Specialty Films Market Size, Share, Trends and Forecast by Resin, Function, End Use Industry, and Region, 2025-2033

Specialty Films Market Size and Share:

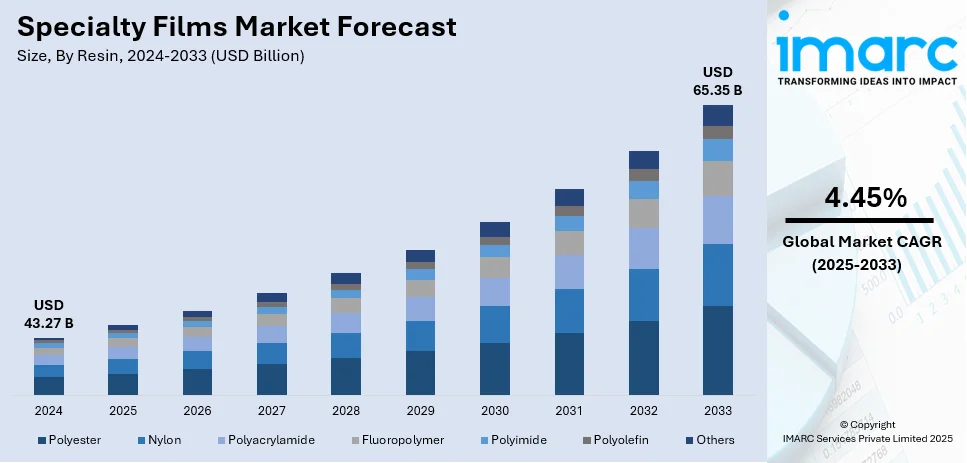

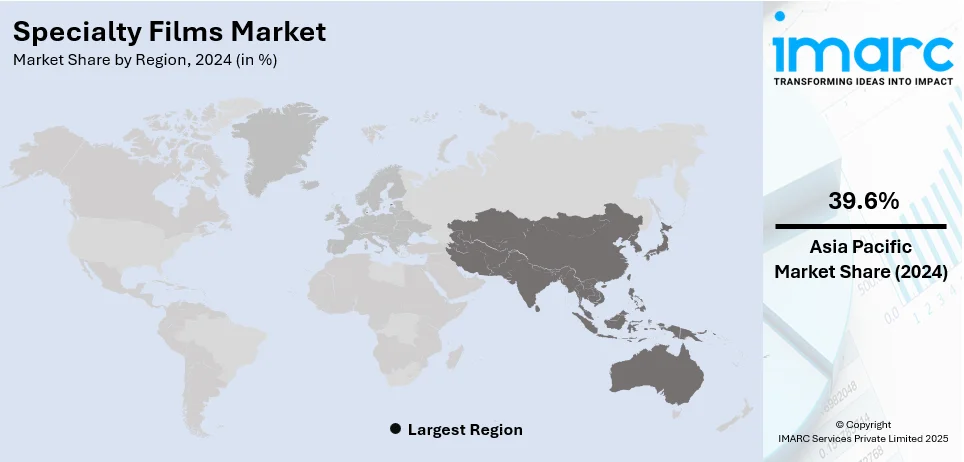

The global specialty films market size was valued at USD 43.27 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 65.35 Billion by 2033, exhibiting a CAGR of 4.45% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 39.6% in 2024. The market is driven by the escalating shift towards convenient, ready-to-eat meals necessitating specialty packaging that maintains quality and freshness, the development of specialty films tailored to individual needs, and the evolution of automotive industry.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 43.27 Billion |

|

Market Forecast in 2033

|

USD 65.35 Billion |

| Market Growth Rate (2025-2033) | 4.45% |

The global market is majorly driven by the rising demand for high-performance packaging solutions, which is propelling the adoption of specialty films that offer excellent barrier properties against moisture, gases, and contaminants. Furthermore, the thriving e-commerce industry requires advanced protective and tamper-evident packaging solutions, further increasing the specialty films market demand. Besides this, the role of industry expos and trade shows has proven pivotal in market expansion as they showcase innovations, foster collaborations, and increase the global visibility of emerging players and technologies. For instance, on July 18, 2024, Specialty Polyfilms announced its participation in Pack Expo 2024 to showcase its Forvara Non-PVC Food Wrapping Films to the North American market. These polyethylene-based films are designed to be odorless, tasteless, and free from harmful substances such as BPA, phthalates, heavy metals, fungicides, and PFAS, ensuring enhanced food and health safety. The company aims to expand its presence in the North American market, emphasizing the demand for environmentally responsible packaging solutions. Also, the increasing need for advanced agricultural films designed to enhance crop yield and optimize water usage is contributing to the market's growth.

