Steel Market Size, Share, Trends and Forecast by Type, Product, Application, and Region, 2026-2034

Steel Market Size and Share:

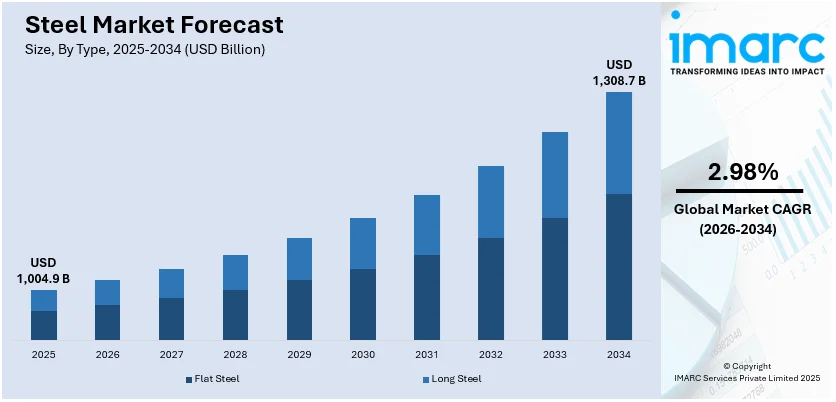

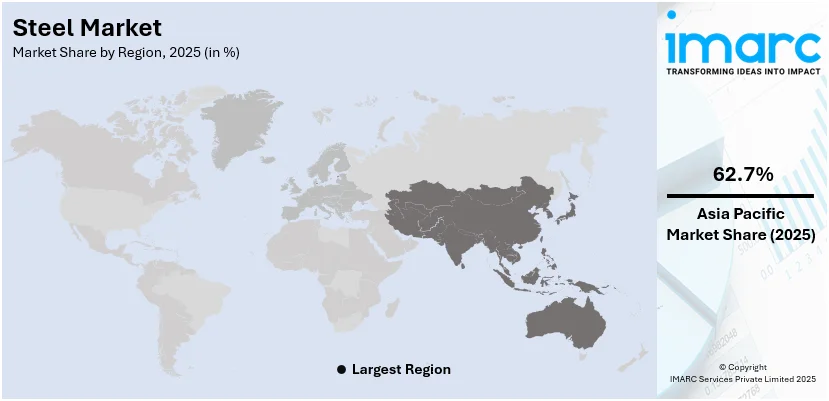

The global steel market size was valued at USD 1,004.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 1,308.7 Billion by 2034, exhibiting a CAGR of 2.98% during 2026-2034. Asia Pacific currently dominates the market, holding a significant market share of over 62.7% in 2025. The increasing product use in military and aerospace applications, the rising demand in electrical appliances, rapid product utilization in shipbuilding, and the rising product uptake in the manufacturing of numerous consumer goods are some of the factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,004.9 Billion |

| Market Forecast in 2034 | USD 1,308.7 Billion |

| Market Growth Rate (2026-2034) | 2.98% |

The global market is primarily driven by the rising adoption of advanced packaging solutions in food and beverage storage, with high durability and recyclability, is positively influencing the global steel industry outlook. The adoption of advanced packaging solutions in food and beverage storage, with high durability and recyclability, fuels the global market for steel. Furthermore, the steel industry is now increasingly adopting green practices to reduce the environment impact and achieve the international targets of emission. For instance, On 29th October 2024, India's JSW Group and South Korea's POSCO have signed a memorandum of understanding to build an integrated steel plant in India with a 5 million tonnes annual capacity. The project aims to use green technologies, aligning with the companies' focus on sustainability and strengthening India's steel industry.

To get more information on this market Request Sample

The United States is a key regional market and is broadening due to expanding construction and real estate sectors, such as infrastructure modernization and residential development projects. Significant investments in public infrastructure in the country, including highways, bridges, and airports, are driving demand for high-quality structural steel. Manufacturing activity, especially in machinery and equipment production, is also reviving and further fueling market growth. The rise in advanced automotive manufacturing that focuses on issues of safety and fuel efficiency makes use of advanced high-strength steel, further contributing to the market growth. The need to harness renewable sources of energy such as solar and wind energy creates increasing demand for special steel in terms of infrastructure in energy. Policies on trade that promote local production and discourage imports increase the growth of domestic steel making. Innovations in recycling and circular economy practices improve the cost effectiveness and environmental performance, creating a stronger market outlook.

