Spain Household Market Size, Share, Trends and Forecast by Type, Nature, Distribution Channel and Region, 2026-2034

Spain Household Market Overview:

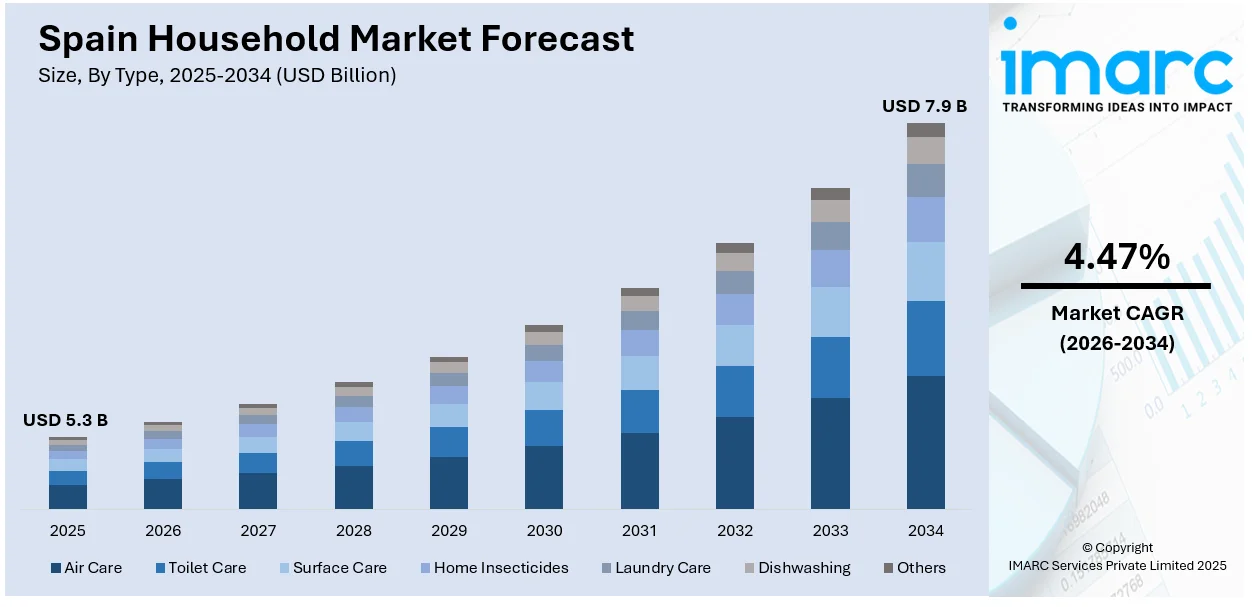

The Spain household market size reached USD 5.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.9 Billion by 2034, exhibiting a growth rate (CAGR) of 4.47% during 2026-2034. The market is driven by rising disposable incomes, urbanization, increasing demand for sustainable and smart home products, evolving consumer preferences for premium and multifunctional household goods, government initiatives promoting energy-efficient appliances, and the growing influence of e-commerce, which enhances product accessibility and market penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.3 Billion |

| Market Forecast in 2034 | USD 7.9 Billion |

| Market Growth Rate 2026-2034 | 4.47% |

Spain Household Market Trends:

Increasing Demand for Smart Home Devices

Smart home technology is becoming highly popular in Spain as consumers become interested in convenience, security, and energy savings. Smart thermostats, lighting, security cameras, and voice assistants are becoming common appliances in contemporary homes. These items not only provide greater control and automation but also blend easily into everyday life as users can monitor and control their homes remotely. For example, in November 2024, El País Escaparate conducted a comparative test that picked TP-Link Tapo C225 and Ezviz C6W as Spain's top-rated indoor security cameras based on their motion detection, two-way talk, and high-resolution capture. Additionally, customers are attracted to the power of monitoring and optimizing energy usage, paying less for utilities and saving the planet. The technology keeps getting better, making these products in greater demand, with more houses embracing networked systems that make life more comfortable and efficient. Spain's technically adept populace is ready to take advantage of smart home technology opportunities, providing opportunities for companies to provide integrated, easy-to-use products. The widespread product adoption in mirrors a wider cultural transformation toward innovation and digital integration in the home space.

To get more information on this market Request Sample

Preference for Sustainable Household Products

Sustainability is intensely becoming a major driver in household consumer buying decisions in Spain. As heightening concerns about the environment rise, consumers in Spain are highly choosing sustainable alternatives for use in their homes. This includes a transition towards natural cleaning supplies, energy-efficient appliances, and biodegradable products. For instance, in February 2025, Madrid-based Nido secured €5 million from investors like Iberdrola and Ship2B Ventures to expand its AI-powered heat pump platform, cutting installation time by 75% and reducing CO₂ emissions. Moreover, sustainable alternatives are being invested in by households to cut down on their environmental impact and help join forces with the world in fighting climate change. Outside of product decisions, attention includes packaging, and most consumers will look for products that reduce wastage by means of recyclable or reusable packaging. Further, power-saving appliances as well as use of renewable energies, including the solar panel system, are fast becoming the go-to option across many areas that have aggressive environment policies. These changes not only transform consumer practices but also put pressure on companies to conform to have ecofriendly alternatives for customers. As sustainability gains importance, the Spanish domestic market keeps shifting towards more eco-friendly options.

