Sports Sunglasses Market Size, Share, Trends and Forecast by Type, Gender, Distribution Channel, and Region, 2025-2033

Sports Sunglasses Market Size and Share:

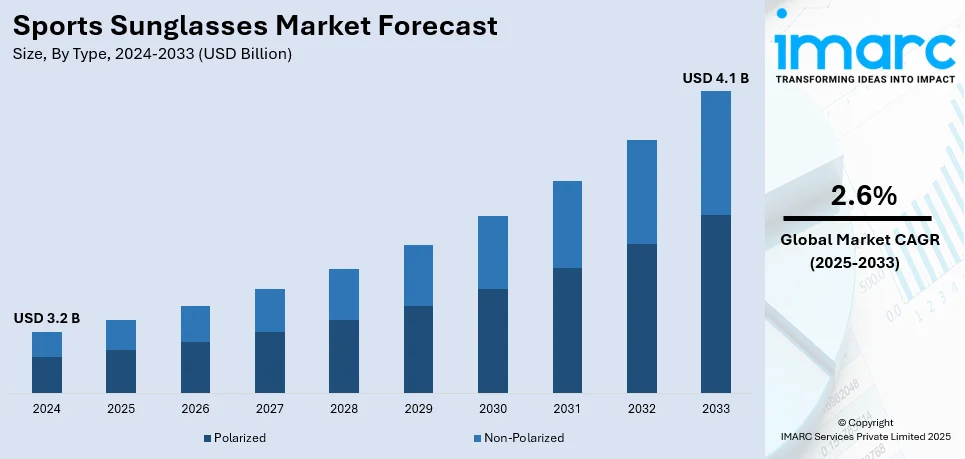

The global sports sunglasses market size was valued at USD 3.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.1 Billion by 2033, exhibiting a CAGR of 2.6% during 2025-2033. North America currently dominates the market, holding a significant market share of 36.8% in 2024. The rising participation in outdoor activities and the expansion of the e-commerce sector is propelling the market growth. Besides this, sports sunglasses market share is driven by the rising awareness among outdoor enthusiasts regarding the importance of eye protection.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3.2 Billion |

|

Market Forecast in 2033

|

USD 4.1 Billion |

| Market Growth Rate (2025-2033) | 2.6% |

Online platforms offer a vast selection of sports sunglasses, allowing athletes to compare brands and prices easily. E-commerce eliminates geographical barriers, enabling buyers to purchase high-quality sports eyewear from global manufacturers. Digital marketing strategies including targeted ads and influencer promotions enhance brand visibility and customer engagement online. Virtual try-on technologies help customers visualize sunglasses, increasing confidence in online purchases and reducing return rates. Customer reviews and ratings provide valuable insights, helping buyers make informed decisions about sports sunglasses’ performance. Subscription-based models and exclusive online discounts attract more buyers to purchase premium sports sunglasses digitally. Leading brands are partnering with major e-commerce platforms to expand their reach and increase product availability. Faster shipping options and hassle-free return policies enhance the overall online shopping experience for sports eyewear buyers. Artificial intelligence (AI)-driven recommendations personalize shopping experiences, suggesting sunglasses based on user preferences and activities, which is major factor strengthening the market growth.

The United States sports sunglasses market demand is driven by brand collaborations and athlete endorsements, which increases credibility. Leading eyewear brands are partnering with professional athletes to showcase performance, durability, and advanced technology in products. Sponsorships with US sports teams and leagues enhance brand visibility, attracting dedicated sports enthusiasts nationwide. In July 2024, Zenni Optical teamed up with USA Volleyball and 2024 US. Olympic Beach Volleyball athletes Taryn Kloth and Kristen Nuss to introduce a new sports performance sunglasses line. This partnership focuses on delivering eyewear that enhances both safety and athletic performance. Athlete endorsements create strong associations between premium sports sunglasses and elite athletic performance across multiple sports. Sports sunglasses companies collaborate with Olympic athletes, leveraging their influence to drive customer trust and sales. High-profile endorsements from NFL, NBA, and MLB players strengthen brand recognition among sports fans and athletes. Athlete-backed sunglasses include customized designs and sports-specific technologies, making them more appealing to US customers. Marketing campaigns featuring professional athletes generate excitement, encouraging fans to buy the same eyewear models. Exclusive limited-edition releases tied to sports personalities create demand and drive premium pricing strategies.

