Streaming Analytics Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Application, Industry Vertical, and Region, 2025-2033

Streaming Analytics Market Size and Share:

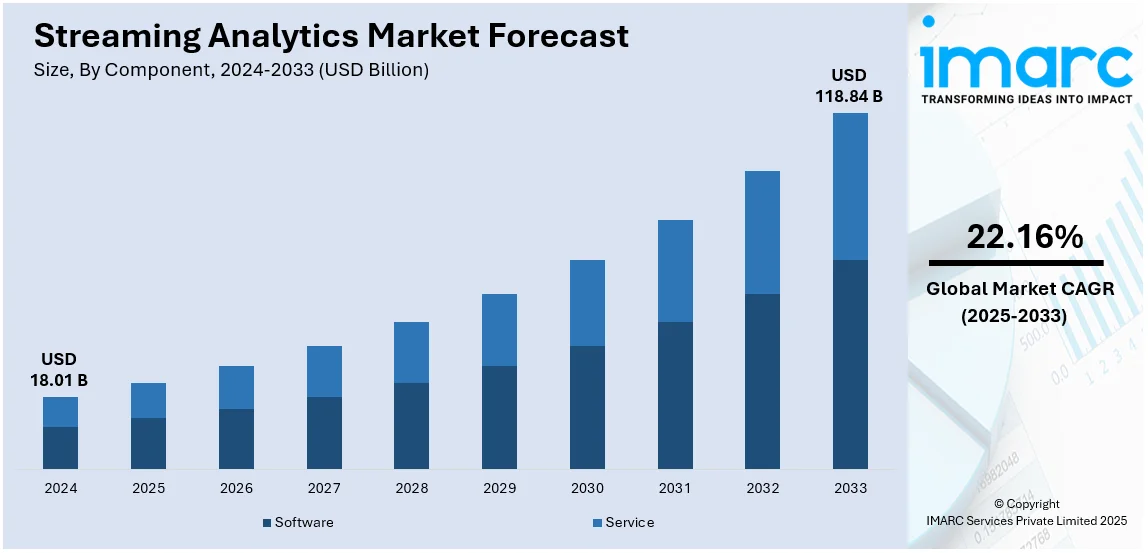

The global streaming analytics market size was valued at USD 18.01 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 118.84 Billion by 2033, exhibiting a CAGR of 22.16% during 2025-2033. North America currently dominates the market, holding a significant market share of over 40.0% in 2024. The market is driven by the growing need for real-time data processing across industries such as healthcare, retail, and finance. The rise of IoT devices, 5G networks, and edge computing enables faster data analysis, while cloud adoption and AI advancements enhance scalability. Additionally, regulatory compliance and smart city initiatives emphasize real-time insights, enhancing streaming analytics market share globally.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 18.01 Billion |

|

Market Forecast in 2033

|

USD 118.84 Billion |

| Market Growth Rate (2025-2033) | 22.16% |

The global streaming analytics market is driven by the increasing adoption of real-time data processing across industries such as healthcare, retail, and finance. The rise in IoT devices and connected technologies generates vast amounts of data, necessitating instant analysis for actionable insights. The number of connected Internet of Things (IoT) devices grew by 15% in 2023 to 16.6 billion. At the end of 2024, that number is expected to grow to 18.8 billion due to 13% growth, according to an industry report. Despite economic challenges and supply chain constraints, 51% of the companies plan to increase their IoT budget (22% predict more than 10% increase). Real-time streaming analytics will grow as the Internet of Things technology increases as it enhances data-driven decision-making processes. Along with this, businesses are prioritizing data-driven decision-making to enhance operational efficiency and customer experiences. Additionally, the rise of cloud computing and advancements in AI and machine learning enable scalable and efficient streaming analytics solutions. Regulatory requirements for data security and compliance further propel the streaming analytics market growth. The demand for predictive analytics and the need to mitigate risks in dynamic environments also contribute significantly.

