Spices and Seasonings Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Spices and Seasonings Market Size and Share:

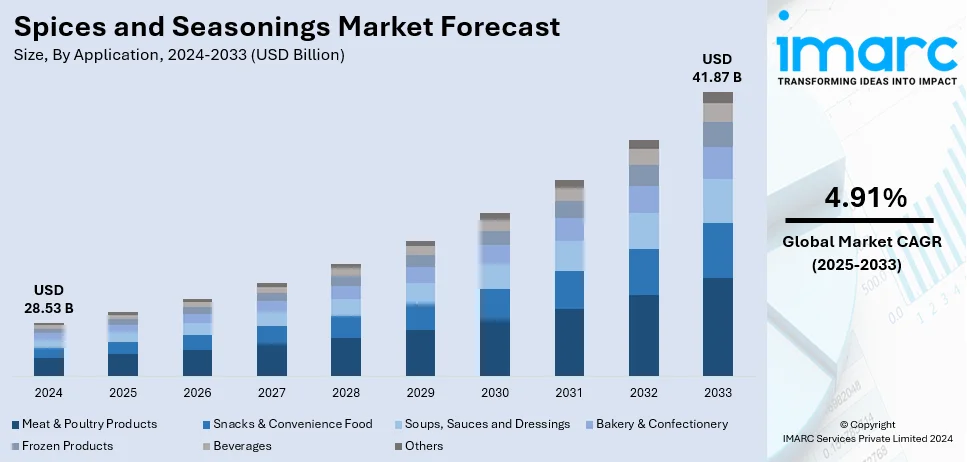

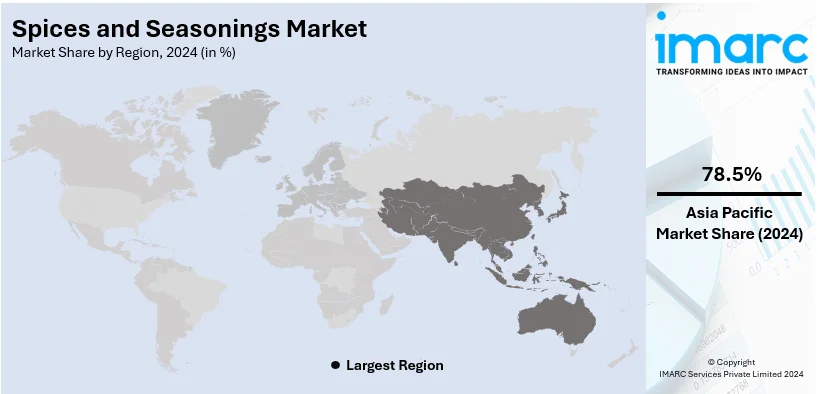

The global spices and seasonings market size was valued at USD 28.53 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 41.87 Billion by 2033, exhibiting a CAGR of 4.91% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 78.5% in 2024. The increasing interest in international cuisines, culinary diversity, the rising consumer demand for natural and healthier flavor enhancers, and the inflating disposable incomes of individuals are some of the leading market growth factors in this region.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 28.53 Billion |

| Market Forecast in 2033 | USD 41.87 Billion |

| Market Growth Rate (2025-2033) | 4.91% |

The global spices and seasonings market is witnessing immense growth due to the rising demand from consumers for diverse and authentic flavors in home-cooked and restaurant meals. Moreover, the awareness of health benefits associated with spices, such as anti-inflammatory and antioxidant properties, is enhancing their consumption. In addition to this, international cuisines, as a result of globalization and cross-cultural culinary exchanges, are on the rise, thus making various exotic spices increasingly used. Furthermore, the food processing and convenience food sectors also are using more seasonings to enhance taste profiles to adapt to changing consumer preferences, which is impelling the market growth.

