Soy Food Market Size, Share, Trends and Forecast by Product Type, Category, Distribution Channel, End-Use, and Region, 2025-2033

Soy Food Market Size and Share:

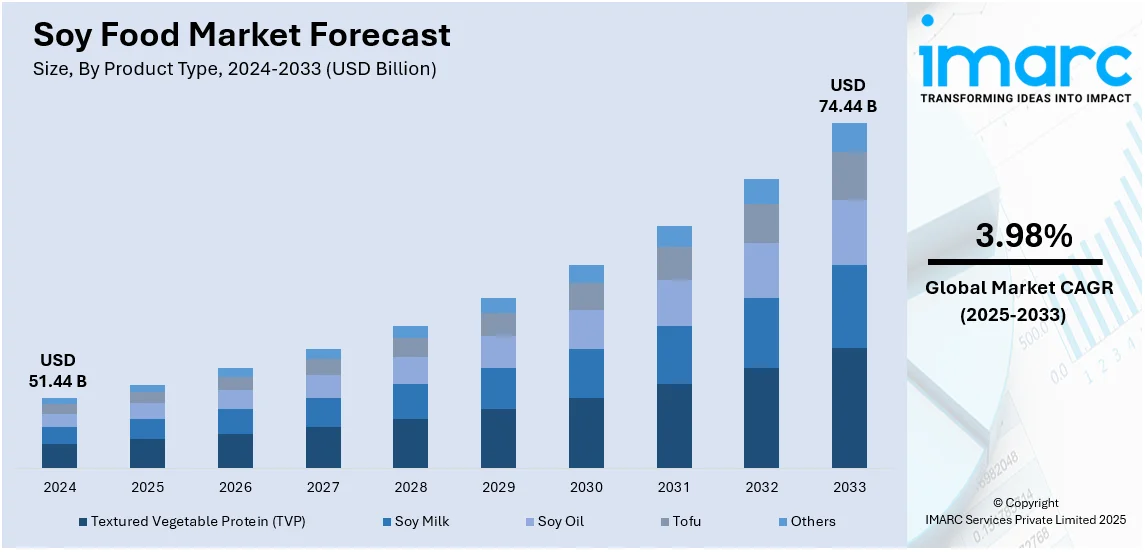

The global soy food market size was valued at USD 51.44 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 74.44 Billion by 2033, exhibiting a CAGR of 3.98% from 2025-2033. Asia Pacific currently dominates the market. The soy food market share in the Asia Pacific region is growing due to high soy consumption, strong plant-based dietary traditions, expanding food processing industries, government support, and increasing demand for functional and protein-rich foods.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 51.44 Billion |

|

Market Forecast in 2033

|

USD 74.44 Billion |

| Market Growth Rate 2025-2033 | 3.98% |

Consumers are becoming more aware about the advantages of plant-based nutrition, leading to higher consumption of soy-based foods. Soy products are rich in protein, low in cholesterol, and contain beneficial compounds like isoflavones, which support heart health and hormonal balance. Moreover, soy foods offer complete protein with all essential amino acids, making them a preferred source of plant-based nutrition. Additionally, soy products are lactose-free, making them ideal for consumers with lactose intolerance. Their cholesterol-lowering properties and association with improved heart health further contribute to their growing popularity among individuals focusing on disease prevention and overall well-being. Besides this, companies are continuously enhancing soy-based foods by improving taste, texture, and nutritional profiles. Fortified soy milk with added vitamins and minerals, flavored tofu, and high-protein soy snacks are gaining traction.

The United States plays a vital role in the market, propelled by advancements in soy food processing, including enhanced texturization methods and flavor improvements. Businesses are funding research to develop tastier, non-genetically modified organism (GMO), and organic soy food alternatives, appealing to health-focused customers. Moreover, clear regulations on labeling plant-based foods are boosting consumer confidence and minimizing uncertainty. Uniform labeling enhances product clarity, promotes knowledgeable buying choices, and bolsters market presence for soy-based options, boosting uptake in both retail and foodservice industries. In 2025, the US Food and Drug Administration (FDA) issued draft guidance to clarify labels for plant-based substitutes for animal-derived products like meat, eggs, and dairy. The recommendation suggests incorporating the main plant ingredient in product titles, like "soy-derived cheddar cheese," to maintain clarity and transparency for shoppers.

