Spain LED Lighting Market Report by Product Type (LED Lamps and Modules, LED Fixtures), Installation (New Installation, Replacement), Application (Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, and Others), and Region 2026-2034

Spain LED Lighting Market Overview:

The Spain LED lighting market size reached USD 1.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2034, exhibiting a growth rate (CAGR) of 7.39% during 2026-2034. The market is experiencing steady growth driven by growing consumer and corporate focus on sustainability across the globe, government policies providing incentives and enforcing regulations favoring LED adoption, and continuous technological advancements in LED technology.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.5 Billion |

| Market Forecast in 2034 | USD 2.8 Billion |

| Market Growth Rate (2026-2034) | 7.39% |

Access the full market insights report Request Sample

Spain LED Lighting Market Trends:

Government initiatives and regulations

The Spanish government's strong emphasis on energy efficiency and sustainability is propelling the LED lighting market. Along with this, various initiatives and regional programs aim to reduce energy consumption and greenhouse gas emissions. These policies often include financial incentives, subsidies, and rebates for both residential and commercial sectors to adopt LED lighting. Therefore, this acts as a significant growth factor. Additionally, stringent regulations mandating the phasing out of incandescent bulbs and promoting LED technology are accelerating market growth. Compliance with European Union directives, such as the Energy Performance of Buildings Directive, also plays a crucial role, as these regulations necessitate the integration of energy-efficient lighting solutions, thereby escalating the demand for LEDs.

Technological advancements and cost reduction

Continuous improvements make LED technology increasingly energy efficient, durable, and high-quality, leading to growing consumer and business interest. The ongoing development of smart lighting systems, integration of LEDs with the Internet of Things, and development of improved control mechanisms are further expanding the potential scope of applications for LED lighting. At the same time, the descending cost of LED products, driven by economies of scale and the competition among LED producers, is making LED lighting more affordable. Moreover, the better price-performance ratio is one of the key drivers for the retrofit of traditional luminaires with LED solutions, as customers are seeking economic benefits together with better lighting performance.

Rising awareness and environmental concerns

The increasing customer awareness of the fact that conventional lighting technologies harm the environment is positively influencing the popularity of LED lighting solutions. LED lights are directly characterized by a massive decrease in the consumed energy and further produce less carbon footprint, thereby in line with the global movement to a possible greener solution. Public campaigns and educational efforts that light the benefits of energy-efficient lighting are intensified. In addition, the accelerating attention to climate change issues and the need for energy reduction both at home and in organizations is driving consumers towards LED lighting solutions. Another driving force behind this trend comes from an increased commitment in the corporate sector regarding leading investments in sustainability and green building certificates.

Spain LED Lighting Market News:

- September 08, 2023: European LED screen manufacturer Alfalite announced its booth at IBC 2023, planned for September 15-18 at the RAI Amsterdam, for the display of its Modularpix Pro VP XR LED panels that are part of the equipment in use in the stands of its partners Canon, Brainstorm, and Mo-Sys. With 1.5 and 1.9 mm of pixel pitch, the screens have more than 1,900 nits of cd/m2 on brightness with optical parameters, 7,680 Hz and a color gamut of 86.22% over REC.2020, HDR10+, 240 Hz, and the lowest average power consumption in the market with 140 W/m2.

- February 21, 2023: Lumishore, the world leader in the design, development, and manufacture of high-performance underwater LED lights, announced IMNASA as its distributor for Spain and Portugal. It further added that IMNASA has put in place a range of strong relationships and a state-of-the-art distribution center that will greatly assist Lumishore in enhancing and expanding the reach of the company's customer support within the key markets of Spain and Portugal.

Spain LED Lighting Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, installation, and application.

Product Type Insights:

To get detailed segment analysis of this market Request Sample

- LED Lamps and Modules

- LED Fixtures

The report has provided a detailed breakup and analysis of the market based on the product type. This includes LED lamps and modules and LED fixtures.

Installation Insights:

- New Installation

- Replacement

A detailed breakup and analysis of the market based on the installation have also been provided in the report. This includes new installation and replacement.

