Specialty Tapes Market Size, Share, Trends and Forecast by Type, Technology, End User Industry, and Region, 2025-2033

Specialty Tapes Market Size and Share:

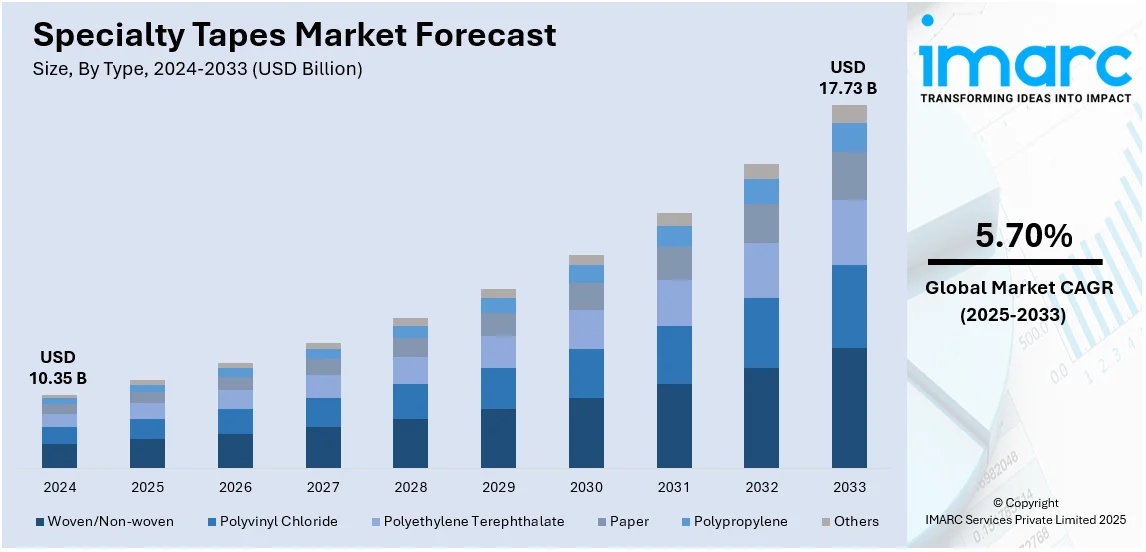

The global specialty tapes market size was valued at USD 10.35 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 17.73 Billion by 2033, exhibiting a CAGR of 5.70% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 44.7% in 2024. The market is spurred by fast industrialization, robust demand from electronics and automotive industries, increasing infrastructure projects, and accelerating healthcare applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.35 Billion |

| Market Forecast in 2033 | USD 17.73 Billion |

| Market Growth Rate 2025-2033 | 5.70% |

The global market for specialty tapes is also registering robust growth with the rising demand from the electronics and electrical industries. As devices are miniaturized and efficiency increases, high-performance adhesive solutions for insulation, circuit protection, and assembly of components are needed by manufacturers. Specialty tapes including conductive, thermal management, and high-temperature-resistant tapes are extremely important in maintaining durability and performance. The surge in smartphone production, wearable technology, and electric vehicle (EV) components is further fueling this demand. Moreover, the fast-growing 5G networks and the Internet of Things (IoT) are accelerating the demand for sophisticated adhesive solutions with high reliability and environmental stress resistance. Owing to technological advancements in stretchable and flexible electronics, specialty tapes are shifting towards offering amplified adhesion, heat dissipation, and electrical conductivity. The growing emphasis on sustainability and recyclable adhesives also spurs research and development (R&D) activities in the industry. For instance, in December 2024, Ahlstrom introduced MasterTape Cristal, a fiber-based clear tape backing that will minimize plastic waste. Composed of renewable raw materials, it provides strength, clarity, and recyclability and is suitable for packaging, office, and retail uses that facilitate sustainability.

