Subscription and Billing Management Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, End User, and Region, 2025-2033

Subscription and Billing Management Market Size and Share:

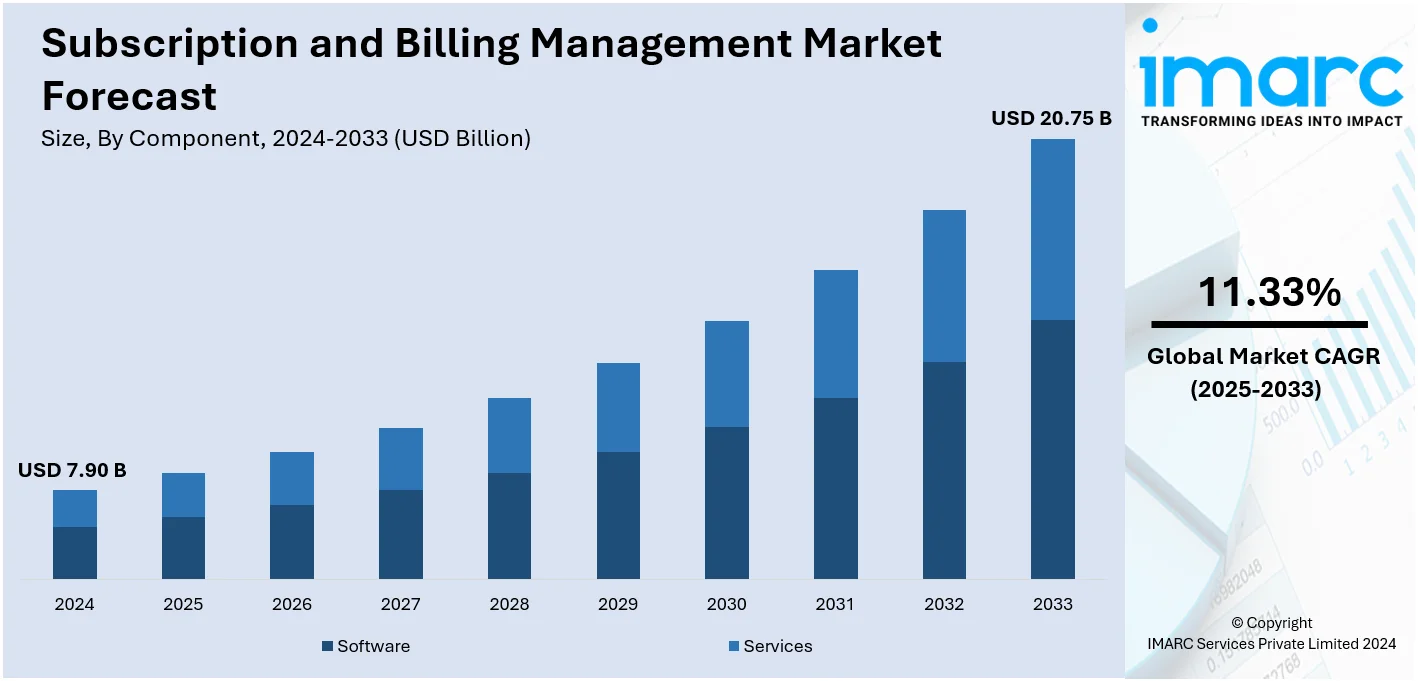

The global subscription and billing management market size was valued at USD 7.90 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20.75 Billion by 2033, exhibiting a CAGR of 11.33% from 2025-2033. North America currently dominates the market, holding a market share of over 30.9% in 2024. The subscription and billing management market growth is driven by the increasing adoption of cloud-based solutions, the growing popularity of the subscription-based business model, and the need for more efficient, automated billing for better customer satisfaction and organizational performance improvement.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.90 Billion |

|

Market Forecast in 2033

|

USD 20.75 Billion |

| Market Growth Rate 2025-2033 | 11.33% |

The subscription and billing management market is primarily driven by the increasing adoption of subscription-based business models across industries, enabling companies to optimize revenue streams. In addition, the growing shift toward digital transformation and cloud solutions allows for scalable and efficient billing management, impelling the market growth. Moreover, the rising customer expectations for seamless and personalized billing experiences necessitate advanced systems, which is fueling the market demand. Besides this, regulatory compliance demands compel the companies to adopt accurate billing solutions, providing an impetus to the market. Furthermore, the need for data analytics in billing processes along with the rise of recurring payments is contributing to the market expansion. The integration of analytics to make dynamic pricing, along with innovative technologies such as Artificial Intelligence (AI) and the Blockchain to improve billing and security is impelling the market growth.

