Stacker Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

Stacker Market Size and Share:

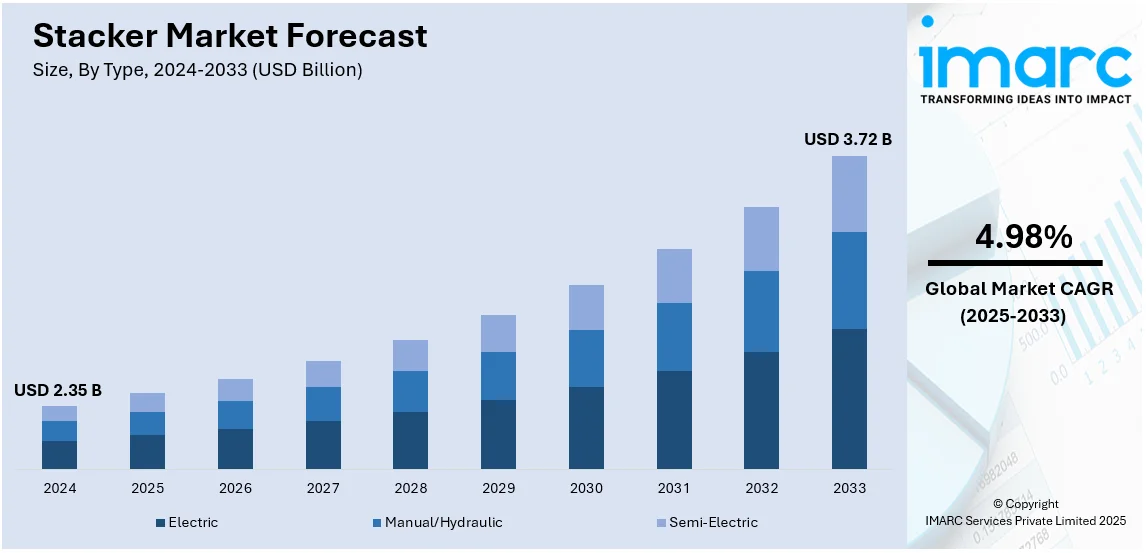

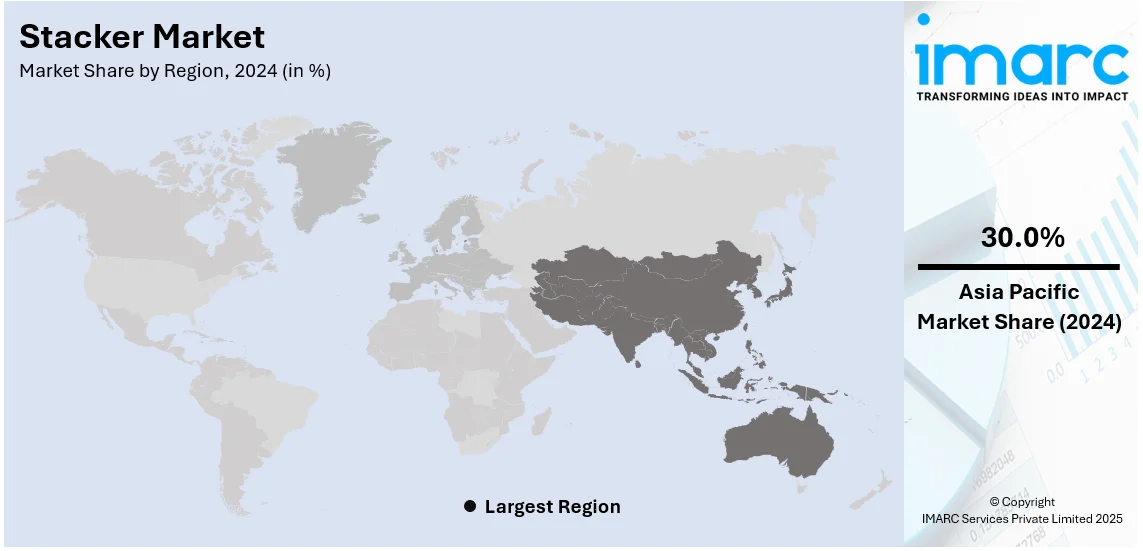

The global stacker market size was valued at USD 2.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 3.72 Billion by 2033, exhibiting a CAGR of 4.98% from 2025-2033. Asia Pacific currently dominates the market, holding a stacker market share of over 30.0% in 2024. The market in this region is expanding rapidly as a result of major increases in E-commerce and warehouse automation, rising labor expenses around the world, and a growing preference for electric stackers due to a greater emphasis on sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.35 Billion |

