Spain Data Center Market Size, Share, Trends and Forecast by Data Center Size, Tier Type, Absorption, and Region, 2026-2034

Spain Data Center Market Summary:

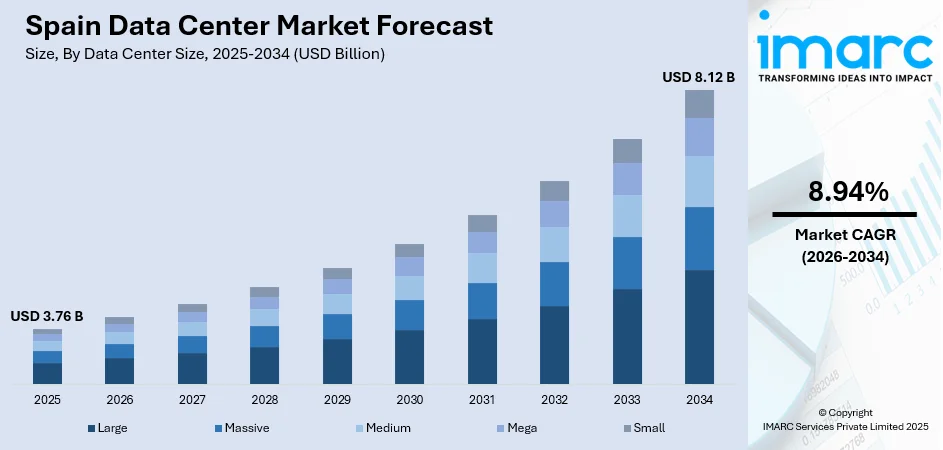

The Spain data center market size was valued at USD 3.76 Billion in 2025 and is expected to reach USD 8.12 Billion by 2034, growing at a compound annual growth rate of 8.94% from 2026-2034.

Spain has rapidly emerged as Southern Europe's premier digital infrastructure hub, driven by accelerating enterprise cloud adoption, artificial intelligence (AI) workload expansion, and robust government digitalization initiatives. The nation's strategic geographic positioning at the crossroads of transatlantic submarine cable networks enables exceptional connectivity between Europe, the Americas, and Africa, attracting substantial hyperscaler investments and colocation demand. The convergence of abundant renewable energy resources, favorable regulatory frameworks, and strong digital infrastructure development continues to strengthen the market share.

Key Takeaways and Insights:

- By Data Center Size: Large dominates the market with a share of 30% in 2025, driven by enterprise requirements for scalable infrastructure between single-cabinet colocation and massive hyperscale facilities, addressing mid-market digital transformation needs across the banking, telecommunications, and manufacturing sectors.

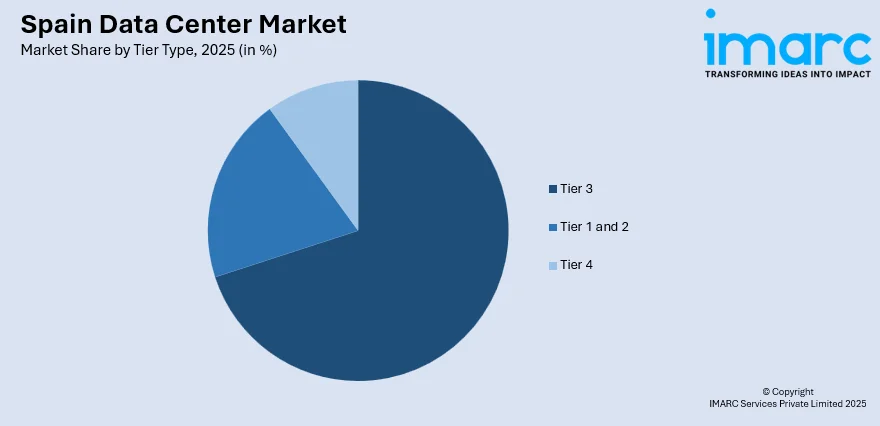

- By Tier Type: Tier 3 leads the market with a share of 70% in 2025, owing to enterprise preference for N+1 redundancy configurations that balance operational reliability with cost efficiency, supporting mission-critical applications requiring concurrent maintainability without service interruption.

- By Absorption: Utilized represents the largest segment with a market share of 70% in 2025, driven by accelerating cloud migration among Spanish enterprises, growing demand for colocation services from multinational corporations, and expansion of digital services requiring immediate processing capabilities.

- Key Players: The Spain data center market exhibits moderate competitive intensity, with established colocation operators competing alongside hyperscale cloud providers and private equity-backed platforms across retail, wholesale, and hyperscale segments.

