Spatial Computing Market Size, Share, Trends and Forecast by Component, Technology, End User, and Region, 2025-2033

Spatial Computing Market Size and Share:

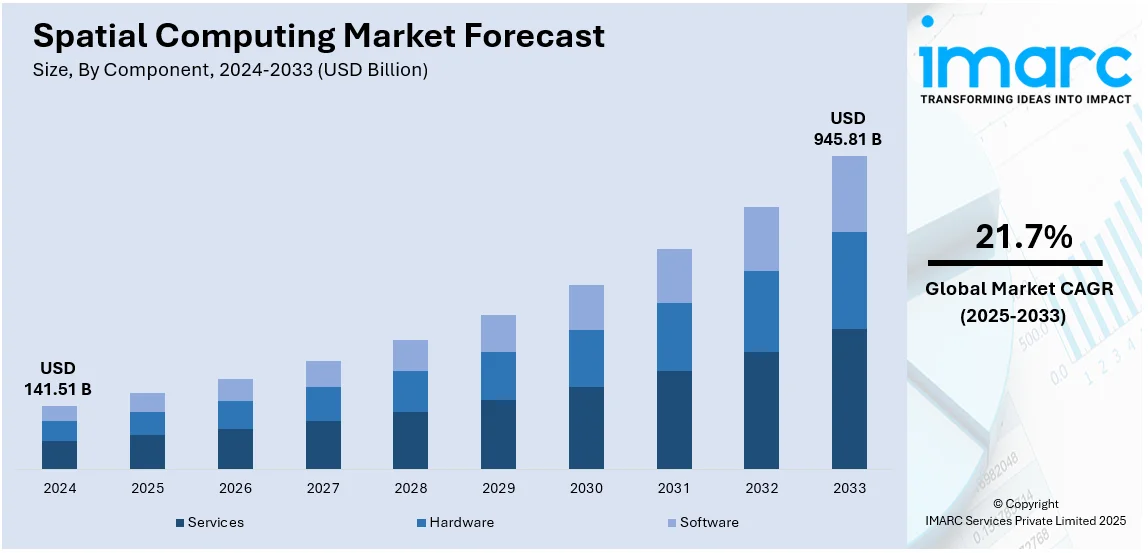

The global spatial computing market size was valued at USD 141.51 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 945.81 Billion by 2033, exhibiting a CAGR of 21.7% from 2025-2033. North America currently dominates the market, holding a market share of over 33.5% in 2024. Strong R&D investments, rapid AR/VR adoption, expanding enterprise applications, 5G rollout, government support, and advanced technological infrastructure are driving the spatial computing market’s growth across various industries and applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 141.51Billion |

| Market Forecast in 2033 | USD 945.81Billion |

| Market Growth Rate (2025-2033) | 21.7% |

The growing adoption of digital twin technology is heavily propelling the spatial computing market worldwide. Manufacturing, construction, and logistics industries are using digital twins for real-time simulation, predictive maintenance, and process optimization. Smart city programs are integrating spatial computing to enhance urban planning, traffic management, and energy efficiency by developing interactive, data-based models of physical spaces. The intersection of Internet of Things (IoT) and artificial intelligence (AI) improves these digital twins, with easy integration and analysis of data. Companies are also using spatial computing for remote monitoring, lowering operational expenses and enhancing decision-making. Augmented reality (AR) overlays in digital twin systems provide more natural interaction with complicated data, facilitating workforce training and efficiency. For instance, in January 2024, Xreal introduced Air 2 Ultra AR glasses with 6DoF, a titanium frame, and 3D sensors, offering developers an affordable mixed reality solution with advanced tracking and spatial computing capabilities. Moreover, as with ongoing developments in cloud computing and edge processing, spatial computing emerges as a necessity for businesses and governments globally to make different applications more efficient, sustainable, and automated.

The U.S. is experiencing a quick expansion of spatial computing uses in healthcare, fueled by the growing need for high-end medical training, surgical simulation, and patient care. The market is currently growing with a total share of 88.70%. Moreover, augmented reality (AR) and virtual reality (VR) are being incorporated into hospitals and medical facilities to train surgeons, allowing for immersive, risk-free learning. Spatial computing-based diagnostics, including AI-enabled imaging and 3D anatomical mapping, are improving early disease detection and precision medicine. Telemedicine is transforming through spatial computing with the ability to remotely monitor patients through AR interfaces and real-time 3D modeling. For instance, In December 2024, HP introduced Project Starline, an immersive holographic telepresence solution, and Z by HP Boost, enabling remote GPU access for AI workloads. These innovations highlight HP’s focus on spatial computing, enhancing real-time collaboration and AI-powered enterprise solutions. Apart from this, rehabilitation programs are being integrated with interactive spatial computing technology to help patients with physical rehabilitation through gamified and customized therapy. The US government and private healthcare companies are investing in spatial computing technologies for better medical outcomes, cost reductions, and operational efficiency in hospitals. As regulatory environments change, spatial computing is also turning into a revolutionary force in the American healthcare sector.