| Market Forecast in 2033 | USD 3.72 Billion |

| Market Growth Rate (2025-2033) | 4.98% |

A stacker is a bulk material handling machine used for lifting, storing, and stockpiling loads. It is commonly available in manual, self-lifting, electric, semi-electric, and powered pallet variants. These machines are widely used in factories, transportation hubs, warehouses, shop floors, logistics, and manufacturing facilities. Stacker is a robust, reliable, and cost-effective machine that enhances operational performance and provides high throughput. It also maximizes space utilization, improves storage density, reduces infrastructure costs, and is easy to maneuver in restricted spaces. As a result, stacker finds extensive applications across the retail, logistics, food and beverage (F&B), and automobile industries.

The global stacker market is expanding, driven by the rising need for efficient material handling solutions in industries such as warehousing, logistics, and manufacturing. The rise of e-commerce has amplified the need for automated storage and retrieval systems, driving the adoption of stackers in warehouses to optimize space and reduce labor costs. Furthermore, the continuous shift towards automation and the adoption of advanced technologies, like electric-powered and smart stackers, have enhanced both operational efficiency and safety. Stringent regulations on workplace safety and the push for environmentally friendly equipment are also contributing to the shift toward electric stackers, which are more sustainable. Furthermore, the expanding industrialization and demand for faster inventory management continue to drive market growth.

The stacker market in the United States is seeing robust growth, driven by several key factors. The swift expansion of warehouses and distribution centers nationwide has created a higher demand for efficient material handling solutions. Technological progress, including the integration of automation and robotics into stacker machinery, has significantly improved both operational efficiency and safety. The rise of e-commerce has further fueled the need for automated storage and retrieval systems, leading to increased adoption of stackers in warehouses to optimize space and reduce labor costs. Moreover, the increasing focus on workplace safety and environmental sustainability has led industries to invest in electric stackers, which provide both eco-friendly and cost-effective solutions. According to a report by IMARC Group, the United States stacker market is projected to exhibit a compound annual growth rate (CAGR) of 4.3% during 2025-2033.

Stacker Market Trends:

Warehouse Automation and E-commerce Growth

In the last decade, there has been continuous year-on-year growth in the global B2B e-commerce sales. As of now, reports estimate that by 2026, the total amount in the global B2B e-commerce market would rise to around USD 36 trillion. Amongst the largest sectors driving major industries for heavy industries, there is advanced manufacturing, energy, healthcare, and professional business services segment driving a majority part of B2B sales value, ITA. The growth in e-commerce and increasing automated warehouses is one of the prime reasons behind the stacker market expansion. With more popularity of online shopping, firms need to optimize their supply chains and warehouse efficiency to mitigate the increasing needs of consumers. Stacker equipment is essential for enabler movement, storage, and retrieval in a warehouse environment, especially when it comes to high-density storage environments. Automated stackers can handle the goods quickly and precisely and reduce operational shutdown time and bring out the overall streamline products while passing through the supply chain. Further, more and more businesses are now investing in warehouse automation to minimize human errors and leverage the streamlined operations, which further promotes the market share of the stacker. When stacker systems are integrated with warehouse management systems, they can be optimized to make maximum use of space and allow for real-time inventory tracking, which is important for companies that deal with large volumes of products.

Rising Labor Costs

According to the European commission, in the first quarter of 2024, the hourly labor costs increased by 5.1% in the euro area and by 5.5% in the EU compared with the same quarter of the previous year. According to the recent stacker market analysis, global increases in labor costs are encouraging businesses to seek alternatives that reduce their reliance on manual labor. In many developed and developing countries, minimum wage laws and rising wage expectations are contributing to higher operating costs for businesses that depend on large workforces for material handling tasks. Stacker equipment offers an effective solution by automating key material handling processes, which significantly reduces the need for human intervention. As a result, businesses can lower labor expenses while maintaining, or even increasing, their productivity levels. This cost-effectiveness is particularly attractive to industries that operate in labor-intensive environments, such as manufacturing, logistics, and retail. Furthermore, the development of automated stackers, which can be operated by a single person or integrated into an automated system that requires minimal human supervision, leading to higher efficiency and less workforce dependency, is supporting the stacker market growth.

