Stretch Marks Treatment Market Size, Share, Trends, and Forecast by Treatment, Distribution Channel, End User, and Region, 2025-2033

Stretch Marks Treatment Market Size and Share:

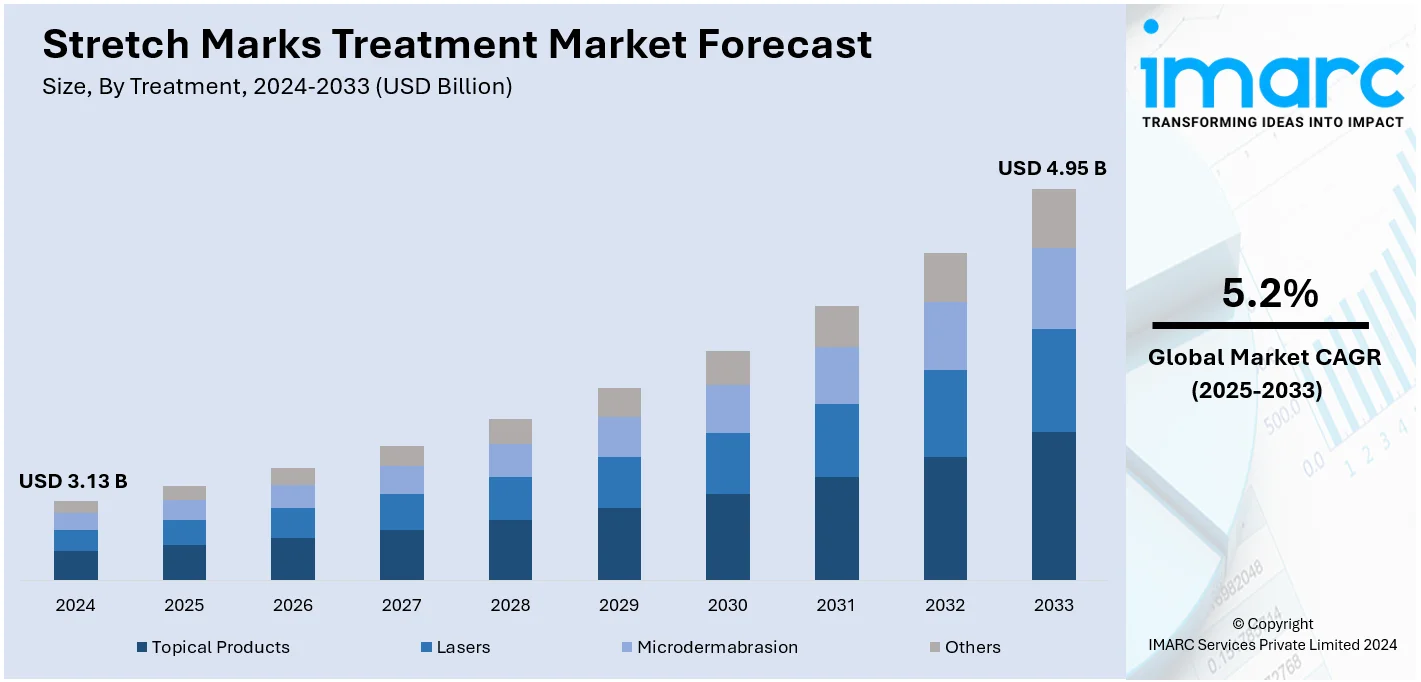

The global stretch marks treatment market size was valued at USD 3.13 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.95 Billion by 2033, exhibiting a CAGR of 5.2% from 2025-2033.Key stretch marks treatment market trends in North America include the high demand for advanced skincare solutions due to increased awareness, rising disposable income, and the prevalence of post-pregnancy and weight-related skin concerns. As per the WHO article released in August 2024, roughly 1 in 8 people worldwide experienced obesity in 2022.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.13 Billion |

| Market Forecast in 2033 | USD 4.95 Billion |

| Market Growth Rate (2025-2033) | 5.2% |

The global stretch marks treatment market is driven by the rising consumer awareness about aesthetic treatments and self-care is the primary driver fueling the demand for advanced solutions. Moreover, the increasing incidences of pregnancy-related stretch marks and weight fluctuations are contributing to the market expansion. For instance, stretch marks affect up to 90% of pregnant individuals by the end of pregnancy, therefore, there is a great market for such creams. In addition, ongoing technological advancements in laser and non-invasive therapies enhance treatment efficacy and attract consumers, fueling the market demand. Besides this, the rising disposable incomes enable access to premium treatments, driving the market demand. The growing popularity of natural and organic products aligns with the preferences of health-conscious consumers, driving stretch marks treatment market growth.

