Stout Market Size, Share, Trends and Forecast by Distribution Channel and Region, 2025-2033

Stout Market Overview:

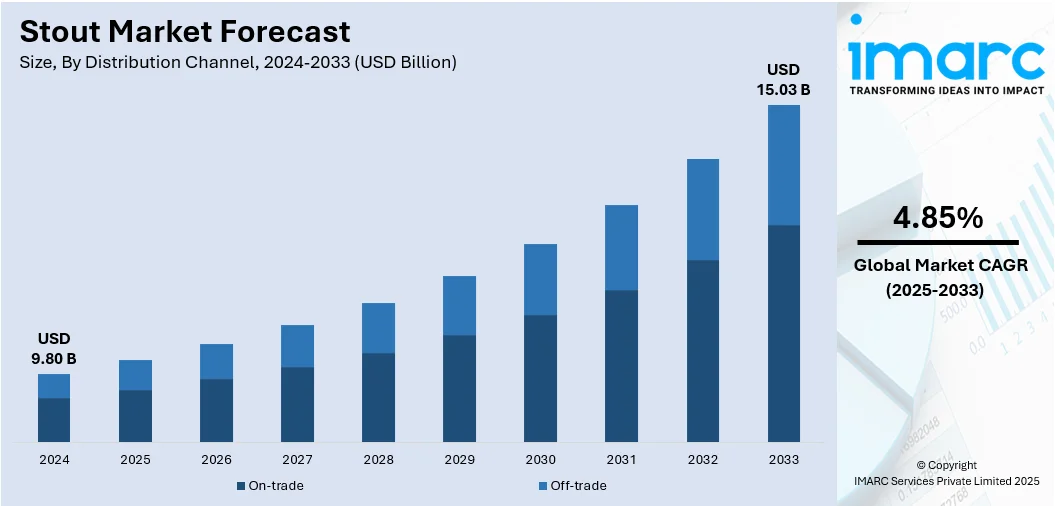

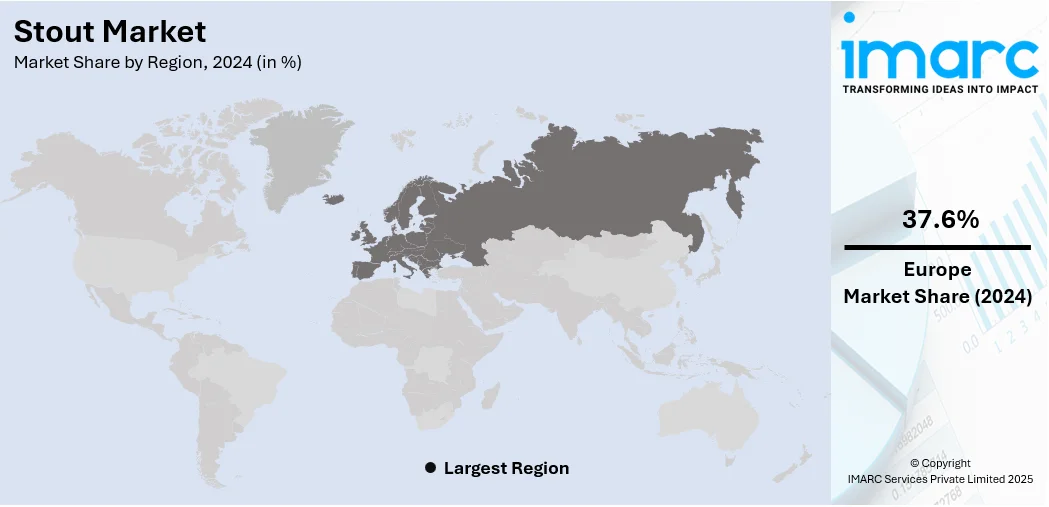

The global stout market size was valued at USD 9.80 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 15.03 Billion by 2033, exhibiting a CAGR of 4.85% from 2025-2033. Europe currently dominates the market, holding a market share of 37.6% in 2024. The dominance of the region is attributed to a rich brewing heritage, established consumer preferences, and a strong craft beer culture. The region also benefits from a well-developed distribution network, high consumer spending power, and a growing interest in premium, diverse beer offerings, influencing the stout market share.

