Stealth Coating Market Size, Share, Trends and Forecast by Resin Type, Application, and Region, 2025-2033

Stealth Coating Market Size and Share:

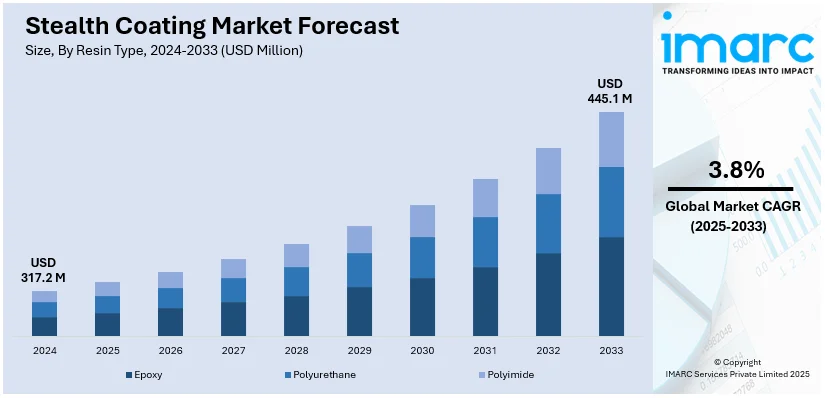

The global stealth coating market size was valued at USD 317.2 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 445.1 Million by 2033, exhibiting a CAGR of 3.8% from 2025-2033. North America currently dominates the market in 2024. The widespread adoption of drones globally, increasing defense spending fueling stealth technology, ongoing development of next-generation stealth aircrafts, and rising collaborative efforts among tech companies, are some of the important factors supporting the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 317.2 Million |

|

Market Forecast in 2033

|

USD 445.1 Million |

| Market Growth Rate (2025-2033) | 3.8% |

The increasing adoption of unmanned aerial vehicles (UAVs) and drones is significantly propelling the global stealth coating market. As UAVs become integral to military operations, the demand for stealth capabilities to enhance their survivability and effectiveness has surged. In 2024, the global drones market was valued at USD 30.7 billion and is projected to reach USD 74.8 billion in 2033, reflecting a growth of 10.41%. This rapid expansion underscores the escalating utilization of drones across various sectors, particularly in defense. Government investments further illustrate this trend. For instance, the Australian government plans to integrate its new fleet of Apache attack helicopters with armed drones, as part of a $4.3 billion to $5.3 billion investment in uncrewed systems over the next decade. The growing emphasis on drone technology necessitates advanced stealth coatings to reduce radar and infrared signatures, ensuring mission success and asset protection. Consequently, the stealth coating market is poised for substantial growth, driven by the expanding deployment of UAVs and drones in modern military strategies.

The growth of the stealth coating market in the United States is primarily driven by substantial investments in the defense and aerospace sectors. In fiscal year 2024, the Department of Defense (DoD) budget was signed into law at $841.4 billion, reflecting the nation's commitment to maintaining and advancing its military capabilities. This budget allocation underscores the emphasis on developing advanced technologies, including stealth capabilities, to ensure national security. The U.S. aerospace and defense industry also demonstrated significant economic impact, generating over $955 billion in sales in 2023—a 7.1% increase from the previous year. This growth highlights the industry's role as an economic powerhouse and its influence on the demand for advanced materials like stealth coatings.

Stealth Coating Market Trends:

Increased Defense Budgets Fueling Stealth Technology Investments

According to Stockholm International Peace Research Institute, global military spending reached unprecedented levels, with overall spending reaching USD 2,443 billion in 2023, a 6.8% increase on 2022 and the highest year-on-year growth since 2009, largely due to increased geopolitical tensions and conflicts, which are putting pressure on nations to arm themselves. The United States leads in defense spending with a budget of USD 939 billion in 2024 followed by China at USD 373 billion and Russia at USD 225 billion. This huge financial outlay allows for the creation and acquisition of sophisticated technologies in military hardware, which in this case includes stealth technologies. Increased funding makes way for more research, development, and use of stealth coatings that make military assets more survivable and effective in operations because they reduce detectability. Thus, with these increasing defense budgets and the emphasis on advanced stealth technologies, the stealth coating market is expected to experience huge growth.

Development of Next-Generation Stealth Aircraft

The pursuit of air superiority and strategic advantage has led nations to heavily invest in next-generation stealth aircraft. According to an industrial report, a prime example is the United States Air Force B-21 Raider, which is a dual-capable penetrating strike stealth bomber, carrying conventional and nuclear munitions. The B-21 program has proven to be cost-effective with a reduction in initial production cost from USD 4 billion to USD 2.7 billion. The program budget for the fiscal year 2025 also stands at USD 13.8 billion, which is nearly down by 28% than the previous ones. With these advancements comes the pressure to incorporate such cutting edge stealth technologies in modern military aircraft, thus driving the demand for specialized stealth coatings that reduce the radar cross-section and make the missions more effective in contested operations.

