Sportswear Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2025-2033

Sportswear Market Size and Share:

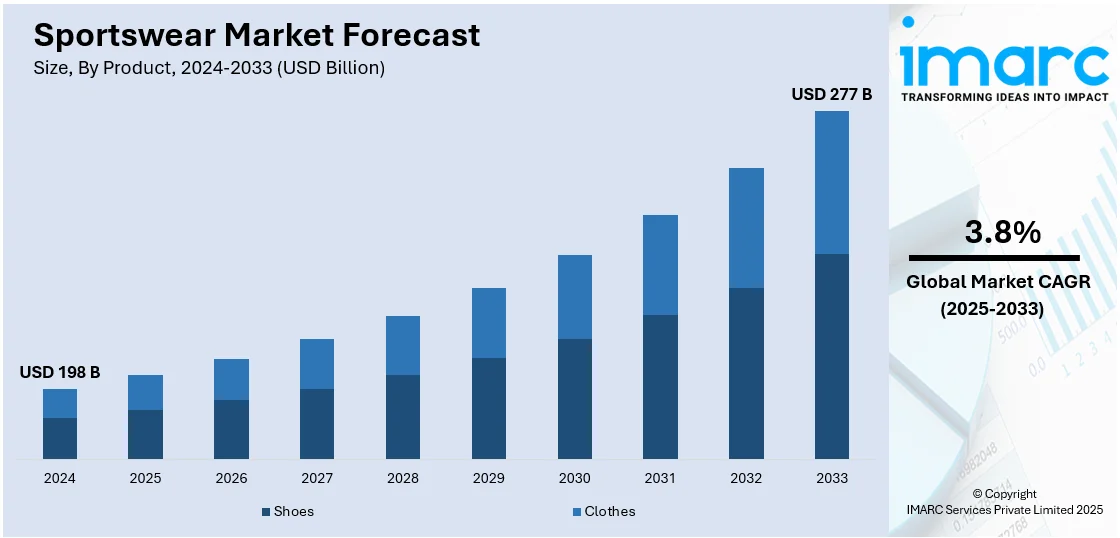

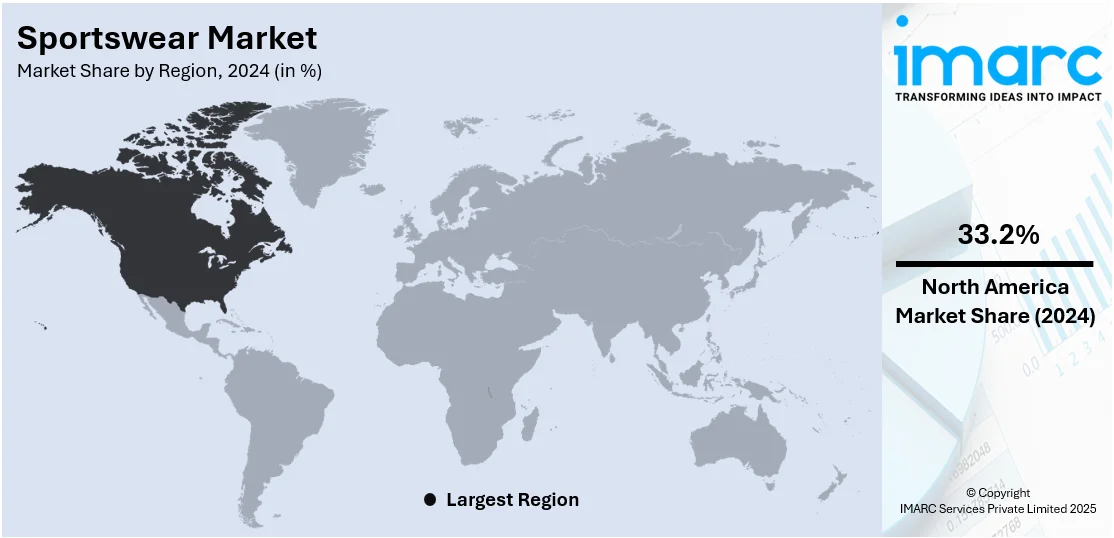

The global sportswear market size was valued at USD 198 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 277 Billion by 2033, exhibiting a CAGR of 3.8% during 2025-2033. North America currently dominates the market, holding a significant market share of over 33.2% in 2024. This leadership is due to high consumer spending, widespread fitness awareness, and strong presence of global and domestic brands. Advanced retail infrastructure, early adoption of athleisure trends, and frequent product innovation contribute to sustained demand, while marketing through celebrity endorsements and social media further boosts regional dominance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 198 Billion |

