Stereolithography (SLA) Technology 3D Printing Market Size, Share, Trends and Forecast by Printer Type, Material Type, Application, End-Use Industry, and Region, 2025-2033

Stereolithography (SLA) Technology 3D Printing Market Size and Share:

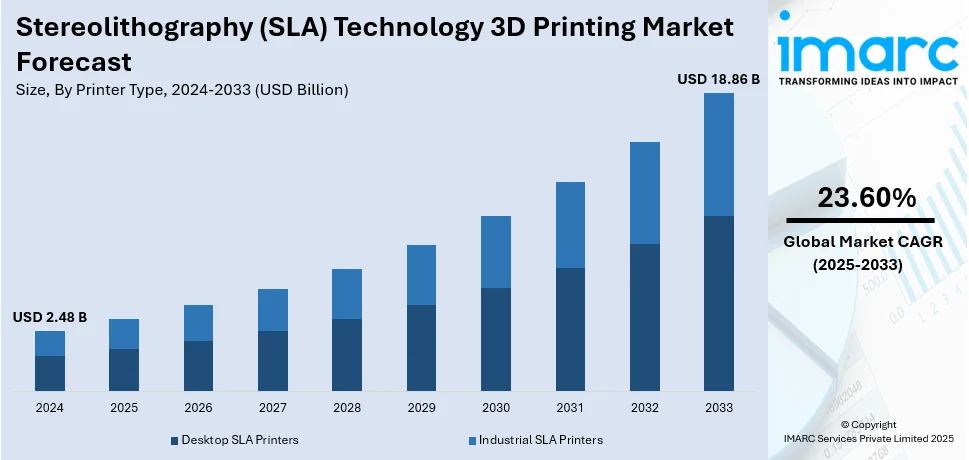

The global stereolithography (SLA) technology 3D printing market size was valued at USD 2.48 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 18.86 Billion by 2033, exhibiting a CAGR of 23.60% from 2025-2033. North America currently dominates the market, holding a market share of over 35.7% in 2024. This dominance is attributed to strong automotive, and aerospace sector, government initiatives, digital manufacturing advancements, and increasing investments in additive manufacturing technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.48 Billion |

| Market Forecast in 2033 | USD 18.86 Billion |

| Market Growth Rate (2025-2033) | 23.60% |

Increased automation, enhanced speed, and greater precision are driving the advancement of stereolithography (SLA) 3D printing. As industries seek faster production cycles and higher throughput, SLA technology is evolving to meet these demands with layer less printing, hybrid printing methods, and material innovations. Additionally, integrated post-processing solutions are emerging as a critical trend, streamlining production workflows and reducing manual labor requirements. The focus on high-volume manufacturing and industrial scalability is accelerating the adoption of next-generation SLA printers capable of delivering sub-micron accuracy and rapid print speeds. For example, in July 2024, Fugo Precision 3D launched the Fugo Model A, the first centrifugal SLA 3D printer, at RAPID + TCT Los Angeles. This printer features layer less printing, sub-30-micron accuracy, and 10× faster throughput, integrating post-processing automation and targeting high-volume manufacturers. With shipments beginning in Q1 2025, this development reinforces the trend of scaling SLA technology for mass production, enabling businesses to optimize efficiency, reduce lead times, and enhance output quality.

The United States is emerging as a key driver of SLA 3D printing innovation, fueled by strong investment in advanced manufacturing technologies. The country is witnessing significant funding inflows into next-generation SLA technologies, facilitating high-speed printing advancements and global market expansion. The demand for hybrid and high-performance SLA systems is rising, particularly in medical devices, aerospace components, and electronics manufacturing, where precision and efficiency are paramount. For instance, in December 2024, US-based Axtra3D secured USD 9.75 Million in Series A funding, led by HZG Group, to enhance its Hybrid Photosynthesis (HPS) and TruLayer technology. This funding will drive high-speed SLA 3D printing advancements and support the company's global expansion efforts, reinforcing the US's leadership in additive manufacturing innovation. With continued investment and technological advancements, the country remains at the forefront of transforming SLA 3D printing into a scalable, high-precision manufacturing solution for industries worldwide.

