Submarine-Launched Missile Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Submarine-Launched Missile Market Size and Share:

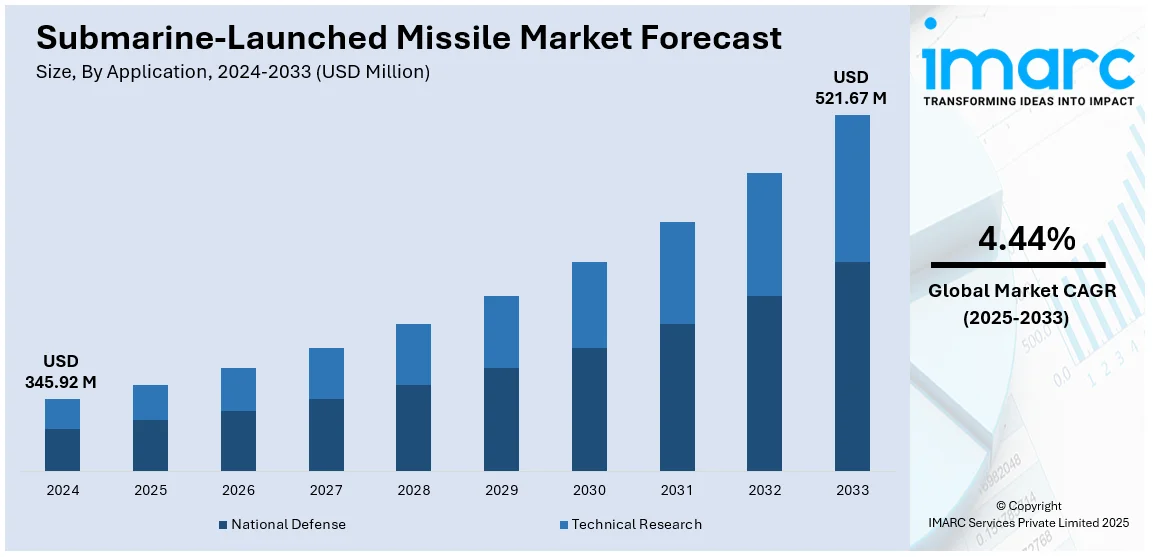

The global submarine-launched missile market size was valued at USD 345.92 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 521.67 Million by 2033, exhibiting a CAGR of 4.44% from 2025-2033. North America currently dominates the market, holding a market share of over 39.6% in 2024. The growth of the North American region is driven by advanced defense technologies, strong military infrastructure, strategic naval capabilities, ongoing modernization programs, and geopolitical security concerns. These factors significantly contribute to North America's dominance in the submarine-launched missile market share, maintaining its leadership in the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 345.92 Million |

|

Market Forecast in 2033

|

USD 521.67 Million |

| Market Growth Rate (2025-2033) | 4.44% |

Many countries around the world are modernizing their defense abilities to address shifting security challenges. Submarine-launched missiles are central to these efforts because they provide stealthy and long-range offensive and defensive options. Moreover, ongoing innovations in missile design, propulsion systems, and guidance technology are boosting interest in next-generation systems. Hypersonic missile development, enhanced precision targeting, and extended operational ranges are making submarine-launched missiles more effective and versatile. These advancements ensure they remain critical components of modern military arsenals. In addition, advanced technologies, including artificial intelligence (AI), are being incorporated into missile systems to improve their precision, adaptability, and operational efficiency. Autonomous targeting and decision-making capabilities are making these systems more effective in complex combat scenarios, further supporting the market growth.

The United States is a crucial segment in the market, driven by robust funding for defense programs, which ensures the availability of resources for the research, development, and deployment of advanced submarine-launched missile systems. Additionally, the country continues to prioritize the modernization and expansion of its submarine-launched missile systems through significant defense contracts. These initiatives focus on producing next-generation missile platforms, upgrading warheads, and enhancing guidance technologies to maintain long-range precision and bolster strategic deterrence capabilities. In 2024, Lockheed Martin secured a $2.1 billion contract to manufacture more Trident II D5 submarine-launched nuclear missiles and provide support for deployed systems for the navies of the U.S. and UK. The directive involves creating the new Warhead 93 to take the place of current W76 and W88 warheads beginning in 2034. The Trident II D5 missile, capable of reaching 4,000-7,000 miles, employs inertial and celestial navigation for its targeting system.