|

Market Forecast in 2033

|

USD 277 Billion |

| Market Growth Rate 2025-2033 | 3.8% |

The sportswear market is advancing due to rising investments in athleisure product lines by fashion brands seeking to capitalize on shifting consumer lifestyles. Increased interest in eco-friendly and recycled materials is also prompting companies to adopt sustainable manufacturing practices. Strategic endorsements by athletes and influencers are amplifying brand visibility and consumer reach. A prominent example is Fila’s 13-piece capsule collection created in collaboration with Hailey Bieber for Spring/Summer 2025. The range merges the brand’s athletic legacy with Bieber’s contemporary style, featuring adaptable wardrobe items such as T-shirts, sweatpants, and sports bras. It also showcases tennis-inspired designs, including pleated skirts and oversized knits, all crafted in a palette of black, white, green, and yellow, with a focus on comfort and practicality. Additionally, expanding digital retail infrastructure, combined with improved logistics networks, is allowing brands to tap into emerging economies more efficiently. For instance, Japanese sportswear brand ASICS plans to expand its presence in India by opening 50 new stores by 2025. This initiative aims to tap into the growing demand for sports across various regions in the country. Moreover, frequent product innovation in moisture-wicking, lightweight, sustainable, and ergonomic designs is reinforcing consumer interest and maintaining repeat purchases across diverse demographic segments.

In the United States, the sportswear market is driven by consumers' increasing prioritization of comfort and functionality in everyday wear. The popularity of hybrid work environments has elevated demand for clothing that accommodates both active and casual settings. Demographic shifts, including a growing Gen Z and millennial consumer base, are influencing brands to adopt trend-driven, tech-integrated designs. Customization and limited-edition drops are helping brands create exclusivity and enhance customer loyalty. Additionally, rising awareness of sustainability is pushing companies to invest in circular economy models and eco-friendly materials, aligning with consumer expectations for responsible production. For instance, in March 2025, PUMA announced a multi-year partnership with RE&UP Recycling Technologies to scale its circular textile initiatives. The collaboration focuses on turning textile waste into next-gen recycled cotton fibers and polyester chips, aligning with PUMA's Vision 2030 goal of having 30% of polyester in apparel sourced from fibre-to-fibre recycling by 2030. RE&UP’s advanced recycling tech can handle complex blends like polycotton and polyester-elastane, traditionally hard to recycle. The partnership supports PUMA’s RE:FIBRE program and expands into the Americas, aiming to reduce reliance on bottle-based polyester and promote circularity in its global supply chain.

Sportswear Market Trends:

Rising Health and Fitness Awareness

One of the major factors driving the global sportswear market is the increasing focus on health, fitness, and general well-being. With an increasing number of individuals prioritizing staying active, there is a rise in the popularity of fitness clothing. This pattern is driven by growing awareness about the advantages of consistent physical activity, including better mental health, weight control, and disease prevention. The increase in chronic diseases such as obesity, diabetes, and cardiovascular conditions worldwide has motivated individuals to engage in more physical activities, leading to a higher demand for sports clothing. The increasing popularity of outdoor activities, sports events, and gym memberships reflects a strong emphasis on health and wellness. According to IHRSA Global Report, about 80% of gym owners expect membership and revenue to increase by more than 5% in 2023. Fitness tracking technology and social media have also been crucial in advocating for exercise as a group-oriented activity. The rise of fitness influencers and online platforms endorsing healthy living has led to a significant need for clothing that caters to different types of exercises, such as yoga and high-intensity workouts. Sportswear companies are creating stylish and functional products by incorporating performance-enhancing fabrics such as moisture-wicking materials and compression technology.

Expansion of E-Commerce and Digital Platforms

As per the latest sportswear market analysis, e-commerce expansion is a major factor driving global sales. According to IMARC Group, the global e-commerce market reached USD 26.8 Trillion in 2024, and is expecting to reach USD 214.5 Trillion by 2033, exhibiting a CAGR of 25.83% during 2025-2033. With the rise in online shopping by consumers, the sportswear sector has taken advantage of this trend by putting resources into strong online retail systems. E-commerce has become a necessary factor in market expansion due to the ease of buying sportswear from home, along with favorable return policies, competitive prices, and a larger product selection. Numerous sportswear companies have adopted omnichannel tactics, combining online and offline experiences to meet evolving consumer habits. Tailoring recommendations and ads based on individual shopping habits and preferences is possible through personalized marketing, which is driven by data analytics and AI. Furthermore, trust and brand awareness are fostered by online reviews, influencer endorsements, and social media engagement. Social media platforms such as Instagram and TikTok have emerged as influential channels for promoting new fashion collections, exercise challenges, and athletic wear trends, establishing a direct connection between brands and consumers.

