Spain Foodservice Market Report by Type (Cafes and Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), and Region 2026-2034

Spain Foodservice Market Size:

The Spain foodservice market size reached USD 166.3 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 322.2 Billion by 2034, exhibiting a growth rate (CAGR) of 7.62% during 2026-2034. The market is experiencing significant growth mainly due to gradual increase in the tourism sector, a rising shift toward digital ordering and delivery, and the rising demand for health conscious and sustainable dining options. The market growth is also being driven by innovations in culinary offerings, technological integration and a diverse range of dining experiences catering to both locals and tourists.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 166.3 Billion |

| Market Forecast in 2034 | USD 322.2 Billion |

| Market Growth Rate (2026-2034) | 7.62% |

Access the full market insights report Request Sample

Spain Foodservice Market Analysis:

- Major Market Drivers: Key market drivers include a robust tourism sector, which boosts the demand for diverse dining experiences and fuels growth across various foodservice segments. The widespread adoption of digital ordering and delivery services is another major factor, driven by the consumer demand for convenience and flexibility. Health-conscious dining trends are gaining traction, with more consumers seeking nutritious and sustainable food options, leading to greater menu diversification and innovation. Additionally, technological advancements, such as AI-driven customer insights and streamlined digital payment systems, enhance operational efficiency and customer experience. The rise of ghost kitchens and flexible dining formats also contributes to the market expansion.

- Key Market Trends: Key market trends in the Spain include a strong shift toward digitalization, with an increasing number of restaurants adopting online ordering and delivery platforms to meet the consumer demand for convenience. This helps in increasing the overall Spain foodservice market share. The market is also seeing a rise in health-conscious dining, with more focus on plant-based and organic menu options as consumers become more aware of their dietary choices. Sustainability is another major trend, with restaurants implementing eco-friendly practices, such as reducing waste and using locally sourced ingredients. Additionally, the growth of ghost kitchens allows operators to reduce costs and focus on delivery-only models, catering to the growing preference for on-demand dining experiences.

- Competitive Landscape: Key players in the market are increasingly focusing on digital transformation to enhance customer convenience and expand their reach. They are partnering with online delivery platforms like Glovo and Uber Eats to tap into the growing demand for home-delivered meals. Many are also investing in technology, such as AI and data analytics, to personalize customer experiences and optimize operations. In order to cater to evolving consumer preferences, leading chains and independent restaurants are expanding their menu offerings to include healthier, plant-based, and organic options. Additionally, they are adopting sustainable practices, such as reducing food waste and using eco-friendly packaging, to align with consumer expectations for environmental responsibility.

The report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. - Challenges and Opportunities: The market faces several challenges, including rising operational costs due to inflation and supply chain disruptions, which strain profitability. Additionally, increasing competition from both local independent eateries and international chains forces businesses to continuously innovate to attract customers. However, these challenges also present opportunities. There is significant potential in adopting digital technologies to streamline operations and enhance the customer experience, such as using AI for personalized marketing. The growing consumer demand for healthy and sustainable dining options offers a chance for differentiation. Furthermore, expanding into delivery-only models like ghost kitchens can reduce overheads and capture the growing market for home-delivered meals.

Spain Foodservice Market Trends:

Rise of Digital Ordering and Delivery Services

The Spain foodservice market is undergoing a significant transformation as digital ordering and delivery services reshape the landscape, fueled by a growing consumer demand for convenience and flexibility. This shift is propelled by technological advancements and evolving lifestyle patterns, especially among younger demographics. The Spain foodservice market research report highlights this trend toward digitalization, noting that more consumers are favoring online ordering and delivery. To stay relevant, traditional restaurants are increasingly partnering with these platforms, integrating digital systems, and tailoring their menus to optimize for delivery, thereby tapping into this burgeoning market segment and expanding their customer base. For instance, in June 2024, Europe's largest food delivery service, Just Eat Takeaway, announced a partnership with Amazon to offer free food delivery to Amazon Prime members in Germany, Austria, and Spain for orders over 15 euros. The companies have disclosed no financial terms for the collaboration, viewing it as mutually beneficial. This marks Just Eat's first partnership with Amazon in Europe. The service will be available through Lieferando in Germany and Austria, and Just Eat in Spain. These strategic partnerships and technological advancements are creating a positive Spain foodservice market outlook, as they enhance customer convenience, expand market reach, and drive growth through innovative offerings and digital integration.

