Strategic Bomber Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Strategic Bomber Market Size and Share:

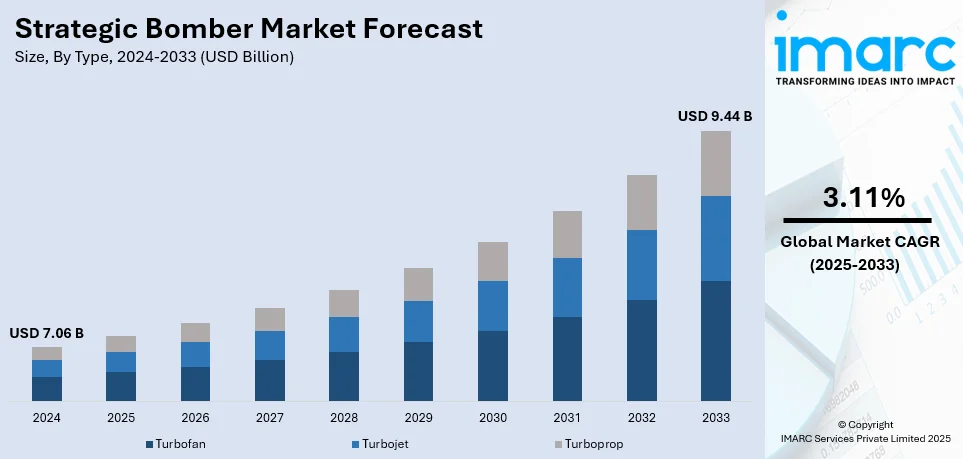

The global strategic bomber market size was valued at USD 7.06 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 9.44 Billion by 2033, exhibiting a CAGR of 3.11% during 2025-2033. North America currently dominates the market. The increasing threat of terrorism and rising geopolitical tensions, especially among neighboring countries represent some of the key factors driving the strategic bomber market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.06 Billion |

|

Market Forecast in 2033

|

USD 9.44 Billion |

| Market Growth Rate (2025-2033) | 3.11% |

The global strategic bomber market is driven by the rising demand for advanced defense capabilities. This can be supported by growing geopolitical tensions and increased military spending across the globe. On 26th December 2024, the Japanese government approved a record initial budget of ¥115.5 trillion (USD 735 billion) for the fiscal year starting April 2025, with huge increases in defense spending and regional support. The budget shows a 2.6% increase from the previous year, and fresh bond issuance will be reduced by nearly a fifth to ¥28.6 trillion. Defense spending will rise by more than 10% to ¥8.5 trillion. Nations are prioritizing the modernization of their air forces with long-range bombers capable of delivering precision strikes and carrying advanced weaponry, including nuclear payloads. The development of next-generation stealth technologies and hypersonic weapons further accelerates investments in strategic bombers. Additionally, the growing need for platforms with enhanced survivability and versatility in high-threat environments is fueling procurement programs. Moreover, emerging economies’ focus on strengthening their defense infrastructure also contributes to the strategic bomber market outlook.

The United States stands out as a key regional market, primarily driven by the nation's commitment to maintaining air dominance and ensuring long-range strike capabilities. The growing emphasis on countering near-peer threats, such as those posed by China and Russia, drives investments in advanced stealth bombers. Concurrently, modernization programs aimed at replacing aging fleets, along with the development of next-generation technologies such as enhanced radar evasion and precision-guided munitions, are pivotal factors. On 19th August 2024, The US State Department cleared the potential Foreign Military Sale to Denmark of up to 5,832 M1156 Precision Guidance Kits (PGKs) worth USD 85 million. The proposed sale includes ancillary program elements and technical support that will improve Denmark's precision capability and first-strike accuracy. Northrop Grumman produces the M1156 PGK in Minneapolis, Minnesota. Furthermore, the U.S. defense budget prioritizes platforms that align with multi-domain operations, ensuring adaptability to changing combat scenarios and supporting global strategic deterrence initiatives.

Strategic Bomber Market Trends:

Rising Threat of Terrorism and Geopolitical Tensions

The strategic bomber market is experiencing considerable growth, majorly driven by the increasing threat of terrorism and geopolitical tensions among neighboring countries. In 2023, over 90% of terrorist attacks and 98% of terrorism-related deaths happened in conflict zones, emphasizing the correlation between terrorism and warfare. These escalating threats are increasing national security concerns, leading to a growing demand for advanced long-range strike platforms. Additionally, the need for superior military capabilities in modern warfare is resulting in the widespread adoption of strategic bombers for military drills and patrols. These factors are collectively fostering the development of advanced technologies and subsystems for strategic bombers, further reinforcing their importance in addressing global security challenges.

