Stereotactic Surgery Devices Market Size, Share, Trends and Forecast by Product, Type, Application, and Region, 2025-2033

Stereotactic Surgery Devices Market Size and Overview:

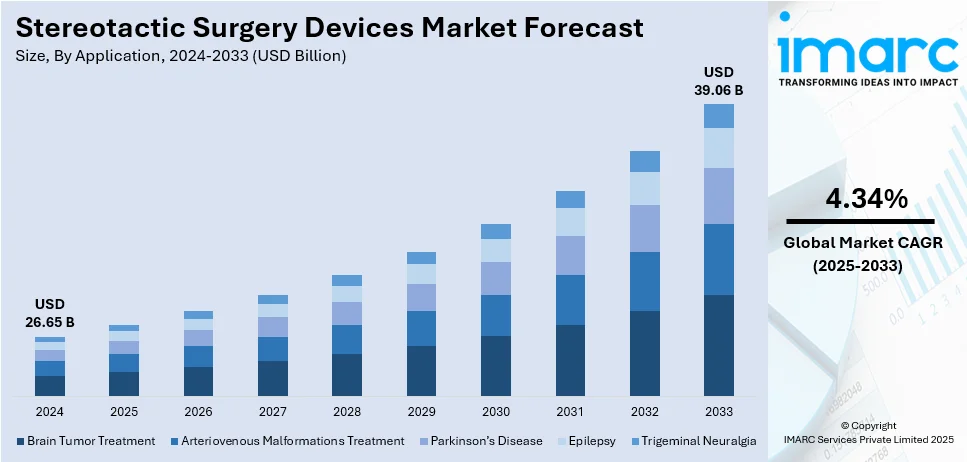

The global stereotactic surgery devices market size was valued at USD 26.65 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 39.06 Billion by 2033, exhibiting a CAGR of 4.34% during 2025-2033. North America currently dominates the market, holding a market share of over 42.6% in 2024. The rising prevalence of chronic and acute indications requiring surgical procedures, increasing geriatric population that is more susceptible to developing neurological disorders the increasing healthcare expenditure represent some of the key factors driving the stereotactic surgery devices market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.65 Billion |

| Market Forecast in 2033 | USD 39.06 Billion |

| Market Growth Rate (2025-2033) | 4.34% |

The increasing number of neurological disorders, such as Parkinson’s disease, epilepsy, and brain tumors, is one of the main factors driving the stereotactic surgery devices market growth. Neurological conditions are becoming more common due to an aging population and lifestyle factors, creating a growing demand for precise surgical solutions. According to the Centers for Disease Control and Prevention (CDC), approximately 1 in 6 people in the U.S. is affected by a neurological condition. Neurological conditions like Parkinson’s disease are becoming more prevalent. According to the Parkinson’s Foundation, over 1 million Americans currently have Parkinson’s disease, and this number is projected to increase to 1.2 million by 2030. Stereotactic surgery is particularly beneficial for treating these disorders because it allows surgeons to target specific areas of the brain or nervous system with high accuracy. Traditional open surgery methods often involve larger incisions and longer recovery times, while stereotactic surgery is minimally invasive, leading to faster recovery, fewer complications, and better overall outcomes.

The United States plays a significant role as a market disruptor, largely due to the rising government investment and support in healthcare infrastructure. The government recognizes the importance of advanced medical technologies such as stereotactic surgery in improving the outcomes of patients and reducing long-term healthcare costs. Consequently, funding through the public domain for the research and implementation of new medical equipment has increased significantly. For example, in 2023, the U.S. government spent more than $1.7 billion for the development and implementation of novel medical technologies under the funding programs of the National Institutes of Health (NIH) and the National Cancer Institute (NCI). Additionally, public health policies that promote early diagnosis and proper treatment of neurological disorders have spurred increased investment in sophisticated surgical technologies. The increasing growth in government-sponsored health programs and funding for medical research and development is creating a beneficial environment for the expansion of the stereotactic surgery devices market share.

