Sports Medicine Market Size, Share, Trends and Forecast by Product, Application, End-User, and Region, 2026-2034

Sports Medicine Market Size and Share:

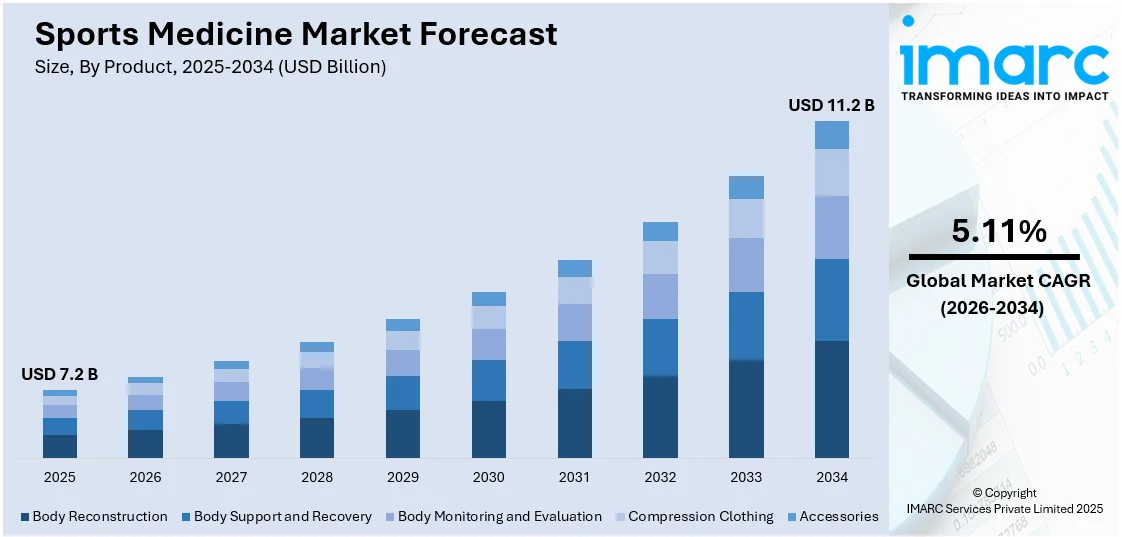

The global sports medicine market size was valued at USD 7.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 11.2 Billion by 2034, exhibiting a CAGR of 5.11% during 2026-2034. North America currently dominates the market, holding a significant market share of over 45.6% in 2025. Increasing sports participation, rising awareness of preventive care, ongoing technological advancements, surging sports injuries, increased research, and development (R&D) funding, growing healthcare expenditure, escalating emphasis on personalized care, and the advent of telemedicine are some of the factors fueling the sports medicine market demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 7.2 Billion |

| Market Forecast in 2034 | USD 11.2 Billion |

| Market Growth Rate (2026-2034) |

5.11%

|

The market is growing significantly, as more individuals are suffering from sports-related injuries, while also engaging in sports and other fitness programs and activities. Rising awareness of the need to stay fit and healthily active is promoting adoption of injury prevention measures that require the latest in sports medicine. Technologically advanced products, which include minimally invasive surgical devices, are also contributing to the sports medicine market growth. For example, on September 9, 2024, temple ortho biologics has emerged as a pioneering company focused on advancing sports medicine solutions, with a special emphasis on orthobiologic therapies for women and youth athletes. Their flagship product, TX-33, combines advanced biomaterials with targeted drug delivery to prevent scar tissue post-injury or surgery, aiming to enhance recovery for athletes and active individuals. Another significant driver for the market is the increasing aging population and recreational sports, as age-related conditions such as osteoarthritis and muscle wear require specific treatments. Furthermore, expansion of the healthcare infrastructure around the globe and improved access to sports medicine services are allowing for wider market reach.

To get more information on this market Request Sample

The United States holds a notable sports medicine market share due to the increasing interest in early diagnosis and treatment of musculoskeletal injuries, primarily as a result of integrating advanced imaging technologies and diagnostic tools. Increasing lifestyle diseases like obesity and cardiovascular diseases are encouraging people to engage in structured exercise routines, which is further fueling the demand for preventive and therapeutic sports medicine solutions. Furthermore, collaborations and strategic agreements of key players within the healthcare and medical technology sector. For instance, on November 14, 2024, Johnson & Johnson MedTech revealed an exclusive U.S. commercial distribution partnership with Responsive Arthroscopy Inc., a company that specializes in sports soft tissue repair solutions. This strategic partnership aims to enhance Johnson & Johnson's sports medicine portfolio, providing advanced soft tissue repair options for shoulder, foot, and ankle procedures.