Sports Sunglasses Market Trends:

Rising awareness about harmful effects of Ultra-violet (UV) radiation

Awareness about the harmful effects of UV radiation on eye health is rising. The WHO reports that overexposure to UV radiation, an avoidable risk factor, contributes to 20% of cataract cases. A Johns Hopkins Medicine article highlights that UV exposure can cause lasting damage including corneal injury, cataracts, and macular degeneration. These conditions can eventually lead to impaired eyesight, making UV protection essential for long-term eye health. UV damage also results in dryness, wrinkles, sagging, loss of elasticity, and uneven skin pigmentation. Sports sunglasses with UV protection help decreases the risks of macular degeneration, cataracts, and photokeratitis. Athletes and outdoor enthusiasts rely on UV-blocking eyewear to prevent eye strain and long-term vision impairment. Increasing health awareness is leading athletes to prioritize protective sunglasses for both performance and everyday use. Manufacturers are integrating advanced UV-resistant coatings to enhance protection against prolonged sun exposure. Regulatory guidelines promoting UV protection further encourage athletes to invest in certified sports eyewear.

Increasing interest in sports activities

As more individuals participate in sports like running, cycling, tennis, skiing, and water sports, demand for specialized equipment including sports sunglasses is increasing. According to SFIA data for 2021, approximately 22.62 Million individuals played tennis in the United States. The growing trend of various sports among fans also encourages children to engage in athletic activities. Sports sunglasses play a crucial role in enhancing performance, protecting against environmental factors, and improving overall safety. Athletes rely on high-quality eyewear to reduce glare, block UV rays, and prevent eye strain during activities. Advanced lens technologies provide better visibility and impact resistance, making them essential for competitive and recreational sports. Sports brands are actively marketing specialized eyewear designed for different sports, further increasing demand. The expanding sports culture and increasing outdoor recreational activities contribute to the continuous demand for protective eyewear. These factors are significantly influencing the sports sunglasses market forecast, reinforcing the market’s strong growth trajectory.

Technological advancements

Technological advancements are fueling the growth of the market by enhancing performance and eye protection. Polarized lenses reduce glare from surfaces like water, snow, and roads, enhancing visibility and minimizing eye strain. Reports show that in 2023, the outdoor recreation participant base increased by 4.1%, reaching a record 175.8 Million. Moreover, advanced materials and coatings improve durability, ensuring long-lasting protection for athletes and outdoor enthusiasts. Smart sunglasses with adaptive lenses and augmented reality integration are gaining traction, further driving the market expansion. Lightweight frame technologies increase comfort, making sports sunglasses more suitable for extended wear during intense activities. Continuous innovations in UV protection and impact resistance are attracting both professional athletes and casual users. The rise of outdoor sports and recreational activities continues to increase demand for technologically advanced sports eyewear.

Sports Sunglasses Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sports sunglasses market, along with forecasts at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, gender, and distribution channel.

Analysis by Type:

- Polarized

- Non-Polarized

Polarized stand as the largest component in 2024, holding 65.8% of the market. The sports sunglasses market outlook indicates that polarized lenses effectively reduce glare from reflective surfaces like water, snow, and roads. This feature benefits athletes and outdoor enthusiasts participating in skiing, snowboarding, fishing, and water sports, where glare can hinder vision and cause eye strain. For example, in March 2023, Roshambo Eyewear introduced the Ludicrous Speed sports eyewear collection. The series featured two styles: kid’s snow goggles with magnetic lens shield attachments and a polarized wrap-around "blade" frame. Additionally, advanced polarization technology blocks harmful UV rays, protecting eyes from long-term damage during outdoor activities. Growing awareness about vision safety is prompting athletes to choose polarized sunglasses over non-polarized options. Continuous innovation in lens materials and coatings enhances durability, performance, and comfort for active users. Many professional athletes endorse polarized sunglasses, shaping customer preferences and reinforcing their market dominance. The availability of polarized lenses in multiple colors and styles attracts both sports professionals and casual users. Retailers are actively promoting polarized sunglasses through special discounts and advertisements, further strengthening their market growth.

