South Korea Kitchen Appliances Market Size, Share, Trends and Forecast by Product, Distribution Channel, End User, and Region, 2026-2034

South Korea Kitchen Appliances Market Size and Share:

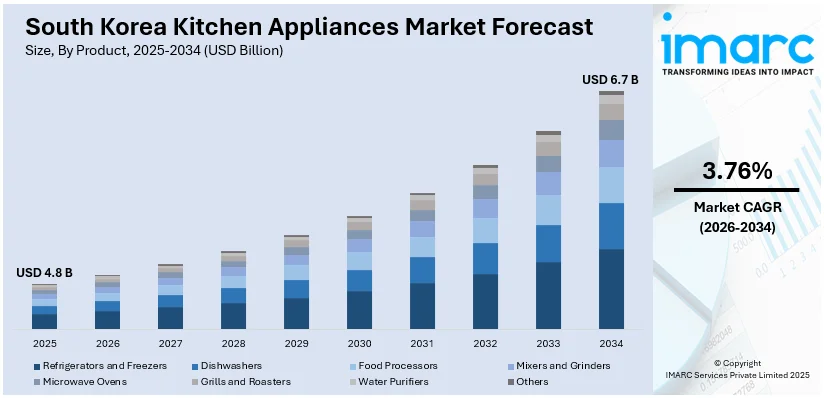

The South Korea kitchen appliances market size was valued at USD 4.8 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 6.7 Billion by 2034, exhibiting a CAGR of 3.76% from 2026-2034. The market is witnessing significant growth due to the escalating consumer demand for convenience and time-saving appliances and technological advancements and smart kitchen integration. Moreover, increasing demand for smart kitchen appliances, focus on health-conscious and sustainable appliances, and integration of multicultural and gourmet cooking solutions are expanding the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 4.8 Billion |

| Market Forecast in 2034 | USD 6.7 Billion |

| Market Growth Rate (2026-2034) | 3.76% |

As the pace of life accelerates, South Korean consumers are increasingly seeking kitchen appliances that enhance convenience and efficiency in meal preparation. This demand for time-saving solutions has led to a surge in popularity for smart kitchen appliances, such as automated cooking devices, smart ovens, and robotic vacuum cleaners. For instance, in February 2025, LG launched the Fit & Max refrigerator, designed for seamless kitchen integration with minimal wall gaps and standard-depth alignment, creating a built-in aesthetic while maximizing space efficiency, showcasing LG’s advanced technology in home appliances. With dual-income households becoming more prevalent and busy lifestyles dominating, consumers are opting for kitchen gadgets that simplify cooking, reduce preparation time, and offer greater control over the cooking process. Furthermore, a growing focus on health and wellness has increased interest in appliances like air fryers, blenders, and juicers, which promote healthier meal options while reducing cooking time. The demand for convenience is expected to continue driving innovation in South Korea's kitchen appliance market, as manufacturers introduce products designed to meet the needs of time-conscious and health-conscious consumers.

To get more information on this market Request Sample

South Korea’s kitchen appliance market is also witnessing significant growth due to technological advancements. With the increasing adoption of smart homes, consumers are demanding appliances that can be seamlessly integrated into their digital ecosystems. Smart refrigerators, dishwashers, and cooking systems equipped with IoT technology offer enhanced functionalities, such as remote control, monitoring, and energy optimization. For instance, in 2024, Graphene Square introduced a cordless, transparent cooker using graphene, cutting energy use by half. The integration of artificial intelligence (AI) and machine learning algorithms in appliances also provides personalized experiences, improving cooking efficiency and reducing energy consumption. As South Korea continues to embrace the digital transformation, the trend of smart kitchen appliances is expected to expand further, positioning the market for long-term growth and innovation.

