Spinal Fusion Devices Market Report by Product (Cervical Fixation Devices, Thoracolumbar Devices, Interbody Fusion Devices), Disease Type (Degenerative Disc, Complex Deformity, Trauma & Fractures, and Others), Surgery Type (Open Surgeries and Minimally Invasive Surgeries), End User (Hospitals & Clinics, Ambulatory Surgical Centres, and Others), Region and Competitive Landscape (Market Share, Business Overview, Products Offered, Business Strategies, SWOT Analysis and Major News and Events) 2025-2033

Spinal Fusion Devices Market Size:

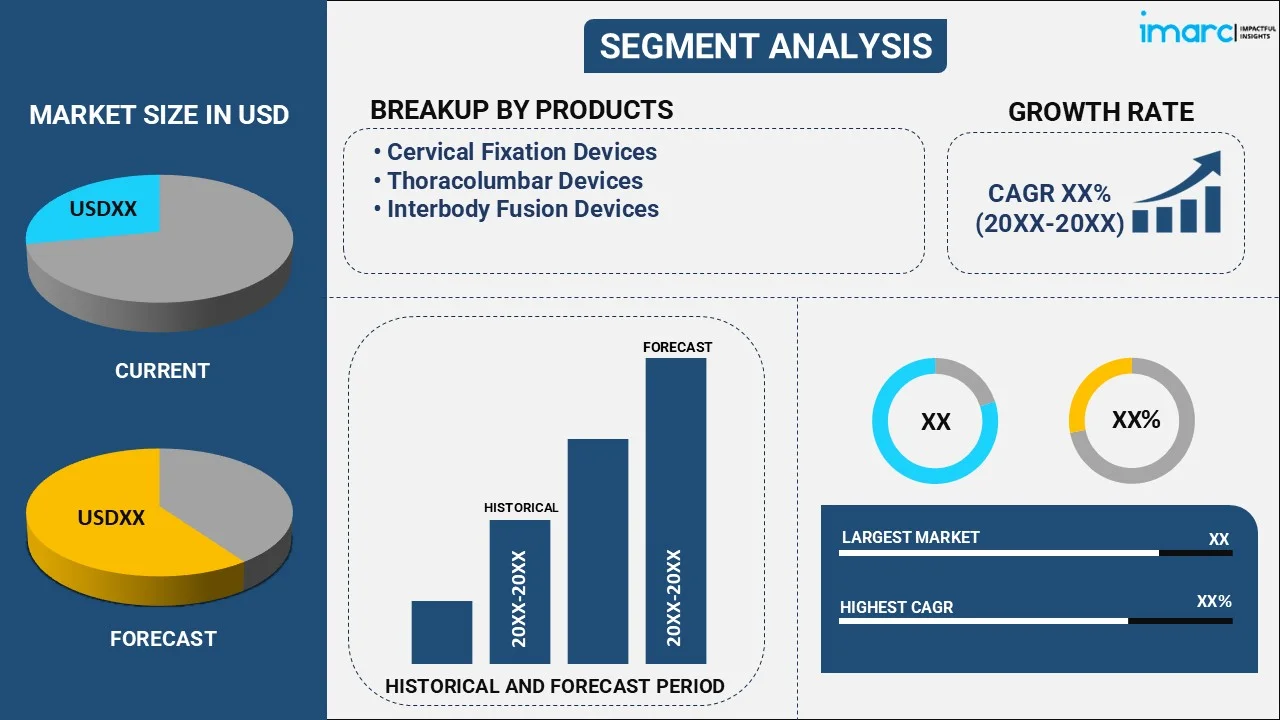

The spinal fusion devices market size reached USD 12.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a growth rate (CAGR) of 4.03% during 2025-2033. The heightened cases of spinal cord complications and injuries among the masses, increasing investments in the healthcare sector to improve treatment procedures around the world, and rising adoption of ambulatory surgical centers are impelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.4 Billion |

| Market Forecast in 2033 | USD 17.7 Billion |

| Market Growth Rate (2025-2033) | 4.03% |

Spinal Fusion Devices Market Analysis:

- Major Market Drivers: The market is experiencing moderate growth owing to the rising occurrence of spinal cord injuries among the masses. It is also influenced by the increasing construction of hospitals around the world.