To get more information on this market, Request Sample

The United States is emerging as a leading market, holding a total of 79.3% share, driven by shifting consumer preferences toward bold and diverse flavors, which are largely influenced by the growing popularity of global cuisines. The U.S. population has grown to 341.8 million in 2024, of which 12.47% are Black or African American, 5.77% Asian, 8.80% multiracial, 6.05% other races, 0.84% American Indian and Alaska Native, and 0.19% Native Hawaiian and Pacific Islander. This multicultural demographic landscape in the USA has introduced a variety of spices and seasonings, such as turmeric, cumin, and cardamom, into mainstream diets. Moreover, health-conscious consumers have increased demand for organic, natural, and minimally processed spices, which are perceived to be healthier, including anti-inflammatory and immune-boosting properties.

Spices and Seasonings Market Trends:

Growth of e-commerce and Online Retail Platforms

The rise of e-commerce and online retail platforms is positively impacting the market. Online shopping has revolutionized how consumers buy their food and culinary ingredients, including spices and seasonings, by offering comfort and convenience. According to industry reports, retail e-commerce sales are expected to be more than USD 4.1 Trillion across the globe in 2024. E-commerce websites cater to diverse products, thereby giving consumers a wide choice for discovering and trying various spices and seasonings available across the globe. They give customers the benefit of home shopping, from where they can browse products, compare prices, read reviews, and then make appropriate choices. Furthermore, direct sales are enabled through online retail, which links consumers with specialty spice vendors, artisanal brands, and unique flavor profiles that may not be available in local stores. This gateway opens many options for consumers who can try new spices and seasonings, allowing them to discover new flavors and varieties. Moreover, with the rise of e-commerce, small and niche spice business operations can reach a wider customer base. It also overcomes geographical boundaries. It fosters entrepreneurship and creates direct communication channels between the consumers and producers to provide more transparent and personalized shopping experiences.

Increasing Consumer Demand for Ethically Sourced and Sustainable Products

Growing demand for ethically sourced and sustainable products from consumers is supporting the market. The consumer today is more conscious of the environmental and social impact of their purchasing decision and actively look for products that resonate with their values. One of the consulting firms' research suggests that products marketed as sustainable constituted a third of all consumer packaged goods growth and increased at 2.7 times the rate of those without such a label. It is very important that ethical sourcing and sustainability are practices for spice manufacturers and suppliers because consumers care about the fair-trade practices of how farmers and workers are treated as well as the environmental impacts related to spice production. Companies that are responding to this demand give priority to fair trade certifications, organic farming practices, and sustainable sourcing methods. They partner with local farmers, support community development initiatives, and implement environmentally friendly cultivation and harvesting techniques. Besides this, brands that demonstrate a commitment to social and environmental responsibility gain a competitive edge and get the attention of conscious consumers. Moreover, the food service establishments, restaurants, and hotels react to this trend, trying to find suppliers that source quality spices responsibly, which is further bolstering the market growth.

Rising Preference for Clean-label and Natural Ingredients

Clean-label and natural ingredient demand is driving the business forward. Consumers are requiring products that have low processing and do not contain artificial additives, preservatives, or enhancers. A solution to their demand has emerged in the form of spices and seasonings, a naturally plant-sourced enhancement of flavor or aromatic substance without artificial or chemical additives to foodstuffs. Clean-label and natural spices and seasonings are healthier and closer to the source, filling consumer needs for greater transparency and closeness to the origin of their food. They also flavor dishes while emphasizing simplicity and purity. Brands and key players are responding to this trend are offering spice and seasoning products that are as minimally processed as possible, organic, non-GMO, and free from artificial ingredients. They also emphasize the use of good-quality raw materials, responsible sourcing, and sustainable agriculture. This has also triggered innovation in the spices and seasonings market and, thus, the development of organic spice blends, reduced-sodium options, and unique flavor profiles globally, strengthening the market growth.

