South Korea Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033

South Korea Seafood Market Size and Share:

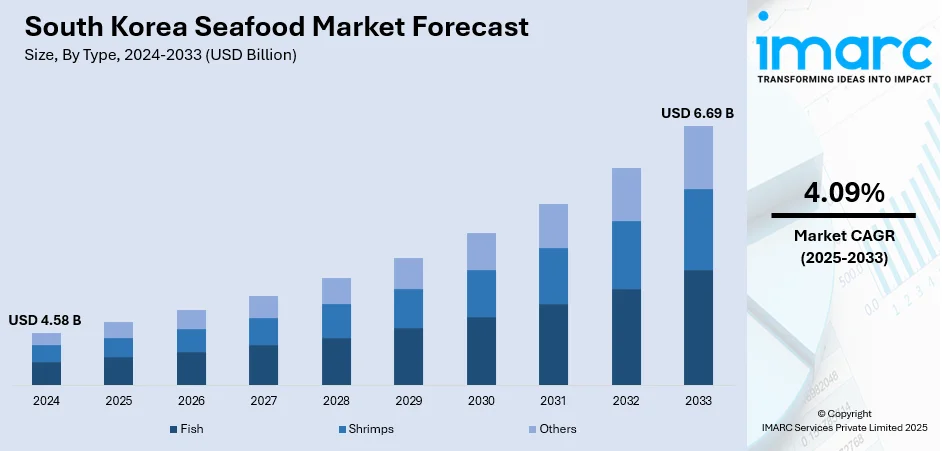

The South Korea seafood market size was valued at USD 4.58 Billion in 2024. Looking forward, the market is expected to reach USD 6.69 Billion by 2033, exhibiting a CAGR of 4.09% during 2025-2033. Honam (Southwestern region) currently dominates the market, holding a significant market share of 41.2% in 2024. The market is fueled by robust domestic demand, cultural dependence on seafood-based diets, and rising demand for healthy protein sources. Aquaculture and cold chain logistics technological enhancements have enhanced supply efficiency, while government initiatives supporting sustainable fishing enhance industry resilience. Urbanization and new consumer patterns are broadening the ready-to-eat and value-added seafood market, further driving the continuous growth and competitiveness of South Korea seafood market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.58 Billion |

|

Market Forecast in 2033

|

USD 6.69 Billion |

| Market Growth Rate 2025-2033 | 4.09% |

Among the key forces behind South Korea's seafood industry is the strong cultural and gastronomical importance of seafood in the lives of its citizens. Seafood is an integral part of Korean gastronomy, with routine items like grilled mackerel, fermented skate, and other raw fish preparations being staples across different generations. Fish markets such as Noryangjin in Seoul are commercial hubs as well as landmarks that reflect the nation's overwhelming desire for locally supplied fresh seafood. Seafood is not only a part of traditional fare but also figuring prominently in contemporary Korean fusion cuisine, appearing in street food, domestic meals, and restaurant fare. Seasonal choices also play a role, as specific fish and shellfish are consumed during particular seasons. The nation's extensive coastline and sophisticated aquaculture infrastructure enable a wide variety of seafood products to be kept easily accessible throughout the country. These strong customs and inclinations guarantee a sustained, consistent demand for seafood as per the South Korea seafood market outlook.

To get more information on this market, Request Sample

South Korea's seafood market is further propelled by its growing export potential along with robust government support for the aquaculture industry. With the increasing global demand for Korean food, particularly in nations with huge Korean diaspora populations or increasing interest in K-culture, export of Korean seafood products has picked up pace. Products like seasoned seaweed, abalone, and frozen octopus have gained popularity overseas, opening doors for local producers to expand operations. The government of South Korea actively promotes the seafood sector through research and development, sustainability, and investment in high-tech aquaculture technologies. These involve encouragement of offshore fish farming and eco-friendly harvesting methods for maintaining resource availability in the long term. Policies also exist to advance traceability and food safety standards that foster global confidence in Korean seafood. This blend of robust institutional foundation and worldwide demand for Korean tastes makes the nation's seafood market resilient with vast growth potential.