The United States stands out as a key regional market, experiencing significant growth due to the rapid growth of the pharmaceutical and healthcare sectors, where specialty films are increasingly utilized in drug delivery systems, blister packaging, and medical devices. In line with this, strategic partnerships and collaborations among key players in the United States, including joint ventures between material suppliers and end-use industries, further support the market expansion. For example, on December 17, 2024, Berry Global Group, Inc. and VOID Technologies announced a collaboration to commercialize a high-performance sustainable polyethylene (PE) film tailored for flexible pet food packaging. This innovative film offers enhanced strength, toughness, and puncture resistance, and enables a recyclable all-PE structure in previously multi-material packaging, contributing to plastic sustainability goals. The partnership combines VOID's patented VO+ technology with Berry Global's expertise in film formulation and machine direction orientation processes, resulting in cavitated micro-scale air pockets that reduce plastic density and increase opacity without pigments, thereby contributing to sustainability goals. Moreover, the robust expansion of the renewable energy sector, particularly in solar energy applications, is raising the requirement for specialty films designed for photovoltaic modules. Furthermore, the growing emphasis on sustainability and eco-friendly solutions leads to increased investments in biodegradable and recyclable films, aligning with stringent environmental regulations and consumer preferences.

Specialty Films Market Trends:

Increased Product Demand in Packaging Applications

Specialty films market is experiencing growth primarily due to increased demands for packaging applications, especially in the food and pharmaceutical industries. The requirement of maintaining the integrity, freshness, and safety of products demands the use of product variants, which provide improved moisture, oxygen, and contaminants' barrier properties. The need for the sustainable and recyclable materials aspect is also currently influencing the development of eco-friendly product variants. For example, the Environmental Protection Agency (EPA) reports that in 2021, the U.S. produced about 5.9 million tons of plastic packaging. Furthermore, the increase in consumer consciousness about hygiene and health, along with stringent regulatory demands, is also driving the use of specialty films in packaging.

Stringent Regulatory Compliance and Sustainability Concerns

The increasing environmental sustainability concerns and the strict regulatory compliance are influencing the specialty films market outlook. Additionally, governments and regulatory authorities are introducing regulations that mandate the usage of materials that meet certain quality, safety, and environmental standards. For example, in the EU Plastics Strategy, which is part of the European Green Deal, there is a target of recycling 50% of plastic packaging by 2025. This has driven the industry to develop specialty films to perform highly and satisfy ecological concerns. Furthermore, the food industry has also been influencing innovation in the development of eco-friendly, recyclable, and biodegradable specialty films. Moreover, consumer awareness towards environmental concerns leads to a huge demand for greener variants. The combination of compliance and concerns toward sustainability are critical drivers that influence and govern direction as well as industry growth.

Technological Advancements and Innovation

Technological advancements play a significant part in propelling the specialty films market share. Innovations in polymer science and materials engineering lead to the creation of films with highly specific attributes such as improved thermal resistance, anti-microbial properties, and enhanced mechanical strength. According to the National Science Foundation (NSF), the U.S. government allocated around USD 1.8 Billion in 2020 for materials research and development (R&D) activities. This includes investments in various materials sciences, such as polymer research. Research and development (R&D) activities further fuel the creation of more sophisticated and diverse specialty films. These technological innovations are allowing manufacturers to cater to unique requirements across industries, such as healthcare, food and beverage, electronics, and automotive. Furthermore, the development of new manufacturing techniques, such as nano-layering and co-extrusion, facilitates customization. This adaptability creates a positive impact on various sectors, ensuring that specialty films meet or exceed industry standards and regulations.

Specialty Films Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global specialty films market report, along with forecasts at the global, regional and country levels from 2025-2033. Our report has categorized the market based on resin, function, and end use industry.