Spatial Computing Market Trends:

Rise of AI-Powered Spatial Computing for Autonomous Systems

Artificial intelligence (AI) is revolutionizing spatial computing by enhancing autonomous systems across various industries. AI-driven spatial computing enables real-time object recognition, environmental mapping, and decision-making in robotics, drones, and self-driving vehicles. In warehouses and logistics, AI-powered spatial computing optimizes inventory tracking and autonomous navigation for automated guided vehicles (AGVs). In agriculture, AI-integrated spatial computing assists in precision farming by analyzing spatial data for optimal planting, irrigation, and harvesting. The military and defense sectors are leveraging AI-enhanced spatial computing for real-time battlefield simulations, autonomous surveillance, and strategic planning. AI-driven spatial computing is also improving accessibility solutions, enabling navigation assistance for visually impaired individuals through AR overlays and real-time spatial awareness. As AI continues to evolve, spatial computing applications are becoming more intelligent, adaptive, and efficient, unlocking new possibilities for automation, real-time analytics, and human-machine collaboration across industries.

Expansion of Spatial Computing in Retail and E-Commerce

Retailers and e-commerce platforms are increasingly adopting spatial computing to enhance customer engagement, streamline operations, and create immersive shopping experiences. Augmented reality (AR) and mixed reality (MR) facilitate virtual try-ons, enabling customers to preview clothing, accessories, and furniture before purchasing. Spatial computing is improving in-store navigation through AR-based wayfinding applications, helping customers locate products seamlessly. E-commerce platforms are integrating 3D product visualization and interactive virtual showrooms to enhance online shopping experiences. Warehouse automation is leveraging spatial computing for smart inventory management, optimizing storage, and reducing fulfillment times. Personalized AI-driven recommendations using spatial computing are transforming the way customers interact with brands, providing customized shopping experiences based on user behavior and preferences. As the demand for omnichannel retail strategies grows, spatial computing is playing a crucial role in bridging the gap between physical and digital shopping environments, driving efficiency and customer satisfaction.

Integration of Spatial Computing in Workplace Collaboration and Training

The rise of remote and hybrid work models is driving the adoption of spatial computing for workplace collaboration and employee training. Companies are utilizing virtual and augmented reality (VR/AR) platforms to create immersive virtual meeting spaces, enabling remote teams to interact as if they were in the same room. For example, in July 2023, Magnopus launched the Connected Spaces Platform as open-source, enabling developers to create cross-platform spatial computing applications. The technology supports AR, VR, and real-time 3D interactions, fostering interoperability and accelerating innovation in immersive digital experiences. Moreover, spatial computing enhances enterprise training programs by offering interactive simulations, reducing the need for physical training materials, and improving knowledge retention. Industries such as manufacturing and aviation are adopting spatial computing for hands-on technical training, allowing workers to practice assembling machinery or operating complex equipment in a virtual environment. Remote assistance through spatial computing enables real-time collaboration, where experts can guide field workers using AR overlays and spatial mapping. The increasing integration of digital twins into corporate environments is further improving workflow efficiency and decision-making. As businesses seek innovative ways to optimize productivity, spatial computing is becoming an essential tool for workplace transformation.

Spatial Computing Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global spatial computing market, along with forecast at the global, regional, and country levels from 2025-2033. The market has been categorized based on component, technology, end user.

Analysis by Component:

- Services

- Hardware

- Software

Software has the biggest market share of 63.2% in 2024, in the space computing industry because of ongoing growth in AI, machine learning, and real-time 3D rendering. As more applications using AR/VR are demanded from gaming, health, retail, and manufacturing segments, software advancement is being catalyzed by this growth. Spatial mapping, gesture recognition, and AI-backed automation are principal areas of enhancement. Cloud-connected spatial computing systems facilitate real-time collaboration, contributing to increased corporate adoption. Spatial analytics and digital twins further intensify demand. The development of tighter integration with IoT, 5G, and edge computing improves the capabilities of real-time processing. Regular software updates and the addition of open-source development tools further fuel market growth. The sector is seeing major SDK and API investment, creating an ecosystem of developers that drives new uses and adoption in the marketplace.

