Spain E-Bike Market Report by Mode (Throttle, Pedal Assist, Speed Pedelec), Motor Type (Hub Motor, Mid Drive), Battery Type (Lead Acid, Lithium Ion, and Others), Class (Class I, Class II, Class III), Design (Foldable, Non-Foldable), Application (Mountain/Trekking Bikes, City/Urban, Cargo), and Region 2026-2034

Spain E-Bike Market Size:

The Spain E-Bike market size reached USD 455.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 819.0 Million by 2034, exhibiting a growth rate (CAGR) of 6.75% during 2026-2034. The market is witnessing substantial expansion, chiefly driven by soaring consumer demand for eco-friendly transportation solutions and beneficial government incentives. The market growth is also facilitated by technological advancements, increasing urbanization, and a magnifying emphasis on sustainability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 455.0 Million |

|

Market Forecast in 2034

|

USD 819.0 Million |

| Market Growth Rate 2026-2034 | 6.75% |

Access the full market insights report Request Sample

Spain E-Bike Market Analysis:

- Major Market Drivers: The market is majorly driven by heightening environmental concerns and government financial policies fostering sustainable transportation. Rapid urbanization and increasing fuel costs further propel the adoption of e-bikes. In addition, escalating inclination towards recreational cycling and technological advancements significantly contribute to the market growth, streamlining with an accelerating global shift towards environment-friendly mobility solutions.

- Key Market Trends: The market is witnessing some key trends including soaring popularity of electric mountain bikes and rapid incorporation of smart technologies, such as the Internet of Things (IoT) and global positioning systems (GPS) features. Moreover, buyer preference is inclining towards high-performance, lightweight models, while both sharing and rental services are emerging as popular choices, highlighting a progressive urban mobility environment.

- Competitive Landscape: Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: While the market experiences challenges like elevated initial costs and regulatory limitations, there are key opportunities in heightening customer awareness and developing infrastructure. Additionally, major companies can leverage the growing demand for eco-friendly mobility solutions and favorable government policies to drive innovation and maintain competitive Spain e-bike market price, further helping them navigate current market challenges.

Spain E-Bike Market Trends:

Rising Product Adoption in Urban Areas

Urban regions in Spain are rapidly adopting e-bikes as an ideal mode of mobility, which is primarily driven by an intense inclination towards sustainable urban transport solutions. Consequently, increasing urbanization significantly contributes to market expansion. According to the UN-Habitat, number of urban populations in Spain is annually increasing by 0.24%. Moreover, the country has over 128.180km of municipal urban roads. E-bikes provide an eco-friendly and convenient alternative to conventional vehicles, lowering traffic emissions as well as congestion. Moreover, the surge in bike-sharing services and dedicated lanes for cycling has further bolstered the adoption of e-bikes, especially among city dwellers and commuters seeking effective, environmentally friendly, and cost-efficient transportations modes.

Advancements in E-Bike Technology

According to the Spain e-bike industry overview, technological advancements in e-bike functionality and design are significantly driving the market growth by improving user experience. Innovation such as improved connectivity features, enhanced battery life, and lighter materials are elevating the e-bikes appeal to a wider consumer base. Moreover, the incorporation of advanced technologies, such as smartphone connectivity and GPS navigation, is elevating the safety as well as convenience of e-bikes, addressing the evolving demands of tech-savvy individuals and establishing e-bikes as an efficient, modern mode of transportation. For instance, in October 2023, Decathlon launched its new Elops Speed 900E electric city bike in numerous European countries, Spain being one of them. This e-bike is integrated with advanced features such as assistance mode, smartphone connectivity, mobility app, and GPS tracking.