Digitalization in the Spices Supply Chain

The increasing investment in digitalization is transforming the global spices and seasonings market by improving supply chain efficiency, transparency, and sustainability. Technologies like satellite, sensors, and drones applications are enabling farmers to observe soil conditions, enhance water efficiency, and forecast pest invasions, leading to higher yields and reduced environmental impact. Digital tools are also streamlining procurement, ensuring better quality control, and enhancing traceability, which is crucial for meeting international safety standards and consumer demand for ethically sourced spices. Governments and private entities are actively supporting digital agriculture initiatives to assist spice producers. For instance, in 2024, the Prime Minister of India announced the Digital Agriculture Mission with an investment of Rs 2,817 crore to modernize farming using digital technology. These advancements are particularly beneficial for emerging economies where digital solutions are driving modernization in spice farming. As the industry adopts digital supply chain solutions, the market is poised for sustained growth, offering improved efficiency, reduced costs, and enhanced sustainability in global spice production and distribution.

Spices and Seasonings Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global spices and seasonings market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on product and application.

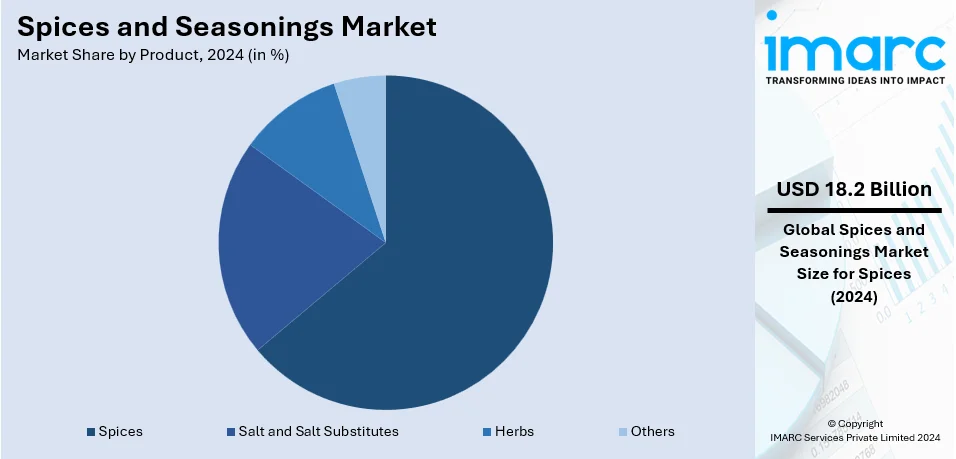

Analysis by Product:

- Salt and Salt Substitutes

- Herbs

- Thyme

- Basil

- Oregano

- Parsley

- Others

- Spices

- Pepper

- Cardamom

- Cinnamon

- Clove

- Nutmeg

- Others

In 2024, by product, spices stood as the largest market component, accounting for about 63.7% of the market share. This is because spices have extensive usage in traditional and modern food systems, supported by their flavor profiling capability and healthier functions. The increasing popularity of international and fusion cuisines has increased demand for various spices, from turmeric and cinnamon to paprika and cumin.

The growing health and wellness trend has also focused attention on the medicinal properties of spices, such as anti-inflammatory and antioxidant effects. Besides this, the rising consumption of packaged and ready-to-eat foods, which are commonly associated with spice blends, adds to the growth of the segment, further consolidating its market leadership.

Analysis by Application:

- Meat & Poultry Products

- Snacks & Convenience Food

- Soups, Sauces and Dressings

- Bakery & Confectionery

- Frozen Products

- Beverages

- Others

Meat and poultry products lead the market as they are staple sources of protein in many diets around the world. They are valued for their nutritional content and contribute to satisfying dietary requirements. The demand for meat and poultry products, including processed meats and fresh cuts, remains consistently high due to widespread consumption. Furthermore, the increasing global population and rising disposable incomes have led to a growing demand for animal-based protein sources. As economies develop and lifestyles change, the consumption of meat and poultry products tends to increase, driving the spices and seasonings market growth.