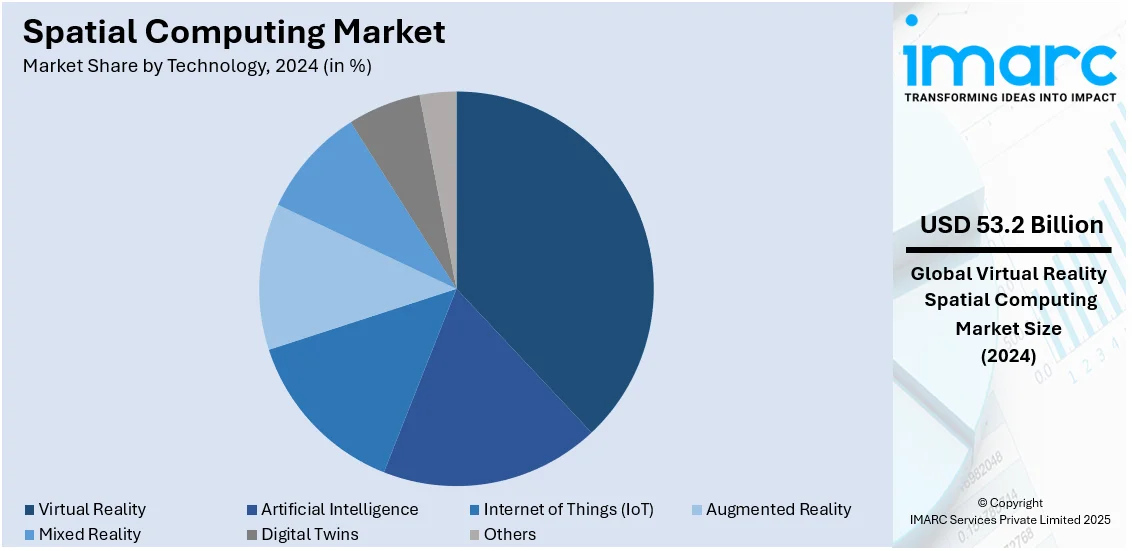

Analysis by Technology:

- Virtual Reality

- Artificial Intelligence

- Internet of Things (IoT)

- Augmented Reality

- Mixed Reality

- Digital Twins

- Others

Virtual reality (VR) leads the spatial computing technology market at a 37.6% share due to growing adoption in gaming, training, simulation, and healthcare applications. Growing accessibility of high-performance VR headsets, led by Meta, HTC, and Sony, is pushing the adoption. Business applications, especially in workforce training and remote team collaboration, are driving market growth. VR is redefining learning with interactive immersive experiences, whereas the retail space uses virtual shop environments to interact with customers in a more intense way. Virtual shopping environments increase rapidly in health care applications like surgical simulations, therapy, and rehabilitation. Interfacing with AI and haptic feedback, VR is enhanced with user experience and immersion deepening. Cloud-based VR environments are increasingly on the rise for scalable deployment options for institutions and businesses. The deployment of 5G boosts VR's real-time responsiveness by lowering latency and allowing for smoother experiences. As hardware, software, and content continue to evolve, virtual reality continues to be a key catalyst for spatial computing expansion.

Analysis by End User:

- Healthcare

- Gaming

- Consumer Electronics

- Government and Public Sector

- Education

- Aerospace & Defense

- Automotive

- Energy & Utilities

- Architecture, Engineering, and Construction (AEC)

- Information Technology

- Others

The healthcare industry is the largest spatial computing end-user, capturing a large portion in 2024, employing AR and VR in medical education, diagnostics, treatment, and patient care. Spatial computing upgrades surgical planning using 3D visualization and holographic imaging to provide more accurate procedures. Virtual reality-based therapy is becoming a standard for managing pain, mental illness treatment, and rehabilitation. Augmented reality aids remote monitoring of patients and real-time diagnosis to enhance telemedicine applications. Hospitals are incorporating spatial computing for sophisticated imaging and diagnostics to improve operational effectiveness. AI-driven spatial analytics support drug discovery and customized treatment protocols. There is increasing demand for training simulations that offer immersion, enabling medical staff to rehearse intricate procedures in a risk-free setting. Market growth is being stimulated by the rising investments in digital health infrastructure and growing hospital adoption of mixed reality technologies. Regulatory encouragement and collaboration between medical professionals and technology companies also drive the adoption of spatial computing in healthcare.

