Spray Adhesives Market Size, Share, Trends and Forecast by Type, Resin Type, End Use Industry, and Region, 2025-2033

Spray Adhesives Market Size and Share:

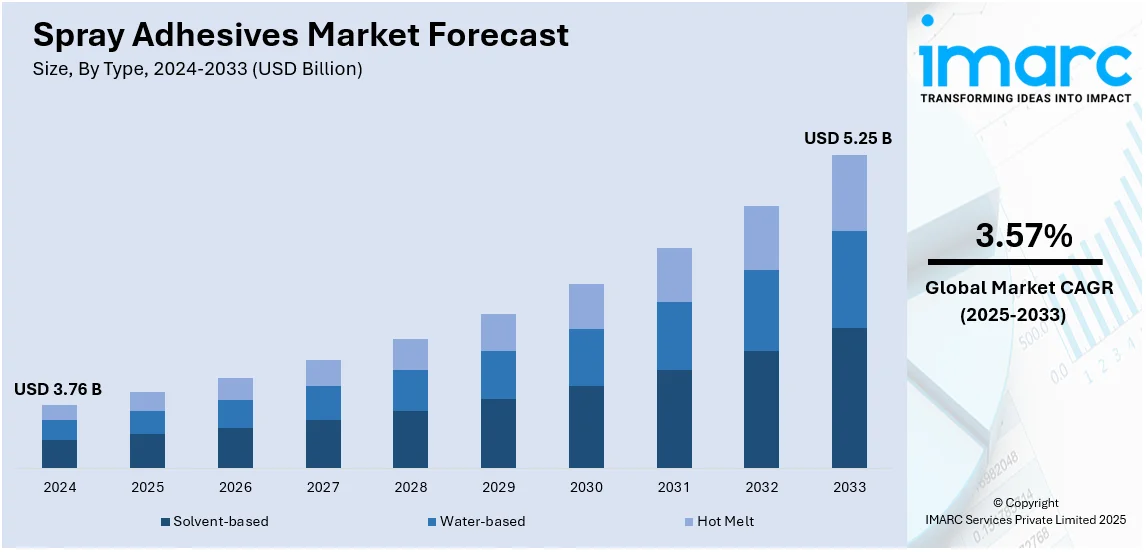

The global spray adhesives market size was valued at USD 3.76 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 5.25 Billion by 2033, exhibiting a CAGR of 3.57% during 2025-2033. Asia-Pacific currently dominates the market, holding a significant market share of over 43.0% in 2024. Significant expansion of automotive sector, the increasing adoption of spray adhesives in packaging industries, the growing product demand across construction and infrastructure projects to enhance efficiency in bonding various materials, and rising awareness regarding environmental benefits are some of the factors positively impacting the spray adhesives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.76 Billion |

| Market Forecast in 2033 | USD 5.25 Billion |

| Market Growth Rate (2025-2033) | 3.57% |

The market is experiencing remarkable growth, majorly driven by the enhanced demand for bonding solutions in diverse end-use sectors, such as packaging, construction, and electronics. In line with this, the increasing utilization of lightweight materials for the automobile and aerospace industry is augmenting the adoption of spray adhesives due to their convenient application and powerful adhesion features. Additionally, environmental regulations demanding green formulations lead to the usage of water-based adhesives, which leads to the development of water-based adhesives. For example, on June 27, 2024, Keck Chimie introduced the 765/22 water-based adhesive, designed specifically for the mattress manufacturing industry. This adhesive offers immediate initial tack and rapid setting, ensuring strong and durable bonds between mattress layers. For optimal application, the company recommends using a spray gun with a nozzle diameter between 1.2 and 2 mm, maintaining air pressure between 1 and 1.5 bar, for precise spraying.