The U.S. market for specialty tapes is expanding considerably as a result of the growth in the auto industry and increased emphasis on lightweight materials with a market share of 86.50%. Automotive companies are using high-performance tapes to substitute conventional mechanical fasteners, allowing vehicles to become more efficient and lighter in weight overall. Specialty tapes find broad applications within interiors and exteriors, including bonding trim parts, wire harnessing, and thermal insulation. For example, in September 2024, Mactac introduced the Macbond 481 and Macbond LS55 industrial tape family, engineered to provide high-bonding performance on a variety of surfaces from low, through medium, to high surface energy materials. Moreover, the growth of electric vehicles (EVs) in the United States is also fueling demand for flame-resistant, vibration-dampening, and thermal management tapes that provide battery safety and longevity. Furthermore, stringent fuel efficiency and emissions regulations are fueling demand for lightweight bonding solutions. The movement toward smart and connected cars is also accelerating the use of specialty tapes in advanced driver assistance systems (ADAS) and infotainment screens. As sustainability picks up, manufacturers are also creating solvent-free and environmentally friendly adhesive tapes to comply with environmental standards.

Specialty Tapes Market Trends:

Sustainability and Eco-Friendly Adhesives

The specialty tapes market is experiencing a major trend toward sustainability as producers aim to minimize their environmental footprint. With increasing regulation and customer pressure for environmentally friendly options, businesses are formulating tapes using bio-based, recyclable, and solvent-free adhesives. Water-based adhesives are also becoming increasingly popular as they drive out dangerous volatile organic compounds (VOCs) and enhance employee safety during production. Moreover, biodegradable and compostable tape solutions are being explored in order to address the global plastic waste epidemic. Post-consumer recycled content is being introduced in many tape backings by numerous companies in support of a circular economy practice. The packaging industry and the construction sector are soon embracing such environment-friendly tapes as a measure towards complying with regulatory standards. Additionally, improvements in green chemistry allow for high-performing, tough tapes that have no negative impacts on adhesive toughness or utility. While sustainability evolves as the mainstream market driver, green specialty tapes are bound to witness sharp growth in diverse sectors globally.

Advanced Functional Tapes for High-Tech Applications

The fast development of high-technology industries such as electronics, automotive, and telecommunications is driving the demand for specialty tapes with advanced properties. For instance, in March 2024, Avery Dennison Performance Tapes introduced a new appliance portfolio with pressure-sensitive adhesive tapes for durability, user-friendliness, and noise/vibration damping. The portfolio accommodates applications in refrigerators, ovens, dishwashers, and others, promoting efficiency in appliance production. Furthermore, such tapes are essential to use in applications involving conductivity, thermal dissipation, and electromagnetic interference (EMI) shielding. In the electronics industry, miniaturization of products has heightened the demand for high-performance tapes that provide component durability, insulation, and defense against environmental stresses. Heat-resistant specialty tapes are becoming unavoidable in battery packs used in electric vehicles (EVs) to ensure safety and shelf life. Growth in 5G communication networks and intelligent devices is also driving demand for EMI shielding tapes that minimize signal interference. The advent of flexible and stretchable electronics has spurred the evolution of adhesive technologies, enabling tapes to flow over intricate surfaces. With continuous research in material science, functional specialty tapes are fast becoming critical pieces in future-generation electronic and automotive products.

Growth in Healthcare and Medical Tapes

The medical industry is emerging as the key growth driver for the specialty tapes market with increasing demand for medical-grade adhesives used in wound dressings, surgery, and wearable medical devices. With the evolving healthcare technologies, the demand for skin-friendly, hypoallergenic, and breathable adhesives has also grown to guarantee patient comfort and safety. Medical tapes have become prevalent for securing dressings, IVs, and diagnostic sensors in general, as a result of home healthcare and off-site monitoring growth. Increasing use of wearable biosensors to track health in real-time has fueled demand further for durable, conformable adhesive products. Medical tapes also have to meet high standards of biocompatibility, and so advances have been required in non-irritating, moisture-permeable adhesives. With the rise in population age and the spread of chronic conditions, the healthcare sector is putting money into advanced adhesive technologies that enhance patient results. Therefore, specialty medical tapes are anticipated to experience consistent growth over the next few years.