Regional Analysis:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America dominates the spatial computing market with a 33.5% share due to robust technology infrastructure, large R&D spend, and pervasive enterprise adoption. The presence of industry giants such as Microsoft, Meta, Apple, and Google support innovation and hastens commercialization. Early adoption in industries like healthcare, gaming, retail, and defense adds to the dominance of the region. The rollout of 5G networks and cloud computing improves the capabilities of spatial computing by enhancing real-time processing and remote access. Public support of AI, AR/VR, and digital transformation fuels the growth of the market. Consumer adoption is still driven by the gaming and entertainment market, with increasing enterprise applications in training, remote team collaboration, and industrial automation widening the breadth of use cases. North America's healthy venture capital network prompts startups to build new spatial computing solutions. Partnerships among technology companies, research organizations, and healthcare organizations further drive innovation. Ongoing software and hardware improvements, North America continues to be the leading market for spatial computing.

Key Regional Takeaways:

United States Spatial Computing Market Analysis

The United States dominates the market of spatial computing thanks to its advanced technological framework, large scale of research and development activities, and high business use rates among sectors. Top tech companies are progressing AR, VR, and AI-based spatial computing solutions for fields such as health care, military, and consumer retail. Spatial computing is utilized by the U.S. army for highly enhanced training simulation, battlefield map modeling, and planning missions. Within the corporate world, companies are deploying spatial computing to enable remote immersion and real-time data visualization. Smart cities apply geospatial AI for town planning, traffic management, and infrastructure monitoring. The growth in metaverse technology applications within the entertainment and social networking domains is driving consumer deployment. The use of spatial computing is highly prevalent in the automobile industry for autonomous vehicles and enhanced driver-assist systems (ADAS). Robust government support for AI and innovation policies also aids the growth of the market, making the U.S. a global leader in the development and implementation of spatial computing.

Europe Spatial Computing Market Analysis

Europe is swiftly stepping up the pace of spatial computing with robust government policies favoring AI development, smart city projects, and digital transformation initiatives. The region's manufacturing sector is adopting digital twin technology for predictive maintenance and process optimization. Spatial computing is transforming the automotive sector with firms using AR-based driver support systems and real-time navigation platforms. Spatial computing is also improving medical imaging, robot-assisted surgeries, and personalized medicine in the healthcare sector. The education industry is intensely using AR/VR for experiential learning and vocational training. Metaverse platforms are being invested in by European businesses, growing interactive virtual spaces for commerce, entertainment, and socialization. Privacy-centric AI laws are defining ethical spatial computing use cases, guaranteeing data protection in digital environments. With joint research from universities, startups, and incumbent companies, Europe is gaining momentum as one of the primary drivers of innovation in spatial computing, shaping global technological developments and market growth.

Asia Pacific Spatial Computing Market Analysis

Asia Pacific is witnessing remarkable growth in spatial computing, driven by fast digitalization, high smartphone penetration, and government funding in AI and smart cities. The entertainment and gaming sectors are key drivers, with AR/VR adoption being high in mobile gaming, virtual concerts, and metaverse experiences. The manufacturing sector in the region is also using spatial computing for real-time monitoring, automation, and quality control. Smart retail is transforming with AI-based virtual shopping and AR-based product visualization. Asian Pacific nations are implementing geospatial AI for disaster response, precision farming, and ecology monitoring. Spatial computing is also applied in optimizing logistics, supply chain management, and urban mobility. Healthcare innovations, such as AI-based diagnostics and AR-aided surgeries, are also increasing market use cases. Given the fast-expanding technology ecosystem and robust government support for digital innovation, Asia Pacific is well-placed to be a leading driver of spatial computing innovation and take-up.

Latin America Spatial Computing Market Analysis

The Latin American market for spatial computing is growing driven by growing investment in digital infrastructure, AI automation, and city-smart initiative. Governments are embracing spatial computing for public protection, transportation infrastructure planning, and environmental protection. The retail segment in the region is embracing AR-enabled virtual shopping fronts and shopping experiences, building customer engagement. The agriculture business is using geospatial AI and IoT for optimizing crop control, irrigation management, and crop yield forecasting. Healthcare centers are embracing spatial computing for telemedicine, robotic surgery, and virtual training for doctors. Amplifying fintech uses are fueling demand for biometric authentication and fraud detection driven by AI technology. Challenges to adoption, such as inadequate infrastructure in certain parts of the world, are hindered by amplified smartphone penetration and internet availability that is boosting use of spatial computing. With increasing support from public and private sectors, Latin America is stimulating adopting spatial computing solutions in all sectors to raise efficiency and innovativeness.