Increased Participation in Sports and Physical Activities

Another key factor contributing to the sportswear market growth is the increasing involvement in structured sports and physical activities. In the last ten years, there has been a clear rise in the number of individuals participating in professional and amateur sports. The 15th annual State of the Industry Report from the Sports & Fitness Industry Association and Sports Marketing Surveys USA, highlights that in 2023, U.S. sports and fitness participation hit a record 242 million. The increase in sports involvement is due to various factors such as government programs encouraging physical fitness, the growing popularity of sports events, and a cultural change toward valuing physical activity and competition. Governments and health organizations worldwide are becoming more conscious of the significance of physical activity in addressing public health issues such as obesity, cardiovascular diseases, and mental health disorders. Consequently, numerous nations have implemented policies and initiatives to promote involvement in sports across various age groups, including schoolchildren and adults. Efforts such as the Olympics, FIFA World Cup, and local marathons have increased interest in sports participation.

Sportswear Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sportswear market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Shoes

- Clothes

Shoes stand as the largest component in 2024, holding around 55.7% of the market. The shoes segment dominates the sportswear market due to its essential role in both performance and lifestyle applications. Athletic footwear is considered a fundamental requirement for various sports and fitness activities, driving consistent demand across age groups. The segment benefits from continuous innovation in cushioning, arch support, and materials tailored for specific sports. Additionally, sneakers have become a fashion statement, often worn beyond athletic settings, further expanding their consumer base. Collaborations with athletes, designers, and pop culture icons also enhance brand appeal and fuel sales. The high replacement cycle, especially for performance shoes, ensures steady revenue generation and market leadership within the sportswear industry. For instance, StockX’s Q3 2024 trend report highlighted a surge in performance shoes on the resale market. Puma and Asics led growth, with Puma topping brand searches (+2,022%) and the Asics Gel-1130 seeing over 1,000% YoY trade growth. Nike continued to dominate high-value collaborations, with its Air Force 1 and Jordan models leading resale premiums. Adidas AE 1, Nike P-6000, and On Running also saw strong performance

Analysis by Distribution Channel:

- Online Stores

- Retail Stores

Retail leads the market with around 35.2% of market share in 2024. The retail segment dominates the sportswear market owing to its extensive reach, diverse product availability, and established consumer trust. Brick-and-mortar stores offer the advantage of in-person product trials, immediate purchases, and tailored customer service, enhancing the overall shopping experience. Many global brands maintain strong retail footprints through exclusive outlets, department stores, and specialty chains, ensuring widespread visibility. Retail locations also serve as experiential hubs, integrating interactive displays and fitness events to attract and retain customers. Additionally, strategic placement in high-footfall areas and integration with digital platforms for omnichannel engagement further strengthen the retail segment's position in driving sportswear sales globally. For instance, in February 2025, Performance sportswear brand Castore expanded its partnership with GXO Logistics to enhance warehousing and transportation operations across the UK, Europe, and the US. Building on this success, GXO will now oversee operations in the Netherlands, with plans for further expansion into the US. This collaboration aims to optimize Castore's supply chain, ensuring seamless distribution to wholesale customers, retail stores, and e-commerce channels globally.

