Steel Tubes Market Size, Share, Trends and Forecast by Product Type, Material Type, End Use Industry, and Region, 2026-2034

Steel Tubes Market Size and Share Statistics:

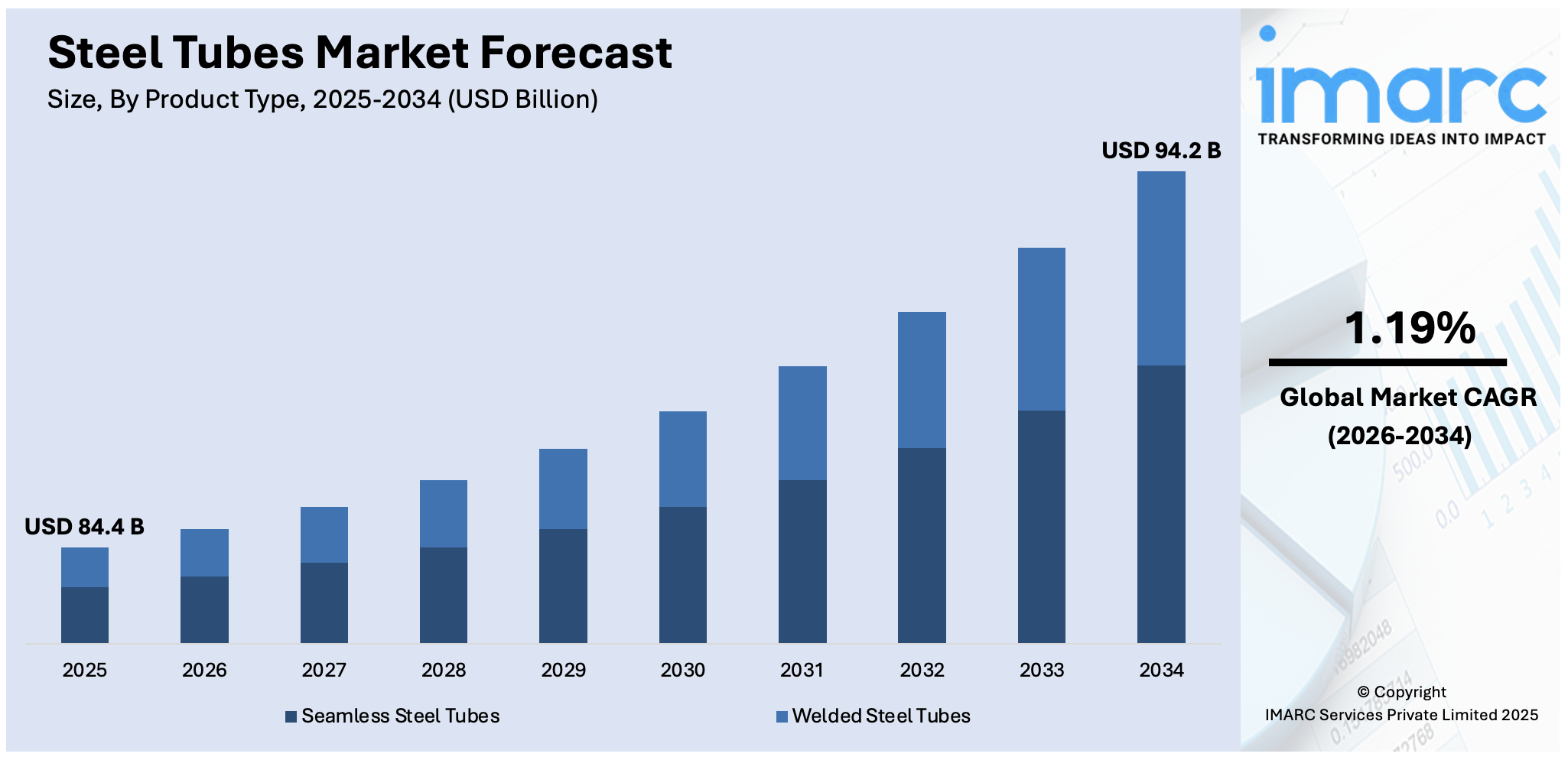

The global steel tubes market size was valued at USD 84.4 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 94.2 Billion by 2034, exhibiting a CAGR of 1.19% from 2026-2034. Asia Pacific currently dominates the market, holding a market share of over 75.6% in 2025. The steel tubes market share is experiencing steady growth driven by rapid urbanization and infrastructural development, particularly in emerging economies, the rising focus on sustainable practices and the use of recycled materials across the globe, and continuous technological advancements in manufacturing processes.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 84.4 Billion |