- Key Market Trends: Certain important trends include rising adoption of ambulatory surgical centers, heightened cases of spinal cord complications, and improvement in healthcare services.

- Geographical Trends: North America is dominating the market owing to rising advancements in spinal fusion device manufacturing and increasing investments in the healthcare sector.

- Competitive Landscape: Some of the major market players in the spinal fusion devices industry include B. Braun Melsungen AG, Exactech, Inc., Johnson & Johnson Services, Inc (Depuy Synthes), Medtronic Plc, MicroPort Scientific Corporation, NuVasive, Inc., RTI Surgical, Inc., Stryker Corporation, Inc., Zimmer Biomet Holdings, Inc., among many others.

- Challenges and Opportunities: The barriers include alternative treatment options, high cost of devices, and stringent regulations, while some of the opportunities for this market include technological improvements, partnerships among the key players, and government spending on healthcare, which is anticipated to overcome the said barriers.

Spinal Fusion Devices Market Drivers:

Improved Healthcare Facilities

The primary cause of the increase in spinal fusion device utilization is global improvements in healthcare facilities. This advancement requires better healthcare facilities, especially in surgical technologies and hospital care standards. Furthermore, advances in imaging technology and surgical techniques are improving the availability, efficacy, and safety of spinal fusion procedures. With the use of cutting-edge surgical instruments, minimally invasive (MI) treatments can be performed in modern healthcare facilities, resulting in quicker recovery times and fewer problems after surgery. The American Medical Association reports that in 2022, US healthcare spending increased by 4.1% to reach $4.4 trillion, or $13,493 per person.

Growing Cases of Spine Injuries

The rising incidence of spine injuries in the population is impelling the growth of the market. Spinal injuries, whether traumatic, caused by degenerative diseases, or congenital, often demand surgical intervention for functional restoration and pain alleviation, with spinal fusion often being taken as a first choice for treatment. A major share of the increased incidence of spinal injuries is attributed to the manifold causes, which are further attributed to the cause of aging, increased participation in sports, increased incidence of vehicular accidents, and sedentary lifestyle habits. According to the article presented by the World Health Organization (WHO) in 2024, over 15 million people are living with spinal cord injury (SCI) globall, and SCI is also a major cause of long-term disability, accounting for over 4.5 million years of life lived with disability in 2021.

Rising Adoption of Ambulatory Surgical Centers

The growing number of outpatient surgical centers offers patients an affordable, practical, and economical alternative for having surgery. This change is made possible by a number of variables working to provide a technique that is efficient for the surgeon and their assistants while also being advantageous to the patient. Ambulatory surgery centers are medical facilities that are completely furnished to handle same-day surgical procedures, including preventive and diagnostic procedures. They have also become more well-liked over time since they provide a means of reducing healthcare expenses without sacrificing the same high standard of service. The spinal fusion ambulatory surgery center provides a facility where surgical care may be substantially less expensive than in a hospital setting.

As reported in an article presented by OR Management News in January 2024, ambulatory surgery centers are expected to skyrocket and, for four decades, have demonstrated an exceptional ability to provide patients the convenience of having surgical procedures performed safely outside hospital settings.

Spinal Fusion Devices Market Opportunities:

Advancement in Technology

Advances in technology are fueling the development of new implants and biomaterials. This is leading to better biocompatibility, increased lifespan, and superior fusion in the spinal implants being offered in the market. Device customization for individual patient anatomy and pathology can help in achieving good surgical outcomes and thus can enhance patient satisfaction. The use of robotics, 3D printing, and artificial intelligence (AI) navigation will also progress the accuracy and efficiency of surgery. The third concept involves the remote monitoring of patients post-surgery for an expedited recovery and readmission reduction. According to the IMARC Group, the global remote patient monitoring system market is expected to reach US$ 4.7 Billion by 2032.

