Steel Drums Market Size, Share, Trends and Forecast by Material, Type, Capacity, Industry Vertical, and Region, 2025-2033

Steel Drums Market Size and Share:

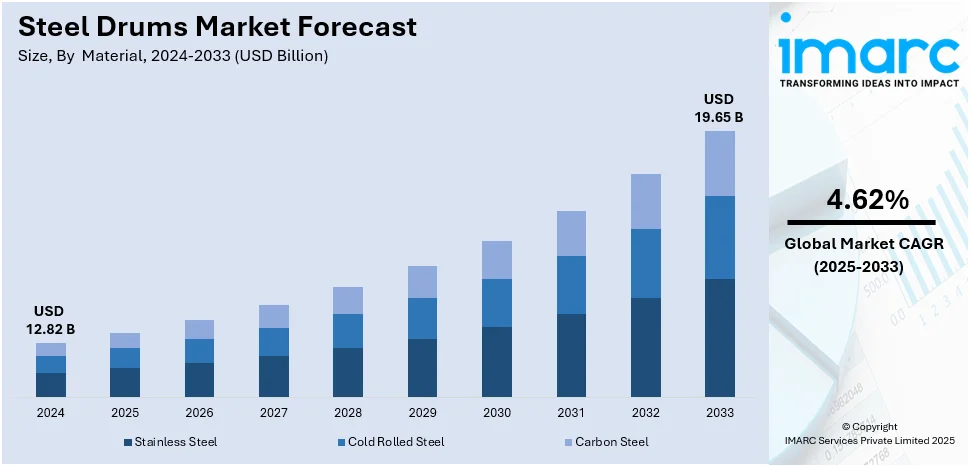

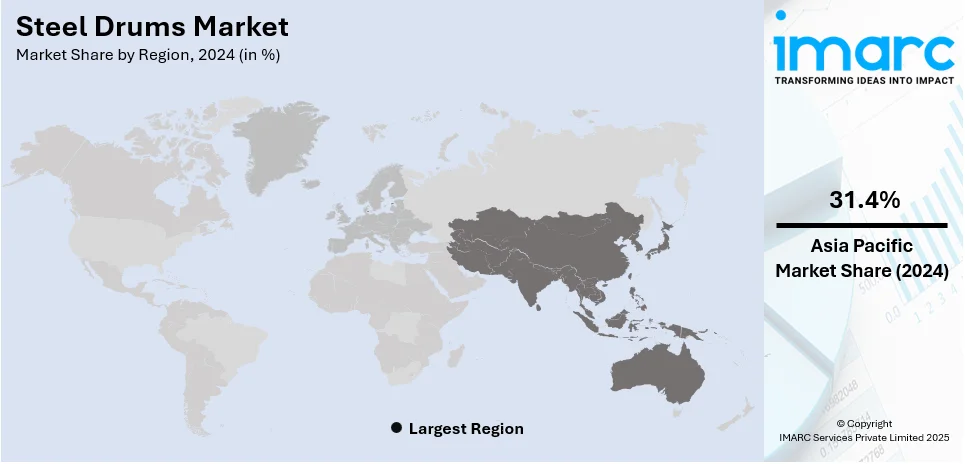

The global steel drums market size was valued at USD 12.82 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 19.65 Billion by 2033, exhibiting a CAGR of 4.62% during 2025-2033. Asia-Pacific currently dominates the market, holding a market share of over 31.4% in 2024. The rise in global trade, the increased demand for eco-friendly packaging solutions, and the growth of industries like chemical and oil and gas represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.82 Billion |

| Market Forecast in 2033 | USD 19.65 Billion |

| Market Growth Rate (2025-2033) | 4.62% |

The high operational efficiency of small steel drums in transporting liquid materials in bulk quantities represents one of the major factors driving the market growth. Besides this, with increasing global trade and rapid industrialization, there is an increasing demand for steel drums for industrial storage and transportation purposes, which is creating a propitious outlook for the market. According to United Nations Industrial Development Organization, industrialization, marked by a 2.3% global growth in industrial sectors and a 3.2% rise in manufacturing, drives demand for steel drums, benefiting waste management, utilities, and supply chain efficiencies amidst evolving global dynamics. Concurrent with this, the widespread product adoption across the flourishing oil and gas, food and beverage (F&B), construction, and chemical industry industries for storage and transportation purposes is acting as another significant growth-inducing factor.