|

Market Forecast in 2034

|

USD 94.2 Billion |

| Market Growth Rate (2026-2034) | 1.19% |

The growth of the oil and gas sector plays a crucial role in driving the global steel tubes market demand. Steel tubes are integral to this sector, serving in applications such as drilling operations, transportation of oil and gas, and construction of infrastructure. Global oil demand is expected to increase by 1.1 million barrels per day (mb/d) in 2025, reaching a total of 103.9 mb/d, according to the International Energy Agency (IEA). This anticipated rise underscores the need for extensive exploration and production activities, which, in turn, drive the demand for steel tubes. Furthermore, the U.S. Energy Information Administration (EIA) reports that between 2024 and 2028, global refining capacity is expected to grow by 2.6 to 4.9 million barrels per day, predominantly in the Asia-Pacific and Middle East regions. This expansion necessitates substantial infrastructure development, including pipelines and refineries, where steel tubes are essential components.

To get more information on this market Request Sample

The steel tubes market growth in the United States is expanding fast, holding a 93.20% share. Infrastructure development remains a key contributor, with significant investments in transportation, energy, and construction projects boosting the demand for steel tubes. The U.S. government's emphasis on modernizing infrastructure under programs like the Bipartisan Infrastructure Law is further accelerating this trend. The energy industry, especially the oil and gas sector, serves as a key contributor to market growth, with steel tubes being vital for applications such as pipelines and drilling operations. According to the U.S. Energy Information Administration (EIA), domestic crude oil production reached an average of 12.8 million barrels per day in 2023, requiring extensive use of steel tubes for transportation and processing. Additionally, robust manufacturing and industrial activities support market growth. The Federal Reserve reported a 1.2% increase in industrial production in the third quarter of 2024, reflecting higher demand for steel tubes in automotive, machinery, and equipment manufacturing. Collectively, these factors shape the U.S. steel tubes market, fostering steady growth across multiple sectors.

Steel Tubes Market Trends:

Global Industrial Growth and Urbanization

The steel tubes market share is significantly driven by the rapid pace of industrial growth and urbanization worldwide. As per World Bank data, about 4.4 billion people, accounting for 56% of the global population, now live in urban areas. Steel tubes are becoming more and more in demand because to the growth of industries like construction, automotive, and oil and gas. This is because of their strength, durability, and versatility. Steel tubes are critical for manufacturing a variety of components in the automobile industry and for providing structural support and architectural uses in the building sector. Large-scale construction projects are currently under way in emerging economies, where the expansion in urbanization has also prompted a surge in infrastructure development. Steel tubes are needed in significant amounts for these projects' pipe systems, building frameworks, and other structural components. Particularly in the Middle East and Asia-Pacific nations, the market is being favorably impacted by the continuous urbanization trend.

Technological Advancements in Manufacturing

Technological developments in steel tube manufacturing are essential to the market's expansion. Innovations in production methods, like seamless tube processing and electric resistance welding, have improved the variety, quality, and efficiency of steel tube products. Manufacturers are now able to create tubes with more accuracy, a wider range of sizes, and better qualities like increased strength and resistance to corrosion thanks to these developments. This advancement is particularly relevant in industries that need high-specification goods, such as aerospace, high-pressure applications, and high temperature settings. Additionally, automation and digital technology integration in manufacturing processes are reducing production time and costs, which results in more competitive product availability and price. The market is profiting from these technical advancements as producers keep spending money on R&D, guaranteeing the supply of high-quality, tailored products for a range of applications. Unlike conventional welding techniques, which typically create steel tubes at a rate of 40 meters per minute, High-Frequency Induction Welding (HFIW) technologies may manufacture steel tubes at up to 120 meters per minute. Today, HFIW technology is used in the production of more than 70% of welded steel tubes worldwide.