To get more information on this market Request Sample

The market demonstrates strong investment momentum, exemplified by Blackstone's €7.5 Billion investment announcement in October 2024 to develop data center infrastructure in Aragon, Spain. This substantial capital deployment reflects growing confidence in Spain's digital infrastructure potential, with operators increasingly leveraging the country's renewable energy advantages to support sustainable operations. The country’s strategic location makes it a key connectivity hub between Europe, North Africa, and transatlantic networks, attracting international colocation providers. The growth in AI, big data analytics, and e-commerce is fueling the demand for high-performance facilities. The trend of smart, energy-efficient, and resilient establishments is also encouraging innovations in cooling, automation, and facility management. The market ecosystem continues to mature through strategic acquisitions, greenfield developments, and expanding hyperscaler presence that collectively strengthen Spain's position as a leading European data center destination.

Spain Data Center Market Trends:

AI Infrastructure Acceleration

The deployment of AI-ready facilities is reshaping Spain's data center landscape, with operators investing in specialized infrastructure to accommodate high-performance computing workloads. In October 2024, EDGNEX Data Centers by DAMAC planned to construct a new AI-ready data center in Madrid with a power capacity of around 40 MW to enhance AI and high performance computing (HPC) capabilities. Facilities catering to AI applications are implementing advanced cooling solutions, including liquid immersion systems, to manage increased rack densities that can exceed traditional configurations by many times, supporting the growing computational demands of machine learning (ML) and generative AI applications.

Regional Diversification Beyond Traditional Hubs

The saturation of electrical grid capacity in Madrid and Barcelona is driving significant infrastructure investment towards secondary regions offering better power availability and land accessibility. Areas like Valencia, Cantabria, and Extremadura, where the data center pipeline surged by 43% from September 2024 to February 2025, are becoming more significant due to their robust connectivity, low-cost land, availability of renewable energy, and closeness to submarine cables. This geographic expansion enables operators to develop large-scale hyperscale campuses while avoiding grid connection delays that can extend project timelines by several years in congested metropolitan areas.

Growing Enterprise and Government IT Demand

Enterprise digitalization and government IT modernization are major drivers of the market expansion in Spain. Businesses across the finance, retail, manufacturing, and healthcare sectors are increasingly dependent on cloud infrastructure, real-time analytics, and AI-enabled platforms, driving the demand for reliable and secure facilities. Government initiatives, such as e-governance, smart city programs, and public sector digital transformation, are increasing the demand for data storage, colocation, and disaster recovery solutions.

Market Outlook 2026-2034:

Continued submarine cable investments, including transatlantic systems, are set to enhance Spain's role as a global connectivity hub. Hyperscaler commitments signal transformative capacity additions through the forecast period. The market generated a revenue of USD 3.76 Billion in 2025 and is projected to reach a revenue of USD 8.12 Billion by 2034, growing at a compound annual growth rate of 8.94% from 2026-2034. Government initiatives supporting grid infrastructure upgrades and renewable energy deployment will address current capacity constraints while reinforcing Spain's competitive positioning as a sustainable digital infrastructure destination within Europe.

Spain Data Center Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Data Center Size | Large | 30% |

| Tier Type | Tier 3 | 70% |

| Absorption | Utilized | 70% |

Data Center Size Insights:

- Large

- Massive

- Medium

- Mega

- Small

Large dominates with a market share of 30% of the total Spain data center market in 2025.

Large data center facilities occupy a critical position within Spain's digital infrastructure ecosystem. These facilities serve enterprises requiring substantial computing resources beyond small colocation deployments but below hyperscale configurations, addressing the needs of financial institutions, telecommunications providers, and multinational corporations establishing regional operations.

The segment benefits from balanced economics that enable operators to achieve efficient power utilization while maintaining flexibility for diverse tenant requirements. Large facilities provide the infrastructure redundancy and connectivity options demanded by enterprise customers without the capital intensity associated with massive or mega-scale developments. This positioning allows operators to serve mid-market customers migrating workloads from on-premises infrastructure while accommodating overflow capacity requirements from hyperscale cloud providers seeking secondary deployment options across Spanish metropolitan areas.

Tier Type Insights:

Access the Comprehensive Market Breakdown Request Sample

- Tier 1 and 2

- Tier 3

- Tier 4

Tier 3 leads with a share of 70% of the total Spain data center market in 2025.