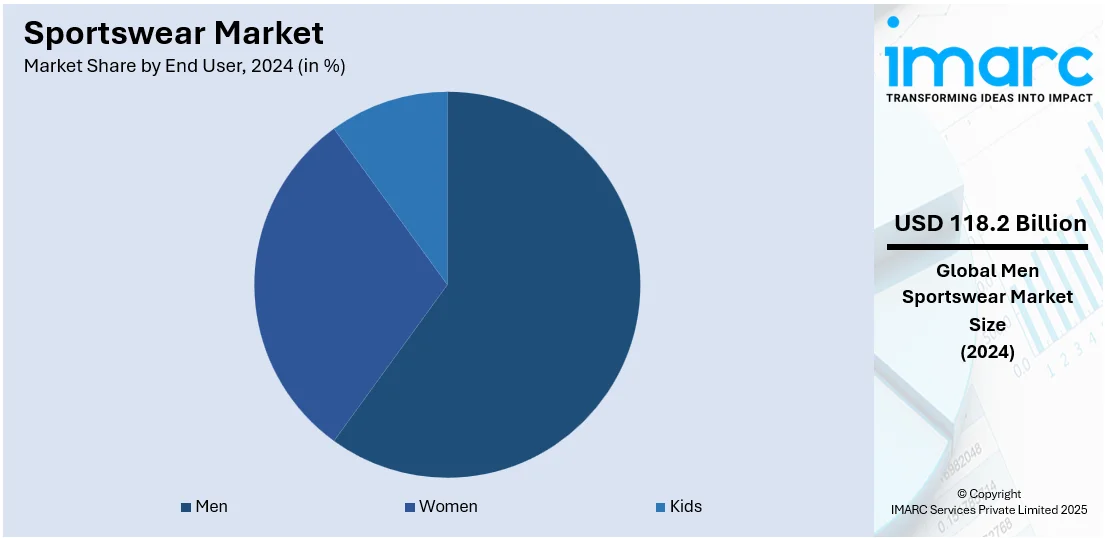

Analysis by End User:

- Men

- Women

- Kids

Men lead the market with around 59.8% of market share in 2024. The men's segment dominates the sportswear market due to consistently high participation in sports, fitness routines, and outdoor activities across various age groups. Men also tend to prioritize functionality and durability, driving demand for performance-oriented apparel and footwear. Established brand loyalty, combined with higher average spending per purchase, strengthens this segment’s market share. The continuous launch of new product lines tailored to male consumers—ranging from compression wear to specialized training gear—further reinforces growth. Marketing campaigns often target male audiences through sports sponsorships and athlete partnerships, enhancing visibility. Moreover, cultural emphasis on strength and athleticism supports steady demand within this segment globally. For instance, in December 2024, Liverpool-based athleisure brand Red Run expanded into menswear with the launch of its debut collection, ‘Drop 1’, featuring 10 essential wardrobe pieces. The expansion follows strong growth in womenswear and comes ahead of Red Run’s planned wholesale growth in 2025.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of over 33.2%. North America dominates the sportswear market due to a combination of high disposable income, a well-established fitness culture, and strong brand penetration across urban and suburban regions. The region's consumers demonstrate a consistent preference for performance-driven, comfortable apparel suited for both athletic and everyday use. Leading global and local brands maintain extensive retail networks and leverage advanced e-commerce capabilities to cater to evolving consumer expectations. Frequent collaborations with celebrities and influencers enhance market visibility, while continuous innovation in materials and design sustains consumer engagement. For instance, in February 2025, US-based Wilson Sporting Goods launched its first women’s-only tennis shoe, Intrigue, developed in collaboration with professional player Marta Kostyuk. Designed specifically for women’s feet, the shoe focuses on responsiveness, comfort, and agility. It features three technologies: UltraShield for breathable durability, FootFrame for customizable fit, and SwiftStep for enhanced responsiveness. Additionally, the popularity of home workouts, wellness trends, and hybrid work lifestyles further supports sustained demand for sportswear products.

Key Regional Takeaways:

United States Sportswear Market Analysis

In 2024, the United States held over 87.8% of the market share in North America. The United States sportswear market is primarily driven by the growing emphasis on health and fitness. In line with this, the rise in consumers prioritizing active lifestyles is also propelling the market growth. Additionally, the emergence of athleisure trends, where sportswear is worn beyond fitness activities, is significantly expanding the market scope. Furthermore, continual advancements in fabric technology, such as moisture-wicking and breathable materials, enhance the performance and comfort of sportswear, further driving consumer interest and product sales. The widespread influence of social media and celebrity endorsements, shaping consumer preferences and creating brand visibility, is supporting market demand. Similarly, the growth of e-commerce, with online sales reaching new heights, is impelling the market. Moreover, an ongoing shift toward sustainability, with eco-friendly and ethical production practices, is appealing to environmentally conscious consumers, thereby encouraging higher product adoption. Besides this, the inclusion of gender-neutral and diverse offerings ensures broad market appeal, driving further expansion of the sportswear market.