The United State stands out as a key regional market, which is driven by the presence of several key companies in the major sectors. Moreover, considerable growth in the DIY home renovation applications is accelerating product demand, as it requires easy-to-use, efficient adhesives. The innovation of low-VOC, eco-friendly adhesives is also adding to the spray adhesives market growth. For instance, US-based Henry Carlisle Company offers a Low-VOC Bonding Adhesive formulated for bonding EPDM and TPO membranes to various substrates, including polyisocyanurate insulation, concrete, plywood, and metals. This solvent-based, high-strength contact adhesive satisfies the OTC Model Rule for Single-Ply Roofing Adhesives' <250 g/L VOC content standards. Advances in spray adhesive technology with enhanced adhesion strength, temperature resistance, and faster drying times are also making them more attractive to a broad user base.

Spray Adhesives Market Trends:

Increase in Construction and Infrastructure Projects

The growth of construction activities is leading to the spray adhesives market demand. For instance, the U.S. Census Bureau stated on February 3, 2025, that in 2024, public construction expenditures in 2024 were USD 492.7 Billion, 9.3 percent (±2.0 percent) higher than the USD 450.7 Billion spent in 2023. These numbers demonstrate an extensive expansion of construction activity, supported by higher investments in the industrial, commercial, and residential sectors, which is escalating the spray adhesives market demand for uses including panel bonding, flooring, and insulation. Global urbanization is picking up speed, especially in emerging nations where the need for new infrastructure drives the use of cutting-edge adhesive technology. Furthermore, the increasing amount of glue used, this growth in construction activities highlights the requirement for adhesives that exceed strict building norms and regulations by providing greater bonding strength, durability, and environmental sustainability across the globe.

Significant Expansion of Automotive Industry

Spray adhesives are essential for the assembly of interior parts such as headliners, trim gluing, and insulation in the automobile industry. Hence, there is a increasing need for creative adhesive solutions that provide excellent strength, flexibility, and compatibility with novel materials, which is enhancing the spray adhesives market outlook. According to the International Energy Agency, over 3 Million electric vehicles were sold in the first quarter of 2024, a 25% increase over the same period the year before. It is anticipated that sales will reach about 17 Million by the end of 2024, with new purchases picking up speed in the second half of this year, which represents a more than 206-per-year rise. Global sales of electric cars were controlled by three main markets, with China holding the largest part of the market. Furthermore, the United States, the third-largest market, is also witnessing increase in electric car sales. Spray adhesives remain crucial for streamlining production procedures and raising overall vehicle quality and safety requirements as manufacturers pursue sustainability and economy.

Packaging Industry Expansion

The packaging sector growth significantly drives the spray adhesives market growth due to the rising need for sustainable and sanitary packaging solutions worldwide. Spray adhesives are widely preferred for their ability to bond various substrates, including plastics, paper, and films, offering flexibility and ease of application. The growing e-commerce sector contributes to the demand for packaging materials that are both secure and sustainable. Additionally, advancements in adhesive formulations for improved environmental compliance, such as low-VOC and solvent-free options, align with the industry’s push toward greener practices, further fueling the adoption of spray adhesives in packaging applications. Additionally, adherence to food safety standards is mandated by government laws, which include strict recommendations from agencies such as the Food and Drug Administration (FDA). Under specific conditions, adhesives can also be safely incorporated into materials used for food packaging, transportation, or storage. According to an IMARC report, the global food packaging market size was valued at USD 405.44 Billion in 2024. Therefore, there is an increased need for packaging adhesive, which is employed for isolating the food by a functional barrier.

Spray Adhesives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global spray adhesives market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, resin type, and end use industry.

Analysis by Type:

- Solvent-based

- Water-based

- Hot Melt

Water-based adhesives lead the market with around 40.0% of market share in 2024 due to environmental considerations and very wide applications. They differ from solvent-based adhesives since water is used as the primary solvent, which contributes far less volatile organic compound (VOC) emissions than other solvent-based adhesives. In terms of performance, water-based adhesives offer fantastic bonding properties to work surfaces like paper, fabric, and foam without providing losses to adhesion strength and durability. They are gaining popularity in the packaging, automotive, and construction industries, where demand for eco-friendly manufacturing is on the rise. Water-based adhesives are also frequently safer to use and provide less odor than other types, making them better suited for both industrial and consumer markets. With increasing environmental concerns, water-based spray adhesives are likely to gain significant importance in the market as the demand for sustainable solutions increases.