Growth in Home Improvement and Renovation

The Spanish domestic market is witnessing an upsurge in home refurbishment and home improvement schemes as people increasingly yearn for custom-designed living quarters. Numerous households are making expenditures on home remodeling to amplify both the utility value and aesthetic appeal of homes, with the intent to update obsolete interiors. This is prompted by impulses like greater in-house time, a homeowner boom, and a quest to develop more convenient and energy-efficient living spaces. The typical improvements involve the renovation of kitchens, bathrooms, and living rooms with an added focus on energy efficiency through improved insulation, window replacements, and the inclusion of smart devices. The trend is also driven by the availability of multiple government incentives to upgrade homes in an energy-efficient manner. As the need for home remodeling accelerate, the demand for furniture, appliances, and remodeling services also stimulates, creating a rich avenue for businesses to serve this sector.

Spain Household Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, nature and distribution channel.

Type Insights:

- Air Care

- Toilet Care

- Surface Care

- Home Insecticides

- Laundry Care

- Dishwashing

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes air care, toilet care, surface care, home insecticides, laundry care, dishwashing, and others.

Nature Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the nature have also been provided in the report. This includes organic, and conventional.

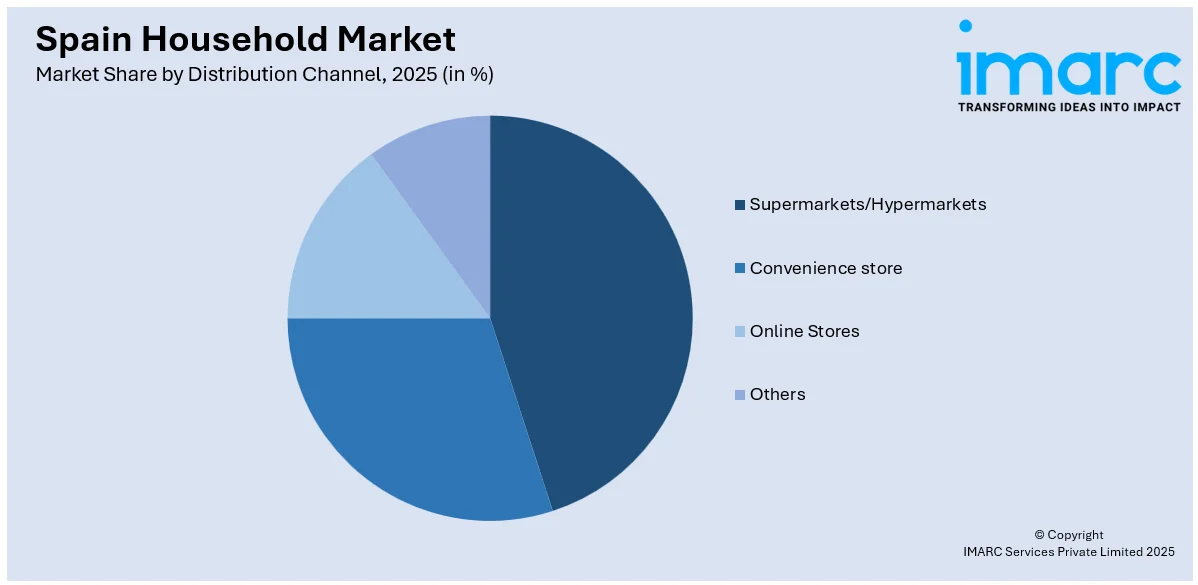

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets/Hypermarkets

- Convenience store

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets/hypermarkets, convenience store, online stores, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Eastern, Southern, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Household Market News:

- In October 2024, Mercadona in Spain launched liquid capsule detergent with a dosing ball that can be reused, ensuring uniform distribution and improved stain elimination. The new formula has enzymatic technology, more fragrance, and color protection. It was designed with supplier Inquiba, which improves the efficiency of washing and meets changing consumer needs.

- In September 2024, BSH Electrodomésticos, brand owners of Bosch and Siemens, solidified their dedication to sustainability. In 2023, it invested €848M in Research and Development to bring AI-fitted dishwashers, smart ovens, and energy-efficient dryers into the market. BSH plans for 100% renewable sources of energy by 2030 and focuses on recyclability, repairability, and environmentally conscious solutions.

Spain Household Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Air Care, Toilet Care, Surface Care, Home Insecticides, Laundry Care, Dishwashing, Others |

| Natures Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience store, Online Stores, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain household market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain household market on the basis of type?

- What is the breakup of the Spain household market on the basis of nature?

- What is the breakup of the Spain household market on the basis of distribution channel?

- What is the breakup of the Spain household market on the basis of region?

- What are the various stages in the value chain of the Spain household market?

- What are the key driving factors and challenges in the Spain household?

- What is the structure of the Spain household market and who are the key players?

- What is the degree of competition in the Spain household market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain household market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain household market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain household industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)