South Korea Kitchen Appliances Market Trends:

Increasing Demand for Smart Kitchen Appliances

The adoption of smart home technology is becoming a significant trend in South Korea's kitchen appliances market. As more consumers integrate their living spaces with IoT (Internet of Things) devices, smart kitchen appliances are gaining popularity. These appliances, such as smart refrigerators, ovens, and dishwashers, offer enhanced functionality through features like remote control, real-time monitoring, and personalized settings. For example, smart refrigerators can monitor food stocks and suggest recipes based on available ingredients, while smart ovens can be controlled via mobile apps for precision cooking. For instance, in 2024, LG unveiled the Signature microwave with a 27-inch LCD touchscreen and speakers, enhancing kitchen entertainment and syncing with LG’s oven to display cooking progress without manual checks. This growing trend is driven by consumers' desire for convenience, energy efficiency, and improved user experiences. As South Korea embraces the digital transformation, manufacturers are increasingly focusing on the development of smart kitchen solutions, positioning them for a dominant role in the market.

Focus on Health-Conscious and Sustainable Appliances

Health and sustainability concerns are significantly influencing consumer purchasing decisions in South Korea’s kitchen appliance market. With a growing interest in health-conscious living, appliances like air fryers, juicers, and blenders that promote healthier cooking options are seeing increased demand. For instance, in February 2025, SHINIL ELECTRONICS unveiled its 2025 vision, EXIT2025, focusing on AI-integrated products, expanded marketing, and enhanced customer service, following strong market response to AI-driven summer products in 2024. Air fryers, for instance, allow consumers to prepare meals with less oil, aligning with the country's focus on reducing fat and promoting healthier eating habits. Additionally, there is a growing trend toward sustainable kitchen appliances. Environmentally conscious consumers are increasingly opting for energy-efficient and eco-friendly devices that reduce both energy consumption and waste. Brands are responding to this trend by incorporating more sustainable materials in product design and offering appliances with energy-saving features.

Integration of Multicultural and Gourmet Cooking Solutions

South Korea's evolving culinary landscape is influencing the kitchen appliance market. As the country becomes more globally connected, there is a rising interest in multicultural cooking, which is pushing the demand for versatile kitchen appliances. This includes appliances such as multi-functional cookers, blenders, and pressure cookers that can prepare a wide range of international cuisines. With the rise in home cooking and gourmet trends, consumers are investing in high-quality kitchen tools that offer more precise control and functionality, enabling them to experiment with diverse recipes. For instance, LG's SKS (Signature Kitchen Suite) products showcased at KBIS 2025, like the Cook-zone free Induction Pro Range and SKS Island System, offer multifunctional features. The Induction Pro Range allows flexible cookware placement, advanced convection cooking, steam technology, real-time monitoring with a built-in camera, and AI-driven precision heating. The SKS Island System combines cooking, ventilation, and storage, featuring a hidden induction cooktop and downdraft ventilation, creating a seamless, efficient kitchen solution that integrates multiple technologies for enhanced functionality. This trend is further supported by the increasing popularity of cooking shows and social media platforms where food enthusiasts share their culinary experiences. Manufacturers are adapting by offering appliances that cater to diverse cooking needs, positioning them to capitalize on this growing demand for culinary exploration.

South Korea Kitchen Appliances Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the South Korea kitchen appliances market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on product, distribution channel, and end user.

Analysis by Product:

- Refrigerators and Freezers

- Dishwashers

- Food Processors

- Mixers and Grinders

- Microwave Ovens

- Grills and Roasters

- Water Purifiers

- Others

Refrigerators and freezers are essential in the South Korean kitchen appliances market, with a focus on energy efficiency, smart features, and large capacities. With growing demand for more innovative designs, products like smart fridges with AI, touchscreen displays, and energy-saving models cater to urban households, offering improved food preservation and convenience.

Dishwashers are gaining popularity in South Korea due to busy lifestyles and the increasing preference for time-saving appliances. With advanced cleaning technologies and eco-friendly features, these appliances address the need for efficiency and convenience. Compact designs are especially favored in small kitchens, aligning with consumer demand for space-saving solutions and water conservation.

Food processors are a key product segment in South Korea, enabling quick and easy preparation of meals. As consumer interest in cooking at home rises, food processors are becoming essential for chopping, slicing, and blending. These multi-functional devices cater to busy urban households, offering efficiency, speed, and versatility for various cooking needs.