Steel Market Trends:

Significant Growth in the Automotive Industry Across the Globe

The growth in the automobile industry has positive prospects for this market. As the auto industry sees growth across the world, its allied sector, steel consumption, has an increased trend as steel is used in vehicles in the most core applications for structural integrity and safety besides achieving a lightweight structure that enhances efficiency and is economical. In pursuit of zero-emission targets, OEMs have outlined ambitious plans, as highlighted in their press releases. Collectively, they have committed over USD 500 Billion toward establishing EV production facilities by 2030. For instance, in November 2023, Hyundai announced an investment of more than USD 1.5 Billion to build a new EV factory in Ulsan, South Korea. Similarly, other major manufacturers such as Honda, Volkswagen, and Ford have also made substantial investments in new manufacturing facilities, reinforcing their commitment to accelerating the transition to electric mobility. Automakers increasingly turn to advanced high-strength and lightweight steel alloys to enhance fuel efficiency and reduce emissions in response to evolving environmental regulations and consumer preferences. This strategic shift has heightened demand for innovative steel solutions tailored to the automotive sector. Furthermore, Steel industry trends and analysis reveal that advancements in high-strength and lightweight steel are critical to supporting the automotive industry's shift towards electric vehicles, driven by environmental regulations and the global push for sustainable transportation solutions.

Rising Product Demand for Manufacturing Military Aircraft

The escalating demand for steel in manufacturing military aircraft is another key driver for the market. Military aircraft require materials with exceptional strength, durability, and resistance to extreme conditions. Steel, with its high tensile strength and reliability, is a preferred choice for various components within these aircraft. The war between Russia and Ukraine has ignited further defense budgets around the world and the call for restatement of readiness levels around the world. The industry report also indicates that world military spending increased 3.7% in 2022. The five major spenders of 2022 are the United States, China, Russia, India, and Saudi Arabia. They were the ones to contribute a massive 63% to global military spending. As defense budgets in many countries continue to fund the modernization and expansion of military fleets, the demand for advanced military aircraft is increasing. Such aircraft include fighter jets, transport planes, and helicopters that are all manufactured from steel, including the airframes, landing gear, engine parts, and other critical structural elements. Furthermore, steel industry trends are significantly influenced by the increasing global military expenditure and the subsequent rise in demand for high-performance steel in military aircraft manufacturing.

Rapid Technological Advancements

Rapid technological advancements are a key driver of growth in various industries and markets, including healthcare, electronics, and transportation. These advancements encompass a wide range of innovations, from artificial intelligence and automation breakthroughs to the development of state-of-the-art materials as well as manufacturing processes. Telemedicine, wearable health devices, and precision medicine are transforming the way patients are cared for and treated. Similarly, in electronics, advancements in semiconductor technology are leading to smaller, more powerful devices and enabling the implementation and utilization of the Internet of Things (IoT). Electric and autonomous vehicles represent significant technological leaps in transportation, promising to revolutionize how we commute and reduce transportation's environmental impact. In the past year, 14% of all new cars sold were electric, a percentage that was reported by the International Energy Agency in 2022. However, three markets dominated its sales, and China came on top with around 60% of global sales in electric cars. And already now more than half of the world's electric cars are placed on roads in China while its target for new energy vehicles is met and exceeded in the same year, 2025. In Europe, the second largest market, electric vehicle sales experienced over a 15% increase in 2022, accounting for more than 20% of total car sales that year. Electric car sales in the United States, the third-largest market, rose by 55% in 2022, reaching a sales share of 8%. Moreover, rapid advancements in renewable energy technologies drive the shift towards a more sustainable and environmentally friendly energy landscape. The steel industry forecast suggests that rapid technological advancements across various industries will continue to drive demand for steel as a crucial component in manufacturing processes, infrastructure development, and the production of advanced machinery and equipment.