Partnership Among Players

Collaboration among key market players and healthcare providers, research institutions, and technology companies is facilitating the development of innovative spinal fusion devices. Partnerships can help share resources, expertise, and risk, accelerating the development and commercialization of novel products. Major companies are collaborating with researchers to develop MI techniques for complex spinal conditions and expand treatment options for patients. As per the IMARC Group, the global minimally invasive surgery market is expected to exhibit a growth rate (CAGR) of 6% during 2024-2032.

Government Spending on Healthcare

Healthcare is one of the most crucial areas where government expenditure comes into play in ensuring public health and economic stability within a country. Governments are making funds for healthcare for hospital services, preventive and public health services, long-term care, and health research. They are also investing in having effective devices for spinal fusions to ensure that their citizens are well supported against lethal spine conditions. They are also setting up standards and strict certifications that ensures the approval of different authentic and effective spinal fusion devices. For instance, in 2024, Xstim received premarket approval from the US Food and Drug Administration (FDA) for its Xstim spine fusion stimulator.

Key Technological Trends & Development:

3D-Printed Technologies

One of the major orthopedic and spinal surgical innovations is the use of 3D-printed technologies for the manufacture of spinal fusion devices. With this technology, tremendous improvements have been made compared to traditional manufacturing, particularly with respect to customization, precision, and eventually, results for the patient. Traditional devices may not provide this level of anatomical conformity and may result in less desirable results, such as implant misfit or unnecessarily longer recovery times. For example, in September 2023, UConn Health spine surgeon Dr. Hardeep Singh created a 3D printed solution which is fabricated to the particular anatomy of patients to perform spinal fusion.

Artificial Intelligence Integration

Artificial intelligence (AI) is significantly enhancing preoperative planning since it can help surgical professionals design a precise surgical approach. Machine learning (ML) algorithms can analyze large amounts of imaging data and can help design very specific surgical approaches that are accurate and can help, with unparalleled precision. Doctors can recommend the most appropriate placement of spinal fusion devices, especially based on a patient's specific anatomical characteristics, thus minimizing the risk of complications and maximizing the opportunity for success. On the other hand, the use of AI-driven simulative tools in surgery lets one simulate the actual surgery to be carried out in a virtual environment prior to the actual surgical procedure, making the procedure more strategic. PathKeeper Surgical is creating vital strides to facilitate worldwide access to navigation-guided procedures for patients dealing with spinal issues that require surgical intervention.

Remote Monitoring

Remote monitoring systems in spinal fusion devices typically involve sensors that can be embedded within the implant or worn externally. These sensors collect data related to the biomechanical and physiological parameters affecting the spine, such as movement patterns, load distribution, and the strain on the implant. The continuous stream of data provided by remote monitoring allows healthcare providers to track the patient's recovery more closely and accurately. This real-time monitoring can quickly identify abnormalities or complications, such as excessive movement at the fusion site or signs of infection.

Surface Technology

The application of advanced surface technology in spinal fusion devices is markedly improving their integration and functionality within the human body. Surface modifications, such as the application of porous structures or micro-texturing, mimic the natural architecture of bone. These textures increase the surface area of the implant that comes in contact with the bone, promoting better bone ingrowth and stronger integration. Implants can also be coated with bioactive substances that encourage bone growth and facilitate the healing process. These coatings might include growth factors, calcium phosphate-based ceramics similar to bone minerals, or other osteoinductive materials.

Smart Implantable Devices

Most smart spinal implants are often embedded with sensors that continuously measure key parameters such as load, strain, pressure, and motion. This data is of paramount importance in the assessment of the integrity and success of the fusion process. Such a device warns the doctor in regard to situations that might go wrong like loosening of the implant or improper fusion, before it goes to the serious stage, by giving real-time feedback on how the spine is tolerating the stress and on its alignment in post-surgery. The inflow of data through smart implants allows health practitioners to provide postoperative care according to the specific needs of the patient.

Imaging Technologies

Imaging plays an important role in the procedure of spinal fusions, from preoperative planning to postoperative monitoring. The technologies that allow for visualizing the anatomical structures before precise surgery and guide the implant placement can monitor the progress of spinal fusion and implant integrity over time. Therefore, the spine of a patient has to be imaged thoroughly before conducting a spinal fusion, so that the surgical approach may be planned meticulously. Some of the technologies include magnetic resonance imaging (MRI) and computed tomography (CT) scans, which provide an image of resolution high enough to allow an understanding of the exact nature of the spinal pathology and surrounding structures.

