Spain Food and Beverages Market Size, Share, Trends and Forecast by Nature, Type, Distribution Channel, and Region, 2026-2034

Spain Food and Beverages Market Overview:

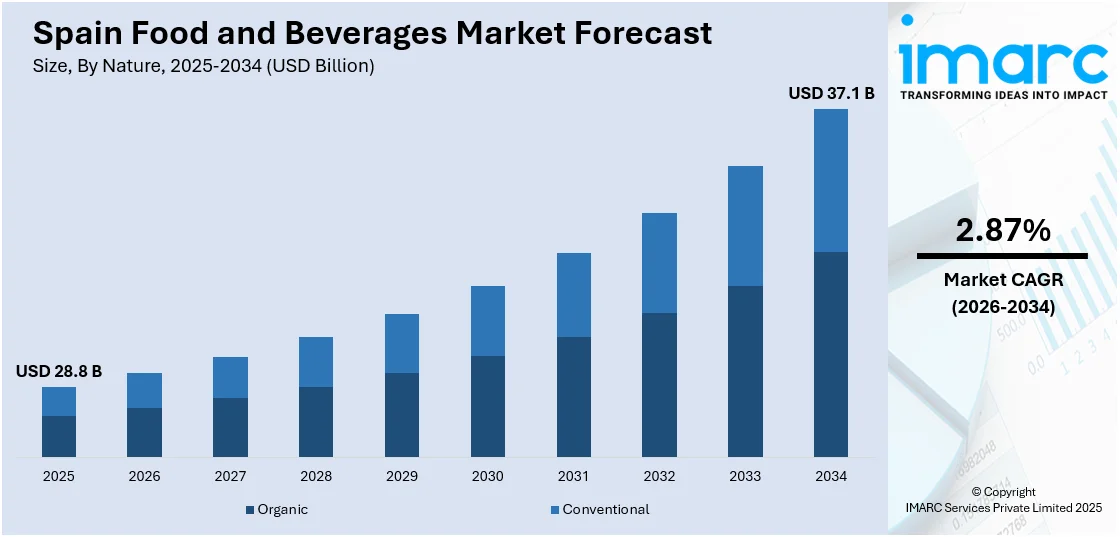

The Spain food and beverages market size reached USD 28.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 37.1 Billion by 2034, exhibiting a growth rate (CAGR) of 2.87% during 2026-2034. The market is driven by a focus on health, sustainability, and premiumization, with rising demand for organic, functional, and clean-label products, increasing popularity of locally sourced ingredients and plant-based options, and evolving consumer behavior shaped by e-commerce and innovative retail formats.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 28.8 Billion |

| Market Forecast in 2034 | USD 37.1 Billion |

| Market Growth Rate 2026-2034 | 2.87% |

Spain Food and Beverages Market Trends:

Rise of Plant-Based and Alternative Proteins

Spain's F&B industry is witnessing an uptick in the presence of plant-based and alternative protein products, driven by consumers' shifting towards healthier and ecofriendly eating patterns. As consumer consciousness regarding climate change and animal well-being becomes higher, plant-based meat alternatives and dairy replacements from soy, pea, and oat proteins are being consumed more by Spanish customers. Businesses are getting creative by using Mediterranean fare, including chickpeas, almonds, and olives to create uniquely Spanish substitutes. Food retail chains and restaurants are expanding their plant food range, and large brands are spending on research for providing improved taste and texture. Governmental endorsement of initiatives such as plant-based foods contributes further to this procedure. New firms and traditional food companies are collaborating in order to launch lab-cultured meat and precision fermentation-based milk substitutes, drawing inspiration from breakthroughs in international food technology. As the market shifts, Spain is also expected to be among the top players in the plant food market in Europe, exporting both domestic and foreign markets.

To get more information on this market Request Sample

Growth of Functional and Health-Enhancing Foods

Spanish consumers now demand functional foods and beverages with health benefits over and above basic nutrition. Demand is on the rise for probiotic yogurts, plant-based drinks fortified with nutrients, and protein-fortified snacks as health-oriented people seek immunity and gut-friendly solutions. For example, In March 2024, Nuveg introduced a high-protein instant rice noodle soup at the Alimentaria trade fair, which contains 42% plant protein. The Catalonian company leads in-house dehydrated vegan food manufacturing with eco-certified, fiber-enriched products. Furthermore, superfoods such as chia, turmeric, and spirulina are gaining traction in juice, dairy-free alternatives, and snack bars due to their perceived health benefits. The Mediterranean diet is still a basis, but companies are fortifying classic products with vitamins, minerals, and antioxidants. Functional drinks like kombucha, herbal teas, and collagen-based beverages are popularizing Spain's growing wellness sector. The European Food Safety Authority (EFSA) regulations guarantee that health claims are supported by scientific proof, which increases consumer confidence in fortified foods. As personalized nutrition picks up pace, businesses are looking to AI-based solutions to create customized food products addressing specific health requirements, driving further innovation in the space.

