Sterilization Indicator Tape Market Size, Share, Trends and Forecast by Type, End User, and Region 2025-2033

Sterilization Indicator Tape Market Size and Share:

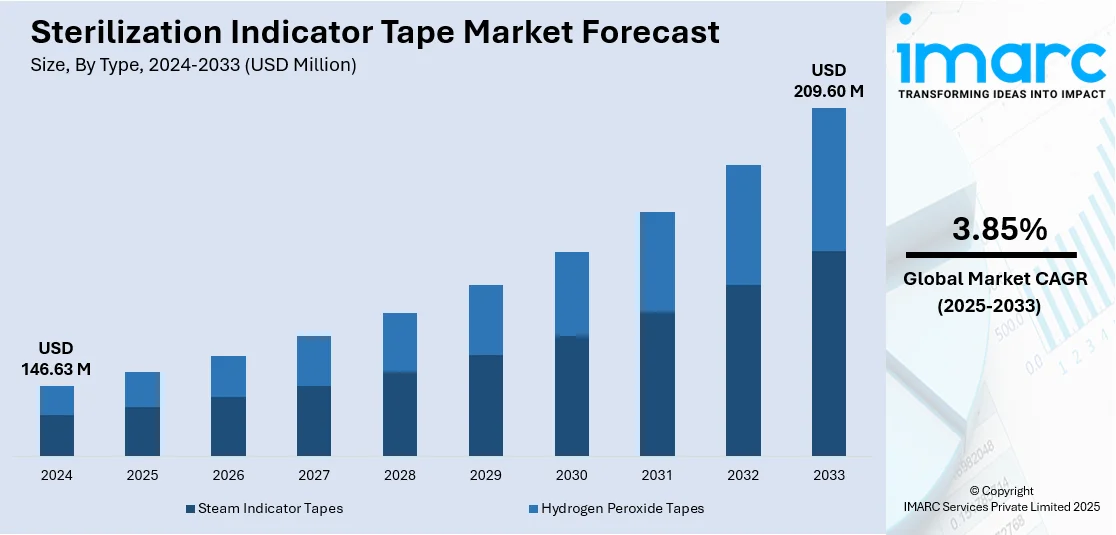

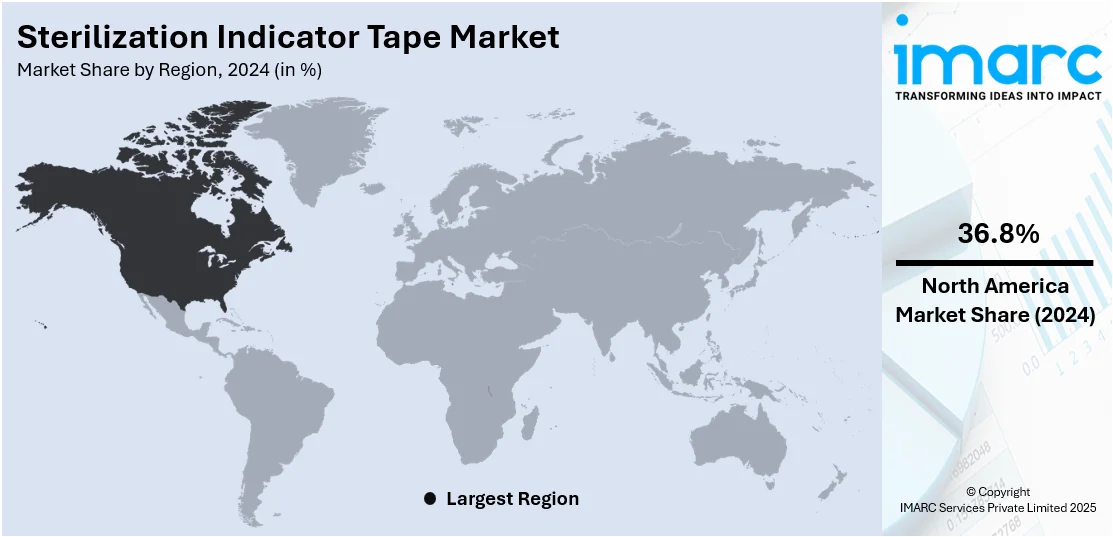

The global sterilization indicator tape market size was valued at USD 146.63 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 209.60 Million by 2033, exhibiting a CAGR of 3.85% during 2025-2033. North America currently dominates the market, holding a significant market share of over 36.8% in 2024. The rising adoption of new sterilization techniques and materials in healthcare settings for infection control, increasing product use in autoclaving and steam sterilization processes, and emerging applications across research facilities, laboratories, and dental clinics represent some of the key factors driving the sterilization indicator tape market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 146.63 Million |

|

Market Forecast in 2033

|

USD 209.60 Million |

| Market Growth Rate 2025-2033 | 3.85% |

The global sterilization indicator tape market is driven by increasing demand for effective sterilization monitoring in the healthcare, pharmaceutical, and food industries. Stringent regulatory standards and the need for infection control are key factors propelling the market growth. Increasing surgical volumes and the expansion of ambulatory care centers create a need for reliable sterilization monitoring tools. According to recent industry reports, in 2023, a total of 34.9 million aesthetic procedures were performed globally, of which 15.8 million were surgical and 19.1 million were non-surgical. This represents an overall increase of 3.4%, with surgical procedures increasing by 5.5%, led by liposuction and eyelid surgeries. The United States also logged the most procedures overall, with over 6.1 million, and Brazil also had top surgical procedures (2.1 million). As surgical interventions, particularly in facial and body procedures, continue to rise in demand, the use of sterilization indicator tape is increasing to enhance safety and reduce infection risk. Besides this, technological advancements, such as the development of multi-parameter indicator tapes, enhance market appeal. Additionally, the expansion of healthcare infrastructure in emerging economies and the growing emphasis on patient safety contribute to market expansion. The COVID-19 pandemic has also heightened the focus on sterilization, accelerating product adoption rates globally.