Steel Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global steel market report, along with forecasts at the global, regional and country levels for 2026-2034. Our report has categorized the market based on type, product, and application.

Analysis by Type:

- Flat Steel

- Long Steel

Long steel leads the market with 49.0% of market share in 2025. Steel industry research highlights that long steel products dominate the market because of their essential function in construction and manufacturing, while a growing inclination for sustainable and high-strength materials is influencing future usage trends. Long steel items, such as rebars, wire rods, and structural sections, constitute a significant segment of the market, propelled by their widespread application in construction and infrastructure projects. Rebars are in great demand for reinforcing concrete in residential, commercial, and industrial constructions to ensure a sturdy structure. Wire rods are utilized in most manufacturing and automotive applications because of their adaptability. The increasing use of prefabricated building techniques is further driving the need for structural components, like beams and channels. Furthermore, the demand for strong and recyclable steel materials has risen, driven by the expansion of sustainable construction practices.

Analysis by Product:

- Structural Steel

- Prestressing Steel

- Bright Steel

- Welding Wire and Rod

- Iron Steel Wire

- Ropes

- Braids

Structural steel leads the market with 45.5% of market share in 2025. Structural steel is commonly utilized for its durability, versatility, and affordability in building and infrastructure initiatives. It serves an essential function in skyscrapers, bridges, factories, and transport networks. It is essential for secure and long-lasting structures because of its ability to withstand severe conditions like seismic events and substantial weight. Additionally, the rising interest in urban development and modernization of public infrastructure is driving the global demand for structural steel. Improvements in prefabrication and modular building methods make them more appropriate for rapid construction projects. The recyclability of structural steel is in harmony with sustainability objectives, promoting its wider use. Elevated funding in renewable energy structures, such as solar farms and wind turbines, helps maintain ongoing demand for this market segment, guaranteeing a consistent future across different sectors. The steel industry trends and analysis indicate that structural steel continues to lead the market, driven by its essential role in supporting diverse construction and infrastructure developments, its adaptability to modern construction technologies, and its alignment with sustainability efforts.