Environmental Regulations and Sustainability Initiatives

Environmental concerns and the implementation of stringent regulations regarding emissions and energy consumption have become major factors influencing the steel tubes market. According to figures from industry participant ABB, steel production is responsible for 7% to 9% of worldwide CO₂ emissions, with steel tubes representing a substantial product sector. Initiatives for sustainability are therefore necessary. The steel industry is under increasing pressure to reduce its carbon footprint and improve sustainability in manufacturing processes. This scenario is prompting steel tube manufacturers to adopt eco-friendly practices, such as utilizing recycled materials and enhancing energy efficiency in production. In addition, there is a growing demand for lightweight and high-strength steel tubes in various industries to improve energy efficiency and reduce environmental impact. For instance, in the automotive sector, lightweight steel tubes contribute to lower vehicle weight, thereby enhancing fuel efficiency and reducing emissions. These environmental and sustainability initiatives comply with regulatory standards and resonate with the evolving preferences of consumers and industries toward more sustainable products. This shift is influencing market dynamics, driving innovation, and the adoption of green practices in the steel tube industry.

Steel Tubes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global steel tubes market, along with forecast at the global, regional, and country levels from 2026-2034. The market has been categorized based on product type, material type, and end use industry.

Analysis by Product Type:

- Seamless Steel Tubes

- Welded Steel Tubes

Welded steel tubes lead the market with around 70.5% of market share in 2025. Welded steel tubes are crucial because they offer cost-effectiveness and versatility. This category contains tubes made through welding the edges of steel strips or coils; most are welded using ERW and SAW techniques. Tubes have common applications in less pressure-related usage, including structures such as building constructions, in non-critical auto parts, and general engineering usage. The improvement in the welding technology itself also increases the quality and reliability of welded tubes, making them more applicable. Flexibility in terms of size and shape, plus the improvements in manufacturing processes, are at the base of steady demand for welded steel tubes in various industrial and commercial applications.

Analysis by Material Type:

- Carbon Steel

- Stainless Steel

- Alloy Steel

- Others

The market leader is carbon steel, accounting for approximately 39.3% of the market share in 2025. As the largest segment in the steel tubes market, carbon steel tubes are predominantly favored due to their versatility and cost-effectiveness. Carbon steel-an alloy of iron and carbon-was well-balanced between strength, malleability, and weldability. This segment caters to industries like construction, which uses steel tubes for structural purposes, and the manufacturing of machinery, where strength and durability are essential. Carbon steel tubes are also used abundantly in the automotive industry for most of its parts. The carbon steel tube enjoys a relatively higher market share primarily because of the lower cost involved compared to other materials.