Soy Food Market Trends:

Rising Vegetarian Population

The growing global vegetarian population is driving the demand for soy-based foods. According to the World Animal Foundation, 22% of the world’s population follows vegetarian diets, creating a strong market for plant-based protein sources like tofu, soy milk, and soy-based meat alternatives. As consumers seek nutritious, sustainable, and ethical food choices, soy products serve as essential protein substitutes, particularly for those avoiding animal-derived proteins. The increasing popularity of plant-based diets extends beyond vegetarians, influencing flexitarians and health-conscious individuals who are integrating soy-based foods into their daily meals. The expansion of vegetarian-friendly restaurants, foodservice chains, and retail offerings further supports the market growth. Additionally, food manufacturers are continuously innovating soy-based products to enhance taste, texture, and nutritional profiles, ensuring wider consumer acceptance. With rising awareness about plant-based nutrition, the demand for soy food products is witnessing growth across various demographics and regions.

Growing Preference for Tofu

The increasing popularity of tofu significantly fuels the soy food market, primarily because of its similarity to meat in appearance, color, flavor, and consistency. Shoppers looking for plant-based protein options are progressively choosing tofu as a flexible and nutrient-dense replacement. The IMARC Group states that the worldwide tofu market hit USD 2.97 billion in 2024 and is expected to expand at a CAGR of 5.08% from 2025 to 2033. The growing flexitarian and vegan market is leading to an increase in tofu use, especially in meat substitutes and protein-rich diets. Food producers are creating new textures and flavors, enhancing the appeal of tofu to mainstream buyers. Moreover, the increasing accessibility of tofu in retail stores and dining establishments, coupled with its incorporation in plant-based meal kits and ready-to-eat (RTE) items, is further enhancing its market presence.

Increasing Demand for Personalized Nutrition

The rising consumer interest in tailored nutrition to meet specific dietary needs is propelling the soy food market growth. A survey conducted in 2023 revealed that 80% of people actively look for foods that meet their dietary requirements, showing a 3% rise from the year before. This trend of personalized diet options is catalyzing the demand for soy products, which provide high-quality protein, necessary amino acids, and health advantages. Shoppers seeking options that are heart-healthy, high in protein, lactose-free, or low in cholesterol are opting for soy products like tofu, soy milk, and soy protein isolates. Producers are reacting by enhancing soy products with extra nutrients like calcium, vitamins, and probiotics to meet particular dietary needs. The increasing recognition of functional foods, along with the growing variety of soy-derived items aimed at fulfilling different nutritional objectives, is driving the market expansion across multiple demographics.

Soy Food Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the global soy food market, along with forecast at the global and regional levels from 2025-2033. The market has been categorized based on product type, category, distribution channel, and end-use.

Analysis by Product Type:

- Textured Vegetable Protein (TVP)

- Soy Milk

- Soy Oil

- Tofu

- Others

Tofu stands as the largest component in 2024, holding 32.2% of the market. It holds the biggest soy food market share accredited to the versatility, substantial protein levels, and broad acceptance among consumers in different cuisines. It acts as a key protein source in vegetarian and vegan diets, attracting health-minded individuals looking for plant-based options. The subtle taste and versatile texture of tofu render it appropriate for various cooking uses, such as stir-fries, soups, salads, and alternatives to meat. Its high content of protein, low calorie count, and absence of cholesterol increase its attractiveness to those concerned with weight control and cardiovascular well-being. The growing need for plant-derived protein and dairy-free options is leading to innovation in tofu-based items, including flavored, marinated, and enriched versions. The expansion of retail distribution, increased awareness about Asian food, and the rising popularity of high-protein diets all contribute to tofu's leading position in the market.

