Stepper System Market Size, Share, Trends and Forecast by Component Type, End-Use, and Region, 2025-2033

Stepper System Market Size and Share:

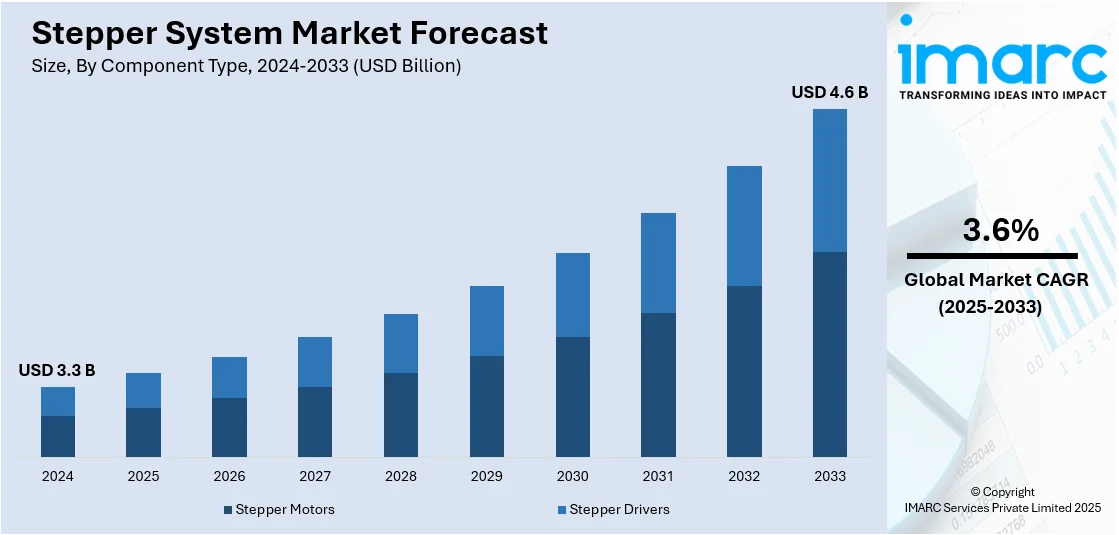

The global stepper system market size was valued at USD 3.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.6 Billion by 2033, exhibiting a CAGR of 3.6% from 2025-2033. Asia Pacific currently dominates the stepper system market share by holding over 55.3% in 2024. The market in the region is driven by rapid urbanization, expanding smart manufacturing initiatives, increasing government investments in industrial automation, and the growing presence of local manufacturers offering cost-effective motion control solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.3 Billion |

|

Market Forecast in 2033

|

USD 4.6 Billion |

| Market Growth Rate 2025-2033 | 3.6% |

The global stepper system market growth is primarily driven by the increasing industrial automation which is boosting demand for precise motion control solutions in manufacturing and logistics. In addition, the growth in robotics adoption across industries such as automotive, electronics, and healthcare is fueling stepper motor usage and aiding the market growth. For example, Mercedes-Benz has invested in Texas-based robotics company Apptronik and is testing humanoid robots in manufacturing tasks, reflecting a shift toward automation in the automotive industry. Moreover, the rising demand for medical devices requiring high-precision motors, such as imaging systems and robotic-assisted surgeries, is contributing to the market expansion. Besides this, advancements in semiconductor manufacturing are increasing the need for stepper systems in wafer processing, providing an impetus to the market. Also, the expanding electric vehicle (EV) production is driving demand for efficient motor control systems, further impelling the market growth.

The United States stepper system market, accounting for 91.30% of the global share, is driven by the strong aerospace and defense sector demands for precise motion control for satellite positioning, avionics, and military robotics. In line with this, the expansion of smart factories with Industry 4.0 adoption is increasing the need for automated motion control solutions and supporting the market growth. Moreover, the growth in 3D printing and computer numerical control (CNC) machining is fostering the need for stepper motors in precision manufacturing. Concurrently, the increasing demand for renewable energy (RE) systems like solar tracking mechanisms is driving adoption and boosting the stepper system market demand. In confluence with this, the rising investments in biotech and pharmaceutical automation are expanding applications in laboratory equipment and providing an impetus to the market. Furthermore, the continuous advancements in consumer electronics manufacturing are creating new opportunities for compact, high-torque stepper systems, thereby propelling the market forward.