Application Insights:

- Residential

- Outdoor

- Retail and Hospitality

- Offices

- Industrial

- Architectural

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, outdoor, retail and hospitality, offices, industrial, architectural, and others.

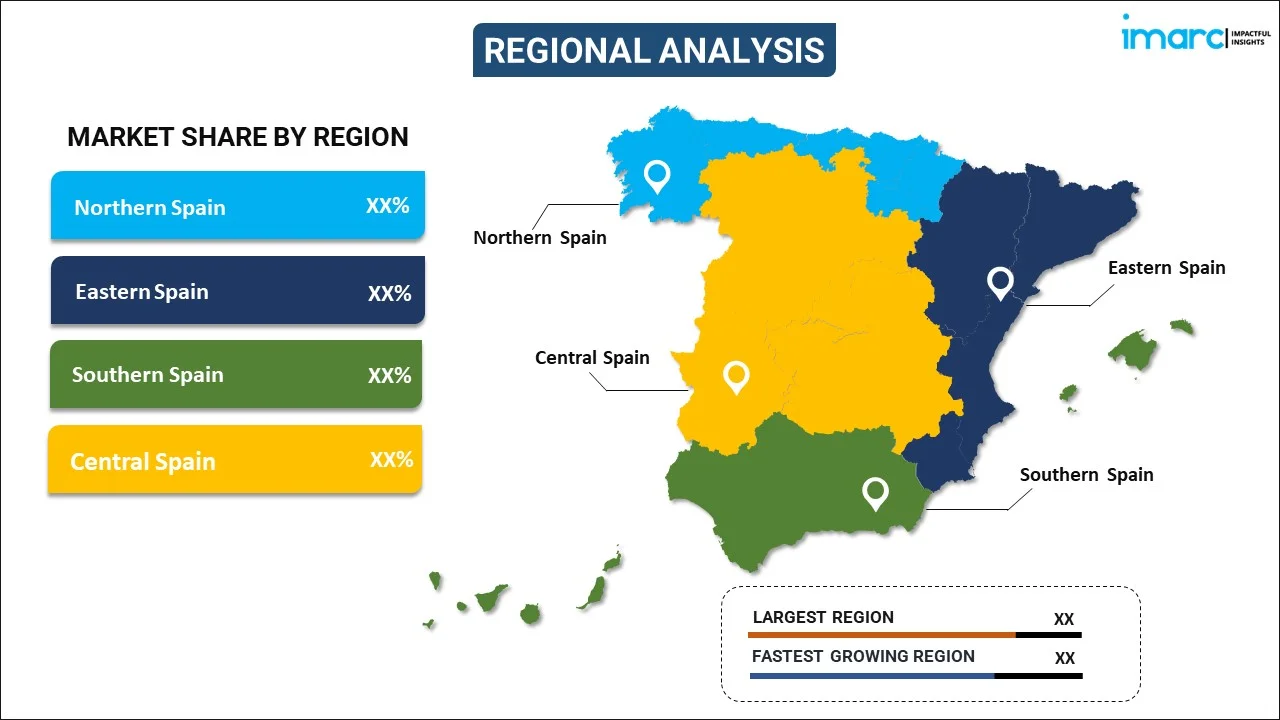

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain LED Lighting Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | LED Lamps and Modules, LED Fixtures |

| Installations Covered | New Installation, Replacement |

| Applications Covered | Residential, Outdoor, Retail and Hospitality, Offices, Industrial, Architectural, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain LED lighting market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Spain LED lighting market?

- What is the breakup of the Spain LED lighting market on the basis of product type?

- What is the breakup of the Spain LED lighting market on the basis of installation?

- What is the breakup of the Spain LED lighting market on the basis of application?

- What are the key driving factors and challenges in the Spain LED lighting?

- What is the structure of the Spain LED lighting market and who are the key players?

- What is the degree of competition in the Spain LED lighting market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain LED lighting market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain LED lighting market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain LED lighting industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)