The United States holds 85% of the market share, driven by the growing popularity of subscription-based services across various industries creating a strong demand for efficient billing platforms. In line with this, enterprises are investing in cloud computing solutions for dependable, efficient, and malleable billing management, aiding the market growth. Concurrently, the need to increase comprehensive customer retention and satisfaction for sensible billing procedures is driving the market demand. In confluence with this, digital payment innovations, such as mobile wallets and cryptocurrencies, are boosting the market growth. Apart from this, the increasing demand to minimize billing errors and fraud formation is fostering the adoption of automated solutions, thereby propelling the market forward. For example, Younium received €2.76 million in funding to grow its B2B subscription management solutions for North America, enhancing the company’s position in the United States market.

Subscription and Billing Management Market Trends:

Thriving Media and Entertainment Industry

Subscription and billing management market demand in the media and entertainment industry simplifies the revenue collection for goods services such as streaming and subscription. In addition, the increasing consumer demand for different over-the-top (OTT) platforms and other media such as YouTube is supporting the market growth. According to the analysis in the research study, global OTT platform usage is projected to rise up to 36% by 2027. Moreover, growing dispensable income per capita and enhanced living standards have encouraged customers to adopt paid entertainment channels like Netflix, Amazon Prime Video, and Disney+ Hotstar. Also, the growing customer network is encouraging entertainment providers to sign deals with the network providers and this rising demand for subscription and billing management solutions and services is reflecting a positive growth for the market. For instance, in June 2024, Vodafone Idea (Vi), operating in the telecommunications industry, launched a new prepaid option with free streaming from Netflix. According to the strategy chart, the user can only avail features of Netflix’s basic composite plan during the entire validity of the specific prepaid recharge plan. Besides this, in June 2024, Airtel introduced a specific recharge offer for the T20 World Cup. Prepaid customers can own subscriptions to this plan, starting from Rs 499 for 28 days. The bundle comes with three months of complimentary Disney+ Hotstar access, on the streaming platform that has the rights to broadcast the tournament in India.

Growth of Subscription-Based Gaming Services

The growth of subscription-based gaming services is further catalyzing the market growth. The gaming sector is experiencing a significant shift towards subscription models, offering users access to a library of games for a fixed monthly fee. This can be attributed to the growth of cloud gaming services and the consumer desire for low-cost and less complex means of gaming. Furthermore, the growing trend for online games and also the increasing number of new launches are strengthening the market share. For example, Microsoft’s Xbox Game Pass is anticipated to release Call of Duty in October 2025. The decision is expected to help the growth of the subscription service, which had 34 million subscribers as of February. Similarly, in April 2024, Vodafone Idea started Cloud Play which is a cloud gaming service in the mobile platform, offering downloads of premium mobile games including Asphalt 9, Modern Combat 5, Shadow Fight, and many more. The service, launched jointly with Paris-based cloud gaming company CareGame, is subscription-based, starting at Rs. 100 per month. Cloud Play is compatible with both iOS and Android and can be accessed either through the Vi app or the website. The increase in the use of the subscription-based revenue model is expected to drive the demand for robust and easily scalable subscription and billing management solutions.

