Southeast Asia Generic Drugs Market Report by Therapy Area (Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, and Others), Drug Delivery (Oral, Injectables, Dermal/Topical, Inhalers), Distribution Channel (Retail Pharmacies, Hospital Pharmacies), and Country 2025-2033

Market Overview:

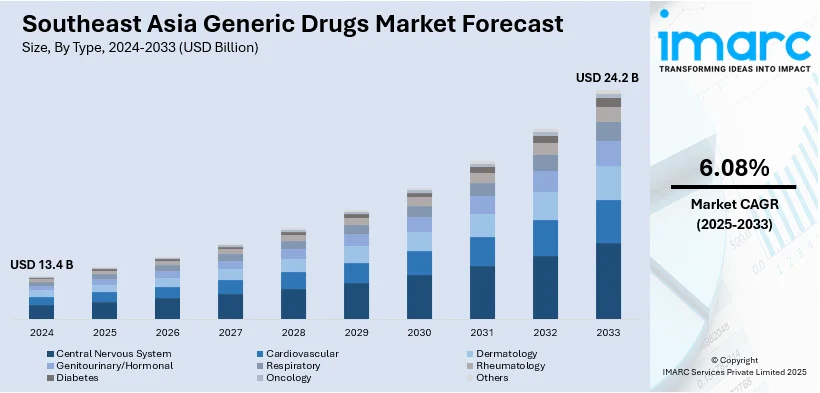

The Southeast Asia generic drugs market size reached USD 13.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 24.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.08% during 2025-2033. The increasing healthcare expenditure, favorable government initiatives and policies to encourage the adoption of generics, rising number of patent expiration, increasing health access and medical tourism across the region, growing chronic illnesses, and strategic partnerships and investments represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 13.4 Billion |

| Market Forecast in 2033 | USD 24.2 Billion |

| Market Growth Rate (2025-2033) | 6.08% |

A generic drug is a medication that is equivalent to a brand-name drug in terms of active ingredients, dosage, strength, route of administration, quality, and intended use. However, it is sold under its chemical or generic name rather than a brand name. Generic drugs are typically less expensive than their brand-name counterparts because they don't involve the same research and development costs or marketing expenses. The approval process for generic drugs is rigorous and involves demonstrating that they are bioequivalent to the brand-name drug, meaning they produce the same therapeutic effect in the body. This ensures that generic drugs are just as safe and effective as their brand-name counterparts. The availability of generic drugs is beneficial for consumers and healthcare systems alike, as it promotes competition in the pharmaceutical industry, which can help drive down drug prices. Patients can often choose between the brand-name version and the generic equivalent, depending on what is most cost-effective for them.

To get more information on this market, Request Sample

Southeast Asia Generic Drugs Market Trends:

As economies in Southeast Asia continue to grow, there is a corresponding increase in healthcare spending. This trend is fueled by rising incomes, urbanization, and an aging population, all of which lead to higher demand for pharmaceuticals, including generic drugs. Additionally, the expiration of patents for several blockbuster drugs has paved the way for generic pharmaceutical companies to enter the market. This allows them to produce and sell lower-cost versions of these medications, further driving the growth of the generic drugs sector. Other than this, generic drugs play a crucial role in improving healthcare access, particularly in rural and underserved areas. They offer a more affordable option for patients who may not have the financial means to purchase expensive brand-name drugs. Besides this, Southeast Asia has become a popular destination for medical tourism, attracting patients from around the world seeking high-quality healthcare at lower costs. The availability of generic drugs at competitive prices enhances the region's appeal as a medical tourism hub. In line with this, the region is witnessing a rise in chronic diseases such as diabetes, cardiovascular diseases, and cancer. This has led to an increased demand for long-term medication. Generic drugs provide an economical solution for managing these chronic conditions. Furthermore, pharmaceutical companies are establishing partnerships and making investments in the Southeast Asia region to capitalize on its growing generic drugs market. This includes collaborations with local manufacturers and distributors to expand their presence. Moreover, governments in several Southeast Asian countries are actively promoting the use of generic drugs as a cost-effective alternative to brand-name medications. Initiatives like price controls and generic substitution policies encourage the adoption of generics, reducing the overall healthcare expenditure for both the government and consumers.

Southeast Asia Generic Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on therapy area, drug delivery, and distribution channel.

Therapy Area Insights:

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

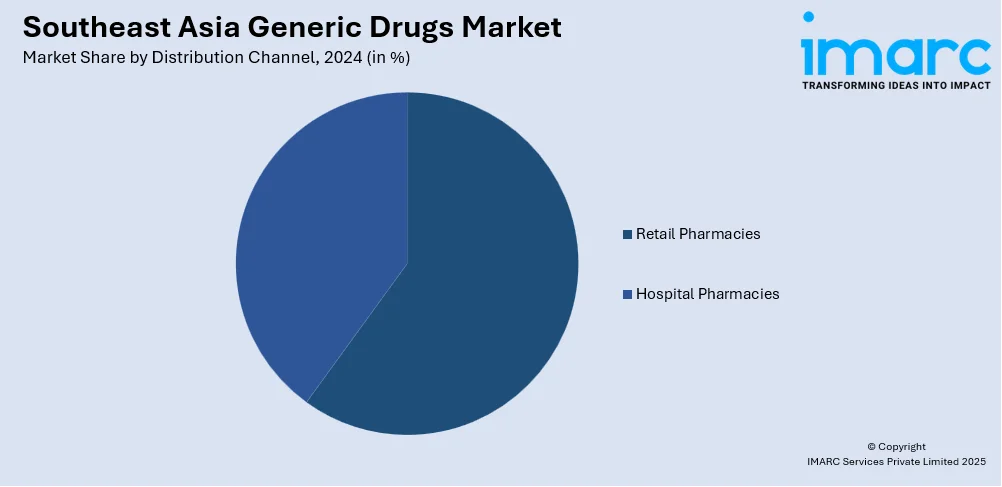

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies and hospital pharmacies.

Country Insights:

- Indonesia

- Thailand

- Singapore

- Philippines

- Vietnam

- Malaysia

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Southeast Asia Generic Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Countries Covered | Indonesia, Thailand, Singapore, Philippines, Vietnam, Malaysia, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Southeast Asia generic drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Southeast Asia generic drugs market on the basis of therapy area?

- What is the breakup of the Southeast Asia generic drugs market on the basis of drug delivery?

- What is the breakup of the Southeast Asia generic drugs market on the basis of distribution channel?

- What are the various stages in the value chain of the Southeast Asia generic drugs market?

- What are the key driving factors and challenges in the Southeast Asia generic drugs?

- What is the structure of the Southeast Asia generic drugs market and who are the key players?

- What is the degree of competition in the Southeast Asia generic drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Southeast Asia generic drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Southeast Asia generic drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Southeast Asia generic drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)