Analysis by Category:

- Organic

- Conventional

Conventional leads the market with 77.6% of market share in 2024. It represents the largest segment because of its affordability, broad consumer approval, and large-scale manufacturing. Conventional soy products, like soy milk, soy flour, tofu, and textured vegetable protein, are less expensive than organic versions, allowing a wider range of consumers to access them. Extensive agricultural methods and effective supply networks guarantee steady availability, catering to widespread market demand. Food producers favor traditional soy components because of their reliable sourcing systems and reduced production expenses, allowing for competitive pricing. Furthermore, conventional soy food items are readily found in supermarkets, hypermarkets, and foodservice venues, bolstering their market presence. The dominance of conventional soy is also because of its widespread use in processed foods, baked goods, and snacks, serving mainstream consumers who desire budget-friendly and protein-rich food choices.

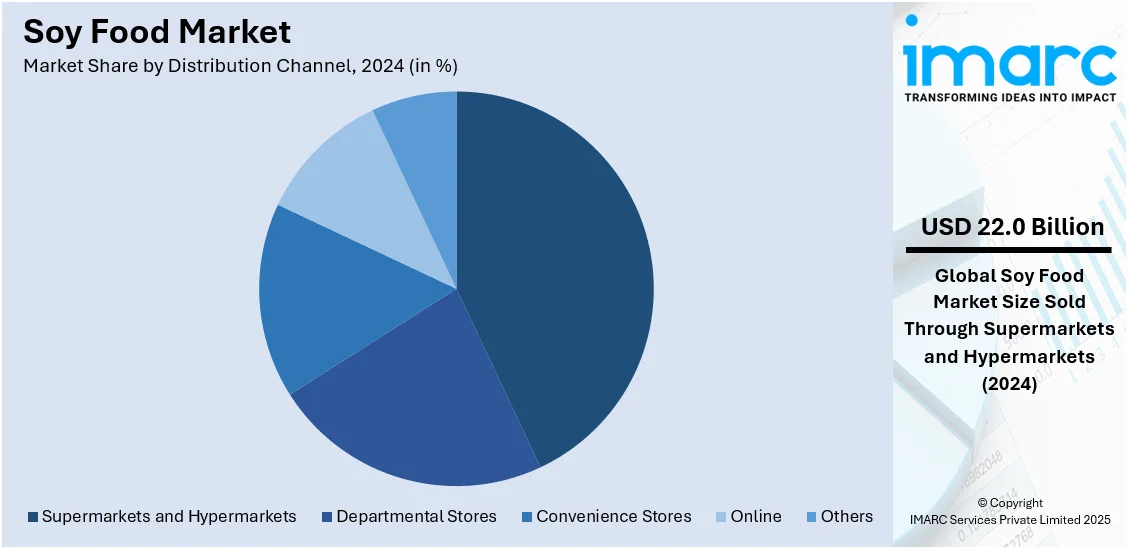

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Departmental Stores

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets represent the largest segment, accounting for 42.8% of market share in 2024. They lead the market because of their wide product range, robust supply chain systems, and capability to provide competitive prices. These expansive retail formats offer consumers convenient access to a variety of soy-based items, such as soy protein isolates, tofu, soy milk, and plant-based meat substitutes, accommodating a range of dietary preferences. The presence of specialized plant-based and health food areas in these stores boosts visibility and encourages spontaneous buying. Shoppers favor supermarkets and hypermarkets due to their convenience, promotional offers, and the opportunity to compare various brands in a single place. Retailers are increasing shelf space for soy products because of the rising preference for plant-based diets. Collaborative alliances between soy food producers and leading retail chains guarantee significant market reach. Moreover, in-store promotional campaigns, product sampling, and loyalty initiatives enhance consumer engagement and brand recognition within this distribution channel.