Additionally, the versatility of meat and poultry makes them suitable for a wide range of culinary applications. They can be cooked, grilled, roasted, or used as ingredients in various dishes, offering diverse flavors and textures. Moreover, meat and poultry products have a significant presence in the food service industry, including restaurants, hotels, and catering services. The demand for these products from the food service sector drives their market share as they are key ingredients in numerous dishes served in restaurants and other food establishments.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 78.5%. The Asia Pacific's rich culinary heritage and diverse food cultures contribute to the demand for a wide variety of spices and seasonings. The influence of various cultures on food habits, including traditional Asian cuisines such as Indian, Chinese, Thai, and Indonesian, catalyzes the market as consumers seek to replicate authentic flavors. Moreover, there is a growing awareness of the medicinal benefits of spices in the Asia Pacific. Many spices, such as turmeric, ginger, and garlic, have long been used in traditional medicine for their therapeutic properties. The rising health consciousness among consumers fuels the product demand with perceived health benefits.

Furthermore, the food processing sector in the Asia Pacific is experiencing significant growth. Spices and seasonings are critical ingredients in processed food products, snacks, and ready-to-eat meals. The growth of the food processing industry is propelling the market in the region. Additionally, the growing population and rising disposable incomes contribute to the market growth. With higher disposable incomes, consumers can afford to try more varieties of spices and seasonings, which will continue to spur demand in the market.

Key Regional Takeaways:

North America Spices and Seasonings Market Analysis

Factors driving the growth of the spices and seasonings market in North America include an increasing consumer demand for diverse, multi-cuisine food options and demand for clean-label and organic products. The surge in home cooking, both during and post-pandemic, also contributes, as consumers are looking for authentic and flavorful ingredients. For example, the United States alone imported turmeric worth over $50 million in 2023, which clearly indicates the need for health-oriented spices. Innovation is also favored by the market through companies like McCormick, and Kerry Group, which are coming up with new seasoning mixes and promoting healthier products, such as sodium-reduction solutions. In addition, the trend of health benefits of spices, as well as anti-inflammatory and antioxidant functions, enhances their adoption and utilization. These trends highlight how this sector is dynamically expanding in North America.

United States Spices and Seasonings Market Analysis

Growing demand for convenience meals, healthy eating, and increased experimentation in the kitchen are pushing the spice and seasonings industry in the United States. Americans employ a variety of spices in their culinary repertoires due to the diversity of food they cook and consume. The most popular food in the United States is Chinese, which garners an average of over 3.35 Million monthly searches, based on Google search data. After Chinese cuisine, there were 1.22 Million Google searches for Mexican food, over 823,000 monthly searches for Thai food, and 673,000 monthly searches for Indian food. As a result of social media food trends and a wide variety of cuisines, consumers are cooking more creatively. Spice use was also increased by a rise in home cooking, which was sped up by the COVID-19 epidemic. Trends in health and wellbeing also provide support for the expansion of the industry.

Consumers are becoming more aware of the health benefits of spices, including the anti-inflammatory effects of turmeric and the antioxidant properties of other herbs and spices. In addition, the increased popularity of plant-based diets is increasing demand for seasoning products that meet the needs of vegan and vegetarian consumers. The growing concern about food additives is reflected in the popularity of clean-label products made with natural and organic components. The demand for seasoning in restaurants is driven by the well-established foodservice industry in the United States.

Europe Spices and Seasonings Market Analysis

The market for spices and seasonings in Europe is boosted by the rising popularity of ethnic cuisine and the growing desire for strong, unique flavors. Consumer interest in spices considered fundamental to Mediterranean and Middle Eastern cuisines, including cumin, curry, and paprika, has surged significantly within the region. The UN Comtrade data depicts that the average volume imported of spices and herbs went up by 2.0% annually between 2018 and 2022. In 2022, the EU imported 397 000 tonnes of spices from third countries. Being the biggest supplier of 38% of the total imports into the EU, the country was China. Customers are becoming increasingly accepting of tasting flavors from different countries due to the increased migration and intercultural interactions within Europe. More European consumers prefer using natural ingredients instead of artificial flavor enhancers. Thus, organic and clean-label spices have gained immense popularity in Europe. This is also reflective of the stringent laws the European Union has regarding food safety and labeling, with the theme of openness and quality. In addition, health-conscious consumers are opting for spices with practical health benefits, such as garlic and ginger for their anti-inflammatory properties. Demand for spices is also driven by the increasing inclination towards vegetarian and plant-based diets.

