Soybean Oil Market Size, Share, Trends and Forecast by End-Use and Region, 2025-2033

Soybean Oil Market Size and Share:

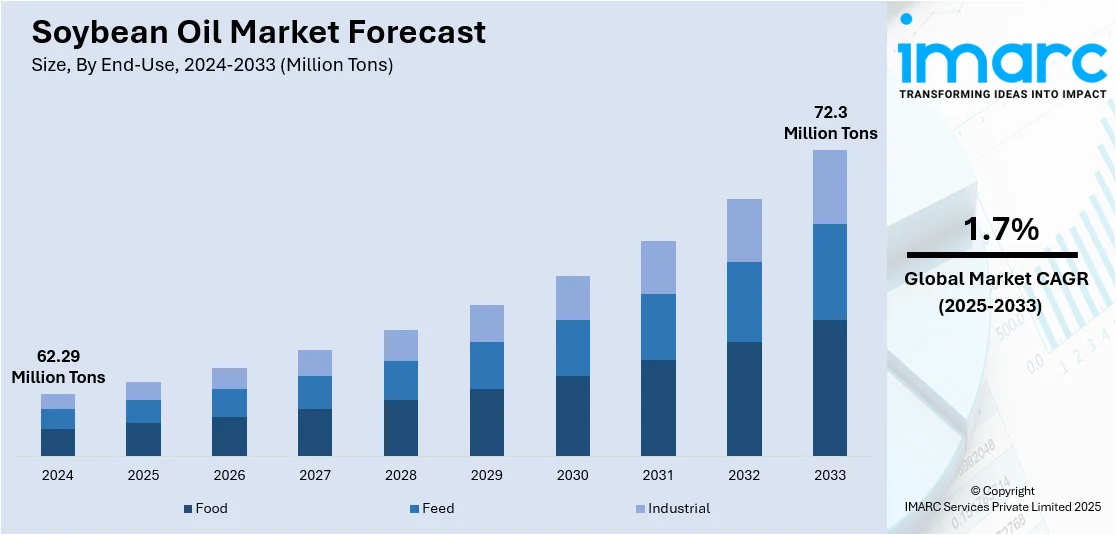

The global soybean oil market size was valued at 62.29 Million Tons in 2024. Looking forward, IMARC Group estimates the market to reach 72.3 Million Tons by 2033, exhibiting a CAGR of 1.7% during 2025-2033. China currently dominates the market, holding a significant market share of over 32.0% in 2024. The increasing preference for plant-based and trans-fat-free oils, rising health consciousness and awareness among the masses and growing product utilization in various industrial applications are strengthening soybean oil market share in the global edible oil industry.

Key Highlights:

- Enhanced health consciousness, surging need for plant-based foodstuffs, rise in the manufacture of biodiesel, growing food processing sector, and advances in the technology of oil extraction are the major drivers of the soybean oil market.

- Food leads the market with around 76.8% of market share in 2024 as it is widely used for various culinary purposes, such as cooking, frying, baking, and as an ingredient in processed foods.

- China accounted for the largest market share of over 32.0% as it is the major producer of soybeans. Apart from this, the rising demand for soybean oil on account of the thriving food service industry is contributing to the growth of the market in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 62.29 Million Tons |

| Market Forecast in 2033 | 72.3 Million Tons |

| Market Growth Rate (2025-2033) | 1.7% |

The soybean oil market is driven by rising consumer demand for plant-based and heart-healthy oils, expanding food processing industries and increasing biodiesel production. Government policies promoting renewable energy and sustainability further boost market growth. Technological advancements in oil extraction and refining enhance yield and quality. Growing awareness of functional health benefits including omega-3 and vitamin E content fuels demand. Fluctuating soybean production, geopolitical trade policies and supply chain dynamics influence pricing and market stability. According to the report published by IBEF, in October 2024, Indian soybean production rose by 6% to 1.26 million tonnes in the current kharif season with an average yield of 1,063 kg per hectare. Soybeans were sown in 11.83 million hectares. Madhya Pradesh produced 5.54 million tonnes, while the government set the MSP at $58.23 per quintal for 2024-25.