The United States stands out as a key regional market, primarily driven by the rapid digital transformation across industries, emphasizing the need for real-time data insights to stay competitive. The expansion of 5G networks and edge computing enhances data processing capabilities, enabling faster and more efficient analytics. The 5G global footprint through early 2024 was nearly 2 billion connections, with 185 million new connections since October 2023, with connections in North America reaching 220 million. The total number of 5G connections will increase to 7.7 billion globally by 2028, driven by widespread adoption, the rising popularity of the Internet of Things (IoT), and increasing network coverage. Real-time streaming analytics plays an important role as 5G technology changes to optimize network performance and provide better data-driven insights. In addition, enterprises are increasingly focusing on personalized customer experiences, driving demand for real-time data analysis. Additionally, the rise of e-commerce and digital services necessitates immediate fraud detection and operational optimization. Government initiatives promoting smart cities and infrastructure development also contribute to market growth, as they rely heavily on real-time data for efficient management and decision-making.

Streaming Analytics Market Trends:

Growing Adoption Across Industry Verticals

The streaming analytics market demand is rising across various industries, including retail, media and entertainment, manufacturing, healthcare, and BFSI. Businesses are leveraging real-time data analysis to gain a competitive edge by identifying trends, monitoring consumer behavior, and optimizing operations. A significant factor propelling this trend is the increasing digital transformation across industries. For instance, the American Hospital Association reports that the United States has approximately 6,093 hospitals, many of which are incorporating streaming analytics for real-time patient monitoring and operational efficiency. As enterprises recognize the value of continuous data processing, the adoption of streaming analytics is expected to accelerate, enabling organizations to make faster, data-driven decisions.

Expansion of IoT and AI Integration

The rapid expansion of IoT and AI technologies is significantly acting as one of the key streaming analytics market trends. As businesses strive to process vast amounts of data in real time, integrating AI-powered analytics with IoT devices has become essential. The number of connected IoT devices has risen by 13%, reaching 18.8 billion globally. This surge enables companies to enhance decision-making by analyzing data streams from sensors, smart devices, and connected systems. Additionally, streaming analytics is being utilized in GPS-based applications, where real-time data from vehicles is merged with user location information. With AI-driven automation improving the efficiency of data analysis, businesses are increasingly investing in these technologies to gain deeper insights and optimize operations.

Rising Demand for Cybersecurity and Fraud Detection

The growing prevalence of cyber threats and financial fraud requiring streaming analytics as an essential tool for real-time threat detection and response is creating a positive streaming analytics market outlook. Businesses are using this technology to automate cybersecurity processes, quickly identifying anomalies and mitigating potential risks. The increasing number of fraud cases worldwide has further fueled the demand for streaming analytics solutions, particularly in the BFSI sector, where real-time monitoring is crucial for fraud prevention. Banking fraud in India rose more than fourfold over five years to 36,075 in 2024, with a sharp rise in digital payment frauds, which comprised a total of 29,082, according to data from the Reserve Bank of India (RBI). However, the overall number of frauds fell to ₹14,000 Crore (approximately USD 1,707.32 Million) as compared to ₹1.85 Trillion (approximately USD 22.56 Billion) in 2020, with most of the frauds within loan portfolios. With the proliferation of financial fraud, the value of streaming analytics for real-time detection and risk management of fraud in online transactions is increasing. By continuously analyzing transactional data, businesses can detect suspicious activities and respond proactively. As companies continue to prioritize data security, the adoption of real-time analytics for fraud detection and cybersecurity is expected to witness significant growth in the coming years.

Streaming Analytics Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global streaming analytics market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, deployment mode, organization size, application, and industry vertical.

Analysis by Component:

- Software

- Service

Software stands as the largest component in 2024, holding around 65.0% of the market due to its critical role in enabling real-time data processing, analysis, and visualization. It provides the foundational tools and platforms necessary for organizations to harness streaming data effectively. The increasing adoption of advanced analytics software, powered by AI and machine learning, allows businesses to derive actionable insights and improve decision-making. Additionally, the flexibility and scalability of software solutions, particularly cloud-based platforms, cater to diverse industry needs. The growing demand for predictive analytics, fraud detection, and operational optimization further drives software adoption. As organizations prioritize digital transformation, software remains essential for integrating streaming analytics into existing systems, ensuring seamless data flow and real-time responsiveness.