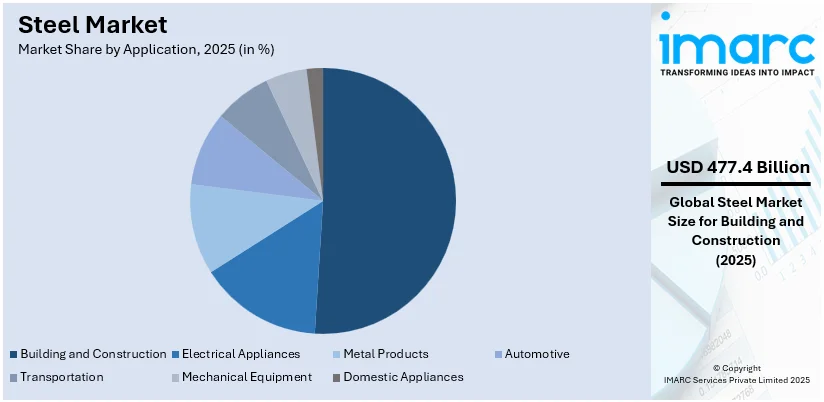

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Electrical Appliances

- Metal Products

- Automotive

- Transportation

- Mechanical Equipment

- Domestic Appliances

Building and construction leads the market with 49.0% of market share in 2025. The building and construction sector is a primary driver of steel demand. Steel is indispensable in this industry for structural purposes, including beams, columns, and reinforcing bars, ensuring the strength and integrity of buildings and infrastructure. As urbanization, population growth, and infrastructure development continue worldwide, the demand for steel in this sector remains robust. Furthermore, its presence in electrical appliances is vital for manufacturing durable and efficient products. It produces various appliances, including refrigerators, washing machines, ovens, etc. Stainless steel, in particular, is favored for its corrosion resistance, making it an ideal choice for devices exposed to moisture. The continuous demand for household appliances, driven by consumer lifestyles and technological advancements, ensures a steady need for steel components, offering a favorable steel industry outlook.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2025, Asia Pacific accounted for the largest market share of over 62.7%. Asia Pacific’s commitment to infrastructure development, including highways, bridges, and commercial real estate projects, fuels the product demand. Investments in infrastructure stimulate the growth of the construction steel segment. The automotive industry is a major consumer, requiring the metal for vehicle production. The region's robust automotive sector contributes to the market expansion. The region's diverse industrial manufacturing sector relies on steel for machinery, equipment, and structural components. The need for the metal in manufacturing industries, such as aerospace and machinery production, sustains market growth. Furthermore, the region's expanding consumer goods industry requires the metal for various products, from kitchen appliances to furniture and electronics. The growth of renewable energy projects, such as wind turbines and solar panel installations, further propels the product demand. The steel market overview in Asia Pacific reveals a robust growth trajectory, underpinned by diverse drivers such as extensive infrastructure projects, thriving automotive and manufacturing sectors, burgeoning consumer goods demand, and a growing emphasis on renewable energy installations, collectively supporting the region’s dominance.

Key Regional Takeaways:

United States Steel Market Analysis

In 2025, the United States accounted for the largest market share in North America with over 89.50%. The United States construction sector serves as a significant driving factor for steel demand, underpinned by robust growth in manufacturing construction and supported by federal programs and reshoring efforts. Despite challenges such as evolving supply chain dynamics and higher costs driven by elevated interest rates, the sector continues to exhibit resilience.

Industry reports indicate that construction spending in April 2024 experienced a year-on-year increase of 10.9%, driven primarily by manufacturing construction, which grew by 17.3%. Highway/street construction followed with a growth rate of 16.4%, and educational construction rose by 16.2%. However, sectors such as lodging and commercial construction showed weaker performance. This growth surge is largely attributed to the introduction of federal programs like the CHIPS Act and the Inflation Reduction Act (IRA) in August 2022.

The CHIPS Act incentivizes investments in semiconductor research and manufacturing within the US, while the IRA offers substantial support for clean energy initiatives, including solar, wind, and other renewable energy projects over the next decade. These programs have propelled monthly manufacturing construction spending to over USD 200 Billion, more than doubling since their introduction. Manufacturing construction has now emerged as the largest category of non-residential construction in the US, showcasing its pivotal role in sustaining momentum in the steel market and driving long-term demand.

Europe Steel Market Analysis

A strong industrial foundation is vital for economic growth, job stability, and global competitiveness in Europe. The steel sector plays a pivotal role in this context, contributing 1.3% to the EU's GDP, as per industrial report. It directly employs 328,000 individuals and supports over two million indirect jobs through the supply chain and related activities, making it a key driver of employment and economic development.

The European steel industry is known for its modern, energy-efficient, and CO2-efficient plants that produce high-value, specialized products for global markets. This success is underpinned by a robust research and development network, fostering continuous innovation and technological progress. As a cornerstone of Europe's economy, the steel sector is crucial to industries such as automotive and machinery, along with other essential sectors. Its ongoing advancement and innovation are vital to maintaining Europe’s industrial leadership on the global stage.

Asia Pacific Steel Market Analysis

The Asia-Pacific (APAC) region is a powerhouse of the global steel industry, and there are many companies contributing to growth and meeting ever-increasing demand for steel in construction, infrastructure, and manufacturing. India has become a dynamic center for industry, infrastructure development, and investment opportunities. Economic activities and high rates of urbanization are set to push demand for steel in India to 240 million and 260 million metric tons by 2035. According to reports, these estimates would mark a CAGR of approximately 6 percent from 2023.

The APAC governments have recently devised national steel policies with an aim of promoting the local steel industry while also cutting import reliance. In 2024, India launched the "National Steel Policy," which aims to increase domestic steel production to 300 million tons by 2030. This policy offers investment incentives for new steel plants, encourages innovation, and reduces tariffs on imported raw materials. Similarly, China's steel policy is focused on modernization and technology adoption. Its ambition is to reduce the emission in the steel industry by 30% by 2025. All of these policies are important drivers of growth in the region. APAC is emerging as a central player in global steel production.