According to a blog post by Chitraka University in 2023, medical imaging technology is presenting medical professionals with powerful tools for visualization and diagnosis.

Spinal Fusion Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on product, disease type, surgery type, and end user.

Breakup by Product:

- Cervical Fixation Devices

- Thoracolumbar Devices

- Interbody Fusion Devices

Thoracolumbar devices account for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the product. This includes cervical fixation devices, thoracolumbar devices, and interbody fusion devices. According to the report, thoracolumbar devices represented the largest segment.

Thoracolumbar devices are crucial in the management and treatment of spinal disorders and injuries, particularly those affecting the middle and lower sections of the spine. These devices encompass a range of implants, including rods, screws, and plates, designed to stabilize and support the thoracolumbar junction, which is where the thoracic spine transitions into the lumbar spine. This region is particularly susceptible to trauma and degenerative diseases due to its range of motion and structural complexity. Additionally, thoracolumbar devices aid in the correction of spinal deformities. They can be adjusted to provide the necessary alignment, which is particularly beneficial in the treatment of scoliosis, where the spine requires realignment and long-term stabilization. The use of such devices can lead to improved posture, reduced pain, and enhanced mobility. For instance, DePuy Synthes showcased its latest innovations like the TriALTIS™ Spine System, which is a next generation posterior thoracolumbar pedicle screw system in the 31st International Meeting on Advance Spine Techniques (IMAST) 2024.

Breakup by Disease Type:

- Degenerative Disc

- Complex Deformity

- Trauma & Fractures

- Others

Degenerative disc holds the largest share of the industry

A detailed breakup and analysis of the market based on the disease type have also been provided in the report. This includes degenerative disc, complex deformity, trauma and fractures, and others. According to the report, degenerative disc accounted for the largest market share.

Degenerative disc disease refers to the wear and tear on the spinal discs that commonly occurs as a natural part of the aging process. Spinal discs are soft, compressible discs that separate the interlocking bones (vertebrae) that make up the spine. These discs act as shock absorbers for the spine, allowing it to flex, bend, and twist. Degenerative disc disease can take place throughout the spine, but it most often occurs in the discs in the lower back (lumbar region) and the neck (cervical region).

Breakup by Surgery Type:

- Open Surgeries

- Minimally Invasive Surgeries

Minimally invasive surgeries represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the surgery type. This includes open surgeries and minimally invasive surgeries. According to the report, minimally invasive surgeries represented the largest segment.

Minimally invasive surgeries (MIS) represent a significant advancement in the field of medical procedures, particularly in their application to various surgical disciplines. These techniques utilize small incisions and specialized tools, such as laparoscopes and endoscopes, to perform operations that once required large, open incisions. The benefits of MIS are multifaceted, impacting patient recovery, the healthcare system, and overall procedural efficiency. It is highly preferred for the inclusion of spinal fusion devices owing to its seamless performance and lower risk of infection. According to the IMARC Group, the global MIS market is expected to reach US$ 91.0 Billion by 2032.

Breakup by End User:

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Others

Hospitals & clinics exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, ambulatory surgical centers, and others. According to the report, hospitals and clinics accounted for the largest market share.

Hospitals and clinics require spinal fusion devices due to their critical role in treating a variety of spinal conditions that compromise the integrity, stability, and function of the spine. Spinal fusion is a surgical technique used to join two or more vertebrae to prevent movement between them, alleviating pain caused by motion and restoring stability to a vulnerable spinal segment. This procedure is pivotal in the treatment of several spinal disorders, including but not limited to degenerative disc disease, spinal stenosis, scoliosis, fractures, tumor, and spondylolisthesis. Moreover, the increasing construction of healthcare facilities is driving the demand for spinal fusion devices. According to the 2022 Hospital Construction Survey conducted by the American Society, hospitals with acute care projects underway or in the planning stages increased from 16% in 2021 to 23% in 2022.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

North America leads the market, accounting for the largest spinal fusion devices market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); the Middle East; and Africa. According to the report, North America represents the largest regional market for spinal fusion devices.