Sustainability and Energy Efficiency

IEA stated that close to 14 million new electric cars were registered worldwide in 2023, putting the total on the roads at 40 million and very close to the sales projection of the 2023 edition of the Global EV Outlook, known as GEVO-2023. Based on the latest stacker market outlook, the growing focus on sustainability and energy efficiency is another factor driving the market demand. Many companies are striving to meet global sustainability standards and reduce their carbon footprints, leading to a shift from traditional fuel-powered equipment to electric alternatives. Electric stackers offer several advantages, such as lower emissions, quieter operation, and reduced energy consumption compared to their diesel or gas-powered counterparts. This transition aligns with broader corporate sustainability goals, including reducing greenhouse gas emissions and energy consumption. Electric stackers are increasingly being adopted in industries like retail, logistics, and warehousing, where businesses are under pressure to improve their environmental performance while maintaining operational efficiency. Additionally, government regulations and incentives aimed at promoting clean energy and reducing industrial emissions are encouraging businesses to invest in electric stackers as part of their environmental responsibility efforts.

Stacker Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global stacker market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type and end user.

Analysis by Type:

- Electric

- Manual/Hydraulic

- Semi-Electric

Based on type, electric stackers dominate the market due to their superior efficiency, cost-effectiveness, and eco-friendly nature. Electric stackers are increasingly preferred over manual or fuel-powered alternatives because they reduce operational costs, require less maintenance, and are quieter, making them ideal for indoor environments like warehouses and retail stores. Their ability to handle heavier loads and work for extended periods without the need for frequent refueling or recharging has made them a top choice in material handling. Additionally, the growing focus on sustainability and compliance with environmental regulations is driving the shift toward electric-powered stackers, as they produce zero emissions compared to their fuel-powered counterparts. As industries seek to improve productivity while reducing their environmental footprint, the demand for electric stackers continues to grow globally. The stacker market forecast indicates sustained growth in demand for electric stackers, driven by advancements in battery technology, increasing automation in warehouses, and stringent emission regulations promoting eco-friendly material handling solutions.

Analysis by End User:

- Retail and Wholesale

- Logistics

- Automobile

- Food and Beverages

- Others

Based on end user, the retail and wholesale sectors dominate the stacker market due to their high demand for efficient material handling solutions. These industries require reliable and fast systems to manage inventory and streamline the movement of goods in large storage areas, making stackers an essential tool. Retailers and wholesalers are increasingly investing in automated systems, including stackers, to improve stock management, reduce labor costs, and enhance space utilization within warehouses and distribution centers. The rise of e-commerce has also contributed to this demand, as businesses need faster, more accurate inventory control to meet customer expectations. As these industries continue to expand and adopt more automated solutions, the stacker market demand, particularly in retail and wholesale, is expected to remain robust, driving continued market growth.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific leads the market with 30.0% share, driven by rapid industrialization and the expansion of logistics and retail sectors in countries like China, India, and Japan. The region's growing manufacturing base, coupled with the rise of e-commerce, has led to an increased need for efficient material handling equipment in warehouses and distribution centers. Additionally, countries in Asia Pacific are investing heavily in automation and smart technologies, boosting the demand for electric and automated stackers. The region's large-scale production and cost-effective manufacturing capabilities further contribute to the market's dominance in Asia Pacific. As these economies keep growing and modernizing, the demand for stackers is expected to increase, solidifying the region's status as the largest market worldwide.

Key Regional Takeaways:

North America Stacker Market Analysis

The North American stacker market is witnessing substantial growth, fueled by several key factors. The rapid rise of e-commerce has heightened the demand for efficient warehouse operations, with stackers playing a vital role in material handling. In 2024, U.S. e-commerce sales are expected to rise by 8.7%, reaching approximately $1.3 trillion. This upward trend is anticipated to continue, with annual growth rates of 8.6% in 2025 and 8.8% in 2026, leading to a projected market size of $1.7 trillion by 2028. The significant growth in e-commerce is also influencing traditional retail, with a record 15,000 chain stores expected to close across the U.S. in 2025. Technological advancements, including the integration of automation and robotics, have enhanced the functionality and efficiency of stackers, making them indispensable in modern warehouses. Additionally, rising labor costs have prompted businesses to adopt stackers to reduce manual labor and improve productivity. The growing emphasis on sustainability has also spurred the adoption of electric stackers, aligning with environmental goals and reducing operational costs. These trends underscore the increasing reliance on stackers in North America's logistics and warehousing sectors.