Specialty Tapes Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty tapes market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on type, technology and end user industry.

Analysis by Type:

- Woven/Non-woven

- Polyvinyl Chloride

- Polyethylene Terephthalate

- Paper

- Polypropylene

- Others

Polyvinyl chloride (PVC) specialty tapes have the largest share in the market with a 37.5% market share in 2024 due to their higher durability, flexibility, and chemical and moisture resistance. PVC tapes are used in a variety of industries, from electrical insulation, wiring in automobiles, and industrial packaging, due to their high adhesive strength and tensile property. The accelerating use of PVC-based insulation tapes in electrical usage, especially in emerging markets, also drives market growth. Moreover, the development of the construction industry, especially in Asia Pacific, is also propelling demand for PVC tapes in HVAC, plumbing, and waterproofing applications. Increasing safety standards in industrial environments are also promoting the use of flame-retardant and high-voltage insulation PVC tapes. Still, environmental issues about PVC's recyclability are driving manufacturers towards green alternatives and environmentally friendly compositions. Even so, the cost advantage and high-performance attributes of the material see it reigning supreme in specialty tapes.

Analysis by Technology:

- Solvent Borne

- Water Borne

- Hot Melt

- Others

Solvent-borne adhesive technology dominates the specialty tapes industry with 46.3% market share in 2024 as a result of its higher adhesion strength, durability, and resilience to harsh environmental conditions. These tapes have extensive applications in high bonding performance requirements, including automotive assembly, aerospace, and industrial manufacturing. The technology's suitability to a broad spectrum of surfaces such as metal, plastic, and glass makes it the most sought-after in extreme conditions. Solvent-borne adhesives also provide superb resistance to moisture, chemicals, and temperature variations, further confirming their reliability in severe conditions. As much as regulations on volatile organic compound (VOC) emissions continue to climb, developments on low-emission and eco-friendly solvent-borne solutions continue to fuel market growth. Applications that demand lasting adhesion, especially in high-stress usage, continue to depend on solvent-based specialty tapes. Technological innovation in hybrid adhesive technologies is also sustaining the dominance of the segment by enhancing performance and mitigating environmental issues.

