Submarine Sensors Market Size, Share, Trends and Forecast by Submarine Type, Type, Technology, Application, and Region, 2025-2033

Submarine Sensors Market Size and Share:

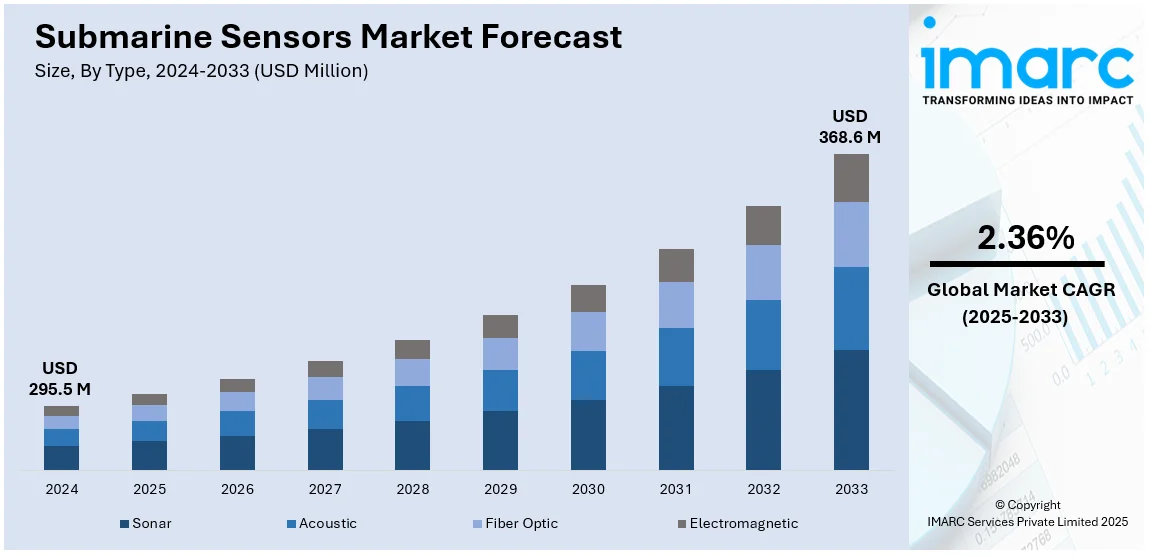

The global submarine sensors market size was valued at USD 295.48 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 368.63 Million by 2033, exhibiting a CAGR of 2.36% from 2025-2033. North America currently dominates the market, holding a market share of over 38.7% in 2024. The submarine sensors market share is increasing due to the increased demand for maritime security, advances in sensor technologies, increased requirements for enhanced underwater surveillance, and the growth in defense budgets and increasing importance of naval operations in geopolitical tensions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 295.48 Million |

|

Market Forecast in 2033

|

USD 368.63 Million |

| Market Growth Rate (2025-2033) | 2.36% |

The submarine sensors market growth is attributed to the increasing focus on maritime security, due to rising geopolitical tensions and territorial disputes, which has created a demand for advanced sensor technologies for submarine detection, surveillance, and communication. Generally, submarine sensors are very much needed to bring about an overall improvement in operating efficiency in defense, to offer better underwater navigation, and to enable real-time observation of submarines. Advances in sensor technologies, including sonar, acoustics, and imaging systems, have allowed submarines to be detected at greater depths and with higher accuracy. This has driven military and commercial applications for submarines, including surveillance, exploration, and environmental monitoring. The growing need for autonomous underwater vehicles (AUVs) also contributes to the demand for sophisticated sensors to support various underwater missions. In the country, increasing defense budgets are further propelling market growth that aligns with investments in modernizing naval fleets. Market expansion for submarine sensors is expected, considering that nations are focusing on technological advancements to ensure strategic advantages in naval operations.

The United States emerged as a key regional market for submarine sensors, driven by the strong defense focus of the country, especially in strengthening its naval capabilities. Advanced Underwater Surveillance Systems of the U.S. Navy are driving demand forward for cutting-edge submarine sensors, and the need is further increased to detect and track submarines with greater efficiency. Technological advancement in sonar systems, acoustics, and underwater communication sensors has further raised the market, which provides higher accuracy and efficiency to mill-tech and commercial applications. More importantly, high-performance sensors are being invested in by the U.S. to build autonomous underwater vehicles. These AUVs are required for navigation, exploration, and environmental monitoring. The U.S. is modernizing its fleet and expanding into critical maritime zones, so submarine sensors are key to maintaining strategic advantage for the military.