United States is a major market disruptor with a share of 87.60% in North America. The chemical and petroleum sectors are major consumers of steel drums in the country due to their need for secure and durable packaging for hazardous materials. It is said that US chemical output volumes will grow 2.2% by the end of the year 2024. Its output is expected to rise 1.9% by the year 2025. As these industries expand to meet global energy and manufacturing demands, the requirement for steel drums correspondingly increases. The rise in international trade has additionally impacted the need for dependable bulk packaging. This is in line with the increased exports of U.S. chemicals that are anticipated to rise 3.1% in the 2024. Steel drums are integral to global supply chains, facilitating the safe transport of goods across long distances and diverse conditions.

Steel Drums Market Trends:

Emphasis on Sustainability

The largescale demand for sustainable packaging solutions due to escalating consumer concerns regarding the environment and climate change is impelling the adoption of steel drums as they are reusable and recyclable. The 2023 Buying Green Report projects that 82% of respondents are now willing to pay more for sustainable packaging which is up by 8% since 2021. Unlike plastic alternatives, steel drums are said to be 100% recyclable, and their robust structure allows them to be reused multiple times. Companies are increasingly adopting circular economy practices, where steel drums are cleaned, refurbished, and brought back into the supply chain instead of being discarded. This not only reduces waste but also helps businesses cut costs.

Global Growth in Industrialization

The demand for steel drums is closely linked to the pace of industrial development worldwide. As industries expand in sectors such as chemicals, petroleum, food, and pharmaceuticals, the need for durable and reliable storage solutions grows. For instance, India's chemicals market was valued at USD 220 billion in the year 2023 and is forecasted to grow to USD 383 billion by 2030. This growth is underpinned by a rate of 8.1 percent from 2021 to 2030. Steel drums offer unmatched strength and versatility, making them a favorable choice for transporting and storing liquids, powders, and hazardous materials. Rapid industrialization in emerging economies, particularly in Asia-Pacific and Africa, has also been a game changer for the steel drum market. These regions are seeing a boom in manufacturing and export activities, creating a ripple effect that boosts the demand for bulk packaging solutions like steel drums. Exports of organic and inorganic chemicals reached US$ 4.78 billion between April and May of 2024.

Boom in the Food and Beverage Industry

The food and beverage (F&B) industry is another major driver for steel drums, particularly when it comes to the transportation of bulk liquids like syrups, oils, and beverages. It has been found that world exports of packaged food and beverages to USA recorded a yearly rise of almost 1.7 billion euros. Steel drums ensure product safety by providing an airtight and hygienic storage environment, which is crucial for maintaining the quality of these food-grade materials. Additionally, the industry’s global expansion has heightened the demand for export-ready packaging solutions, and steel drums meet these needs with their high durability and compatibility with international shipping standards. As consumer preferences shift towards processed and packaged foods, the demand for bulk ingredients transported in steel drums is steadily climbing.

Steel Drums Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global steel drums market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on material, type, capacity, and industry vertical.

Analysis by Material:

- Stainless Steel

- Cold Rolled Steel

- Carbon Steel

Carbon steel stand as the largest component in 2024, holding around 81.0% of the market. In this market, carbon steel became the biggest segment because of its flexibility, durability, and affordability. Carbon steel drums are the first choice in various industries, such as chemicals, petroleum, and food processing, as they are strong and resistant to deformation under heavy loads. These drums are especially used for transporting hazardous and non-hazardous liquids, powders, and semi-solid materials. The carbon steel drums are highly safe and are in complete compliance with industrial standards. The market for carbon steel drums has gained tremendous momentum, and it is driven by recyclability and the reconditioning of these drums to be reused for longer periods. Its large usage in industrial packaging and its growing focus on cost-effective and environment-friendly packaging solutions is likely to further the leadership of this segment.