Analysis by End-Use:

- Dairy Alternatives

- Meat Alternatives

- Bakery and Confectionary

- Functional Foods

- Infant Nutrition

- Others

Bakery and confectionery dominate the market due to the growing demand for high-protein, plant-based ingredients in baked goods, chocolates, and sweets. Soy protein isolates and concentrates are widely used for improving texture, moisture retention, and shelf stability in bread, cakes, cookies, and pastries. Health-conscious consumers are seeking fortified bakery products with added soy protein to support dietary needs, including weight management and muscle health. Additionally, soy lecithin, a common emulsifier in confectionery, enhances product consistency, texture, and mouthfeel in chocolates and candies. The rise of lactose-free and vegan bakery products is further driving the adoption of soy-based alternatives. Manufacturers are innovating with soy-based formulations to meet clean-label and gluten-free trends. Expanding retail distribution, increased snacking habits, and growing consumer awareness about functional bakery ingredients are also contributing to the strong presence of soy in this segment.

Regional Analysis:

- Asia Pacific

- North America

- Europe

- Middle East and Africa

- Latin America

The Asia Pacific region leads the market owing to a robust consumer inclination towards soy-derived products, influenced by longstanding dietary practices and increasing recognition of plant-based nutrition. The area has a strong soybean production foundation, guaranteeing a consistent supply of raw materials for producers. In addition, government efforts encouraging plant-based eating and funding in food processing facilities is bolstering the market growth. The rise of structured retail, online shopping platforms, and foodservice industries is improving access and market reach. Health-aware consumers are moving towards soy-derived dairy alternatives, meat replacements, and functional soy items, fostering innovation in product development. In 2024, Vezlay, a pioneer in India's plant-based meat sector, showcased its soy-based products at the India International Trade Fair (IITF) in New Delhi. The company introduced two new soy-based products, Crispy Veg Chicken and Tofu Fries, which impressed visitors with their taste resembling animal-based counterparts.

Key Regional Takeaways:

United States Soy Food Market Analysis

In North America, the market portion held by the United States was 87.60% of the overall total. The United States soy food market is primarily because of growing consumer preference for plant-based protein substitutes, driven by rising health consciousness and dietary shifts toward vegetarian and vegan lifestyles. According to the World Animal Foundation (WAF), 4% of the population of the United States follows vegan diets. Consequently, soy-based products, like tofu, tempeh, soy milk, and soy protein isolates, are gaining popularity as they offer high protein content, essential amino acids, and cholesterol-lowering benefits. The growing awareness about the role of soy in heart health, weight management, and digestive health is further boosting consumption. Moreover, the expansion of functional and fortified soy-based foods enriched with vitamins, minerals, and probiotics is attracting health-focused consumers. The rising lactose-intolerant population is also driving demand for soy milk as a dairy alternative. Furthermore, the food industry’s innovation in soy-based meat and dairy substitutes, supported by advanced processing technologies, is increasing product variety and market penetration. Besides this, the growing trend of clean-label and non-GMO products is propelling manufacturers to develop organic and minimally processed soy foods. Government initiatives promoting plant-based diets and sustainability are further supporting market growth, as soy cultivation has reduced environmental impact in comparison to protein sources from animals.

Europe Soy Food Market Analysis

The Europe soy food market is growing, fueled by the increasing demand for high-protein, functional foods, driven by escalating consumer interest in nutrition and wellness. The rise of sports and fitness-conscious individuals is driving demand for soy protein isolates and concentrates in plant-based supplements, protein bars, and meal replacements. Food safety regulations and stringent labeling laws set by the European Food Safety Authority (EFSA) are also encouraging manufacturers to improve product transparency, leading to the expansion of organic and sustainably sourced soy products. The rising trend of clean-label, organic, and non-GMO food products is further influencing purchasing decisions, prompting manufacturers to focus on transparency and natural ingredients. According to the IMARC Group, the Europe organic food market reached USD 57.48 Billion in 2024 and is expected to grow at a CAGR of 9.7% from 2025-2033. Moreover, the growing influence of environment-conscious consumers is propelling the food industry to adopt sustainable plant-based protein sources, with soy being a preferred option due to its lower carbon footprint compared to animal proteins. The increasing presence of multinational food companies and startups investing in soy-based meat analogs is further accelerating market penetration. Additionally, collaborations between agricultural producers and food manufacturers are ensuring a consistent and high-quality supply of soy ingredients across the region.

