South Korea Hydrogen Generation Market Report by Technology (Coal Gasification, Steam Methane Reforming, and Others), Systems Type (Merchant, Captive), Application (Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, and Others), and Region 2025-2033

South Korea Hydrogen Generation Market:

The South Korea hydrogen generation market size reached USD 3,287.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,782.6 Million by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The implementation of various government initiatives, rising demand for clean and sustainable energy sources, rapid technological advancements and innovations in electrolysis, and the increasing strategic collaborations and partnerships, represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 3,287.6 Million |

|

Market Forecast in 2033

|

USD 4,782.6 Million |

| Market Growth Rate 2025-2033 | 4.25% |

South Korea Hydrogen Generation Market Analysis:

- Major Market Drivers: The implementation of various government initiatives promoting hydrogen as a vital element of the energy strategy is one of the major factors boosting the market growth. In line with this, the increasing recognition of hydrogen’s potential to reduce dependence on imported fossil fuels and promote environmental sustainability is favoring the South Korea hydrogen generation market growth.

- Key Market Trends: The rising demand for clean and sustainable energy sources in the country to lower greenhouse gas emissions and facilitate the transition to a low-carbon economy is providing a thrust to the market growth. Additionally, the sudden shift in the automotive industry towards hydrogen fuel cell vehicles (FCVs) is stimulating the South Korea hydrogen generation market demand.

- Competitive Landscape: The South Korea hydrogen generation market outlook report has also provided a comprehensive analysis of the competitive landscape in the market. Also, detailed profiles of all major companies have been provided.

- Geographical Trends: The South Korean government has set ambitious goals for hydrogen adoption and green energy transition. The Seoul Capital Area is a focal point for these initiatives due to its economic and technological hubs. Moreover, Yeongnam is a key industrial and manufacturing hub, with significant industries like shipbuilding, petrochemicals, and automotive. These sectors are increasingly adopting hydrogen as a cleaner energy source.

- Challenges and Opportunities: High production costs of hydrogen generation and a limited number of hydrogen refueling stations are hampering the market's growth. However, ongoing research and development can lead to breakthroughs in hydrogen production, storage, and fuel cell technologies, reducing costs and improving efficiency.

South Korea Hydrogen Generation Market Trends:

Rising Hydrogen Demand

There is an increasing demand for hydrogen across various sectors, including transportation (hydrogen fuel cell vehicles), industrial processes (e.g., steel production), and power generation. For instance, according to Statista, by 2050, the demand for hydrogen energy in South Korea is expected to exceed 75 exajoules. This would be nearly ten times the demand recorded in 2015. This growing demand is stimulating investment in hydrogen generation capacity and infrastructure. These factors are further positively influencing the South Korea hydrogen generation market forecast.

Environmental Goals

South Korea is committed to reducing its greenhouse gas emissions and transitioning to cleaner energy sources. For instance, South Korea amended its 2030 NDC in 2021, committing to a 40% reduction in greenhouse gas emissions from 2018. In December 2016, the Korean government approved the Basic Plan for Climate Change Response and the Road Map to Achieve National Greenhouse Gas Reduction Goals. Hydrogen is seen as a critical part of this transition, particularly in decarbonizing sectors, such as transportation, industry, and power generation. These factors are further contributing to the South Korea hydrogen generation market share.

Government Initiatives

The South Korean government has been actively promoting hydrogen as a key component of its energy transition strategy. This includes substantial investments in hydrogen infrastructure, subsidies for hydrogen production, and incentives for research and development in hydrogen technologies. For instance, during FY2021, the South Korean government spent over US$ 702 million on hydrogen projects. Also, in January 2019, South Korea announced its Hydrogen Economy Roadmap which intended to put at least 35 hydrogen buses on the road in 2019, increasing to 2,000 by 2022 and 41,000 by 2040. These factors are augmenting the market growth.

South Korea Hydrogen Generation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, systems type, and application.