Submarine Sensors Market Trends:

Rise in maritime conflicts and security threats

Increasing and perforce anti-national activities, along with maritime conflict, are pushing the need for high-end submarine sensor demand. The International Maritime Bureau (IMB) has recorded 120 maritime piracy and armed robbery against ships incidents in 2023, which is higher by five incidents compared to the record 115 incidents in 2022. The increasing trend has called for more emergence by enhancing the naval capabilities of countries for safeguarding marine routes and national security. Acoustic submarine sensors detect sound waves emanating from threats such as submarines, mines, and enemy vessels, thus offering information on contours, speed, and range. With the growing cases of maritime incidents, nations are compelled to update their defense systems, resulting in increased spending on submarine sensors for better surveillance, threat detection, and anti-submarine warfare capabilities. In addition, more attack submarines are being deployed in strategic maritime areas by the naval forces for security, hence increasing the submarine sensors market further. These aspects together are stimulating the growth of the submarine sensors market, and countries are taking steps to develop their naval capabilities with national security on the increase because of increased maritime threats.

Technological innovations and interfacing of submarine sensors

The incorporation of advanced technologies including artificial intelligence, IoT, and wireless technologies is revolutionizing the submarine sensors market trends. These advancements have significantly enhanced the remote monitoring and control of submarines, enabling naval forces to track and respond to threats in real-time. AI and IoT technologies optimize sensor data processing, allowing for more accurate and efficient decision-making, while wireless systems improve the transmission of critical data collected by submarine sensors. The development of electromagnetic sensors further strengthens the market by enabling precise object detection, crucial for submarine operations and anti-submarine warfare. Furthermore, the real-time analytics that runs through AI along with inputs from sensors also help enhance the efficiency of operation in attack submarines in terms of maneuverability, speed, and adjustment of depth while operating. Such rapid changes under the water with emerging threats make such technological changes very crucial for the present form of naval warfare. As these technologies advance, they are going to fuel further growth in the submarine sensors market, with high demand for very advanced, integrated systems that can ensure superior underwater surveillance and threat detection.

Environmental monitoring and resource detection applications

The submarine sensors are being put in for both military and defense purposes, as well as growing numbers of non-defense applications, including marine environmental monitoring and the observation of underwater resources. Some of its most vital uses include detection of oil reserves, ocean health monitoring, and identification of potential environmental disasters, which is taking on greater prominence with growing climate change and resource management concerns. The increasing use of submarine sensors for scientific research and resource exploration is opening doors to new vistas of market development. In addition, submarine sensors are now instrumental in the earlier detection of calamities, wherein authorities can preempt and plan responses to submarine seismic events or other natural calamities. Growing interest from all quarters of society and private parties is further galvanizing investments in sensor technology. The dual demand by the military and commercial sectors from the investment made by nations to improve their capabilities for monitoring their marine environment would likely benefit the submarine sensors market. Further propelling this trend is the continued development of more sensitive and accurate sensors, thereby making the prospects for growth in the market bright.

Submarine Sensors Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global submarine sensors market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on submarine type, type, technology, and application.

