Spain Luxury Goods Market Size, Share, Trends and Forecast by Distribution Channel, End User, and Region, 2026-2034

Spain Luxury Goods Market Overview:

The Spain luxury goods market size reached USD 4.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 6.6 Billion by 2034, exhibiting a growth rate (CAGR) of 3.62% during 2026-2034. The high tourism spending, rising disposable incomes, growing brand consciousness, digital retail expansion, sustainability trends, and a strong domestic fashion and craftsmanship heritage are the factors propelling the growth of the market. Luxury experiences, personalization, and premiumization in fashion, jewelry, and cosmetics further boost demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 6.6 Billion |

| Market Growth Rate (2026-2034) | 3.62% |

Spain Luxury Goods Market Trends:

Rising Tourist Spending

Luxury expenditure in Spain is increasing as tourism grows. Visitors from key international markets are driving up demand for high-end clothes, accessories, and luxury experiences. The broader European industry is also steadily expanding, with southern Europe gaining as wealthy travelers choose unique shopping experiences. Luxury retailers are increasing their store footprints, improving in-store services, and integrating digital channels to attract high-net-worth customers. This move illustrates foreign tourism's expanding effect on premium retail, which will shape future strategies in the high-end consumer market. According to industry reports, in 2024, Spain's luxury goods industry expanded, owing to rising visitor spending, especially in southern Europe. This tendency helped the European personal luxury goods market reach around USD 115.05 Billion, representing a 3% to 4% growth over 2023.

Expanding Luxury Retail for Affluent Global Shoppers

Luxury retailers in Spain are increasingly concentrating on attracting rich overseas customers, notably those from the Middle East. Premium shopping experiences, such as customized services, VIP lounges, and carefully curated product selections, are sought after by high-net-worth tourists. To meet this demand, firms are expanding their in-store services, collaborating with travel experts, and implementing specific benefits for top consumers. The goal is to provide seamless shopping experiences that mix luxury with culture and hospitality-based elements. This strategy improves Spain's appeal as a top destination for high-end retail, utilizing tourism-driven spending to increase sales of fashion, accessories, and luxury lifestyle items. As global tourism recovers, companies are pursuing strategic alliances and customer engagement activities that meet the demands of rich tourists seeking exclusivity and ease. For instance, in August 2024, El Corte Inglés partnered with Akhom Consulting to lure high-spending Middle Eastern travelers to its flagship stores in Spain and Portugal. This program seeks to improve luxury shopping experiences for wealthy GCC travelers. By expanding its worldwide audience, the company aims to increase sales of premium apparel, accessories, and exclusive services, cementing Spain's status as a vital luxury shopping destination.

Spain Luxury Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, distribution channel and end user.

Product Type Insights:

- Watches and Jewellery

- Perfumes and Cosmetics

- Clothing

- Bags/Purse

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes watches and jewellery, perfumes and cosmetics, clothing, bags/purse, and others.

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

End User Insights:

- Women

- Men

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes women and men.

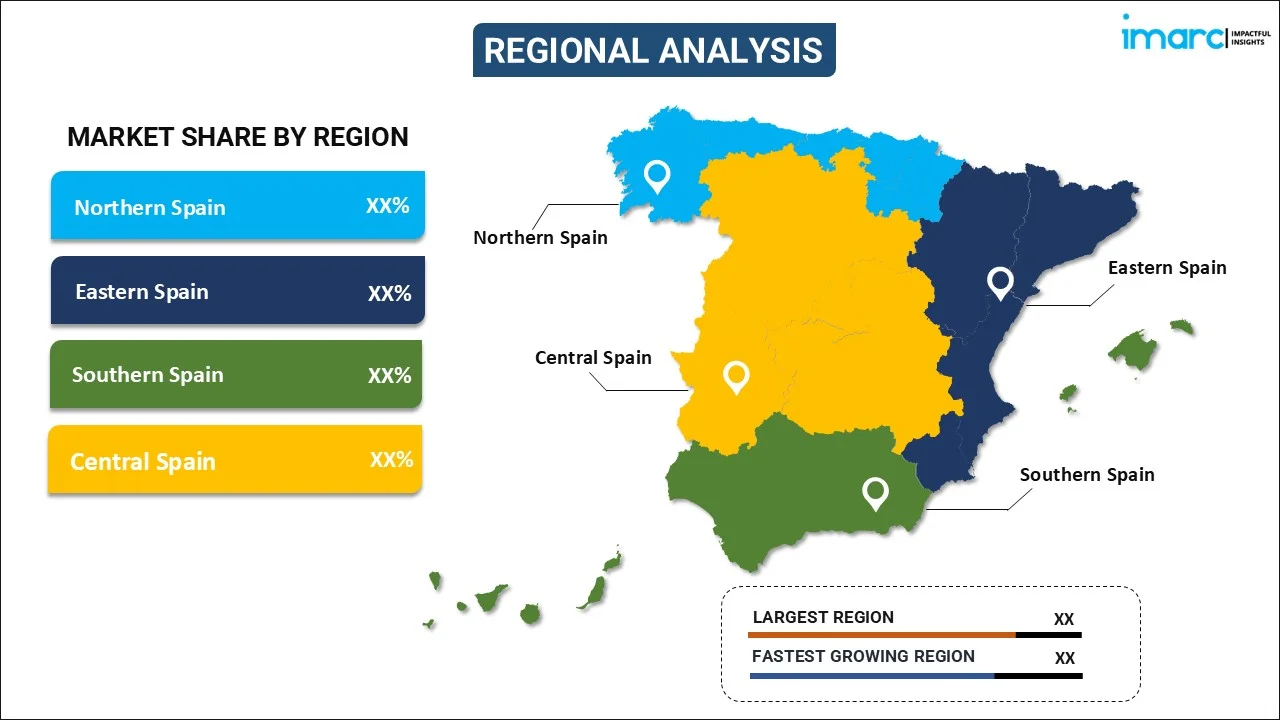

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Luxury Goods Market News:

- In December 2024, Balenciaga launched The Zero, an avant-garde footwear design for their Fall 2025 collection, bolstering its position in high-end fashion. The Spanish luxury brand, founded by Demna Gvasalia, continues to push creative limits with fresh products. Known for its unique designs, the current collection reflects the rising need for bold and statement luxury goods. This move reflects the growing interest in experimental fashion among consumers and increases Spain's influence in the premium industry through innovative and high-fashion product offerings.

- In March 2024, Tissa Fontaneda, a luxury handbag designer, opened an owner-operated store in Madrid, making her products more accessible to local buyers. The store offers a carefully chosen assortment of handcrafted leather items that prioritize quality and uniqueness. This development reflects rising demand for high-end clothes and personalized shopping experiences, supporting the brand's dedication to craftsmanship and direct consumer involvement in a thriving luxury retail landscape.

Spain Luxury Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Watches and Jewellery, Perfumes and Cosmetics, Clothing, Bags/Purse, Others |

| Distribution Channels Covered | Offline, Online |

| End Users Covered | Women, Men |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain luxury goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain luxury goods market on the basis of distribution channel?

- What is the breakup of the Spain luxury goods market on the basis of end user?

- What are the various stages in the value chain of the Spain luxury goods market?

- What are the key driving factors and challenges in the Spain luxury goods market?

- What is the structure of the Spain luxury goods market and who are the key players?

- What is the degree of competition in the Spain luxury goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain luxury goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain luxury goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain luxury goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)