The United States stands out as a key regional market, primarily driven by the growing demand for sterilization validation across healthcare, pharmaceutical, and research facilities. Rising awareness about hospital-acquired infections (HAIs) and the importance of sterilization validation further enhance demand. According to the CDC's 2023 HAI Progress Report, most of the U.S. concerning hospital-acquired infections (HAIs) are on the decline, including a 13% decrease in central line-associated bloodstream infections (CLABSI), an 11% drop in catheter-associated urinary tract infections (CAUTI), and a 16% fall in methicillin-resistant Staphylococcus aureus (MRSA) bacteremia, compared with 2021. In addition, 44 states exceeded the 2015 CLABSI benchmarks, while metrics for 52 states improved for C. difficile standards, according to the data from over 38,000 reporting facilities. The need for effective sterilization validation in acute and long-term care settings will create considerable growth potential for the sterilization indicator tape market as hospitals seek to improve their infection control practices. Along with this, rising awareness about the risks of cross-contamination and the importance of compliance with FDA and CDC guidelines further fuels the market growth. Additionally, advancements in sterilization technologies and the adoption of automated systems in hospitals enhance the demand for high-quality indicator tapes. The focus on reducing healthcare-associated infections (HAIs) and ensuring patient safety remains a significant driver for market expansion.

Sterilization Indicator Tape Market Trends:

Growing Demand in Healthcare Settings Due to HAIs and Surgical Procedures

The global demand for sterilization indicator tapes is rising due to increased adoption in hospitals and healthcare facilities for infection control and surgical instrument sterilization. Tools including lancets, scalpels, and forceps require rigorous sterilization processes. According to the CDC, 1 in 31 U.S. hospital patients and 1 in 43 nursing home residents acquire hospital-acquired infections (HAIs) daily, which underscores the urgent need for sterilization solutions. Moreover, the growing number of surgical procedures, ongoing healthcare infrastructure improvements, and government initiatives supporting sterile product adoption further propel the market. The use of indicator tapes in autoclaving and steam sterilization ensures sterilization compliance, enhancing patient safety and reducing cross-contamination risks.