Latin America Steel Market Analysis

Latin America is to experience high growth in the steel industry. This is due to the strategic investments and the proper government initiatives. The main sector for this is Brazil's steel, which has already seen an investment of Brazilian Real 100 billion (USD 16.5 Billion), for expanding production capacity and competitiveness for domestic products. This investment is preceded by a series of government measures such as tax incentives, regulatory reforms, and infrastructure improvements all meant to promote industrial growth and improve the economic landscape. These efforts are meant to reduce the cost of production and boost the global competitiveness of Brazilian steel.

The investment will be used in the modernization of existing structures, construction of new plants, and integration of state-of-the-art technologies to enhance production efficiency, product quality, and thereby make Brazil a global leader in the steel market. The substantial milestones expected in 2028 make this investment a strong growth driver for the Brazilian steel sector, thereby improving both domestic and international market reach.

In addition, the steel market trends in Mexico is also experiencing significant growth, driven by nearshoring and growing demand from the construction sector. Growth in the region is expected to be between 1.5% and 2%, with steel being one of the most in-demand materials for construction and other sectors. In a country count of 64 belonging to the World Steel Association (World steel), Mexico takes a proud 14th spot as the world's largest producer, providing the second biggest market of steel supplied in the United States, securing an all-time position. Adding on that to the current strategy Brazil invested in its place within the global industry map places Latin America as one of the prominent regions that shall characterize its future.

Middle East and Africa Steel Market Analysis

The Middle East and Africa (MEA) steel market is growing due to a combination of sustainable practices and strong government initiatives. A rising focus on carbon-emission reduction in the steel-making process is driving more interest in low-carbon or renewable fuels for steel products. As a result, the region's steel industry is becoming one of the leaders in the world's push toward greener manufacturing processes.

In Oman, the steel industry is the backbone of the country's manufacturing and infrastructure sectors. The 2022 industrial survey data shows that there are 1,681 direct workers in Oman's steel factories, besides thousands of indirect jobs, at a notable Omanization rate of 45%. This shows that the sector is important for the national economy and provides sustainable employment.

Meanwhile, the ambitious development agenda undertaken by the UAE, which includes its "Projects of the 50" initiative, provides further impetus to growth in the region's steel market. While this initiative targets specific projects in industrial, transportation, and energy infrastructure that will eventually attract almost USD 150 Billion worth of foreign direct investment by 2030, the encouraged growth in the UAE's construction sector will continue to drive demand for steel products. These factors altogether make the Middle East and Africa steel market a dynamic growth driver. The region has, in fact become a very significant player in the global steel industry with its thrust on sustainable and high-tech production.

Competitive Landscape:

Steel market overview highlights that top companies are driving the industry forward through strategic initiatives to meet the evolving demands of key sectors. Numerous industry giants prioritize research and development by investing in cutting-edge technologies to enhance steel production processes, improve product quality, and create innovative steel alloys that meet evolving industry demands. By collaborating with the automotive, construction, and manufacturing sectors, they develop customized steel solutions that align with specific needs, promoting wider steel adoption. Furthermore, top companies emphasize sustainability, incorporating eco-friendly practices into their operations, such as efficient recycling processes and reduced carbon emissions, to meet environmental regulations and address global concerns about climate change. Through global expansion, mergers, and acquisitions, they strengthen their market presence, ensuring a stable supply of steel products worldwide. Additionally, top steel firms shape industry standards and regulations, contributing to a well-regulated and expanding steel market.

The report provides a comprehensive analysis of the competitive landscape in the steel market with detailed profiles of all major companies, including:

- ArcelorMittal S.A.

- EVRAZ plc

- Gerdau S.A.

- Hyundai Steel Co. Ltd

- JFE Steel Corporation (JFE Holdings Inc.)

- Jiangsu Shagang Group Co. Ltd

- Nippon Steel Corporation

- Nucor Corporation

- Shougang Group Co. Ltd.

- Tata Steel Ltd. (Tata Group)

- thyssenkrupp AG

- United States Steel Corporation

Recent Developments:

- January 2025: The Indian government is set to initiate another phase of the Production-Linked Incentive (PLI) scheme for the steel industry, concentrating on specialty steel to enhance local production and decrease imports. The earlier PLI scheme drew investments totaling ₹27,106 crore and generated 14,760 jobs, but additional involvement is required.