Analysis by Deployment Mode:

- Cloud-based

- On-premises

Cloud leads the market with around 60.0% of market share in 2024 due to its scalability, flexibility, and cost-effectiveness. Organizations increasingly prefer cloud-based solutions to handle massive volumes of real-time data efficiently without significant infrastructure investments. Cloud platforms enable seamless integration with existing systems, ensuring faster deployment and easier access to advanced analytics tools. The rise of remote work and digital transformation has further accelerated cloud adoption, as it supports distributed data processing and collaboration. Additionally, cloud services offer enhanced security, regular updates, and the ability to scale resources on demand, making them ideal for dynamic business environments. Industries such as healthcare, retail, and finance leverage cloud-based streaming analytics to improve decision-making, operational efficiency, and customer experiences, driving its dominance in the market.

Analysis by Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises

Large enterprises lead the market with around 65.8% of market share in 2024 due to their extensive data generation and complex operational needs. These organizations often operate across multiple locations and handle vast volumes of real-time data, necessitating advanced analytics solutions for efficient processing and decision-making. With significant financial resources, large enterprises invest heavily in cutting-edge technologies including AI, machine learning, and cloud-based platforms to gain actionable insights and maintain a competitive edge. Additionally, they prioritize scalability, security, and integration capabilities to streamline operations and enhance customer experiences. Industries such as banking, healthcare, and retail leverage streaming analytics to optimize processes, detect fraud, and improve forecasting, driving adoption among large enterprises. Their ability to implement and sustain sophisticated analytics infrastructure solidifies their dominance in this segment.

Analysis by Application:

- Fraud Detection

- Predictive Asset Management

- Risk Management

- Network Management and Optimization

- Sales and Marketing

- Supply Chain Management

- Location Intelligence

- Others

Fraud detection is a critical application in the streaming analytics market, driven by the need to identify and prevent fraudulent activities in real time. Industries such as banking, insurance, and e-commerce rely on streaming analytics to monitor transactions, detect anomalies, and mitigate risks. By leveraging advanced algorithms and machine learning, organizations can enhance security, reduce financial losses, and maintain customer trust, making fraud detection a key growth segment.

Predictive asset management utilizes streaming analytics to monitor equipment and infrastructure in real time, enabling proactive maintenance and reducing downtime. Industries such as manufacturing, energy, and transportation benefit from predictive insights that optimize asset performance and extend lifespan. By analyzing data from IoT sensors and other sources, businesses can improve operational efficiency, cut costs, and ensure reliability, driving demand for this application.

Risk management applications of streaming analytics help organizations identify, assess, and mitigate risks in real time. Sectors including finance, healthcare, and supply chain use these solutions to monitor market trends, operational vulnerabilities, and compliance issues. By providing actionable insights, streaming analytics enables businesses to make informed decisions, enhance resilience, and minimize potential disruptions, solidifying its importance in the market.