Stepper System Market Trends:

Significant Growth in the Robotics Industry Driving Market Expansion

The rapid expansion of the robotics industry is a major factor boosting the stepper system market share. The International Federation of Robotics reports that worldwide operational robot units reached 3.9 million units representing the escalating market need for automated systems. Industrial machine and robot manufacturers require stepper motors because they deploy easily and perform better in automated equipment implementations to increase efficiency. Reports also indicate that the global robotics industry will expand at an annual growth rate of 16.35% between 2025 to 2033 and reach USD 178.7 billion. The market started 2024 at USD 53.2 billion. As a result, the combination of automated requirements and industrial development creates new opportunities for stepper systems to spread throughout different sectors.

Development of Miniaturized Motors Enhancing Product Adoption

The development of miniaturized stepper motors has significantly expanded their adoption in applications requiring high precision, torque, and speed control. Industries such as robotics, medical devices, and consumer electronics increasingly rely on compact stepper motors for efficiency and performance. These motors offer enhanced operational accuracy, making them ideal for precision equipment, automated machinery, and space-constrained applications. For instance, in 2024, Kollmorgen launched the POWERMAX II® M and P Series stepper motors, delivering high torque in a compact design, catering to applications requiring precision and space efficiency. The increasing need for high-performance, lightweight motors has spurred innovation, and energy efficiency and torque density have consequently improved. With industries going all out to miniaturize without sacrificing performance, next-generation stepper motors with sophisticated design capabilities are poised to see greater traction. This shift is significantly enhancing the stepper system market outlook.

Technological Advancements in Stepper Motors Creating a Positive Market Outlook

Innovations in stepper motor technology, including the integration of input/output (I/O) terminals, have enhanced their efficiency, making them more cost-effective and suitable for compact machinery. These advancements provide superior performance in applications with spatial constraints, enabling greater flexibility in industrial automation. For example, in 2024, Siemens' introduction of a fully electronic e-Starter using semiconductor technology has further improved motor efficiency and reliability, supporting the trend toward compact and advanced motor control solutions. The continuous evolution of stepper motor designs, including improved torque-to-size ratios and digital control capabilities, is driving their adoption across industries. Additionally, rapid industrialization and extensive R&D initiatives are influencing the stepper system market trends. As manufacturers focus on enhancing precision, energy efficiency, and durability, stepper motors are becoming increasingly vital in automated manufacturing, medical equipment, and high-performance machinery, shaping the future of motion control technology.

Stepper System Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stepper system market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component type and end-use.

Analysis by Component Type:

- Stepper Motors

- Stepper Drivers

Stepper motors account for 61.1% of the stepper system market, making them the largest segment. The market dominance of stepper motors originates from their application in automated industries that include manufacturing sectors, robotics operations and medical device manufacturing. In addition, high-precision motion control requirements in CNC machines and 3D printing applications as well as semiconductor equipment production lead to market expansion. Modern miniaturized and energy-efficient motor technology enables their use in tight applications including healthcare equipment and consumer electronics. Besides this, the growth of the EV market leads to greater stepper motor use in battery management systems as well as control systems. As a result, the market continues to expand because researchers maintain ongoing studies that enhance torque efficiency and durability alongside real-time control abilities.