South Korea Seafood Market Trends:

Rising Consumption and Popularity of Seafood

Seafood continues to be a foundation of the South Korean diet, and its popularity is further increasing because of changing consumer preferences, health consciousness, and the growing global popularity of Korean cuisine. Seafood is a traditional food in South Korea and is also a living ingredient of contemporary eating, appearing in everything ranging from street foods to gourmet indulgences. Food such as grilled eel, fish stews served hot and spicy, hoe served as sashimi, and seafood pancakes are popular amongst everyone. This growing South Korea seafood market demand is also escalated due to rising health-conscious individuals who prefer seafood, as it is high in protein and has less fat than red meats. The increasing popularity of Korean food culture overseas, or "K-food" wave, has also contributed to more demand for seafood-based Korean food at home, supporting domestic seafood production and processing sectors. Besides, ready-to-cook seafood dinner and marinated items are picking up in the urban market, supporting hectic lives while preserving traditional flavor.

Improvements in Transport and Logistics

According to the South Korea seafood market forecast, technological and infrastructural advancements in logistics and transportation have increased the efficiency and coverage of the region’s seafood supply chains dramatically. The highly developed cold chain infrastructure of the nation enables fresh seafood to be moved swiftly from aquaculture farms and coastal fishing villages to urban areas such as Seoul, Busan, and Incheon. For instance, the logistics market in South Korea is forecasted to grow at a CAGR of 2.91% during 2025-2033, as per a report published by the IMARC Group. Advances in packaging, refrigeration, and real-time monitoring guarantee product freshness and safety, making live and high-quality seafood widely available even in landlocked regions. This technology has also enabled seafood producers and cooperatives to increase their scale of operations and minimize post-harvest losses. High-speed rail and express delivery facilities also complement the rapid transportation of perishables, enabling seafood to reach more consumers in different segments of the market, such as supermarkets, restaurants, and online platforms. Moreover, the development of e-commerce websites and food apps in South Korea has increased direct-to-consumer delivery, enabling consumers to have fresh seafood delivered to their homes with little time lag, supporting steady market demand.

Increasing Trend of Sustainable and Responsible Fishing Practices

With growing awareness about environmental concerns, South Korea is witnessing an increasing shift toward sustainable and environmentally friendly fishing practices as deduced from the South Korea seafood market trends. Government, industry players, and consumers are all focusing more on marine ecosystem protection and long-term sustainability of fish stocks. This has prompted the introduction of tighter regulations for fishing quotas, closed seasons, and conservation of threatened species. For instance, in October 2024, South Korean biotech company K-Cell Biosciences and WSG, a provider of bioprocess solutions, established a partnership with Singapore-based Umami Bioworks to create a pipeline for environment-friendly manufacturing of cultivated seafood in South Korea. The collaboration intends to develop scalable cell-grown seafood production systems, providing a sustainable substitute for traditional fishing practices. There is also a significant increase in eco-certification and labeling initiatives that encourage sustainably produced seafood, enabling people to make more green-friendly decisions. The aquaculture industry is also changing, with the adoption of cleaner technology, low-impact feeds, and disease management techniques. In fact, the aquaculture market in South Korea reached 3.3 Million Tons in 2024 and is projected to grow at a CAGR of 5.04% during 2025-2033, according to IMARC Group reports. Apart from this, coastal communities in South Korea are also engaging actively in conservation, frequently facilitated by local authorities and NGOs. These eco-friendly efforts serve to protect the future of seafood resources while also increasing the international reputation of Korean seafood, making it more attractive to morally conscious consumers at home and abroad.

South Korea Seafood Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea seafood market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, form, and distribution channel.

Analysis by Type:

- Fish

- Shrimps

- Others

Fish stands as the largest component in 2024, holding around 65.5% of the market. Fish leads South Korea's seafood market, dominating consumption trends and industry attention owing to their cultural, culinary, and economic importance. As a staple of Korean meals, fish are the focus of classic dishes like grilled mackerel, braised croaker, and fresh sashimi-style offerings. Coastal areas like Busan and Jeju are major fishing centers, producing a rich variety of species that underpin local consumption as well as national distribution. South Korea's sophisticated aquaculture industry, dominated by species such as yellowtail and sea bream, supports this fish dominance, allowing consistent year-round supply and consistency in quality. In addition to raw deliveries, fish-based foods are extensively processed into convenient ready-to-eat formats—smoked, seasoned, or marinated—which satisfy busy urban lifestyles. Retailers and online shopping sites regularly promote domestic fish origins, with an emphasis on traceability and freshness, which appeals strongly to consumers who value source and quality. With technological advancement in fish culture and packaging, fish is the driving force of South Korea's seafood market, indicative of long-standing eating cultures and continued modernization in production.