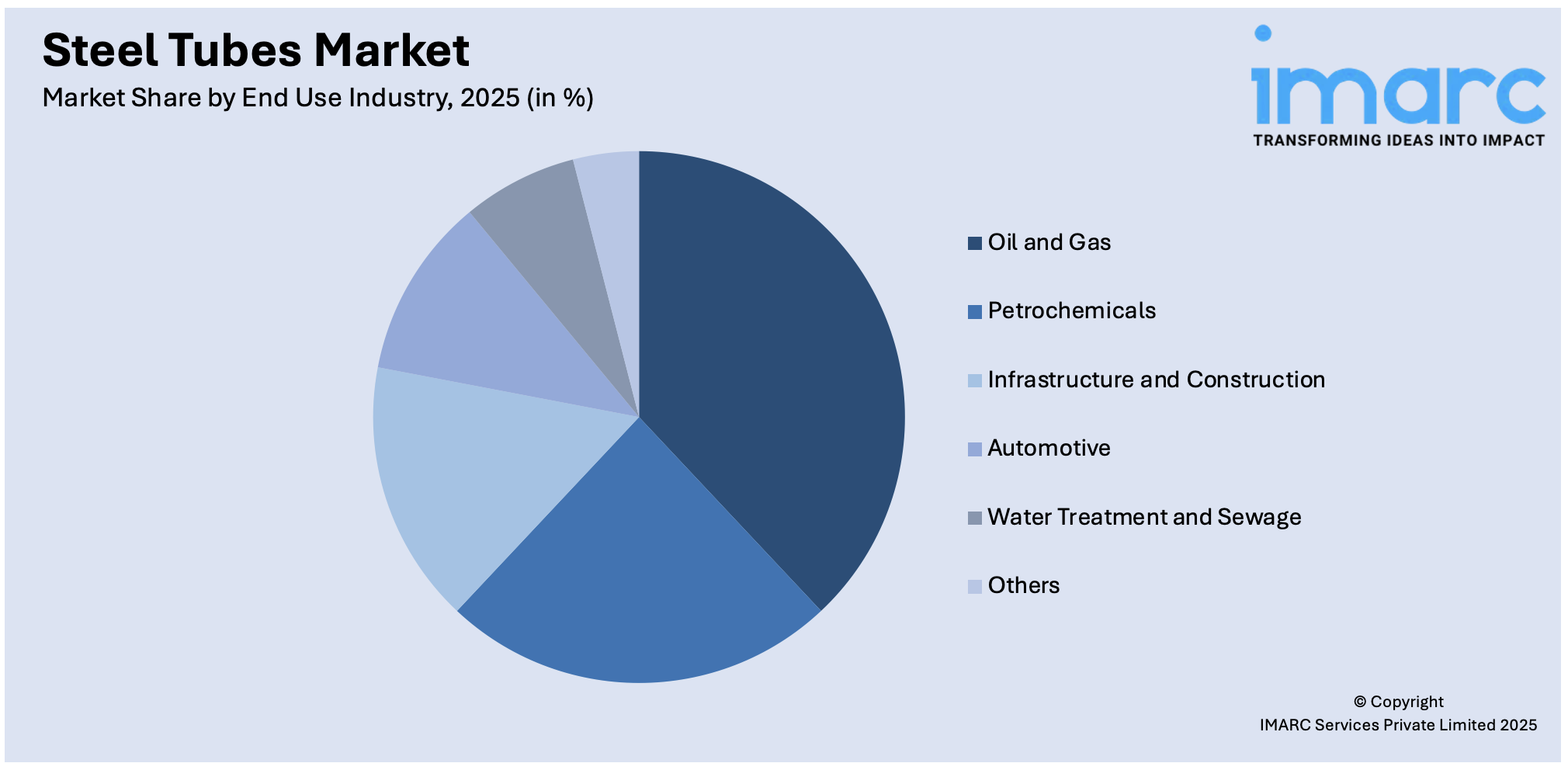

Analysis by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Oil and Gas

- Petrochemicals

- Infrastructure and Construction

- Automotive

- Water Treatment and Sewage

- Others

As per the latest steel tubes market outlook, oil and gas is expected to lead in market with 46.5% share as projected in 2025. The sector with oil and gas as the largest segment in the steel tubes market takes full advantage of using them in various exploration, drilling, and transportation procedures. Steel tubes, especially in this sector, are being used to construct pipelines, drilling rigs, and other infrastructure needed in oil and natural gas extraction and transportation. Thus these tubes help in the construction of well engineered infrastructures that can withstand environmental stressors like corrosion, high pressure, and temperature problems, which are prevalent in oil and gas extraction and processing. Above all, seamless steel tubes have been in high demand in this segment due to their important role in high-stress applications, such as drilling operations, redirection, and conveyance of fluids under high pressure.

Regional Analysis:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

As per the latest steel tube market forecast, the Asia Pacific region is the largest segment in the market, accounting for a market share of 75.6%. This is mainly due to rapid industrialization and urbanization in major economies such as China, India, and Japan. This region's growth is further supported by the expansive development in sectors such as construction, automotive, and oil and gas. The market is highly driven by infrastructure development due to the growing importance of manufacturing and industrial expansion. Governments in the region invest highly in infrastructure projects, including transportation networks, urban development, and energy projects, which further fuels the demand for steel tubes.