Technological Advancements in Strategic Bomber Systems

Ongoing technological innovations are one of the significant strategic bomber market trends. Notably, the integration of padded active electronically scanned array (ASEA) radar systems in strategic bombers is driving growth. These radar systems enhance operational efficiency by emitting powerful signals while maintaining stealth capabilities, even in contested environments or adverse weather conditions. Such advancements are tailored to meet the changing demands of modern warfare. Furthermore, substantial government investments in defense procurement and modernization are catalyzing technological progress. For instance, India’s Ministry of Defense allocated its highest-ever budget in 2023-24, highlighting a strong focus on domestic defense capabilities. These investments are aiding the development of next-generation strategic bombers, reinforcing their role in addressing contemporary security challenges.

Increasing Government Investments and Strategic Collaborations

Large-scale defense investments and collaborations among industry leaders are significantly shaping the strategic bomber market. Governments worldwide are prioritizing the procurement and modernization of advanced bomber platforms to bolster their defense capabilities. In India, defense exports increased to an unprecedented USD 2,530 million in 2023-24, reflecting efforts to strengthen the domestic defense sector. Furthermore, collaborations between key players are driving innovation, enabling the design of highly effective warfare devices. The escalating deployment of strategic bombers across a wide range of military applications and operations underscores their rising importance. These developments, alongside enhancements in military infrastructure and capabilities, are positively influencing the strategic bomber market demand.

Strategic Bomber Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global strategic bomber market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and application.

Analysis by Type:

- Turbofan

- Turbojet

- Turboprop

Turbofan stands as the largest component in 2024, due to their superior fuel efficiency, extended range capabilities, and ability to support heavy payloads. These engines are specifically designed to provide a balance of high thrust and operational endurance, making them ideal for long-range missions crucial to strategic bombers. Their quieter operation compared to other engine types also enhances stealth capabilities, a critical requirement for modern bombers operating in contested airspace. Furthermore, advancements in turbofan technology, such as improved thrust-to-weight ratios and lower maintenance requirements, have made them the preferred choice for next-generation platforms including the B-21 Raider. This combination of performance, reliability, and adaptability cements turbofan engines as the leading segment in the market.

Analysis by Application:

- Military Operation

- Military Training

The military operation segment holds a significant share in the strategic bomber market, driven by the increasing demand for advanced long-range strike capabilities to counter modern threats. Strategic bombers play a vital role in military operations by delivering precision strikes, conducting surveillance, and maintaining air superiority in contested environments. These aircraft are equipped with advanced stealth technologies, high payload capacities, and long operational ranges, enabling them to perform missions across vast geographic areas. Additionally, increasing incidences of geopolitical tensions and the need for robust deterrence strategies are compelling nations to invest heavily in next-generation bombers. As military forces prioritize adaptability and technological advancement, the military operation segment is expected to remain a dominant and critical driver of the strategic bomber market.

The military training segment is also an essential part of the strategic bomber market, supporting the development of skilled aircrews capable of operating advanced bomber platforms. Effective training ensures mission readiness, operational efficiency, and mastery of cutting-edge technologies such as stealth systems, electronic warfare capabilities, and precision-guided weaponry. Training programs often utilize simulation technologies to replicate complex combat scenarios, enhancing pilot proficiency while reducing operational risks. Additionally, as next-generation bombers are integrated into fleets, specialized training is required to familiarize crews with new systems and combat techniques. The growing focus on pilot preparedness and combat effectiveness is driving investments in modern training solutions, making this segment a crucial enabler of sustained strategic bomber performance worldwide.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share due to its robust defense infrastructure, substantial military spending, and the presence of major aerospace and defense manufacturers. The United States, in particular, leads this segment, driven by its focus on maintaining global military supremacy and enhancing long-range strike capabilities. Investments in next-generation platforms, like the B-21 Raider, alongside modernization efforts for existing bomber fleets, further bolster the region's leadership. Additionally, strong government initiatives, technological advancements in stealth and precision-strike systems, and an emphasis on countering changing threats contribute to North America’s market prominence. The region's vast defense budget and commitment to innovation ensure its strategic bomber market remains a global leader in capability and scale.