Market Size & Forecasts:

- Stout market was valued at USD 9.80 Billion in 2024.

- The market is projected to reach USD 15.03 Billion by 2033, at a CAGR of 4.85% from 2025-2033.

Dominant Segments:

- Distribution Channel: On-trade accounts for the largest market share because people prefer enjoying stout in social settings like pubs, bars, and restaurants. These venues offer fresh draught options, enhance the drinking experience, and promote premium and craft stout consumption.

- Region: Europe leads the market, driven by its long-standing beer culture, high consumption rates, and strong presence of traditional and craft breweries. User preference for dark, full-bodied beers are further supporting stout’s popularity across the region.

Key Players:

- The leading companies in stout market include Anheuser-Busch InBev, Asahi Group Holdings Ltd., Carlsberg Breweries A/S, Diageo plc, Heineken N.V., Kirin Brewery Co. Ltd., Molson Coors Beverage Company, Port Brewing Company, Stone Brewing Co., The Boston Beer Company Inc, etc.

Key Drivers of Market Growth:

- Growing Demand for Premiumization and Specialty Beers: People are seeking high-quality, unique drinking experiences. Barrel-aged and limited-edition stouts are gaining popularity, offering rich flavors and exclusivity similar to fine wines and craft spirits.

- Expansion of Pub Culture: Pubs often serve as key venues for introducing customers to craft and specialty brews, including stouts. With their cozy ambiance and focus on curated drinking experiences, pubs encourage patrons to try rich, full-bodied options like milk stouts, oatmeal stouts, and barrel-aged varieties.

- Influence of Younger Generations: Millennials and Gen Z prefer bold, unique flavors and craft experiences. Their interest in artisanal beverages, social media trends, and limited-edition products is driving the demand for innovative and visually appealing stout offerings.

- Broadening of E-commerce Portals: The expansion of e-commerce is making a wide range of stout varieties accessible to consumers. Online platforms offer convenience, detailed product information, and home delivery, encouraging more people to explore and purchase craft and specialty stouts.

- Expansion of Beer Culture in Emerging Markets: Disposable incomes are rising and interest in premium beverages is growing, especially in regions like Asia-Pacific. People are exploring diverse styles, making stouts more popular in new and developing beer markets.

Future Outlook:

- Strong Growth Outlook: The stout market is expected to see sustained expansion, driven by the growing interest in craft beers, evolving consumer tastes, and expanding on-trade channels. Innovations in flavors and rising social drinking culture continue to support steady market growth globally.

- Market Evolution: The sector is anticipated to shift from a niche traditional beer segment to a popular choice among craft beer enthusiasts. It is expanding through innovations in flavors, increasing global exposure, and rising availability in both on-trade and off-trade channels, supporting broader consumer appeal.

The on-trade industry, such as pubs, bars, and restaurants, remains a key influence on stout consumption. Experiences of social drinking, where patrons can sample various types of stouts in a thoughtfully arranged setting, are essential. This direct interaction enhances brand loyalty and recognition, playing a major role in strong market expansion worldwide. Besides this, the growing consumer interest in sustainability is encouraging breweries to prioritize eco-friendly methods and obtain ingredients from local sources. This trend appeals to environmentally aware consumers who prioritize ethical manufacturing, enhancing the attractiveness of stouts that focus on sustainable brewing practices and locally sourced components, thereby increasing the market demand.