Key Regional Takeaways:

North America Steel Tubes Market Analysis

Factors related to the steel tubes' growth in North America include infrastructure development, energy sector expansion, and stress on sustainable manufacturing within the region. More than $1.2 trillion was provided in the most prominent areas that require considerable rebuilding and modernization, including the bridges, highways, and even water systems, revealed by the Infrastructure Investment and Jobs Act of 2021. Strength, durability, and versatility are integral parts of the steel tubes required for such projects. High activity of oil and gas exploration has still been experienced in North America under this sector. However, new requirements under renewable energy applications, such as in wind and solar power installations, have increased the need for steel tubes in equipment manufacturing and structural support. In addition, the recycling and technological improvements in the steel tube manufacturing industry help in making steel with the higher sustainability considerations across North America.

United States Steel Tubes Market Analysis

The US steel tubes market is driven by strong expansion in the energy, automotive, and construction industries. In addition, a large percentage of the nation's steel usage comes from the building sector, which is a significant contributor. The U.S. government has committed USD 1.2 Trillion under the Infrastructure Investment and Jobs Act to update infrastructure, driving demand for steel tubes in residential and non-residential building projects. Structural tubing has its primary importance in oil and gas exploration within the energy sector, due to the generation of more than 12.9 million barrels of crude oil daily in 2023 as reported. Solar and wind energy projects also add fuel to this requirement for the increased use of renewable energy.

The automotive industry also uses steel tubes to manufacture more than 9 million cars per year. They use the same in structural elements and exhaust systems. The increased popularity of steel tubes across industries can be attributed to improved durability and efficiency due to advanced manufacturing techniques like high-strength steel.

Europe Steel Tubes Market Analysis

The robust demand in the energy, building, and automotive sectors supports the steel tubes market in Europe. By 2023, more than half of new power installations will be renewable due to the region's emphasis on lowering carbon emissions, which has encouraged investment in renewable energy projects. Steel tubes are essential parts of the frameworks for solar panels and wind turbines. As per reports, about 18 million cars yearly are produced from the automotive industry, which is in need of steel tubes to be used as drivetrain parts, exhaust systems, and even safety structures. Because of modernization in the infrastructure through the help of the European Union's € 723.8 billion (USD 742.24 Billion) Recovery and Resilience Facility, steel tubes now find more use in pipelines and construction. Demand is also being spurred by advancements in light steel technology, which are facilitating the transition of the region to energy-efficient automobiles and clean building methods.

Asia Pacific Steel Tubes Market Analysis

The Asia-Pacific region is leading the steel tube market, and it is followed by China, India, and Japan. This trend can be attributed to the growing pace of urbanization and industrialization in the area. Given the production of over half of the world's steel in China, the domestic demand for steel tubes has also been significantly high, especially for energy and automotive applications as well as for construction work. According to an industry reports, steel tubes are extensively used on India's bridges, highways, and pipelines with over 9,000 active infrastructure projects. With over 50 million vehicles produced yearly, the growing automotive industry in the region is increasing demand for steel tubes for structural and safety purposes. The oil and gas sector, in particular, is still investing in pipeline networks, and steel tubes are being used more often as a result of projects like China's West-East Gas Pipeline. The growth of renewable energy projects like India's solar energy projects and Japan's offshore wind farms contributes majorly to the market.

Latin America Steel Tubes Market Analysis

Expansion of the energy, automotive, and construction industries is driving the Latin American steel tubes market. The two major producers in this region are Brazil and Mexico, and Brazil alone produces more than 30 million tonnes of steel a year, as per reports. Steel tubes are also in high demand for a wide range of applications in pipelines and construction projects. For instance, infrastructure development includes the Mayan Train in Mexico and the road extensions in Brazil. Yet another significant factor contributing to this requirement is the oil and gas sector in the region; according to reports, Brazil alone produces over 3.5 million barrels of oil every day, implying that drilling and transportation activities necessitate the use of steel tubes. The other large application area for steel tubes is in the automobile industry. In Mexico alone, 4 million cars are manufactured every year. They use them for structural parts and exhausts.