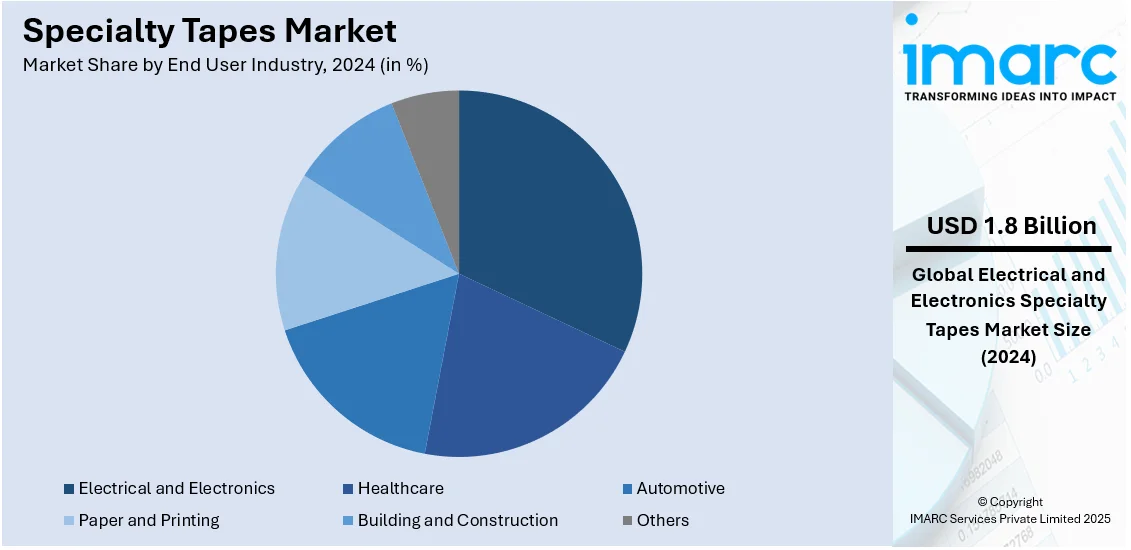

Analysis by End User Industry:

- Healthcare

- Electrical and Electronics

- Automotive

- Paper and Printing

- Building and Construction

- Others

The electrical and electronics sector accounts for a large 17.5% market share in specialty tapes in 2024 due to speedy technological improvements and rising miniaturization of electronics. Specialty tapes are vital for use in wire harnessing, shielding of circuit boards, heat removal, and bonding displays in consumer electronics, telecom, and industrial equipment. The increasing uptake of 5G networks, IoT devices, and wearable tech is also driving the demand for high-performance adhesive products with electrical insulation, thermal conductivity, and EMI shielding properties. Furthermore, the growth in the electric vehicle (EV) industry is boosting the demand for flame-retardant and high-voltage insulation tapes to ensure battery safety. The demand for lightweight yet rugged materials in smart devices is also driving manufacturers towards creating ultra-thin, high-strength tapes. With the electronics market developing further, advances in flexible and stretchable adhesive tapes will also continue driving the market growth.

Regional Analysis:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East

- Africa

Asia Pacific leads the world in the specialty tapes market, with a significant 44.7% share in 2024. The region is driven by swift industrialization, a thriving electronics industry, and growing demand from the automotive and construction sectors. China, Japan, South Korea, and India are key drivers of market growth because of their robust manufacturing sectors and growing infrastructure investments. The boom in consumer electronics manufacturing, especially smartphones, laptops, and wearables, is fueling demand for high-performance adhesive tapes. Moreover, government policies favoring electric vehicles (EVs) and renewable energy initiatives are accelerating demand for specialty tapes in battery insulation and photovoltaic uses. The increased use of lightweight materials in the automotive and aerospace sectors also drives market growth. Albeit rising environmental norms on adhesive chemicals, ongoing technology development in recyclable and solvent-free specialty tapes is guaranteeing long-term growth in regional markets.

Key Regional Takeaways:

North America Specialty tapes Market Analysis

The North America specialty tapes market is witnessing stable growth fueled by robust demand from healthcare, automotive, and electronics sectors. The region is supported by sophisticated manufacturing capabilities and rising investments in high-performance adhesive technologies. Specialty tapes are extensively applied in medical applications ranging from wound care and surgical drapes to medical device assembly, driven by the rising healthcare spending in the region. Further, the growing electric vehicle (EV) market in North America is driving demand for specialty tapes for battery insulation as well as light automotive applications. The aerospace and defense industries also drive growth, demanding high-performance tapes for bonding, sealing, and thermal management solutions. Sustainability drivers are promoting the formulation of environment-friendly, solvent-free adhesive tapes with enhanced recyclability. Although markets expand, raw material price fluctuations and regulatory limitations to volatile organic compounds (VOCs) affect manufacturers. Nevertheless, the relentless struggle to develop more advanced adhesive formulations via R&D keeps stimulating innovation and market growth.