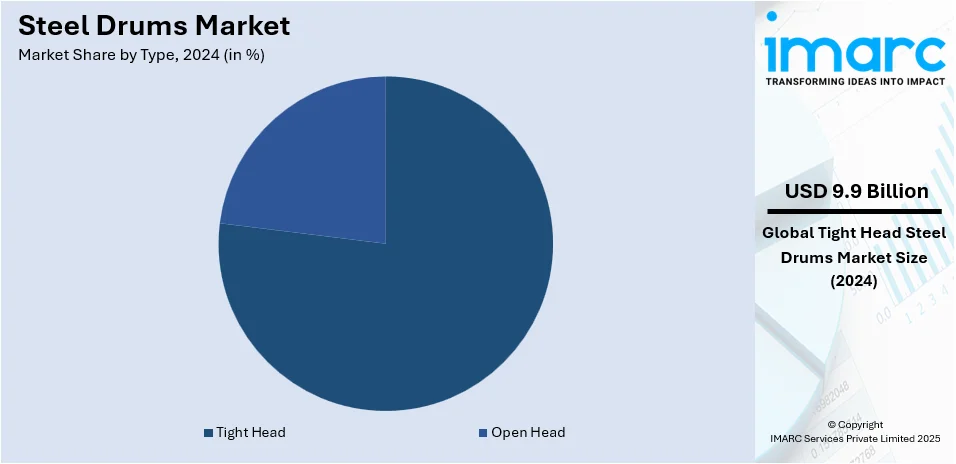

Analysis by Type:

- Tight Head

- Open Head

Tight head leads the market with around 76.8% of market share in 2024. The tight head steel drum segment holds the largest share in the market, driven by its superior sealing capabilities and versatility in storing and transporting liquids, including hazardous materials. Tight head drums, also known as closed head drums, are designed with a fixed lid, making them ideal for industries such as chemicals, petroleum, and food processing where leak-proof storage is crucial. These drums are widely favored for transporting volatile or sensitive liquids, as their secure design minimizes the risk of contamination or spillage. Their dominance in industrial applications requiring high safety standards is boosting their market expansion. With increasing global trade and stringent safety regulations, the demand for tight head drums is expected to continue rising, cementing their position as a leading segment in the steel drum market.

Analysis by Capacity:

- Up to 10 Gallons

- 10-30 Gallons

- 30-50 Gallons

- 50-80 Gallons

- 80 Gallons and Above

50-80 gallons capacity leads the market in 2024. This is because of its widespread application across industries such as chemicals, petroleum, and food processing. This capacity range is highly preferred due to its versatility and practicality, offering ample storage for bulk materials while remaining manageable for handling and transportation. Drums in this range are particularly suited for liquids, powders, and semi-solid materials, making them a standard choice for both domestic and international logistics. The increasing focus on efficient storage and cost-effective bulk transportation is further fueling the demand for drums in this capacity range, ensuring their dominance in the market.

Analysis by Industry Vertical:

- Food and Beverages

- Healthcare and Pharmaceuticals

- Oils and Lubricants

- Paints and Dyes

- Chemicals and Solvents

- Building and Construction

- Agriculture

- Others

Chemicals and solvents lead the market in 2024. This due to their critical requirement for packaging solutions that are secure, durable, and compliant. Steel drums are the preferred choice in this particular industry for the transportation and storage of both hazardous and non-hazardous chemicals, solvents, and intermediates owing to their robust, leak-proof constructions. These drums provide safety for volatile and sensitive substances during handling and transit. The increased global chemical industry growth and stringent regulations for transporting hazardous materials are the major factors driving steel drum adoption in this sector. The chemicals and solvents segment will continue to lead the market, because of the continued growth in industry and a greater focus on safe packaging.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 31.4%. The region dominates the market for steel drums as fast-paced industrialization, urbanization, and expansion of primary industries such as chemicals, petroleum, and food processing have led to high industrial output growth in countries such as India, China, and Southeast Asian nations. The region has further strengthened its leadership because of its cost-effective production capabilities and high consumption of bulk packaging solutions. Growing international trade along with stronger packaging safety regulations in these emerging markets are also going to have a positive effect on demand for steel drums in the Asia-Pacific region.