Stereolithography (SLA) Technology 3D Printing Market Trends:

Expanding Build Volumes for Industrial Manufacturing

The growing demand for large-scale, high-precision components in industries like aerospace, healthcare, and automotive is driving the expansion of build volumes in SLA 3D printing. Larger build capacities enable efficient prototyping, reduced material waste, and improved production speed, making SLA an increasingly viable solution for full-scale manufacturing. For instance, in 2024, ZRapid introduced the iSLA660 Industrial SLA 3D Printer, featuring a 600×600×400mm build volume, Nd:YVO4 laser, and 6–10 m/s scanning speed. This development enhances rapid prototyping and production efficiency, offering remote monitoring capabilities and photosensitive resin compatibility to meet the growing demand for high-precision industrial applications. As large-format SLA printers continue to evolve, businesses can achieve faster turnaround times, higher throughput, and greater cost savings, strengthening the adoption of additive manufacturing for functional, end-use parts. The scalability and precision of these systems ensure greater design flexibility and innovation, supporting industry-wide advancements in product development and manufacturing efficiency.

Advancing Continuous High-Speed SLA Printing

The advancement of continuous SLA 3D printing is revolutionizing manufacturing speed and efficiency by enabling uninterrupted printing cycles. This innovation reduces manual intervention, increases throughput, and lowers production costs, making SLA more competitive for mass customization and industrial manufacturing. The integration of automation and real-time process control allows companies to scale operations with minimal downtime, ensuring consistent quality and high-resolution output. In March 2024, Israeli startup Sprybuild introduced an SLA 3D printer featuring conveyor belt technology and a rigid optical interface, enabling continuous, high-speed printing. The system ensures stable resin flow and automated part release, significantly improving manufacturing scalability across applications like dental, footwear, medical, and industrial production. The adoption of high-speed SLA printers is streamlining on-demand manufacturing and rapid prototyping, supporting faster product iterations with minimal lead time. Further, industries can achieve greater operational efficiency, cost reductions, and material optimization, reinforcing the shift toward scalable, high-performance 3D printing solutions.

Enhancing Material Performance for Extreme Conditions

The development of high-performance SLA resins is enabling superior durability, temperature resistance, and regulatory compliance, expanding the application of SLA 3D printing beyond prototyping. Industries like aerospace, automotive, and electronics benefit from materials with improved mechanical properties, allowing for functional, end-use components that can withstand extreme operational environments. These resins also offer greater chemical resistance and enhanced part stability, ensuring long-term performance and reliability. In 2024, UnionTech introduced high-performance SLA resins, including UL94 V-0 flame-retardant and high-temperature-resistant (220°C) materials, reinforcing industrial applications in aerospace, automotive, and electronics. With advancements in material science, SLA technology is expanding its industrial footprint, offering customizable, high-strength solutions for complex manufacturing needs. The development of heat-resistant, impact-resistant, and specialty resins is driving greater innovation in additive manufacturing, enabling companies to optimize product performance while maintaining sustainability and efficiency.

Stereolithography (SLA) Technology 3D Printing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stereolithography (SLA) technology 3D printing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on printer type, material type, application, and end-use industry.

Analysis by Printer Type:

- Desktop SLA Printers

- Industrial SLA Printers

In 2024, industrial SLA printers led the market by printer type with 74.5% of the market share. Industrial SLA printers are leading the market due to their precision, speed, and scalability in high-performance applications. Industries such as aerospace, healthcare, and automotive are increasingly adopting SLA technology for prototyping and end-use parts. For example, Formlabs’ industrial SLA printers are widely used for creating detailed medical models and automotive components. The demand for high-resolution, cost-effective 3D printing is driving this trend forward.

Analysis by Material Type:

- Standard Resins

- Engineering Resins

- Dental & Medical Resins

- Others

In 2024, standard resins led the market by material type with 40% of the market share. The increasing adoption of standard resins in Stereolithography (SLA) 3D printing is a key market driver. These resins offer high accuracy, smooth surface finish, and cost-effectiveness, making them ideal for prototyping and end-use applications. Industries such as automotive, healthcare, and consumer goods are leveraging SLA technology for rapid prototyping and functional parts. Companies like Formlabs and 3D Systems are continuously innovating in standard resin formulations, enhancing properties like durability and heat resistance. The demand for affordable yet high-performance materials is fueling market growth, making standard resins a dominant choice in SLA printing.