To get more information on this market, Request Sample

The United States (U.S.) stretch marks treatment market is primarily driven by the increasing prevalence of obesity and lifestyle changes, prompting increased treatment adoption. According to new data from the Centers for Disease Control and Prevention (CDC) on population, in 2023, 23 states in America had over 1 in 3 adults obese, which is around 35%. In confluence with this, the widespread availability of advanced medical infrastructure supports innovative therapies like radio frequency (RF) and ultrasound treatments, strengthening the market share. Additionally, the growing awareness of personalized skincare fosters demand for customized solutions, fostering the market growth. Concurrently, the increasing influence of celebrity endorsements and wellness trends drives interest in aesthetic care, boosting the market demand. Furthermore, the rising adoption of over-the-counter (OTC) creams and lotions highlights consumer preference for convenience, thereby impelling the market growth.

Stretch Marks Treatment Market Trends:

Growing cosmetic surgery industry

The growth in the cosmetic surgery industry significantly impacts the stretch marks treatment market, as evidenced by an increasing preference for non-surgical procedures. According to a research article, in 2023, the global aesthetic procedures market reached 34.9 million procedures, a 3.4% increase from the previous year. Additionally, with advances in minimally invasive technologies, there is less downtime and more accessible options available for individuals who wish to enhance their cosmetic characteristics. Moreover, the popular treatments include laser therapy, microdermabrasion, and chemical peels that are increasingly used to eliminate imperfections while improving the skin. This is driven by consumer demand for the treatments that bring the effects and eliminate the risks and recovery time that accompany surgeries. Besides, the widespread adoption of cosmetic procedures is due to the minimization of stigma, which is driving individuals to indulge in these procedures, thus driving stretch mark treatments market growth.

Rising obesity rates

Another important stretch marks treatment market trends is the growing obesity rates worldwide are another critical driver for the stretch marks treatment market. According to the Centers for Disease Control and Prevention (CDC), data from 2023 reveals that in 23 states, over one-third of adults (35%) are now classified as obese. Over a decade ago, no state reported an obesity rate of 35% or higher. Currently, every state in the U.S. has almost 20% of its adult population that is living with obesity. Additionally, frequent weight fluctuations, a common consequence of obesity, can lead to the formation of stretch marks. This creates a robust demand for effective treatment solutions that can minimize their appearance. Besides, the beauty and wellness industries are developing marketing products and procedures that cater specifically to this need. Along with this, from topical creams and oils to advanced laser therapies, the market is expanding to include a wide range of options catering to different preferences and budgets. This response reflects the growing issue of obesity and aligns with a broader consumer shift toward personal care and body positivity, emphasizing the treatment of conditions like stretch marks more openly and innovatively across the globe.

Growing medical aesthetic procedures

The increase in medical aesthetic procedures, particularly non-invasive ones, also plays a crucial role in the expansion of the stretch marks treatment market. In 2023, 34.9 million aesthetic procedures were performed around the world, an increase of 3.4% over the previous year. These include 15.8 million surgical procedures and 19.1 million non-surgical procedures, an industrial report stated. Additionally, with advancements in medical technology, treatments that were once considered complex and invasive are now more accessible and convenient. Moreover, non-invasive treatments like laser therapy and microdermabrasion are preferred for their efficacy in reducing the visibility of stretch marks without the need for surgical intervention. The stretch marks treatment market trends suggest that this shift toward gentler, technologically advanced solutions aligns with the modern consumer's lifestyle, which often prioritizes minimal recovery time. Besides, the aesthetic appeal of these procedures, coupled with their promoted benefits, has led to wider acceptance and subsequent demand, fueling market growth in regions with a high uptake of cosmetic procedures.

Stretch Marks Treatment Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stretch marks treatment market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on treatment, distribution channel, and end user.