Asia Pacific Spices and Seasonings Market Analysis

This vast history of spice usage for everyday cooking has placed the Asia-Pacific region at an important position in the world of spice and seasoning business. Thailand, China and India are some of the major producers and consumers of spices. The convenience factor leading people to use spice blends contributes immensely towards the growth of the market mainly in developing countries like India and Southeast Asia. Asia and thus countries like China and India are the world's major exporter of spices. India became the world's largest exporter in 2021–2022, exporting USD 4.1 Billion worth of spices and spice-related products, as per an industrial report. The e-commerce platforms are increasingly accessible to spices among the urban dwellers in countries like China and India, particularly in rural areas where the traditional markets are not easily accessed. The developing middle class is also expanding the market as it opts for more and more high-end and organic products. Demand for spices that are highly valued for their culinary and therapeutic properties, such as cardamom, black pepper, and turmeric, is also driving market growth.

Latin America Spices and Seasonings Market Analysis

Global interest in Latin American and Caribbean cuisines is gaining and creating demand for spices and seasonings in Latin America. This demand in the domestic and foreign market due to ethnic influences has seen an increase in the sale of spices such as cumin, coriander, and chilli. Consumer knowledge regarding the health benefits of spices, for example, capsaicin in chilli peppers, has also continued to drive the market further. With an increasing middle class, whose purchasing power is increasing, the region is experiencing the trend towards more sustainable, organic, and high-end spice goods. The expansion of fast-food restaurants and online meal delivery services is increasing the need for seasonings in nations like Brazil and Mexico. According to Tradeimex data, Mexico was one of the leading exporters in the region in 2023, with its spice exports totalling almost USD 1 Billion. With spice exports worth over USD 515.56 Million, Peru came in second, underscoring the nation's important position in the world spice trade. Besides, in 2023, Colombia exported USD 209.07 Million spices which showed that Latin American spice export was gaining popularity among people of other regions.

Middle East and Africa Spices and Seasonings Market Analysis

The reason behind this growth is due to the fact that the people living in this region value culinary heritage and spices used daily for cooking. Common spices found in Egyptian, Moroccan, and Saudi Arabian cuisines as well as hospitality business include cinnamon, cumin, and saffron. The increasing interest of people in the region towards functional, healthy food is thereby increasing the demand for nutritious and curative spices. Moreover, the increased tourism and hospitality sectors of the countries like United Arab Emirates have also been increasing the demand for authentic regional spices. For instance, according to an industrial report, Saudi Arabia has established an ambitious target for its tourism industry, seeking to attract 39 million overnight visitors by 2030. This illustrates the nation's aim of emerging as a vital participant in the worldwide tourism sector, which will also infuse the market.

Competitive Landscape:

Top companies in the market play a pivotal role in propelling the market growth of this industry. These companies invest in research and development (R&D) to create innovative spice blends, unique flavor profiles, and sustainable sourcing methods. They have established strong supply chains and partnerships with farmers and growers worldwide, ensuring a consistent supply of high-quality spices and seasonings. These companies prioritize responsible and ethical sourcing practices, promoting fair trade and sustainability throughout the value chain. They also invest in marketing and branding initiatives to create awareness and promote their products. They collaborate with chefs, culinary experts, and influencers to showcase the versatility and benefits of their spice offerings. Moreover, these companies focus on product quality and safety, adhering to strict quality control measures and certifications to meet consumer expectations. They actively engage with consumers, gathering feedback and adapting their product offerings to meet evolving tastes and preferences.

The report provides a comprehensive analysis of the competitive landscape in the spices and seasonings market with detailed profiles of all major companies, including:

- Ajinomoto Co. Inc.

- ARIAKE JAPAN Co. Ltd.

- Associated British Foods plc

- Baria Pepper Co. Ltd.

- Döhler GmbH

- DS Group

- EVEREST Food Products Pvt. Ltd.