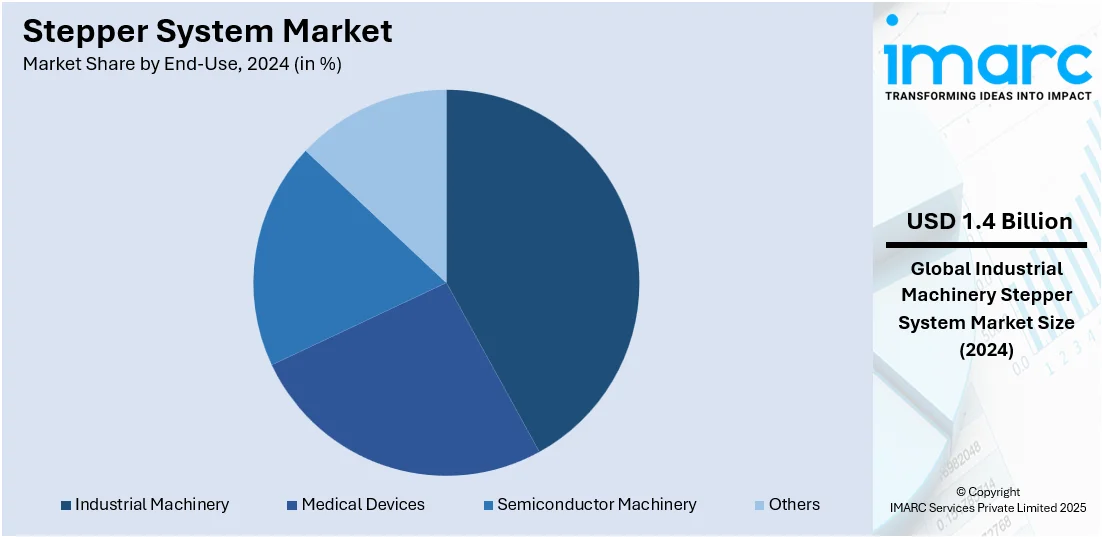

Analysis by End-Use:

- Industrial Machinery

- Medical Devices

- Semiconductor Machinery

- Others

Industrial machinery holds the largest share of the stepper system market at 41.6% because manufacturing and production facilities are increasingly using automation and precision control systems. The market is also expanding because of rising requirements for high-precision motion control technology within CNC machines, packaging equipment, and textile machinery. The adoption of stepper motors gets additional momentum from increased spending on smart factories together with Industry 4.0 technologies. Besides this, miniaturized energy-efficient stepper motors support better performance in industrial applications that have space constraints. Semiconductor and electronics manufacturers benefit from market demand because stepper systems provide accurate positioning, speed control, and efficient motion handling throughout production lines.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific dominates the stepper system market with a 55.3% share, driven by rapid industrialization and expanding automation in manufacturing. The region maintains a significant position in electronics manufacturing, semiconductor production, and automotive manufacturing thus driving demand for exact motion control systems. In confluence with, the growing smart manufacturing and Industry 4.0 adoption rates are contributing to the market expansion. The increasing production of EVs in China Japan and South Korea is also leading to higher requirements for stepper motors owing to their operational efficiency. Additionally, government backing of robotic automation helps industries throughout various sectors to adopt new technology. Furthermore, low-cost manufacturing along with local supplier networks are positioning the Asia Pacific region as a main center for stepper system production and innovation, thereby propelling the market forward.

Key Regional Takeaways:

North America Stepper System Market Analysis

The North America stepper system market is steadily growing because of expanding industrial automation across manufacturing sectors, healthcare systems, and robotic applications. The United States along with Canada possesses an advanced industrial foundation that leads to escalating needs for precise motion control technologies. For instance, Honeywell announced plans to split into three independent companies, aiming to enhance focus on automation and aerospace sectors, potentially increasing demand for precise motion control solutions. Moreover, industrial sectors, medical institutions, and automotive companies are progressively adopting stepper motors for their applications. Besides this, the improved performance and efficiency are driven by the miniature motor development and integrated control technology advancements. Government programs that promote industrial automation and smart manufacturing are also impelling the market growth. As a result, the market demonstrates strong growth potential through continuous technological development and R&D investments.

