Spain Flooring Market Report by Type (Resilient, Non-Resilient, and Others), End User (Residential, Non-residential), and Region 2026-2034

Spain Flooring Market Overview:

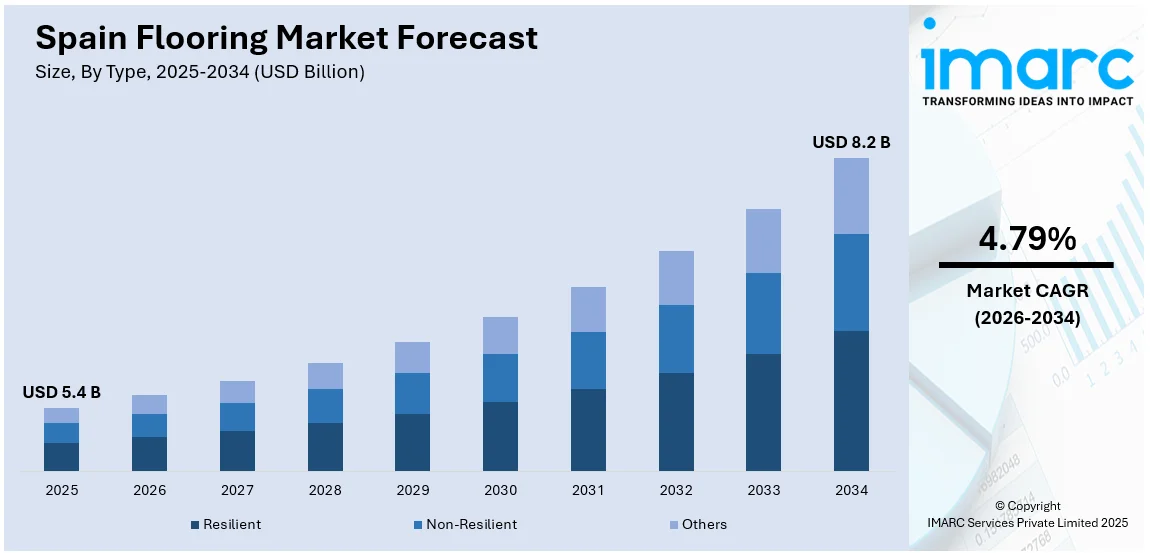

The Spain flooring market size reached USD 5.4 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 8.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.79% during 2026-2034. The rising number of residential and commercial spaces, technological advancements in materials, increasing renovation projects, and the escalating demand for eco-friendly materials are some of the top factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 5.4 Billion |

| Market Forecast in 2034 | USD 8.2 Billion |

| Market Growth Rate (2026-2034) | 4.79% |

Spain Flooring Market Trends:

Rising Number of Residential and Commercial Spaces

The Spain construction market accounted for US$ 206.4 Billion in 2023, as claimed by the Global Data. The increasing number of residential and commercial projects in the country is propelling the market growth. New residential constructions including single-family homes, apartments, and condominiums that require flooring materials for various spaces such as living rooms, bedrooms, kitchens, and bathrooms. Additionally, office buildings, retail spaces, hotels, restaurants, and other commercial establishments need flooring materials suitable for high-traffic areas and specific design requirements. Furthermore, builders are utilizing materials such as luxury vinyl tile (LVT), ceramic tile, carpet tiles, and polished concrete in commercial settings to offer enhanced durability, ease of maintenance, safety, and aesthetics. In addition, there is a rise in the demand for flooring materials in airports, train stations, hospitals, schools, and public buildings. These facilities require flooring solutions that meet stringent safety, hygiene, and durability standards. Besides this, homeowners and businesses renovate their properties to update the aesthetics, improve functionality, or address wear and tear, which is bolstering the market growth.

To get more information on this market Request Sample

Technological Advancements in Materials

On 8 October 2023, i4F announced that Novalam Innovacion SA signed an i4F drop-lock technologies license agreement for its entry into the global stone polymer core (SPC) flooring market. As a result, Novalam becomes Spain’s first manufacturer of SPC products, all of which will be enhanced with i4F drop-lock installation technologies. Furthermore, technological innovations such as eco-friendly materials, improved durability, easier installation methods, and smart flooring solutions enhance the appeal and functionality of flooring products.