To get more information on this market, Request Sample

The United States plays a vital role in the market, supported by the growing demand for specialty and premium beers, influenced by a change in consumer preferences towards quality instead of quantity. Stouts, especially creative types like pastry stouts or barrel-aged versions, are becoming popular among consumers who value craft and artisanal beers. Furthermore, partnerships and collaborations between breweries are producing distinctive, limited-release stouts that cater to a variety of consumer preferences. These partnerships promote innovation, enhance brand visibility, and draw in both dedicated customers and new buyers, increasing the overall market presence of stouts. In 2025, Percival Creek introduced its inaugural American Stout, crafted in partnership with Olympia's ilk Beer. This dark seasonal launch signifies a significant achievement for the Craft Brewing & Distilling program at South Puget Sound Community College, providing students with practical experience. The robust profile includes roasted malts, hints of chocolate, and a silky hop conclusion, offered at the Percival Creek Tasting Room.

Stout Market Trends:

Growing Social Media Influence

Social media platforms are enabling breweries to showcase unique stout varieties, engage with a global audience, and leverage influencer endorsements, which significantly increase brand visibility and consumer interest. Digital platforms allow breweries and enthusiasts to showcase distinctive stout types, brewing methods, and tasting events, with visually appealing content like pour images, foam details, and exclusive packaging attracting consumer interest. According to industry reports, the total user count of social networking platforms grew from 970 million in 2010 to 5.24 billion users by January 2025. Influencers and craft beer critics are essential in presenting new products to larger audiences, fostering trust and sparking interest. Hashtags, reviews, and user-created content enhance community involvement, enabling stouts to connect with younger, trend-focused audiences. Social media promotes direct interaction between brands and consumers, boosting loyalty and engagement. With individuals relying more on social media for recommendations, discovery, and self-expression, brands that successfully utilize these platforms are experiencing wider reach, increased engagement, and heightened demand.

Rising Disposable Incomes

Inflating disposable incomes are influencing the market by enabling consumers to opt for premium, high-quality brews, such as stouts, over mass-produced alternatives, while also catalyzing the demand for unique and artisanal varieties that offer richer, more complex flavor profiles. As per government statistics, by December 2024, disposable personal income (DPI) grew by USD 79.7 billion (0.4 percent), whereas personal consumption expenditures (PCE) increased by USD 133.6 billion (0.7 percent). With higher earnings, consumers are shifting from budget and mass-market beers to richer, more flavorful choices such as stouts. This change is catalyzing the demand for high-quality brews, such as barrel-aged, chocolate-infused, and special edition stout types. As disposable income rises, consumers are more frequently pursuing distinctive, high-quality experiences, which makes stouts appealing because of their intricacy, richness, and craft-focused character. Restaurants, bars, and retailers are adapting by increasing their stout offerings to meet these changing consumer tastes.

Increasing Tourism Activities

Rising tourism activities are playing a major role in the growth of the stout market by driving the demand for authentic local experiences, including regional stout offerings at breweries, pubs, and festivals, which attract tourists and promote broader brand recognition. The Indian Ministry of Tourism forecasts that international tourist arrivals (ITAs) will hit 20 million by 2025. Travelers frequently look for genuine, engaging experiences, and sampling local drinks like stouts, which is becoming a crucial aspect of their journeys. Breweries, pubs, and taprooms located in sought-after tourist spots draw in guests by providing distinctive experiences like tasting events, brewery excursions, and special stout variations. Such activities foster favorable impressions, promoting repeat purchases even once the traveler is back home. Furthermore, regional beer festivals and cultural events highlighting stouts help enhance visibility and engage consumer interest. Travelers' word-of-mouth suggestions and social media posts showcase these unique stout varieties to a broader audience, increasing brand awareness and extending the reach of stout makers in the international market.

Stout Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stout market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on distribution channel.