Sports Medicine Market Trends:

Increasing Participation in Sports and Physical Activities

The increasing participation rate in physical activities across the globe is bolstering the market growth. The rise of fitness trends across all age groups has considerably surged the prevalence of sports-related injuries, which is further fostering the market growth. For instance, in the US, there are about 1,00,000- 2,00,000 cases of anterior crucial ligament (ACL) ruptures in the country every year, especially prevalent among recreational and professional athletes. Furthermore, the shifting focus on health and wellness has heightened consumer interest in achieving peak physical fitness, which has further propelled the demand for preventive as well as curative sports medicine services. sports medicine market trends indicate a growing preference for minimally invasive treatments, innovative therapies, and advanced rehabilitation techniques, which are significantly driving the market expansion.

Rising Awareness About Preventive Care and Injury Management

Escalating awareness related to preventive care and injury management is propelling the sports medicine market revenue. Studies show that the availability of early intervention and preventive sports medicine services can cut sports injuries by 20%-30%. This reflects an increased uptake of the services. Since 2020, there has been a 35% increase in consumer inquiries about the prevention of sports injuries due to increased availability of health information via the internet, media, and campaigns. The surging understanding of the advantages of early intervention and preventive sports medicine services is aiding market expansion. Concurrently, the growing access to health information through the internet, media, and educative campaigns is positively impacting the market growth. Apart from this, the expanding demand for advanced diagnostic tools, therapeutic products, and rehabilitation programs among sports medicine professionals to maintain the best physical health and performance is another factor impelling the sports medicine industry growth.

Advancements in Technology and Innovation

The continuous technological development and innovations in the industry to deliver enhanced medical care for players are bolstering the sports medicine market value. In confluence with this, advancement in wearable technology, such as motion capture systems, wearable technology, and biomechanical analysis has enabled a better understanding of physical performance and injury risk, thus propelling the market forward. The national heart, lung, and blood institute reports that one of three Americans uses a wearable technology device, such as a smartwatch or fitness band, for tracking health and fitness. That would amount to around 33% of the entire adult population in the United States. Apart from this, significant improvements in imaging technology, such as high-resolution magnetic resonance imaging (MRI) and computed tomography (CT) scans have enhanced the accuracy of diagnoses and treatment planning, providing an impetus to the sports medicine market outlook.

Sports Medicine Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global and regional levels for 2026-2034. Our report has categorized the market based on product, application, and end-user.

Analysis by Product:

- Body Reconstruction

- Fracture and Ligament Repair Products

- Arthroscopy Devices

- Implants

- Orthobiologics

- Prosthetics

- Body Support and Recovery

- Braces and Supports

- Physiotherapy

- Thermal Therapy

- Ultrasound Therapy

- Laser Therapy

- Electrostimulation Therapy

- Body Monitoring and Evaluation

- Cardiac Monitoring

- Respiratory Monitoring

- Hemodynamic Monitoring

- Musculoskeletal Monitoring

- Compression Clothing

- Accessories

- Bandages

- Disinfectants

- Tapes

- Others

Body reconstruction leads the industry with around 40.2% of the sports medicine market share in 2025. The sports medicine market forecast reveals the demand for body reconstruction is driven by the increasing prevalence of sports-related injuries, which necessitates advanced surgical interventions and rehabilitation solutions. The growing demand for effective treatments for complex musculoskeletal injuries, such as torn ligaments and fractures is strengthening the market growth. Besides this, the escalating awareness and focus on long-term recovery and functionality also fuel demand for sophisticated reconstruction procedures and products. Moreover, technological advancements in surgical techniques and materials, including minimally invasive procedures and bioengineered implants, significantly enhance the efficacy of body reconstruction, leading to improved patient outcomes and shorter recovery times. Apart from this, the expanding adoption of personalized medicine, tailored specifically to individual anatomical and physiological needs is further bolstering sports medicine demand.