Analysis by Treatment:

- Topical Products

- Creams

- Oils and Serum

- Lotions

- Lasers

- Fractional Lasers

- Pulse-Dye Lasers

- Others

- Microdermabrasion

-

Others

Topical products hold the maximum number of stretch marks treatment market share in 2024 because it is convenient, inexpensive, and does not involve any invasion of the body. These products are widely used as first-choice treatments since consumers are in constant search of affordable and easy-to-use products. The segment’s growth is also attributed to the widespread awareness among consumers regarding preventive skincare, especially during pregnancy or major weight changes. Also, health-conscious consumers are drawn to new products that are made with natural and organic ingredients. Additionally, optimized marketing techniques like endorsement by celebrities or partnerships with influencers increase product awareness and sales. Furthermore, the existence of all products that are aimed at different skin types and problems, increases the prospects of the segment. Apart from this, ongoing research to enhance the effectiveness and safety of topical products is propelling the stretch marks treatment market trends.

Analysis by Distribution Channel:

- Institutional

- Retail

- Supermarkets and Hypermarkets

- Specialist Retailers

- Medical Retailers

- Online Stores

- Others

The need for stretch marks treatment products is significantly influenced by institutional markets, including hospitals and dermatological clinics as customers due to recommended treatments. Furthermore, these channels leverage the ongoing trends of consumers opting for professional advice and attention, thus fueling the market demand.

In the retail segment, supermarkets and hypermarkets which are highly dependent on convenience and broad choice are oriented to the mass consumer. Specialist retailers are for the audience interested in premium or organic products, while medical retailers focus on the product effectiveness and credibility offered by dermatology-approved products. Besides this, the online channel is the fastest-growing channel, as salons and spas, use wellness trends to provide specific skin treatment services. In addition, these channels reach a large audience, satisfy consumer demand, impelling the market growth.

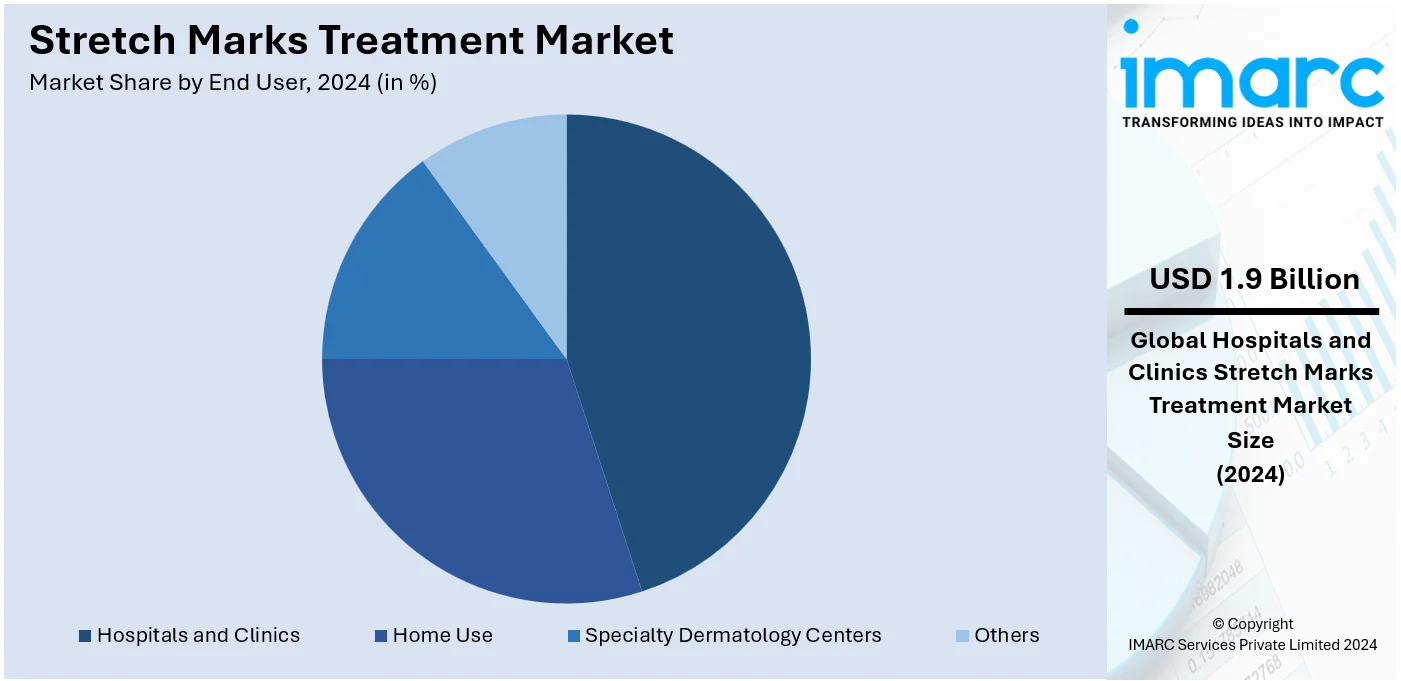

Analysis by End User:

- Hospitals and Clinics

- Home Use

- Specialty Dermatology Centers

- Others

Home use led the market in 2024 because it is easy to use and inexpensive, and consumers are increasingly turning to home remedies. The segment’s expansion is further propelled by the rising popularity of OTC products such as creams, oils, serums, and lotions for different skin types and issues. The inclusion of natural and organic ingredients in advanced formulations effectively meets the needs of health-conscious customers. Concurrently, the increase in e-commerce websites has magnified the availability and use of home-use products, accompanied by descriptions and reviews to assist people in making their purchases. Besides this, the role of social networks and beauty standards also enhances the active use of skincare procedures and products. As a result, innovations in home-use devices, including handheld laser tools and RF technology have enabled the development of professional treatments, contributing to the market expansion.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share driven by the high prevalence of obesity, sedentary lifestyles, and significant weight fluctuations. Moreover, advanced healthcare infrastructure supports the availability of innovative therapies, including laser treatments and radiofrequency devices, supporting the market growth. In addition, the rising awareness about aesthetic wellness and the importance of skincare, particularly among postpartum women, is impelling the market demand. Concurrently, the region’s strong presence of leading dermatology clinics, spas, and skincare brands provides consumers with diverse and effective solutions, strengthening the market share. Furthermore, the increasing disposable incomes enable access to premium products and treatments, fueling the market demand. Apart from this, social media influence and celebrity endorsements are one of the primary key stretch marks treatment market trends.

Key Regional Takeaways:

United States Stretch Marks Treatment Market Analysis

The U.S. stretch marks treatment market is increasing because more and more people are becoming aware of the importance of skincare and advanced treatments. As the American Society of Plastic Surgeons reports, there were nearly 1.6 million laser skin resurfacing procedures in 2023, increasing demand for stretch mark reduction methods. Non-invasive treatments are gaining ground as they work effectively. High disposable income and wellness trends drive further market expansion. Lumenis and Cynosure are the most significant players in the market, with innovative devices.

Europe Stretch Marks Treatment Market Analysis

Europe's stretch marks treatment market is fueled by advancements in technology and increased adoption of the non-invasive procedure. As an industrial report, in the year 2023, Germany stood at 781,440 non-surgical aesthetic procedures, France had 560,100, and Italy had 495,188. So, the non-invasive ways for stretch marks treatments by laser therapy and microneedling are highly emerging too. The UK and Spain also see a growing demand for post-pregnancy and weight-loss treatments. Eco-friendly, innovative solutions by companies such as Candela Corporation and Alma Lasers are taking the lead while strict regulations ensure safety and quality.

Asia Pacific Stretch Marks Treatment Market Analysis

The Asia Pacific stretch marks treatment market is expected to exhibit strong growth, influenced by increased disposable incomes and increasing demand for advanced skincare solutions. According to IMARC Group, the skincare market in China has been sized at about USD 46.3 Billion in 2023. It is also estimated to grow to USD 98.3 Billion during 2025-2033 at a CAGR of 8.5%. This good growth also reflects on the requirement for advanced treatment models such as RF microneedling and laser therapy. Medical tourism in Thailand and India, among others, boosts the expansion of the market further. Local and international partnerships lead to the advancement of technology.

Latin America Stretch Marks Treatment Market Analysis

The growth in aesthetic procedures has led to an increase in Latin America's stretch marks treatment market. An industrial report estimated that Brazil conducted around 3.4 million cosmetic and aesthetic procedures in 2023, including surgical and non-surgical procedures. Laser removals and microneedling are the primary drivers of this growth in stretch mark treatment. Mexico and Argentina are growing markets, as they are more affordable and offer a source of medical tourism. Local manufacturers like Ibramed are innovating in collaboration with global companies, and social media awareness about post-pregnancy skin care boosts demand.