Tier 3 data centers have established clear market leadership in Spain, offering N+1 redundancy configurations that enable concurrent maintainability without requiring service interruption during routine equipment maintenance or upgrades. This infrastructure standard addresses the operational requirements of enterprise customers seeking reliable computing environments while maintaining cost efficiency compared to fully fault-tolerant Tier 4 configurations.

The preference for Tier 3 facilities reflects Spanish enterprise requirements for high availability without the premium costs associated with 2N redundancy architectures. These facilities support mission-critical applications across the banking, e-commerce, and telecommunications sectors where downtime carries significant financial implications but where absolute fault tolerance may represent overengineering relative to operational requirements. The segment continues to attract investment as colocation operators expand capacity to accommodate cloud migration initiatives and digital transformation programs across Spanish industries.

Absorption Insights:

- Non-Utilized

- Utilized

- Colocation Type

- Hyperscale

- Retail

- Wholesale

- End User

- BFSI

- Cloud

- E-Commerce

- Government

- Manufacturing

- Media and Entertainment

- Telecom

- Others

- Colocation Type

Utilized exhibits a clear dominance with a 70% share of the total Spain data center market in 2025.

The substantial proportion of utilized data center capacity reflects strong demand dynamics across Spain's digital economy, with enterprises increasingly migrating computing workloads to professional colocation and cloud environments. The utilized segment encompasses active IT deployments across hyperscale, retail, and wholesale colocation configurations serving diverse customer requirements from single-rack deployments to multi-megawatt enterprise installations.

The colocation demand growth is driven by cloud service provider expansion, financial services digitalization, and e-commerce infrastructure requirements across the Spanish market. In January 2025, eight European tech organizations, including Arsys, BIT, Gdańsk University of Technology, Infobip, IONOS, Kontron, MONDRAGON Corporation, and Oktawave, unveiled the Virt8ra federated infrastructure, Europe’s inaugural sovereign edge cloud. The first stage of this pan-European project, designed to deliver portability and interoperability among various cloud providers, provided computing and storage capabilities in six EU Member States: Croatia, Germany, the Netherlands, Poland, Slovenia, and Spain. Wholesale colocation is gaining momentum, as hyperscalers and large enterprises are seeking dedicated capacity with customizable configurations supporting AI workloads and high-performance computing applications.

Regional Insights:

- Northern Spain

- Eastern Spain

- Southern Spain

- Central Spain

Northern Spain’s data center market benefits from cooler climatic conditions, which help reduce cooling costs and improve energy efficiency. The region attracts facilities supporting industrial, logistics, and cross-border data traffic with France. Availability of renewable energy and lower land costs also encourage regional development.

Eastern Spain, led by cities like Barcelona and Valencia, is driven by strong digital business activities and tourism-based data demand. The presence of ports and submarine cable connectivity supports international traffic handling. Growing technology startups and smart city projects create steady colocation and cloud demand.

Southern Spain is emerging as a strategic region due to rising investment, lower real estate costs, and improving power infrastructure. Data centers here support regional businesses, government digitization, and telecom expansion. Renewable energy availability, especially solar power, is encouraging operators to develop energy-efficient facilities.

Central Spain, especially around Madrid, dominates the country’s data center market due to strong connectivity, enterprise concentration, and government institutions. The region hosts the largest cloud, financial, and telecom customers. Advanced network infrastructure and skilled workforce availability further strengthen Central Spain’s leadership position.

Market Dynamics:

Growth Drivers:

Why is the Spain Data Center Market Growing?

Transformative Hyperscaler Investment Commitments

Global technology giants have identified Spain as a strategic priority for European infrastructure expansion, committing unprecedented capital to develop cloud regions and hyperscale campuses. In May 2024, AWS declared it would allocate €15.7 Billion to enhance its Aragon area, with assistance from the regional government, representing one of the largest single data center investments in European history. This substantial commitment reflects hyperscaler confidence in Spain's digital infrastructure potential, with Amazon planning to power facilities through renewable energy sources while generating thousands of direct and indirect employment opportunities across the construction, operations, and technology services sectors. The hyperscaler presence attracts ecosystem partners, including colocation operators, connectivity providers, and enterprise customers, seeking proximity to major cloud platforms.

Increasing investments in renewable energy projects

Rising investments in renewable energy projects are strongly driving the growth of the market in Spain by improving power availability, cost stability, and sustainability credentials. Expanding solar and wind capacity provides data center operators with access to cleaner and more predictable energy sources, which is critical for energy-intensive facilities running 24/7. Renewable power purchase agreements help operators control electricity costs and reduce exposure to price volatility in conventional energy markets. In May 2024, Digital Realty signed five power purchase agreements in France and Spain for solar and wind projects totaling 134MW, advancing sustainability objectives while securing competitive long-term renewable energy supply for its European data center portfolio. Green energy availability also makes Spain more attractive to international cloud providers and hyperscale companies that follow strict carbon-reduction targets. In addition, renewable projects are strengthening grid infrastructure in emerging regions, enabling development beyond major cities. The availability of green power supports long-term site planning and improves regulatory acceptance of new facilities.