Analysis by Distribution Channel:

- On-trade

- Off-trade

On-trade stands as the largest component in 2024, holding 60.8% of the market, as it offers individuals a premium and interactive drinking experience. Pubs, bars, and restaurants provide a perfect setting for consumers to enjoy different stouts, as the atmosphere and social vibe enhance the appeal of these distinctive beers. The on-trade segment allows direct engagement between individuals and skilled personnel, promoting tailored suggestions and enhancing brand loyalty. Moreover, the on-trade channel gains from its capacity to provide fresh, high-quality products that showcase the unique flavors and scents of stouts, resulting in an experience that is hard to duplicate via retail. The availability of stouts in bars and restaurants also helps to boost their visibility and accessibility for consumers, promoting both initial trials and repeat purchases. The stout market forecast indicates continued growth of the on-trade segment, driven by the growing consumer demand for premium beer experiences.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Europe accounted for the biggest market share of 37.6%, because of its historical beer brewing tradition and a strong cultural connection to various beer styles, such as stouts. The area enjoys a well-developed beer infrastructure, featuring a wide range of established breweries, distributors, and retailers, which guarantees extensive access to stout selections. There is an increase in consumer desire for premium, flavorful beers, particularly favoring rich, full-bodied stouts that match local preferences. Additionally, Europe's strong craft beer movement is supporting innovation in the stout category, encouraging new flavors and brewing methods. In 2024, Northern Monk and Timothy Taylor’s introduced a collaborative stout named Northern Rising. The 4.4% stout, brewed with roast barley, crystal malt, and Golden Promise malt, was available in cask, keg, and 440ml nitro cans. It launched in UK pubs and supermarkets, including Morrisons, on October 27, 2024.

Key Regional Takeaways:

United States Stout Market Analysis

In North America, the market portion held by the United States was 83.20%, influenced by shifting taste preferences, industry advancements, and consumer trends. Craft breweries have advanced stouts as a category marked by intricate flavors, innovation, and artistry, with microbreweries exploring barrel-aging, coffee, chocolate, and dessert-themed versions. This increase in diversity attracts consumers looking for high-quality and artisanal experiences beyond typical lagers. Younger generations, especially Millennials and Gen Z, are driving this trend by emphasizing distinctiveness, vibrant flavor profiles, and drinks that provide social media allure and brand narratives, frequently disseminated through visually focused platforms. Additionally, the resurgence of heritage brands, promotional efforts, and exclusive releases are further boosting the attraction of stout. In April 2025, Guinness introduced a new marketing initiative in the United States named ‘A Lovely Day,’ showcasing real friend groups and their stories of connecting through shared interests and enjoyed pints. In connection with this campaign, Guinness launched a limited-edition can of Guinness Draught Stout that modernizes the classic Lovely Day toucan artwork with a modern American flair. The recently introduced stout is perfect for spring and summer while honoring Guinness’s visual legacy. In addition, taprooms, brewery events, and tasting experiences are increasing consumer involvement and loyalty, establishing stouts as a niche category with cultural significance and emotional ties.

North America Stout Market Analysis

In North America, the stout market is influenced by various important factors, such as the increasing popularity of craft beer and a movement towards high-quality alcoholic drinks. With consumers progressively searching for unique, rich, and intricate flavors, stouts are becoming more popular among beer lovers owing to their distinct taste profiles. For instance, in 2025, Virginia Distillery Co. launched a limited-edition stout-finished American Single Malt whisky as part of its Brewer’s Coalition series. The whisky, aged in barrels that previously held Foothills Brewing's Sexual Chocolate imperial stout, is bottled at 100 proof (50% ABV). With only twelve barrels produced, it offers a complex flavor profile of cocoa, espresso, dark fruit, and malted chocolate. Furthermore, the growing admiration for local and small-scale brewing are fostering a positive atmosphere for craft breweries that focus on stouts. The market is also bolstered by the increasing range of stouts offered, such as seasonal, flavored, and stronger alcohol varieties, appealing to various consumer preferences. Shifts in consumer drinking preferences, such as a shift toward more refined and quality-oriented drinks, are also offering a favorable stout market outlook. Additionally, the growing presence of beer festivals, craft beer pubs, and retail shops focused on distinctive beer varieties is enhancing the exposure and accessibility of stouts, thereby solidifying their status in North America's competitive beer industry.