Analysis by Gender:

- Male

- Female

- Unisex

In 2024, Male dominates the market, holding 54.5% of the market share. Increased involvement in activities such as cycling, running, skiing, golfing, and water sports is catalyzing the need for specialized eyewear for sports. Industry reports reveal that in 2023, men's participation in sports and outdoor activities was 20.7%, exceeding the female rate of 18%. Male athletes and outdoor lovers emphasize sturdiness, impact resistance, and UV shielding when choosing eyewear. Sports brands and manufacturers vigorously promote sunglasses for men, strengthening their leading position in the industry. Professional male athletes promote high-performance sunglasses, greatly impacting the buying choices of male sports fans globally. Male shoppers tend to prefer investing in high-end sports sunglasses equipped with sophisticated lens technologies and performance upgrades. The increasing popularity of cycling, skiing, and water activities among men is driving the need for sports eyewear. Men's sports sunglasses typically showcase striking designs, oversized frames, and durable looks to match their tastes. The rise in disposable income of male customers is leading to greater expenditures on premium and branded sports sunglasses. Specialty shops and online platforms provide a wide variety of sports sunglasses for men, enhancing accessibility. Trends in adventure tourism and outdoor fitness motivate men to purchase both stylish and protective eyewear. Promotional efforts aimed at men by major sports brands are enhancing brand loyalty and increasing customer engagement.

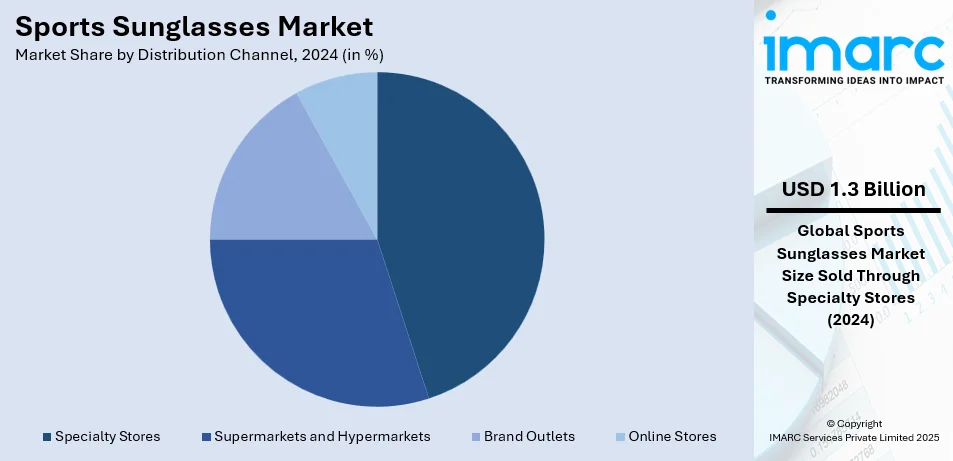

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Brand Outlets

- Online Stores

Specialty stores dominate the market with 42.0% of market share in 2024. Specialty stores offer expert guidance and personalized service, helping customers select the best sports sunglasses. Customers prefer trying on eyewear before purchasing to ensure a proper fit and optimal performance. These retailers provide premium sports eyewear brands, attracting professional athletes and serious sports enthusiasts. Exclusive collections and limited-edition designs in specialty stores drive higher customer foot traffic and engagement. Trained sales representatives educate buyers on lens technologies, polarization, and impact resistance for specific sport’s needs. Specialty retailers uphold high-quality standards, ensuring customers receive authentic and durable sports sunglasses. Leading sports brands prioritize specialty stores for new product launches and strategic brand-building initiatives. Professional athletes and sports teams collaborate with specialty retailers, enhancing brand credibility and customer trust. In-store customization services allow customers to personalize frames and lens colors to match their preferences. Loyalty programs and exclusive discounts encourage repeat purchases, strengthening long-term customer relationships.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, North America accounted for the largest market share of 36.8%. According to sports sunglasses market statistics, outdoor sports and recreational participation is rising across North America. The Outdoor Industry Association reported that in 2022, outdoor recreation participants grew by 2.3% to nearly 168 million. This figure represents 55% of the United States population aged six and above are engaged in outdoor activities. The increasing trend of adventure tourism and extreme sports is driving demand for durable, impact-resistant sunglasses. North America's well-developed retail infrastructure supports strong sales through specialty stores, online platforms, and brand outlets. Higher disposable incomes in the region, allows greater spending on premium sports sunglasses. Extensive marketing campaigns featuring professional athletes and celebrities enhance brand recognition and market penetration. Advanced product innovations, including smart sunglasses and adaptive lenses, are increasing demand for high-tech eyewear. A strong e-commerce presence ensures North American customers have easy access to various sports sunglasses. The region's changing climate conditions encourage year-round investment in UV-protective and polarized sunglasses. Sporting events, marathons, and outdoor fitness trends continue to drive demand for high-performance sports eyewear.