Collaborative Efforts Among Tech Companies to Secure Defense Contracts

The evolving landscape in defense has seen technology companies venture into strategic partnerships in their quest for securing defense contracts and participation in military innovation. According to industrial reports, firms like Palantir and Anduril are among the first to have collaborated with other tech groups to place a Pentagon contract. The partnerships develop complex defense solutions such as advanced stealth technologies and coatings, for instance, made possible through the collaboration by leveraging the expertise of those firms in data analytics, artificial intelligence, and autonomous systems. Combining forces and technological capabilities of such consortiums enhances their competitiveness regarding government contracts, thus significantly influencing the growth path that the stealth coating market undertakes. Such a process is a part of integrating commercial technological innovations into defense applications, which leads to continuous advancements in stealth capabilities as well as related markets.

Stealth Coating Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stealth coating market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on resin type and application.

Analysis by Resin Type:

- Epoxy

- Polyurethane

- polyimide

Epoxy resins dominate the stealth coating market due to their superior mechanical properties, chemical resistance, and excellent adhesion to various substrates. Their ability to be engineered for specific performance characteristics, such as radar absorption and thermal stability, makes them ideal for advanced stealth applications. Epoxy-based stealth coatings are widely used in aerospace and defense applications because they provide the durability needed to withstand extreme conditions, including high temperatures, corrosive environments, and mechanical stress. Moreover, epoxy coatings can be customized with radar-absorbing additives, enabling high levels of radar signature reduction.

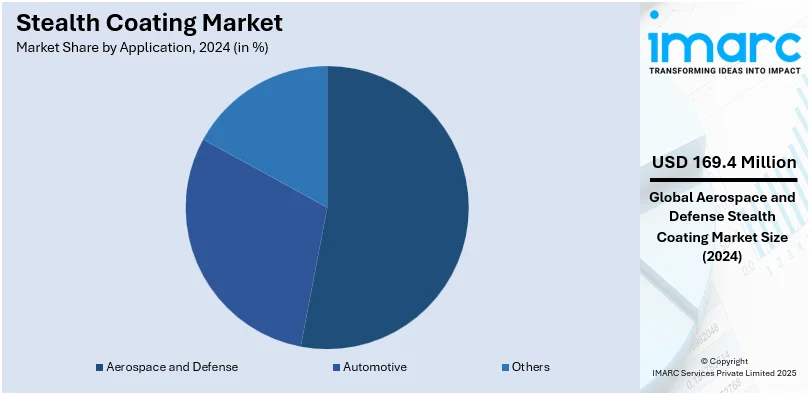

Analysis by Application:

- Aerospace and Defense

- Automotive

- Others

The aerospace and defense sector represents the largest share of the stealth coating market, driven by the increasing need for advanced technologies to enhance the survivability of military assets. Stealth coatings are critical in reducing the radar and infrared signatures of fighter jets, UAVs, naval vessels, and ground vehicles, enabling them to evade detection. Major investments in next-generation military programs, such as the F-35 Lightning II and advanced drones, are fueling demand for stealth coatings in this segment. The aerospace industry also benefits from these coatings in commercial and experimental aircraft, where electromagnetic interference mitigation is essential.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the global stealth coating market, driven by significant investments in defense and aerospace industries, particularly in the United States. The region’s dominance is attributed to its advanced military programs, extensive fleet of stealth aircraft, and strong focus on research and development in cutting-edge materials. The U.S. Department of Defense allocates substantial budgets for stealth technologies, including radar-absorbing coatings, to maintain strategic superiority. In addition to defense, the presence of major aerospace manufacturers further strengthens the region’s market leadership. Canada’s growing focus on modernizing its military infrastructure also contributes to regional demand. Moreover, North America is home to key stealth coating manufacturers, which enables rapid innovation and deployment of new products.

Key Regional Takeaways:

United States Stealth Coating Market Analysis

The U.S. stealth coating market is supported by significant defense spending and technology development. The U.S. defense budget was around USD 820.3 billion in fiscal year 2023, which constitutes around 13.3% of the federal budget, according to an industrial report data. This heavy funding fuels the research and implementation of stealth technologies in all branches of military hardware, such as aircraft, naval ships, and land-based vehicles. At the leading edge are companies such as PPG Industries and AkzoNobel, whose products introduce new coatings that have advanced radar-absorbing and infrared-suppressing capabilities. Stealth-related technologies are a component of U.S. international defense partnerships and are among the key areas in which the country maintains a strong position in global defense exports.

Europe Stealth Coating Market Analysis

Europe's stealth coating market is growing, driven by defense modernization and environmental factors. According to an industry report, Germany's defense spending in 2022 has been USD 107.2 billion, which is invested in military modernization programs, including stealth technologies' integration. France and the UK are investing in coatings of next-generation fighter jets like FCAS and Tempest programs. The leading players- AkzoNobel and BASF-are focusing on developing environmentally friendly coatings to meet the stringent rules of the EU. This promotes state-of-the-art technologies such as materials with radar-absorbing and nanocomposite coatings ensuring Europe's leading edge into the global market for innovation in stealth coatings.