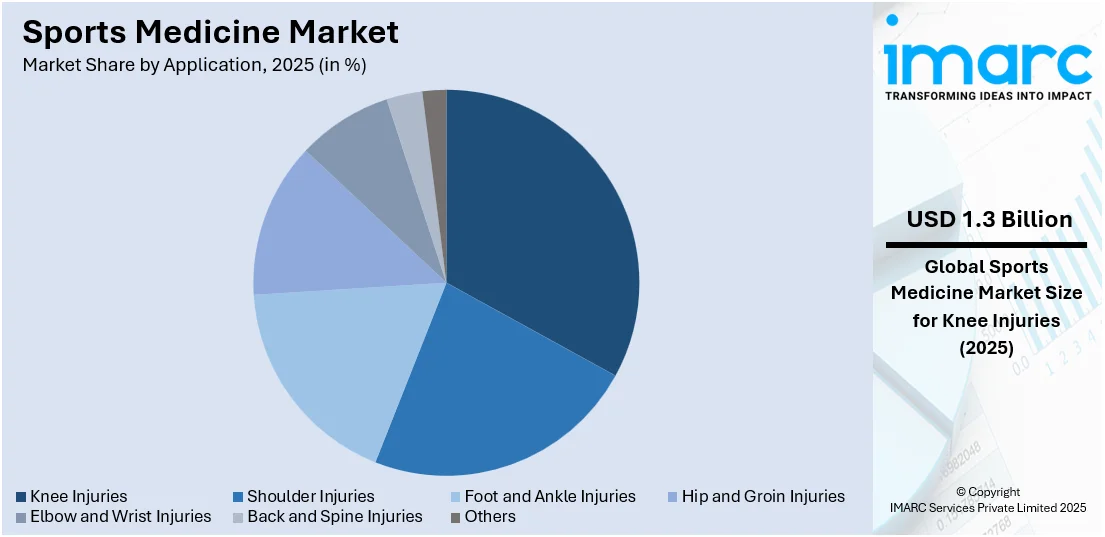

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Knee Injuries

- Shoulder Injuries

- Foot and Ankle Injuries

- Hip and Groin Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Others

Knee injuries lead the market with around 18.7% of market share in 2025. The increasing prevalence of sports-related knee injuries, which are common in both professional and recreational athletes due to high-impact and repetitive activities is presenting lucrative opportunities for market expansion. The rise in number of individuals participating in sports and fitness activities further exacerbates this demand, leading to a higher incidence of knee injuries such as ACL tears, meniscus damage, and ligament strains. Additionally, the escalating awareness regarding the importance of early diagnosis and effective treatment for knee injuries has led to greater demand for specialized medical solutions, including advanced diagnostic imaging and innovative surgical techniques. Furthermore, the rising focus on injury prevention and rehabilitation in sports is also driving the demand for knee-specific products and therapies, such as braces, physical therapy equipment, and regenerative treatments.

Analysis by End-User:

- Hospitals

- Orthopedic Specialty Clinics

- Fitness and Training Centers

- Ambulatory Surgical Centers (ASCs)

- Others

Hospitals dominate the market with around 52.3% of market share in 2025. Based on the sports medicine market research report, the demand for these products in hospitals is driven by the increasing need for specialized care and advanced surgical procedures for sports-related injuries. The growing prevalence of sports injuries and the complexity of these cases require the expertise and resources available in hospital settings, which are equipped with state-of-the-art diagnostic and treatment technologies. Additionally, the widespread adoption of minimally invasive surgical (MIS) techniques and the need for comprehensive rehabilitation services are pushing athletes and patients toward hospitals that offer these advanced options. Concurrent with this, the rising number of sports-related activities and professional sports events globally is further influencing market growth, with hospitals playing a crucial role in managing both acute and chronic injuries.

Regional Analysis:

To get more information on the regional analysis of this market Request Sample

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- Latin America

In 2025, North America accounted for the largest market share of over 45.6%. The sports medicine market report shows that North America leads the industry with its increasing prevalence of sports-related injuries and a growing focus on preventative care and rehabilitation. In addition to this, a significant rise in sports participation across all age groups, from youth to adults, has heightened the demand for advanced sports medicine solutions. The region's strong emphasis on health and fitness, bolstered by a high rate of gym memberships and recreational sports involvement, further propels market growth. In confluence with this, North America also benefits from a robust healthcare infrastructure and substantial healthcare spending, which supports the adoption of innovative sports medicine technologies and treatments. Furthermore, the presence of leading sports medicine companies and research institutions in the region fosters continuous advancements and product development, fostering market expansion.

Key Regional Takeaways:

United States Sports Medicine Market Analysis

In 2025, the United States accounted for the largest market share in North America of over 88.10%. The U.S. market for sports medicine is expected to boom in the forthcoming years as the participation for sports and other recreational activities tends to rise. According to an industrial report, in 2023, over 60 million Americans participated in fitness-related activities, driving demand for sport injury treatments. The advance of minimally invasive procedures with regenerative medicine, PRP therapy, is also backing up the market. The American orthopaedic society for sports medicine estimated that 3.5 million injuries were treated every year in the United States. Coordination between sports organizations and healthcare providers has fostered the use of advanced therapies. Market leaders like Arthrex and Smith & Nephew are diversifying product lines to remain competitive. Increasing insurance coverage for sports injuries and consumer awareness also propel growth. Rehabilitation and performance enhancement further expand the scope of market opportunities for U.S.-based companies domestically and abroad.