Analysis by Resin Type:

- Epoxy

- Polyurethane

- Synthetic Rubber

- Vinyl Acetate Ethylene

Epoxy spray adhesives offer excellent bonding strength and endurance which make them perfect for numerous applications in the electronics, automotive, and aerospace sectors. These adhesives have a well-known reputation for having exceptional heat and chemical resistance, which guarantees dependable performance under challenging circumstances. Additionally, epoxy adhesives are especially useful due to their demanding extreme strength and accuracy, such as gluing glass, composite materials, and metal components. Furthermore, technological developments that enhance usability and cure periods also help the epoxy spray adhesive business across the globe.

Polyurethane spray adhesives are highly valued for their flexibility and versatility across a broad range of materials, including wood, plastics, and textiles. These adhesives are especially popular in the construction and furniture industries, where they are used for panel lamination and flooring applications due to their robust moisture resistance and strong bonding capabilities. Additionally, polyurethane adhesives adapt well to thermal expansion and contraction, making them suitable for outdoor and weather-exposed applications. Besides this, the ongoing development of low-VOC polyurethane adhesives aligns with the increasing environmental regulations, which is further creating a positive spray adhesives market outlook. Furthermore, their ability to bond dissimilar materials creates opportunities for innovation in multi-material applications, ensuring continued growth in diverse sectors.

Synthetic rubber spray adhesives are a staple in commercial and industrial applications owing to their quick-setting properties and effective bonding in non-structural applications. Additionally, commonly used in the automotive and packaging industries, synthetic rubber spray adhesives offer good flexibility and are capable of bonding a wide array of materials including paper, leather, fabric, and metal. Moreover, synthetic rubber adhesives are prized for their ease of use and rapid strength development, facilitating speedy assembly processes and production cycles. They generally have lower temperature and chemical resistance compared to other adhesives, positioning them as more suitable for general-purpose applications rather than high-stress or extreme environments. Furthermore, the market potential for synthetic rubber adhesives is enhanced by ongoing product innovations aimed at improving performance and environmental compliance, thus generating significant spray adhesives market revenue.

Vinyl acetate-ethylene (VAE) spray adhesives are gaining traction due to their low environmental impact and excellent adhesion properties on porous materials such as paper, board, and textiles. They are predominantly employed in the packaging and bookbinding industries, where safety, ease of use, and cost-effectiveness are paramount. Additionally, VAE adhesives are water-based, which reduces the exposure to harmful solvents but also complies with stringent environmental regulations. Moreover, their increasing popularity is driven by the shift toward sustainable and safe adhesive solutions in consumer and industrial applications.