Breakup by Technology:

- Coal Gasification

- Steam Methane Reforming

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes coal gasification, steam methane reforming, and others.

According to the South Korea hydrogen generation market outlook, coal gasification involves converting coal into a synthesis gas (syngas) composed primarily of hydrogen (H₂), carbon monoxide (CO), carbon dioxide (CO₂), and methane (CH₄). This is achieved by reacting coal with oxygen (O₂) and steam (H₂O) at high temperatures and pressures. Moreover, steam methane reforming is the most common method for hydrogen production. It involves reacting methane (CH₄) with steam (H₂O) at high temperatures (700–1,000°C) in the presence of a catalyst to produce hydrogen.

Breakup by Systems Type:

- Merchant

- Captive

A detailed breakup and analysis of the market based on the systems type have also been provided in the report. This includes merchant and captive.

According to the South Korea hydrogen generation market overview, merchant hydrogen systems involve the production of hydrogen for sale to multiple customers or industries. Hydrogen is produced in large quantities and sold on the open market to various end-users, which can include industrial users, fuel cell vehicle operators, and other businesses. Moreover, captive hydrogen systems are designed to produce hydrogen for use within a specific facility or by a single entity. This hydrogen is typically consumed on-site or within a closed network, such as a single industrial plant, refinery, or large-scale manufacturing operation.

Breakup by Application:

- Methanol Production

- Ammonia Production

- Petroleum Refinery

- Transportation

- Power Generation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes methanol production, ammonia production, petroleum refinery, transportation, power generation, and others.

According to the South Korea hydrogen generation market analysis report, hydrogen is a key feedstock in the production of methanol (CH₃OH). Methanol is used in various applications including as a solvent, antifreeze, and as a feedstock for producing chemicals and fuels. Moreover, ammonia (NH₃) production is one of the largest industrial uses of hydrogen. Hydrogen is combined with nitrogen (N₂) to produce ammonia through the Haber-Bosch process. Besides this, hydrogen is used in petroleum refining processes such as hydrocracking and desulfurization. It helps in breaking down larger hydrocarbons into more valuable products and in removing sulfur from fuels. Furthermore, hydrogen fuel cells are used in the transportation sector to power vehicles such as cars, buses, and trucks. These fuel cells convert hydrogen into electricity, with water as the only byproduct.