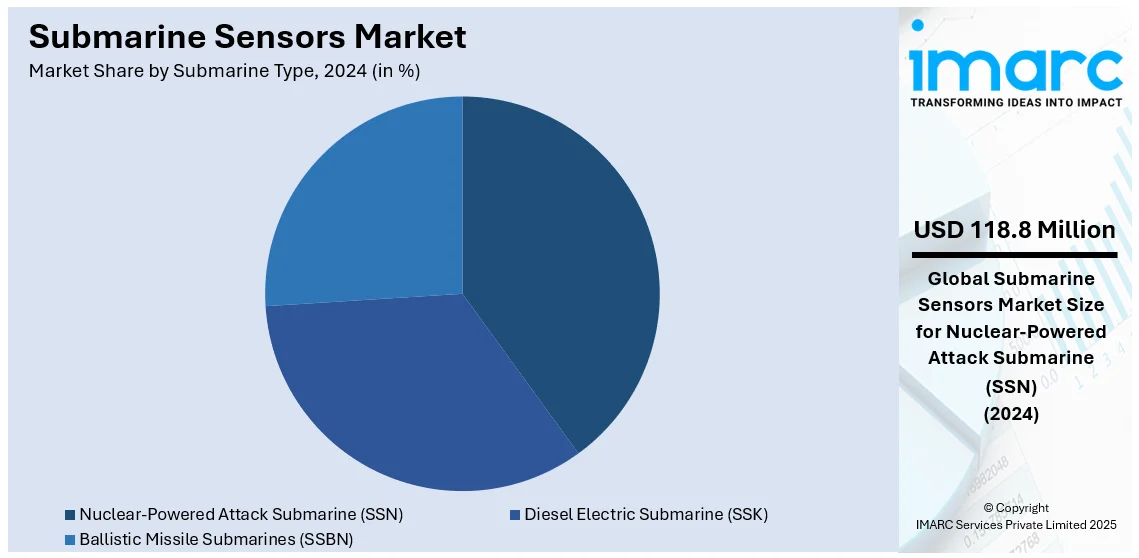

Analysis by Submarine Type:

- Diesel Electric Submarine (SSK)

- Nuclear-Powered Attack Submarine (SSN)

- Ballistic Missile Submarines (SSBN)

Nuclear-powered attack submarines (SSN) represent the leading market for submarines' sensors with a share of 40.2%. Submarines armed with nuclear reactors would provide their means of operational extensions, which help them endure prolonged submerged hours and give them excellent speeds. Therefore, SSNs are equipped with the most sophisticated sonar systems, radar technologies, and communication tools to maximize their operational efficiency and survivability. The integration of advanced acoustic sensors is also one of the critical elements for SSNs to perform their functions; it allows them to detect and track enemy vessels and underwater threats more accurately than anyone else. The increasing demand for SSNs in defense strategies, especially in surveillance, reconnaissance, and anti-submarine warfare, has triggered huge investments in sensor technologies. Such sensors allow for real-time collection of high-grade data in virtually any underwater condition, thus advancing decision-making capacities for naval forces. In addition, SSNs have been designed to progressively include more sophisticated underwater communication systems to enhance their operational capabilities in hard and remote areas. As military budgets for defense and security continue increasing, SSNs remain at the center of building naval power as well as growing the submarine sensor market.

Analysis by Type:

- Sonar

- Acoustic

- Fiber Optic

- Electromagnetic

Acoustic sensors are currently the leading technology in the submarine sensors market because of their major role in underwater detection and communication. The sounds are utilized for detecting objects and measuring distances or in developing detailed maps of the underwater surrounding environment; they are crucial in submarines. Generally, acoustic sensors come in active and passive. The former is used in emitting sound waves and then measuring the reflection back from the object, and the latter is a listener of sound waves originating from other entities, like ships and marine animals. This versatility allows submarines to work covertly and efficiently in both offensive and defensive scenarios. The development of military and commercial applications of submarines has increased the interest in acoustic sensors with superior accuracy, a longer range of detection, and resistance against environmental noise. As acoustic sensors have developed in sensitivity and speed due to more advancements in signal processing and AI, they have become increasingly effective in detecting submerged objects at large distances. As the scope of underwater warfare, surveillance, and marine exploration continues to expand, acoustic sensors play a crucial role in the operational success of submarines, thus propelling further market growth.

Analysis by Technology:

- CMOS

- MEMS

- NEMS

- Others

CMOS technology is known for its low power consumption, high-speed processing, and cost efficiency, making it ideal for high-volume applications in imaging, sensing, and communications. MEMS, on the other hand, integrates mechanical elements in electronics on a single chip, which offers compactness and versatility with the potential to feature high sensitivity, thus making it ideal for the automotive, healthcare, and consumer electronics industries. They are mainly used for motion, pressure, and environmental sensing. NEMS, an advanced step in MEMS, employs nanotechnology to construct highly sensitive sensors whose detection of minute variations in parameters such as mass and force is thus sharper in sensitivity. NEMS also offers more miniaturization and performance while promising applications like medical diagnostics or environmental monitoring that require high sensitivity.

Analysis by Application:

- Marine Environmental Monitoring

- Underwater Species Protection

- Oil Resources Detection

- Underwater Communication

- Others

Underwater communication dominates the submarine sensor market, allowing submarines to maintain reliable and secure communication during their submerged operations. Traditional communication methods, such as radio waves, cannot effectively penetrate water, making specialized sonar-based or acoustic communication systems essential for naval and research operations. Acoustic modems and underwater communication devices, equipped with advanced signal processing capabilities, allow submarines to transmit and receive data, even in deep and challenging underwater environments. The increasing requirement for real-time communication, especially in military operations such as command, control, and intelligence gathering, is a significant driver of more robust and high-performance underwater communication systems. Such systems are applied to various purposes, from fleet coordination and remote monitoring to scientific research and deep-sea exploration. Advances in digital signal processing, noise cancellation, and frequency modulation are making underwater communication much more reliable even in high-noise environments. As submarines become more advanced and autonomous, the need for underwater communication technology is growing, ensuring the effective and continuous exchange of critical information in the underwater domain.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America holds the leading position for submarine sensors with a share of 38.7%, fueled by the massive naval capabilities of the United States and Canada with extensive defense budgets and technological sophistication. The US Navy is, therefore, highly at the lead in the development of submarine sensors as it seeks to stay ahead with continuous research and innovations regarding underwater warfare. North American submarines, especially nuclear-powered attack submarines, are highly dependent on advanced sensors for effective functionality in highly complex underwater environments, ensuring the optimal performance of such military and research functions. The increased development in naval defense forces with antisubmarine warfare, surveillance, and reconnaissance has spurred the demand for advanced submarine sensors in North America significantly. The region is also experiencing increasing investments in commercial underwater exploration and research, where sensor technologies play a crucial role in mapping the seafloor, detecting marine life, and enabling underwater communication for deep-sea exploration. Additionally, North American defense contractors are teaming up with technology companies to develop and integrate next-generation sensors to ensure that submarine fleets remain state-of-the-art. This has seen the North American region continue to dominate the submarine sensor market through innovations and growth.

The submarine sensors market is expanding rapidly in the Asia Pacific due to the defense investment of this region. Countries such as China, India, and Japan are particularly contributing to these defense investments. Tensions in geopolitical affairs and the Indian Ocean, along with the South China Sea, are at their peak and demand advanced detection systems for submarines. Furthermore, the increasing adoption of AUVs and the expanding naval fleets across Asia are stimulating the demand for high-performance submarine sensors. Technological advancements in the region and strategic defense collaborations will continue to fuel market growth.

The submarine sensors market in Europe is driven by the strategic naval importance of the region and growing defense budgets. The UK, France, and Germany are modernizing their naval forces with advanced sensors for underwater surveillance and submarine detection. Growing concerns over submarine threats and environmental monitoring also drive demand. Europe is a significant player in the global submarine sensors market due to its focus on research and development and innovations in sonar and acoustic technologies.

In Latin America, the submarine sensors market is gaining traction as countries like Brazil and Argentina enhance their naval forces. The region’s expanding defense budgets, coupled with increasing concerns over territorial waters and maritime security, have led to investments in advanced submarine detection systems. Technological advancements in sonar and underwater sensor technologies are further boosting market growth. Latin America's strategic focus on enhancing naval capabilities and fostering regional defense collaborations is likely to drive long-term growth in the submarine sensors market.

The Middle East and Africa submarine sensors market is driven by increasing defense expenditure and regional maritime security concerns. Countries such as Saudi Arabia, the UAE, and South Africa are improving their naval capabilities, focusing more on the detection and tracking of submarines in critical waters. The strategic location of the region and its investment in modern defense technologies, including sonar and underwater communication systems, are boosting demand in the market. The growing importance of naval defense in safeguarding maritime trade routes also contributes to the market's expansion.

Key Regional Takeaways:

United States Submarine Sensors Market Analysis

In 2024, the United States held a market share of 85.00%, driven by good defense spending coupled with technological enhancement. According to reports, among the five primary Armed Forces led by DoD, the amount used towards funding for the Navy was USD 202.6 Billion and the Marine Corps was USD 53.2 Billion. The U.S. Navy has consistently focused on modernizing its fleet, thus increasing investments in cutting-edge sonar systems, electronic warfare tools, and integrated sensor platforms. Programs such as Virginia-class submarine production and the Columbia-class ballistic missile submarines amplify demand for advanced sensors capable of detecting, classifying, and tracking potential threats. The other critical driver is the rising emphasis on countering underwater threats posed by near-peer competitors like China and Russia. This focus has been on increasing the range of sensors, as well as enhancing their precision and resistance to electronic countermeasures, to be able to retain its strategic position regarding maritime security. Breakthroughs in sensor miniaturization, AI-based data analytics, and real-time threat assessment technologies between the Department of Defense and the private sector also continue to promote innovations that support stealth and survivability. There has also been the deployment of undersea surveillance networks in the form of the Sound Surveillance System (SOSUS) and its derivatives; hence, complex sensors that fit in wide-area surveillance systems are indispensable. This further falls in with the U.S. strategy towards securing its interest in the high seas and protecting freedom of navigation in contested areas.