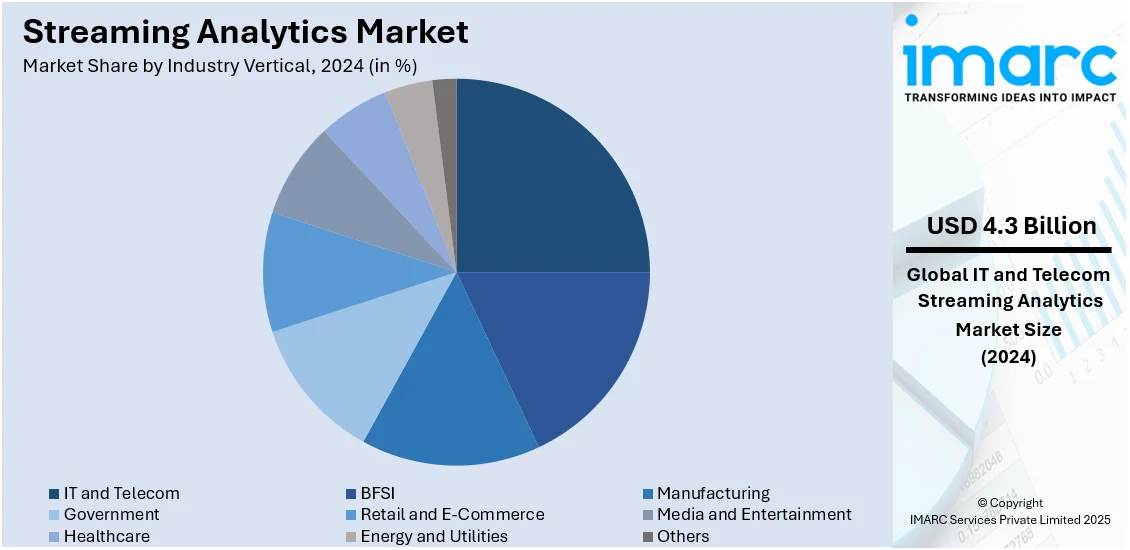

Analysis by Industry Vertical:

- IT and Telecom

- BFSI

- Manufacturing

- Government

- Retail and E-Commerce

- Media and Entertainment

- Healthcare

- Energy and Utilities

- Others

IT and telecom sector leads the market with around 23.6% of market share in 2024 due to its reliance on real-time data processing for network optimization, customer experience enhancement, and operational efficiency. With the rapid expansion of 5G networks, IoT devices, and cloud services, telecom companies generate massive volumes of data that require instant analysis. Streaming analytics enables them to monitor network performance, detect anomalies, and predict potential outages, ensuring seamless connectivity. Additionally, it supports personalized customer services, fraud detection, and dynamic pricing strategies. The sector's continuous technological advancements and the need for scalable, secure, and efficient data solutions drive the adoption of streaming analytics, making IT and telecom a dominant segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 40.0%, driven by advanced technological infrastructure, high adoption of cloud-based solutions, and the presence of major industry players. The region's early embrace of digital transformation, IoT, and 5G technologies has created a strong demand for real-time data processing and analytics. Industries such as IT, telecom, healthcare, and finance leverage streaming analytics to enhance operational efficiency, customer experiences, and decision-making. Additionally, stringent regulatory requirements for data security and compliance further propel market growth. The U.S., in particular, leads in innovation and investment in AI, machine learning, and big data technologies, solidifying North America's dominance in the global streaming analytics market. The region's focus on smart cities and connected devices also contributes significantly to its market leadership.

Key Regional Takeaways:

United States Streaming Analytics Market Analysis

The US accounted for around 88.30% of the total North America streaming analytics market in 2024. The growing streaming analytics adoption is largely driven by the expanding retail and e-commerce sector, where businesses increasingly rely on real-time data processing to optimize supply chains, enhance customer experiences, and improve fraud detection. According to reports, e-commerce sales in the United States have been steadily increasing for over a decade, hitting a record high of USD 1.12 Trillion in 2023. That is a 330% increase from USD 260.4 Billion in 2013. As digital transactions rise, companies are integrating streaming analytics into their operations to track consumer behavior, personalize marketing strategies, and automate inventory management. The proliferation of omnichannel shopping experiences further fuels demand for real-time insights, allowing businesses to seamlessly merge online and offline sales channels. Additionally, with an increase in digital payment solutions, retailers leverage streaming analytics to monitor transactions, detect anomalies, and enhance security. Advanced recommendation engines powered by streaming analytics are transforming customer engagement, increasing conversion rates, and reducing cart abandonment. Retailers are also utilizing real-time data for dynamic pricing strategies, improving sales forecasting, and enhancing customer service through AI-driven chatbots.

Asia Pacific Streaming Analytics Market Analysis

The growing small and medium enterprises (SMEs) sector is a key driver for streaming analytics adoption, as businesses seek to harness real-time data for operational efficiency and competitive advantage. According to India Brand Equity Foundation, the number of MSMEs in the country is projected to grow from 6.3 crore to around 7.5 crore at a CAGR of 2.5%. SMEs are increasingly leveraging streaming analytics to optimize supply chains, monitor inventory, and enhance customer interactions through personalized recommendations. The expansion of digital payment solutions and mobile commerce necessitates real-time fraud detection and transaction monitoring, further accelerating demand. As SMEs integrate cloud computing and AI into their operations, streaming analytics becomes vital for predictive maintenance, demand forecasting, and workflow automation. Many SMEs are investing in real-time data-driven decision-making to improve resource allocation, minimize downtime, and enhance customer engagement. The rise of smart logistics and digital marketplaces also fuels the need for real-time insights to track shipments, manage vendors, and streamline order fulfilment. With increasing digital transformation, SMEs continue to invest in scalable and cost-effective streaming analytics solutions to enhance operational agility, enhance profitability, and strengthen their market position.