To get more information on this market, Request Sample

The U.S. soybean oil market is driven by strong demand from the food processing, biofuel and industrial sectors. The expansion of renewable diesel and biodiesel production supported by government incentives like the Renewable Fuel Standard (RFS) fuels growth. Rising consumer preference for plant-based and trans-fat-free oils boosts food industry adoption. Technological advancements in refining and genetically modified soybean varieties enhance yield and quality. Additionally, fluctuating soybean crop yields, trade policies, and global supply chain shifts impact pricing and market dynamics. In October 2024, the USDA's Crop Production report forecasts U.S. soybean production at 4.58 billion bushels, a 10% increase from 2023. Yields are expected to average 53.1 bushels per acre, down 0.1 bushel from the previous forecast, with a harvested area of 86.3 million acres, unchanged from earlier estimates.

Soybean Oil Market Trends:

Rising Demand for Edible Oil

The rising demand for edible oils is a significant driver of growth in the soybean oil market. For instance, according to IMARC, the India edible oil market size reached 24.7 Million Tons in 2023. Looking forward, IMARC Group expects the market to reach 27.9 Million Tons by 2032, exhibiting a growth rate (CAGR) of 1.35% during 2024-2032. As populations expand and consumer preferences shift towards healthier and more versatile cooking oils, soybean oil's favorable properties and affordability make it a top choice. Additionally, its use in various food products and cooking applications further fuels the soybean oil market demand. These factors are expected to propel the soybean oil market in the coming years.

Increasing Health Consciousness

There is a rise in the demand for soybean oil due to the growing health consciousness among consumers across the globe. People are increasingly preferring nutrient-rich food products, which offer a positive market outlook. According to a report from the industry, India used approximately over five million metric tons of soybean oil during the fiscal year 2023. A significant part of this quantity was brought into the country. Soybean oil is considered a healthier choice due to its favorable fatty acid composition. For instance, according to an article published by the National Library of Medicine, soybean oil reduces circulating cholesterol and the risk of coronary heart disease while having no effect on inflammation or oxidation indicators. These factors further positively influence the soybean oil market forecast.

Growing Biofuel Production

The rising biofuel production is significantly driving growth in the soybean oil market. For instance, according to an article published by IEA, biofuel demand is expected to grow by 38 billion liters between 2023 and 2028, an almost 30% rise over the previous five years. In fact, worldwide biofuel consumption climbs 23% to 200 billion liters by 2028. Soybean oil is a key feedstock for biodiesel production. Biodiesel made from soybean oil is widely used as an alternative to petroleum diesel, and its production has been increasing due to environmental policies and mandates, thereby boosting the soybean oil market revenue.

Soybean Oil Market Opportunities:

Rising Demand for Biofuels

Growing demand for biofuels, particularly biodiesel from soybean oil, is improving market opportunities. Asia-Pacific and African emerging economies are offering untapped markets because of urbanization and shifting food consumption behavior. Technology developments in oil processing like enzymatic extraction and genetic improvement of soybeans for greater oil yield are providing scope for cost savings and quality enhancement. Also, the increasing applications of soybean oil in cosmetics, pharmaceuticals, and industries enhance its market space. Government subsidies towards sustainable and renewable energy also drive demand. Online growth allows for direct-to-consumer sales, increasing reach. All these tendencies, along with the rise in demand for non-GMO and organic soybean oil, create a positive environment for market participants to innovate and grow.

Soybean Oil Market Challenges:

Fluctuations in Raw Material

Price fluctuations of raw materials from climate change, pests, and international trade tensions affect production and stability of supplies. Health issues related to trans fats and ultra-processed oils prompt other consumers towards substitutes such as olive or avocado oil, minimizing the attractiveness of soybean oil. Bureaucratic pressures related to genetically modified (GMO) crops provide obstacles in areas that prefer non-GMO. Furthermore, high competition from other vegetable oils like palm and sunflower oil squeezes market share and price. Concerns about environmental sustainability for soybean cultivation, deforestation, and excessive water consumption threaten the reputation of the market. Instability through politics and export bans in key producing nations like the U.S., Brazil, and Argentina also make global trade more difficult. Finally, possible reaction against biodiesel policy may cut demand from industry, offering a further challenge to growth in the market.