- January 2025: The UK government established the Steel Council to advance its Steel Strategy, which focuses on revitalizing the steel industry through a £2.5 billion investment initiative. This effort highlights the industry's importance in national defense and economic stability.

- January 2025: AM/NS India introduced Optigal®, a high-quality color-coated steel brand, in Karnataka, highlighting its 25-year warranty and excellent corrosion resistance. The launch event in Bengaluru showcased the product's uses in roofing, cladding, and architectural endeavors, reflecting the growing need for sustainable materials.

- September 2024: The Ministry of Steel organized the "Greening Steel: Pathway to Sustainability" event in New Delhi, launching the report "Greening the Steel Sector in India: Roadmap and Action Plan." The report, derived from the findings of 14 task forces, details strategies such as renewable energy and green hydrogen aimed at decarbonizing India's steel sector. This event incorporated a panel discussion that mainly focused on leadership and innovation in facilitating the green steel transition.

- June 2024: SteelAsia has inaugurated its Compostela Works, the biggest steel mill in the Philippines, boasting an annual production capacity of 1 million tons. The facility will concentrate on manufacturing high strength rebar and welded rebar mesh.

- May 2024: Electra, a startup backed by Bill Gates and Amazon, announced its intentions for a green steel manufacturing facility in Colorado, U.S. This facility will produce clean metallic iron from high-purity ores utilizing renewable energy sources.

- May 2024: Tosyali Algeria, part of Turkey's Tosyal Holding, inaugurated a new flat-rolled steel facility in Algeria. The site employs Electric Arc Furnace (EAF) technology and boasts an annual production capacity of 2.2 million tons.

- July 2023: ArcelorMittal SA disclosed a USD 5 Million investment in CHAR Technologies.

- April 2022: JFE Steel Corporation and thyssenkrupp Steel Europe (tkSE), the largest steel producer in Germany, revealed the introduction of new high-strength steel sheets in the 980- and 1180MPa classes suitable for cold forming to manufacture automobile frame parts.

Steel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flat Steel, Long Steel |

| Products Covered | Structural Steel, Prestressing Steel, Bright Steel, Welding Wire and Rod, Iron Steel Wire, Ropes, Braids |

| Applications Covered | Building and Construction, Electrical Appliances, Metal Products, Automotive, Transportation, Mechanical Equipment, Domestic Appliances |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ArcelorMittal S.A., EVRAZ plc, Gerdau S.A., Hyundai Steel Co. Ltd, JFE Steel Corporation (JFE Holdings Inc.), Jiangsu Shagang Group Co. Ltd, Nippon Steel Corporation, Nucor Corporation, Shougang Group Co. Ltd., Tata Steel Ltd. (Tata Group), thyssenkrupp AG, United States Steel Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the steel market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global steel market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the steel industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Steel is an alloy primarily composed of iron and carbon, known for its strength, durability, and versatility. It is widely used in construction, automotive, manufacturing, and numerous other industries due to its adaptability and recyclability.

The steel market was valued at USD 1,004.9 Billion in 2025.

IMARC estimates the global steel market to exhibit a CAGR of 2.98% during 2026-2034.

Key drivers include rising demand in infrastructure development, automotive production, renewable energy projects, and consumer goods manufacturing. Increased adoption of sustainable practices and advancements in steel recycling also contribute significantly.

Long steel products, such as rebars and wire rods, lead the market in 2025.

Structural steel dominates the market, driven by its applications in construction and infrastructure.

The building and construction sector leads the market in 2025.

The key regions include Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa, with Asia Pacific holding the largest market share in 2025.

Major players include ArcelorMittal S.A., EVRAZ plc, Gerdau S.A., Hyundai Steel Co. Ltd, JFE Steel Corporation, Jiangsu Shagang Group Co. Ltd, Nippon Steel Corporation, Nucor Corporation, Shougang Group Co. Ltd., Tata Steel Ltd., thyssenkrupp AG, and United States Steel Corporation, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)