Expansion of the SaaS Industry

The expansion of the Software as a Service (SaaS) industry is creating a positive subscription and billing management market outlook. The research report of the IMARC Group states that the SaaS market reached USD 319.4 Billion in 2024. SaaS is a method of delivering applications using the internet through a subscription model. Whereas, businesses and individuals gain productive use of software without buying the hardware or licenses. Furthermore, as the SaaS industry grows, more sophisticated solutions are being required for the subscription and billing manners. Besides this, various software firms are introducing the subscription-based service model into their assortment to increase the revenues that fuel the subscription and billing management market expansion. For example, in 2016, Hewlett Packard Enterprise Co. introduced a software platform, GreenLake Central, to assist customers with the difficult task of managing more complex information technologies. GreenLake Central enables clients to make tangible evaluations of the cost, performance, and security of different computer data systems. The tool also promotes companies to buy new computing services and choose whether to run them on their corporate servers or those operated by vendors such as Amazon.com Inc. and Microsoft Corp. The move was made to generate more recurring revenue during HPE’s transition to a subscription-based business model.

Subscription and Billing Management Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global subscription and billing management market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, and end user.

Analysis by Component:

- Software

- Services

Software stands as the largest component in 2024, holding around 65.0% of the market. This segment includes subscription and billing management platforms and applications that automate recurring billing, invoicing, and subscription management processes. As businesses increasingly adopt subscription-based revenue models, the demand for advanced and feature-rich software solutions escalates. These software platforms allow companies to streamline billing operations, optimize pricing strategies, and gain valuable insights into customer behavior through data analytics. The continuous evolution of software capabilities, with cloud-based solutions and integration options, further drives the market growth.

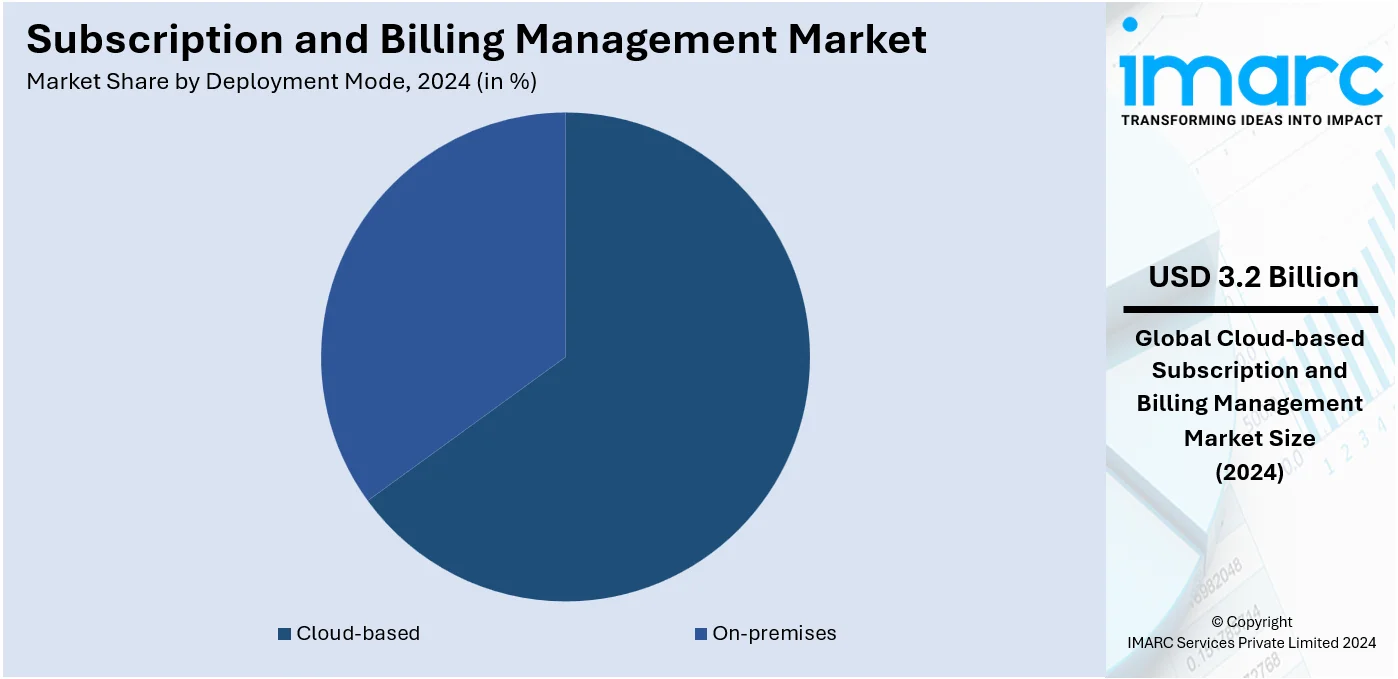

Analysis by Deployment Mode:

- On-premises

- Cloud-based

Cloud-based leads the market with around 40.0% of the market share in 2024. Subscription and billing management market share analysis by IMARC indicates that the cloud-based deployment mode has emerged as a dominant force in the market due to its flexibility, scalability, and cost-effectiveness. Cloud-based solutions offer businesses the convenience of accessing the software via the Internet, eliminating the need for on-site infrastructure. This model is easy to deploy, allows seamless updates, and can be integrated with other cloud applications. In addition, due to the continuous adoption of digital solutions and the new normal of remote working, the cloud-based model has become the go-to model for various industries, driving the market forward. Concurrently, the significant market players are extending efforts in the adoption and innovation of the cloud-based subscription model, thus impelling the market growth. For instance, in December 2022, Amazon Web Services Inc. and Slalom LLC (Slalom) entered into a Strategic Cooperation Agreement (SCA). The two companies collaborated towards the development of AWS-based vertical solutions for clients in sectors such as energy, financial, life sciences, public sector, and media and entertainment. They were also expected to offer clients end-to-end cloud migration and modernization services to help them hasten their cloud transformation processing.

Analysis by Organization Size:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises lead the market in 2024. These big enterprises with extensive customer bases and complex billing requirements require robust and feature-rich subscription and billing management systems. Large enterprises require high transaction processing capabilities, different plans, and multiple billing strategies to manage their subscription-based revenue models effectively. For instance, in January 2023, Walmart Commerce Technologies and Salesforce announced that they will help retailers give shoppers around the world the technologies and services they need to deliver seamless local pickup and delivery. With the combined power of Walmart and Salesforce, retailers can take success to the next level with the best-in-breed technology for its omnichannel operations, to improve efficiency and make sure every purchase made gets to the shopper as soon as possible. Apart from this, the increasing utilization of subscription and billing solutions in large enterprises is one of the major factors for the subscription and billing management industry trends.

Analysis by End User:

- BFSI

- Retail

- IT

- Healthcare

- Media and Entertainment

- Others

IT leads the market in 2024. The information technology (IT) industry offers various software- and cloud-based services through subscription models. Subscription and billing management solutions are crucial for IT companies to manage subscriptions efficiently, provide seamless billing experiences, and monitor customer usage. The increasing adoption of software-as-a-service (SaaS) and cloud-based offerings in the IT sector drives the demand for subscription and billing management platforms. Additionally, the escalating demand for a public cloud on account of the growing number of remote work settings is offering a positive market outlook. For instance, according to the Hosting Tribunal, in 2020, about 94% of enterprises were estimated to be already using cloud services, and about 83% of enterprise workloads were on the cloud. The rise in the adoption of cloud platforms and cloud-based offerings is projected to fuel market growth in the coming years.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 30.9%. The market in the region is witnessing significant demand due to the presence of a large number of technology-driven businesses and the early adoption of subscription-based revenue models. Additionally, the presence of several significant industry participants, including SAP, Salesforce, Oracle, Apttus, Recurly, Amazon Web Services, and others, is transforming the subscription and billing management market dynamics in North America. Moreover, the US's growing use of mobile devices and cloud-based solutions by large organizations and SMEs is further driving the growth of the regional market.