Soybean Oil Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soybean oil market report, along with forecasts at the global, and regional level from 2025-2033. Our report has categorized the market based on end-use.

Analysis by End-Use:

- Food

- Feed

- Industrial

Food leads the market with around 76.8% of market share in 2024. According to the soybean oil market outlook, the food industry is one of the largest consumers of soybean oil as it is widely used for various culinary purposes, such as cooking, frying, baking, and as an ingredient in processed foods. In line with this, the rising adoption of ready-to-eat (RTE) food products among the masses is contributing to the growth of the market. Additionally, increasing health consciousness is driving demand for soybean oil due to its high unsaturated fat content and omega-3 fatty acids. Expanding food service and restaurant industries further fuel consumption while innovations in oil processing improve product stability and shelf life.

Regional Analysis

- China

- United States

- Brazil

- Europe

- Argentina

- India

- Others

In 2024, China accounted for the largest market share of over 32.0%. According to the soybean oil market statistics, China held the biggest market share as it is the major producer of soybeans. Apart from this, the rising demand for soybean oil on account of the thriving food service industry is contributing to the growth of the market in the country. In line with this, the increasing consumption of processed and convenience food products is propelling the growth of the market in China. Furthermore, the rising adoption of soybean oil due to changing consumer eating habits is bolstering the growth of the market in the country. In 2023, industry reports indicated that approximately 17.8 million metric tons of soybean oil were consumed by China's population.

Key Regional Takeaways:

United States Soybean Oil Market Analysis

The US soybean oil market is growing, fueled by robust domestic production, rising biodiesel demand, and government policies favoring renewable energy. The USDA now projects 12.8 billion pounds of soybean oil will be used in biofuel production during 2023-'24, emphasizing the expanding role of renewable fuels. Federal policies such as the Renewable Fuel Standard (RFS) and tax credits continue to drive soybean oil use in biodiesel and renewable diesel. In addition, food processing firms use soybean oil for myriad purposes, generating stable demand. Large processors including ADM and Bunge control refining and distribution, securing domestic market supply while sending increasing volumes into key markets in China and Mexico. Ongoing investment in processing capacity and sustainability efforts further entrenches the market.

Brazil Soybean Oil Market Analysis

Supported by its massive soybean production and strong exporting capabilities, Brazil is the dominant force in the global soybean oil industry. According to USDA forecasts for 2023–2024, Brazil produced 10.94 million metric tons of soybeans, or 17% of global production. In 2023, the nation's soybean exports were about 102 million metric tons, a 29% increase over the previous year and worth approximately USD 53.2 billion. Due to its use in food processing and the creation of biodiesel, soybean oil is becoming more and more in demand locally. Government regulations requiring the blending of biodiesel also encourage market expansion. Processing and exports are driven by major businesses like Bunge and Cargill, which maintain Brazil's competitiveness in the global market.

Europe Soybean Oil Market Analysis

At present, the European soybean oil market is swinging in various imports and demanding more food and biofuel applications. For the soybean imports into the European Union in the 2023/24 season, which started in July, figures had already amounted to 4.23 million metric tons by November, as per reports. Because of limited domestic soybean cultivation, the region heavily relies on imports, principally from Brazil and the United States. Soybean oil is commonly regarded as oil to be used in food processing, while currently, sustainability initiatives and biofuel mandates are going to bring its application into renewable energy. Leading refiners like Bunge and Cargill contribute considerably to processing and distribution. Again, stricter EU regulations would only create have to import goods deforested linked throughout the seas into such very same markets trends. Those would push suppliers to adapt their sustainable sourcing policies.

Argentina Soybean Oil Market Analysis

Argentina significantly influences the global soybean oil market, being one of the major producers and exporters. An industrial report indicated that the country's soybean oil consumption was around 2.29 million metric tons in 2022, with projections suggesting it will rise to 2.55 million metric tons by 2023. The country is a key exporter mainly to the European Union and Asia due to large-scale soybean cultivation. Policies supporting biodiesel from soybean oil further enhance domestic demand. Major processing and export players are Vicentin and Molinos Río de la Plata. With its favorable location and infrastructure for soybean oil production, Argentina's attractiveness in the competitive global market is assured.