Increase in Environmentally Conscious Buyers

The intensified surge in environmental awareness among Spanish customers is substantially driving the demand for e-bikes as a sustainable alternative to conventional modes of transportation. As more consumers are gaining knowledge about the heavy pollution caused by conventional automobiles, there is a notable inclination towards eco-friendly alternatives such as e-bikes. In addition, government beneficial funds endorsing green mobility, like tax breaks and subsidies for e-bike procurements, further reinforce this adoption. For instance, Spain’s National Energy and Climate Plan 2021-2030 has targeted to lower its carbon emission by 39% by 2030, through the electrification of the vehicles. The government aims to completely decarbonize transportation network by 2050. Moreover, to support this strategy, central government has allocated € 400 fund for the subsidies of EV purchases. Furthermore, this trend is facilitating the expansion of Spain e-bike market size by presenting these bikes as an ideal option for both commercial and personal commuting use, especially in urban environment where lowering carbon footprints and fostering sustainable lifestyle are foremost objectives.

Spain E-Bike Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on mode, motor type, battery type, class, design, and application.

Breakup by Mode:

To get detailed segment analysis of this market Request Sample

- Throttle

- Pedal Assist

- Speed Pedelec

The report has provided a detailed breakup and analysis of the market by mode. This includes throttle, pedal assist, and speed pedelec.

Throttle mode provides riders direct control of motor without the need to pedal, appealing to those customers who prefer minimal effort and ease of use while driving. Throttle e-bikes are generally preferred for leisure riding or short distance traveling, offering versatility and fast acceleration. Moreover, the demand is majorly driven by tourist and urban riders seeking effortless, convenient mobility options. However, regulatory protocols regarding power and speed in urban regions affect their adoption, compelling manufacturers to align compliance with performance.

Pedal assist e-bikes couple traditional cycling with electric support, providing riders with an intuitive and energy-efficient experience. This mode appeals to commuters and recreational users seeking longer ranges and exercise benefits without excessive strain. Moreover, the heightening emphasis on health and fitness, alongside government incentives for eco-friendly transportation, has bolstered demand for pedal assist models. These bikes are also favored for their compliance with local regulations, making them a practical choice for various consumer segments.

Speed pedelecs, capable of reaching higher speeds than standard e-bikes, are gaining traction in Spain for long-distance commuting and robust performance needs. Positioned between conventional e-bikes and scooters, they appeal users seeking faster travel times while maintaining the benefits of electric assistance. Additionally, these models require specific licensing and adherence to stricter regulations, limiting their appeal to a niche market. Nonetheless, their growing popularity reflects an increasing demand for high-speed, sustainable transport solutions in Spain's evolving mobility landscape.

Breakup by Motor Type:

- Hub Motor

- Mid Drive

A detailed breakup and analysis of the market based on the motor type have also been provided in the report. This includes hub motor and mid drive.

Hub motors are a popular motor type in the Spain e-bike market, offering a straightforward design and easy installation. Positioned either in the front or rear wheel, hub motors provide a smooth and quiet riding experience, appealing to urban commuters. Moreover, their affordability and low maintenance requirements make them a preferred choice for entry-level e-bikes, catering to a wide range of consumers. Additionally, the rising demand for cost-effective and efficient e-bike solutions further drive the adoption of hub motors.

Mid-drive motors, positioned at the bike’s crankshaft, are gaining momentum in the Spain e-bike market due to their superior torque and balanced weight distribution. These motors offer enhanced power efficiency and better performance on varied terrains, making them ideal for mountainous regions and off-road cycling. Moreover, this segment appeals to performance-focused riders and enthusiasts seeking a natural riding feel. As demand for high-performance e-bikes increases, mid-drive motors are expected to capture a growing share of the market.

Breakup by Battery Type:

- Lead Acid

- Lithium Ion

- Others

The report has provided a detailed breakup and analysis of market by battery type. This includes lead acid, lithium ion, and others.

Lead-acid batteries are a traditional choice in the Spain e-bike market due to their lower initial cost and reliable performance for short-distance commutes. These batteries are valued for their high surge current capabilities, making them suitable for basic e-bike models. However, their heavier weight, shorter lifespan, and lower energy density compared to newer technologies limit their appeal as consumer demand shifts toward more efficient and lightweight alternatives, prompting manufacturers to explore more advanced battery solutions.

