Spain Household Goods Market Size, Share, Trends and Forecast by Product Category, Distribution Channel, End User, and Region, 2026-2034

Spain Household Goods Market Overview:

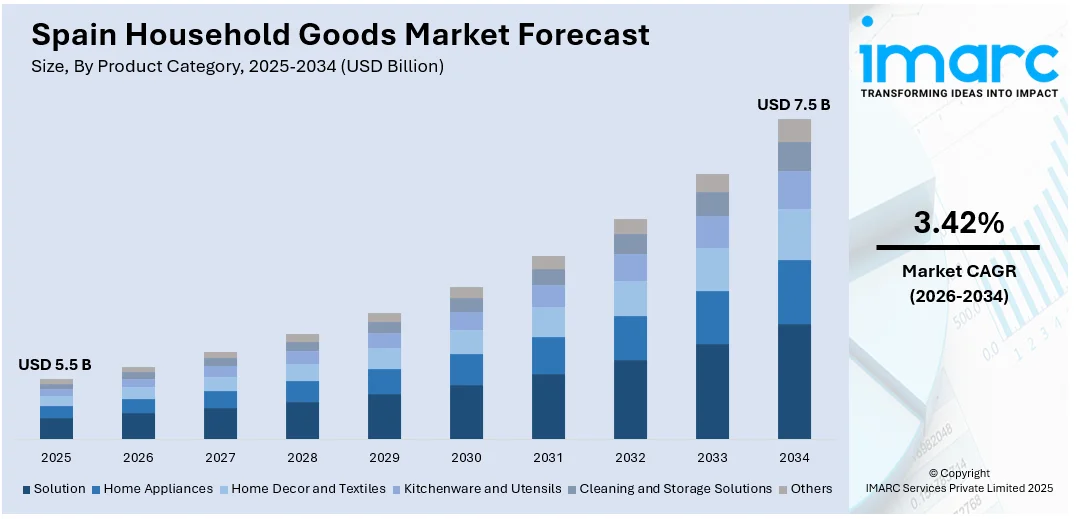

The Spain household goods market size reached USD 5.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 7.5 Billion by 2034, exhibiting a growth rate (CAGR) of 3.42% during 2026-2034. The market is witnessing significant growth, driven by the growth of sustainable and eco-friendly household products and acceleration of e-commerce and omnichannel distribution

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.5 Billion |

| Market Forecast in 2034 | USD 7.5 Billion |

| Market Growth Rate 2026-2034 | 3.42% |

Spain Household Goods Market Trends:

Growth of Sustainable and Eco-Friendly Household Products

The Spain household goods market is witnessing a significant shift toward sustainable and eco-friendly product offerings. Increasing environmental awareness among consumers, coupled with regulatory pressure to reduce single-use plastics and carbon emissions, is driving the demand for biodegradable, recyclable, and refillable household items. Brands are responding by introducing packaging made from recycled materials and promoting products with reduced environmental footprints, including plant-based cleaning agents and energy-efficient appliances. Retailers are also allocating more shelf space to green alternatives, particularly in urban centers where sustainability-conscious millennials and Gen Z form a substantial consumer base. Government initiatives, such as Spain’s Circular Economy Strategy (España Circular 2030), are further encouraging innovation in product design, material reuse, and waste minimization across the household goods sector. For instance, in December 2024, Spain’s Ministry for Ecological Transition announced the approval of a €500,000 investment to build the National Centre for Packaging Technologies in La Rioja, focused on R&D for sustainability and circularity in packaging. Moreover, third-party certifications and eco-labels are becoming important tools for brand differentiation and consumer trust. Private labels from major retail chains like Mercadona and Carrefour are expanding their sustainable product portfolios to meet evolving consumer expectations without significantly raising price points. As consumers increasingly align purchasing decisions with environmental values, companies that integrate sustainability into their core value propositions are gaining market share and improving long-term brand equity in Spain’s competitive household goods market.