Expanding Applications Across Food, Beverage, and Pharma Industries

Sterilization indicator tapes are increasingly used beyond hospitals, notably in the food and beverage (F&B) sector to ensure hygiene and prevent contamination. The World Health Organization (WHO) reports that each year, 600 million individuals fall ill, and 420,000 die due to contaminated food. This issue costs low- and middle-income countries around USD 110 Billion annually in lost productivity and medical costs. Children under five bear 40% of the burden, with 125,000 deaths yearly. As a result, food manufacturers are prioritizing sterilization solutions. Similarly, pharmaceutical and medical device companies are leveraging these tapes to maintain product integrity and meet stringent safety standards, driving sustained demand in these sectors.

Advancements in R&D and Emerging Applications in New Sectors

Key players are investing significantly in R&D to enhance the accuracy, reliability, and usability of sterilization indicator tapes. These innovations aim to improve sterilization tracking and reduce the margin of error during complex procedures. The market is also witnessing expanded adoption in research labs, dental clinics, and diagnostic centers. A research report from the IMARC Group indicates that the global diagnostic imaging market was valued at USD 34.9 Billion in 2024. It is projected to grow to USD 53.5 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 4.37% from 2025 to 2033. Combined with the increasing use of chemical and biological indicators to verify sterilization and packaging processes, this trend is fueling the sterilization indicator tape market demand. The push toward innovation, along with continual product development and the rise of emerging use cases, is helping sterilization tapes transform into essential components of modern infection control strategies.

Sterilization Indicator Tape Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sterilization indicator tape market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Steam Indicator Tapes

- Hydrogen Peroxide Tapes

Steam indicator tapes stand as the largest component in 2024, holding around 65.8% of the market, primarily due to their widespread use in autoclave sterilization processes across healthcare, pharmaceutical, and laboratory settings. These tapes are cost-effective, easy to use, and provide immediate visual confirmation of sterilization exposure through color-changing indicators. The growing adoption of steam sterilization, driven by its efficiency and effectiveness in killing microorganisms, further increases demand. Additionally, stringent regulatory standards mandating sterilization validation in medical and surgical procedures contribute to their prominence. The expansion of healthcare infrastructure, particularly in emerging economies, and the increasing focus on infection control also reinforce the leading position of steam indicator tapes in the market.

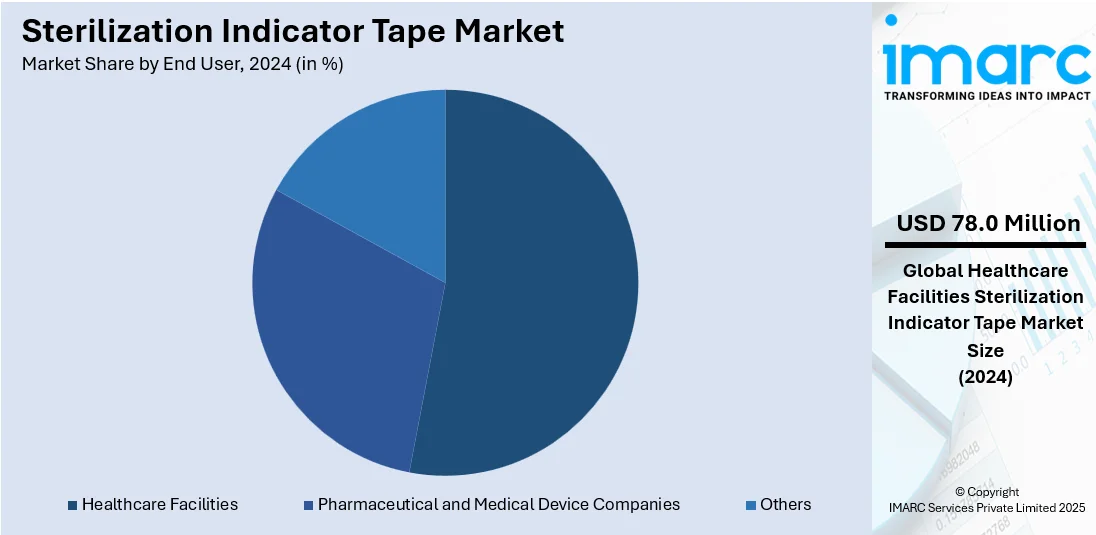

Analysis by End User:

- Healthcare Facilities

- Pharmaceutical and Medical Device Companies

- Others

Healthcare facilities lead the market with around 53.2% of the market share in 2024, driven by the critical need for effective sterilization and infection control in hospitals, clinics, and surgical centers. The rising prevalence of hospital-acquired infections (HAIs) and stringent regulatory requirements for sterilization validation in medical settings significantly enhance demand. Increasing surgical volumes, expanding healthcare infrastructure, and the growing emphasis on patient safety further propel sterilization indicator tape market growth. Additionally, the COVID-19 pandemic has heightened awareness about sterilization practices, accelerating adoption. Healthcare facilities rely on sterilization indicator tapes to ensure compliance with safety standards, reduce contamination risks, and maintain operational efficiency, solidifying their position as the dominant segment in the market.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 36.8%, driven by advanced healthcare infrastructure, stringent regulatory standards, and high awareness about infection control. The region's well-established healthcare system, coupled with the increasing prevalence of hospital-acquired infections (HAIs), fuels demand for reliable sterilization validation tools. The presence of leading market players and continuous technological advancements further strengthen the market. Additionally, the COVID-19 pandemic has influenced the focus on sterilization practices, increasing adoption. High healthcare expenditure, robust research and development activities, and the growing number of surgical procedures also contribute to North America's dominance, making it a key regional segment in the global sterilization indicator tape market.

Key Regional Takeaways:

United States Sterilization Indicator Tape Market Analysis

In 2024, the US accounted for around 92.80% of the total North America sterilization indicator tape market. The United States leads the sterilization indicator tape market, driven by strict regulations from the FDA, CDC, and ANSI/AAMI ST79 standards. In line with this, the increasing number of surgical procedures, expansion of outpatient facilities, and stringent sterilization requirements in medical device manufacturing also fuel market growth. According to NCBI, 1 in 9 U.S. residents undergo surgery annually, with 1 in 5 among seniors and Medicare beneficiaries. Surgical procedures represent a significant financial burden, accounting for over 25% of U.S. healthcare expenditures, as per the 2023 Milliman Health Cost Guidelines, with costs ranging from USD 4,000 to USD 200,000, and heart transplants exceeding USD 1 Million. Furthermore, rising awareness of hospital-acquired infections (HAIs) and the presence of leading manufacturers further drive demand for high-quality sterilization tapes. Additionally, continual technological advancements, including lead-free chemical indicators and multi-parameter monitoring, enhance product innovation and market appeal. Moreover, the market is witnessing a shift toward sustainable and EO-free sterilization processes, with manufacturers developing eco-friendly alternatives that align with changing regulatory requirements and green healthcare initiatives, ensuring compliance with stringent sterilization standards while reducing environmental impact.

Europe Sterilization Indicator Tape Market Analysis

The European sterilization indicator tape market is expanding due to strict regulatory oversight from the European Medicines Agency (EMA) and Medical Device Regulation (MDR 2017/745). The increasing prevalence of healthcare-associated infections (HAIs) and the growing use of single-use medical devices are key drivers of demand. As per the European Centre for Disease Prevention and Control (ECDC), 4.3 Million patients in EU/EEA hospitals acquire at least one HAI annually, highlighting the need for stringent sterilization protocols. The United Kingdom, Germany, and France lead the market, supported by advanced healthcare infrastructure and a strong focus on infection control. Furthermore, increasing innovation in indicator tape formulations aligns with ISO 11140 standards, ensuring compliance with sterilization requirements. The market is also witnessing a shift toward low-temperature sterilization methods, such as hydrogen peroxide vapor (VH2O2) and plasma sterilization, to accommodate heat-sensitive medical instruments. Additionally, color-changing chemical indicator tapes that provide instant sterilization verification are gaining traction in the market. With increasing sustainability concerns, manufacturers are investing in biodegradable and non-toxic formulations, developing recyclable and environmentally friendly sterilization tapes to meet changing regulatory and ecological demands while maintaining high safety standards.