Key Regional Takeaways:

United States Sports Sunglasses Market Analysis

The United States possesses 83.20% of the market share in North America. The growing popularity of sports sunglasses in the United States is fueled by the developing sports culture and heightened demand for performance equipment. In 2023, the count of individuals engaged in sports and fitness hit an all-time high of 242 million, reflecting a 12.1% rise from 215.8 million in 2016. As increasing numbers of people participate in activities such as cycling, running, and outdoor sports, the demand for top-quality sports eyewear keeps rising. Athletes and outdoor lovers are increasingly finding sports sunglasses indispensable, as they provide UV protection, diminish glare, and enhance impact resistance. This transition to active living is motivating individuals to purchase specialized eyewear for improved functionality and performance enhancement. The advancement of sports culture via media, endorsements from influencers, and community activities enhances awareness and encourages participation. Sports professionals and fitness influencers significantly influence customer choices for premium athletic sunglasses. With rising worries about eye safety, more people are choosing eyewear that improves visibility and shields against external factors. The persistent focus on outdoor activities and fitness trends is driving the need for sports sunglasses across the area.

Asia Pacific Sports Sunglasses Market Analysis

In the Asia Pacific area, the increasing number of hypermarkets and supermarkets is leading to the rise in popularity of sports sunglasses. As of January 2025, India boasts 66,225 supermarkets, marking a 3.88% rise since 2023. The growth of retail networks has increased the availability of sports sunglasses to a broader range of customers, from casual fans to competitive athletes. Pricing competition and the ease of shopping in-store are impacting sales and user uptake. With the growth of these retail formats in both urban and rural regions, sports sunglasses are becoming vital for outdoor and recreational pursuits. Retailers are vital in informing customers about the advantages of sports sunglasses, rising awareness and demand. The growing middle class and enhanced purchasing power are catalyzing interest in health and wellness products. Sports sunglasses shield against UV rays and glare, improving performance in outdoor sports and activities. Marketing campaigns and in-store presentations are motivating customers to purchase high-quality sports eyewear. The existence of different styles and costs accommodates a variety of tastes throughout the region.

Europe Sports Sunglasses Market Analysis

In Europe, the growing number of sports events is driving the adoption of sports sunglasses. Reports indicate that sports and physical activities contribute £39 billion to the UK economy. The rise of professional and amateur tournaments is leading both athletes and spectators to recognize the importance of specialized eyewear. Sports sunglasses offer essential protection from UV rays, glare, and environmental factors, enhancing visibility and performance during competitive events. As outdoor sports like cycling, skiing, and running are gaining traction, more participants are seeking high-quality sunglasses tailored to their needs. Major sporting events including regional championships and international competitions, encourage athletes to invest in sports sunglasses for both functionality and style. Event organizers, sponsors, and sporting brands are increasingly emphasizing athlete well-being including eye protection, which influences adoption. The growing focus on eye protection at sporting events further drives the increasing demand for this specialized eyewear.

Latin America Sports Sunglasses Market Analysis

In Latin America, sports sunglasses are associated with the increased penetration of e-commerce. Statistics indicate that over 300 million people in the region are digital buyers, thereby pointing to online shopping trends. Since internet penetration has expanded, making digital platforms available to customers, the increase in sales for online purchases, especially of sports gears like sunglasses. Wider availability of products is now accessible through browsing and ordering from home, along with the availability of international brands. Online stores offer a wide variety, so athletes can find sports sunglasses that suit their needs. Increasing numbers of people are engaging in outdoor activities and healthy lifestyles, and thus there is a growing demand for good-quality, functional eyewear. Online stores offer competitive pricing, customer reviews, and virtual try-on, making shopping easier. There is also a tendency for customers to buy sports sunglasses online, motivated by discounts and exclusive deals plus fast delivery. The option of comparing brands or access to international trends influences a purchase decision all over Latin America.

Middle East and Africa Sports Sunglasses Market Analysis

In the Middle East and Africa, the rising adoption of sports sunglasses is driven by the increasing number of sports clubs. In 2022, the number of companies organizing sports events and training camps grew to 700, while sports academies reached 400. Gym and fitness centers are also expanding in number, each totaling 400, with Dubai’s sports clubs increasing to 100. As more individuals engage in activities like tennis, golf, and fitness training, demand for specialized eyewear is growing. Sports sunglasses provide essential eye protection and performance enhancement during outdoor training. Their integration into club offerings further reinforces their importance for both safety and performance.