India Soybean Oil Market Analysis

An expansive yet growing Indian populace, a burgeoning middle class, and rising consumption of processed foods have created a demand for soybean oil both home and abroad. According to an industrial report, by August 2023, India had brought in 357,890 tonnes of crude soybean oil, which represented 48 percent of the country's overall vegetable oil imports. Thus, soybean oil remains the most imported edible oil in India, with Brazil and Argentina as the major suppliers. The demand for soybean oil comes primarily from cooking and food processing and packaged foods. While import dependence is relieved by domestic refining capacity, primarily players such as Adani Wilmar and Ruchi Soya have been refining a large volume of imported crude oils. The government supports local oilseed production to lessen import dependence, alongside policies to control oil prices. Healthy oil consumption awareness leads to pressure on the market for new opportunities and innovation.

Competitive Landscape:

Key players in the industry are investing in research and development (R&D) activities to improve production processes, develop new product formulations, and enhance the quality and functionality of soybean oil. They are also exploring new extraction techniques, optimizing refining processes, and developing specialty variants of soybean oil to cater to specific customer needs. In line with this, major manufacturers are offering organic or non-genetically modified organism (GMO) variants of soybean oil, introducing specialty blends, and diversifying into value-added products, such as flavored or infused soybean oils. Apart from this, companies are opening soybean oil production facilities across the globe, which is positively influencing the market.

The report provides a comprehensive analysis of the competitive landscape in the soybean oil market with detailed profiles of all major companies, including:

- Archer Daniels Midland Company

- Bunge Limited

- Cargill, Incorporated

- Louis Dreyfus Company B.V.

- Wilmar International Limited

Latest News and Developments:

- In July 2024, Louis Dreyfus Company (LDC) reintroduced its Vibhor edible oil brand in India. The updated product range features Vibhor Refined Soybean Oil, along with other oils that are fortified with vitamins A and D. LDC's goal is to enhance Vibhor's footprint throughout India by 2026, targeting health-conscious consumers with a variety of dietary preferences.

- In July 2024, ADM announced that it will provide European customers with fully traceable and segregated soybean meal and oil, in accordance with the new EU deforestation regulations set to take effect on December 30, 2024. The company’s program, which includes more than 5,300 farmers in the United States, utilizes advanced technology to improve traceability throughout global supply chains.

- In July 2024, Benson Hill, Inc. announced significant progress in its innovation pipeline, focusing on adding valuable features for end users in the soybean market, which includes applications in animal feed, soybean oil, and biofuels.

- In March 2024, Nabil Group introduced its new soybean oil brand, Foodella, during an event at Padma Hall in the Grand Riverview Hotel, Rajshahi.

- In March 2024, the Bursa Malaysia Derivatives Exchange (BMD), which focuses on palm oil trading, announced plans to introduce a futures contract for soy oil. This initiative aims to facilitate arbitrage opportunities between soy oil and palm oil contracts.

Soybean Oil Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons, Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| End-Uses Covered | Food, Feed, Industrial |

| Regions Covered | China, United States, Brazil, Europe, Argentina, India, Others |

| Companies Covered | Archer Daniels Midland Company, Bunge Limited, Cargill, Incorporated, Louis Dreyfus Company B.V., Wilmar International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soybean oil market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global soybean oil market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the soybean oil industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soybean oil market size reached 62.29 Million Tons in 2024.

IMARC estimates the soybean oil market to reach 72.3 Million Tons by 2033, exhibiting a CAGR of 1.7% during 2025-2033.

The soybean oil market is driven by rising demand from the food and beverage industry, expanding biofuel production, and increasing health awareness. Government policies promoting renewable energy, technological advancements in refining, and growing consumer preference for plant-based oils further support market growth. Fluctuating crop yields and global trade policies also impact supply dynamics.

China accounted for the largest market share driven by high domestic consumption, strong demand from the food and biofuel industries, and government initiatives supporting soybean oil production and imports. The country’s growing population and expanding food processing sector further contribute to its market leadership.

Some of the major players in the soybean oil market include Archer Daniels Midland Company, Bunge Limited, Cargill, Incorporated, Louis Dreyfus Company B.V., Wilmar International Limited, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)