Asia Pacific Soy Food Market Analysis

The Asia Pacific soy food market is expanding due to the region’s long-established consumption of soy-based products including soy milk, tempeh, tofu, and miso, combined with growing preference for plant-based protein substitutes. Rising health awareness, particularly regarding cardiovascular health and weight management, is driving consumers toward soy-based functional foods. The growing vegan, vegetarian, and flexitarian population, particularly in urban centers, is further boosting demand. For instance, as per industry reports, 25-30% of the population in India follows a vegetarian diet. Rapid urbanization and changing dietary patterns in countries, such as China, India, and Japan, are also fueling the adoption of convenient, protein-rich soy-based snacks and beverages. As per recent industry reports, in 2025, 67.5% of the population of China lives in urban cities. Similarly, 37.1% of the Indian population lives in urban areas in 2025. Besides this, government initiatives promoting plant-based nutrition and sustainable food sources are also supporting market growth.

Latin America Soy Food Market Analysis

The Latin America soy food market significantly benefits from increasing consumer understanding about plant-based nutrition and the health advantages of soy protein. Rising demand for meat and dairy alternatives, driven by vegetarian and flexitarian dietary trends, is fueling the adoption of soy-based products such as tofu, textured soy protein, and soy milk. As per industry reports, 19% of the Mexican population follows vegetarian diets, while approximately 14% of the population in Brazil is vegetarian. Moreover, the expanding middle class in countries, such as Brazil, Mexico, and Argentina, is increasing demand for affordable and protein-rich food options. Government initiatives promoting sustainable agriculture and plant-based diets are also supporting market growth.

Middle East and Africa Soy Food Market Analysis

The Middle East and Africa soy food market is being increasingly propelled by the growing health awareness among the masses and rising preference for plant-based protein alternatives. Rising lactose intolerance rates are driving the adoption of soy-based dairy substitutes, like soy milk and yogurt. Urbanization and changing dietary habits are also fueling the demand for convenient, protein-rich soy products. Moreover, the expansion of supermarkets, specialty health stores, and e-commerce platforms is improving accessibility to soy products across the region. According to a report published by the IMARC Group, the Middle East e-commerce market reached USD 1,888 Billion in 2024 and is forecasted to grow at a CAGR of 21.58% from 2025-2033. Besides this, the hospitality and food service sectors are also incorporating soy-based ingredients into menus, further promoting adoption.

Competitive Landscape:

Major stakeholders in the market are broadening their product offerings, concentrating on creative plant-based substitutes, and allocating funds to research aimed at improving flavor, texture, and nutritional quality. For instance, in 2025, Magnum announced a reformulation of its vegan ice cream, replacing pea protein with soy to create a velvety texture. The new recipe applies to all three flavors: Vegan Classic, Vegan Almond, and Vegan Blueberry Cookie. Leading companies are also enhancing supply chains, improving production efficiency, and implementing sustainable sourcing methods to adhere to environmental and ethical benchmarks. Businesses are boosting market penetration via strategic alliances, purchases, and collaborations with retailers and foodservice entities. Branding approaches highlight health advantages, transparent ingredients, and non-GMO certification to appeal to health-aware customers. The growth of digital marketing and e-commerce is boosting direct-to-consumer sales. Moreover, investments in local production plants and region-tailored formulations are enabling companies to address various consumer preferences. Ensuring regulatory compliance, implementing food safety protocols, and enriching products with functional components are essential priorities as well.