To get more information on this market Request Sample

Acceleration of E-Commerce and Omnichannel Distribution

E-commerce adoption in Spain’s household goods market is growing rapidly, reshaping traditional retail dynamics. Consumers are prioritizing convenience, price comparison, and home delivery options, prompting both established players and emerging brands to invest in robust online channels. This trend accelerated notably during the COVID-19 pandemic and has since become a permanent fixture of consumer behavior. For instance, in September 2024, Spain’s Q2 consumer spending on goods and home technology reached €36.24 billion, according to the latest NIQ-GfK Retail Spending Barometer. Retailers are enhancing digital experiences through user-friendly websites, mobile apps, and AI-powered recommendation engines. Loyalty programs and flexible return policies are being deployed to improve customer retention. Moreover, omnichannel strategies are enabling seamless integration of online and offline experiences. Click-and-collect services, real-time inventory updates, and in-store digital kiosks are bridging the gap between digital and physical shopping journeys. Online marketplaces such as Amazon.es and local platforms like PCComponentes are gaining traction in household goods, particularly for home cleaning tools, small appliances, and storage solutions. Meanwhile, direct-to-consumer (DTC) brands are leveraging social media and influencer marketing to reach niche audiences with curated product lines. As consumer expectations evolve, agility in delivery logistics, secure payment systems, and post-purchase support are becoming key differentiators. The rise of e-commerce and omnichannel retailing is not only expanding reach but also influencing product development, packaging, and customer service strategies across the Spain household goods sector.

Spain Household Goods Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on product category, distribution channel, and end user.

Product Category Insights:

- Furniture

- Home Appliances

- Home Decor and Textiles

- Kitchenware and Utensils

- Cleaning and Storage Solutions

- Others

The report has provided a detailed breakup and analysis of the market based on the product category. This includes Furniture, Home Appliances, Home Decor and Textiles, Kitchenware and Utensils, Cleaning and Storage Solutions, and Others.

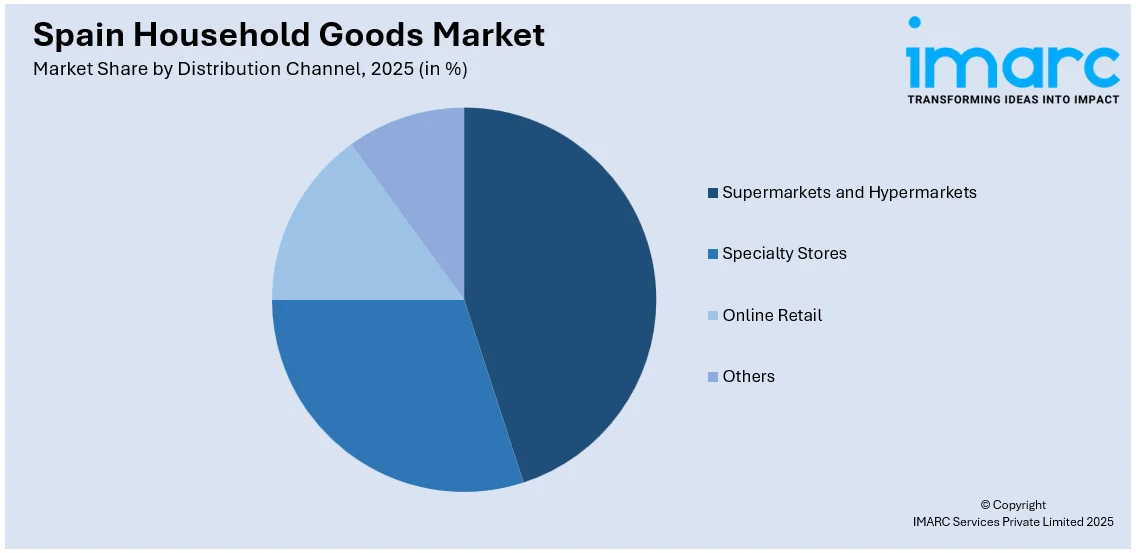

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes Supermarkets and Hypermarkets, Specialty Stores, Online Retail, and Others.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Household Goods Market News:

- In January 2025, IKEA announced its plans to expand its second-hand furniture marketplace across Europe, following successful pilots in Madrid and Oslo. The initiative, set to roll out across Spain and Norway by August, attracted around 200,000 visitors to the IKEA Preowned website, highlighting strong consumer interest in sustainable, circular solutions within the home furnishings market.

Spain Household Goods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Categories Covered | Furniture, Home Appliances, Home Decor and Textiles, Kitchenware and Utensils, Cleaning and Storage Solutions, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Retail, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain household goods market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain household goods market on the basis of product category?

- What is the breakup of the Spain household goods market on the basis of distribution channel?

- What is the breakup of the Spain household goods market on the basis of end user?

- What is the breakup of the Spain household goods market on the basis of region?

- What are the various stages in the value chain of the Spain household goods market?

- What are the key driving factors and challenges in the Spain household goods?

- What is the structure of the Spain household goods market and who are the key players?

- What is the degree of competition in the Spain household goods market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain household goods market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain household goods market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain household goods industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)