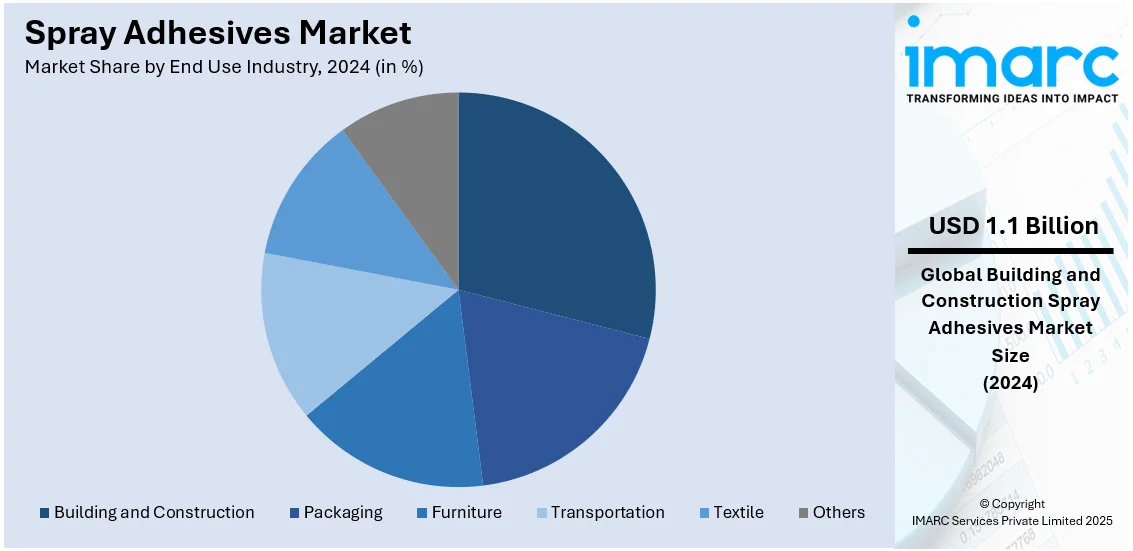

Analysis by End Use Industry:

- Building and Construction

- Packaging

- Furniture

- Transportation

- Textile

- Others

Building and construction leads the market with around 29.2% of market share in 2024 due to the widespread use of spray adhesives in various construction processes. Spray adhesives are widely utilized in the building industry for laying flooring, providing insulation, setting up roofing, and wall panel bonding. They prove to be convenient and fast options for applying an adhesive, producing a strong joint without the additional use of elaborate tools or special application procedures. They are in high demand, mainly for carpets and tiles, as well as wood and foam used for insulation. Moreover, along with the urgency of saving both time and money in construction processes, spray adhesives will become a preference over traditional adhesive bonding. Another spray adhesives market trend is rising water-based environmentally friendly adhesives, satisfying both performance standards and environmental parameters.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia-Pacific accounted for the largest market share of over 43.0%, influenced by speedy industrialization and rapid urbanization with massive construction work. Many of the world's largest automobile markets, along with a thriving packaging and construction sector, are present in the region, especially in countries such as China, India, Japan, and South Korea, which is propelling demand for spray adhesives. Additionally, the region's strong emphasis on infrastructure development, automotive production, and packaging industries significantly contributes to the rising demand for spray adhesives. Moreover, Asia Pacific benefits from a large consumer base which further propels the market. The region's cost-effective manufacturing capabilities attract numerous international companies, enhancing local market growth. Furthermore, with the ongoing developments and investments in technology and industrial sectors, Asia Pacific is poised to maintain its leadership in the spray adhesives market.

Key Regional Takeaways:

United States Spray Adhesives Market Analysis

Growth in the U.S. market for spray adhesives is increasing with the demand from end-use sectors like automotive, packaging, and construction. According to IMARC Group's forecast, the construction equipment market would increase at a compound annual growth rate (CAGR) of 4.60% from 2024 to 2032, reaching US$ 68.11 Billion in 2033. This growth in construction equipment indicates that the spray adhesives that are used for applications like insulation, flooring, and ceiling installation are also on the rise. Improved adhesive formulations provide better performance than their predecessors, with high strength, flexibility, and resistance to heat and moisture. With the construction and automotive sectors booming, there is a growing need for spray adhesives to bond materials such as plastics, metals, and composites. Environmental factors are also impacting pr duct development, with manufacturers targeting low-VOC (volatile organic compounds) and eco-friendly products. The major players in the U.S. market are in testing in innovation and technological advancements to capture a larger market share. Such innovations in adhesive technology, offering enhanced bonding strength and faster drying times, continue to drive adoption. These combined factors suggest robust growth prospects for the US spray adhesives market.

Asia Pacific Spray Adhesives Market Analysis

Asia Pacific is the fastest-growing region for spray adhesives, with growth due to industrialization and urbanization in China, India, and Japan. The largest consumer industries of spray adhesives in the region are automotive, construction, and packaging. With a strong foundation of manufacturing activities and the fast-growing demand for cost-effective methods, spray adhesive usage for assembly processing in different lines of business operations is increasing nowadays. E-commerce and retail packaging growth helps to increase this demand. Furthermore, the e-commerce boom in Southeast Asia is accelerating the demand for packaging solutions, contributing to the increased use of spray adhesives in packaging applications. According to an industry report, the Southeast Asia e-commerce market is projected to grow at a CAGR of 19.40% from 2024 to 2032, hence raising the need for dependable and effective adhesive solutions. Businesses in the area are increasing their capacity for production. and improving product quality to meet the changing needs of local markets while at the same time meeting environmental standards.