Stereotactic Surgery Devices Market Trends:

Technological Advancements

The stereotactic surgery devices market has made rapid technological advancements especially through the application of robotic-assisted surgery, AI, and high-definition imaging systems. One notable development is the incorporation of 2.8 Magnetic Resonance-Guided Radiotherapy (MRgRT), especially for Stereotactic Radiosurgery (SRS) and Stereotactic Body Radiotherapy (SBRT) applications. MRgRT combines high-precision radiotherapy with on-board magnetic resonance imaging (MRI), offering superior image contrast that allows for better delineation of tumors and surrounding healthy tissue. This technology has improved treatment accuracy and minimized radiation exposure to healthy tissue, crucial in delicate procedures like brain surgery. Other areas that have developed within intraoperative navigation systems allow more procedures with the least interference from surrounding tissues, thereby promoting safer surgery but less time taken in recovery due to the noninvasive technique involved. In the coming years, technological advancement will increase the effectiveness of stereotactic surgery devices in promoting better surgical outcomes and deeper applications across different medical fields.

Increased Demand for Minimally Invasive (MI) Procedures

Preference for minimally invasive procedures is highly affecting the stereotactic surgery devices market demand. The minimally invasive surgery (MIS) has various benefits, such as less patient trauma, smaller incisions, less risk of infection, and less time to recover. Patients increasingly demand options that will minimize postoperative pain and get them back to normal activities more quickly. According to American Society of Plastic Surgeons, in the United States, the trend toward minimally invasive procedures is evident, with approximately 25.4 million cosmetic procedures performed in 2023, reflecting a 7% increase from the previous year. Stereotactic surgeries require the utmost precision; the development of imaging systems such as MRI and CT scans, which have enhanced the ability to conduct these operations with minimal destruction of surrounding tissue, has become a reality. The technologies further allow for less time spent in the hospital and thus lower costs in healthcare. Patient preference drives the demand for minimally invasive procedures, but advances in surgical technique and instrumentation can make it easier to achieve the goal of higher accuracy. This trend will continue to increase, and, therefore, the usage of stereotactic surgery devices will be further increased in neurosurgery, oncology, and other highly specialized fields requiring precision.

Expansion in Emerging Markets

As per the stereotactic surgery devices market outlook, emerging markets in the Asia-Pacific, Latin American, and Middle East regions are rapidly growing and turning into significant contributors to the market. These countries have witnessed the upsurge in healthcare investment, as both government and private institutions are making an effort to strengthen healthcare infrastructure and provide easier access to state-of-the-art medical technologies. As per an industry report, emerging economies collectively allocate 5.2% of their GDP to healthcare, significantly less than the spending in developed nations. Increasing cases of neurological disorders and cancers in the aforementioned regions have led to further increase in the demand for high-tech surgical equipment, including stereotactic devices. Moreover, higher disposable incomes and awareness among the patients regarding the minimal invasiveness of these surgeries have inspired the patients of emerging economies to seek better options. Medical tourism destinations have further fueled the growth of stereotactic surgery device markets in these countries, mainly in India, Thailand, and Mexico. These markets will be a great opportunity for manufacturers to expand their reach, thus higher adoption rates of these devices and hence market growth in the coming years.

Stereotactic Surgery Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stereotactic surgery devices market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product type and application.

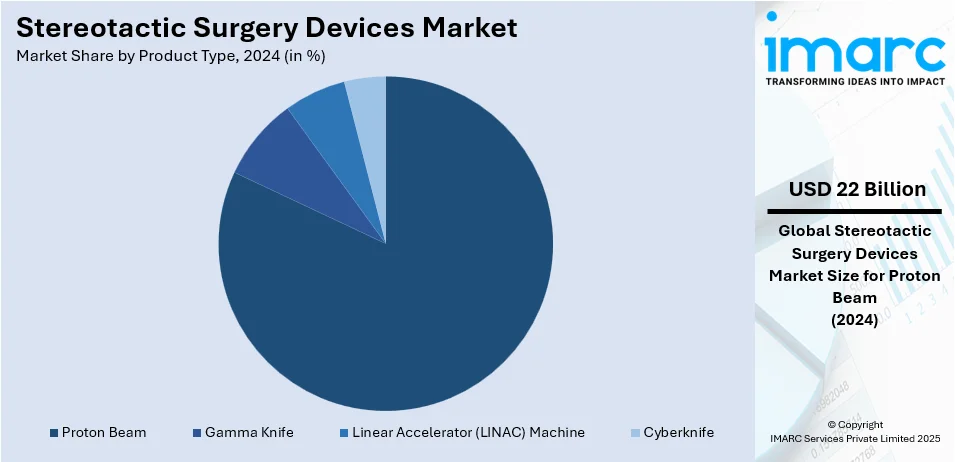

Analysis by Product Type:

- Gamma Knife

- Linear Accelerator (LINAC) Machine

- Proton Beam

- Cyberknife

As per the stereotactic surgery devices market forecast, linear acceptors (LINAC) machine is leading the industry, accounting for approximately 82.6% of the market share in 2024. This is primarily due to its widespread use in stereotactic radiosurgery (SRS) and stereotactic body radiation therapy (SBRT) for treating tumors. LINAC machines are noted for their high precision in providing high doses of radiation to specified tumor sites, thus minimizing harm to the rest of the surrounding healthy tissue. This makes them particularly effective for treating brain tumors, spinal tumors, and other types of cancer that require highly targeted radiation. As the demand for non-invasive and precise treatment options grows, LINAC machines have become an essential part of modern radiation therapy, providing excellent outcomes for patients.

Analysis by Application:

- Brain Tumor Treatment

- Arteriovenous Malformations Treatment

- Parkinson’s Disease

- Epilepsy

- Trigeminal Neuralgia

Based on the stereotactic surgery devices market trends, brain tumor treatment is one of the largest and most significant application segment in the market. Stereotactic radiosurgery (SRS) using LINAC or Gamma Knife is a non-invasive method with a very high precision in treating brain tumors, particularly those located in hard-to-reach areas. This method facilitates the delivery of focused beams of radiation, which do very limited damage to the surrounding healthy brain tissue, making it suitable for patients with malignant or benign brain tumors.

Arteriovenous malformations are abnormal entanglements of blood vessels that could be either in the brain or the spinal cord, and it is also another area for which there are key applications in stereotactic surgery devices. AVMs can easily lead to serious complications, such as hemorrhages or seizures, while with the help of stereotactic radiosurgery, closing off abnormal blood vessels with utmost precision can be achieved without involving the traditional open surgery. The benefit of stereotactic radiosurgery is that it allows AVMs deep within the brain to be treated with little risk of injury to the healthy tissue surrounding it.

Parkinson's disease, a neurodegenerative movement and coordination disorder, is another critical application that fuels the growth of the stereotactic surgery devices market. Deep brain stimulation (DBS) is the most effective treatment for Parkinson's disease in patients who do not respond to medication. DBS involves implanting electrodes in the brain at precise locations. Stereotactic surgery devices are crucial in ensuring the precise placement of electrodes during DBS. The procedure is highly targeted and results in considerable relief from symptoms and improvement in the quality of life for Parkinson's patients.

In cases of epilepsy, stereotactic surgery is increasingly used as it can identify the seizure-causing brain tissue with much more accuracy. Stereotactic laser ablation is most commonly used, where small specific areas of the brain generating seizure activity are killed through targeted heat produced by lasers. This minimally invasive approach is preferred over the more traditional open surgery because it can accurately treat even the harder-to-reach areas of the brain with minimal complications and faster recovery time.

Trigeminal neuralgia is another crucial application of stereotactic surgery devices. The condition is described as chronic pain along the trigeminal nerve with sudden, sharp facial pain; it can be triggered by minor stimuli such as touch or chewing. Stereotactic radiosurgery, such as Gamma Knife or CyberKnife, is a non-invasive treatment that delivers focused radiation to damage the blood vessels pressing against the trigeminal nerve, thereby relieving pain without the need for traditional surgery. This targeted and precise method reduces harm to nearby structures while providing substantial relief for patients.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 42.6%. A strong healthcare infrastructure in the region combined with increased expenditures on health facilities and neurological disease prevalence pushes this market forward. The US leads this industry owing to their developed healthcare setup and cutting-edge innovations in medical devices that tend to gain quicker acceptance due to increased research investments. The demand for accurate treatment modalities such as stereotactic radiosurgery and deep brain stimulation has increased because of the increasing prevalence of diseases like brain tumors, Parkinson's disease, epilepsy, and other neurological disorders. Moreover, North American countries enjoy robust government support, with grants for medical technologies from organizations like the National Institutes of Health (NIH) and the Centers for Disease Control and Prevention (CDC). Advanced medical equipment's availability and wide-ranging awareness across the patient spectrum as well as that of physicians to minimize any intervention by minimally-invasive (MI) therapy enhances the North American market growth.