Key Regional Takeaways:

North America Steel Drums Market Analysis

The North American steel drum market holds an important share because of its well-established industrial base, and the region's stringent standards for safety and regulations on packaging and transportation. North America's industry share in the global market, driven by key industries such as chemicals, petroleum, and food processing. The United States and Canada are significant contributors and enjoy a strong focus on sustainability and advancements in manufacturing technologies that have increased adoption of recyclable and reusable steel drums. Growth in the region from e-commerce and international trade further fuels a need for reliable bulk packaging solutions. With continued investment in industrial development and a rising emphasis on eco-friendly practices, the North American market is expected to maintain balanced growth in the coming years.

United States Steel Drums Market Analysis

United States holds 87.60% of the market share in North America. The steel drum market in the United States is expanding due to the robust growth of the chemical and petrochemical industries, which rely heavily on durable and efficient storage solutions. The increasing demand for hazardous material transportation compliant with safety regulations is driving the adoption of steel drums in the country. The focus on sustainability has also led to higher utilization of reusable steel drums, which align with environmental mandates and corporate sustainability goals. Growth in the food and beverage industry, particularly for the transportation of edible oils and liquids, adds to the demand. For instance, in 2024 Food & Beverage Benchmarking Survey highlights a 16% average revenue growth in 2023, with 80% of respondents planning increased capital spending in 2024. This growth, driven by expanding production lines and automation, underscores rising demand for durable packaging solutions like steel drums, vital for supporting the thriving food and beverage sector. The flourishing pharmaceutical sector in the United States further propels steel drum usage, as these containers ensure product safety and maintain integrity during transport. The expansion of the lubricant and oil industries due to industrial growth is a significant factor boosting market demand. Furthermore, advancements in drum manufacturing technology, improving their longevity, and handling efficiency, have gained traction among end-users. With the rise of e-commerce logistics and distribution channels, the demand for secure packaging options, such as steel drums, continues to climb. Regulatory adherence to stringent packaging standards by the Department of Transportation and other agencies underscores their importance. Growing investments in infrastructure and industrial facilities further bolster the need for reliable bulk storage solutions.

Asia Pacific Steel Drums Market Analysis

In Asia-Pacific, the rising industrialization and urbanization are fueling the growth of the steel drum market, especially in emerging economies. Rapidly expanding manufacturing industries, including paints, coatings, and construction materials, drive the demand for efficient and durable storage solutions. The region’s robust growth in the chemical and fertilizer sectors necessitates reliable containers for safe transportation, further increasing steel drum consumption. Food-grade steel drums are increasingly popular due to rising demand for secure food and beverage transportation. The booming pharmaceutical sector, particularly in countries like India and China, has significantly bolstered the adoption of steel drums for transporting sensitive raw materials. According to the Indian Economic Survey 2021, India's pharmaceutical market is set to grow from USD 42 Billion in 2021 to USD 65 Billion by 2024 and USD 120-130 Billion by 2030, driving increased demand for steel drums as secure, durable packaging solutions for pharmaceutical products. Additionally, increasing trade activities across the region create a heightened need for robust packaging that ensures product safety during long-haul shipping. The emphasis on reducing plastic usage and promoting recyclable materials contributes to the adoption of steel drums, which are considered environmentally friendly. Furthermore, government initiatives supporting industrial growth and export activities are indirectly propelling steel drum demand. Growth in lubricant and oil production, driven by automotive and machinery markets, further amplifies the usage of steel drums. Enhanced supply chain networks and infrastructure development also create opportunities for their application in a variety of industries.

Europe Steel Drums Market Analysis

In Europe, the steel drum market is influenced by the region's stringent environmental and safety regulations, which prioritize the use of durable and recyclable packaging materials. The petrochemical and lubricant industries play a crucial role, as steel drums are highly sought after for their reliability in storing and transporting volatile and corrosive materials. Additionally, the growth of the agricultural chemicals market, particularly in countries such as Germany and France, drives demand for steel drums to store fertilizers, pesticides, and other agrochemical products. The increasing focus on renewable energy and biofuels also contributes to market growth, with steel drums being employed for storing bio-based liquids. According to European Environment Agency, renewable energy's rapid growth, now accounting for 24.1% of the EU's final energy use in 2023, supports sustainable practices across sectors, benefiting solutions like steel drums for efficient storage and transport in heating, cooling, and manufacturing systems. The region's emphasis on a circular economy promotes the use of reusable packaging options, making steel drums a preferred choice for manufacturers. Furthermore, the rise of cross-border trade within the European Union enhances the demand for secure packaging solutions, further boosting the adoption of steel drums in various industrial sectors.