Europe Submarine Sensors Market Analysis

Heightened security concerns due to the Russian naval activities in the Baltic and North Atlantic are driving the European submarine sensors market. Countries such as the United Kingdom, France, and Germany are investing significantly in modernizing their submarine fleets for enhanced maritime security and deterrence. According to reports, in 2023, there were 12 fatalities in maritime accidents worldwide involving EU-registered ships and another 8 fatalities in accidents within the EU territorial seas involving ships registered outside the EU. This necessitates advanced sensors capable of detecting increasingly stealthy adversary submarines. Another driver is Europe’s commitment to NATO’s collective defense strategy, which emphasizes the importance of undersea capabilities in maintaining deterrence. Other examples of advanced sensor systems being integrated into programs include the UK's Dreadnought-class submarines and France's Barracuda-class submarines, used for anti-submarine warfare and intelligence missions. In Europe, autonomous underwater vehicle development is adding more pressure to the demand for compact and high-performance sensors. Such AUVs are increasingly being used for mine detection, surveillance, and scientific research, where high-performance sensors must operate under the most demanding conditions in underwater environments. In addition to this, the interest of European industries in sustainability and green technologies is promoting innovations in energy-efficient sensors for long-duration missions. The region's expertise in sonar technology and hydroacoustic sensors makes it a leader in advancing capabilities for military as well as civilian applications.

Asia Pacific Submarine Sensors Market Analysis

The Asia Pacific submarine sensors market is growing rapidly due to escalating maritime tensions and regional military modernization efforts. As per reports, the Ministry of Defence signed two major contracts worth USD 344.04 Million with Mumbai-based Mazagon Dock Shipbuilders Limited and Naval Group, France. Other markets are the nations of China, India, and Japan, which are rapidly expanding their submarine fleets to secure supremacy in strategic waterways such as the South China Sea and the Indian Ocean. Such geopolitical competition prompts a demand for advanced sensors for situational awareness with superior undersea domain monitoring. The expansion of the Chinese naval forces with their Type 094 and Type 096 ballistic missile submarines is a great market driver. To balance this, India and Japan are investing in their submarine capabilities, including sophisticated sensors to improve detection and tracking. For example, India's Project 75 and 75I, which aim to develop advanced submarines, require state-of-the-art sensor technologies. The increasing use of submarine sensors for non-military purposes, such as monitoring undersea cables and resources, is also a driving force. The region's countries are utilizing sensor technologies to protect underwater assets that are crucial for energy and communication networks. Additionally, the growth of the market is also influenced by technological advancements in acoustic sensors, low-frequency sonar, and AI-based systems. These advancements provide better performance in shallow and cluttered waters that are common in the Asia Pacific, thus ensuring effective operations in different environments.

Latin America Submarine Sensors Market Analysis

In Latin America, the submarine sensors market is motivated by efforts to protect vast coastlines and valuable underwater resources. Brazil, Argentina, and Chile are investing in modern submarine technologies to strengthen their maritime security and resource protection capabilities. For example, Brazil's Scorpène-class submarines are spurring the demand for advanced sensors to monitor and secure vital offshore oil fields. Another key driver is the growing interest of the region in protecting undersea infrastructure, such as communication cables and pipelines. According to reports, Brazil plans to structure a framework to protect the 15 submarine fiber cables that currently connect the country, both internally and to other parts of the world, ensuring critical connectivity and content delivery to users and companies. Latin America also focuses on anti-smuggling and anti-narcotics operations, wherein sensors play a crucial role in identifying and tracking illicit activities underwater. The integration of cost-effective, durable technologies suitable for diverse marine environments further supports market growth in the region.

Middle East and Africa Submarine Sensors Market Analysis

Increasing geopolitical tensions and the necessity of protecting maritime trade routes are also enhancing market growth. Strategic waterways of the region, like the Strait of Hormuz and the Red Sea, play a significant role in the transportation of oil across the world. Such regions require high-tech sensors for surveillance and threat detection. Furthermore, the modernization of defense programs in Saudi Arabia, the UAE, and South Africa is enhancing the demand for cutting-edge submarine sensor systems. According to the announcement from the Saudi Arabia Ministry of Finance in December 2022, the Kingdom plans to spend USD 69 Billion on defense in 2023, representing nearly 23 percent of its entire budget, up 50% from 2022 defense budget. The above countries are also acquiring new submarines equipped with advanced sonar and acoustic technologies to provide a greater degree of security in the marine environment. Moreover, the emphasis on preserving offshore resources, such as oil and gas fields, contributes to the growth of the market in this region.