Integration of Technology for Enhanced Customer Experience

The integration of technology is significantly enhancing the customer experience in Spain's foodservice market. Restaurants are increasingly adopting digital menus and mobile apps to provide seamless ordering and payment processes, catering to the growing preference for contactless interactions. These technologies help streamline operations by reducing wait times and minimizing errors, improving overall customer satisfaction. Furthermore, AI and data analytics play a crucial role in personalizing the dining experience by analyzing customer preferences and purchasing patterns, allowing for tailored recommendations and promotions, which, in turn, helps businesses increase their share by attracting and retaining a loyal customer base. Additionally, these tools assist in optimizing inventory management, reducing waste, and ensuring the availability of popular menu items. For instance, in May 2024, Faborit, a Spanish coffee and health food chain, teamed up with nsign.tv to modernize menu boards in 28 of its stores across Spain. The project involved installing 50-inch and 55-inch LCDs integrated with nsign.tv's digital signage player in 17 locations in Madrid, 10 in Barcelona, and one in Logroño. The digital transformation aims to enhance customer experience and improve sales by showcasing a variety of offerings in a visually appealing and effective manner.

Growth of Health-Conscious and Sustainable Dining

The growth of health-conscious and sustainable dining is a significant trend in Spain's foodservice market. Sustainability is becoming a key focus in food service in Spain, with many restaurants adopting eco-friendly practices and sourcing locally. Consumers are becoming more mindful of their health and the environmental impact of their food choices, thus driving the demand for healthier options such as plant-based menus and organic ingredients. Restaurants are responding by incorporating more sustainable practices, including sourcing locally to reduce carbon footprints, minimizing food waste through smarter inventory management, and using eco-friendly packaging materials. These initiatives not only attract health-conscious customers but also align with a growing global focus on sustainability, allowing restaurants to differentiate themselves and appeal to ethically-minded diners who prioritize environmental responsibility. For instance, in March 2024, Aponiente Restaurant, located in a former garbage site in southern Spain, stands as a model for sustainability, utilizing sea-based resources and creating jobs in an area with 27% unemployment. Aponiente's exponential impact extends beyond culinary recognition, making it a global role model for revitalization.

Spain Foodservice Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, outlet, and location.

Breakup by Type:

To get detailed segment analysis of this market Request Sample

- Cafes and Bars

- By Cuisine

- Bars and Pubs

- Cafes

- Juice/Smoothie/Desserts Bars

- Specialist Coffee and Tea Shops

- By Cuisine

- Cloud Kitchen

- Full Service Restaurants

- By Cuisine

- Asian

- European

- Latin American

- Middle Eastern

- North American

- Others

- By Cuisine

- Quick Service Restaurants

- By Cuisine

- Bakeries

- Burger

- Ice Cream

- Meat-based Cuisines

- Pizza

- Others

- By Cuisine

The report has provided a detailed breakup and analysis of the market based on the type. This includes cafes and bars (by cuisine (bars and pubs, cafes, juice/smoothie/desserts bars, specialist coffee and tea shops)), cloud kitchen, full-service restaurants (by cuisine (Asian, European, Latin American, Middle Eastern, North American, others)), quick service restaurants (by cuisine (bakeries, burger, ice cream, meat-based cuisines, pizza, others)).

The cafes and bars segment in Spain's foodservice market includes various formats such as bars and pubs, cafes, juice/smoothie/dessert bars, and specialist coffee and tea shops. Bars and pubs are popular for their casual atmosphere and wide beverage offerings. Cafes serve light meals and beverages, while juice bars focus on health-conscious consumers. Specialist coffee and tea shops cater to niche markets seeking high-quality, unique beverage experiences.