Submarine-Launched Missile Market Trends:

Growing Defense Budgets and Naval Modernization Programs

Escalating geopolitical tensions and the demand for improved maritime security are prompting countries around the globe to boost defense expenditures, particularly focusing on naval strength. Investments in missiles launched from submarines, known for their stealth capabilities and strategic deterrence, are undergoing considerable expansion. Major military nations like the U.S. and China are focusing on improvements in their submarine capabilities. The United States is upgrading its Ohio-class submarines with modern Trident II D5 missile systems, whereas China is outfitting its Type 094 Jin-class submarines with cutting-edge JL-3 submarine-launched ballistic missiles. The Stockholm International Peace Research Institute (SIPRI) reports that worldwide military spending in 2022 increased by 3.7% when adjusted for inflation, hitting an unprecedented level of USD 2,240 Billion. This increase in defense spending highlights the rising emphasis on advanced technologies to enhance naval capabilities, positioning submarine-launched missiles as an essential part of sustaining strategic dominance and protecting maritime territories.

Advancements in Missile Technology

Advancements in missile design are significantly supporting the submarine-launched missile market growth. Innovations such as enhanced propulsion systems, extended operational ranges, and advanced guidance technologies have elevated the strategic importance of these missiles. Features like improved target discrimination, resilience to adverse weather conditions, and sophisticated electronic countermeasures ensure their effectiveness in modern warfare scenarios, making them indispensable for naval forces worldwide. For instance, the MBDA Exocet SM40, equipped with a turbojet engine and advanced RF seekers, demonstrates how cutting-edge technologies are enhancing precision and operational range. Additionally, China’s JL-3 submarine-launched ballistic missiles (SLBMs), capable of striking targets up to 10,000 km away, underscore the strategic emphasis on upgrading submarine-based deterrence capabilities. According to the U.S. Defense Department, such systems bolster nuclear-powered ballistic missile submarines, enabling countries to enhance their defense postures. These advancements are central to modernizing military fleets, fueling global demand for submarine-launched missile technologies.

Rising Focus on Strategic Deterrence and Underwater Capabilities

Submarine-launched missiles represent the most important tools in modern defense strategies, where stealth and survivability are offered in a way never seen before. These characteristics contribute to nuclear deterrence as well as ensure a second strike, which always provides a positive response in retaliation to an attack. As nations develop their strategic arsenals, the needs for submarine-launched ballistic and cruise missiles rise because of their potential application in both conventional and nuclear forces. For example, the UGM-133 Trident II D5 is a three-stage, solid-fueled intercontinental ballistic missile that represents cutting-edge technology in its systems. The Trident D5 serves as a backbone of global deterrence for both the United States in Ohio-class submarines and the United Kingdom in Vanguard-class submarines. According to CSIS, these capabilities strengthen the strategic posture of naval forces and stimulate investments in submarine-launched missile programs around the world. This increasing deployment also reflects their important role in augmenting offensive as well as defensive military operations.

Submarine-Launched Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global submarine-launched missile market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

