Sports Betting Market Size, Share, Trends and Forecast by Platform, Betting Type, Sports Type, and Region, 2025-2033

Sports Betting Market Size and Share:

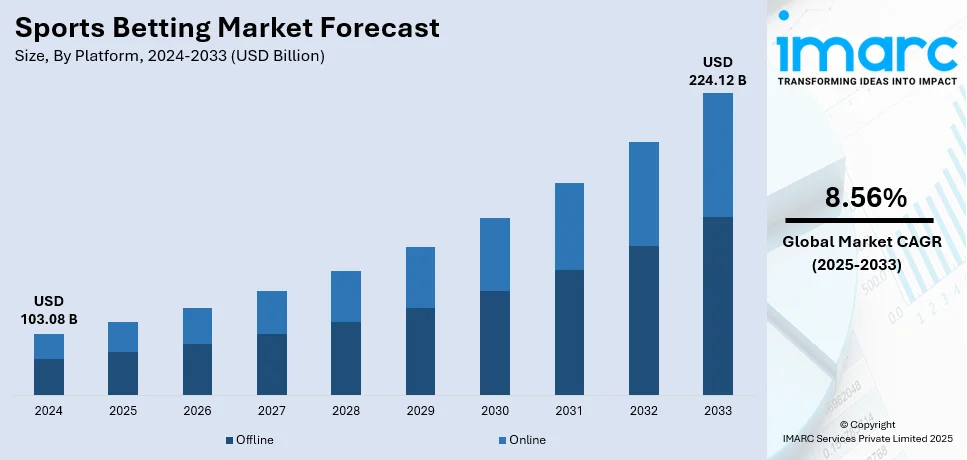

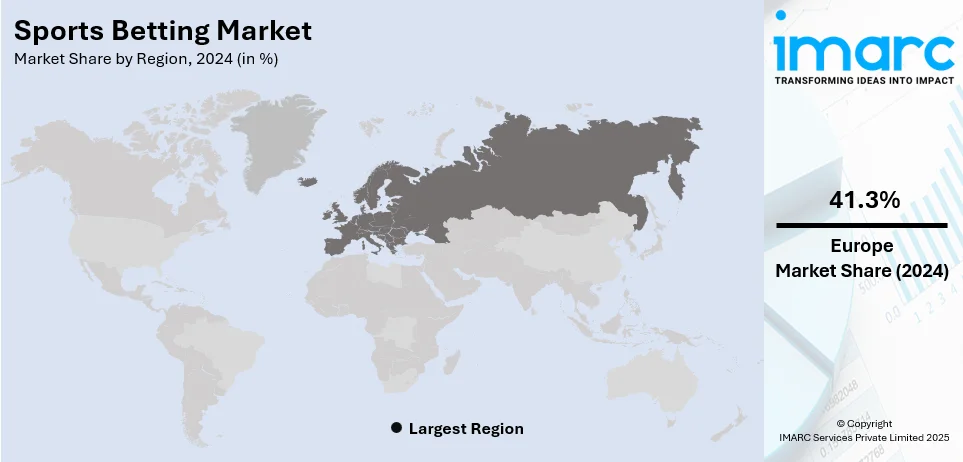

The global sports betting market size was valued at USD 103.08 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 224.12 Billion by 2033, exhibiting a CAGR of 8.56% from 2025-2033. Europe currently dominates the market, holding a market share of over 41.3% in 2024. The regional sports betting market share is mainly driven by the rising popularity of e-sports and competitive gaming, heightened adoption of advanced technologies, and increasing demand for personalized and ergonomic gaming peripherals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 103.08 Billion |

|

Market Forecast in 2033

|

USD 224.12 Billion |

| Market Growth Rate 2025-2033 | 8.56% |

Sports betting is now becoming very common with the high use of digital and mobile platforms. With the proliferation of smartphones and high-speed internet, mobile betting applications have become a dominant channel for users to place bets. These platforms offer unmatched convenience, allowing users to access a wide variety of betting options from anywhere, at any time. Other than the benefit of convenience, mobile betting also often possesses features such as an easy user interface, real-time data analytics, and recommendations made based on previous performances and so forth. Innovations in mobile betting are increasingly coupled with those found in live or in-play betting, through which users place their bets while an event is underway. It would also make provision for users to watch their favorite events via a live streaming feature that integrates live streaming services in mobile betting applications, thereby impelling the sports betting industry growth.