Europe Streaming Analytics Market Analysis

The growing streaming analytics adoption is being fuelled by the increasing demand for packaging solutions driven by the expansion of banking, financial services, and insurance (BFSI) facilities. According to reports, there were 784 foreign bank branches in the EU in 2021, of which 619 were from other EU Member States and 165 from third countries. With rising digital transactions and financial activities, BFSI institutions are relying on advanced analytics to monitor real-time transactions, detect fraudulent activities, and enhance risk management. As the financial sector expands, the need for secure, traceable, and intelligent packaging solutions for financial products grows, leading to the integration of streaming analytics. Packaging facilities are utilizing real-time data to improve production efficiency, monitor supply chains, and enhance quality control. The adoption of smart packaging with embedded sensors is further driving demand for real-time analytics, ensuring product integrity and compliance with changing industry regulations. The integration of AI-driven analytics in packaging operations enables predictive maintenance, reducing downtime and improving cost efficiency. As BFSI facilities continue to invest in digital transformation, packaging companies leverage streaming analytics to optimize production processes, track logistics, and enhance customer experience.

Latin America Streaming Analytics Market Analysis

The growing streaming analytics adoption is driven by the increasing expansion of healthcare facilities, where real-time data processing is crucial for patient care, operational efficiency, and predictive analytics. According to the Brazilian Federation of Hospitals (FBH) and the National Confederation of Health (CNSaúde), of Brazil’s 7,191 hospitals, 62% are private. Hospitals and clinics are leveraging streaming analytics for real-time patient monitoring, enabling faster diagnosis and treatment decisions. The growing demand for telemedicine and remote healthcare services further accelerates adoption, allowing seamless data integration from wearable devices and medical sensors. Streaming analytics supports efficient resource allocation, helping healthcare providers optimize staffing and equipment utilization. With expanding healthcare infrastructure, real-time analytics enhances patient outcomes by detecting anomalies in medical data, improving diagnostics, and streamlining administrative processes.

Middle East and Africa Streaming Analytics Market Analysis

The growing streaming analytics adoption is driven by the rising preference for healthy snacks and drinks, which is influenced by increasing investment in IT and telecom infrastructure. For instance, overall spending on information and communications technology (ICT) across the Middle East, Türkiye, and Africa (META) will top USD 238 Billion this year, an increase of 4.5% over 2023. Businesses in the food and beverage industry are leveraging real-time data to track consumer preferences, optimize supply chains, and improve product development. Streaming analytics enables companies to monitor purchasing trends, forecast demand, and enhance production efficiency. The integration of AI-powered analytics supports dynamic pricing strategies, personalized promotions, and inventory management. With greater IT and telecom investments, real-time data insights enhance market competitiveness, allowing businesses to meet evolving consumer demands.

Competitive Landscape:

The competitive landscape of the streaming analytics market is characterized by intense rivalry among key players, who are focusing on innovation, partnerships, and strategic expansions to strengthen their market position. Companies are investing heavily in research and development to enhance their analytics platforms with advanced AI and machine learning capabilities. Many are also expanding their cloud-based offerings to cater to the growing demand for scalable and flexible solutions. Strategic collaborations with technology providers and industry stakeholders are common, enabling integration with emerging technologies such as IoT and 5G. Additionally, players are targeting diverse industry verticals, such as healthcare, finance, and retail, to broaden their customer base. Competitive pricing, robust customer support, and compliance with data security regulations further differentiate leading providers in this dynamic market.

The report provides a comprehensive analysis of the competitive landscape in the streaming analytics market with detailed profiles of all major companies, including:

- Cloudera Inc.

- Conviva Inc.

- Gathr

- Google LLC

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- SAS Institute Inc.