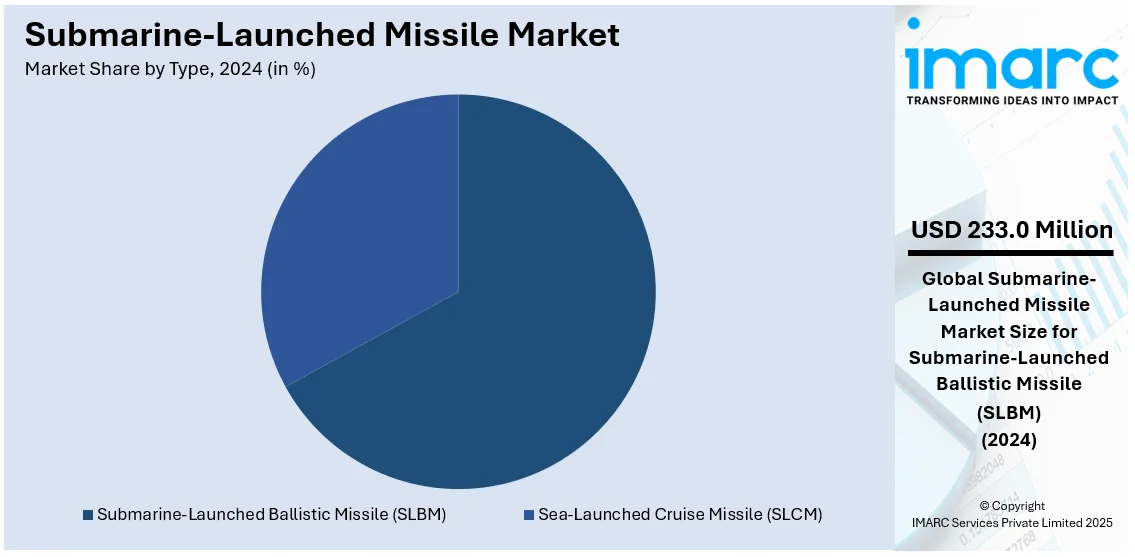

Analysis by Type:

- Submarine-Launched Ballistic Missile (SLBM)

- Sea-Launched Cruise Missile (SLCM)

Submarine-launched ballistic missile (SLBM) represented the largest segment, accounting 67.36% in 2024. The submarine-launched ballistic missile (SLBM) leads the market because of its unparalleled strategic deterrence ability and function in nuclear defense. SLBM provides unmatched stealth, serving as an essential component for a nation's second-strike capability, as it can be fired from underwater submarines, reducing its risk of being targeted by preemptive attacks. Its reach, precision, and load capacity provide enhanced operational versatility, enabling nations to exert influence over long distances without exposing the weaknesses of surface ships or aerial resources. Furthermore, SLBM is crucial for sustaining the power equilibrium in a multi-polar world where nuclear deterrence continues to be a fundamental aspect of defense strategies. The ongoing development of missile technology, featuring enhanced propulsion systems and guidance methods, reinforces its significance in naval weaponry.

Analysis by Application:

- National Defense

- Technical Research

The national defense segment holds a notable submarine-launched missile market share, driven by the need for strategic deterrence and maritime security. These missiles are crucial for maintaining a nation's defense posture, enabling rapid response capabilities and ensuring second-strike nuclear deterrence. As geopolitical tensions rise, countries are prioritizing investments in submarine-launched missile systems to safeguard their interests and bolster their military strength. The ability to launch missiles from submerged submarines enhances stealth, making these systems nearly impossible to detect, which further amplifies their effectiveness in national defense strategies.

In the technical research segment, submarine-launched missiles play a pivotal role in advancing missile technology, guidance systems, and propulsion mechanisms. Research institutes and defense contractors are focused on improving missile capabilities like range, payload precision, and maneuverability. This segment fosters innovation, driving the development of next-generation systems with enhanced stealth and accuracy. Collaborations between military and academic research entities provide valuable data and simulations, driving breakthroughs in advanced missile technologies.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 39.6%. North America leads the market because of its strong military presence and advanced defense technologies. The US Navy, with its extensive fleet of nuclear-powered submarines, plays a crucial role in driving the submarine-launched missile market demand. Ongoing modernization programs to enhance strategic deterrence capabilities and maintain maritime superiority contribute significantly to market growth. Additionally, North America’s focus on cutting-edge research activities ensures continuous innovation in missile range, precision, and stealth technologies. The geopolitical landscape, with increasing concerns over potential threats from rival nations, further amplifies the need for reliable and advanced submarine-launched missiles. Partnership between defense contractors and government agencies in the US and Canada are strengthening the production and deployment of next-generation missile systems. In 2024, the US announced plans to equip its submarines with nuclear-armed cruise missiles, marking the first such move in nearly 30 years. The Navy issued a Request for Information (RFI) for a Sea-Launched Nuclear Cruise Missile (SLCM-N), aiming for deployment by 2024. This new missile system is intended to provide flexible nuclear options and enhance deterrence capabilities.

