South Korea Neurology Devices Market Report by Type of Device (Cerebrospinal Fluid Management Devices, Interventional Neurology Devices, Neurosurgery Devices, Neurostimulation Devices, and Others), and Region 2026-2034

South Korea Neurology Devices Market:

South Korea neurology devices market size reached USD 259.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 564.0 Million by 2034, exhibiting a growth rate (CAGR) of 9.00% during 2026-2034. The increasing availability of advanced diagnostic and therapeutic equipment is propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 259.7 Million |

|

Market Forecast in 2034

|

USD 564.0 Million |

| Market Growth Rate 2026-2034 | 9.00% |

Access the full market insights report Request Sample

South Korea Neurology Devices Market Analysis:

- Major Market Drivers: The rising investments in research capabilities, healthcare infrastructures, and public health awareness are stimulating the market.

- Key Market Trends: The extensive healthcare investments in South Korea, aimed at improving neurological care and infrastructure, contribute significantly to the growing adoption of innovative neurology devices, thereby accelerating the market growth.

- Competitive Landscape: The report has provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

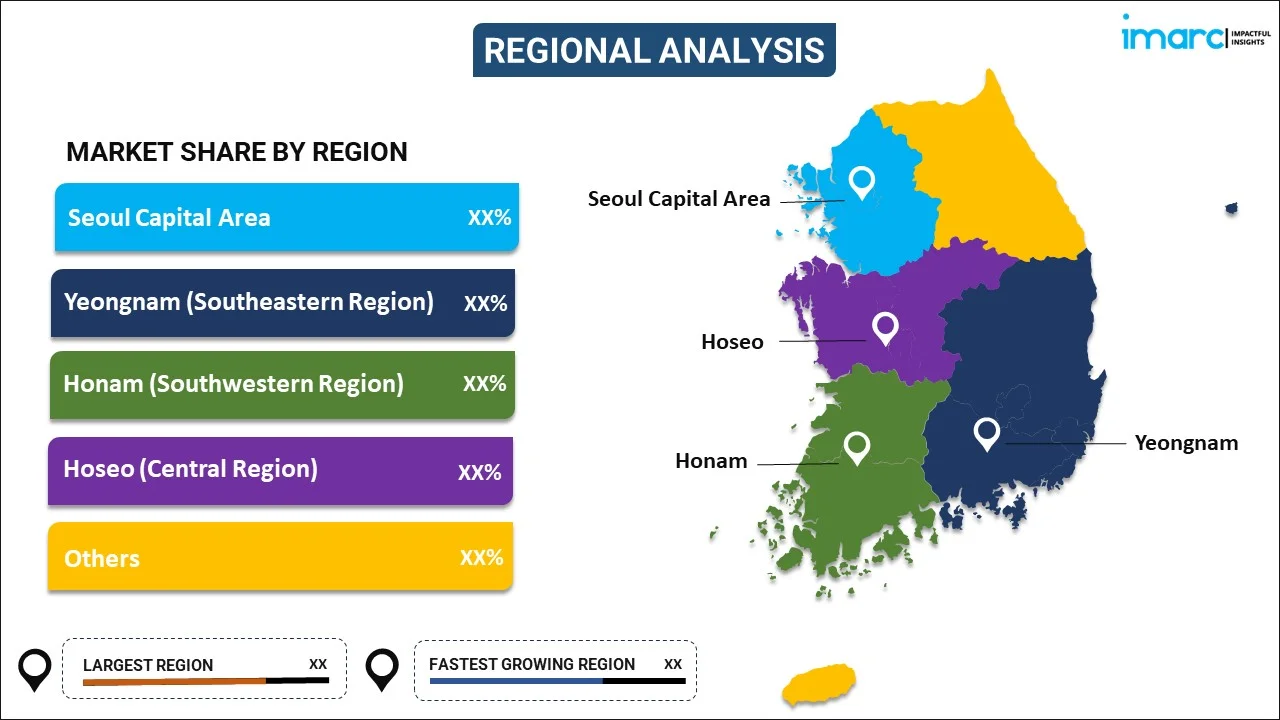

- Geographical Trends: Seoul Capital Area leads in neurology device adoption due to its advanced medical infrastructure. Moreover, Yeongnam experiences growth driven by the rising number of Parkinson’s cases. In contrast, Honam shows increased adoption with improving healthcare investments. Hoseo and other regions are expanding their market presence as regional healthcare infrastructure develops.

- Challenges and Opportunities: The high cost of advanced technologies and equipment can restrict access and adoption, which is hindering the market. However, increased government subsidies, financial incentives for healthcare providers, and collaborations with local manufacturers to reduce costs and improve accessibility will continue to bolster the market growth.