Middle East and Africa Steel Tubes Market Analysis

The main drivers for the steel tubes market in the Middle East and Africa are infrastructure development and the oil and gas sector. According to an industry report, the Middle East produces around 27% of the world's crude oil, and steel tubes are widely applied there in the manufacture of drilling equipment and pipelines. The demand for steel tubes in the construction industry has been boosted due to projects like Saudi Arabia's Neom City and the improvement of infrastructure in the UAE in preparation for Expo 2020. Africa's rising urbanisation and industrialization have led to an increase in the use of steel tubes for housing developments, transportation infrastructure, and water pipelines. According to UN-habitat data, over 60% of the population of the continent is projected to live in cities by 2050. Initiatives for renewable energy, like Morocco's Noor Solar Project, also support market expansion.

Competitive Landscape:

According to the recent steel tubes market trends, key players are actively engaging in various strategic initiatives to maintain and enhance their market positions. This includes investments in research and development to innovate and improve the quality and range of their products, especially focused on developing high-strength, lightweight, and corrosion-resistant steel tubes. Some are also strengthening their manufacturing capabilities and global presence by strategic mergers, acquisitions, and partnerships in order to capture new markets and diversify products. There is a significant focus on sustainability and eco-friendly manufacturing processes, which is in line with global trends and regulatory requirements. These players are not only focused on operational efficiency but also on meeting the changing demands of industries such as automotive, construction, and energy, which are the major consumers of steel tubes.

The report provides a comprehensive analysis of the competitive landscape in the steel tubes market with detailed profiles of all major companies, including:

- ArcelorMittal

- Jindal Steel & Power Ltd.

- Nippon Steel Corporation

- Rama Steel Tubes Limited

- Steel Authority of India Limited (SAIL)

- Tata Steel

Latest News and Developments:

- December 2024: Sambhv Steel has introduced a new line of stainless steel coils designed to meet diverse industrial requirements. These coils offer exceptional durability, resistance to corrosion, and improved performance across multiple applications. Their introduction reflects the company's commitment to providing high-quality, sustainable steel solutions designed to meet the evolving demands of modern industries.

- July 2024: Rama Steel Tubes plans to increase the size of its Anantapur, Andhra Pradesh, manufacturing facility. The corporation is taking this calculated step as part of its efforts to increase its manufacturing capacity and satisfy the rising demand from the market. By creating jobs, the expansion seeks to boost local economic growth and increase its market presence.

Steel Tubes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Seamless Steel Tubes, Welded Steel Tubes |

| Material Types Covered | Carbon Steel, Stainless Steel, Alloy Steel, Others |

| End Use Industries Covered | Oil and Gas, Petrochemicals, Infrastructure and Construction, Automotive, Water Treatment and Sewage, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | ArcelorMittal, Jindal Steel & Power Ltd., Nippon Steel Corporation, Rama Steel Tubes Limited, Steel Authority of India Limited (SAIL), Tata Steel, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the steel tubes market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global steel tubes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the steel tubes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The steel tubes market was valued at USD 84.4 Billion in 2025.

IMARC estimates the steel tubes market to exhibit a CAGR of 1.19% during 2026-2034, reaching USD 94.2 Billion by 2034.

The market is experiencing steady growth driven by rapid urbanization and infrastructural development, particularly in emerging economies, the rising focus on sustainable practices and the use of recycled materials across the globe, and continuous technological advancements in manufacturing processes.

Asia Pacific currently dominates the market due to rapid industrialization and urbanization, along with infrastructure advancements, fueled by the increasing emphasis on manufacturing and industrial growth.

Some of the major players in the steel tubes market include ArcelorMittal, Jindal Steel & Power Ltd., Nippon Steel Corporation, Rama Steel Tubes Limited, Steel Authority of India Limited (SAIL), Tata Steel, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)