United States Specialty Tapes Market Analysis

The United States leads the North American specialty tapes market with its strong industrial base and strong demand across various end-user industries. The country's well-developed healthcare infrastructure fuels demand for medical-grade adhesive tapes, utilized in wound dressings, transdermal patches, and surgery. The automotive sector, especially the amplified use of electric and self-driving cars, further propels specialty tape demand in wire harnessing, thermal management, and light-weight bonding applications. The U.S. electronics industry, dominated by semiconductor production and consumer product manufacturing, also depends on specialty tapes for circuit protection, display bonding, and EMI shielding. Strict environmental legislation is driving OEMs towards low-VOC, water-based, and bio-based adhesive tapes. Growing investment in infrastructure programs also increases construction and HVAC tapes demand. Continuous innovation in high-performance adhesives underpins the market's growth, led by research and development efforts spearheaded by companies based in the United States.

Europe Specialty Tapes Market Analysis

The European specialty tapes industry is growing with rising demand from the automotive, healthcare, and industrial industries. Germany, France, and the United Kingdom are major market drivers with robust manufacturing platforms and technology advances in adhesive solutions. The European automotive market, especially in the production of electric vehicles, is a major market driver, in need of specialty tapes for insulation, bonding, and vibration damping. The region's high environmental regulations are speeding the move towards solvent-free and recyclable adhesive technologies. The demand is also coming from the healthcare sector for medical tapes, wound dressings, and surgical adhesives with growing population age and healthcare investment. The packaging industry, especially that of e-commerce, is also fueling the demand for high-durability specialty tapes and tamper-proof tapes. Moreover, the innovation in the area of high-performance and lightweight adhesive tapes keeps fueling the market growth.

Asia Pacific Specialty Tapes Market Analysis

Asia Pacific dominates the world specialty tapes market with the highest share because of fast-paced industrialization, a vibrant electronics industry, and infrastructure growth. China, Japan, South Korea, and India are prominent contributors based on high output volumes of consumer electronics, automotive, and construction industries. The surge in demand for smartphones, wearable products, and EVs is driving the innovation of high-performance adhesive tapes. Besides this, large-scale infrastructure development in emerging countries is growing the utilization of specialty tapes in HVAC, waterproofing, and industrial adhesives segments. Cost-friendly production and volume output enhance market growth with the region's manufacturing industry. Initiatives of government towards electric mobility and renewable energy are also spurring demand for specialty tapes for battery insulation and photovoltaics. Yet, pressure from regulation over VOC emissions and green issues is compelling manufacturers towards environmentally friendly, solvent-free adhesive solutions to meet global environmental standards.

Latin America Specialty Tapes Market Analysis

The Latin America market for specialty tapes is expanding with growing industrialization, infrastructure development, and demand from the healthcare industry. Brazil and Mexico are the major markets, with growing automotive and electronics manufacturing hubs. Specialty tapes have broad applications in packaging, construction, and medical devices, favoring market expansion. The investments by the healthcare industry in wound care, surgical adhesives, and medical tapes are fueling demand. Moreover, the auto sector, more so in automotive assembly and interior uses, is driving the specialty tape usage. The region's e-commerce surge is also spurring specialty packaging tape demand with improved strength and security functions. Economic uncertainties, high cost of imports, and low domestic manufacturing capacities constrain expansion. According to these barriers, investment in sustainable adhesive technologies and broadening manufacturing capacity locally will drive higher opportunities in the market within the next few years.

Middle East and Africa Specialty Tapes Market Analysis

The Middle East and Africa (MEA) specialty tapes market is witnessing steady growth, led by rising construction activity, healthcare growth, and industrialization. The infrastructure projects in the region, especially in the UAE, Saudi Arabia, and South Africa, are driving demand for specialty tapes in waterproofing, HVAC insulation, and bonding applications. Also, the expanding healthcare industry is fueling demand for medical adhesive tapes in wound care, surgical uses, and wearable medical devices. The oil and gas sector also sustains demand, demanding high-performance tapes for insulation of pipes and sealing processes. Rising government investments in industrial diversification and sustainability programs are promoting the use of environmentally friendly adhesive tapes. Emergence of e-commerce and logistics providers in the area is also strengthening demand for security and durability-boosted specialty packaging tapes in the region. In addition to this, there is technological upgrading in adhesive developments that is increasing tape performance levels, making tapes more efficient as well as well-suited to a variety of applications.