United States Stepper System Market Analysis

The United States stepper system market is expanding driven by semiconductor manufacturing companies, medical device developers, and robotic manufacturers. Stepper systems serve diverse precision motion control requirements due to their ability to deliver precise positioning and speed control. Moreover, the industries are increasingly accepting automation technologies, which is strengthening the market share. Besides this, the semiconductor market expansion drives market growth through its booming sector because stepper systems are essential for semiconductor fabrication operations. According to the Semiconductor Industry Association, The CHIPS Act initiated more than 90 new semiconductor manufacturing projects which received nearly USD 450 Billion worth of investments across 28 states during August 2024. The increasing semiconductor production will create substantial growth opportunities for stepper systems used in precise motion control systems. Additionally, the market players release upgraded stepper systems equipped with controller units along with efficient motors and improved torque functions to fulfill modern customer needs. Furthermore, increasing stepper system applications in 3D printing, aerospace, and laboratory equipment are providing an impetus to the market. As a result, continued technological development and industrial automation expansion will drive substantial growth of the United States stepper system market throughout the upcoming years.

Europe Stepper System Market Analysis

The Europe stepper system market is growing, driven by the region's strong focus on industrial automation and advanced manufacturing technologies. Stepper systems are widely utilized in the automotive, electronics, and healthcare sectors for precision motion control applications. The increasing adoption of automated production lines and robotic systems is boosting market demand. According to the European Commission, the robotics market is set to exceed 90 Billion EUR by 2030, further supporting the demand for stepper systems as essential components in robotic applications. Market players are offering high-performance stepper motors with enhanced durability and precision to cater to various industrial needs. Additionally, the rising trend of miniaturized electronic devices and customized motion control systems is supporting market expansion. With the ongoing digital transformation in industries and the escalating investment in automation technologies, the Europe stepper system market is expected to witness steady growth in the foreseeable future.

Asia Pacific Stepper System Market Analysis

The stepper system market within Asia Pacific demonstrates strong expansion because of regional electronics manufacturing industries, automotive sector, and robotics industries. These countries play a significant role in market expansion because the rising demand for automation technologies together with precision motion control systems continues to support their growth. Consumer electronics and medical devices gain popularity at a time that boosts market demand. The International Federation of Robotics reported that China's factories now operate 1,755,132 industrial robots in their facilities while also experiencing a 17% rise which demonstrates the region's expanding automation needs. The rising market demand encourages manufacturers to introduce affordable stepper systems with advanced features suitable for industrial applications. The Asia Pacific stepper system market will experience substantial growth during the next few years due to fast industrialization together with technological improvements and rising industrial robot adoption.

Latin America Stepper System Market Analysis

The Latin America stepper system market is gradually expanding, supported by the region's growing automotive, medical devices, and packaging industries. The increasing adoption of industrial automation technologies in manufacturing sectors is boosting the demand for stepper systems. The rising focus on factory automation and precision motion control solutions is further accelerating market growth. For instance, Brazil's factory automation and industrial controls market size reached USD 10.5 Billion in 2024, with expectations to reach USD 17.8 Billion by 2033, exhibiting a CAGR of 5.94% during 2025-2033, according to IMARC Group. Market players are offering compact and energy-efficient stepper systems to meet the diverse requirements of industries. Additionally, the growing investment in smart manufacturing solutions and the increasing need for automated motion control applications are contributing to market expansion.

Middle East and Africa Stepper System Market Analysis

The Middle East and Africa stepper system market is witnessing gradual growth, driven by the increasing demand for automated systems across the healthcare, oil and gas, and manufacturing sectors. Stepper systems play a vital role in laboratory equipment, robotic systems, and industrial machinery, enabling precise motion control and positioning in various applications. The rising adoption of smart manufacturing technologies and automated laboratory instruments is supporting market expansion. Saudi Arabia's smart manufacturing market size reached USD 3,324.9 Million in 2024, and is projected to reach USD 10,974.7 Million by 2033, exhibiting a CAGR of 14.2% during 2025-2033 according to IMARC Group. This growing focus on industrial automation and technological innovation is further boosting the demand for advanced stepper systems.