The United States has emerged as a major region in the sports betting market owing to various reasons. The significant driving force behind the rapid entry into sports betting is the increasing legalization of sports gaming in many states across the country. May states have legalized sports gaming while several other states are considering legislation. Each state takes a different approach, ranging from allowing in-person betting only to retail and online, and increasing numbers take a mobile-first framework. In actual fact, mobile and online platforms dominate the US sports betting industry: they account for more than half of all bets taken in states that have legalized this activity. Their popularity stems primarily from the broad penetration of smartphone availability, along with the improvements seen in app usability and internet broadband speed. BetMGM launched its mobile sports betting app in 2024 across Washington D.C. It provided the chance to enjoy the BetMGM sports wagering experience together with rewards linked with both MGM Resorts and Marriott Bonvoy destinations.

Sports Betting Market Trends:

The Rising Global Popularity of Sports

The global popularity of sports is expanding the sports betting market share. Sports like basketball, football (soccer), tennis and cricket have a huge fan base that transcends the world. These sports are supported by well-established professional leagues and tournaments that attract millions of viewers and participants. Examples are the FIFA World Cup and Olympics, which arouse enormous global interest and enhance significant betting activity. Another region-specific league examples are IPL of cricket and EPL of football, which give a positive signal to the market forecast for sports betting. With growing streaming services and social media platforms, which make sports content more available than before, a large number of people follow and even bet on various sports events. GITNUX research report also says that in the global sport industry revenue, 26% comes directly from money generated from the media and sponsorship.

Significant Technological Advancements

Technological innovations have dramatically changed the landscape of sports betting, which makes it more convenient and accessible. Available anywhere and anytime through ubiquitous smartphones and fast internet, bettors now can wager easily through their mobile devices. According to reports, the number of smartphone users is expected to reach 6 billion globally by 2027. Mobile betting apps have made it easier and facilitated features like live streaming of sports events, real-time odds, and instant payment options. AI and data analytics also enable much more precise prediction and personalized experiences while betting. Blockchain technology is also being integrated, enhancing security, openness, and trust in transactions. These innovations in technology are attracting new customers and also retaining previous ones by offering an incredible experience in betting.

Legalization and Regulatory Developments

The legalization and regulation of sports betting in various regions have been influential in increasing the sports betting market size. Regions that once possesses stringent anti-gambling laws are now recognizing the potential economic advantages of legal sports betting, such as increased tax revenues and job creation. For instance, the U.S. Supreme Court's 2018 decision to overturn the Professional and Amateur Sports Protection Act (PASPA) has sparked a wave of legalization across multiple states. This shift has untapped new markets and drawn substantial investments from major industry players. Furthermore, regulated markets provide safer environments for bettors, mitigating the risks linked to illegal betting activities. As per a report by the AMERICAN GAMING ORGANIZATION, legalizing sports betting could possibly generate USD 8 Billion in local taxes, offering hundreds of job opportunities, and adding USD 22.4 Billion to the gross domestic product (GDP).

Sports Betting Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global sports betting market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on platform, betting type, and sports type.

Analysis by Platform:

- Offline

- Online

Online stand as the largest component in 2024, holding 67.5% of the market. The online betting is dominating the market, due to its unique access and convenience. According to GITNUX, the global online gambling market, which includes sports betting is expected to reach USD 127.3 Billion by the year 2027. Users can place bets from virtually anywhere, at any time, using their smartphones or computers. Advanced integrations of live streaming, in-play betting, and secure payment options really enhance user experience. Additionally, online platforms often present a wider variety of bets and lower odds compared to traditional street betting shops which brings a bright sport betting market forecast report. Online sports betting apps really have made this experience even more accessible.

Analysis by Betting Type:

- Fixed Odds Wagering

- Exchange Betting

- Live/In Play Betting

- Pari-Mutuel

- eSports Betting

- Others

Fixed odds wagering leads the market with 28.2% of market share in 2024. The market share for fixed odds wagering is the biggest one because of the clear nature. Bettors are aware precisely what they stand to win based on the odds provided at the time of placing their bets. Such predictability and transparency are fundamental for any kind of novice and experienced bettors, since they simplify decision-making and the managing of expectations effectively. Besides, fixed odds betting is the oldest form of sports betting, and it's very intense in the culture of betting for hundreds of years. This experience makes it the most favorite choice by many bettors. Fixed odds wagering offers full transparency; this is an essential requirement for establishing trust between the operators and the bettors. At the time of making the wager, there is a clear display of odds and possible payouts, leaving no room for ambiguity or confusion. The outcome of losing or winning is clearly put before the bettor, thereby enabling him to make the right decisions with the information at hand.