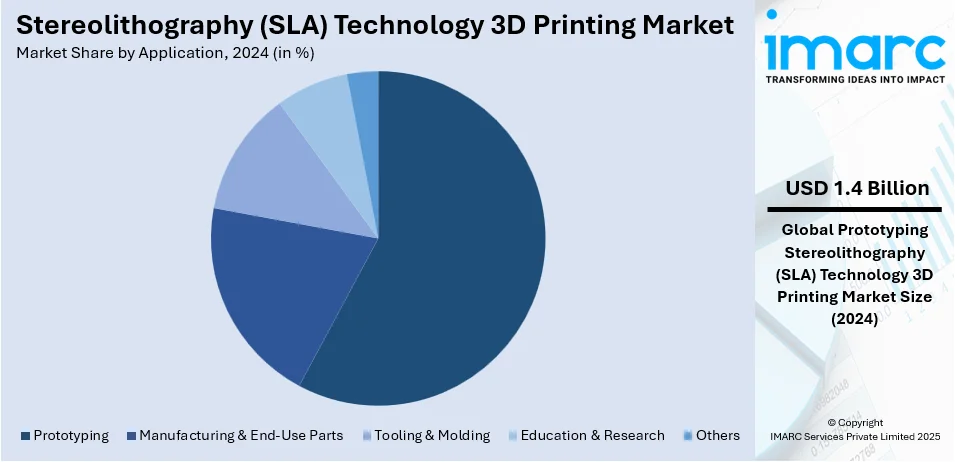

Analysis by Application:

- Prototyping

- Manufacturing & End-Use Parts

- Tooling & Molding

- Education & Research

- Others

In 2024, prototyping led the market by application with 57.6% of the market share. Prototyping drives the growth of Stereolithography (SLA) 3D printing, with industries such as automotive, healthcare, and aerospace adopting it for rapid design validation. SLA offers high precision, smooth surface finishes, and intricate detailing, making it ideal for developing complex prototypes. The rising need for faster product development and cost efficiency accelerates its adoption. Medical device manufacturers use SLA to create detailed prototypes of implants and surgical tools, improving innovation. The increasing demand for efficient, high-resolution prototyping continues to expand the SLA 3D printing market.

Analysis by End-Use Industry:

- Automotive

- Aerospace

- Healthcare

- Consumer Goods

- Manufacturing

- Education

- Others

In 2024, automotive led the market by end-use industry with 26.5% of the market share. The automotive sector is propelling the adoption of Stereolithography (SLA) technology in 3D printing due to its precision, rapid prototyping capabilities, and material versatility. Manufacturers use SLA for developing intricate components, functional prototypes, and customized interior parts. The demand for lightweight, durable materials is increasing SLA-based production, reducing design iteration times and costs. Companies integrate SLA for tooling applications and low-volume production, optimizing vehicle performance. As electric vehicles expand, SLA supports the design of aerodynamic structures and battery enclosures, improving efficiency and sustainability in automotive manufacturing.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

In 2024, North America led the market by region, holding 35.7% of the market share. North America dominates the market, driven by strong adoption across industries like healthcare, aerospace, and automotive. The region benefits from advanced manufacturing capabilities, high R&D investments, and a well-established 3D printing ecosystem. Companies leverage SLA for rapid prototyping, customized medical implants, and precision engineering components. The growing demand for biocompatible materials in dental and medical applications further strengthens market expansion. Additionally, government initiatives supporting additive manufacturing and increased funding for technological innovation fuel industry growth. The availability of high-performance photopolymer resins and advancements in laser-based curing techniques continue to enhance SLA’s adoption in North America.

Key Regional Takeaways:

United States Stereolithography (SLA) Technology 3D Printing Market Analysis

In 2024, United States accounted for 82.50% of the market share in North America. The United States stereolithography (SLA) 3D printing market is experiencing strong growth, driven by advancements in software integration, automation, and sustainability tracking. The increasing demand for high-precision additive manufacturing across industries such as aerospace, healthcare, and automotive is fueling investments in next-generation SLA technologies. Additionally, the emphasis on digital manufacturing and process optimization is encouraging the adoption of AI-driven workflow solutions that enhance efficiency, accuracy, and sustainability. Companies are focusing on reducing emissions, improving energy efficiency, and ensuring real-time process monitoring to align with sustainability regulations and industry best practices. In November 2024, Stratasys enhanced GrabCAD Print for Neo SLA 3D printers in the US, introducing streamlined build preparation, emissions estimation, and advanced workflow integration. This software optimizes additive manufacturing efficiency by enabling precision print control, sustainability tracking, and centralized management, ensuring greater carbon footprint transparency. With government initiatives supporting advanced manufacturing, rising investments in automation, and the expansion of smart factories, the US SLA 3D printing market is poised for continuous innovation and broader industrial adoption. The integration of AI-driven software solutions is reinforcing the country’s leadership in additive manufacturing, making SLA technology more scalable, sustainable, and cost-efficient for high-volume production.