United States Stacker Market Analysis

The U.S. retail e-commerce market is still growing with a projected total of USD 288.8 Billion in sales for the third quarter of 2024, up 2.2% from the second quarter of 2024, according to the U.S. Census Bureau. This increase in e-commerce is significantly driving the growth of the U.S. stacker market. The rising demand of the consumer in shopping online has resulted in an optimization of the supply chain and warehouse operations by more businesses. Currently, the demand for efficient material handling and storage solutions, including stackers, has never been higher. In particular, automated stackers have faster, more precise handling of goods to streamline companies' operations while saving labor costs and improving inventory management. The growth of e-commerce warehouses and distribution centers and the increasing need for space-saving storage solutions keep fueling the adoption of stacker equipment in various industries and thus boost the U.S. stacker market.

Europe Stacker Market Analysis

Europe ranks as the third-largest retail e-commerce market in the world, with total revenues reaching USD 631.9 billion. This market will continue to grow at an annual rate of 9.31% to reach USD 902.3 Billion by 2027, as indicated by ITA. This surge in e-commerce is, in turn, increasing demand for efficient warehouse operations and hence propelling the European stacker market. As e-commerce expands, companies in Europe are emphasizing their supply chains and warehousing capabilities to meet growing consumer demand. Stacker equipment essentially helps companies move, store, and retrieve products in the high-density warehouse environment. Automated stackers significantly help businesses streamline their functions, reduce dependence on manpower, and improve product flow. With the growing requirement of automation due to the high volume of inventory and saving space, the market for stackers in Europe has numerous growth prospects, considering the increasing demand in e-commerce and need for faster and more efficient material flow.

Asia Pacific Stacker Market Analysis

According to industry reports, China achieved a historic high in transport infrastructure investment in 2023, averaging Yuan 10.7 Billion (approximately USD 1.47 Billion) per day. This is the main growth driver for the Asia Pacific stacker market, especially in logistics and warehousing. The expansion of transport infrastructure is directly fueling the growth of e-commerce and retail, thereby driving the demand for efficient material handling solutions. Businesses invest in larger, more sophisticated warehouse systems to manage the growing flow of goods. This calls for stacker equipment that will help in streamlining operations. Stacker systems, including automated and electric models, are essential for enhancing productivity, lowering operational costs, and optimizing warehouse space. As the focus for China remains on developing logistics network and establishing greater automation within its supply chain, there will be increased demand for stacker equipment across the Asia Pacific region, thus supporting growth in its coming market.

Latin America Stacker Market Analysis

In Latin America automotive industry, with an estimated sale of 4.8 million units in 2023, 8.2% is also expected for growth in the coming year of 2024, as per reports. Its growth, according to these data, indicates significant growth prospects in the region. As more facilities are created due to an ever-growing automobile business, warehousing and material handling solutions must ensure efficiency and efficacy in automobile production and distribution centres. Stacker machines are one of the main methods of making the plants more efficient, with the machines designed to help individuals shift, store, and recover automotive parts and finished products. In an era where businesses are more focused on automating the operations to save on costs and ensure smooth processes, most automotive firms are actually opting for automation and electric stacker to boost their operational performance. Moreover, the significant increase in the production and sales of automobiles is boosting demand for higher-capacity advanced warehouse systems, which in turn boosts further demand for modern stacker systems across Latin America. This trend is expected to keep driving the growth of the Latin American stacker market.

Middle East and Africa Stacker Market Analysis

The UAE has emerged as the eCommerce leader among the GCC states, with a significant 53% growth in the market in 2020, reaching a record USD 3.9 Billion in eCommerce sales, which accounted for 10% of total retail sales, according to ITA. The rise in eCommerce activity is fueling the demand for efficient warehousing and material handling solutions throughout the region, especially in the UAE. Stacker equipment is one of the most important tools for optimizing warehouse operations by improving the movement, storage, and retrieval of products. With the rapid growth of online shopping, companies are investing in automated and electric stackers to enhance operational efficiency and reduce labor costs. The integration of stackers with warehouse management systems (WMS) further supports businesses in maximizing space utilization and enabling real-time inventory tracking. As online shopping rapidly grows, companies are increasingly investing in automated and electric stackers to boost operational efficiency and cut labor costs.