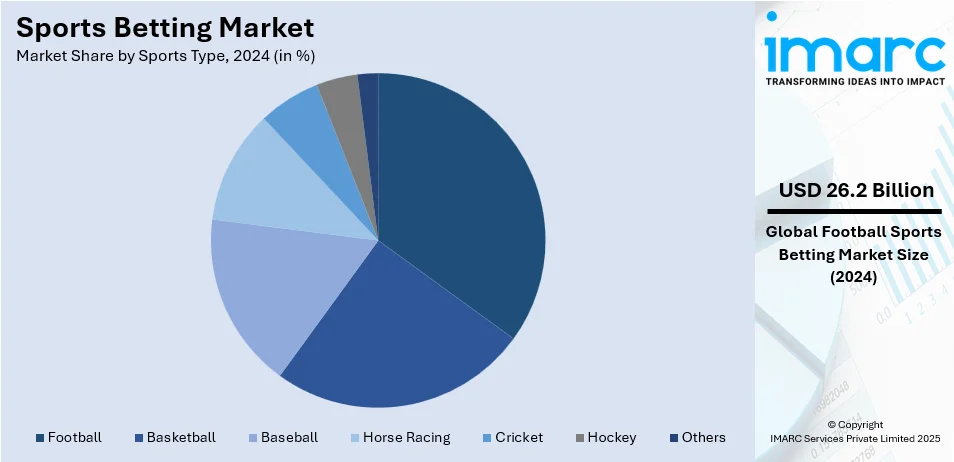

Analysis by Sports Type:

- Football

- Basketball

- Baseball

- Horse Racing

- Cricket

- Hockey

- Others

Football leads the market with 25.4% of market share in 2024. Football is the largest segment in the sports betting market due to its immense global popularity and expansive fan base. According to FIFA, the 2018 FIFA WORLD CUP RUSSIA, had an approximate global betting turnover of 2.1 Billion Euros, with the final between Croatia and France generating approximately 7.2 Billion Euros. Major football leagues and tournaments, such as the FIFA World Cup, UEFA Champions League, and the English Premier League, draw billions of viewers globally, creating countless betting opportunities. The frequent matches and extensive media coverage of the sport further amplify betting activity. Additionally, the straightforward nature of the game and its widespread accessibility contribute significantly to its dominance in the sports betting market.

Analysis by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Europe accounted for the largest market share of 41.3%. The European region is the largest segment in the sports betting sector, owing to its high population density, extensive internet penetration, and cultural affinity for sports and gambling activities. Countries such as Italy, Spain, and Germany boast massive sports fan bases and rapidly expanding economies, resulting in higher disposable incomes and greater participation in sports betting. Furthermore, progressive regulatory changes and technological advancements in online platforms within the region facilitate easy access to betting services, significantly propelling the sports betting market growth. The digital transformation of the sports betting industry has been significant in Europe. The proliferation of smartphones, combined with high-speed internet access, has fueled the adoption of mobile betting platforms. Mobile betting now accounts for the majority of sports betting activity in Europe, as users gravitate toward the convenience and accessibility of placing bets via their smartphones. In 2024, OpenBet, a major sports betting company reported strong operation following the year’s UEFA European Football Championship processing more than 140 million bets throughout all channels with more than £850m wagered.

Key Regional Takeaways:

United States Sports Betting Market Analysis

The United States hold 86.50% share of North America. The sports betting market in the United States has seen significant growth, driven by several key factors. One of the primary drivers is the legalization of sports betting in multiple states. This allows the authority to regulate sports betting, resulting in a rising number of legal betting platforms. In line with this, technological advancements are playing a pivotal role in the market. The utilization of smartphones and high-speed internet is making online and mobile sports betting increasingly convenient. The vast majority of Americans around 98% owns a cellphone of some kind and about nine-in-ten (91%) own a smartphone in 2024, as per the Pew Research Center. In addition, modern platforms integrate user-friendly interfaces, real time betting options, and secure payment systems, attracting a broad audience. Furthermore, innovative technologies, such as live streaming and artificial intelligence, enhance the user experience while providing personalized recommendations and predictive analytics. Apart from this, a surge in media partnerships and marketing campaigns is supporting the sports betting market growth. Major leagues, teams, and broadcasters are increasingly collaborating with sports betting operators, normalizing betting activities and integrating them into sports culture. These partnerships, combined with aggressive advertising, benefit in increasing awareness and engage new users. Lastly, evolving consumer attitudes toward sports betting are significantly contributing to market expansion. Betting is no longer viewed solely as a niche activity but as an entertainment option for casual and avid sports fans alike.