Competitive Landscape:

Market participants in the stepper system market are actively engaging in investments in technological developments, including integrated control systems, improved torque efficiency, and miniaturized designs to provide greater performance. Firms are also emphasizing strategic alliances and mergers to diversify their global footprint and consolidate supply chains. The increasing adoption of smart manufacturing and Industry 4.0 is compelling manufacturers to create stepper motors with improved connectivity and real-time monitoring features. In addition, companies are ramping up R&D spending to support new applications in robotics, electric vehicles, and medical devices. As demand rises, most players are boosting production capacities in the Asia Pacific to take advantage of cost benefits and serve regional demand. Sustainability efforts, such as energy-efficient motor designs, are also becoming popular among major market players.

The report provides a comprehensive analysis of the competitive landscape in the stepper system market with detailed profiles of all major companies, including:

- ABB

- Beckhoff Automation

- MinebeaMitsumi

- Nidec Corporation

- Nippon Pulse Motor Co. Ltd.

- Oriental Motor Co. Ltd.

- Parker Hannifin

- Sanyo Denki Co. Ltd.

- Schneider Electric SE

Latest News and Developments:

- In February 2025: Oriental Motor expanded its Rotary Encoder lineup, introducing 14 resolution types ranging from 100 to 4000 P/R and a new open collector output option. The compact, lightweight encoders enable precise position and speed detection for motion control applications, enhancing versatility in industrial automation systems.

- In December 2024: MinebeaMitsumi Inc. announced plans to launch a new factory in Pursat province in 2025, becoming Cambodia's first 100% renewable energy-powered factory. Prime Minister Hun Manet praised the company's investment expansion since 2011, highlighting its role in attracting more Japanese investors to Cambodia.

- In September 2024: Nidec Corporation announced an additional ₹150 crore investment in its Hubballi-Dharwad facility, expanding the total investment to ₹600 crore. The facility will cover 50 acres and generate 800+ jobs, producing alternators, motors, and EV solutions.

- In January 2024: ABB hosted Electrification Innovation Week 2024 in Xiamen, unveiling 20+ new products to accelerate the energy transition across sectors like energy, buildings, and data centers. The event marked 100 years of the resettable miniature circuit breaker and the rollout of the one-millionth ring main unit in Beijing.

Stepper System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Stepper Motors, Stepper Drivers |

| End-Uses Covered | Industrial Machinery, Medical Devices, Semiconductor Machinery, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB, Beckhoff Automation, MinebeaMitsumi, Nidec Corporation, Nippon Pulse Motor Co. Ltd., Oriental Motor Co. Ltd., Parker Hannifin, Sanyo Denki Co. Ltd., Schneider Electric SE., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stepper system market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stepper system market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stepper system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stepper system market was valued at USD 3.3 Billion in 2024.

IMARC estimates the stepper system market to exhibit a CAGR of 3.6% during 2025-2033, expecting to reach USD 4.6 Billion by 2033.

The key factors driving the stepper system market include increasing industrial automation, rising adoption of robotics, growing demand for high-precision motion control, advancements in miniaturized motors, expanding applications in medical devices and semiconductor manufacturing, and technological innovations enhancing energy efficiency, torque performance, and integrated control capabilities across various industries.

Asia Pacific currently dominates the market, accounting for a share exceeding 55.3% in 2024. This dominance is fueled by the rising demand for industrial automation, robotics, consumer electronics, electric vehicles (EVs), medical devices, and semiconductor manufacturing.

Some of the major players in the stepper system market include ABB, Beckhoff Automation, MinebeaMitsumi, Nidec Corporation, Nippon Pulse Motor Co. Ltd., Oriental Motor Co. Ltd., Parker Hannifin, Sanyo Denki Co. Ltd., and Schneider Electric SE.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)