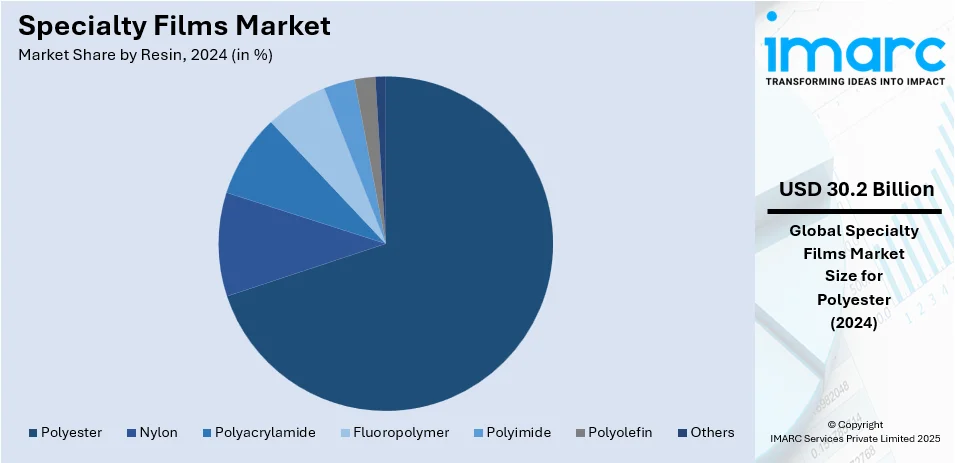

Analysis by Resin:

- Polyester

- Nylon

- Polyacrylamide

- Fluoropolymer

- Polyimide

- Polyolefin

- Others

Polyester leads the market with around 69.7% of market share in 2024 due to the augmenting demand for lightweight, durable, and flexible packaging solutions. In addition to this, the steady growth of end-use sectors such as food and beverages, healthcare, and electronics increases the importance of polyester resin-based product variants in ensuring and enhancing the integrity of the final product. The cost-effectiveness, along with its tensile strength, moisture, and chemical resistance, further reinforces the resin's position as the favorable option for manufacturers seeking to secure a long shelf life of products without compromising quality standards.

Analysis by Function:

- Barrier

- Conduction and Insulation

- Microporous

- Safety and Security

- Others

Barrier leads the market in 2024 due to the increased shelf life and freshness preservation with minimal exposure to external contaminants. These attributes are essential in industries, including food packaging, pharmaceuticals, and electronics, where product integrity must be guaranteed. Barrier function, characterized by features such as oxygen and moisture barrier, UV protection, and aroma retention, is an identifier of the quality and safety of the product. Growing consumer awareness relating to health and sustainability further supports the growth, prompting manufacturers to work with advanced materials and technologies as part of their products.

Analysis by End Use Industry:

- Packaging

- Personal Care

- Electrical and Electronics

- Transportation

- Construction

- Medical

Packaging leads the market in 2024. As consumer preferences shift towards convenience and aesthetics, packaging plays an increasingly pivotal role in influencing purchasing decisions. Specialty films, renowned for their versatility and ability to cater to diverse packaging needs, emerge as a preferred choice for manufacturers seeking to create impactful and functional packaging solutions. Moreover, the rising demand for sustainable practices fuels innovation in the sector, driving the adoption of product variants that minimize environmental impact while maintaining product integrity. The ever-expanding e-commerce landscape further amplifies the significance of packaging, necessitating films with heightened protective properties to ensure safe transit and delivery of goods.

Regional Analysis:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

In 2024, Asia Pacific accounted for the largest market share of over 39.6%. The specialty films industry in the Asia Pacific region is propelled by the region's robust economic expansion, coupled with a burgeoning middle-class population. The increased consumer spending and demand for advanced packaging, electronics, and automotive solutions further facilitates market growth. Rapid urbanization and changing lifestyles further bolster this need, as consumers seek products with enhanced functionality and aesthetic appeal. Additionally, the Asia Pacific region's status as a manufacturing hub draws attention to the requirement for specialized films that protect, preserve, and enhance the quality of goods during storage, transportation, and use. The drive towards sustainability and eco-conscious practices resonates strongly in the region, prompting manufacturers to develop environmentally friendly specialty films that align with stringent regulatory norms and consumer preferences. As technological advancements continue to reshape industries, the specialty films sector in the Asia Pacific remains poised for growth, driven by a fusion of economic dynamism, evolving consumer needs, and a commitment to innovation.