Competitive Landscape:

The global stacker market features a competitive landscape, with several key players providing a diverse range of solutions to address the rising demand for efficient material handling systems. Major companies in the market are focusing on product innovations, such as the development of electric and automated stackers, to cater to industries seeking sustainable and cost-effective solutions. Strategic partnerships, mergers, and acquisitions are frequently seen as companies strive to broaden their product offerings and extend their market presence. The market is fiercely competitive, with companies focusing on technology, performance, and cost-effectiveness. As automation and smart technologies drive industry evolution, companies are heavily investing in research and development to maintain a competitive edge. Regional players are also emerging, providing cost-effective solutions tailored to meet the specific needs of local markets.

The report provides a comprehensive analysis of the competitive landscape in the stacker market with detailed profiles of all major companies, including:

- Clark Material Handling Company

- Crown Equipment Corporation

- Doosan Corporation

- Godrej & Boyce Mfg. Co. Ltd.

- Hangcha Group Co. Ltd.

- Hyster-Yale Materials Handling Inc.

- Jungheinrich AG

- Linde Material Handling (Kion Group AG)

- Mitsubishi Logisnext Co. Ltd. (Mitsubishi Heavy Industries Ltd.)

- NIDO Machineries Pvt. Ltd.

- Toyota Industries Corporation

Latest News and Developments:

- December 2024: Linde Materials Handling announced the launch of the Linde L-MATIC core fully automated pallet stacker, set for release in February 2025. The L-MATIC core is designed for compact warehouse spaces and offers a load capacity of 1.6 tons with a 3.8-meter lift height.

- July 2024: Telestack introduced the "only" ro-ro radial telescopic stacker, the TSR 40. This machine was designed to enhance material handling efficiency and flexibility in bulk handling operations. The launch aimed to provide a unique solution for loading and stacking operations in industries requiring precise and efficient handling.

- February 2024: JBT’s Proseal launched a fully automated CDS Case De-Stacker to enhance case packing efficiency. The machine reduces manual handling by automatically de-stacking cases and delivering them to packing machines. It supports both RPC and cardboard cases in various sizes and orientations, offering up to 35 cases per minute.

- May 2024: Hangcha Group began constructing the Hangcha Technology Park Phase IV Intelligent Production Base. This new project costs USD 142 million. Using this facility, the company plans to create 10,000 AGVs (AMRs), 1,000 stacker cranes, and 100,000 meters of conveyor lines each year.

- April 2023: Toyota Material Handling launched a new electric Walkie Stacker under its Tora-Max brand. The company has expanded its material handling range with this new addition. Superior flexibility, user-friendliness, and secure load handling characterize the Tora-Max Walkie Stacker.

- March 2023: Kivnon introduced the new K55 Pallet Stacker in March 2023 as part of their AGV product line. This new carry vehicle has been especially designed for the automated transport and stacking of pallets.

Stacker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Electric, Manual/Hydraulic, Semi-Electric |

| End Users Covered | Retail and Wholesale, Logistics, Automobile, Food and Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Clark Material Handling Company, Crown Equipment Corporation, Doosan Corporation, Godrej & Boyce Mfg. Co. Ltd., Hangcha Group Co. Ltd., Hyster-Yale Materials Handling Inc., Jungheinrich AG, Linde Material Handling (Kion Group AG), Mitsubishi Logisnext Co. Ltd. (Mitsubishi Heavy Industries Ltd.), NIDO Machineries Pvt. Ltd. and Toyota Industries Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the stacker market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global stacker market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the stacker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The stacker market was valued at USD 2.35 Billion in 2024.

IMARC estimates the stacker market to exhibit a CAGR of 4.98% during 2025-2033.

The stacker market is driven by the growing demand for efficient warehouse and logistics solutions, especially in e-commerce. Technological advancements in automation and robotics, rising labor costs, the need for space optimization, and the shift towards electric stackers for sustainability are key factors fueling the market.

Asia Pacific dominates the stacker market due to rapid industrialization, a booming e-commerce sector, and the expansion of manufacturing and logistics industries. Countries like China, Japan, and India are significant contributors, with investments in infrastructure development and warehouse automation driving demand for stackers in the region.

Some of the major players in the stacker market include Clark Material Handling Company, Crown Equipment Corporation, Doosan Corporation, Godrej & Boyce Mfg. Co. Ltd., Hangcha Group Co. Ltd., Hyster-Yale Materials Handling Inc., Jungheinrich AG, Linde Material Handling (Kion Group AG), Mitsubishi Logisnext Co. Ltd. (Mitsubishi Heavy Industries Ltd.), NIDO Machineries Pvt. Ltd. and Toyota Industries Corporation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)