Europe Sports Medicine Market Analysis

European sports medicine is rising steadily, with more individuals becoming aware of and gaining governmental support for sports. As per an industrial report, close to 38% of the Europeans are reported to take part in regular physical activities, thus creating an attractive demand for injury management solutions. Germany leads this region with a market focus on innovative therapies, such as stem cell treatment for sports injuries, thanks to its robust healthcare infrastructure. According to the European sports medicine association, more than 1.2 million knee injuries were treated in Europe annually. Companies, such as Stryker and DJO Global, are investing in R&D for new products catering for the needs of professional and recreational users. EU regulations relating to the innovation and safety of medical devices further supports product adoption. Training programs and sports injury prevention initiatives by national governments also contribute to the region's expanding market potential.

Asia Pacific Sports Medicine Market Analysis

The Asia Pacific market is developing sports medicine in regard to high sports participation and investment by the governments. The one-year sports injury prevalence among 10,998 Japanese collegiate athletes has reported that 50% are athletes who have developed this particular injury. The males have this 52% rate, which surpasses the females with 46.7%. The Thai national team during the 2017 Southeast Asian Games had a ten percent male injury rate and 6.6% female injury rate. These statistics reflect the increasing demand for sports injury prevention and rehabilitation solutions. The Indian government's allocation of INR 1,000 crore (approximately USD 120 Million) to the Khelo India program in the 2023-24 budget also emphasizes the focus on sports infrastructure development and injury management. Investments in advanced treatment modalities, coupled with the increasing popularity of competitive sports, make the Asia Pacific a dynamic market for sports medicine innovation and growth.

Latin America Sports Medicine Market Analysis

The Latin American sports medicine market is expanding due to increased participation in sports and investment in healthcare. A study on professional football in Latin America reported that the incidence of training injuries was 3.2 injuries per 1,000 hours, and match injury incidence was 20.9 injuries per 1,000 hours. Ligament injuries were significantly higher in South American teams than in European teams, placing a heavy burden on orthopedic services. The sports infrastructure investments and preparations of international events create demand in Brazil, with the region leading in that area. Zimmer Biomet and Breg are a few major players that will be seeking collaborations with local suppliers to take advantage of their services. Mexico's healthcare report says its sports medicine market expanded 12% in 2023 through public and private sector investment. Increasing awareness of injury management and post-treatment rehabilitation further places Latin America as a dynamic market.

Middle East and Africa Sports Medicine Market Analysis

The sports medicine market in the Middle East and Africa is expanding due to more investments in sports infrastructure as well as healthcare. Recently, a press release highlighted that Saudi Arabia is under an agreement between Alpha Jossor Investments and Blockchain Sports Ecosystem to build a USD 3.3 Billion complex for sports. This fits in with Saudi Vision 2030's targets as it will boost sports involvement from 13% to 40% of the population. Advanced sports hubs, including a football academy, will be included, emphasizing injury prevention and rehabilitation needs. More than USD 2 billion annually is invested in sports, aiming at developing infrastructure and healthcare for enhanced improvement of demand for sophisticated sports medicine solutions. Such activities are expected to spur the economy by USD 22 Billion in addition to more than 100,000 jobs in the sporting industry and its supporting areas. Collaborations for digital athlete identity platforms and talent scouting further position the region as a growing hub for sports medicine innovation.

Competitive Landscape:

Some of the key sports medicine companies are actively engaging in a variety of strategic initiatives to maintain their competitive edge and drive the market growth. Many are investing heavily in R&D to innovate and enhance their product offerings, focusing on advanced technologies such as wearable devices, robotics, and regenerative medicine. They are increasingly incorporating cutting-edge materials and designs into their products to improve performance and safety for athletes at all levels. Additionally, these companies are also expanding their portfolios through strategic partnerships and acquisitions to broaden their market reach and diversify their solutions. Collaborations with sports teams, medical institutions, and research organizations help in developing and validating new technologies and treatment methods.