Key Regional Takeaways:

United States Specialty Films Market Analysis

U.S. specialty films continue to enjoy steady growth due to strong demand from various end markets, including packaging, automotive, and electronics. According to OECD, the United States generated an estimated 221 kilograms of plastic waste per person in 2019, and it is important to note the country's strong consumption of plastic. This demand is primarily from the packaging industry that has increased in flexible and specialty films in the food, beverages, and the medical sector packaging. The other significant area is the automobile industry that increasingly requires a lightweight yet long-lasting material, thereby increasing efficiency and the capability of vehicles with fuel. Industrial research reports that car plastics will eventually break USD 19 Billion in the market by the end of 2025 and therefore leads to further growth for the specialty films market. Innovation frontiers of key players such as Amcor and Berry Global have launched recyclable films and advanced coating to create sustainability, which leads the government regulatory rules in enhancing their market growth and make it possible to adapt eco-friendly solutions in them.

Europe Specialty Films Market Analysis

The demand for ecologically friendly and innovative solutions is driving the specialty films market in Europe. The European Commission has estimated that in 2022, the European Union produced 16.1 million metric tons of plastic waste for packaging, signifying the growing concern for sustainable packaging. This transformation to biodegradable and recyclable films arises directly from stricter regulations in reducing plastic waste. Consumer demand for high-performance and transparent films, specifically in the food packaging industry, is also expanding. The rising demand for lighter and more robust materials in the automotive sector has also been beneficial for the industry, as demand for advanced specialty films continues to grow. Industry leaders such as BASF and Mondi focus on product innovations in high-barrier and environmentally friendly films. With strong government backing for research and development (R&D) activities in countries like Germany and the UK, Europe has a leadership role in the specialty films market of the world.

Asia Pacific Specialty Films Market Analysis

The market for specialty films in the Asia Pacific region is particularly exhibiting rapid growth. The primary drivers behind this growth are the demand from the packaging, automotive, and electronics industries. China primarily accounts for much of the growth, being a leader in this region. Industrial reports show that China's total production of plastic products stood at almost 75 million metric tons during 2023, further confirming China as a plastic manufacturing giant. The demand for higher performance films, especially in food and beverages, is fueling growth in the packaging industry. The automotive industry is also having a great effect on specialty films as it focuses on improving fuel efficiency and reducing emissions by using lightweight yet durable materials. Top firms in China and across the Asia Pacific are investing heavily in sustainable materials and higher sophisticated manufacturing technologies. The implementation of favorable government initiatives to encourage innovation and infrastructure development enhances the growth prospects for the specialty films market in this region.

Latin America Specialty Films Market Analysis

Latin America's specialty films market is growing rapidly due to the growing need for sustainable and efficient packaging solutions. Brazil contributes to the region's market growth as it produces approximately 7 million tons of plastic products annually. Industrial reports state that 44% of these products are disposable and single-use plastics, mainly used in food packaging, and most of them find their way into one of Brazil's 3,000 dumps. This underscores the increasing requirement for innovative, green solutions in packaging. In addition to this, consumer demand for high-quality films, lightweight yet strong films, is also on the rise in this region. The increasing demand in the automotive industry for advanced materials contributes to the growth of the market. Companies are also developing sustainable films, as governments and industries increase investment in recycling and circular economy initiatives to deal with environmental issues. This is thus placing Latin America at the center of the global specialty films market.

Middle East and Africa Specialty Films Market Analysis

In the Middle East and Africa region, the growth of specialty films is prominent and rapid in the United Arab Emirates. According to an industrial report, the UAE is considered a promising region for the market, especially in the field of packaging with a volume reaching 12.5 billion units in the year 2023. This represents a growing requirement for packaging solutions influenced by an expansion in consumer size and a shift towards sustainable packing. In the area of innovation and sustainability, the government launches supportive initiatives that include the prohibition of single-use plastic bags in Abu Dhabi, the creation of the Circular Packaging Association in an effort to reach green economy targets, among others. Keryas Paper Industry in 2022 has announced its Kraft liner project in the UAE, which is estimated to be capable of 200,000 metric tons a year. These initiatives, along with increased consumer demand for eco-friendly packaging, are driving the UAE's packaging market forward, making it a leader in the region's specialty films market.