South Korea Neurology Devices Market Trends:

Growing Demand for Advanced Medical Technologies

The surge in technological advancements in neurology, including AI-based imaging systems, reflects a heightened need for advanced medical diagnostic tools. This trend signifies a push towards integrating cutting-edge technologies to improve neurological disorder detection and treatment efficacy. As the focus intensifies on enhancing the capabilities of neurology tools, the market responds to the growing need for diagnostic and therapeutic solutions. For example, in March 2024, Philips and SyntheticMR introduced an AI-based quantitative brain imaging system in South Korea, integrating SmartSpeed, 3D SyntAc, and SyMRI NEURO technologies. This advanced tool enhances the diagnosis of neurological disorders, including multiple sclerosis and traumatic brain injuries, by analyzing brain tissues more precisely. This is the increasing the South Korea neurology devices market demand.

Increased Focus on Personalized Healthcare Solutions

Specialized treatments for individual patient needs, such as deep brain stimulation systems, demonstrate a shift towards more customized care approaches. Emphasizing personalized solutions aims to enhance treatment outcomes by addressing unique patient profiles and evolving medical conditions. For instance, in January 2024, Medtronic's FDA-approved Percept RC Deep Brain Stimulation system introduced BrainSense technology, enhancing the personalization of treatments for movement disorders and epilepsy. According to South Korea neurology devices market analysis report, this breakthrough positively impacted patient care options.

Expansion of Healthcare Infrastructure and Innovations

The strategic growth in healthcare infrastructure, coupled with new drug approvals and distribution agreements, signifies a commitment to enhancing treatment options. This expansion supports the development and accessibility of innovative therapies, thereby improving overall patient care and healthcare delivery. It is contributing to the South Korea neurology devices market share. They facilitate a broader range of solutions and improve patient outcomes, as these advancements drive greater market involvement. For example, in April 2024, Nxera Pharma announced an exclusive distribution agreement with Handok for PIVLAZ in South Korea. This drug, the first approved for preventing cerebral vasospasm after aneurysmal subarachnoid hemorrhage, will be available in early 2025, enhancing treatment options for neurological patients.

South Korea Neurology Devices Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with the South Korea neurology devices market forecast at the country and regional levels for 2026-2034. Our report has categorized the market based on the type of device.

Breakup by Type of Device:

To get detailed segment analysis of this market Request Sample

- Cerebrospinal Fluid Management Devices

- Interventional Neurology Devices

- Interventional/Surgical Simulators

- Neurothrombectomy Devices

- Carotid Artery Stents

- Embolic Coils

- Support Devices

- Neurosurgery Devices

- Neuroendoscopes

- Stereotactic Systems

- Aneurysm Clips

- Others

- Neurostimulation Devices

- Spinal Cord Stimulation Devices

- Deep Brain Stimulation Devices

- Sacral Nerve Stimulation Devices

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type of device. This includes cerebrospinal fluid management devices, interventional neurology devices (interventional/surgical simulators, neurothrombectomy devices, carotid artery stents, embolic coils, and support devices), neurosurgery devices (neuroendoscopes, stereotactic systems, aneurysm clips, and others), neurostimulation devices (spinal cord stimulation devices, deep brain stimulation devices, sacral nerve stimulation devices, and others), and others.

Cerebrospinal fluid (CSF) management devices are vital for conditions like hydrocephalus. Interventional neurology devices are generally used in neurovascular and stroke management procedures. Neurosurgery is critical in tumor removal processes. Neurostimulation devices are employed for treating movement disorders like Parkinson’s disease. The escalating demand for minimally invasive procedures will continue to augment the South Korea neurology devices market in the coming years.

Breakup by Region:

To get detailed regional analysis of this market Request Sample

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

According to the South Korea neurology devices market outlook report, the Seoul Capital Area benefits from advanced healthcare facilities. Moreover, Yeongnam is experiencing increased demand due to the rising neurological disorder cases and the expanding hospital capabilities. In addition, Honam is investing in healthcare infrastructure to enhance access to neurology devices and treatments. Meanwhile, Hoseo is focusing on modernizing its medical facilities to support neurology services, whereas other regions are gradually adopting advanced technologies to improve neurological care, accessibility, and treatment outcomes.

Competitive Landscape:

The South Korea neurology devices market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Neurology Devices Market Recent Developments:

- April 2024: Nxera Pharma announced an exclusive distribution agreement with Handok for PIVLAZ in South Korea for preventing cerebral vasospasm.

- March 2024: Philips and SyntheticMR introduced an AI-based quantitative brain imaging system in South Korea, integrating SmartSpeed, 3D SyntAc, and SyMRI NEURO technologies. This advanced tool enhances the diagnosis of neurological disorders, including multiple sclerosis and traumatic brain injuries, by analyzing brain tissues more precisely.

- January 2024: Medtronic's FDA-approved Percept RC Deep Brain Stimulation system developed BrainSense technology, enhancing the personalization of treatments for movement disorders and epilepsy.

South Korea Neurology Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Type of Devices Covered |

|

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea neurology devices market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea neurology devices market growth?

- What is the breakup of the South Korea neurology devices market on the basis of type of device?

- What are the various stages in the value chain of the South Korea neurology devices market?

- What are the key driving factors and challenges in the South Korea neurology devices?

- What is the structure of the South Korea neurology devices market, and who are the key players?

- What is the degree of competition in the South Korea neurology devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea neurology devices market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea neurology devices market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea neurology devices industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)