The report provides a comprehensive analysis of the competitive landscape in the sports medicine market with detailed profiles of all major companies, including:

- Arthrex

- Smith & Nephew PLC

- Medtronic PLC

- Wright Medical Group

- Bioventus LLC

- Stryker Corporation

- Mueller Sports Medicine

- RTI Surgical Holdings

- Breg

- Conmed Corporation

- Performance Health International Limited

- Bauerfeind AG

- KARL STORZ GmbH & Co. KG

- Zimmer Biomet Holdings

Recent Developments:

- November 2024: RTI Surgical has announced, that it has closed the acquisition of Collagen Solutions. The acquisition expands RTI's biomaterials portfolio, establishing a strong presence in cardiac, sports medicine, orthopedics, and plastic surgery high-growth therapeutic areas. The companies bring more than 50 years of combined experience in regenerative medicine.

- February 2024: Smith & Nephew reported that the company launched its enhanced portfolio in sports medicine at AAOS 2024 Annual Meeting, including CARTIHEAL AGILI-C Cartilage Repair Implant and REGENETEN Bioinductive Implant. Both are supported by clinical evidence that should improve biological healing in soft tissue repair and advance patient outcomes.

- January 2024: Arthrex launched a new patient-focused online resource, TheNanoExperience.com, which highlights the benefits of Nano arthroscopy, a minimally invasive orthopedic procedure. This innovative technology uses a high-quality camera at the tip of a needle-like device, allowing surgeons to diagnose and treat injuries in small joints such as the wrist, ankle, and elbow with minimal disruption to surrounding tissues. This development underscores Arthrex's commitment to advancing minimally invasive surgical (MIS) technologies and improving patient outcomes in sports medicine.

- January 2024: Smith & Nephew completed the acquisition of a novel cartilage regeneration technology, Agili-C, for sports medicine knee repair. This technology has shown superiority over current standards of care, such as microfracture and debridement, for treating knee joint surface lesions. The acquisition, valued at up to USD 330 Million, is expected to significantly enhance Smith & Nephew's capabilities in regenerative therapy and knee repair.

- March 2023: Stryker announced the release of its new Mako Total Knee 2.0 application, which is part of the Mako SmartRobotics™ system. This advancement enhances the precision of knee replacement surgeries by integrating 3D CT-based planning with haptic technology, allowing surgeons to execute highly personalized surgical plans with greater accuracy. The improved system aims to reduce variability in surgery and improve patient outcomes, positioning Stryker at the forefront of technological innovation in orthopedic and sports medicine solutions.

Sports Medicine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Knee Injuries, Shoulder Injuries, Foot and Ankle Injuries, Hip and Groin Injuries, Elbow and Wrist Injuries, Back and Spine Injuries, Others |

| End Users Covered | Hospitals, Orthopedic Specialty Clinics, Fitness and Training Centers, Ambulatory Surgical Centers (ASCs), Others |

| Regions Covered | North America, Europe, Asia Pacific, Middle East and Africa, Latin America |

| Companies Covered | Arthrex, Smith & Nephew PLC, Medtronic PLC, Wright Medical Group, Bioventus LLC, Stryker Corporation, Mueller Sports Medicine, RTI Surgical Holdings, Breg, Conmed Corporation, Performance Health International Limited, Bauerfeind AG, KARL STORZ Gmbh & Co. kg, Zimmer Biomet Holdings, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sports medicine market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global sports medicine market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the sports medicine industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

Sports medicine focuses on preventing, diagnosing, and treating sports-related injuries while enhancing physical performance. It includes surgical and non-surgical interventions, rehabilitation, and advanced technologies for athletes and active individuals.

The sports medicine market was valued at USD 7.2 Billion in 2025.

IMARC estimates the global sports medicine market to exhibit a CAGR of 5.11% during 2026-2034.

Key drivers include increasing sports participation, awareness of preventive care, technological advancements, rising sports injuries, an aging population, expanding healthcare infrastructure, and the advent of telemedicine.

Body reconstruction leads the market, driven by demand for advanced surgical interventions for injuries like torn ligaments and fractures.

Knee injuries dominate the market due to the prevalence of sports-related knee injuries and rising participation in fitness activities.

Hospitals lead the market due to their advanced surgical capabilities and comprehensive rehabilitation services.

North America dominates the market driven by robust healthcare infrastructure, high sports participation, and technological innovation.

Key players include Arthrex, Smith & Nephew PLC, Medtronic PLC, Wright Medical Group, Bioventus LLC, Stryker Corporation, Mueller Sports Medicine, RTI Surgical Holdings, Breg, Conmed Corporation, Performance Health International Limited, Bauerfeind AG, KARL STORZ Gmbh & Co. kg, and Zimmer Biomet Holdings, among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)