Asia Pacific Sterilization Indicator Tape Market Analysis

The Asia Pacific market is experiencing rapid growth, propelled by rising healthcare investments, expanding hospital infrastructure, and stringent regulatory policies in key countries such as China, India, and Japan. According to the International Trade Administration, India’s hospital market, valued at USD 99 Billion in 2024, is projected to reach USD 193 Billion by 2032. The Government of India (GOI) has significantly augmented healthcare development, inaugurating five new AIIMS facilities and launching 202 healthcare infrastructure projects across medical colleges, specialty units, and research centers. A 12.59% increase in the FY24 healthcare budget further supports market expansion. In addition to this, growing medical tourism, rising surgical procedures, and increased disposable medical device manufacturing are fueling market demand. Moreover, China and India are strengthening sterilization guidelines and aligning regulatory frameworks with international standards. Likewise, increasing awareness of sterile packaging in pharmaceuticals and food processing further broadens market applications. Besides this, key manufacturers are leveraging cost-effective production and local partnerships to expand their market presence.

Latin America Sterilization Indicator Tape Market Analysis

The sterilization indicator tape market in Latin America is witnessing steady growth, driven by improving healthcare access, rising infrastructure investments, and increasing surgical procedures. For example, in, 2024, IFC invested BRL 500 Million (USD 90 Million) in Afya to expand medical education in Brazil’s North and Northeast regions, adding 200 new medical seats and supporting free community consultations under SDG 3 and SDG 4. Brazil, Mexico, and Argentina are leading the market, backed by government initiatives to modernize healthcare facilities and reduce infection rates. Furthermore, increasing demand for EO sterilization-compatible indicator tapes for surgical instruments and medical supplies is impelling the market. Despite economic volatility and regulatory disparities, local and international suppliers and the increasing use of sterilization monitoring in food products and pharmaceuticals are creating a positive sterilization indicator tape market outlook.

Middle East and Africa Sterilization Indicator Tape Market Analysis

The Middle East and Africa market is expanding, as a result of improving healthcare infrastructure, rising medical imports, and growing infection control awareness. For instance, on February 20, 2025, the Italian Trade Agency (ITA) highlighted Italy’s presence at Arab Health 2025 in Dubai, with over 200 Italian companies showcasing medical innovations. UAE imports of Italian medical devices and pharmaceuticals reached EUR 107 Million in 2024, marking a 19.24% increase and strengthening UAE-Italy healthcare ties. GCC countries, South Africa, and Egypt are key markets, driven by hospital and pharmaceutical facility investments. Apart from this, stringent government mandates on sterilization compliance and medical tourism growth in the UAE and Saudi Arabia further fuel market demand. Despite import dependency, price sensitivity, and regulatory inconsistencies, global manufacturers and regional distributors are expanding their presence and supporting dental, surgical, and laboratory sterilization protocols across MEA markets.

Competitive Landscape:

The competitive landscape of the sterilization indicator tape market is characterized by intense rivalry among key players, who are focusing on innovation, product differentiation, and strategic expansions to strengthen their market position. Companies are investing in research and development to introduce advanced sterilization tapes with enhanced features, such as multi-parameter indicators and improved durability. Strategic collaborations, mergers, and acquisitions are common tactics to expand geographic reach and product portfolios. Additionally, players are now emphasizing compliance with stringent regulatory standards to gain customer trust. Marketing efforts are geared toward educating end-users about the benefits of sterilization tapes, while competitive pricing and customization options are being offered to cater to diverse industry needs.

