South Korea Insurance Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

South Korea Insurance Market Overview:

The South Korea insurance market size reached USD 158.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 292.4 Billion by 2034, exhibiting a growth rate (CAGR) of 7.03% during 2026-2034. The increase in aging population, rising healthcare costs, growing demand for life, health, and pension insurance products, favorable government initiatives promoting social security and personal financial protection, and continual technological advancements are some of the factors positively impacting South Korea insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 158.7 Billion |

| Market Forecast in 2034 | USD 292.4 Billion |

| Market Growth Rate 2026-2034 | 7.03% |

Access the full market insights report Request Sample

South Korea Insurance Market Trends:

Digital Transformation and Insurtech Growth

The rapid technological advancements and shifting consumer expectations are contributing to the South Korea insurance market growth. Traditional insurance companies in the region are incorporating emerging technologies, such as artificial intelligence (AI), big data, and blockchain technology, to bring more accurate underwriting, better quality customer service, and efficient claims processing. Insurtech companies are also competing with traditional insurance companies by innovating more customer-centric insurance products through online platforms. These companies use automation and machine learning (ML) methodologies to make policies easier to apply for, faster, and more efficient. The increasing mobile usage and online insurance platforms result in customers making most of their purchases, managing, and even claiming their insurance products online. Also, regulators have been on board in facilitating and promoting digitization by introducing policies that would inspire innovation while ensuring consumer protection. According to the Digital New Deal Action Plan 2022, to encourage the integration of data, networks, and artificial intelligence (D.N.A.) across the nation's economy, KRW 5.9 Trillion will be allotted. Additionally, South Korea intends to spend USD 527 Million on artificial intelligence (AI) innovation in 69 different areas, and estimates integrating AI might produce KRW 310 Trillion yearly by 2026. The industry is shifting towards a more efficient, data-driven ecosystem, with government and insurance companies continuing to invest in digital capabilities.

Aging Population and Demand for Health and Retirement Products

South Korea's aging population is creating a demand for insurance products, which is positively influencing the South Korea insurance market outlook, driving demand for products that cater to elderly consumers. According to industry reports, 20% of South Korea's 51.22 Million citizens are above the age of 65, qualifying the nation as a super-aged society. With a growing number of retirees, there is an increasing need for long-term care insurance, retirement savings plans, and health insurance policies that cover age-related conditions. These are the factors putting pressure on insurance companies to come up with specialized plans, including critical illness, home health care, and customized pension benefits. The transformation of demographics is also leading to the rethinking of the underwriting strategies of insurers. Rather than the traditional age-biased risk assessment, more sophisticated analytics that involve lifestyle, medical history, and genetics are undertaken. Additionally, hybrid insurance products that combine life insurance with health and retirement benefits are gaining popularity. These policies provide policyholders with flexibility, allowing them to adjust coverage as their needs evolve. Insurers also realize the necessity to provide education towards retirement and healthcare costs. The industry is developing solutions aimed at securing individuals' financial futures while also fostering emotional confidence by offering sustainable, customer-centric options that promote a stress-free life.

South Korea Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type.

Type Insights:

To get detailed segment analysis of this market Request Sample

- Life Insurance

- Non-life Insurance

- Automobile insurance

- Fire insurance

- Liability insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes life insurance and non-life insurance (automobile insurance, fire insurance, liability insurance, and others).