Key Regional Takeaways:

United States Subscription and Billing Management Market Analysis

The subscription and billing management market in the United States is experiencing rapid growth driven by the shift toward recurring revenue models across industries. Businesses are increasingly adopting subscription-based services to enhance user retention and generate predictable revenue streams. This shift is prominent in sectors like streaming, SaaS, and e-commerce. The Department of Commerce of Census Bureau of announced that the U.S. retail e-commerce sales for Q3 of 2024, adjusted for seasonal variation was USD 300.1 Billion, which is an increase of 2.6% from the Q2 of 2024. In addition, companies are leveraging sophisticated platforms to manage subscriptions, automate invoicing, and handle complex pricing models, such as usage-based or tiered plans. This streamlines operations and reduces errors, thereby improving user satisfaction. Integration with payment gateways and secure transactions is also a focus, aligning with consumer demand for seamless and flexible payment options. Apart from this, the rising focus on personalization and improved user experience is impelling the market growth. Subscription services significantly use data analytics to tailor offerings to suit individual preferences, driving customer engagement and loyalty. Predictive analytics is also helping companies reduce challenges by identifying at-risk subscribers and implementing retention strategies. Furthermore, compliance with evolving regulations, such as tax laws and data privacy standards, is another significant factor shaping the market.

Europe Subscription and Billing Management Market Analysis

The subscription and billing management market in Europe is growing steadily as businesses across sectors are embracing recurring revenue models. Industries, such as media, SaaS, e-commerce, telecommunications, and utilities, are leading this transformation, leveraging subscription frameworks to enhance customer loyalty and create predictable income streams. In line with this, automation and compliance are pivotal in the European market. Businesses are adopting advanced platforms that not only manage subscriptions and automate billing but also ensure adherence to stringent regional regulations. GDPR and country-specific tax laws, like VAT compliance, significantly influence the design and implementation of subscription management solutions. Moreover, the shift toward flexible and customer-centric billing systems is another driving factor. Consumers in Europe prefer transparent pricing and convenient digital payment options. The Europe mobile payment market size reached USD 643.8 Billion in 2024, as reported by the IMARC Group. Apart from this, data-driven insights and analytics play a crucial role in helping companies tailor offerings and improve retention rates. Sustainability trends are also influencing subscription models, especially in sectors like fashion and mobility. Companies are incorporating eco-friendly practices, such as promoting subscriptions for reusable products or shared services, aligning with Europe’s emphasis on sustainability. The market is also witnessing growth in small and medium-sized enterprises (SMEs) as they are adopting subscription management tools to compete with larger players.

Asia Pacific Subscription and Billing Management Market Analysis

The growing adoption of digital services and subscription-based models in diverse industries is offering a favorable market outlook. The region's increasing internet utilization, rising smartphone usage, and digital transformation are impelling the market growth. As per Invest India, a user's average monthly data consumption reached 20.27GB as of March 2024 in India. Additionally, automation and scalability are critical in managing the high volume of transactions and diverse customer bases across countries. Advanced subscription platforms are helping businesses streamline operations, enabling automated billing, customizable pricing models, and flexible payment options to meet varied consumer preferences. Integration with multiple payment gateways, including emerging options like digital wallets and UPI in markets like India, is supporting the market growth. Moreover, data-driven personalization is another major trend, with businesses using analytics to create tailored subscription plans and improve user retention. Furthermore, the regulatory landscape, particularly regarding tax compliance and data privacy, is catalyzing the demand for subscription management solutions. Businesses are prioritizing tools that ensure adherence to regional laws in certain areas and local taxation frameworks such as goods and services tax (GST) in countries like India and Australia. Apart from this, innovations in technology, including artificial intelligence (AI)-powered insights and real-time reporting, are becoming essential for companies to remain competitive.

Latin America Subscription and Billing Management Market Analysis

The growing demand for subscription and billing management due to rapid digital transformation in the region is positively influencing the market. Additionally, the rising utilization of mobile phones in countries like Brazil is impelling the market growth. In Brazil, a total of 210.3 million cellular mobile connections were active in early 2024. Furthermore, industries like streaming services, telecommunications, e-commerce, and SaaS are adopting subscription models to tap into the expanding middle-class consumer base. Automation is a key trend, with businesses implementing platforms to streamline billing, manage recurring payments, and handle complex pricing structures. Moreover, flexible payment options, such as installment plans and mobile wallets, cater to diverse consumer preferences and regional economic conditions.