Asia Pacific Sports Betting Market Analysis

The Asia Pacific sports betting market is propelled by several key drivers, making it one of the most lucrative regions in the global gambling industry. A major factor is the region's large and diverse population, coupled with a deeply ingrained culture of sports and gaming. The India population reached 1,395.0 Million in March 2024, as per the CEIC. Popular sports, such as cricket, soccer, and basketball, attract millions of fans who actively engage in betting as part of their entertainment. The passion for sports events like the Indian Premier League (IPL), English Premier League (EPL), and international tournaments is further increasing betting activities. Additionally, technological advancements in the region are another critical driver. Markets like India, China, and Southeast Asia are witnessing a surge in app-based sports betting, offering users convenience, live betting features, and personalized experiences. Innovations, such as blockchain and digital payment solutions, are improving transaction security and transparency, making sports betting more accessible and trustworthy. Apart from this, the regulatory landscape in various parts of the region, though fragmented, is witnessing a gradual change that favor the market. In addition, inflating income levels and changing attitudes toward betting contribute to its popularity. As economies grow, individuals are willing to spend more on leisure activities, including betting. Besides this, younger, tech-savvy consumers view sports betting as a form of entertainment rather than taboo, driving market expansion.

Europe Sports Betting Market Analysis

The European sports betting market is driven by a combination of mature infrastructure, favorable regulations, and cultural acceptance. Europe has one of the most established gambling markets globally, underpinned by a long-standing tradition of sports betting, particularly on football, horse racing, and tennis. The popularity of major events like the UEFA Champions League, English Premier League, and Wimbledon improves the sports betting market value and draws substantial betting activity, supported by a sports-loving culture that integrates betting as part of the experience. One of the most significant drivers is the robust regulatory environment in Europe. Countries, such as the United Kingdom, Spain, Italy, and Germany, have well-defined laws and licensing frameworks, which create a transparent and competitive market. These regulations protect individuals and attract legitimate operators to the region, favoring the sports betting market outlook. The responsible gambling measures, along with consumer protection policies, are enhancing user trust and ensuring sustained engagement. In line with this, technological advancements are catalyzing the sports betting market demand. Features, such as in-play betting, live streaming, and cash-out options, provide a dynamic user experience. Furthermore, advancements in artificial intelligence and data analytics allow platforms to offer personalized experiences, which resonate with Europe’s tech-savvy consumers. Furthermore, the widespread use of smartphones, coupled with high-speed internet access, is popularizing online and mobile betting platforms. In the EU, the portion of households with internet connection was 94% in 2024, according to reports.

Latin America Sports Betting Market Analysis

The sports betting market in Latin America is propelled by a combination of factors like cultural enthusiasm for sports, improving regulatory frameworks, mobile adoption, and widespread internet access. A total of 210.3 Million cellular mobile connections were active in Brazil in early 2024. Football, the most popular sport in the region, drives significant betting activity, particularly during events like the Copa Libertadores, FIFA World Cup, and national leagues. The deep-rooted passion for sports creates a large, engaged audience for betting platforms. Apart from this, regulatory advancements in key markets such as Brazil, Colombia, and Argentina are unlocking new growth opportunities. Moreover, governing agencies in the region are increasingly recognizing sports betting as a source of tax revenue and economic activity, leading to the establishment of legal frameworks that encourage market entry for domestic and international operators.

Middle East and Africa Sports Betting Market Analysis

The sports betting market in the Middle East and Africa region is influences by a young, sports-oriented population, increasing smartphone penetration, and evolving regulatory landscapes. A considerable count of young people, including 15-24 years old, has risen from 51 Million in 1995 to around 82 Million in 2023 in the Arab region, as per the HPC. Football is generally seen as a dominant sport in the region, with global tournaments like the FIFA World Cup and local leagues attracting substantial betting interest. The cultural enthusiasm for sports creates a large base of potential bettors. Besides this, technological advancements, particularly the widespread adoption of smartphones and mobile internet, are enabling the growth of online betting platforms. These platforms offer accessibility and convenience, making sports betting more appealing to a tech-savvy, younger demographic. Additionally, the rise of digital payment systems, including mobile money services, facilitates seamless transactions, further supporting market growth. These factors collectively position the Middle East and Africa as emerging markets in the global sports betting industry.