Key Regional Takeaways:

United States Submarine-Launched Missile Market Analysis

The United States is significantly strengthening its submarine-launched missile capacity as part of its strategic nuclear deterrence. The Navy aims to spend approximately USD 130 Billion in conducting research, developing, and purchasing 12 Columbia-class submarines in place of its existing fleet of 14 Ohio-class ballistic missile submarines, the Government Accountability Office reported. The advanced Trident II D5 missiles with intercontinental range and multiple nuclear warhead-carrying capability will arm the Columbia-class submarines. They are the crucial component of sea-based nuclear deterrence in the United States, guaranteeing second-strike capability in case of a nuclear attack. The investment thus signifies that submarine-launched missiles have increasingly become the future for a credible nuclear deterrence force. As geopolitical tensions increase worldwide, the U.S. is further expanding its missile defense systems to better protect its strategic interests and enhance its national security while countering constantly changing threats. Deployment and development are crucial for the U.S. defense strategy.

Europe Submarine-Launched Missile Market Analysis

The military expenditure growth across Europe in 2022 has been impacted by Russia's invasion of Ukraine. According to Stockholm International Peace Research Institute (SIPRI), the increase in military spending in Europe has been reported to be the largest annual increment since the post-Cold War era, growing by 13%. This defense budget increase has resulted from a greater need for sophisticated defense technologies, such as submarine-launched missiles, for the enhancement of national security and strategic deterrence capabilities. With an increased focus on improving nuclear and conventional deterrence against geopolitical instability, European nations are building up their nuclear and conventional arsenals. One of the many ways this is being done is through the upgrading and expansion of naval fleets for several countries with advanced submarine-launched missile systems. These can provide improved stealth and survivability, making them a prime weapon for both nuclear deterrence and conventional defense. The rising security concerns in the region, especially due to increased tensions with Russia, are likely to fuel continued investment in submarine-launched missile technology, thereby driving the growth of this market in Europe over the next few years.

Asia Pacific Submarine-Launched Missile Market Analysis

The growth in military spending by Asia Pacific in 2022 can be traced to major leaps in China, India, and Japan, as the three together accounted for 73% of the total defense expenditure of the region, as per SIPRI. This leapfrogging in defense budgets is a result of geopolitical tensions and territorial issues that require countries to upgrade their defense systems. Strengthening of navy forces, upgrading strategic deterrence- advanced submarine launched missiles; Development and Procurement. In other words, developing advanced submarines launching missiles in huge numbers has a high strategic potential which can boost a country's defense power to another level. On the one hand, China invests heavily on SLBM (Submarine-launched ballistic missile), JL-3 systems that further improve nuclear deterrence, meanwhile India and Japan keep improving naval fleet with leading missile technologies. An increasing demand for maritime security, coupled with a modern, technology-savvy defense system, is creating a favorable Asia Pacific submarine-launched missile market outlook.

Latin America Submarine-Launched Missile Market Analysis

SIPRI reports that Brazil, the largest military spender in Latin America, allocated USD 20.2 Billion to its defense sector in 2022. This followed a pattern of rising military expenditure in the country as it places greater importance on strengthening national security and modernizing its defense capabilities. As Brazil continues to look to improve its naval capabilities, the demand for cutting-edge defense technologies like submarine-launched missiles is increasing. The country is investing in conventional as well as nuclear-powered submarines, since a strong naval deterrent would be essential in the coming future. Efforts by Brazil in modernizing the military have spread across the region of Latin America, as countries in this subregion start up-gradation work on defense infrastructure. Another factor pushing the market for submarine-launched missiles in Latin America is the emphasis on increased maritime security, which, together with geopolitical considerations and the demand for greater deterrence capabilities, is further accelerating. In turn, this is set to continue as countries in the subregion continue to strengthen their defense capabilities and strategies.