Competitive Landscape:

Major companies are focusing on research and development (R&D) to improve durability, UV protection, and impact resistance. Collaborations with athletes and sports teams are enhancing brand recognition and customer confidence globally. Businesses are utilizing e-commerce platforms to connect with a wider audience and provide attractive pricing. Marketing initiatives that highlight professional athletes and influencers are establishing robust brand connections and driving demand. Ongoing technological innovations like photochromic and polarized lenses are enhancing both functionality and user satisfaction. For instance, in July 2024, Adidas introduced the DUNAMIS glasses, designed especially for the Summer Games. Drawing from the Greek idea of inner potential, this newest entry in the adidas Sport Eyewear line embodies the brand’s vibrant energy, athletic essence, and commitment to innovation and quality. Moreover, personalization features, like swapable lenses and style variations, are appealing to style-savvy customers. Entering emerging markets where sports participation is increasing is generating new business prospects. Sustainability efforts, such as eco-conscious materials and recyclable packaging are improving brand image and customer loyalty. Mergers and acquisitions assist companies in enhancing distribution channels and broadening international market presence. Pricing strategies that are competitive and promotional discounts are fostering greater acceptance among cost-sensitive customers.

The report provides a comprehensive analysis of the competitive landscape in the sports sunglasses market with detailed profiles of all major companies, including:

- Adidas AG

- Columbia Sportswear Company

- Decathlon S.A.

- EssilorLuxottica SA

- NIKE Inc

- PUMA SE

- Rudy Project S.p.A.

- Safilo Group S.p.A.

- Under Armour Inc.

Latest News and Developments:

- September 2024: Voyage Eyewear introduced the DRIFT Collection, a high-performance sports sunglasses line in India. Designed for sports enthusiasts, it blends advanced technology with a sleek, modern design. The sunglasses provide superior comfort, durability, and enhanced visual clarity for active users.

- July 2024: Oakley unveiled new sunglasses at the 2024 Olympics, with 2,000 athletes showcasing their innovative designs. The QNTM Kato, debuting in Paris, features advanced lens geometry for a close-to-the-face fit, enhancing performance. Additionally, the Inner Spark Collection introduces frames inspired by the dynamic movement of the human nervous system.

- April 2024: Article One and Ciele Athletics collaborated to introduce the GTGlass 2.0 sunglasses, designed for athletes and outdoor enthusiasts. Featuring durable hexetate frames and CR-39 polarized lenses, they offer superior UVA/UVB protection and reduce road glare. These sunglasses provide enhanced visibility, making them ideal for cycling and other outdoor activities.

- January 2024: VALLON Sunglasses launched the Watchtowers, a new eyewear design tailored for cycling enthusiasts. These sunglasses combine modern aesthetics with functional features, ensuring optimal protection for cyclists. The lightweight yet durable frames provide long-lasting comfort during extended rides. Equipped with advanced lens technology, they enhance clarity and visibility in diverse outdoor conditions.

Sports Sunglasses Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Polarized, Non-Polarized |

| Genders Covered | Male, Female, Unisex |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Brand Outlets, Online Stores |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Adidas AG, Columbia Sportswear Company, Decathlon S.A., EssilorLuxottica SA, NIKE Inc, PUMA SE, Rudy Project S.p.A., Safilo Group S.p.A., Under Armour Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, sports sunglasses market outlook, and dynamics of the market from 2019-2033.

- The sports sunglasses market research report provides the latest information on the market drivers, challenges, and opportunities in the global market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sports sunglasses industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sports sunglasses market was valued at USD 3.2 Billion in 2024.

The sports sunglasses market is projected to exhibit a CAGR of 2.6% during 2025-2033, reaching a value of USD 4.1 Billion by 2033.

The sports sunglasses market growth is driven by rising awareness about UV protection, increased participation in outdoor sports, and advancements in lens technology. The rise in health consciousness and outdoor activities increases demand for eyewear offering comfort, durability, and enhanced performance. Brand collaborations, athlete endorsements, and e-commerce growth also contribute to market expansion.

North America currently dominates the sports sunglasses market, accounting for a share of 36.8% in 2024. The advanced retail network in the region, featuring specialty stores and e-commerce platforms, provides convenient access to high-end sports eyewear. Additionally, the growing participation in outdoor sports like cycling, skiing, and running further strengthens market growth. The region’s climate conditions also drive year-round demand for UV-protective and polarized eyewear, contributing to its dominant market position.

Some of the major players in the sports sunglasses market include Adidas AG, Columbia Sportswear Company, Decathlon S.A., EssilorLuxottica SA, NIKE Inc, PUMA SE, Rudy Project S.p.A., Safilo Group S.p.A., Under Armour Inc., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)