Analysis by Form:

- Fresh/Chilled

- Frozen/Canned

- Processed

Frozen/Canned leads the market with around 49.6% of market share in 2024. Frozen and canned seafood are the powerhouse products in South Korea's seafood market, providing convenience, longer shelf life, and a wide range of culinary uses that appeal to busy lifestyles of contemporary consumers. Time-starved households and convenience-oriented consumers increasingly turn to frozen seafood—prawns, squid, and fillets—for rapid meal preparation. Such foods are even available in supermarkets and internet sites, usually with recipes and simple cooking directions, making them perfect for urban residents who have little time to cook. Canned fish, from mackerel and tuna to flavored anchovies and salmon—is a pantry favorite owing to economic prices and utilization in familiar preparations such as stews and stir-fries. Canned fish popularity is attributed to South Koreans' affinity for banchan (side dishes), as the latter can be easily integrated into daily diets. In addition, South Korea's strong cold-chain infrastructure and sophisticated food processing facilities facilitate the market's dependency on such products. Manufacturers frequently emphasize origin and freshness, which are reinforced by eco-labeling and traceability claims to boost consumer confidence. The canned and frozen category remains pivotal to satisfy both practical and cultural needs in South Korea's developing seafood industry.

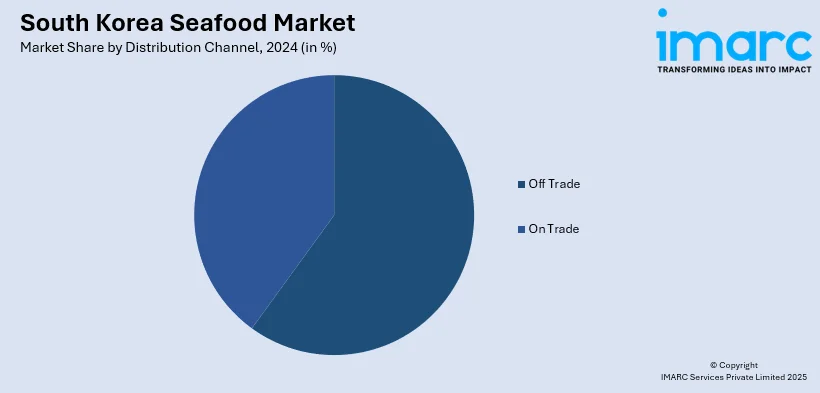

Analysis by Distribution Channel:

- Off Trade

- On Trade

Off trade leads the market with around 64.4% of market share in 2024. Off-trade outlets—supermarkets, hypermarkets, convenience stores, and e-commerce—dominate South Korea's seafood distribution sector. Consumers in Korea often visit these places for seafood, as they are drawn to the convenience, assortment, and consistent product quality they can provide. Supermarkets and hypermarkets offer a wide range of frozen, fresh, and value-added seafood products, frequently with shellfish displays accompanied by live fish tanks or chilled shelves filled with sashimi-grade products. Their advanced cold chain distribution maintains freshness, allowing seafood from seaboards like Busan or Jeju to arrive in major cities like Seoul in little time. Convenience stores likewise have an important role to play, especially in urban areas, providing single-serve or ready-to-eat seafood meals for fast-paced lifestyles. Supporting physical stores, Internet commerce and online supermarket sites are gaining popularity, offering home delivery and subscription services for seafood products. Most online stores stress traceability and eco-certification labels to satisfy the demands of consumers.

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

In 2024, Honam (Southwestern Region) accounted for the largest market share of 41.2%. Honam, the southwestern part of South Korea, is one of the major contributors to the nation's seafood industry because of its vast coastline, productive marine environments, and long-standing tradition of fishing. Major coastal cities such as Mokpo, Yeosu, and Gunsan are major hubs for seafood, highly renowned for their busy fish markets and variety of seafood products. The area has a diverse range of sea products, such as oysters, clams, anchovies, and croaker, which are both crucial to local consumption and national distribution. Honam's positioning along the Yellow Sea offers rich fishing grounds, and its highly developed port facilities allow for easy transportation to the rest of the country. The region also enjoys successful aquaculture farms supplying both local and export markets. Government investments in sustainable fishing and marine resource management have further secured Honam's position. Consequently, the area sits at the center of propelling supply, innovation, and food influence in South Korea's seafood industry.