Competitive Landscape:

The market is highly competitive, with major players focusing on research and development (R&D) efforts to innovate and enhance the performance characteristics of specialty films. This includes improving barrier properties, durability, transparency, and eco-friendliness to cater to various end-use applications. Along with this, small as well as large companies are investing in sustainable practices by developing specialty films with reduced environmental impact, including recyclable and biodegradable options. Strategic collaborations between suppliers and partners ensure the sourcing of raw materials, which aligns with sustainability goals. In addition to this, manufacturers are expanding their product portfolios to offer a diverse range of specialty films tailored to specific industries such as packaging, electronics, automotive, and construction. Furthermore, the key players are also adopting advanced manufacturing technologies to increase efficiency, reduce production costs, and maintain high-quality standards.

The report provides a comprehensive analysis of the competitive landscape in the specialty films market with detailed profiles of all major companies, including:

- 3M Company

- Avery Dennison Corporation

- Covestro AG

- DuPont de Nemours Inc.

- Evonik Industries AG

- Honeywell International Inc.

- Inteplast Group Corporation

- Kaneka Corporation

- Mondi plc

- Saudi Basic Industries Corporation (Saudi Arabian Oil Co.)

- Toray Industries Inc.

- Ube Industries Ltd

Recent Developments:

- September 2024: Inteplast Group acquired a paper packaging manufacturer, which will now operate under its Integrated Bagging Systems (IBS) Division. Additionally, Inteplast's Barrier-Bac anti-vapor film is being used in a residential construction project near Washington, D.C., and South Carolina, marking an expansion of XF Films.

- June 2024: Avery Dennison introduced SP 1504 Easy Apply RS™, a sustainable digital print film for automobile wrapping and corporate branding in Australia as well as New Zealand. The film reduces greenhouse gas emissions by 53%, is chlorine and phthalate-free, and ensures superior printability and easy installation with Air Egress technology.

- July 2023: Avery Dennison launched several new lines with an emphasis on sustainability. The company's revolutionary adhesive technique, the AD CleanFlake technique, makes it possible to recycle hard plastic packaging without compromising its usefulness.

- March 2023: Covestro AG announced intentions to increase its capacity to make these films as the Asia-Pacific area and the world are experiencing increasing demand for specialty polycarbonate (PC) films. Therefore, in Thailand, the company has started building further extrusion lines at the Map Ta Phut Industrial Park.

- October 2022: According to the EU Merger Regulation, the European Commission approved DuPont's Mobility and Materials Business's planned acquisition of Celanese. For approval to be given, Celanese must fulfill all of their commitments.

Specialty Films Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resins Covered | Polyester, Nylon, Polyacrylamide, Fluoropolymer, Polyimide, Polyolefin, Others |

| Functions Covered | Barrier, Conduction and Insulation, Microporous, Safety and Security, Others |

| End Use Industries Covered | Packaging, Personal Care, Electrical and Electronics, Transportation, Construction, Medical |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | 3M Company, Avery Dennison Corporation, Covestro AG, DuPont de Nemours Inc., Evonik Industries AG, Honeywell International Inc., Inteplast Group Corporation, Kaneka Corporation, Mondi plc, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), Toray Industries Inc., Ube Industries Ltd. etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the specialty films market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global specialty films market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the specialty films industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty films market was valued at USD 43.27 Billion in 2024.

The specialty films market is projected to exhibit a CAGR of 4.45% during 2025-2033, reaching a value of USD 65.35 Billion by 2033.

The specialty films market is driven by the increasing demand from industries such as packaging, electronics, and automotive, advancements in film technology, rising environmental concerns encouraging sustainable films, and rapid urbanization driving infrastructure and construction applications.

Asia Pacific currently dominates the specialty films market, accounting for a share of 39.6% in 2024. The dominance is fueled by robust industrial growth, expanding packaging needs, and increasing investments in construction and electronics sectors.

Some of the major players in the specialty films market include 3M Company, Avery Dennison Corporation, Covestro AG, DuPont de Nemours Inc., Evonik Industries AG, Honeywell International Inc., Inteplast Group Corporation, Kaneka Corporation, Mondi plc, Saudi Basic Industries Corporation (Saudi Arabian Oil Co.), Toray Industries Inc., and Ube Industries Ltd., among others.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)