Cloud kitchens, also known as virtual or ghost kitchens, have become a significant part of Spain's foodservice landscape. These facilities focus on food delivery without a dine-in option, optimizing operations for online orders. They cater to diverse cuisines and offer flexibility, lower overhead costs, and scalability, meeting the growing demand for convenient and varied food delivery options.

Spain’s full-service restaurant segment offers a wide range of cuisines, including Asian, European, Latin American, Middle Eastern, North American, and others. These establishments provide a complete dining experience, including table service, a diverse menu, and often a focus on high-quality ingredients and ambiance. They cater to various tastes and preferences, making them popular for social dining occasions.

Quick service restaurants in Spain cater to fast-paced lifestyles with a variety of cuisine options like bakeries, burgers, ice cream, meat-based dishes, pizza, and others. These establishments focus on speed and convenience, offering affordable meals with minimal wait times. QSRs are popular among consumers looking for quick, tasty, and accessible food options.

Breakup by Outlet:

- Chained Outlets

- Independent Outlets

A detailed breakup and analysis of the market based on the outlet have also been provided in the report. This includes chained outlets and independent outlets.

Chained outlets in Spain's foodservice market have seen consistent growth due to their standardized menus, efficient service, and recognizable brand appeal. These establishments often benefit from economies of scale, allowing them to offer competitive pricing and maintain a strong presence across various regions. Popular fast-food chains, coffee shops, and casual dining restaurants have expanded their reach, targeting both urban centers and suburban areas. Additionally, the adoption of digital ordering and delivery services has enhanced customer convenience, further boosting sales. The resilience of chained outlets during economic fluctuations has solidified their position in Spain's diverse foodservice landscape.

Independent outlets play a vital role in Spain's foodservice market, offering unique dining experiences and authentic local cuisine. These establishments often reflect regional flavors and culinary traditions, attracting both locals and tourists seeking a more personalized dining experience. While they may face challenges such as limited resources and higher costs compared to chains, independent outlets often leverage creativity and customer loyalty to thrive. The emphasis on fresh, locally-sourced ingredients and artisanal preparation methods helps distinguish them from their chain counterparts, contributing to the rich diversity of Spain's vibrant food culture.

Breakup by Location:

- Leisure

- Lodging

- Retail

- Standalone

- Travel

The report has provided a detailed breakup and analysis of the market based on the location. This includes leisure, lodging, retail, standalone, and travel.

The leisure segment of Spain's foodservice market includes establishments within entertainment venues such as cinemas, theme parks, and sports arenas. These venues cater to visitors seeking convenient and quick dining options while enjoying leisure activities. The market is driven by an increasing number of domestic and international tourists seeking diverse culinary experiences. Additionally, partnerships between foodservice providers and leisure venues enhance customer experience by offering varied menu options, from fast food to gourmet dining, attracting a broad audience. This segment also capitalizes on seasonal events and festivals, contributing significantly to the growth of Spain's overall foodservice market.

The lodging segment in Spain's foodservice market encompasses food and beverage services provided in hotels, motels, and guesthouses. This sector benefits from the robust tourism industry, particularly in popular destinations such as Barcelona, Madrid, and the Costa del Sol. Offering diverse dining options, from breakfast buffets to fine dining, helps hotels differentiate themselves and enhance guest satisfaction. As travelers increasingly seek unique culinary experiences during their stay, hotels focus on regional and international cuisine, as well as innovative dining concepts. This segment is crucial in adding value to guest experiences, ultimately driving repeat visits and customer loyalty.

In Spain's foodservice market, the retail segment includes cafes, kiosks, and quick-service restaurants located within shopping centers and retail outlets. This segment thrives on high foot traffic and the growing trend of shoppers seeking convenient meal options while shopping. Retail foodservice establishments often offer fast, affordable, and diverse menus to cater to a wide range of tastes and preferences. The integration of grab-and-go formats and the emphasis on freshly prepared food options have become popular trends. The retail segment benefits from Spain's vibrant shopping culture and contributes significantly to the foodservice market by targeting both locals and tourists.