Key Regional Takeaways:

United States Stereotactic Surgery Devices Market Analysis

The U.S. stereotactic surgery device market is growing at a steady pace due to neurosurgery advances and the high demand for minimal invasive procedures. Industrial reports claim that in 2022, 52,949 minimally invasive neurosurgery procedures were performed in the United States. This has greatly boosted the demand for specialized devices. With rising cases of neurological conditions and cancer, surgical techniques are constantly advancing, and so is the use of stereotactic technologies. Market leaders, Medtronic and Elekta, are positioned with high-precision solutions that gain strength from the focus on AI-powered advancements in treatment planning. As healthcare providers increasingly embrace minimally invasive (MI) approaches, the market continues to gain from higher surgical volume and rising R&D investments in next-generation stereotactic devices.

Europe Stereotactic Surgery Devices Market Analysis

The European market for stereotactic surgery devices is expanding as neurological disorders continue to rise, while treatment patterns also change in the direction of more minimally invasive procedures. Over 3,500 brain operations are carried out each year at Heidelberg University Hospital using less-invasive procedures like stereotactic surgery, computer-guided neuro-navigation, and intra-operative magnetic resonance tomography, as per reports. Residency programs in neurosurgery also contribute to growth in Europe. The average annual number of independent, supervised, and assisted surgical procedures in residency programs is 540, 482, and 579, respectively, as per reports. The demand for surgical navigation systems is growing in countries such as the UK, France, and Italy. Advanced technologies in healthcare systems will increase precision in treatments, according to market experts. Brainlab and Elekta are driving innovation in the surgical navigation systems and radiosurgery fields. Public health programs are also under investment by the European countries in order to support the technological progress while increasing stereotactic surgery.

Asia Pacific Stereotactic Surgery Devices Market Analysis

The market for Asia Pacific stereotactic surgery devices is growing rapidly due to an increase in neurological diseases and cancer, as well as the progress of medical technologies. According to an industrial report, in 2022, there were 3,631 minimally invasive neurosurgery procedures performed in Japan, which shows growth in the region using this stereotactic technique. China and India are also leaders in market growth, with the healthcare reforms of these countries supporting the adoption of innovative medical technology. The region is witnessing key investments in R&D for advanced surgical solutions, smart and precision-guided devices, and collaborations among local firms with global medical technology companies driving innovations in minimally invasive solutions. With rising disposable income and an increased emphasis on health care access, Asia Pacific is seen as a critical market in the global stereotactic surgery device market.

Latin America Stereotactic Surgery Devices Market Analysis

The market for Latin America stereotactic surgery devices is growing gradually as the demand for advanced neurosurgical procedures continues to rise with the development of healthcare infrastructure. According to an industrial report, there were 1,917 minimally invasive neurosurgery procedures performed in Mexico in 2022, and demand for specialized equipment to support this will continue to be high. Both Brazil and Mexico are leading countries in adopting these technologies, especially in medical technology and training. Healthcare spending in Brazil for the year 2022 was USD 161 billion, with huge investments directed towards medical technologies, of which stereotactic devices are one, as per reports. The companies, like Varian Medical Systems and Elekta, are making their entry into this area. Hospitals are increasingly adopting cutting-edge technologies for stereotactic surgery that will be able to provide precision treatment. It is also supported through government healthcare reforms and partnerships from international manufacturers to strengthen the local distribution and training programs.

Middle East and Africa Stereotactic Surgery Devices Market Analysis

The demand for stereotactic surgery devices is likely to increase significantly in the Middle East and Africa in the upcoming years, following technological advancements, health care spending growth, and neurological disorders surging. This was reflected in 2022 in Saudi Arabia with about USD 36.8 billion earmarked under health and social development, up 14.4% from its total budget and reflecting the regional government's aim of enhancing health-care infrastructure, as per reports. Some examples are the adoption of advanced medical technology, such as stereotactic surgery devices, and other major investments in health care by regional countries, for example, in the UAE and South Africa. The region sees some of the key players in cooperation with local global market players, pushing innovation and more advanced stereotactic solutions. With continued evolution in healthcare systems, the Middle East and Africa will be the hub for growth in the stereotactic surgery device market.