Europe Stereolithography (SLA) Technology 3D Printing Market Analysis

The Europe stereolithography (SLA) 3D printing market is expanding rapidly, driven by technological advancements, increasing industrial adoption, and material innovation. The region’s strong focus on sustainability, high-performance manufacturing, and medical advancements is fostering demand for next-generation SLA materials with improved mechanical properties, heat resistance, and biocompatibility. Additionally, government initiatives promoting additive manufacturing, investments in research and development, and the presence of key industry players are accelerating the adoption of SLA technology across aerospace, automotive, and healthcare sectors. With the need for faster production, precision engineering, and sustainable materials, European manufacturers are prioritizing advanced resins and high-speed printing solutions to enhance efficiency and cost-effectiveness. In October 2023, Henkel Loctite 3D Printing, Germany, expanded its SLA 3D printing materials portfolio at Formnext, Frankfurt, introducing four advanced photopolymer resins designed for industrial and medical applications. These resins offer high-speed printing, heat resistance (up to 190°C), elastomeric properties, and biocompatibility, reinforcing Europe’s leadership in additive manufacturing. With a growing emphasis on material innovation, regulatory compliance, and industrial scalability, Europe continues to position itself as a global hub for SLA 3D printing, enabling greater production efficiency, sustainability, and product customization across various sectors.

Asia Pacific Stereolithography (SLA) Technology 3D Printing Market Analysis

The Asia-Pacific stereolithography (SLA) 3D printing market is witnessing strong growth, driven by rapid industrialization, increasing demand for high-precision manufacturing, and advancements in additive manufacturing technologies. The region’s expanding automotive, healthcare, and electronics sectors are accelerating the adoption of SLA 3D printing for prototyping and production-grade applications. Additionally, government initiatives supporting Industry 4.0, digital transformation, and localized production are fostering further market expansion. In January 2024, STPL 3D expanded its SLA 3D printing portfolio in the Asia-Pacific region, launching new industrial SLA solutions at IMTEX 2024 in India. These innovations enhance precision, scalability, and rapid prototyping, reinforcing India’s role in additive manufacturing innovation. With rising investments in advanced manufacturing, increasing accessibility to 3D printing solutions, and a growing ecosystem of startups and industry collaborations, the Asia-Pacific SLA 3D printing market is expected to experience sustained growth, positioning the region as a key hub for additive manufacturing advancements and industrial scalability.

Latin America Stereolithography (SLA) Technology 3D Printing Market Analysis

The Latin America stereolithography (SLA) 3D printing market is expanding due to technological advancements, rising industrial demand, and cost-effective prototyping solutions. Countries like Brazil and Mexico are leading the adoption, with increasing use in automotive, aerospace, and healthcare sectors. The market is witnessing growth in localized manufacturing and material innovations, supporting efficient production and reduced costs. With a growing startup ecosystem and investments in additive manufacturing, the region is set to experience strong market expansion, driven by enhanced SLA capabilities and improved accessibility to advanced 3D printing solutions.

Middle East Stereolithography (SLA) Technology 3D Printing Market Analysis

The Middle East stereolithography (SLA) 3D printing market is experiencing growth, driven by industrial localization, supply chain optimization, and government initiatives supporting advanced manufacturing technologies. The region’s focus on reducing dependency on imports and enhancing domestic production is fostering the adoption of SLA 3D printing for spare parts, energy infrastructure, and industrial applications. Additionally, investments in digital transformation and automation are accelerating the shift toward on-demand manufacturing and cost-efficient production. In July 2024, NAMI Saudi Arabia expanded SLA 3D printing capabilities by adopting 3D Systems’ additive manufacturing solutions, enabling localized spare parts production for Saudi Electricity Company. This initiative improves supply chain efficiency and supports Saudi Arabia’s Vision 2030 for industrial and energy sector advancements. With a growing emphasis on self-sufficiency, technology-driven manufacturing, and sustainability, the Middle East is positioning SLA 3D printing as a key enabler of industrial growth, ensuring faster production cycles, reduced costs, and enhanced operational resilience across various sectors.