Latin America Steel Drums Market Analysis

In Latin America, the burgeoning agriculture sector plays a pivotal role in driving steel drum adoption. Farmers and distributors favor steel drums for storing and transporting fertilizers, crop protectants, and other agricultural chemicals due to their robustness and reliability. For instance, the rising fertilizer demand in Brazil, projected to grow by 3.2% annually, driven by expanded agricultural production and higher application rates, enhances the prospects for steel drums as efficient and durable storage and transportation solutions. The growing beverage industry also boosts demand, as steel drums are used for bulk storage of juices and alcoholic beverages. Additionally, increasing investment in local manufacturing capacities has led to a rise in steel drum production, catering to the regional demand. The recyclability and reusability of steel drums further appeal to businesses aiming for cost-effective and environmentally responsible packaging solutions.

Middle East and Africa Steel Drums Market Analysis

Steel drum usage in the Middle East and Africa is largely driven by the thriving oil and gas industries, which require secure storage for crude oil, lubricants, and chemical derivatives. According to ITA, the UAE's robust oil and gas industry, producing 3.2 Million barrels daily and targeting 5 Million by 2030, is driving demand for steel drums, essential for safe storage and transport, supported by discoveries like 80 Trillion cubic feet of gas at Jebel Ali and ADNOC's expanding offshore exploration. The increasing demand for durable packaging in bulk liquid transportation is another contributing factor. In regions with extreme climatic conditions, steel drums provide reliable performance in terms of heat resistance and structural integrity. Furthermore, the growth of food exports, particularly liquid goods like cooking oils, has boosted adoption. The recyclability of steel drums aligns with the growing awareness of sustainable packaging solutions, appealing to both local and international stakeholders in the region.

Competitive Landscape:

To increase their market position, key market players are investing in strategic initiatives such as innovation, mergers and acquisitions, and sustainability. Companies are also investing in refined manufacturing technology to create steel drums that are lightweight and robust, with improved linings and sealing capabilities. Sustainability remains a top concern, with many companies developing eco-friendly solutions including totally recyclable barrels and refurbishment services to promote the circular economy. Furthermore, these corporations are increasing their worldwide presence by establishing production facilities in emerging areas such as Asia-Pacific and Latin America to meet rising demand. Partnerships with industries such as chemicals, petroleum, and food are also being reinforced to provide tailor-made solutions for specific requirements. Through digitalization, key players are improving logistics and supply chain efficiency, enabling faster delivery times and cost reductions. These strategies collectively enhance their competitive edge and meet the evolving needs of their customers.

The report provides a comprehensive analysis of the competitive landscape in the steel drums market with detailed profiles of all major companies, including:

- Balmer Lawrie & Co. Ltd

- Chicago Steel Container Corp.

- Clouds Drums Dubai LLC

- General Steel Drum LLC (Stavig Group)

- Great Western Containers Inc.

- Greif Inc.

- Izvar Packaging (İzvar Ambalaj)

- James G Carrick and Co Ltd.

- Mauser Group B.V.

- Obal Centrum s.r.o.

- Orlando Drum Co.

- Rahway Steel Drum Co Inc. (Novvia Group)

Latest News and Developments:

- December 2024: Schütz has introduced the Combi steel drum, combining a coated steel exterior with a high-quality HDPE plastic inner liner, offering enhanced corrosion resistance and product purity. Available in 205-liter (3 kg liner) and 202-liter (6 kg liner) versions, this design provides double leakage protection and allows immediate stacking after hot filling. Serial production commenced in autumn 2024 at Schütz's Selters plant, with options for customized branding and the use of their innovative Laser Drum exterior.