The report provides a comprehensive analysis of the competitive landscape in the soy food market with detailed profiles of all major companies, including:

- Blue Diamond Growers

- Dean Foods

- Earth's Own Food Company

- Eden Foods

- Freedom Foods Group

- Harvest Innovations

- House Foods America Holding

- Archer Daniels Midland

- Miracle Soybean Food International Corp

- Cargill

- Nordic Soya Oy

- Victoria Group

- Hain Celestial

- Adisoy Foods & Beverages Pvt. Ltd.

Latest News and Developments:

- July 2024: Nestle launched Maggi Rindecarne, a plant-based alternative to meat created from a blend of soy and spices. The product enabled customers to make a dish that doubles the number of servings at a reasonable cost through the combination of animal and plant-based proteins. The meal maintained its nutritious content without diminishing flavor.

- June 2024: Otsuka Pharmaceutical Co. Ltd. and Korea Otsuka Pharmaceutical Co. Ltd., a subsidiary of Otsuka, launched their whole-soy nutrition bar, ‘SOYJOY’ on online channels in South Korea.

- March 2024: The Illinois Soybean Association (ISA) established a novel Soy Innovation Center in an effort to help the State of Illinois achieve its objective of being a national leader in environment-friendly technologies. The establishment of this center would boost the state’s green image and lead the development and growth of both new and current sustainable soy-based food products.

- February 2024: Amfora, a leading manufacturer of sustainable foods, launched its first commercial products. These included the Amfora Ultra-High Protein Soy flour, Texturized Vegetable Protein, and Crisps. All three products were produced using Amfora’s patented soybeans, which was created through traditional breeding methods to naturally have a protein level that is almost 25% greater than that of standard soybeans.

- January 2024: Kikkoman launched its first dark soy sauce designed specifically for the Indian market. Using its standard soy sauce as the base, which is made with just soybeans, wheat, salt, and water, Kikkoman achieved the deep, rich color of its dark soy sauce using its patented technologies. The result was a naturally dark soy sauce without any chemicals or artificial flavorings.

Soy Food Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Textured Vegetable Protein (TVP), Soy Milk, Soy Oil, Tofu, Others |

| Categories Covered | Organic, Conventional |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Departmental Stores, Convenience Stores, Online, Others |

| End-Uses Covered | Dairy Alternatives, Meat Alternatives, Bakery and Confectionary, Functional Foods, Infant Nutrition, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Companies Covered | Blue Diamond Growers, Dean Foods, Earth's Own Food Company, Eden Foods, Freedom Foods Group, Harvest Innovations, House Foods America Holding, Archer Daniels Midland, Miracle Soybean Food International Corp, Cargill, Nordic Soya Oy, Victoria Group, Hain Celestial, and Adisoy Foods & Beverages Pvt. Ltd. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the soy food market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the global soy food market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the soy food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soy food market was valued at USD 51.44 Billion in 2024.

The soy food market is projected to exhibit a CAGR of 3.98% during 2025-2033, reaching a value of USD 74.44 Billion by 2033.

The soy food market is expanding because of rising health consciousness, increasing vegan and vegetarian adoption, lactose intolerance concerns, and demand for high-protein diets. Innovations in soy-based dairy alternatives, functional foods, and sustainable plant-based proteins further support growth, alongside supportive government policies and expanding retail distribution.

Asia Pacific currently dominates the soy food market. The dominance of the region is attributed to high soy consumption, a strong vegetarian population, growing health awareness, and government support. Expanding food processing industries, rising consumption of plant-based proteins, and widespread soy-based traditional diets further contribute to the market growth.

Some of the major players in the soy food market include Blue Diamond Growers, Dean Foods, Earth's Own Food Company, Eden Foods, Freedom Foods Group, Harvest Innovations, House Foods America Holding, Archer Daniels Midland, Miracle Soybean Food International Corp, Cargill, Nordic Soya Oy, Victoria Group, Hain Celestial, and Adisoy Foods & Beverages Pvt. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)