Middle East and Africa Submarine-Launched Missile Market Analysis

Military spending in the Middle East was predicted at USD 184 billion in 2022. SIPRI reported a 3.2% rise from the last year. This growth in defense spending reflects an increasing concern for military capabilities that respond to greater security concerns and increasing instability in the region. This will be the growing demand for submarine-launched missiles as nations in the Middle East seek to improve their deterrence capabilities and safeguard their maritime borders. Advanced naval technologies, such as ballistic and cruise missiles launched from submarines, will become integral parts of military strategies in the region. Countries like Saudi Arabia, the UAE, and Israel are investing in their fleets to modernize, but with a strong focus on stealthy missiles, mobility, and strategic reach. Further geopolitical tensions in the Gulf region and ongoing crises will, therefore, drive the necessity for submarine-launched missile capabilities, which will fuel market growth in the Middle East and Africa.

Competitive Landscape:

Major participants in the submarine-launched missile market are concentrating on improving missile range, precision, and stealth features by utilizing cutting-edge technologies such as hypersonic propulsion and autonomous guidance systems. Businesses are putting money into research and development to enhance missile payloads and maneuverability under different underwater scenarios. Collaborative alliances between defense suppliers and naval forces are being enhanced to address particular national defense requirements, focusing on modernizing current missile systems and incorporating new ones into submarines. Participants are expanding their products to serve both traditional and nuclear-capable systems, while carefully observing geopolitical changes to synchronize their advancements with changing defense plans. Moreover, there is significant advocacy for interoperability with partner countries to guarantee collective defense abilities. In 2024, India conducted a successful test of the K-4 submarine-launched nuclear missile, which has a range of 3,500 km, from the newly commissioned INS Arighaat in the Bay of Bengal. This represents an important achievement in strengthening India’s naval deterrence abilities. The assessment highlights India's expanding fleet of nuclear submarines and its sophisticated strategic defense stance.

The report provides a comprehensive analysis of the competitive landscape in the submarine-launched missile market with detailed profiles of all major companies, including:

- BAE Systems Plc

- BrahMos Aerospace

- General Dynamic Corporation

- Lockheed Martin Corporation

- MBDA

- Raytheon Technologies Corporation

- The Boeing Company

Latest News and Developments:

- November 2024: MBDA unveiled the Exocet SM40, the future generation of anti-ship missiles for submarines with modern naval combat. It possesses J-band RF seekers for high-resolution target acquisition, a turbojet engine expanding its range up to 120 km, and additional capabilities for more demanding weather and electronic warfare. The SM40 retains the underwater launch characteristics of the SM39 but provides more effective self-defense and anti-submarine warfare capabilities. It further strengthens MBDA's position as one of the top European submarine-launched missile systems manufacturers.

- September 2023: Lockheed Martin, along with the U.S. Navy, has successfully launched an unarmed Trident II D5 Life Extension Fleet Ballistic Missile in a Demonstration and Shakedown Operation-32 (DASO-32).

- May 2023: The US Defense Department stated that China is equipping its nuclear submarines with advanced JL-3 submarine-launched ballistic missiles, marking a substantial advancement in its naval missile capabilities.

Submarine-Launched Missile Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Submarine-Launched Ballistic Missile (SLBM), Sea-Launched Cruise Missile (SLCM) |

| Applications Covered | National Defense, Technical Research |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | BAE Systems Plc, BrahMos Aerospace, General Dynamic Corporation, Lockheed Martin Corporation, MBDA, Raytheon Technologies Corporation, The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the submarine-launched missile market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global submarine-launched missile market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the submarine-launched missile industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The submarine-launched missile market was valued at USD 345.92 Million in 2024.

IMARC estimates the submarine-launched missile market to exhibit a CAGR of 4.44% during 2025-2033.

The submarine-launched missile market is driven by increasing defense budgets, geopolitical tensions, and the growing need for advanced naval deterrence systems. Technological advancements in missile accuracy, stealth capabilities, and payload efficiency, coupled with the modernization of naval fleets and strategic defense initiatives, further fuel demand for submarine-launched missile systems.

North America currently dominates the market driven by its strong military presence and advanced defense technologies along with its extensive fleet of nuclear-powered submarines.

Some of the major players in the submarine-launched missile market include BAE Systems Plc, BrahMos Aerospace, General Dynamic Corporation, Lockheed Martin Corporation, MBDA, Raytheon Technologies Corporation, The Boeing Company, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)