Lithium-ion batteries are prevalent in the Spain e-bike market segment due to their superior energy density, lighter weight, and longer lifespan. They provide enhanced performance and extended range, catering to consumers preferences for high-efficiency and long-distance travel. As technological advancements reduce costs and improve safety, lithium-ion batteries continue to gain traction, driving innovation in e-bike design and functionality. In addition, their popularity is further bolstered by increasing environmental awareness and the demand for sustainable, energy-efficient transportation options.

Breakup by Class:

- Class I

- Class II

- Class III

The report has provided a detailed breakup and analysis of market by class. This includes class I, class II, and class III.

The class I segment of the Spain e-bike market includes pedal-assist bicycles, which provide motor assistance only when the rider is pedaling and terminate assistance at 25 km/h. This category appeals to urban commuters and recreational cyclists seeking an eco-friendly transportation option without compromising exercise. The market growth for class I e-bikes is primarily driven by increasing awareness of sustainable mobility solutions and supportive infrastructure developments, making them a popular choice for daily commutes and city travel.

Class II e-bikes in Spain feature throttle-controlled systems that allow the rider to engage the motor without pedaling, with a speed limit of 25 km/h. These e-bikes cater to a broad consumer base, including casual riders and those seeking ease of use, particularly in hilly or challenging terrains. Furthermore, this segment profits from innovation in battery technology and design, enhancing range and durability, thus making them attractive for both leisure and functional purposes in the Spanish market.

The class III segment includes high-performance e-bikes capable of reaching speeds up to 45 km/h with pedal assistance. This category targets more experienced cyclists and long-distance commuters who require higher speeds and efficiency. Moreover, regulatory support and demand for faster, more versatile transportation solutions are driving growth in this segment. Class III e-bikes are increasingly seen as alternatives to traditional vehicles for urban commuting, appealing to riders seeking speed and performance without the limitations of conventional bicycles.

Breakup by Design:

- Foldable

- Non-Foldable

The report has provided a detailed breakup and analysis of market by design. This includes foldable and non-foldable.

The foldable e-bike segment in Spain is gaining momentum due to its practicality and convenience for urban commuters. These bikes appeal to riders seeking compact, portable options that can be easily stored in small spaces, such as apartments or public transportation. Furthermore, increased urbanization and limited parking availability are driving demand for foldable designs, making them a popular choice among city dwellers. In addition, Spanish e-bike brands are currently focusing on lightweight materials and innovative folding mechanisms to enhance usability and attract consumers.

The non-foldable e-bike segment in Spain remains robust, favored for its stability and performance across varied terrains. These bikes cater to both recreational riders and long-distance commuters who prioritize durability and ride quality over portability. As the demand for e-bikes extends beyond city commuting to leisure and fitness markets, non-foldable designs continue to thrive. In addition, manufacturers in this segment focus on comfort, enhanced battery life, and rugged construction to appeal to a broad consumer base seeking reliable transportation solutions.

Breakup by Application:

- Mountain/Trekking Bikes

- City/Urban

- Cargo

The report has provided a detailed breakup and analysis of market by application. This includes mountain/trekking bikes, city/urban, and cargo.

The mountain and trekking bike segment in the Spain e-bike market caters to adventure enthusiasts seeking robust, durable bikes for off-road and challenging terrains. The demand is principally driven by the country's diverse landscapes, making these e-bikes ideal for both recreational and professional use. Moreover, manufacturers are currently focusing on enhancing features like suspension, battery life, and motor efficiency to improve performance and endurance, appealing to a growing base of cyclists looking for reliable and high-performing options for outdoor activities. For instance, in January 2024, MMR, a Spanish company of bikes, launched its new electric mountain bike Kaizen. This ultra lightweight e-bike is integrated with Bosch Performance Line SX motor.

City or urban e-bikes segment is chiefly driven by the heightening preference for eco-friendly transportation in urban areas. These bikes are designed for daily as well as short-distance commuting, providing a sustainable alternative to traditional vehicles. Moreover, market players are actively emphasizing on comfort, ease of use, and design to cater to urban riders seeking practical and stylish solutions. In addition, the increasing development of bike-friendly infrastructure in Spanish cities further reinforces the growth of this segment, enhancing the appeal of e-bikes for city dwellers.