Key Regional Takeaways:

United States Strategic Bomber Market Analysis

The strategic bomber market in the United States is driven by a combination of military modernization, geopolitical considerations, and advancements in technology. The country’s commitment to maintaining air superiority and global military presence remains a pivotal factor. The U.S. Department of Defense (DoD) consistently invests in upgrading its equipment to counter emerging threats. As per reports, the US military spent approximately USD 820.3 Billion, or roughly 13.3% of the entire federal budget for the year 2023. Apart from this, geopolitical tensions, particularly with nations such as China and Russia, amplify the need for strategic deterrence. The U.S. relies on its bomber fleet to project power across contested regions, including the Indo-Pacific and Eastern Europe. This approach underscores the strategic bomber’s role as a critical component of the country’s nuclear triad. Additionally, changing defense strategies prioritize multi-role bombers capable of offering conventional and nuclear payloads. Integration of next-generation weapons, including hypersonic missiles and electronic warfare systems, enhances operational flexibility. Increased budgets allocated under the National Defense Authorization Act (NDAA) facilitate such advancements, sustaining demand for innovative systems. The focus on sustainability and reduced lifecycle costs acts as a major market driver. Efforts to incorporate modular designs and autonomous capabilities in newer platforms align with these objectives. Furthermore, collaboration between defense contractors and government agencies accelerates development timelines, reinforcing the U.S. strategic bomber market’s growth trajectory.

Asia Pacific Strategic Bomber Market Analysis

The Asia Pacific strategic bomber market is shaped by regional security concerns and defense spending growth. Escalating territorial disputes in the South China Sea, along with rising tensions between China, India, and neighboring countries, drive regional agencies to invest in advanced air power. Strategic bombers are considered vital for deterrence and power projection in this dynamic environment. In line with this, defense budgets in Asia Pacific nations, including India, Japan, and Australia, is experiencing significant growth. Investments are directed toward acquiring advanced systems to address modern threats. Australia’s involvement in partnerships such as AUKUS and the Joint Strike Fighter program also influences its strategic bomber development efforts, particularly in terms of interoperability with allied forces. Apart from this, rising terrorist activities is cataltzing the demand for strategic bombers. During 2023, the NIA undertook 21 terrorism-related investigations and detained 65 individuals suspected of having connections to ISIS. Likewise, technological advancements are another driving force. The integration of AI, hypersonic weaponry, and electronic warfare systems in strategic bombers enhances combat effectiveness. Countries in the region are increasingly collaborating with global defense contractors to access these cutting-edge capabilities, enhancing the market’s growth potential.

Europe Strategic Bomber Market Analysis

The European strategic bomber market is propelled by rising geopolitical tensions, NATO’s strategic priorities, and investments in technological innovation. The ongoing war in Ukraine continued to dominate European geopolitical concerns in 2023. The EU, its member states, as well as European financial institutions have collectively contributed USD 72,684 Million in financial, humanitarian, and emergency aid for Ukraine in 2022, as per reports. The renewed hostilities in Eastern Europe, and recently due to the Russia-Ukraine conflict, challenge European nations to reevaluate their postures on defense. Strategic bombers are important as they help assure credible deterrence and enhance the collective security mechanisms of the alliance. The relevance of the strategic bomber is highlighted by the NATO focus on nuclear sharing agreements. Member states, including the United Kingdom and France, prioritize maintaining a robust and modern bomber fleet. The UK’s commitment to the Dreadnought program and France’s Rafale-B modernization efforts highlight these trends. Such initiatives ensure readiness for both conventional and nuclear missions. The push for greater self-reliance in defense manufacturing is another significant factor. Collaborative projects, such as the Future Combat Air System (FCAS) led by France, Germany, and Spain, aim to develop next-generation air power solutions, which is bolstering the strategic bomber market growth. Besides this, the integration of advanced capabilities, including stealth, AI, and hypersonic weapon systems, remains a priority. European defense contractors are investing in R&D to meet these demands. Additionally, policies encouraging cross-border cooperation facilitate resource pooling, reducing costs and accelerating deployment timelines.