Competitive Landscape:

Market players in the submarine sensors industry are focusing on technological advancements and strategic partnerships to strengthen their market presence. Companies are investing heavily in the development of cutting-edge sonar, acoustic, and imaging technologies to offer superior detection and tracking capabilities. Major players like Lockheed Martin, Thales Group, and Raytheon Technologies are involved in the production of advanced sensors for naval defense and autonomous underwater vehicles (AUVs). Market players engage in close collaborations with defense agencies and research organizations to increase the performance of sensors and meet the changing needs of modern naval operations. There is a growing trend in the integration of submarine sensor systems with AI and machine learning for efficient data processing and on-site detection of threats, giving a competitive edge to the market. Companies are also exploring opportunities in environmental monitoring and commercial applications, which are going beyond the defense markets. These efforts create a positive submarine sensors market outlook.

The report provides a comprehensive analysis of the competitive landscape in the submarine sensors market with detailed profiles of all major companies, including:

- Atlas Elektronik (ThyssenKrupp AG)

- L3Harris Technologies Inc.

- Leonardo DRS Inc

- Northrop Grumman Corporation

- Raytheon Technologies Company

- Safran Electronics & Defense (Safran S.A.)

- Thales Group

Latest News and Developments:

- January 2025: The Indian Navy's sixth Kalvari-class submarine, INS Vagsheer, is modeled after the French "Scorpene." This sub is a component of 'Project 75,' which includes technological collaboration with Naval Group, a French corporation. It was created with the cooperation of many Indian businesses as part of the "Make in India" campaign.As a continuation of the Vela-class submarines, INS Vagsheer has sophisticated weapons systems, stealth characteristics, and cutting-edge technology that strengthen its powerful capabilities.

- February 2024: To improve the Royal Navy's sonar and sensors' long-term availability and robustness, Thales has inked a USD 2.3 Billion deal. Equipment availability and problem prediction using AI-assisted data collection will be the main objectives of the 15-year Maritime Sensor Enhancement Team (MSET) contract.

- December 2023: Northrop Grumman Systems Corp., the NOC business subsidiary of Northrop Grumman Corp., secured a contract to provide assistance for a maritime sensor system. It would buy 12 parts to support the WSN-7 ship inertial navigation system or INS. Its estimated value was USD 12.5 Million; it will likely be done in June 2028.

- June 2023: Thales and COMMIT (Dutch Command Materiel and IT) have agreed to produce and supply the fire control cluster and sensor suite for the Above Water Warfare System (AWWS) for the four new ASW (Anti-Submarine Warfare) Frigates built by the Netherlands and Belgium. This deal, which is valued at several hundred million euros, further solidifies Thales' position as a global leader in cutting-edge naval fire control and sensor technologies.

- April 2023: Lockheed Martin Rotary and Mission Systems were awarded a 17.2 Million dollar contract amendment to support the manufacturing of systems and related components for submarines of the new construction and in-service classes.

Submarine Sensors Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Submarine Types Covered | Diesel Electric Submarine (SSK), Nuclear-Powered Attack Submarine (SSN), and Ballistic Missile Submarines (SSBN) |

| Types Covered | Sonar, Acoustic, Fiber Optic, and Electromagnetic |

| Technologies Covered | CMOS, MEMS, and NEMS |

| Applications Covered | Marine Environmental Monitoring, Underwater Species Protection, Oil Resources Detection, and Underwater Communication |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Atlas Elektronik (ThyssenKrupp AG), L3Harris Technologies Inc., Leonardo DRS Inc, Northrop Grumman Corporation, Raytheon Technologies Company, Safran Electronics & Defense (Safran S.A.), Thales Group, etc |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the submarine sensors market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global submarine sensors market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the submarine sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The submarine sensors market was valued at USD 295.48 Million in 2024.

The submarine sensors market is estimated to exhibit a CAGR of 2.36% during 2025-2033.

The submarine sensors market is driven by the increased demand for maritime security, advances in sensor technologies, increased requirements for enhanced underwater surveillance, and the growth in defense budgets and increasing importance of naval operations in geopolitical tensions.

North America currently dominates the market with a share of 38.7%, driven by the massive naval capabilities of the United States and Canada with extensive defense budgets and technological sophistication.

Some of the major players in the submarine sensors market include Atlas Elektronik (ThyssenKrupp AG), L3Harris Technologies Inc., Leonardo DRS Inc, Northrop Grumman Corporation, Raytheon Technologies Company, Safran Electronics & Defense (Safran S.A.), Thales Group, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)