The cargo e-bike segment in Spain's e-bike market is gaining momentum due to the growing demand for efficient, low-emission delivery solutions and family transport options. These bikes are designed to carry heavy loads, making them ideal for last-mile delivery and small businesses. In addition, major companies are investing in innovative designs and sturdy materials to improve load capacity and durability. Furthermore, this segment is bolstered by urban congestion concerns and the shift towards sustainable logistics, positioning cargo e-bikes as a practical alternative in densely populated areas.

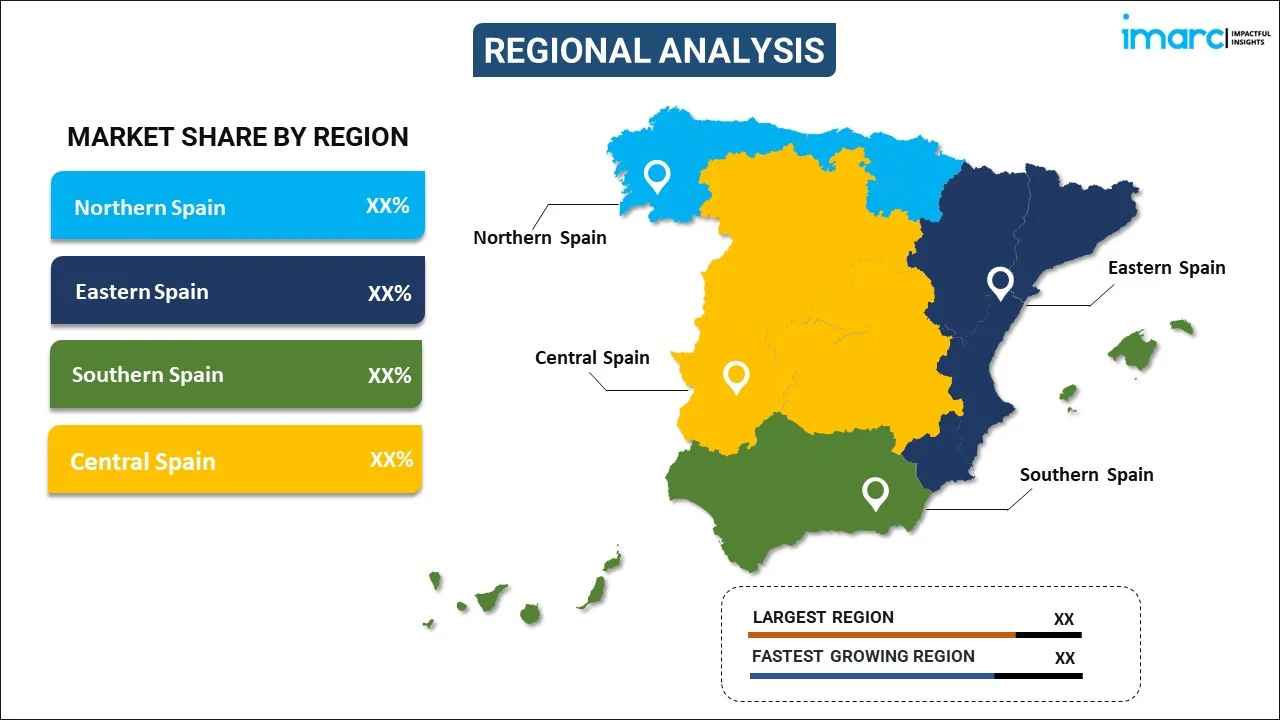

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

The report has also provided a comprehensive analysis of the Spain e-bike market by region, including Northern Spain, Eastern Spain, Southern Spain, and Central Spain.

The e-bike market in Northern Spain is expanding rapidly due to the region's varied terrain, which includes both urban and rural landscapes. Increasing demand for recreational cycling and sustainable commuting solutions is driving growth. Moreover, regional initiatives promoting eco-friendly transportation and infrastructure developments, such as dedicated bike lanes, further support market expansion. Key cities, including Bilbao and San Sebastián, play a crucial role in this dynamic, fostering local interest in e-bikes as a versatile and sustainable mobility option.