Accelerating Digital Transformation Initiatives

Spanish enterprises across the financial services, healthcare, retail, and manufacturing sectors are accelerating cloud adoption and digital modernization programs that drive sustained data center demand. As per IMARC Group, the Spain cloud market size reached USD 5.31 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.40 Billion by 2033, exhibiting a growth rate (CAGR) of 20.00% during 2025-2033. Government digitalization initiatives support this transformation through regulatory frameworks encouraging technology adoption and investment incentives attracting international operators. The convergence of enterprise requirements with supportive policy environment creates favorable conditions for sustained infrastructure expansion, with organizations increasingly recognizing professional data center environments as essential foundations for competitive digital capabilities and operational resilience.

Market Restraints:

What Challenges is the Spain Data Center Market Facing?

High Energy Costs and Power Constraints

Rising electricity prices and uneven grid capacity increase operating expenses for data centers in Spain. High-density computing requires uninterrupted power, but in urban areas, infrastructure strain and limited expansion capacity delay new projects. Investments in backup power and renewable integration further raise capital costs for operators.

Water Scarcity and Cooling Challenges

Recurring droughts and limited water availability make traditional cooling methods difficult to sustain. Data center developers must adopt advanced liquid and air-based cooling systems, increasing upfront investment. Environmental pressure and public concern also create permitting challenges, especially in water-stressed regions.

Regulatory Complexity and Approval Delays

Multiple layers of local and national regulations slow development timelines. Environmental assessments, zoning rules, and sustainability mandates increase paperwork and compliance costs. Policy variation across regions makes national expansion difficult, creating project uncertainty and discouraging rapid investment decisions.

Competitive Landscape:

The Spain data center market features a diverse competitive environment, encompassing global hyperscalers, international colocation operators, and regional platform developers. Major colocation providers maintain substantial capacity portfolios concentrated in Madrid and Barcelona, offering carrier-neutral connectivity and enterprise-grade infrastructure. Private equity involvement has intensified through strategic acquisitions and greenfield developments, with investors recognizing attractive risk-adjusted returns from digital infrastructure assets. Competition increasingly centers on securing electrical grid capacity, renewable energy access, and strategic land positions that enable large-scale development in an environment of constrained metropolitan resources.

Recent Developments:

- In December 2025, Nostrum Group selected AECOM to oversee the design and management of its USD 2.1 Billion data center campus in Badajoz, Spain. The project aimed to meet the growing demands for high-density computing.

- In November 2025, Microsoft obtained the preliminary authorization for its proposed data center facilities in the Aragón region of Spain. The regional authorities approved the ‘Plan of General Interest of Aragón’ (PIGA), called MSFT Region, which would involve creating three campuses in La Muela, Villamayor de Gállego, and Zaragoza, along with connecting them through fiber optics. The campuses would cover a total area of 283.79 hectares (701.3 acres), with the La Muela site being the largest campus.

Spain Data Center Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Center Sizes Covered | Large, Massive, Medium, Mega, Small |

| Tier Types Covered | Tier 1 and 2, Tier 3, Tier 4 |

| Absorptions Covered |

|

| Regions Covered | Northern Spain, Eastern Spain, Southern Spain, Central Spain |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Spain data center market size was valued at USD 3.76 Billion in 2025.

The Spain data center market is expected to grow at a compound annual growth rate of 8.94% from 2026-2034 to reach USD 8.12 Billion by 2034.

Large dominates the market with 30% share, since hyperscale and cloud operators prefer centralized, high-capacity facilities for better economies of scale, lower unit operating costs, stronger security, and higher efficiency in handling massive enterprise and cloud workloads.

Key factors driving the Spain data center market include substantial hyperscaler investment commitments, expanding submarine cable connectivity enhancing Spain's role as a European digital gateway, accelerating enterprise cloud adoption and digital transformation initiatives, and abundant renewable energy resources enabling sustainable operations.

Major challenges include electrical grid saturation constraining new connections, particularly in Madrid, limited transmission node availability extending project development timelines, skilled workforce shortages across technical disciplines, and water scarcity concerns requiring investment in advanced cooling technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)