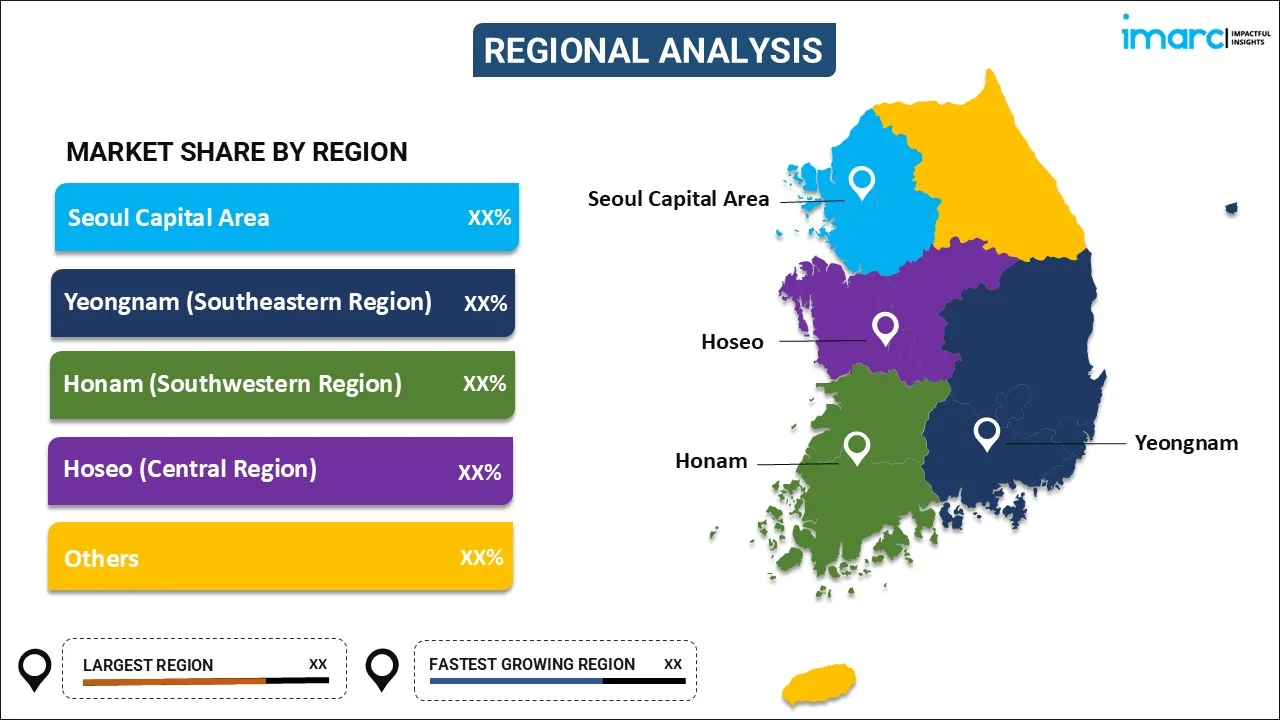

Regional Insights:

To get detailed regional analysis of this market Request Sample

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern region), Honam (Southwestern region), Hoseo (Central region), and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Insurance Market News:

- September 14, 2024: South Korea launched a USD 7.5 Billion initiative aimed at advancing AI-driven manufacturing modernization. The Korea Trade Insurance Corporation will provide AI Plus+. It is a unique insurance product that offers financial support, focusing on helping manufacturers secure lower interest rates for AI-related projects.

- January 2025: South Korea increased its foreign exchange insurance by KRW 14 Trillion to stabilize its financial market. The government aims to strengthen the resilience of businesses against currency fluctuations amid global economic uncertainties. This measure is expected to provide enhanced protection for South Korean exporters and importers, reducing potential risks from exchange rate volatility.

- February 7, 2025: Samsung Fire & Marine Insurance announced its plan to become a subsidiary of Samsung Life Insurance. This strategic move aims to streamline the integration of the two companies and enhance their operational efficiency. The reorganization is expected to strengthen Samsung Life's position in the South Korean insurance market by expanding its product offerings and customer base.

South Korea Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered |

Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the South Korea insurance market on the basis of type?

- What is the breakup of the South Korea insurance market on the basis of region?

- What are the various stages in the value chain of the South Korea insurance market?

- What are the key driving factors and challenges in the South Korea insurance market?

- What is the structure of the South Korea insurance market and who are the key players?

- What is the degree of competition in the South Korea insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea insurance market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)