Africa Stereolithography (SLA) Technology 3D Printing Market Analysis

The Africa stereolithography (SLA) 3D printing market is expanding, driven by the need for localized manufacturing, infrastructure maintenance, and supply chain efficiency. The region's industrial sectors, particularly oil & gas, energy, and manufacturing, are increasingly adopting SLA 3D printing to reduce dependency on imports, lower production costs, and accelerate spare parts availability. Additionally, government approvals and industry collaborations are fostering the integration of advanced additive manufacturing technologies to enhance operational efficiency and sustainability. In May 2024, RusselSmith and 3YOURMIND established Nigeria’s first oil & gas additive manufacturing center, integrating SLA 3D printing to streamline spare parts production. Approved by NUPRC, this initiative enhances infrastructure maintenance, improves supply chain efficiency, and strengthens local manufacturing, reinforcing West Africa’s energy sector. With rising investments in industrial automation, digital manufacturing, and energy sector advancements, Africa is positioning SLA 3D printing as a transformative technology, ensuring cost-effective production, faster turnaround times, and improved self-sufficiency across key industries.

Competitive Landscape:

Technological advancements, material innovations, and industrial demand for high-precision manufacturing shape the competitive landscape of the stereolithography (SLA) 3D printing market. Key players like 3D Systems, Stratasys, and Formlabs are expanding their portfolios with high-speed, scalable SLA solutions. Rising investments, government support, and increasing adoption in automotive, healthcare, and aerospace sectors are driving market growth. Strategic partnerships, R&D, and regional expansions are intensifying competition, fostering innovation and cost-effective manufacturing solutions globally.

The report provides a comprehensive analysis of the competitive landscape in the stereolithography (SLA) technology 3D printing market with detailed profiles of all major companies, including:

- 3D Systems Inc.

- Formlabs

- Stratasys

- Flashforge

- Zortrax, B9Creations

- Anycubic

- Phrozen Technology

- Kudo3D

- Asiga

- MiiCraft

- Uniz Technology LLC

Latest News and Developments:

- November 2024: Sauber Motorsports acquired ten 3D Systems SLA printers—eight SLA 750 Dual and two PSLA 270—to enhance wind tunnel part production. The SLA 750 Dual offers high-speed dual-laser printing, while PSLA 270 ensures precision and flexibility, reinforcing additive manufacturing in motorsports.

- October 2024: Formlabs launched the Form 4L and Form 4BL, expanding large-format SLA 3D printing with five times larger build volume and 80mm/hour speed. It also introduced third-party material compatibility, enhanced software, and new SLS materials.

- September 2024: Materialise and Stratasys introduced the Neo Build Processor for Investment Casting, optimizing SLA 3D printing for Neo 450 and Neo 800. The tool enhances file processing by 50%, boosts print speeds and enables 75% time savings in aerospace and automotive investment casting applications.

- March 2024: Eplus3D launched the EP-A800, a large-format laser SLA 3D printer with an 800×800×450mm build volume, dual-laser technology for 30–45% faster printing, patented VarioBeam technology for high precision, and open material compatibility, enhancing mass production and prototyping applications.

Stereolithography (SLA) Technology 3D Printing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Printer Types Covered | Desktop SLA Printers, Industrial SLA Printers |

| Material Types Covered | Standard Resins, Engineering Resins, Dental & Medical Resins, Others |

| Applications Covered | Prototyping, Manufacturing & End-Use Parts, Tooling & Molding, Education & Research, Others |

| End-Use Industries Covered | Automotive, Aerospace, Healthcare, Consumer Goods, Manufacturing, Education, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3D Systems Inc., Formlabs, Stratasys, Flashforge, Zortrax, B9Creations, Anycubic, Phrozen Technology, Kudo3D, Asiga, MiiCraft, Uniz Technology LLC, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stereolithography (SLA) technology 3D printing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stereolithography (SLA) technology 3D printing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stereolithography (SLA) technology 3D printing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stereolithography (SLA) technology 3D printing market was valued at USD 2.48 Billion in 2024.

The stereolithography (SLA) technology 3D printing market is projected to exhibit a CAGR of 23.60% during 2025-2033, reaching a value of USD 18.86 Billion by 2033.

High precision, rapid prototyping demand, advanced resin materials, industrial scalability, automation, cost efficiency, rising adoption in healthcare, etc., are the factors driving the market growth.

North America currently dominates the stereolithography (SLA) technology 3D printing market, accounting for a share of 35.7%. High R&D investments, advanced manufacturing infrastructure, rising adoption in healthcare and aerospace, availability of specialized resins, and strong government support for additive manufacturing innovation and commercialization drive north America's dominance in the market.

Some of the major players in the stereolithography (SLA) technology 3D printing market include 3D Systems Inc., Formlabs, Stratasys, Flashforge, Zortrax, B9Creations, Anycubic, Phrozen Technology, Kudo3D, Asiga, MiiCraft, Uniz Technology LLC, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)