Europe Sportswear Market Analysis

The European sportswear market is experiencing significant growth, propelled by the increasing popularity of fitness-focused lifestyles. The 2024 European Health & Fitness Market Report showed a rise by 7.5% in memberships and a 14% increase in revenues to EUR 31.8 billion in 2023. The number of fitness clubs saw a modest increase of 1.4%, reaching nearly 65,000. Similarly, the popularity of major sporting events, such as the UEFA Champions League and the Olympics, is stimulating consumer interest and market appeal. Furthermore, the expansion of retail partnerships, especially with premium and boutique stores, is enhancing product accessibility. The continual technological advancements, such as smart textiles and wearables, appeal to the tech-savvy consumer, further supporting market demand. Additionally, rapid urbanization and active city living driving more people toward outdoor activities, is encouraging the widespread uptake of the product. The growing focus on mental well-being, including yoga and mindfulness, is augmenting sales of athleisure. The favorable environmental sustainability initiatives, such as the use of recycled materials, resonating with eco-conscious consumers is impelling the market. Moreover, the emerging trend of personalized sportswear is strengthening brand loyalty and ensuring sustained market growth.

Asia Pacific Sportswear Market Analysis

The market in Asia-Pacific (APAC) is expanding due to the rising popularity of athleisure as a mainstream fashion trend. In accordance with this, increasing disposable incomes, particularly in emerging economies, enabling consumers to invest in premium and performance-driven sportswear is impelling the market. Similarly, growth in sustainability, with brands incorporating recycled polyester and organic cotton to cater to environmentally conscious consumers, is fostering market expansion. The rise in e-commerce, supported by digital marketing and social media, is stimulating market appeal. Apart from this, strategic partnerships with regional celebrities and influencers are enhancing brand loyalty and positively impacting the market. Moreover, favorable government initiatives promoting sports participation and physical activities are bolstering a supportive environment for sustained market development.

Latin America Sportswear Market Analysis

In Latin America, the sportswear market is propelled by the changing consumer preferences and economic shifts. Similarly, the increasing popularity of local and international sporting events, such as the Copa Libertadores and regional marathons, is fueling demand for performance-oriented sports apparel in the market. Furthermore, the rise in international sports brands is expanding their presence through strategic retail investments, enhancing product availability across the region. In addition to this, growing middle-class income levels are driving premium sportswear purchases, thereby impelling the market. Besides this, continual advancements in fabric technologies, including moisture-wicking and temperature-regulating materials, are further attracting health-conscious consumers to the market.

Middle East and Africa Sportswear Market Analysis

The market in the Middle East and Africa is experiencing growth, due to the rising influence of fitness culture, driven by government initiatives promoting active lifestyles. In line with this, the rapid expansion of shopping malls and retail infrastructure enhancing consumer access to global brands is bolstering the market demand. Furthermore, a growing youth population with a strong inclination toward fashion and fitness is also propelling the market. Moreover, the increasing presence of international sporting events, such as the FIFA World Cup in Qatar, driving regional sports enthusiasm is expanding the market. The ongoing advancements in lightweight and breathable fabric technologies catering to hot and arid climates are further impacting the market trends.

Competitive Landscape:

The sportswear market is highly competitive, dominated by global players such as Nike, Adidas, and Puma, alongside rising brands like Under Armour, ASICS, and New Balance. These companies compete on performance innovation, brand visibility, pricing, and sustainability. Collaborations with athletes, designers, and cultural influencers are key strategies to capture consumer interest. The rise of niche and direct-to-consumer labels, particularly in athleisure and eco-friendly segments, is intensifying competition. E-commerce expansion and digital marketing are reshaping customer engagement, while regional players are gaining ground in specific markets. Continuous investment in technology, customization, and fast product turnaround is critical to maintaining market share. For instance, in March 2025, Under Armour signed a long-term agreement with the NFL to serve as the official provider of footwear and gloves. This renewed partnership reinforces Under Armour’s commitment to high-performance sportswear innovation, with products designed to enhance speed, grip, and overall athlete performance on the field. The deal also grants the brand access to NFL media platforms for increased visibility. Additionally, it supports grassroots programs and youth development through initiatives focused on advancing the future of athletic apparel and gear in football.

The report provides a comprehensive analysis of the competitive landscape in the sportswear market with detailed profiles of all major companies, including:

- Adidas AG

- Anta Sports Products Limited

- ASICS Corporation

- Columbia Sportswear Company

- Fila Inc.

- Lululemon Athletica Inc.