The standalone segment of Spain's foodservice market includes independent restaurants, cafes, and bars that are not affiliated with larger chains or specific venues. This segment is characterized by its diversity, offering everything from traditional Spanish cuisine to international dishes. Standalone establishments often focus on creating unique dining experiences through personalized service, innovative menus, and distinctive atmospheres. The rise of food tourism and the preference for authentic local dining experiences among tourists and locals alike drive this market segment. Standalone foodservice providers contribute significantly to Spain’s culinary scene, adding variety and attracting a dedicated customer base.

The travel segment in Spain's foodservice market encompasses food services in airports, train stations, and other transit locations. This segment caters to travelers looking for convenient dining options while on the move. It is driven by the increasing number of domestic and international travelers, particularly in busy hubs like Madrid-Barajas and Barcelona-El Prat airports. The demand for quick-service restaurants, cafes, and grab-and-go options remains strong, with a growing emphasis on healthier and high-quality food offerings. The travel segment benefits from continuous improvements in transportation infrastructure and increased travel frequency, contributing to the growth of the foodservice market in Spain.

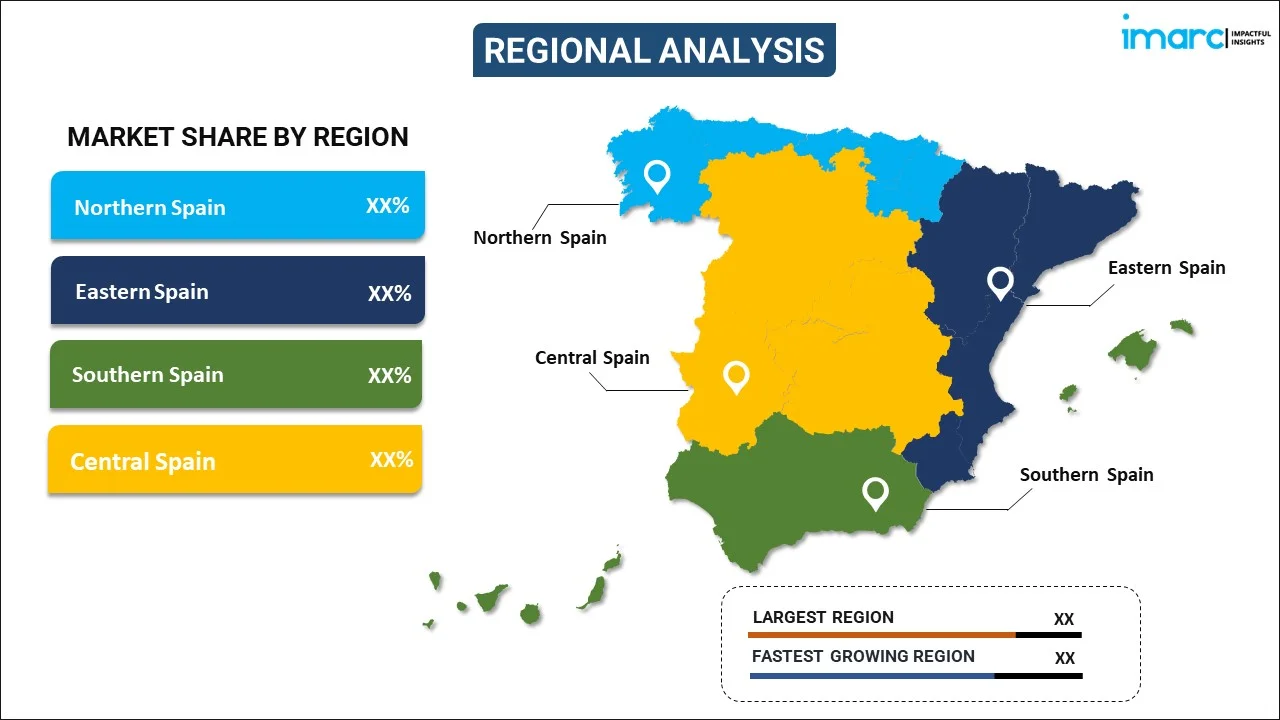

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major markets in the region, which include Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

Northern Spain's foodservice market thrives on its rich culinary heritage and diverse offerings, influenced by Basque, Galician, and Cantabrian cuisines. This region is known for its seafood, pintxos (small snacks), and traditional dishes, attracting both locals and tourists. The market benefits from the region's cultural and gastronomic festivals, which draw food enthusiasts year-round. A focus on locally sourced ingredients and sustainable practices enhances the appeal of dining establishments. Additionally, the presence of renowned restaurants and a strong local dining culture contribute to the growth and vibrancy of the foodservice market in Northern Spain.