- May 2024, the Sasakawa Africa Association (SAA) proposed a partnership with the Nigerian Stored Products Research Institute (NSPRI) to reduce postharvest grain losses. The collaboration aims to utilize NSPRI's hermetic steel drums for improved grain storage, preserving quality and preventing losses due to pests and moisture. This initiative is expected to enhance food security and support agricultural sustainability in the region.

- May 2023, Novvia Group, a global distributor of rigid containers and life sciences packaging, announced the acquisition of Rahway Steel Drum Company, a New Jersey-based distributor of drums, pails, IBCs, and other rigid packaging solutions. Rahway, with over 70 years of experience, operates from Cranbury, New Jersey, and maintains its own fleet for just-in-time delivery. This acquisition expands Novvia's presence into the Northeast U.S. market.

- November 2023, Myers Container, General Steel Drum, North Coast Container, and Chicago Steel Container unified under the name North Coast Container. This rebranding reflects the company's expansion as a leading independent manufacturer of sustainable steel drums in North America. The consolidation aims to simplify customer interactions and highlight the company's nationwide footprint and commitment to quality. CEO Kyle Stavig emphasized the continuation of a family tradition in producing high-quality industrial steel drums.

- January 2023, SCHÜTZ Container Systems expanded its steel drum plant in Houston, Texas, to include the production of open-head steel drums. The facility, located in Pasadena, is SCHÜTZ's fifth steel drum plant worldwide and was the first new steel drum production facility in the U.S.. This expansion allows SCHÜTZ to offer a comprehensive range of new and reconditioned IBCs, PE, and steel drums to local customers, enhancing supply security and flexibility.

Steel Drums Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Stainless Steel, Cold Rolled Steel, Carbon Steel |

| Types Covered | Tight Head, Open Head |

| Capacities Covered | Up to 10 Gallons, 10-30 Gallons, 30-50 Gallons, 50-80 Gallons, 80 Gallons and Above |

| Industry Verticals Covered | Food and Beverages, Healthcare and Pharmaceuticals, Oils and Lubricants, Paints and Dyes, Chemicals and Solvents, Building and Construction, Agriculture, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Balmer Lawrie & Co. Ltd, Chicago Steel Container Corp., Clouds Drums Dubai LLC, General Steel Drum LLC (Stavig Group), Great Western Containers Inc., Greif Inc., Izvar Packaging (İzvar Ambalaj), James G Carrick and Co Ltd., Mauser Group B.V., Obal Centrum s.r.o., Orlando Drum Co., Rahway Steel Drum Co Inc. (Novvia Group), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the steel drums market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global steel drums market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the steel drums industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Steel drums are cylindrical containers made of durable steel, designed for the storage and transportation of liquids, powders, and semi-solid materials. They are known for their strength and resistance to leaks or damage, and are widely used in industries like chemicals, petroleum, food processing, and hazardous material handling.

The global steel drums market was valued at USD 12.82 Billion in 2024.

IMARC estimates the global Steel Drums market to exhibit a CAGR of 4.62% during 2025-2033.

The global steel drums market is driven by the increasing demand from industries such as chemicals, petroleum, and food processing, rapid industrialization, sustainability trends, and strict regulations for hazardous material handling. Their durability, recyclability, and ability to ensure safe transportation further boost the market growth worldwide.

According to the report, carbon steel represented the largest segment by material, as it is widely preferred due to its strength, durability, and cost-effectiveness.

Tight head leads the market by type as they offer superior leak-proof sealing, making them ideal for storing and transporting liquids, including hazardous materials.

According to the report, 50-80 gallons represented the largest segment by capacity, as it helps balancing bulk storage needs with ease of handling and transport.

Chemicals and solvents lead the market by industry vertical as this industry demands robust, secure packaging to handle hazardous and volatile materials safely.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global steel drums market include Balmer Lawrie & Co. Ltd, Chicago Steel Container Corp., Clouds Drums Dubai LLC, General Steel Drum LLC (Stavig Group), Great Western Containers Inc., Greif Inc., Izvar Packaging (Izvar Ambalaj), James G Carrick and Co Ltd., Mauser Group B.V., Obal Centrum s.r.o., Orlando Drum Co., Rahway Steel Drum Co Inc. (Novvia Group), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)