The report provides a comprehensive analysis of the competitive landscape in the sterilization indicator tape market with detailed profiles of all major companies, including:

- 3M Company

- 4A Medical

- Advanced Sterilization Products Inc. (Fortive Corporation)

- Brand Gmbh + Co. Kg

- Excelsior Scientific Ltd

- Guangdong New Era New Materials Technology Co. Ltd.

- Healthmark Industries Company Inc.

- Kartell S.p.A

- PMS Healthcare Technologies

- Shinva Medical Instrument Co. Ltd.

- Steris PLC

- Young Mydent LLC (Young Innovations Inc.)

Latest News and Developments:

- October 2024: Solventum launched the 2487 Hi-Tack Silicone Tape, a double-coated medical tape for sensitive skin. It offers repositionability, EtO sterilization compatibility, minimal residue, fluid resistance, and up to seven-day wear with reduced skin trauma, expanding medical wearable accessibility for all patient groups, including pediatric and chronic care.

- September 2024: Propper Manufacturing Company announced FDA clearance for EO Chex Ethylene Oxide Indicator Tape, the only FDA-cleared EO tape in the U.S. It seals packages during EO sterilization, ensuring process verification. EO Chex meets ISO 11140-1:2014 standards and is available through Propper and major distributors.

- August 2024: ASP introduced Chemical Indicator (CI) Strips designed to monitor the attainment of specific parameters required for effective sterilization processes. They provide an easy-to-read indication, differentiating between unprocessed and processed loads. These strips are available for both steam and low temperature systems, including STERRAD Sterilization Systems.

- July 2024: Ugaiya Bio-Sciences Co., Ltd. introduced its VHP Indication Tape (Product Code: UGTP0201) for vaporized hydrogen peroxide sterilization. The tape changes color from red to yellow upon exposure, complies with ISO 11607 and EN868 standards, and is designed for reliable sterilization identification and packaging of medical devices with SMS.

- March 2024: 3M Malaysia highlighted its 3M Comply Lead Free Steam Indicator Tape 1322-12MM, featuring lead-free ink, a trusted adhesive, and a stretchable backing to minimize "pop-off" during sterilization. It securely seals packs, providing visual assurance of steam sterilization exposure.

Sterilization Indicator Tape Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Steam Indicator Tapes, Hydrogen Peroxide Tapes |

| End Users Covered | Healthcare Facilities, Pharmaceutical and Medical Device Companies, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, 4A Medical, Advanced Sterilization Products Inc. (Fortive Corporation), Brand Gmbh + Co. Kg, Excelsior Scientific Ltd, Guangdong New Era New Materials Technology Co. Ltd., Healthmark Industries Company Inc., Kartell S.p.A, PMS Healthcare Technologies, Shinva Medical Instrument Co. Ltd., Steris PLC, Young Mydent LLC (Young Innovations Inc.), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sterilization indicator tape market from 2019-2033.

- The sterilization indicator tape market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sterilization indicator tape industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sterilization indicator tape market was valued at USD 146.63 Million in 2024.

IMARC estimates the sterilization indicator tape market to exhibit a CAGR of 3.85% during 2025-2033, reaching a value of USD 209.60 Million by 2033.

The market is driven by rising demand for infection control in the healthcare and food sectors, growing surgical procedures, increasing awareness of hospital-acquired infections (HAIs), strict regulatory standards, and advancements in sterilization technologies.

North America currently dominates the sterilization indicator tape market, accounting for a share exceeding 36.8%. This dominance is fueled by high surgical volumes, strict regulatory compliance, advanced healthcare infrastructure, and growing awareness of sterilization protocols.

Some of the major players in the sterilization indicator tape market include 3M Company, 4A Medical, Advanced Sterilization Products Inc. (Fortive Corporation), Brand Gmbh + Co. Kg, Excelsior Scientific Ltd, Guangdong New Era New Materials Technology Co. Ltd., Healthmark Industries Company Inc., Kartell S.p.A, PMS Healthcare Technologies, Shinva Medical Instrument Co. Ltd., Steris PLC, and Young Mydent LLC (Young Innovations Inc.), among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)