Eastern Spain's foodservice market, especially in the regions of Catalonia and Valencia, is characterized by its vibrant food culture and Mediterranean influence. The area is famous for dishes like paella, tapas, and seafood, which attract both domestic and international tourists. With cities like Barcelona being major tourist hubs, the market benefits from high footfall and a demand for diverse dining experiences. The region's foodservice market is bolstered by a mix of traditional eateries, modern fusion restaurants, and a thriving café culture, making it a significant contributor to Spain's overall foodservice industry.

Southern Spain's foodservice market is heavily influenced by Andalusian cuisine, known for its tapas, gazpacho, and seafood dishes. The region’s warm climate and coastal location contribute to a thriving outdoor dining scene, popular with both residents and visitors. The market is driven by the influx of tourists, particularly in cities like Seville, Granada, and Malaga, known for their historical sites and lively culinary traditions. Seasonal events and festivals, coupled with a focus on local produce and traditional cooking methods, play a key role in sustaining the vibrant foodservice market in Southern Spain.

Central Spain, particularly the Madrid region, represents a dynamic foodservice market with a blend of traditional and contemporary dining options. Known for its diverse culinary scene, this area offers everything from classic Spanish cuisine to international fare, catering to a broad spectrum of tastes. The market benefits from Madrid’s status as a major urban and tourist center, attracting visitors year-round. The rise of gastronomic tourism, along with a robust local dining culture, supports a wide range of establishments, from tapas bars to fine dining restaurants, making Central Spain a key player in the nation's foodservice landscape.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided. Some of the major market players in the Spain Foodservice industry include.

- The Spain foodservice market is highly competitive, featuring a blend of local establishments and international chains. Well-known global brands and local players compete by leveraging strong brand identities and expanding their presence across the country. Independent restaurants and cafes distinguish themselves through unique offerings, focusing on regional flavors and personalized customer experiences, which appeal to both locals and tourists. The growth of online food delivery services has added a new layer of competition, prompting traditional foodservice providers to innovate and adapt. According to the Spain foodservice market forecast, businesses that invest in digital platforms and prioritize menu diversification to meet changing consumer preferences are expected to experience the most significant growth in the coming years.

Spain Foodservice Market News:

- In February 2023, Ibersol Travel España, a division of the Ibersol Group, secured a significant contract from AENA, increasing its presence at Adolfo Suárez Madrid-Barajas airport by ten times. The contract is expected to generate over €30 million and includes the addition of 12 new locations featuring popular brands such as Pret a Manger and Café Pans. Additionally, the company has also been awarded a contract for eight restaurants at the César Manrique-Lanzarote International Airport.

- In February 2024, METRO's delivery specialist, Pro a Pro Spain, which is part of METRO, announced its plans for a major expansion of its Spanish activities by 2030. The company intends to invest in multi-temperature warehouses and extend its logistics and distribution structure across Spain. Pro a Pro Spain aims to become a leading provider of food delivery services for the organized hospitality sector in Spain, complementing MAKRO Spain's wholesale business. This expansion supports METRO's group-wide core strategy to grow its Food Service Distribution business significantly.

Spain Foodservice Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Outlets Covered | Chained Outlets, Independent Outlets |

| Locations Covered | Leisure, Lodging, Retail, Standalone, Travel |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain foodservice market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Spain foodservice market?

- What is the breakup of the Spain foodservice market on the basis of type?

- What is the breakup of the Spain foodservice market on the basis of outlet?

- What are the various stages in the value chain of the Spain foodservice market?

- What are the key driving factors and challenges in the Spain foodservice market?

- What is the structure of the Spain foodservice market, and who are the key players?

- What is the degree of competition in the Spain foodservice market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain foodservice market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain foodservice market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain foodservice industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)