Middle East and Africa Subscription and Billing Management Market Analysis

The subscription and billing management market in the Middle East and Africa (MEA) is expanding as digital adoption grows across the region. Sectors like telecommunications, streaming services, e-commerce, and SaaS are driving this shift on account of high internet and smartphone utilization. According to reports, in early 2024, there were over 49.89 million active cellular mobile connections in Saudi Arabia. In addition, businesses are investing in automated platforms to streamline billing processes, manage recurring payments, and offer flexible pricing models tailored to diverse consumer needs. Integration with regional payment methods, such as mobile money services and localized payment gateways, is critical for accessibility in underbanked markets. As SMEs embrace digital transformation, scalable and cost-effective tools are enabling them to adopt subscription models, expanding their reach and enhancing revenue stability.

Competitive Landscape:

Market players in the subscription and billing management industry are increasingly focusing on enhancing their platforms with advanced features such as AI-driven automation, real-time analytics, and predictive billing models. Many companies are integrating cloud-based solutions to provide scalable, flexible, and cost-efficient services, responding to the growing demand for digital transformation. A significant trend is the expansion of multi-currency and multi-tax capabilities, which cater to global business needs. Additionally, players are prioritizing compliance with evolving regulatory standards, ensuring accurate billing and invoicing processes. Strategic partnerships and acquisitions are also common, allowing companies to broaden their service offerings and expand their market reach. Furthermore, personalization and customer-centric billing experiences are becoming central to many solutions, reflecting the shift toward more customer-focused business models.

The report provides a comprehensive analysis of the competitive landscape in the subscription and billing management market with detailed profiles of all major companies, including:

- 2Checkout.com Inc. (VeriFone Holdings Inc.)

- Aria Systems Inc.

- BillingPlatform LLC

- Bright Market LLC dba FastSpring

- Cerillion

- Chargebee

- Fusebill

- Oracle Corporation

- SaaSOptics

- Salesforce Inc.

- SAP SE

- Zoho Corporation

- Zuora

Latest News and Developments:

- June 2024: Aria Systems unveiled the Aria Billing Studio for ServiceNow. The solution is enabled with Customer Service Management (CSM) and Sales and Order Management (SOM) to address billing issues and enhance productivity with real-time billing features.

- April 2024: Recurly announced plans to launch its new dashboards equipped with built-in benchmarks. These solutions bring Recurly’s insights to merchant's accessibility, enhancing their data to attain competitive advantage.

- March 2024: Younium, a B2B subscription management and billing software company based in Stockholm, Sweden received SEK 31 million (approximately €2.76 Million) in funding. The company will utilize the funds to scale up its operations in Europe and North America, with a view of consolidating its position in its core markets, while seeking to inherit new growth opportunities.

- May 2024: Vodafone Idea (Vi) launched two new prepaid plans at Rs 998 and Rs 1,399 that come with a Netflix Basics subscription for the first time. The Vi Rs 998 prepaid plan comes with a validity of 70 days, 1.5GB daily data, 100 SMS per day and unlimited voice calling.

Subscription and Billing Management Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Services |

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| End Users Covered | BFSI, Retail, IT, Healthcare, Media and Entertainment, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 2Checkout.com Inc. (VeriFone Holdings Inc.), Aria Systems Inc., BillingPlatform LLC, Bright Market LLC dba FastSpring, Cerillion, Chargebee, Fusebill, Oracle Corporation, SaaSOptics, Salesforce Inc., SAP SE, Zoho Corporation, Zuora, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the subscription and billing management market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global subscription and billing management market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the subscription and billing management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global subscription and billing management market was valued at USD 7.90 Billion in 2024.

IMARC Group estimates the market to reach USD 20.75 Billion by 2033, exhibiting a CAGR of 11.33% from 2025-2033.

Key factors driving the global subscription and billing management market include the growing adoption of subscription-based business models, increasing demand for cloud-based solutions, rising customer expectations for personalized billing experiences, regulatory compliance requirements, and the need for data analytics and dynamic pricing to optimize revenue and improve operational efficiency.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global subscription and billing management market include Cerillion, Chargebee, Fusebill, Oracle Corporation, SaaSOptics, Salesforce Inc., SAP SE, Zoho Corporation, Zuora, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)