Europe Spray Adhesives Market Analysis

The European spray adhesives market is experiencing substantial growth, driven by demand across sectors such as automotive, construction, packaging, and consumer goods. The automotive industry is a key contributor, as the need for lightweight and durable bonding solutions for vehicle assembly increases. For instance, the Europe automotive connectors market, valued at USD 5.1 Billion in 2023, is projected to reach USD 8.1 Billion by 2032, growing at a CAGR of 5.3% during 2024-2032. This growth reflects the broader trend in the automotive sector, which continues to rely on advanced adhesive technologies for efficient bonding. In construction, the increasing focus on sustainability and urban development propels the demand for spray adhesives, particularly in applications such as insulation and flooring. The rise in e-commerce in Europe further boosts the packaging sector, driving the need for reliable and efficient adhesive solutions. As environmental regulations tighten, the shift towards water-based and low-VOC adhesives is becoming more pronounced. Ongoing innovations in adhesive formulations, offering enhanced bonding strength and faster curing times, are further contributing to the growth of the spray adhesives market across Europe.

Latin America Spray Adhesives Market Analysis

The spray adhesives market is emerging in Latin America, driven by the growth in the construction, automotive, and packaging industries. Middle-class and infrastructure developments are on the rise in this region, so the demand for spray adhesives is high in construction and automotive applications. Brazil and Mexico are significant markets in Latin America, wherein the automotive segment is a primary user of spray adhesives to bond different parts in assembling a vehicle. According to an industry report, it is projected that there will be a 6.8% increase in Brazil's auto production for 2025, anticipating a total of 2.75 Million units. Domestic auto sales are expected to rise by 5.6% to 2.8 Million units, while exports are forecasted to grow by 6.2%, reaching 428,000 vehicles. Also, the increasing demand for sustainability is motivating manufacturers to invest in environmentally friendly solutions, such as water-based adhesives, to comply with regional environmental regulations and cater to consumer preferences for eco-conscious products.

Middle East and Africa Spray Adhesives Market Analysis

The spray adhesives market in the Middle East and Africa is growing slowly but steadily, mainly driven by the construction, automotive, and packaging sectors. In the Middle East, the demand for spray adhesives increases due to massive infrastructure projects and fast-booming construction businesses. Spray adhesives are widely used in all sorts of insulation, bonding, and sealing applications during a construction project. In Africa, the market is growing due to urbanization, through which the packaging, textile industries, and automotive sectors widely use spray adhesives. According to reports, Africa's urban population is expected to double by 2050, adding approximately 500 million people to its cities, which leads to the growth of the construction sector, thereby increasing the requirement for spray adhesives. Manufacturers are emphasizing the improvement of their distribution channels and cost-effective solutions to enter these markets. Moreover, a growing trend toward the production of environmentally friendly adhesives to meet the demand of the increasingly conscious consumer base is observed.

Competitive Landscape:

Key players in the spray adhesives market are strategically strengthening their market position through significant investments in research and development to innovate and enhance product offerings. These companies are also actively pursuing mergers and acquisitions to expand their geographic reach and penetrate new industry segments. Additionally, they focus on sustainability initiatives, developing environmentally friendly products to meet stringent global regulations and shifting consumer preferences towards safer, greener alternatives. These efforts are essential for maintaining competitive advantage and responding effectively to evolving market demands. For instance, in January 2023, 3M has innovatively combined adhesive science and robotics to redefine the tape concept. It introduces a fresh product category and an advanced bonding technique, marking a significant stride in manufacturing innovation. The recent launch of the product, an automatically dispensed pressure-sensitive adhesive tape that is tacky and sticky to the touch.