- Software AG

- SQLstream (Guavus Inc.)

- Striim Inc.

- TIBCO Software Inc.

Latest News and Developments:

- July 2024: IBM acquired StreamSets to strengthen its real-time data integration and observability capabilities. This acquisition enhances IBM’s streaming analytics by improving pipeline observability, automated data drift detection, and end-to-end data lineage. Businesses can now analyze live data more efficiently, optimizing decision-making in hybrid and multi-cloud environments. The integration positions IBM as a key player in advanced data management and streaming analytics.

- April 2024: SAS Institute and AWS expanded their collaboration to enhance real-time data processing. The launch of SAS Viya Workbench on AWS Marketplace improves streaming analytics by enabling seamless machine learning model management. Georgia-Pacific has leveraged these capabilities for high-performance AI development, demonstrating real-time insights at scale. This partnership strengthens AWS’s position in AI-driven analytics and cloud-based data solutions.

- January 2024: Streams Charts, a live-streaming analytics platform, launched MIRAI, an influencer advertising and marketing agency. MIRAI provides consulting, creator partnerships, campaign management, and market insights. This expansion strengthens Streams Charts' role in streaming analytics by integrating influencer marketing strategies.

- June 2024: Informatica Inc. launched new generative AI and Snowflake native app offerings on the Snowflake AI Data Cloud. These advancements streamline data integration and access management, enhancing efficiency in data-driven decision-making. The integration supports organizations in leveraging AI-powered insights with improved governance. This reinforces Informatica’s role in streaming analytics by optimizing data flow for real-time applications.

- May 2024: Striim appointed Neil Holloway as Senior Vice President of Strategic Partnerships to drive revenue growth through collaborations. With 35 years of leadership experience from Microsoft, Holloway strengthens Striim’s industry positioning. His expertise bolsters Striim’s partnership with Microsoft Azure, expanding data streaming capabilities. This move enhances Striim’s impact in streaming analytics by fostering deeper cloud-based integrations.

- February 2024: SAS Institute Inc. partnered with Carahsoft to provide analytics, AI, and data management solutions to the U.S. public sector. This collaboration expands access to SAS products for government agencies, improving data-driven decision-making. By integrating advanced analytics with public sector operations, the partnership enhances efficiency and transparency. The initiative strengthens SAS’s role in streaming analytics by supporting real-time data processing for agencies.

Streaming Analytics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployment Modes Covered | Cloud-based, On-premises |

| Organization Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Fraud Detection, Predictive Asset Management, Risk Management, Network Management and Optimization, Sales and Marketing, Supply Chain Management, Location Intelligence, Others |

| Industry Verticals Covered | IT and Telecom, BFSI, Manufacturing, Government, Retail and E-Commerce, Media and Entertainment, Healthcare, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Cloudera Inc., Conviva Inc., Gathr, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Software AG, SQLstream (Guavus Inc.), Striim Inc., TIBCO Software Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the streaming analytics market from 2019-2033.

- The streaming analytics market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the streaming analytics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The streaming analytics market was valued at USD 18.01 Billion in 2024.

IMARC estimates the streaming analytics market to exhibit a CAGR of 22.16% during 2025-2033, reaching a value of USD 118.84 Billion by 2033.

The market is driven by the increasing adoption of real-time data processing across industries such as healthcare, retail, and finance. The rise of IoT devices, 5G networks, and edge computing enables faster data analysis, while cloud adoption and AI advancements enhance scalability. Additionally, regulatory compliance, cybersecurity concerns, and smart city initiatives emphasize the need for real-time insights, fueling market growth.

North America currently dominates the streaming analytics market, accounting for a share exceeding 40.0% in 2024. This dominance is fueled by advanced technological infrastructure, high adoption of cloud-based solutions, and the presence of major industry players. The region’s early adoption of 5G, IoT, and AI-driven analytics further strengthens its position.

Some of the major players in the streaming analytics market include Cloudera Inc., Conviva Inc., Gathr, Google LLC, International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, SAP SE, SAS Institute Inc., Software AG, SQLstream (Guavus Inc.), Striim Inc. and TIBCO Software Inc., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)