Latin America Strategic Bomber Market Analysis

The Latin American strategic bomber market is influenced by limited but focused modernization efforts and regional security dynamics. While the region’s defense priorities often center on internal security and counterinsurgency, some nations are exploring strategic capabilities to address emerging challenges. Brazil’s role as a regional defense leader underscores the market’s potential. Apart from this, the country’s collaboration with global manufacturers, such as Embraer’s ventures, is driving advancements in strategic bombers. In line with this, terrorist activities in the region are catalyzing the demand for strategic bombers. According to reports, terrorism Index in Brazil increased to 1.99 Points in 2023 from 0.60 Points in 2022.

Middle East and Africa Strategic Bomber Market Analysis

In the Middle East and Africa, strategic bomber market drivers include regional instability, defense modernization, and external partnerships. According to reports, estimated military expenditure in the Middle East increased by 9.0% to USD 200 Billion in 2023. Apart from this, persistent conflicts and territorial disputes necessitate the development of advanced air power. Gulf Cooperation Council (GCC) states, led by Saudi Arabia and the UAE, are investing in modernizing their fleets to counter perceived threats from regional adversaries such as Iran. Africa’s market, though less developed, sees demand driven by growing partnerships with global powers. In addition, collaborative agreements for technology transfer and training are bolstering the market growth.

Competitive Landscape:

This market for strategic bombers is highly competitive, and the key players are focusing on innovation, modernization, and long-term contracts that ensure their sustainability in this highly competitive market. The major defense companies are investing heavily in advanced technologies, including stealth and hypersonic weapons and artificial intelligence, to enhance bomber capabilities. Next-generation platforms are also being developed in partnership with the governments. It also emphasizes upgrading current bomber fleets with advanced avionics, sensors, and weapons systems. These measures help the players improve their market competitiveness while simultaneously addressing changing military requirements and geopolitical challenges around the world.

The report provides a comprehensive analysis of the competitive landscape in the strategic bomber market with detailed profiles of all major companies, including:

- Northrop Grumman Corporation

- PJSC Tupolev (United Aircraft Corporation)

- The Boeing Company

Latest News and Developments:

- November 2024: The Tu-95MSM strategic bomber was enhanced with long-range Kh-101 and Kh-102 cruise missiles, increasing its strike range to 5,500 km. The upgrades boost accuracy, resilience, and electronic warfare capabilities, strengthening its function in extended-range strategic and tactical operations across Ukraine.

- September 2024: Russian Tu-22M3 bombers fired Kh-22 missiles at Snake Island. The Kh-22 is hard to intercept because of its rapid speed and approach angle.

- November 2024: Russia deployed six Tu-160 bombers to launch Kh-101 missiles as a part of a collective large-scale attack, which was registered as the first known operational utilization of these bombers against Ukraine in 550 days.

- November 2024: The next Bomber Task Force-Europe deployment is expected to begin soon with U.S. strategic bombers transiting from the continental U.S. to the U.S. European Command area of responsibility. This deployment is scheduled to kick-off with the U.S. Air Force bombers flying on a pre-filed flight plan via international airspace.

- September 2024: Russian Tu-160 strategic bomber planes, were part of the "Ocean-2024" drills, flew over the Barents and Norwegian seas during a major naval exercise.

- December 2022: The Pentagon unveiled its first new strategic bomber in more than 30 years, a nuclear-capable bat-wing plane that will become a central component of the US effort to counter China’s military build-up when it enters service around 2027.

Strategic Bomber Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Turbofan, Turbojet, Turboprop |

| Applications Covered | Military Operation, Military Training |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Northrop Grumman Corporation, PJSC Tupolev (United Aircraft Corporation), The Boeing Company, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the strategic bomber market from 2019-2033.

- The strategic bomber market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the strategic bomber industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The strategic bomber market was valued at USD 7.06 Billion in 2024.

IMARC estimates the strategic bomber market to exhibit a CAGR of 3.11% during 2025-2033, reaching a value of USD 9.44 Billion by 2033.

The strategic bomber market is driven by rising geopolitical tensions and national security concerns, increasing military spending, and modernization of air forces globally. Additionally, the development of next-generation technologies such as stealth systems and hypersonic weapons, and growing demand for advanced long-range strike platforms with high survivability and versatility.

North America currently dominates the strategic bomber market. This dominance is fueled by robust defense infrastructure, significant military spending, the presence of major defense manufacturers, and investments in next-generation bombers such as the B-21 Raider.

Some of the major players in the strategic bomber market include Northrop Grumman Corporation, PJSC Tupolev (United Aircraft Corporation), and The Boeing Company, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)