Middle East and Africa Spatial Computing Market Analysis

The Middle East and Africa (MEA) market is experiencing a continuous increase in spatial computing adoption due to government-driven smart city initiatives, AI-powered infrastructure growth, and growing digital ecosystems. Governments in the Middle East are using spatial computing to invest in energy management, city planning, and tourism boost using interactive AR-based experiences. Defense and security are using AI-enhanced spatial computing for surveillance, border security, and threat monitoring in real time. In Africa, spatial computing is revolutionizing healthcare with telemedicine, AI-aided diagnostics, and remote medical training. The banking sector is adopting AI-driven biometric security systems to improve fraud detection and online banking services. Notwithstanding infrastructure deficits, rising mobile and internet penetration is fueling AR/VR adoption across education, entertainment, and distance collaboration. With digital transformation speeding up, spatial computing is taking a crucial role in driving technological capabilities in the Middle East and Africa.

Competitive Landscape:

The spatial computing industry is transforming at a fast pace, with a multitude of technology providers, software companies, and hardware firms spearheading the innovation. Firms are concentrating on AR, VR, AI, and IoT integration breakthroughs to improve user experience and extend applications across industries. Strategic collaborations and alliances between governments, research bodies, and tech companies are spurring the progress of spatial computing solutions. Venture investments in digital twin technology, AI-based automation, and cloud-based computing are heightening rivalry. Mergers and acquisitions are rising within the market as companies strive to enhance their portfolio and boost market share. Open-source development and cross-platform capability are emerging differentiators. The demand for privacy-compliant spatial computing solutions is propelling regulation adjustments. With the growth of spatial computing across industries like healthcare, automotive, and smart cities, players in the market are constantly innovating to create competitive differentiation.

The report provides a comprehensive analysis of the competitive landscape in the spatial computing market with detailed profiles of all major companies, including:

- Apple Inc.

- Blippar Group Limited

- Google LLC

- HTC Corporation

- Lenovo Group Limited

- Magic Leap, Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Seiko Epson Corporation

- Sony Group Corporation

Latest News and Developments:

- In September 2024, Lenovo introduced the ThinkPad X1 Carbon Gen 13 Aura Edition and Auto Twist AI PC proof of concept, advancing AI-driven and spatial computing technologies. The AI PC Fast Start solution accelerates AI adoption, reinforcing Lenovo’s leadership in next-gen computing and personalized user experiences.

- In February 2024, Apple introduced the Vision Pro headset, marking a major step into spatial computing. Analysts debate its adoption potential, with initial buyers primarily developers and enthusiasts. The launch highlights Apple’s strategic push beyond smartphones, aiming to redefine immersive digital experiences through advanced augmented and virtual reality integration.

- In February 2024, HTC unveiled its latest spatial computing innovations, including the VIVE XR Elite Business Edition, AI-integrated VIVERSE, and advanced VR workspace solutions. Key highlights focus on multilingual translation, immersive collaboration, and enterprise-ready VR applications, strengthening HTC’s position in extended reality technology.

Spatial Computing Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Services, Hardware, Software |

| Technologies Covered | Virtual Reality, Artificial Intelligence, Internet of Things (IoT), Augmented Reality, Mixed Reality, Digital Twins, Others |

| End Users Covered | Healthcare, Gaming, Consumer Electronics, Government and Public Sector, Education, Aerospace & Defense, Automotive, Energy & Utilities, Architecture, Engineering, and Construction (AEC), Information Technology, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Apple Inc., Blippar Group Limited, Google LLC, HTC Corporation, Lenovo Group Limited, Magic Leap, Inc., Microsoft Corporation, NVIDIA Corporation, Seiko Epson Corporation, Sony Group Corporation. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the spatial computing market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global spatial computing market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the spatial computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The spatial computing market was valued at USD 141.51Billion in 2024.

The spatial computing market is projected to exhibit a CAGR of 21.7%during 2025-2033, reaching a value of USD 945.81Billion by 2033.

The spatial computing market is driven by advancements in AI, AR/VR, and IoT integration, increasing demand for immersive experiences, expanding applications in healthcare, automotive, and education, rising investments in smart infrastructure, and growing adoption of digital twins for real-time simulations, automation, and enhanced human-computer interaction across industries.

North America currently dominates the spatial computing market, accounting for a share of 33.5%. North America's spatial computing market growth is driven by strong tech investments, AI advancements, AR/VR adoption, enterprise applications, gaming expansion, 5G deployment, and government support.

Some of the major players in the spatial computing market include Apple Inc., Blippar Group Limited, Google LLC, HTC Corporation, Lenovo Group Limited, Magic Leap, Inc., Microsoft Corporation, NVIDIA Corporation, Seiko Epson Corporation, Sony Group Corporation, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)