- The Kraft Heinz Company

- Kerry Group plc

- McCormick & Company

- Olam International

- Sensient Technologies Corporation

- SHS Group

- Spice Hunter (Sauer Brands Inc.)

- Unilever plc

- Worlée-Chemie GmbH

Latest News and Developments:

- October 2025: UAC Foods Limited has ventured into the competitive seasoning market by introducing Zuri Seasoning, indicating its goal to diversify and enhance its product lineup. The decision is consistent with the firm's long-term plan to stimulate growth by fostering innovation and enhancing consumer interaction in Nigeria’s changing FMCG market.

- August 2025: McCormick & Co. is investing $750 million to gain a majority interest in a joint venture in Mexico as the spice and condiment leader expands its reach in Latin America. The firm obtained an extra 25% stake from Grupo Herdez in McCormick de Mexico, a joint venture established in 1947. The agreement raises McCormick’s ownership share to 75%.

- July 2025: Sonoco is happy to collaborate with Kotányi GmbH – an Austrian family-run firm with more than 140 years of expertise in the spice industry. They are establishing new benchmarks in quality and sustainability by merging innovative packaging solutions with premium herbs and spice blends. The new spice collection is set to debut in Sonoco’s GreenCan® packaging, emphasizing the brand’s dedication to sustainability.

- July 2025: Indian conglomerate DG Group announced the introduction of its spice brand Catch in the Nepal market on Thursday. To strengthen its presence, Catch Spices has teamed up with Chief Santosh Shah, a globally recognized culinary expert and brand ambassador in Nepal.

- July 2025: AWL Agri Business, previously known as Adani Wilmar, aims to broaden its presence in South and Central India by acquiring food firms specializing in condiments and kitchen necessities, as stated by MD & CEO Angshu Mallick. AWL has allocated more than Rs 1,000 crore for capex in FY26 to enhance capacities. Mallick anticipates mid-to-high teen revenue growth in FY26, backed by an increase in consumption, reduced edible oil prices, and favorable macroeconomic conditions.

Spices and Seasonings Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Meat & Poultry Products, Snacks & Convenience Food, Soups, Sauces and Dressings, Bakery & Confectionery, Frozen Products, Beverages, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Ajinomoto Co. Inc., ARIAKE JAPAN Co. Ltd., Associated British Foods plc, Baria Pepper Co. Ltd., Döhler, DS Group, EVEREST Food Products Pvt. Ltd., The Kraft Heinz Company, Kerry Group plc, McCormick & Company, Olam International, Sensient Technologies Corporation, SHS Group, Spice Hunter (Sauer Brands Inc.), Unilever plc, Worlée-Chemie GmbH, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the spices and seasonings market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global spices and seasonings market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the spices and seasonings industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Spices and seasonings are natural or processed flavoring agents derived from plants, seeds, roots, bark, or fruits, used to enhance the taste, aroma, and appearance of food.

The spices and seasonings market was valued at USD 28.53 Billion in 2024.

IMARC estimates the global spices and seasonings market to exhibit a CAGR of 4.91% during 2025-2033.

Market growth is driven by increasing demand for diverse flavors, health benefits of spices, globalization of cuisines, and rising consumer preference for clean-label and organic products.

In 2024, Spices dominate the market, driven by their extensive culinary uses and health-enhancing properties such as anti-inflammatory and antioxidant effects.

Meat and poultry products lead by application due to their widespread global consumption and versatility in culinary uses.

On a regional level, the market has been classified into North America, Asia Pacific, Europe, Latin America, and Middle East and Africa, wherein Asia Pacific currently dominates the global market.

Some of the major players in the global spices and seasonings market include Ajinomoto Co. Inc., ARIAKE JAPAN Co. Ltd., Associated British Foods plc, Baria Pepper Co. Ltd., Döhler, DS Group, EVEREST Food Products Pvt. Ltd., The Kraft Heinz Company, Kerry Group plc, McCormick & Company, Olam International, Sensient Technologies Corporation, SHS Group, Spice Hunter (Sauer Brands Inc.), Unilever plc, Worlée-Chemie GmbH, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)