Eastern Spain, particularly Catalonia and Valencia, presents a vibrant market for e-bikes, driven by strong tourism and a culture of outdoor activities. The region's favorable climate and well-developed cycling infrastructure encourage both residents and tourists to adopt e-bikes for recreational and commuting purposes. Furthermore, increasing urbanization in cities like Barcelona, along with government incentives for sustainable transport, boosts demand. In addition, local companies and international brands actively compete, emphasizing on innovation and customer-centric offerings to capture market share.

In Southern Spain, the e-bike market is gaining momentum, supported by the region's warm climate and scenic routes that attract both locals and tourists. Cities like Málaga and Seville are witnessing a rise in e-bike usage for leisure and daily commuting, driven by growing awareness of environmental sustainability. In addition, the market is also influenced by government efforts to reduce carbon emissions and enhance urban mobility, leading to increased investments in cycling infrastructure and public awareness campaigns promoting the benefits of e-bikes.

Central Spain, including Madrid and surrounding areas, is emerging as a significant market for e-bikes, driven by increasing urban congestion and a growing emphasis on sustainable transportation. The region's market is characterized by a shift towards smart mobility solutions, with consumers opting for e-bikes to navigate the busy cityscape. Furthermore, government policies promoting green transportation, coupled with expanding cycling infrastructure and a rising health consciousness among urban dwellers, are propelling the adoption of e-bikes as a practical alternative to traditional commuting methods.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- The competitive landscape is represented by a mix of emerging domestic companies and well-established international firms that are intensely competing for Spain e-bike market share through strategic partnerships and innovations. For instance, in June 2024, Velco announced a strategic partnership with Panot, a Spain-based e-bike rental company, to transform its e-bikes into smartbikes using Velco’s cutting-edge IoT device, Mobitrax. This partnership reflects a tactical step in Velco’s expansion into the thriving Spanish market for e-bikes. Key players are currently emphasizing on improving connectivity features and efficiency to address the evolving demands of consumers. Moreover, the market is also boosted by proliferating distribution network, competitive pricing, and technological advancements, driving growth as well as differentiation in this adapting sector.

Spain E-Bike Market News:

- In May 2024, Decathlon launched its new electric foldable bike BTWIN E-Fold 900 across European regions, including Spain. This bike is integrated with company’s patented hinge locking system which facilitates faster folding, making storage and transportation easier.

- In November 2023, SEG Automotive, a Germany-based manufacturer of automotive parts, announced a partnership with BH Bikes, a Spain-based bike manufacturer. As per the contract, SEG will supply its new e-bike motor to BH, which is compact, equipped with a 36-volt battery, offers 600W of power, and weighs less than 2.6kg.

Spain E-bike Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Modes Covered | Throttle, Pedal Assist, Speed Pedelec |

| Motor Types Covered | Hub Motor, Mid Drive |

| Battery Types Covered | Lead Acid, Lithium Ion, Others |

| Classes Covered | Class I, Class II, Class III |

| Designs Covered | Foldable, Non-Foldable |

| Applications Covered | Mountain/Trekking Bikes, City/Urban, Cargo |

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Spain e-bike market performed so far, and how will it perform in the coming years?

- What is the breakup of the Spain e-bike market on the basis of mode?

- What is the breakup of the Spain e-bike market on the basis of motor type?

- What is the breakup of the Spain e-bike market on the basis of battery type?

- What is the breakup of the Spain e-bike market on the basis of class?

- What is the breakup of the Spain e-bike market on the basis of design?

- What is the breakup of the Spain e-bike market on the basis of application?

- What are the various stages in the value chain of the Spain e-bike market?

- What are the key driving factors and challenges in the Spain e-bike market?

- What is the structure of the Spain e-bike market, and who are the key players?

- What is the degree of competition in the Spain e-bike market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Spain e-bike market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Spain e-bike market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Spain e-bike industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)