North America spinal fusion devices market is driven by the rising push towards the development of more advanced and minimally invasive spinal fusion devices. This includes devices made from biocompatible materials that can better integrate with the human body, such as titanium and polyether ether ketone (peek). The increasing occurrence of spinal disorders, such as degenerative disc disease and osteoarthritis, is supporting the market growth. Apart from this, the growing incidence of spinal injuries among the masses is positively influencing the market. According to the information presented by the National Spinal Cord Injury Statistical Center in 2023, the annual occurrence of spinal cord injury is approximately 54 cases per one million people in the US.

Analysis Covered Across Each Country:

- Historical, current, and future market performance

- Historical, current, and future performance of the market based on product, disease type, surgery type, and end user

- Competitive landscape

- Government regulations

Competitive Landscape:

The market research report has provided a comprehensive analysis of the competitive landscape covering market structure, market share by key players, market player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, among others. Detailed profiles of all major companies have also been provided. This includes business overview, product offerings, business strategies, SWOT analysis, financials, and major news and events. Some of the major market players in the spinal fusion devices industry include B. Braun Melsungen AG, Exactech, Inc., Johnson & Johnson Services, Inc (Depuy Synthes), Medtronic Plc, MicroPort Scientific Corporation, NuVasive, Inc., RTI Surgical, Inc., Stryker Corporation, Inc., Zimmer Biomet Holdings, Inc., etc. Companies are heavily investing in research and development (R&D) to produce more advanced, efficient, and safer spinal fusion devices. This includes the development of biocompatible materials that enhance osseointegration, the integration of smart technologies such as sensors to monitor the healing process, and the use of 3D printing to create customized implants tailored to individual patient anatomy. These innovations aim to improve surgical outcomes and patient recovery times, thereby increasing the attractiveness of their products. Leading companies are also ensuring strict compliance with various regulations to avoid legal complications. For example, in 2023, Johnson & Johnson MedTech* announced that DePuy Synthes secured 510(k) clearances from the U.S. Food and Drug Administration (FDA) for the TriALTIS™ Spine System and for TriALTIS™ Navigation Enabled Instruments.

Analysis Covered for Each Player:

- Market Share

- Business Overview

- Products Offered

- Business Strategies

- SWOT Analysis

- Major News and Events

Spinal Fusion Devices Market News:

- In 2021, Medtronic plc announced the latest addition to its minimally invasive spine surgery ecosystem, thereby making it the only company to combine spinal implants, biologics, robotics, and AI-powered data for surgeons and patients.

- In 2023, Orthofix declared the full U.S. commercial launch of the WaveForm® L Lateral Lumbar Interbody System, which is designed for lateral lumbar interbody fusion (LLIF) procedures.

Spinal Fusion Devices Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cervical Fixation Devices, Interbody Fusion Devices |

| Disease Types Covered | Degenerative Disc, Complex Deformity, Trauma & Fractures, Others |

| Surgery Types Covered | Open Surgeries and Minimally Invasive Surgeries |

| End Users Covered | Hospitals & Clinics, Ambulatory Surgical Centers, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | B. Braun Melsungen AG, Exactech, Inc., Johnson & Johnson Services, Inc (Depuy Synthes), Medtronic Plc, MicroPort Scientific Corporation, NuVasive, Inc., RTI Surgical, Inc., Stryker Corporation, Inc., Zimmer Biomet Holdings, Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global spinal fusion devices market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global spinal fusion devices market?

- What is the impact of each driver, restraint, and opportunity on the global spinal fusion devices market?

- What are the key regional markets?

- Which countries represent the most attractive spinal fusion devices market?

- What is the breakup of the market based on the product?

- Which is the most attractive product in the spinal fusion devices market?

- What is the breakup of the market based on the disease type?

- Which is the most attractive disease type in the spinal fusion devices market?

- What is the breakup of the market based on the surgery type?

- Which is the most attractive surgery type in the spinal fusion devices market?

- What is the breakup of the market based on the end user?

- Which is the most attractive end user in the spinal fusion devices market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global spinal fusion devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the spinal fusion devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global spinal fusion devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the spinal fusion devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)