Competitive Landscape:

The specialty tapes market is competitive, and it is driven by innovation, technology, and growing markets of application. The participants in the market concentrate on creating high-performance adhesive solutions specific to the industries like electronics, healthcare, automotive, and construction. Ongoing R&D activities are encouraging improvements in the strength of the adhesives, durability, and environmental friendliness. Firms are investing in sustainable and solvent-free adhesive technologies to align with strict green regulations and to satisfy consumer pressures for environmentally responsible solutions. Furthermore, strategic partnerships, mergers, and acquisitions are defining competition, allowing businesses to increase worldwide presence and bolster product offerings. Heightening demand in emerging markets is motivating manufacturers to expand distribution channels and set up regional manufacturing operations. Manufacturing process improvements, including precision coating and better polymer formulations, are further improving product quality. With mounting demand from various industries, competition is still keen, leading to ongoing product differentiation and innovation.

The report provides a comprehensive analysis of the competitive landscape in the specialty tapes market with detailed profiles of all major companies, including:

- 3M

- Avery Dennison Corporation

- DuPont

- Henkel AG & Co. KGaA

- Intertape Polymer Group

- Lintec Corporation

- Nitto Denko Corporation

- Scapa Group Plc

- Sekisui Chemical Co. Ltd

- Tesa SE

Latest News and Developments:

- In November 2024, Berry Global Group, Inc. (NYSE: BERY) has agreed to sell its Specialty Tapes business to private equity firm Nautic Partners. The move aligns with Berry’s strategy to focus on high-growth consumer markets. The transaction is expected to close in the first half of 2025.

- In November 2024, at Labelexpo India, tesa introduced its new flexographic tape solutions for the narrow-web print market. The tapes are developed for plate mounting, splicing, and gripping applications and provide increased efficiency as well as improved print quality. tesa highlighted its focus on innovation, partnership, and fostering industry growth in flexographic and digital printing.

Specialty Tapes Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Woven/Non-woven, Polyvinyl Chloride, Polyethylene Terephthalate, Paper, Polypropylene, Others |

| Technologies Covered | Solvent Borne, Water Borne, Hot Melt, Others |

| End User Industries Covered | Healthcare, Electrical and Electronics, Automotive, Paper and Printing, Building and Construction, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East, Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico, Others |

| Companies Covered | 3M, Avery Dennison Corporation, DuPont, Henkel AG & Co. KGaA, Intertape Polymer Group, Lintec Corporation, Nitto Denko Corporation, Scapa Group Plc, Sekisui Chemical Co. Ltd, Tesa SE, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty tapes market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global specialty tapes market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the specialty tapes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty tapes market was valued at USD 10.35 Billion in 2024.

The specialty tapes market is projected to exhibit a CAGR of 5.70% during 2025-2033, reaching a value of USD 17.73 Billion by 2033.

The specialty tapes industry is spurred by growing demand in the electronics, automotive, healthcare, and construction sectors. The growth drivers are technology advances in adhesives, greater adoption of high-performance tapes for insulation and bonding, environmental trends toward more sustainable tapes, and growing e-commerce logistics that need tough and secure packaging solutions.

Asia Pacific currently dominates the specialty tapes market, accounting for a share of 44.7%. The market is driven by sustained industrialization, surging electronics and automotive industries, increasing infrastructure projects, and expanding healthcare needs. Growing manufacturing bases, rising consumer electronics output, and robust e-commerce growth further fuel regional market growth.

Some of the major players in the specialty tapes market include 3M, Avery Dennison Corporation, DuPont, Henkel AG & Co. KGaA, Intertape Polymer Group, Lintec Corporation, Nitto Denko Corporation, Scapa Group Plc, Sekisui Chemical Co. Ltd, Tesa SE, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)