Middle East and Africa Stretch Marks Treatment Market Analysis

The Middle East and Africa region is also exhibiting a steadily growing stretch marks treatment market, fueled by the demand for cosmetic surgeries. According to an industrial report, Saudi Arabia's aesthetic market is expanding with noticeable growth in non-invasive procedures. In South Africa, the year 2023 saw as many as 85,869 aesthetic treatments, with an increasing interest in skin rejuvenation treatments including stretch mark treatments. The trend is witnessed in the UAE and even other Gulf nations. Due to government-driven healthcare systems and partnerships with international players, better access, and availability increase.

Competitive Landscape:

The stretch marks treatment market is marked by continuous innovation, with leading companies concentrating on broadening their product offerings and enhancing treatment effectiveness. A significant trend is the rise of advanced technologies, such as laser therapies and non-invasive treatments, which offer more effective and quicker results compared to traditional methods. Additionally, there is a growing consumer demand for natural and organic ingredients, prompting companies to develop products using safer, eco-friendly formulations. The market is experiencing a shift towards personalized skincare, offering customized solutions designed to meet individual needs. Companies are increasingly leveraging e-commerce platforms, enhancing online availability and accessibility, to meet the rising demand for stretch marks treatments.

The report provides a comprehensive analysis of the competitive landscape in the stretch marks treatment market with detailed profiles of all major companies, including:

- Alliance Pharma Ltd

- basq NYC.

- Bayer AG

- Candela Corporation

- Clarins

- Cynosure, LLC.

- Dermaclara

- E.T. Browne Drug Co., Inc.

- Laboratoires Expanscience

- Perrigo

- Weleda

Latest News and Developments:

- In January 2024: Cynosure and Hahn & Company completed the acquisition of Lutronic and announced a definitive merger agreement to strategically combine Cynosure and Lutronic. Both firms are international suppliers of energy-based medical aesthetic treatment systems and associated technologies. The merger is anticipated to be finalized in the first quarter of 2024, pending standard closing conditions.

- In May 2022: Givaudan Active Beauty introduced Centella CAST, an ingredient targeting the processes that lead to the development of stretch marks. It operates on four distinct levels to enhance skin elasticity, density, and firmness, thereby diminishing the visibility of stretch marks.

- In April 2022: Skin Science Solutions introduced Icoone Roboderm, an advanced device that employs distinctive cellular technologies to provide painless and non-invasive rejuvenation for the face and body. The Icoone technology provides various customizable and efficient treatments for both the face and body, addressing issues like stretch marks and wrinkle reduction.

Stretch Marks Treatment Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Treatments Covered |

|

| Distribution Channels Covered |

|

| End User Covered | Hospitals and Clinics, Home Use, Specialty Dermatology Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Alliance Pharma Ltd, basq NYC., Bayer AG, Candela Corporation, Clarins, Cynosure, LLC., Dermaclara, E.T. Browne Drug Co., Inc., Laboratoires Expanscience, Perrigo, Weleda, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stretch marks treatment market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stretch marks treatment market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stretch marks treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Stretch marks, also known as striae, are visible streaks or lines on the skin that occur when the skin stretches or shrinks rapidly due to factors like pregnancy, rapid weight gain or loss, puberty, or hormonal changes. They often appear as red, purple, or silvery marks.

The stretch marks treatment market was valued at USD 3.13 Billion in 2024.

IMARC estimates the global stretch marks treatment market to exhibit a CAGR of 5.2% during 2025-2033.

Key factors driving the global stretch marks treatment market include increasing awareness of aesthetic treatments, the rising prevalence of pregnancy-related stretch marks and obesity, advancements in non-invasive therapies, growing disposable incomes, and the rising demand for natural and organic skincare products among health-conscious consumers.

In 2024, topical products (creams, oils and serum, lotions) represented the largest segment by treatment, driven by their affordability, convenience, and widespread availability. Consumers increasingly prefer these non-invasive treatments due to their ease of application and effectiveness in managing stretch marks over time.

The home use is the leading segment by end user, driven by the growing preference for cost-effective, convenient, and non-invasive solutions that can be applied privately at home.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global stretch marks treatment market include Alliance Pharma Ltd, basq NYC., Bayer AG, Candela Corporation, Clarins, Cynosure, LLC., Dermaclara, E.T. Browne Drug Co., Inc., Laboratoires Expanscience, Perrigo, Weleda, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)