Sustainable and Clean-Label Food Revolution

Transparency and sustainability are highly becoming the core of Spain's F&B sector, with consumers requiring clean-label foods without artificial additives, preservatives, and over-processing. Demand for organic and locally sourced products is greater than ever, with an intense inclination towards traceable, minimally processed foods. For instance, in May 2023, La Fageda released its inaugural organic yogurts in their natural, lemon, and bifidus versions at Biocultura Fair using organic milk from Vall d'En Bas Cooperative to go hand in hand with its environmental pledge. Moreover, Spanish companies are pushing back with re-formulated recipes, decreasing the amount of sugar and salt used, and introducing environmentally friendly packaging options like compostable wrap and refill containers. The farm-to-table culture is picking up momentum, as small-scale growers are working in conjunction with stores to deliver fresh, seasonal food to city residents. Changes in regulation, such as Spain's recent food waste legislation, are leading businesses to more sustainable operations in sourcing, manufacturing, and delivery. Furthermore, upcycling food scraps as new materials into products like snacking with upcycled olive pulp or reusing vegetable residue for vegan broths is breaking through as an innovative intervention that can amplify the circular economy approaches in the market.

Spain Food and Beverages Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on nature, type, and distribution channel.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the nature. This includes organic, and conventional.

Type Insights:

- Alcoholic Beverages

- Non-alcoholic Beverages

- Grain Products

- Bakery and Confectionery

- Frozen

- Canned and Dried Food

- Dairy Food

- Meat

- Poultry and Seafood

- Syrup

- Seasoning Oils

- Animal and Pet Food

- Tobacco Products

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes alcoholic beverages, non-alcoholic beverages, grain products, bakery and confectionery, frozen, canned and dried food, dairy food, meat, poultry and seafood, syrup, seasoning oils, animal and pet food, tobacco products, and others.

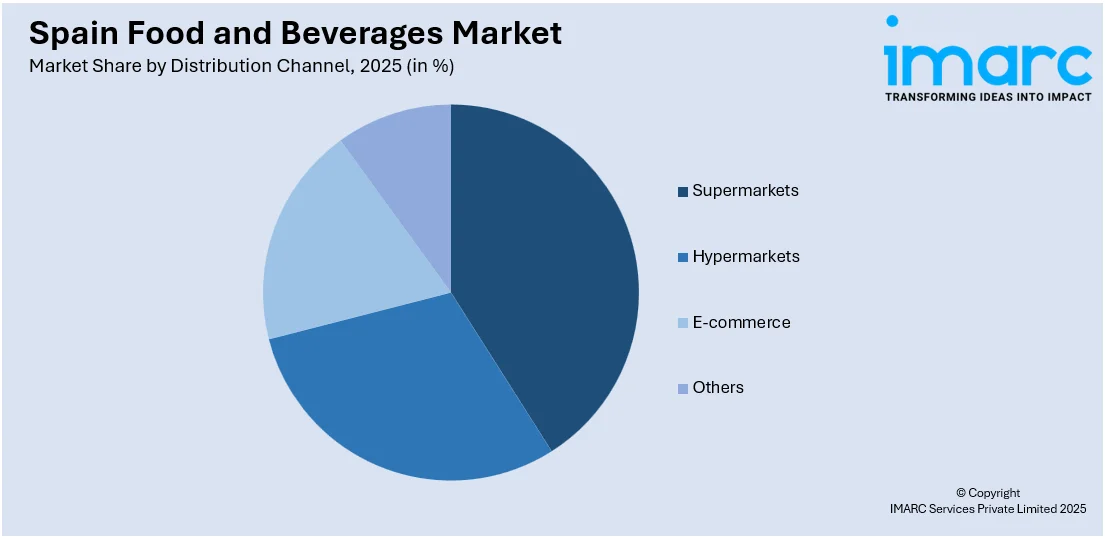

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets

- Hypermarkets

- E-commerce

- Others

The report has provided a detailed breakup and analysis of the market based the distribution channel. This includes supermarkets, hypermarkets, e-commerce, and others.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern, Eastern, Southern, and Central Spain.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Food and Beverages Market News:

- In November 2024, Refresco finalized the acquisition of Frías Nutrición, a top Spanish producer of plant-based beverages. The acquisition enhances Refresco's market position, improving its expertise in almond, rice, hazelnut, and soy drinks while complementing its European growth and innovation strategy in the expanding plant-based market.

- In October 2024, Heura Foods launched prototypes of plant-based cheese, snacks, and pasta with its patent-pending technology. The innovations target high protein content and low carbohydrates in the ultra-processed food industry. Heura seeks to drive the protein shift and reshape nutritional norms in various food categories.

Spain Food and Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Types Covered | Alcoholic Beverages, Non-alcoholic Beverages, Grain Products, Bakery and Confectionery, Frozen, Canned and Dried Food, Dairy Food, Meat, Poultry and Seafood, Syrup, Seasoning Oils, Animal and Pet Food, Tobacco Products, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, E-commerce, Others |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain food and beverages market performed so far and how will it perform in the coming years?

- What is the breakup of the Spain food and beverages market on the basis of nature?

- What is the breakup of the Spain food and beverages market on the basis of type?

- What is the breakup of the Spain food and beverages market on the basis of distribution channel?

- What is the breakup of the Spain food and beverages market on the basis of region?

- What are the various stages in the value chain of the Spain food and beverages market?

- What are the key driving factors and challenges in the Spain food and beverages?

- What is the structure of the Spain food and beverages market and who are the key players?

- What is the degree of competition in the Spain food and beverages market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain food and beverages market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain food and beverages market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain food and beverages industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)