Competitive Landscape:

Key players in the market are investing in research and development (R&D) to improve their product offerings through innovation. The companies are also working on developing more precise and accurate devices by equipping them with modern imaging technologies, such as MRI and CT scans, to facilitate real-time guidance during surgeries. There is also a focus on developing more efficient and minimally invasive (MI) solutions to reduce patient recovery times and complications. Many players are also working on expanding the capabilities of their systems, incorporating features like robotic assistance and AI-driven navigation to increase the overall effectiveness and safety of procedures. As demand for non-invasive treatment is rising, companies are developing in fields like radiosurgery and deep brain stimulation, including treating condition with brain tumors, Parkinson's disease, and epilepsy.

The report provides a comprehensive analysis of the competitive landscape in the stereotactic surgery devices market with detailed profiles of all major companies, including:

- Accuray Incorporated

- Elekta

- Hitachi Ltd.

- Mevion Medical Systems

- Shinva Medical Instrument Co. Ltd

- Varian Medical Systems Inc. (Siemens Healthineers)

Latest News and Developments:

- December 2024: Accuray Incorporated announced a study demonstrating the CyberKnife® System's safety and efficacy in treating brainstem metastases using stereotactic radiosurgery (SRS) and fractionated stereotactic radiotherapy (FSRT). Published in the International Journal of Cancer, the analysis revealed high local control rates and a robust safety profile, enhancing treatment options.

- February 2024: National Centre for Stereotactic Radiosurgery in Sheffield became the first to treat patients using Elekta’s new Leksell Gamma Knife Esprit system. The system’s advanced technology offers more comfort and efficiency, allowing patients like Derry Crighton to resume normal activities just days after treatment for brain arteriovenous malformation (AVM).

- January 2024: The FDA has granted 510(k) clearance to the SmartFrame OR Stereotactic System by ClearPoint Neuro. This device aids in neurologic surgeries, such as catheter placement, biopsies, and electrode introduction, using preoperative CT/MR imaging. Its non-MRI dependence increases accessibility, with a limited launch planned for early 2024 and full release later.

- August 2023: The Varian TrueBeam and Edge radiosurgery systems have received FDA 510(k) approval to treat medically resistant essential tremors using stereotactic radiosurgery. This non-invasive, linear accelerator-based treatment is targeted at areas affected by the tremor and offers a speedier alternative to invasive procedures like deep brain stimulation or focused ultrasound therapies.

Stereotactic Surgery Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Gamma Knife, Linear Accelerator (LINAC) Machine, Proton Beam, Cyberknife |

| Applications Covered | Brain Tumor Treatment, Arteriovenous Malformations Treatment, Parkinson’s Disease, Epilepsy, Trigeminal Neuralgia |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Accuray Incorporated, Elekta, Hitachi Ltd., Mevion Medical Systems, Shinva Medical Instrument Co. Ltd, Varian Medical Systems Inc. (Siemens Healthineers), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stereotactic surgery devices market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stereotactic surgery devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stereotactic surgery devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stereotactic surgery devices market was valued at USD 26.65 Billion in 2024.

IMARC Group estimates the market to reach USD 39.06 Billion by 2033, exhibiting a CAGR of 4.34% during 2025-2033.

Key factors driving the stereotactic surgery devices market include the increasing prevalence of neurological disorders, rapid advancements in medical technology, growing demand for minimally invasive (MI) procedures, rising healthcare investments, escalating government support, greater patient awareness, and the expansion of healthcare access in emerging markets.

North America currently dominates the market, driven by advanced healthcare infrastructure, high healthcare spending, and a growing prevalence of neurological disorders.

Some of the major players in the stereotactic surgery devices market include Accuray Incorporated, Elekta, Hitachi Ltd., Mevion Medical Systems, Shinva Medical Instrument Co. Ltd, Varian Medical Systems Inc. (Siemens Healthineers), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)