Competitive Landscape:

Major players in South Korea's seafood industry are taking innovative and strategic measures to consolidate the industry and meet changing consumer needs. Major seafood companies and cooperatives are investing heavily in aquaculture technology in order to enhance yield, minimize environmental footprint, and achieve constant supply throughout the year. Measures include deploying recirculating aquaculture systems (RAS), green-feeds, and disease control strategies for sustaining fish health and water quality. Large processors have been diversifying their product lines with value-added and ready-to-eat seafood products targeted at Korean consumers with busy urban lifestyles. E-commerce channels and food retailers are also collaborating with domestic fisheries to provide traceable, fresh seafood products, enhancing consumer trust and access. Apart from that, several businesses are pursuing sustainability certifications like the Marine Stewardship Council (MSC) and marketing responsibly harvested products in order to satisfy increasing international and local demands. Private industry and government-supported ventures are partnering on research programs to establish intelligent fisheries and enhance logistics infrastructure, especially cold chain facilities. Marketing campaigns linked to K-food's worldwide popularity also are assisting major players in tapping into the export potential in Asia, North America, and Europe. These efforts, together represent an integrated strategy for innovation, sustainability, and global growth that further determines the future of South Korea seafood market growth.

The report provides a comprehensive analysis of the competitive landscape in the South Korea seafood market with detailed profiles of all major companies, including:

- Billion Food Co. Ltd.

- E & K Co. Ltd.

- Woowon Holdings Co. Ltd.

- Yurim Fishery and Distribution Co. Ltd.

Latest News and Developments:

- April 2025: The first land-based salmon farm in South Korea officially commenced operations, representing a significant step toward producing salmon domestically in the country. Utilizing recirculating aquaculture system (RAS) technology from the AKVA group, the facility was constructed by GS Engineering & Construction and is run by its subsidiary, Eco Aquafarm.

- April 2025: Under the leadership of seafood executive Mingu Jeong, Lerøy Seafood Group unveiled the establishment of Lerøy Korea, the Norwegian group's new South Korean branch. While the company has already introduced its trout on Market Kurly and Coupang, two of Korea's largest online marketplaces for fresh food, this strategic launch aims to increase Lerøy’s footprint in the rapidly expanding South Korean seafood market.

- February 2025: The first Aquaculture Stewardship Council (ASC) certification for olive flounder, also known as Gwangeo, was obtained by the South Korean company Raon Bada. This unprecedented certification highlights Raon Bada's commitment to bringing about a revolutionary transformation in South Korea's seafood sector.

- January 2025: The South Korean Ministry of Oceans and Fisheries officially presented the Development Plan for the Oyster Aquaculture Industry during the State Affairs Cabinet Meeting. Three strategies are included in the Development Plan for the Oyster Aquaculture Industry to accomplish two objectives: boosting oyster production by 100,000 tons by 2030 and doubling oyster exports by 2030, from USD 80 million in 2023 to USD 160 million in 2030, to fulfill South Korea’s vision of being the world's leading oyster exporting nation.

South Korea Seafood Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fish, Shrimps, Others |

| Forms Covered | Fresh/Chilled, Frozen/Canned, Processed |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Companies Covered | Billion Food Co. Ltd., E & K Co. Ltd., Woowon Holdings Co. Ltd., Yurim Fishery and Distribution Co. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea seafood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea seafood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea seafood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The South Korea seafood market was valued at USD 4.58 Billion in 2024.

The South Korea seafood market is projected to exhibit a CAGR of 4.09% during 2025-2033, reaching a value of USD 6.69 Billion by 2033.

South Korea’s seafood market is driven by strong domestic consumption, cultural reliance on seafood-rich diets, advancements in aquaculture, and growing global demand for Korean cuisine. Government support, improved logistics, and consumer preference for healthy, protein-rich foods further strengthen the market’s expansion and resilience across domestic and international channels.

Honam (Southwestern Region) currently dominates the South Korea seafood market, driven by its coastal geography, abundant fishing grounds in the Yellow Sea, and deeply rooted maritime traditions. Key ports like Mokpo and Yeosu support vibrant fish markets and efficient distribution networks. Local aquaculture, sustainable fishing initiatives, and regional culinary heritage further drive Honam’s industry growth.

Some of the major players in the South Korea seafood market include Billion Food Co. Ltd., E & K Co. Ltd., Woowon Holdings Co. Ltd., Yurim Fishery and Distribution Co. Ltd., etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)