Spain Flooring Market News:

- 27 September 2023: The Pamesa Group, Europe’s largest ceramic tile manufacturer, acquired Best Surfaces in Alcora (Castellón) from the Italian group Laminam. Renamed Ascale, the factory is equipped entirely with B&T Group technologies and has a production capacity of 1.5 million sqm/year of large ceramic slabs in thicknesses ranging from 6 to 20 mm and mainly focus on the production of 120x280 cm and 160x320 cm sizes. The new products are included in the catalogs of the group’s various brands and will be presented at Cersaie in Bologna.

- 1 March 2024: STN Ceramica introduced a new large-format tile production site in Nules (Castellón) and is set to begin operation in the second quarter of this year. The Spanish group’s new facility will be equipped with state-of-the-art technology from Sacmi for the production of large ceramic surfaces. The centerpiece of the new plant will be the Continua+ line, equipped with a PCR2000 compactor and a TPV on-the-fly cutting machine, together with an APB feed device and digital dry decoration (DDD) machine. New top-of-the-range sizes will be added to the portfolio, including the 1600x3200 mm and 1200x2800 mm, together with the most popular sub-sizes on the market.

Spain Flooring Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and end user.

Type Insights:

- Resilient

- Non-Resilient

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes resilient, non-resilient, and others.

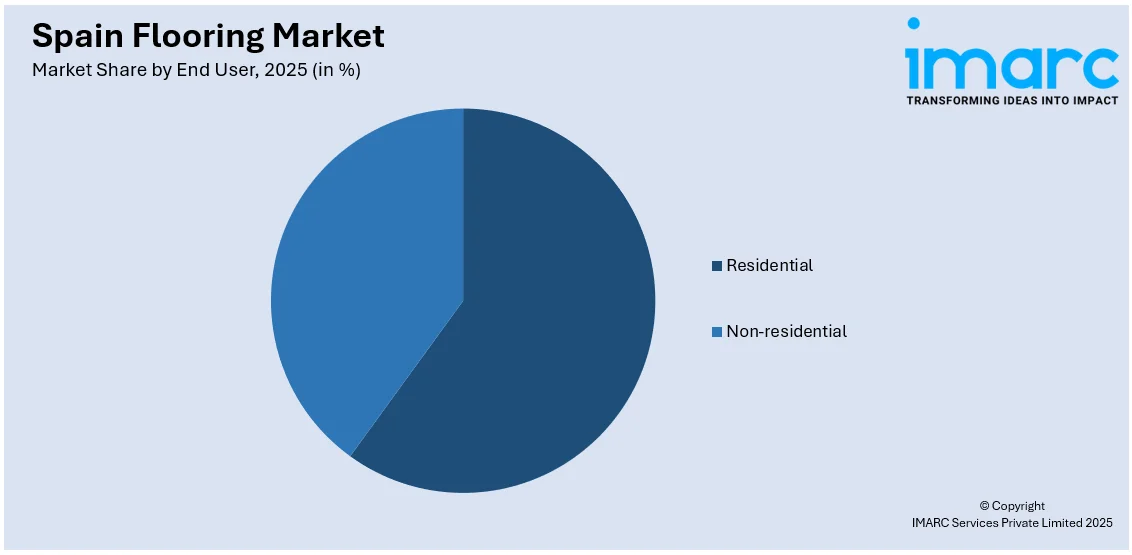

End User Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Non-residential

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and non-residential.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Northern Spain, Eastern Spain, Southern Spain, Central Spain, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Spain Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Resilient, Non-Resilient, Others |

| End Users Covered | Residential, Non-residential |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain flooring market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Spain flooring market?

- What is the breakup of the Spain flooring market on the basis of type?

- What is the breakup of the Spain flooring market on the basis of end user?

- What are the various stages in the value chain of the Spain flooring market?

- What are the key driving factors and challenges in the Spain flooring?

- What is the structure of the Spain flooring market and who are the key players?

- What is the degree of competition in the Spain flooring market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain flooring market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain flooring market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain flooring industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)