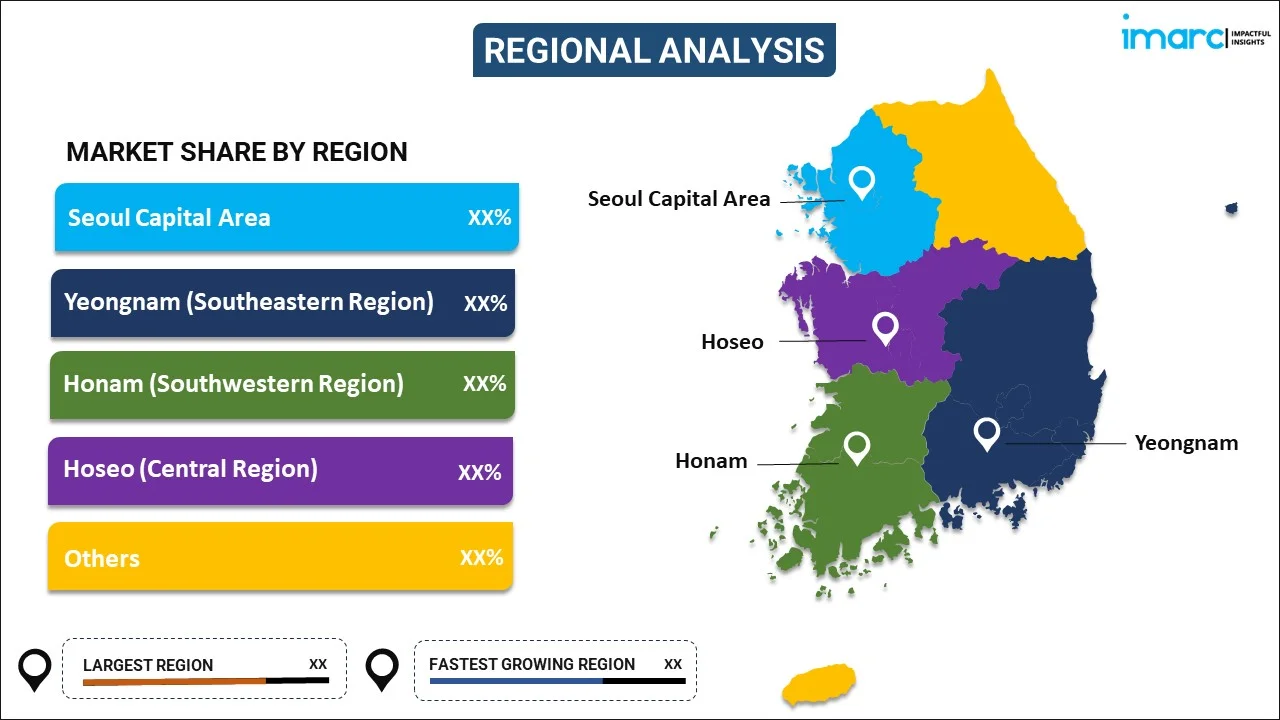

Breakup by Region:

- Seoul Capital Area

- Yeongnam (Southeastern Region)

- Honam (Southwestern Region)

- Hoseo (Central Region)

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), and others.

According to the South Korea hydrogen generation market statistics, the Seoul Capital Area is a leader in implementing government policies for hydrogen infrastructure, including hydrogen refueling stations and hydrogen buses. Moreover, the region hosts numerous research institutions and companies focusing on advanced hydrogen technologies and applications. Besides this, Yeongnam is integrating hydrogen generation into its industrial processes, particularly in the petrochemical and steel industries. Furthermore, Honam is exploring hydrogen production from renewable sources, such as wind and solar, due to its favorable climate conditions for these energy sources.

Competitive Landscape:

The South Korea hydrogen generation market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis, such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant, has been covered in the report. Also, detailed profiles of all major companies have been provided.

South Korea Hydrogen Generation Market News:

- June 2024: Nikkiso Clean Energy & Industrial Gases Group unveiled a series of contracts to construct and operate around two dozen liquid-based hydrogen (LH2) fueling stations throughout South Korea.

- May 2024: Hyundai Engineering & Construction Co. (Hyundai E&C) developed South Korea's hydrogen manufacturing plant utilizing water electrolysis, as part of a government-supported sustainable energy project.

- May 2024: South Korea's Ministry of Trade, Industry, and Energy (MOTIE) launched a clean hydrogen power bidding market for supplying and purchasing energy generated using clean hydrogen or hydrogen derivatives such as ammonia.

South Korea Hydrogen Generation Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Technologies Covered | Coal Gasification, Steam Methane Reforming, Others |

| Systems Types Covered | Merchant, Captive |

| Applications Covered | Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, Others |

| Regions Covered | Seoul Capital Area, Yeongnam (Southeastern Region), Honam (Southwestern Region), Hoseo (Central Region), Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the South Korea hydrogen generation market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the South Korea hydrogen generation market?

- What is the breakup of the South Korea hydrogen generation market on the basis of technology?

- What is the breakup of the South Korea hydrogen generation market on the basis of systems type?

- What is the breakup of the South Korea hydrogen generation market on the basis of application?

- What are the various stages in the value chain of the South Korea hydrogen generation market?

- What are the key driving factors and challenges in the South Korea hydrogen generation?

- What is the structure of the South Korea hydrogen generation market and who are the key players?

- What is the degree of competition in the South Korea hydrogen generation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the South Korea hydrogen generation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the South Korea hydrogen generation market.

- The study maps the leading, as well as the fastest-growing, markets. It further enables stakeholders to identify the key country-level markets within the region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the South Korea hydrogen generation industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)