 Billion Sukuk issuance in two parts, incorporating both fixed and floating interest rates. The announcement of the issuance was made in a statement to Tadawul. This action enhanced SAB's financial strategy and market visibility.

- December 2024: The Ministry of Finance in Oman unveiled a fresh Ijarah sukuk offering aimed at generating a minimum of RO100mn, including a greenshoe option to expand the total amount. The seven-year sukuk provided a 4.8% yearly profit rate, featuring semiannual payments through 2031. Public subscription remained available until December 25, 2024, for investors both local and from abroad.

- October 2024: Aramco finalized a USD 3 Billion global sukuk issuance, split into two tranches of USD 1.5 Billion each, maturing in 2029 and 2034 with profit rates of 4.25% and 4.75%, respectively. The listing on the London Stock Exchange saw six times more subscriptions than available shares, indicating robust demand from investors. This issuance aided the firm in diversifying its investor pool, improving liquidity, and reinforcing its sukuk yield curve.

- May 2024: Emirates Islamic achieved a significant milestone in Islamic finance by issuing its inaugural USD 750 Million 5-year sustainability Sukuk. The offering, which was oversubscribed by 2.8 times, saw robust investor interest, surpassing USD 2.10 Billion. Offered at a profit rate of 5.431%, it complied with the Sustainable Finance Framework of Emirates NBD Group and adhered to Shariah principles.

Sukuk Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sukuk Types Covered | Murabahah Sukuk, Salam Sukuk, Istisna Sukuk, Ijarah Sukuk, Musharakah Sukuk, Mudarabah Sukuk, Hybrid Sukuk, Others |

| Currencies Covered | Turkish Lira, Indonesian Rupiah, Saudi Riyal, Kuwaiti Dinar, Malaysian Ringgit, United States Dollar, Others |

| Issuer Types Covered | Sovereign, Corporate, Financial Institutions, Quasi-Sovereign, Others |

| Regions Covered | Gulf Cooperation Council (GCC), South East Asia, Middle East and Africa (Excluding GCC Countries), Others |

| Companies Covered | Abu Dhabi Islamic Bank PJSC, Al Baraka Group B.S.C., Al Rajhi Bank, Banque Saudi Fransi, Dubai Islamic Bank Public Joint Stock Company, Kuwait Finance House, Malayan Banking Berhad, Qatar International Islamic Bank, RHB Bank Berhad, The Saudi National Bank, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sukuk market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sukuk market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sukuk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sukuk market was valued at USD 1,376.7 Billion in 2025.

The sukuk market is projected to exhibit a CAGR of 12.51% during 2026-2034, reaching a value of USD 4,190.9 Billion by 2034.

Government agencies and regulatory bodies are supporting Sukuk issuance by implementing favorable policies and frameworks. Besides this, infrastructure and development projects also play a key role, as many nations use Sukuk to finance large-scale initiatives in sectors like energy, transportation, and real estate. Additionally, investors are turning to Sukuk for portfolio diversification, as they provide stable and ethical investment options.

South East Asia currently dominates the sukuk market, accounting for a share of 57.3% in 2025, driven by strong government support, well-established Islamic finance frameworks, and high demand for Sharia-compliant investments. Countries like Malaysia and Indonesia actively issue Sukuk to fund infrastructure projects, while financial institutions fuel the market growth through innovations and accessibility.

Some of the major players in the sukuk market include Abu Dhabi Islamic Bank PJSC, Al Baraka Group B.S.C., Al Rajhi Bank, Banque Saudi Fransi, Dubai Islamic Bank Public Joint Stock Company, Kuwait Finance House, Malayan Banking Berhad, Qatar International Islamic Bank, RHB Bank Berhad, The Saudi National Bank, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)