Europe Stout Market Analysis

The expansion of the European stout market is primarily driven by a revived recognition of complexity, artistry, and local character in beer culture. Consumers, especially in Western Europe, are more frequently looking for roasted, dark beers with complex profiles that include coffee, dark chocolate, caramel, and delicate smoke notes that complement robust dishes and cooler temperatures. For example, in April 2025, Shepherd Neame, a brewery from the UK, introduced the Iron Wharf, its newest stout. The recently introduced stout combines ale and brown malts sourced from the UK with a hint of roasted barley to achieve a harmonious, smooth finish featuring notes of chocolate and roasted flavors, along with an appealing ruby red color. Additionally, seasonal launches and exclusive barrel-aged or flavored versions, frequently linked to regional festivals or cultural occasions, generate enthusiasm and consumer involvement. Trends focused on health are impacting the category, as lower-alcohol stout varieties are increasing in popularity among moderate drinkers looking for richness without elevated alcohol levels. Moreover, the trend of sustainability is influencing the market, as brewers are progressively opting for organic malts, using renewable energy in their production, and implementing minimal-waste methods that attract environmentally aware consumers.

Asia Pacific Stout Market Analysis

The stout market in the Asia Pacific region is growing as consumer preferences shift towards premium and artisanal drinks that provide unique character and high quality. With the rise of middle-class demographics and growing disposable income, an increasing number of people are delving into specialty beer varieties, such as stouts, as a component of an overall lifestyle enhancement. For example, the disposable income per capita in India hit USD 2.54 Thousand in 2023 and is projected to rise to USD 4.34 Thousand by 2029, according to the India Brand Equity Foundation (IBEF). Additionally, the attraction of rich and dessert-inspired stout varieties, including milk stouts, chocolate stouts, and pastry stouts, is increasing among younger drinkers looking for tasty options to popular lagers. Heightened exposure to worldwide beer trends via travel, digital platforms, and global trade is further shaping local tastes and broadening the market offerings to include more diverse stout styles. The growth of homebrewing and beer education in some areas of Asia Pacific is fostering a greater appreciation for the intricacies and artistry involved in stout production. The stout market trends show a clear shift towards innovation and premiumization, with consumers becoming more adventurous and discerning in their beer choices.

Latin America Stout Market Analysis

The stout market in Latin America is greatly shaped by rising consumer demand for high-quality and unique beer styles that combine strong flavors with local identity. With the growth of craft brewing in nations like Brazil, Argentina, and Colombia, breweries are innovating stout variations that appeal to both classic beer enthusiasts and intrigued newcomers. The rise of middle-class populations and increasing urbanization are also driving the need for refined beverage experiences. Estimates indicate that 88.4% of the Latin American population will reside in urban regions by 2025, amounting to 387,287,563 people. In addition to this, lighter, lower alcohol, or sessionable options are becoming more popular with consumers looking for moderation while still maintaining richness. Collaborations between local breweries and global stout manufacturers are also introducing knowledge and creativity to the area.

Middle East and Africa Stout Market Analysis

The stout market growth in the Middle East and Africa is driven by the area's increasing awareness about worldwide beverage trends and evolving consumer attitudes toward beer variety. With the rise of international travel, digital media, and lifestyle content, people are increasingly willing to experiment with bolder, darker beer varieties like stouts. Sustainability trends and the incorporation of indigenous grains into stout recipes are appealing to consumers interested in cultural heritage and environment-friendly brewing practices. In November 2024, Guinness and Brooklyn Brewery introduced the Guinness Fonio Stout, a special edition stout beer that honors African culture by combining the traditional West African grain fonio with the creative vision of Brooklyn Brewery Brewmaster Garrett Oliver. Apart from this, premiumization in the alcohol industry is also increasing interest in high-quality, expertly crafted selections, with stouts marketed as a lavish and indulgent choice.