Mixers and grinders are integral to the South Korean kitchen, especially for baking and preparing traditional Korean dishes. With innovations in design and performance, these products support diverse culinary needs, from mixing dough to grinding spices. They serve the growing interest in home cooking and baking, ensuring convenience and precision in food preparation.

Microwave ovens remain a staple in South Korean kitchens, valued for their quick cooking and reheating capabilities. The demand for smart microwave ovens, featuring touch controls, preset cooking programs, and energy-efficient operations, is increasing. These microwaves align with consumers' need for convenience, quick meal preparation, and compact kitchen solutions.

Grills and roasters have seen a surge in popularity in South Korea, driven by the cultural preference for grilling and barbecuing. These appliances cater to consumers' desire for home cooking experiences similar to outdoor grilling. With advanced features like temperature control and smoke reduction, they provide convenience, quality, and enhanced flavor for both indoor and outdoor use.

Water purifiers are crucial in the South Korean market due to concerns about water quality and health. The increasing focus on health-conscious living has driven demand for high-performance water purifiers that offer advanced filtration systems, ensuring clean and safe drinking water. These products are widely adopted in households and offices, offering consumers peace of mind regarding water purity.

Analysis by Distribution Channel:

Access the comprehensive market breakdown Request Sample

- Multi-Brand Stores

- Exclusive Stores

- Online

- Others

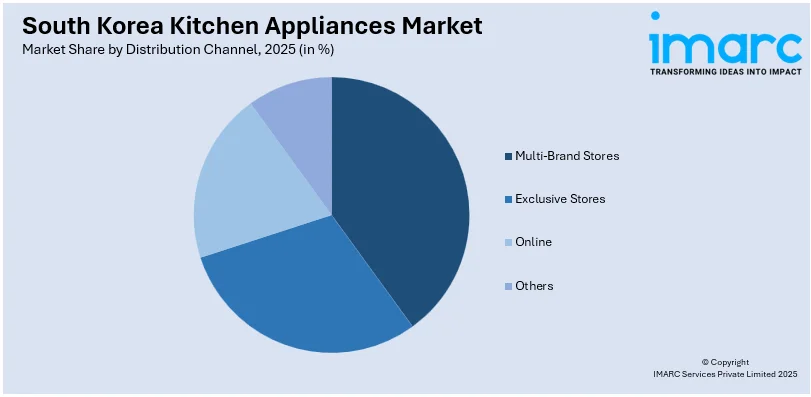

Multi-brand stores are a dominant distribution channel in South Korea's kitchen appliances market, offering a wide variety of products from different brands under one roof. These stores cater to price-sensitive consumers seeking variety and convenience, allowing them to compare different models, features, and prices. The presence of knowledgeable staff also helps in making informed purchase decisions.

Exclusive stores focus on specific brands, offering a premium shopping experience with direct access to the latest kitchen appliances. These stores allow customers to experience the brand's full product range and personalized services, including expert consultations and after-sales support. They serve the growing demand for high-end, innovative appliances among discerning South Korean consumers.

Online platforms have gained significant traction in South Korea, driven by the rise of e-commerce and digital convenience. Customers can easily browse and purchase kitchen appliances from various brands, often with competitive pricing, home delivery, and flexible return policies. Online stores cater to busy consumers seeking convenience, offering detailed product reviews, comparisons, and promotions to aid purchase decisions.

Analysis by End User:

- Residential

- Commercial

In South Korea, the residential sector is a major driver of the kitchen appliances market. Homeowners seek modern, energy-efficient, and multifunctional appliances to enhance convenience and improve cooking experiences. With increasing interest in smart kitchens, residential consumers are adopting advanced refrigerators, dishwashers, and cooking gadgets, contributing to demand for innovative, space-saving, and aesthetically pleasing products.

The commercial sector in South Korea, including restaurants, hotels, and catering services, requires durable and high-capacity kitchen appliances to meet operational needs. These establishments prioritize efficiency, food safety, and time-saving appliances such as industrial refrigerators, dishwashers, and food processors. Commercial-grade appliances ensure large-scale operations maintain quality, speed, and reliability, driving demand for professional kitchen solutions.