- New Balance Athletics Inc.

- Nike Inc.

- Patagonia Inc.

- Puma SE

- Under Armour Inc.

Latest News and Developments:

- April 2025: PUMA launched the Audacity Pack, a new line of football boots designed for bold, fearless play. The collection includes updated versions of the FUTURE 8, ULTRA 5, and KING silos, each tailored for different playing styles and featuring performance-enhancing technologies like FUZIONFIT³ uppers, GRIPCONTROL Pro, and SPEEDSYSTEM outsoles. The boots come in vibrant colorways and are available in unisex and women-specific fits, promoting inclusivity and optimized performance.

- February 2025: Adidas launched a new premium line called A-Type under its Adidas Originals label, targeting luxury consumers with refined versions of iconic products. The debut collection features elevated takes on the Superstar sneaker, Firebird tracksuit, and Airliner bag, crafted with premium materials like supple leather and cashmere. Handmade in Italy, the products reflect Adidas’ heritage while catering to modern tastes.

- January 2025: Adidas replaced Puma as the official clothing partner of the Mercedes-AMG Petronas Formula 1 Team in a deal reportedly worth over USD 30 Million. Adidas will supply clothing, footwear, and accessories for the entire team, including drivers and engineers. The collaboration aims to blend high performance with sophisticated style and will be available through Adidas, Mercedes F1 online platforms, and select retailers.

- February 2025: Nike and SKIMS introduced NikeSKIMS, a new brand focused on empowering women athletes with innovative, inclusive activewear. Combining Nike's performance expertise with SKIMS' body-positive design, the brand aims to disrupt the fitness industry. Its debut collection will launch in the U.S. this spring, with global expansion in 2026.

- October 2024: Nike unveiled new super shoes featuring Air Zoom technology for athletes, including Maxfly 2, Victory 2, G.T. Hustle 3, and Mercurial. Designed for sprinting, middle-distance running, basketball, and football, these shoes maximize energy return and enhance performance.

- October 2024: PUMA and fitness influencer Pamela Reif launched an athleisure collection inspired by the dynamic energy of volcanoes. The collection features form-fitting leggings, shorts, sports bras, tees, etc., crafted with PUMA's Cloudspun and Shapeluxe technologies. Available in Europe and selected regions, it combines style, comfort, and performance for confident, empowered women.

- October 2024: Nike launched the Tech Woven Suit, offering six new color options alongside the original black and cobalt. The suit, designed for movement, includes a full-zip jacket and customizable trousers. It is available globally at Nike.com and select retailers, with a reflective "Flash" color coming soon.

- July 2024: PUMA and Formula 1® unveiled a new collection inspired by the excitement and speed of motorsport. Featuring bold designs and functional materials, the collection includes footwear and apparel designed for F1® fans, reflecting the dynamic nature of the sport.

- January 2024: Platinum Equity acquired Augusta Sportswear Brands (ASB) and Founder Sport Group (FSG) to form a stronger, integrated player in the youth and recreational sportswear market. The merger aims to streamline operations, improve customer experience, and expand product offerings.

Sportswear Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shoes, Clothes |

| Distribution Channels Covered | Online Stores, Retail Stores |

| End Users Covered | Men, Women, Kids |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Anta Sports Products Limited, ASICS Corporation, Columbia Sportswear Company, Fila Inc., Lululemon Athletica Inc., New Balance Athletics Inc., Nike Inc., Patagonia Inc., Puma SE, Under Armour Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sportswear market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sportswear market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sportswear industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sportswear market was valued at USD 198 Billion in 2024.

The sportswear market is projected to exhibit a CAGR of 3.8% during 2025-2033, reaching a value of USD 277 Billion by 2033.

The sportswear market is driven by rising health awareness, increasing participation in fitness and sports activities, the popularity of athleisure, and demand for stylish yet functional apparel. Growth in e-commerce, sustainability preferences, and innovation in performance materials also contribute to the market’s continued expansion.

North America currently dominates the sportswear market, accounting for a share of 33.2% in 2024. The region’s dominance in the market is driven by high consumer spending, strong fitness culture, athleisure trends, and widespread brand presence.

Some of the major players in the sportswear market include Adidas AG, Anta Sports Products Limited, ASICS Corporation, Columbia Sportswear Company, Fila Inc., Lululemon Athletica Inc., New Balance Athletics Inc., Nike Inc., Patagonia Inc., Puma SE, Under Armour Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)