Competitive Landscape:

Major participants in the market are concentrating on broadening their product ranges by launching new types and flavors to meet changing consumer tastes. They are putting resources into cutting-edge brewing methods to improve product quality and satisfy the increasing demand for craft and premium stouts. Numerous businesses are adopting sustainability methods, like using local ingredients and minimizing environmental effects, to attract eco-aware individuals. Moreover, these firms are improving their marketing approaches to reinforce brand identity and connect with larger audiences. In 2024, Singapore-based Lion Brewery launched a nitrogen-infused stout in a canned format, aiming to compete with market leader Guinness. The new product catered to the growing demand for at-home consumption, offering a smoother and more convenient drinking experience.

The report provides a comprehensive analysis of the competitive landscape in the stout market with detailed profiles of all major companies, including:

- Anheuser-Busch InBev

- Asahi Group Holdings Ltd.

- Carlsberg Breweries A/S

- Diageo plc

- Heineken N.V.

- Kirin Brewery Co. Ltd.

- Molson Coors Beverage Company

- Port Brewing Company

- Stone Brewing Co.

- The Boston Beer Company Inc

Latest News and Developments:

- July 2025: Goose Island Beer Co. officially released its Bourbon County Brand Stout Family lineup for 2025. The collection includes the company’s Original Stout, Cherries Jubilee Stout, Chocolate Praline Stout, Proprietor’s Stout, Double Barrel Heaven Hill Bottled-in-Bond Stout, and Parker’s Heritage Reserve Stout. Each variation provides a different expression, showcasing the nuanced richness of this exceptional beer through the use of diverse ingredients and casks.

- June 2025: Heaps Normal unveiled Jazz Stout, a daring, limited-edition addition to its expanding non-alcoholic lineup. The limited-edition product, which was brewed using East Kent Goldings hops, Australian Cascade, and Fuggles, intends to celebrate the similar enigmatic aspects of jazz music and stout.

- June 2025: Felons unveiled the dual release of Imperial Stout. The 2025 Imperial Stout presented scents of roasted malt and dark fruits, while the taste revealed layers of toffee, cocoa, and anise, ending with a dry and lasting finish.

- February 2025: Heineken UK broadened the distribution of the Irish stout brand Murphy’s in the off-trade by introducing 4x440ml and 10x440ml multipacks. The multipacks would be accessible in grocery, wholesale, and convenience outlets starting March 2025.

- January 2025: Nirvana, the UK’s first no/low brewery, launched ‘Nitro Stout’ (0.5% ABV) in a 330ml can featuring the brand’s eye-catching new design. Characterized by its deep, roasted tastes and smooth texture, Nitro Stout presented hints of coffee, chocolate, and caramel.

Stout Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Distribution Channels Covered | On-Trade, Off-Trade |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Anheuser-Busch InBev, Asahi Group Holdings Ltd., Carlsberg Breweries A/S, Diageo plc, Heineken N.V., Kirin Brewery Co. Ltd., Molson Coors Beverage Company, Port Brewing Company, Stone Brewing Co., The Boston Beer Company Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stout market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stout market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stout industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stout market was valued at USD 9.80 Billion in 2024.

The stout market is projected to exhibit a CAGR of 4.85% during 2025-2033, reaching a value of USD 15.03 Billion by 2033.

The stout market is driven by increasing consumer demand for diverse beer styles, rising interest in craft brewing, and a growing preference for rich, bold flavors. Shift toward premium products, innovative brewing techniques, and the expanding craft beer culture also contribute to the market growth, alongside changing drinking habits and regional preferences.

Europe currently dominates the stout market, accounting for a share of 37.6%. The dominance of the region is attributed to a rich brewing heritage, established consumer preferences, and a strong craft beer culture. The region also benefits from a well-developed distribution network, high consumer spending power, and a growing interest in premium, diverse beer offerings, fostering continued market growth and innovation.

Some of the major players in the stout market include Anheuser-Busch InBev, Asahi Group Holdings Ltd., Carlsberg Breweries A/S, Diageo plc, Heineken N.V., Kirin Brewery Co. Ltd., Molson Coors Beverage Company, Port Brewing Company, Stone Brewing Co., The Boston Beer Company Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)