Regional Analysis:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The Seoul Capital Area, including Seoul and Incheon, is the leading market for kitchen appliances in South Korea, driven by high population density, affluence, and urbanization. Consumers here demand advanced, space-saving, and energy-efficient appliances due to smaller living spaces and a fast-paced lifestyle. The area's high purchasing power also fuels the demand for premium, smart kitchen devices.

The Yeongnam region, including major cities like Busan and Ulsan, exhibits significant demand for kitchen appliances due to growing industrial and residential developments. The rising middle-class population seeks efficient and durable home appliances. Additionally, with a strong manufacturing base, the region also sees commercial appliance demand, particularly in food processing and industrial kitchens, enhancing market growth.

The Honam region, encompassing cities like Gwangju and Jeonnam, sees increasing interest in kitchen appliances driven by rising disposable incomes and lifestyle changes. As more households upgrade their living standards, there is growing demand for modern home appliances. The region’s expanding commercial food industry also boosts demand for large-scale kitchen equipment such as refrigerators and cooking systems.

Hoseo, known for its agricultural focus, has seen growth in kitchen appliances, particularly in rural households and commercial kitchens. With urbanization spreading, more consumers are adopting modern kitchen solutions to improve living standards. Commercial demand is also rising due to increased food services and hospitality establishments seeking efficient kitchen appliances to support business operations.

Competitive Landscape:

The South Korea kitchen appliances market is highly competitive, with both domestic and international players vying for market share. Major South Korean brands such as Samsung, LG Electronics, and SK Networks dominate the market, offering a wide range of innovative and high-tech products. These companies are increasingly focusing on smart kitchen appliances, energy efficiency, and user-centric designs to cater to evolving consumer preferences. For instance, in April 2024, Samsung launched its AI-powered BESPOKE home appliances, including washers, refrigerators, and vacuums, featuring interactive screens, SmartThings connectivity, and multilingual accessibility for a seamless consumer experience. In addition, global brands like Bosch, Whirlpool, and Panasonic have a significant presence, competing by leveraging their advanced technology, premium quality, and sustainable product offerings. The growing trend towards health-conscious and sustainable living also drives competition, encouraging continuous innovation and product differentiation among key players.

The report provides a comprehensive analysis of the competitive landscape in the South Korea kitchen appliances market with detailed profiles of all major companies.

Latest News and Developments:

- In January 2025, Kyungdong Navien announced plans to expand its kitchen appliance business after acquiring sales rights for gas and electric cooktops and ovens from SK Magic. The company established a sales and service network, transferred production facilities, and will launch Navien Magic in early 2025 to strengthen its market presence.

- In January 2025, Roborock launched the compact M1 washer dryer for small households in Korea, targeting a niche market with its space-efficient design, ideal for studios and officetels at 428mm width and 512mm height.

- In August 2023, Samsung and LG prepared for IFA 2023 in Berlin, showcasing high-tech consumer products with a sustainability focus. They introduced AI-optimized washers and dryers with top-rated energy efficiency, designed to lower power consumption, reduce costs, and minimize environmental impact while enhancing convenience in modern households.

South Korea Kitchen Appliances Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Refrigerators and Freezers, Dishwashers, Food Processors, Mixers and Grinders, Microwave Ovens, Grills and Roasters, Water Purifiers, Others |

| Distribution Channels Covered | Multi-Brand Stores, Exclusive Stores, Online, Others |

| End Users Covered | Residential, Commercial |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea kitchen appliances market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the South Korea kitchen appliances market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea kitchen appliances industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The kitchen appliances market in South Korea was valued at USD 4.8 Billion in 2025.

The South Korea kitchen appliances market is growing due to rising demand for convenience, smart technology integration, health-conscious cooking solutions, and sustainability. Increasing dual-income households, urbanization, AI-powered appliances, and energy-efficient innovations are driving adoption. Additionally, multicultural culinary trends and premiumization are boosting demand for advanced, high-quality kitchen appliances.

The South Korea kitchen appliances market is projected to exhibit a CAGR of 3.76% during 2026-2034, reaching a value of USD 6.7 Billion by 2034.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)