Asia Pacific Stealth Coating Market Analysis

Asia Pacific is also the rapidly growing market for stealth coating due to rising defense budgets and industrial innovation. According to industry reports, China has estimated the defense budget at approximately USD 229 billion for the year 2022. In the case of India, it allocated about USD 72.6 billion to the defense in the fiscal year of 2023-2024 with special focus on the "Make in India" initiative on indigenous production. In recent times, the region is putting high-end ammunition technologies, smart as well as precision-guided munitions, in production. Domestic and international collaborations and partnerships, for instance between Bharat Dynamics with foreign organizations, are promoting innovation and even technology transfer. Aerospace-based applications in South Korea and Japan are driving further the market growth.

Latin America Stealth Coating Market Analysis

Latin America's stealth coating market is seeing an increase in defense budget allocations and regional security ventures. According to industrial reports, Brazil's defense budget for 2022 was USD 21.8 billion that will help the country's military fleet modernize, incorporating advanced stealth coatings into their designs. Civilian applications are also using stealth coating on high-end vehicles as well as industrial applications. Aerospace designs in Brazil are in collaboration with global players wherein stealth coatings are integrated; regional expertise is enhanced further. Joint military programs, for example Colombia's border security upgrades are boosting the demand for radar-absorbent materials. Increased investments in infrastructure and government-funded R&D increase the environment-friendly solutions being developed.

Middle East and Africa Stealth Coating Market Analysis

Increased defense spending and security issues have furthered the Middle East and Africa's stealth coating market. According to ITA, Saudi Arabia has spent a defense budget of about USD 69 billion in 2023, which has emphasized military modernization through the acquisition of ammunition. South Africa has developed local defense industries, including Denel, an ammunition manufacturer catering to both local and export markets. Regional cooperation and infrastructure development projects are boosting innovation with radar-absorbing and heat-resistant coatings taking precedence. The Middle East strategically focuses on low-observable technologies. Hence, it forms an essential player in the global stealth coating industry.

Competitive Landscape:

Leading players in the stealth coating market are focusing on innovation, strategic collaborations, and expanding their product portfolios to address the growing demand for advanced stealth technologies. Major companies are also at the forefront of developing next-generation stealth coatings with enhanced capabilities. They are investing heavily in research and development to create coatings that offer multi-spectral stealth, including radar, infrared, and visual concealment. For instance, advanced radar-absorbing materials (RAMs) are being designed to meet the evolving requirements of military and aerospace applications. Many companies are also adopting nanotechnology and metamaterials to improve the performance and durability of their coatings. Strategic partnerships between defense contractors and coating manufacturers are further becoming increasingly common.

The report provides a comprehensive analysis of the competitive landscape in the stealth coating market with detailed profiles of all major companies, including:

- CFI Custom Military Solutions

- Intermat Group SA

- Micromag

- MWT Materials Inc.

- Stealth Coatings

- Surrey NanoSystems

- Veil Corporation.

Latest News and Developments:

- November 2024: The Chinese military claimed that it has developed a paper-thin radar-defeating coating that absorbs low-frequency electromagnetic waves from multiple angles, the Chinese military said. According to the sources, it is the newest material discovered so far in stealth technology by effectively countering EM waves in radar. As opposed to existing radar-absorbing materials, these are restricted in their functionality.

- October 2024: XPEL, Inc., demonstrated its wide range of automotive protective films and coatings at the 2024 Specialty Equipment Market Association (SEMA) Show in Las Vegas, November 5-8. XPEL also emphasized its collaborations with Kia America, Tesla, and other partners.

Stealth Coating Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Epoxy, Polyurethane, Polyimide |

| Applications Covered | Aerospace and Defense, Automotive, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | CFI Custom Military Solutions, Intermat Group SA, Micromag, MWT Materials Inc., Stealth Coatings, Surrey NanoSystems and Veil Corporation, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stealth coating market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stealth coating market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stealth coating industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Stealth coating, also known as radar-absorbing material (RAM) coating, is a type of material or surface treatment designed to reduce the radar, infrared, and other electromagnetic signatures of objects, typically military vehicles or equipment. This makes the objects less detectable by radar, thermal sensors, or other surveillance technologies.

The global stealth coating market was valued at USD 317.2 Million in 2024.

IMARC estimates the global stealth coating market to exhibit a CAGR of 3.8% during 2025-2033.

The widespread adoption of drones globally, increasing defense spending fueling stealth technology, ongoing development of next-generation stealth aircrafts, and rising collaborative efforts among tech companies, are some of the important factors supporting the market expansion.

In 2024, epoxy represented the largest segment by resin type due to their superior mechanical properties, chemical resistance, and excellent adhesion to various substrates.

Aerospace and defense lead the market by application owing to the increasing need for advanced technologies to enhance the survivability of military assets.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein North America currently dominates the global market.

Some of the major players in the global stealth coating market include CFI Custom Military Solutions, Intermat Group SA, Micromag, MWT Materials Inc., Stealth Coatings, Surrey NanoSystems, Veil Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)