Competitive Landscape:

Leading sports betting companies are heavily investing in technology to enhance user experience. They are integrating AI and machine learning to provide personalized betting recommendations, real-time analytics, and more accurate odds. Mobile apps are being continuously improved to offer seamless, on-the-go betting experiences, complete with live streaming of events and instant updates. Blockchain technology is also being explored to ensure secure and transparent transactions. Other than this, to capitalize on the growing global interest in sports betting, key players are expanding into new markets. The legalization of sports betting in various countries is impelling the market growth. Strategic collaborations with sports leagues, teams, and media companies are helping operators enhance their brand visibility and credibility. Sponsorships of high-profile teams, players, or events provide operators with extensive marketing exposure. Moreover, sports betting companies often appear on team jerseys, stadium billboards, or official websites, ensuring consistent visibility among fans. In 2025, bey365 expanded into Brazil by launching its online sports betting operations.

The report provides a comprehensive analysis of the competitive landscape in the sports betting market with detailed profiles of all major companies, including:

- 888 Holdings PLC

- Bet365 Group Ltd.

- Bet-at-home.com AG (BetClic Everest Group S.A.S.)

- Betfred USA Sports

- Betsson AB

- DraftKings Inc.

- Entain plc

- Flutter Entertainment plc

- International Game Technology PLC

- Kindred Group plc

- Sportech PLC

- TwinSpires (Churchill Downs Incorporated)

Latest News and Developments:

- August 2024: International Game Technology PLC expanded its presence in the emerging sports betting marketplace in Nevada and Colorado with the signing of a technology and services agreement for its IGT PlaySports™ solution at Monarch Casino & Resort, Inc. IGT's best-in-class, award-winning IGT PlaySports platform and advisory trading services support retail and mobile sports betting through the Atlantis Casino Resort Spa at Reno, Nevada, and at Monarch Casino Resort Spa in Black Hawk, Colorado.

- January 2024: FanDuel launched its sports betting app in Vermont enabling people to use its Sportsbook app for iOS and Android as well as via desktop.

- October 2024: Flutter, the Dublin-headquartered parent company of FanDuel, acquired the Italian gambling provider Snaitech last month for $2.6 billion, shortly after its acquisition of a controlling interest in NSX Group, one of Brazil’s largest gambling firms.

- January 2025: Kambi Group plc, a provider of sports betting solutions, revealed a strategic alliance with the fast-growing global operator Stake, aimed at broadening its presence in regulated markets. The partnership was introduced with the rollout of Stake’s Kambi-enhanced sportsbook in Brazil, as the nation’s updated gambling framework turned it into one of the globe’s most eagerly awaited sports betting markets.

- September 2024: Sportradar announced its plans to revolutionize the betting industry by introducing micro markets, an advanced form of in-play betting products, across major sports, creating new revenue opportunities for operators. In a tactical step, Sportradar, alongside Tennis Data Innovations (TDI), launched micro markets for ATP tennis events during October.

Sports Betting Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Offline, Online |

| Betting Types Covered | Fixed Odds Wagering, Exchange Betting, Live/In Play Betting, Pari-Mutuel, eSports Betting, Others |

| Sports Types Covered | Football, Basketball, Baseball, Horse Racing, Cricket, Hockey, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 888 Holdings PLC, Bet365 Group Ltd., Bet-at-home.com AG (BetClic Everest Group S.A.S.), Betfred USA Sports, Betsson AB, DraftKings Inc., Entain plc, Flutter Entertainment plc, International Game Technology PLC, Kindred Group plc, Sportech PLC, TwinSpires (Churchill Downs Incorporated), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the sports betting market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global sports betting market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sports betting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The global sports betting market was valued at USD 103.08 Billion in 2024.

IMARC estimates the global sports betting market to exhibit a CAGR of 8.56% during 2025-2033.

The market is driven by the rising popularity of sports and esports, the adoption of advanced technologies like AI and blockchain, increasing smartphone and internet penetration, regulatory changes promoting legalization, and the growing accessibility of online and mobile betting platforms.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and the Middle East and Africa, wherein Europe currently dominates the global market.

Some of the major players in the global sports betting market include 888 Holdings PLC, Bet365 Group Ltd., Bet-at-home.com AG (BetClic Everest Group S.A.S.), Betfred USA Sports, Betsson AB, DraftKings Inc., Entain plc, Flutter Entertainment plc, International Game Technology PLC, Kindred Group plc, Sportech PLC, TwinSpires (Churchill Downs Incorporated), etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)