The report provides a comprehensive analysis of the competitive landscape in the spray adhesives market with detailed profiles of all major companies, including:

- 3M Company

- AFT Industries

- Ashland

- BASF SE

- Bostik SA (Arkema S.A.)

- Gemini Adhesives Ltd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Phillips MFG

- Sika AG

- Spray-Lock Inc

- The Kroger Co.

Latest News and Developments:

- December 2024: 3M introduces Fastbond Pressure Sensitive Adhesive 1049, a solventless, non-flammable, water-based spray adhesive designed to minimize VOCs and solvents. It is available in a portable spray system from Worthington Enterprises, which enables quick tack and easy repositioning for lightweight bonding applications. This sustainable adhesive meets environmental and safety standards while delivering strong performance.

- March 2024: Gorilla introduced Heavy Duty Spray Adhesive, which provides a quick-setting, heavy-duty adhesive to join heavy-duty applications and crafts projects. It adheres to surfaces well, whether for wood, metal, fabric, plastic, or more. It is appropriate for applications such as photo mounting and upholstery and provides convenience due to its quick drying time and versatility for various projects.

- January 2024: Duro-Last launched TECH-Bond TPO adhesives, which include a spray adhesive, to increase the efficiency of installations.

- September 2023: H.B. Fuller Company acquired UK-based Sanglier Limited, a manufacturer of sprayable industrial adhesives. The strategic acquisition will strengthen H.B. Fuller's innovation capacity and product portfolios in the United Kingdom and Europe, especially the Construction and Engineering Adhesives. The acquisition of Sangliers' nearly 60 employees will join H.B. Fuller's global business unit in Construction Adhesives, giving the company additional manufacturing and packaging capacity, improving operations, innovation, and service competitiveness.

- October 2022: Floorwise launched a safer, eco-friendly version of its F599 heavy-duty spray adhesive, known as F597 Heavy Duty Spray Adhesive. This eliminates the dichloromethane from F599 and significantly reduces the risks to health and the environment. The risks of asphyxiation have been reduced with improved dispersion times. It can be used for various floor coverings and accessories, and distributors are available across the UK and Ireland.

Spray Adhesives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Solvent-based, Water-based, Hot Melt |

| Resin Types Covered | Epoxy, Polyurethane, Synthetic Rubber, Vinyl Acetate Ethylene |

| End Use Industries Covered | Building and Construction, Packaging, Furniture, Transportation, Textile, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, AFT Industries, Ashland, BASF SE, Bostik SA (Arkema S.A.), Gemini Adhesives Ltd., H.B. Fuller Company, Henkel AG & Co. KGaA, Phillips MFG, Sika AG, Spray-Lock Inc., The Kroger Co., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the spray adhesives market from 2019-2033.

- The spray adhesives market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the spray adhesives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The spray adhesives market was valued at USD 3.76 Billion in 2024.

The spray adhesives market is projected to exhibit a CAGR of 3.57% during 2025-2033, reaching a value of USD 5.25 Billion by 2033.

The market is driven by the increasing demand across industries such as automotive, packaging, and construction, where convenience and time-efficiency are crucial. The growth in consumer goods packaging, coupled with the rise in lightweight materials and automation, is also supporting market expansion. Additionally, eco-friendly product innovations are driving consumer preference and adoption of sustainable adhesive solutions.

Asia Pacific currently dominates the spray adhesives market, accounting for a share of 43.0% in 2024. The dominance is fueled by rapid industrialization, growing automotive and construction sectors, and a rising demand for efficient, cost-effective adhesive solutions in packaging and manufacturing industries across countries like China and India.

Some of the major players in the spray adhesives market include 3M Company, AFT Industries, Ashland, BASF SE, Bostik SA (Arkema S.A.), Gemini Adhesives Ltd., H.B. Fuller Company, Henkel AG & Co. KGaA, Phillips MFG, Sika AG, Spray-Lock Inc., and The Kroger Co., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)